Sports Electronics Market Report

Published Date: 31 January 2026 | Report Code: sports-electronics

Sports Electronics Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Sports Electronics market, covering trends, insights, forecasts, and market dynamics from 2023 to 2033. Key segments, industry leaders, and regional insights are highlighted to support strategic decision-making.

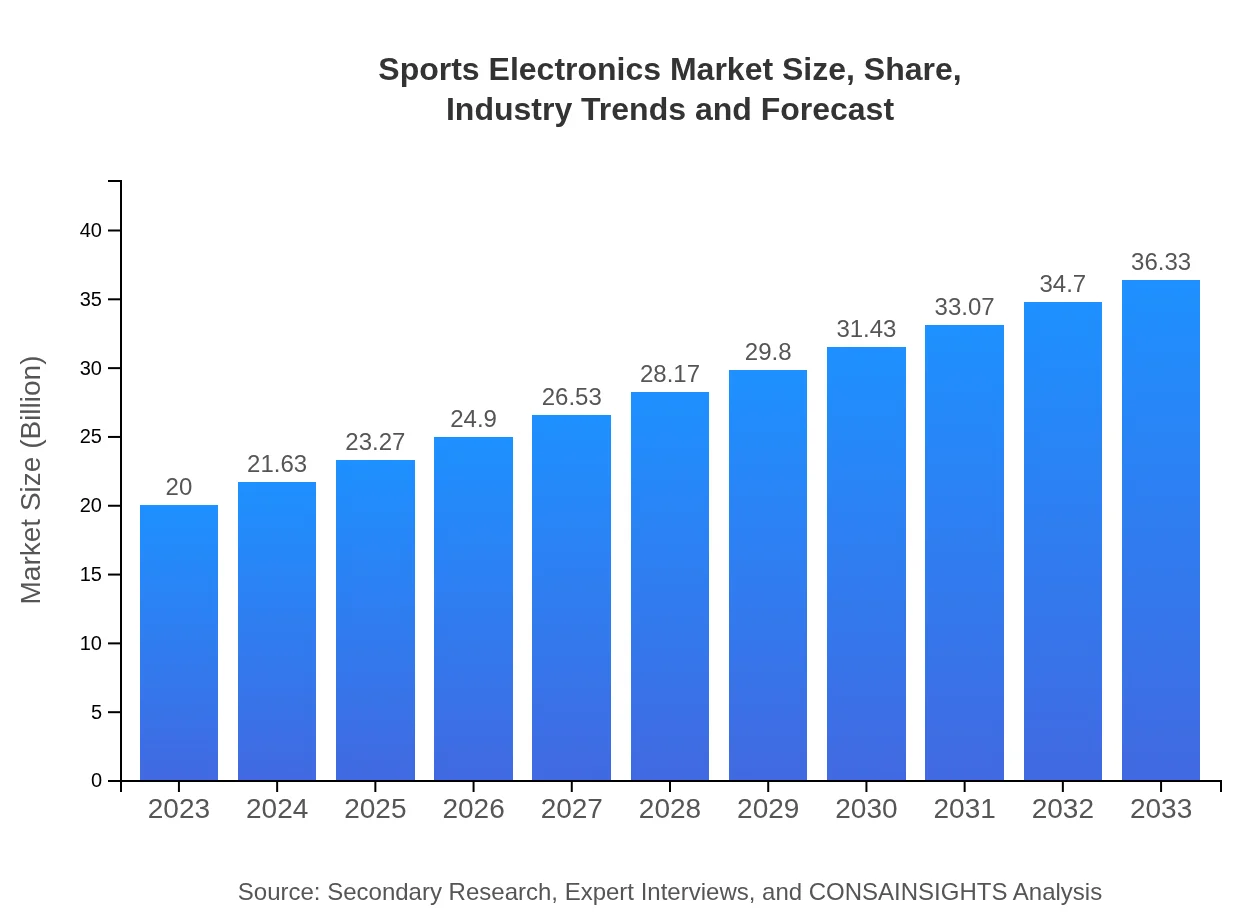

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $20.00 Billion |

| CAGR (2023-2033) | 6% |

| 2033 Market Size | $36.33 Billion |

| Top Companies | Nike, Inc., Adidas AG, Fitbit (Google LLC), Garmin Ltd., Apple Inc. |

| Last Modified Date | 31 January 2026 |

Sports Electronics Market Overview

Customize Sports Electronics Market Report market research report

- ✔ Get in-depth analysis of Sports Electronics market size, growth, and forecasts.

