Sputter Coater Market Report

Published Date: 22 January 2026 | Report Code: sputter-coater

Sputter Coater Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Sputter Coater market from 2023 to 2033, highlighting market size, growth rates, industry dynamics, technological advancements, and key players shaping the industry landscape.