- ✔ Understand Sports Electronics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Sports Electronics

What is the Market Size & CAGR of the Sports Electronics market in 2023?

Sports Electronics Industry Analysis

Sports Electronics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Sports Electronics Market Analysis Report by Region

Europe Sports Electronics Market Report:

Europe's market is projected to grow to $9.93 billion by 2033. Innovations in health technology, sustainability concerns, and government initiatives promoting sports engagement are strong market drivers in this region.Asia Pacific Sports Electronics Market Report:

The Asia Pacific region, projected to reach $7.08 billion by 2033, exhibits rapid growth due to increasing participation in sports and fitness activities. The market is fueled by a burgeoning middle class increasingly investing in health and fitness technology. Major players are also localizing their offerings to cater to diverse consumer needs.North America Sports Electronics Market Report:

North America remains a crucial market, anticipated to expand to $13.68 billion by 2033. The U.S. leads the charge, underpinned by a robust fitness culture, high expenditure on sports technologies, and established distribution channels.South America Sports Electronics Market Report:

In South America, the market is expected to grow to $2.12 billion by 2033. The demand for sports electronics is primarily driven by the popularity of soccer and fitness trends, with increasing disposable income allowing consumers to invest in newer technologies.Middle East & Africa Sports Electronics Market Report:

The Middle East and Africa are expected to see the market rise to $3.52 billion by 2033. Increasing health awareness, a growing youth population, and investments in sports infrastructure characterize this growth.Tell us your focus area and get a customized research report.

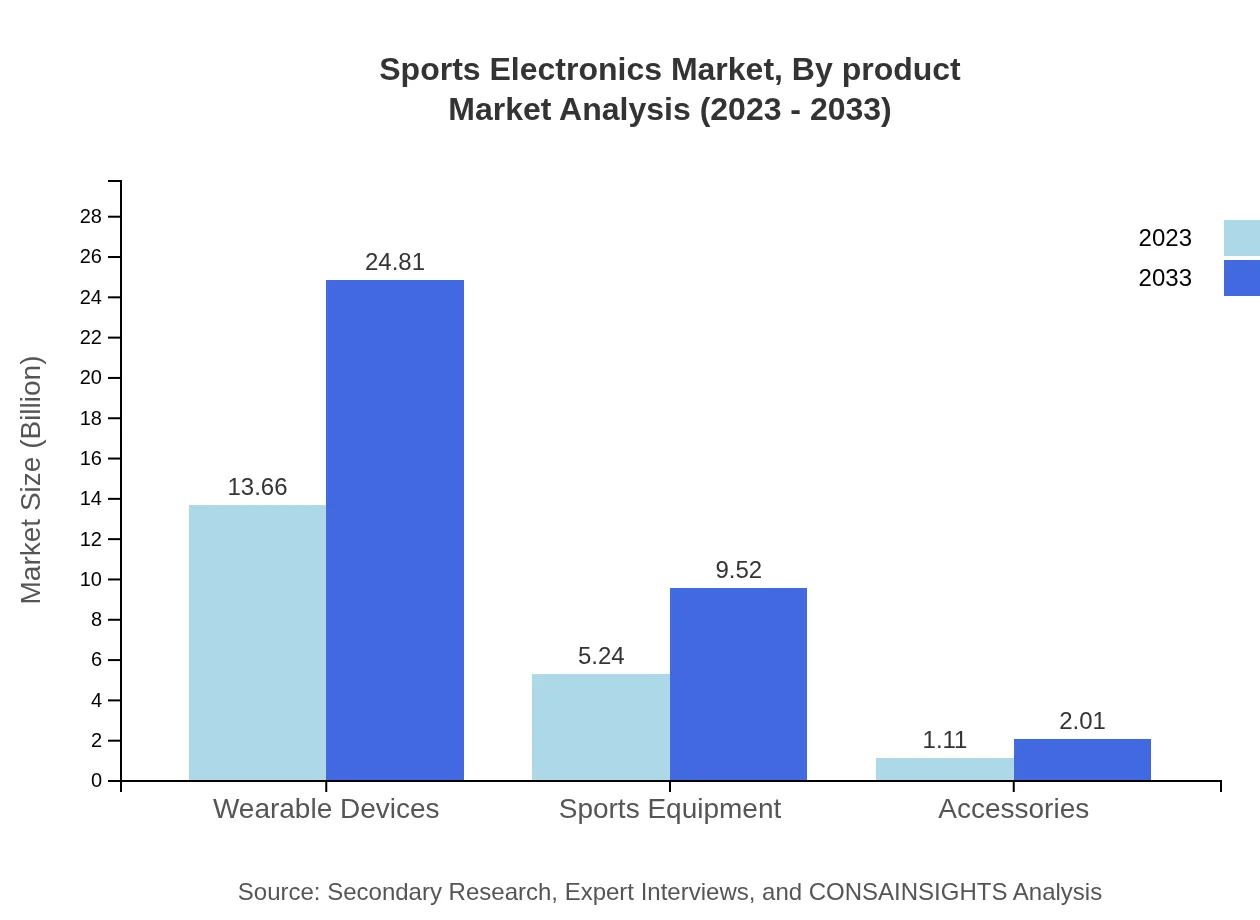

Sports Electronics Market Analysis By Product

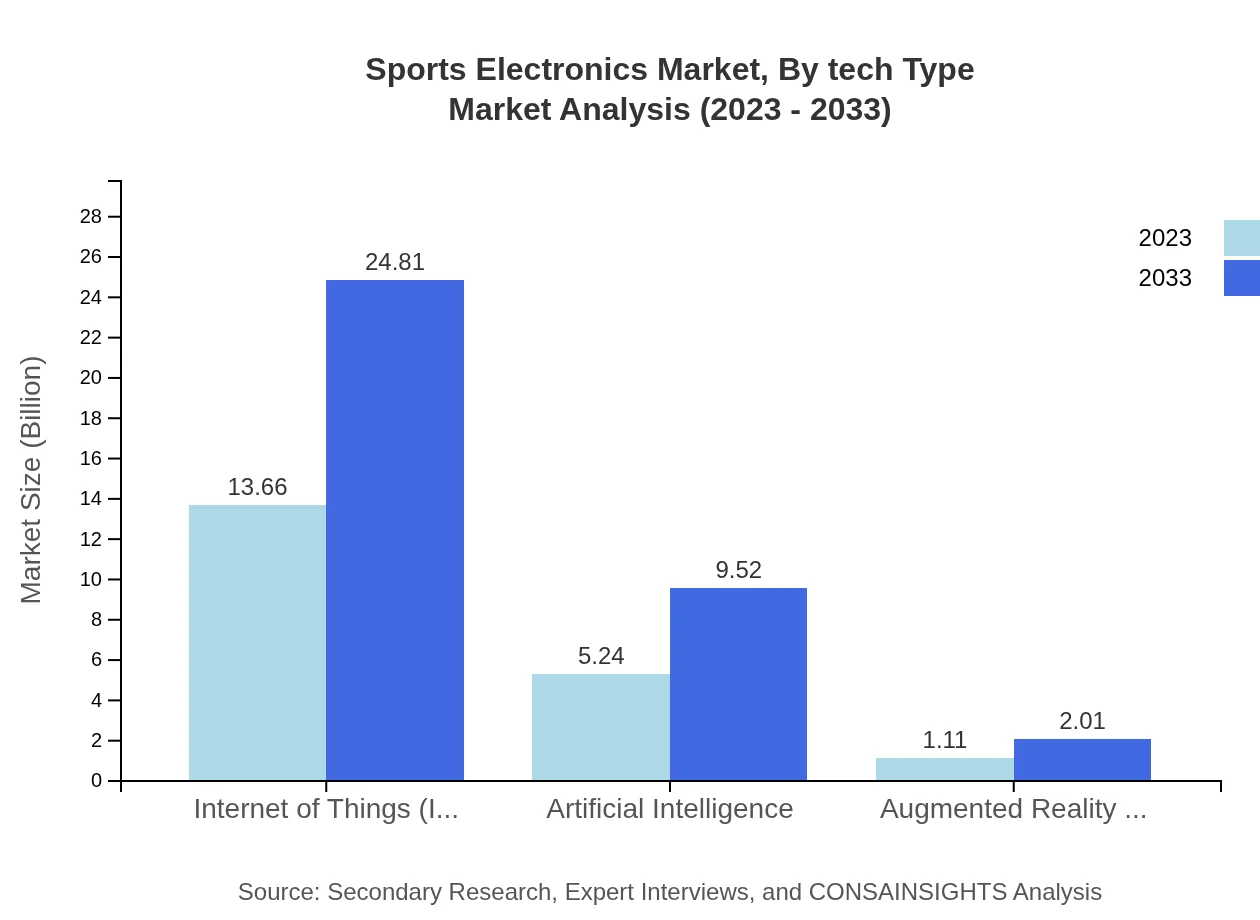

In 2023, the Sports Electronics market by product segment highlights wearable devices leading with a market size of $13.66 billion, predicted to reach $24.81 billion by 2033. Sports equipment follows with a size of $5.24 billion in 2023 and forecasted to grow to $9.52 billion, while accessories are expected to grow from $1.11 billion to $2.01 billion. This illustrates the heavy focus on health-oriented technology aligned with personal fitness goals.

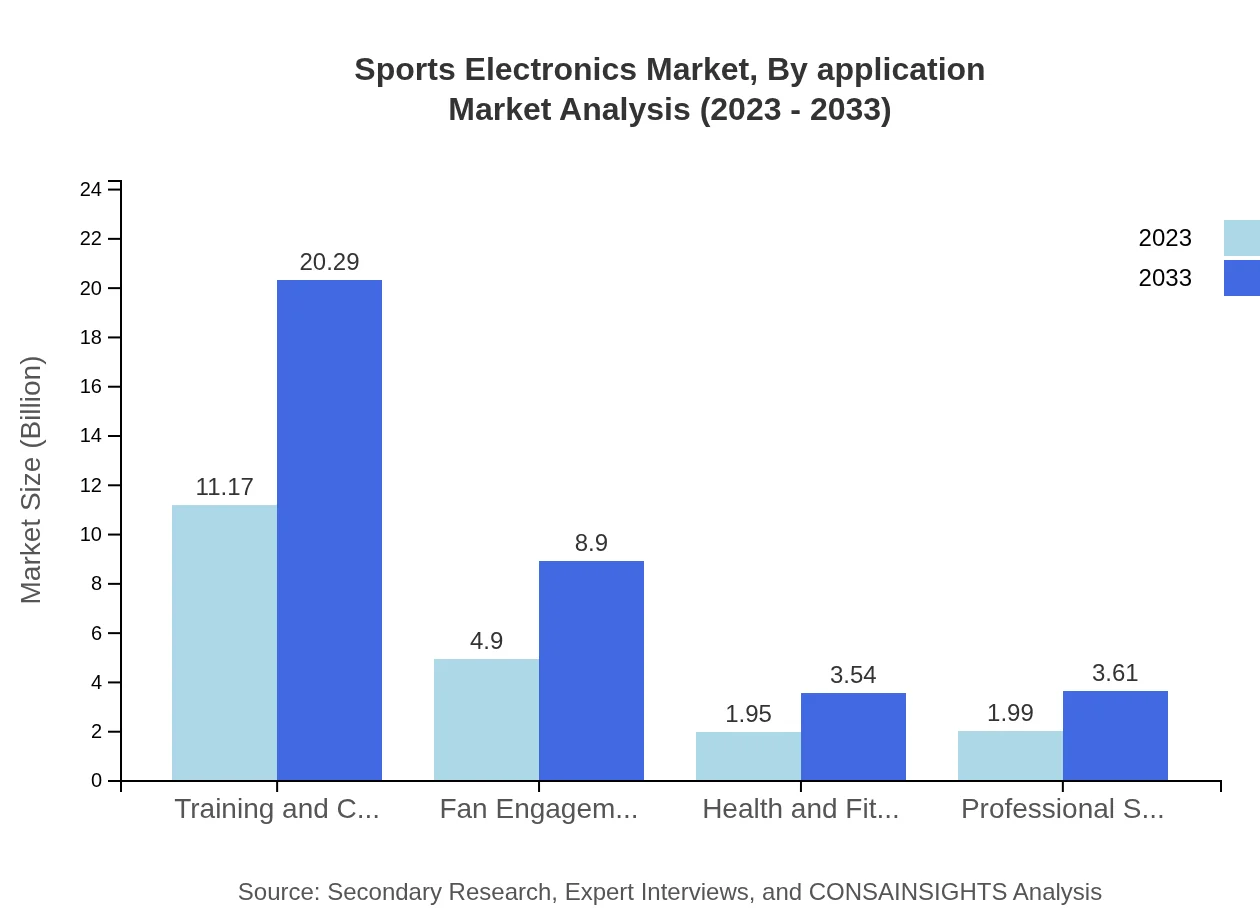

Sports Electronics Market Analysis By Application

The market segmentation by application indicates a significant tilt towards individual athletes, with a market size of $11.17 billion in 2023 – expanding to $20.29 billion by 2033. Coaches and teams represent another substantial segment, expected to grow from $4.90 billion to $8.90 billion. The rising trend of personalized training and coaching tools aligns with these growth patterns.

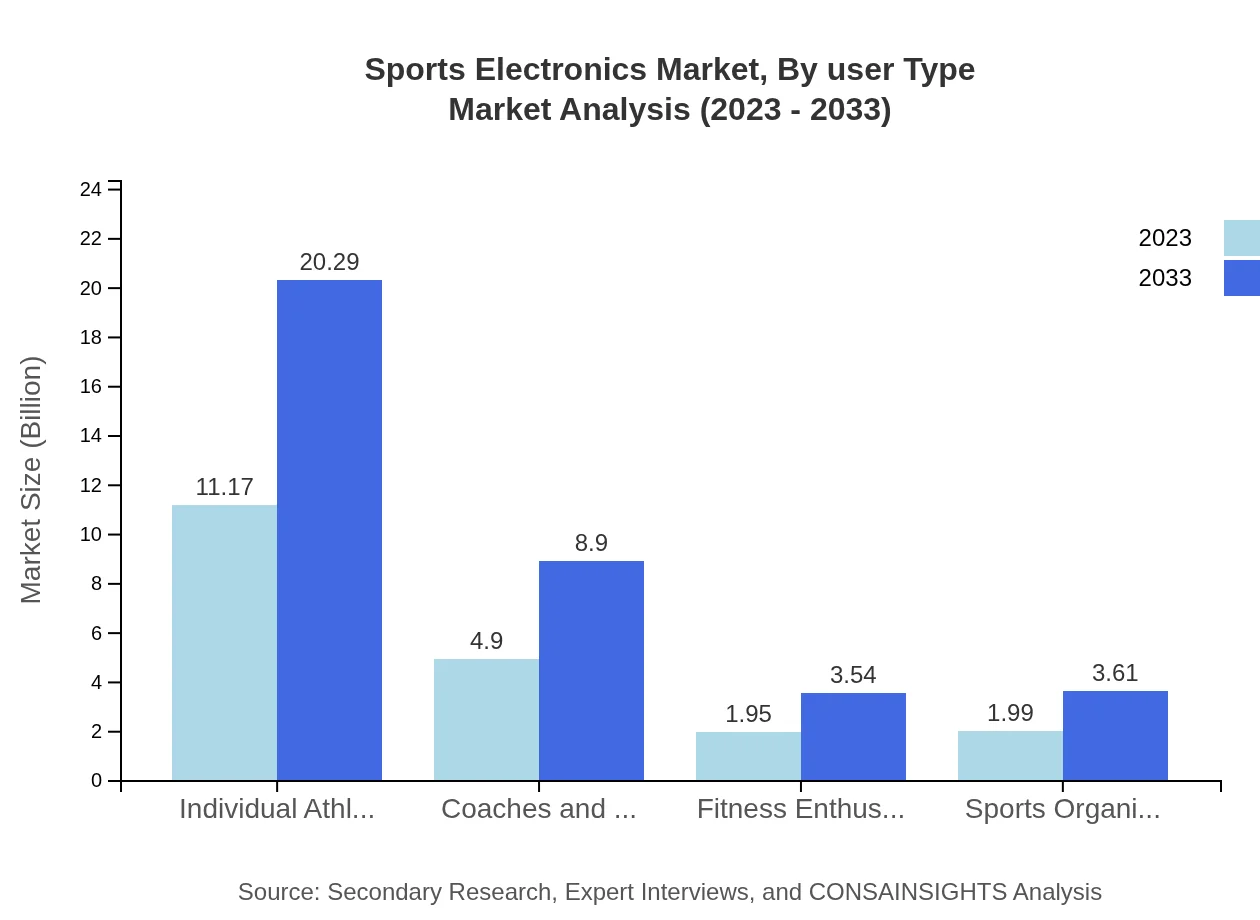

Sports Electronics Market Analysis By User Type

The user-type segmentation reinforces the robust demand from individual athletes at $11.17 billion in 2023, reflecting a 55.84% market share, sustained up to 2033. Coaches and teams, alongside fitness enthusiasts, also illustrate significant shares, suggesting that personalized experiences and targeted performance insights are key across user types.

Sports Electronics Market Analysis By Tech Type

With IoT technologies dominating at 68.28% market share, worth $13.66 billion in 2023, the segment is predicted to grow significantly in tandem with AI and AR/VR technologies, which are growing influences in enhancing training and fan engagement experience. The rapid advancement in technology coupled with consumer demand for interactive experiences bolsters growth in this segment.

Sports Electronics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Sports Electronics Industry

Nike, Inc.:

A leading sportswear manufacturer, NIKE has pioneered in wearable technology, offering smart shoes and fitness trackers that enhance athletic performance.Adidas AG:

With a focus on innovation, Adidas integrates advanced technology in products like smart clothing and connected sports equipment, driving engagement in fitness activities.Fitbit (Google LLC):

A major player in the wearable device market, Fitbit specializes in health and fitness tracking technology offering comprehensive solutions for personal fitness management.Garmin Ltd.:

Known for GPS technology, Garmin excels in sports watches and fitness trackers, enhancing athlete training through precise data analytics.Apple Inc.:

Apple's integration of fitness technologies into its devices, notably the Apple Watch, has positioned it as a significant player in the sports electronics sector.We're grateful to work with incredible clients.

FAQs

What is the market size of sports Electronics?

The sports-electronics market is valued at approximately $20 billion in 2023, with a projected compound annual growth rate (CAGR) of 6% from 2023 to 2033. This growth indicates a significant expansion in the sector over the decade.

What are the key market players or companies in this sports Electronics industry?

In the sports-electronics industry, key players include major brands like Apple, Fitbit, Garmin, Adidas, and Under Armour. These companies lead in innovation, developing products that enhance both athletic performance and consumer engagement.

What are the primary factors driving the growth in the sports Electronics industry?

Key factors driving growth in the sports-electronics sector include increasing health awareness among consumers, the rise in wearable technology adoption, and advancements in IoT and AI that boost product functionalities and user engagement.

Which region is the fastest Growing in the sports Electronics?

The fastest-growing region in the sports-electronics market is North America, with a market size projected to increase from $7.53 billion in 2023 to $13.68 billion by 2033, reflecting significant consumer interest and technological advancements.

Does ConsaInsights provide customized market report data for the sports Electronics industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the sports-electronics industry, providing insights that align with unique business goals and market conditions.

What deliverables can I expect from this sports Electronics market research project?

Deliverables from the sports-electronics market research project may include detailed market analysis, projections by region and segments, competitor analysis, and strategic recommendations tailored to enhance market positioning.

What are the market trends of sports Electronics?

Trends in the sports-electronics market include the integration of AI and IoT technologies, growing consumer interest in health-monitoring wearables, and increasing investments in training and coaching technologies by both individual athletes and sports organizations.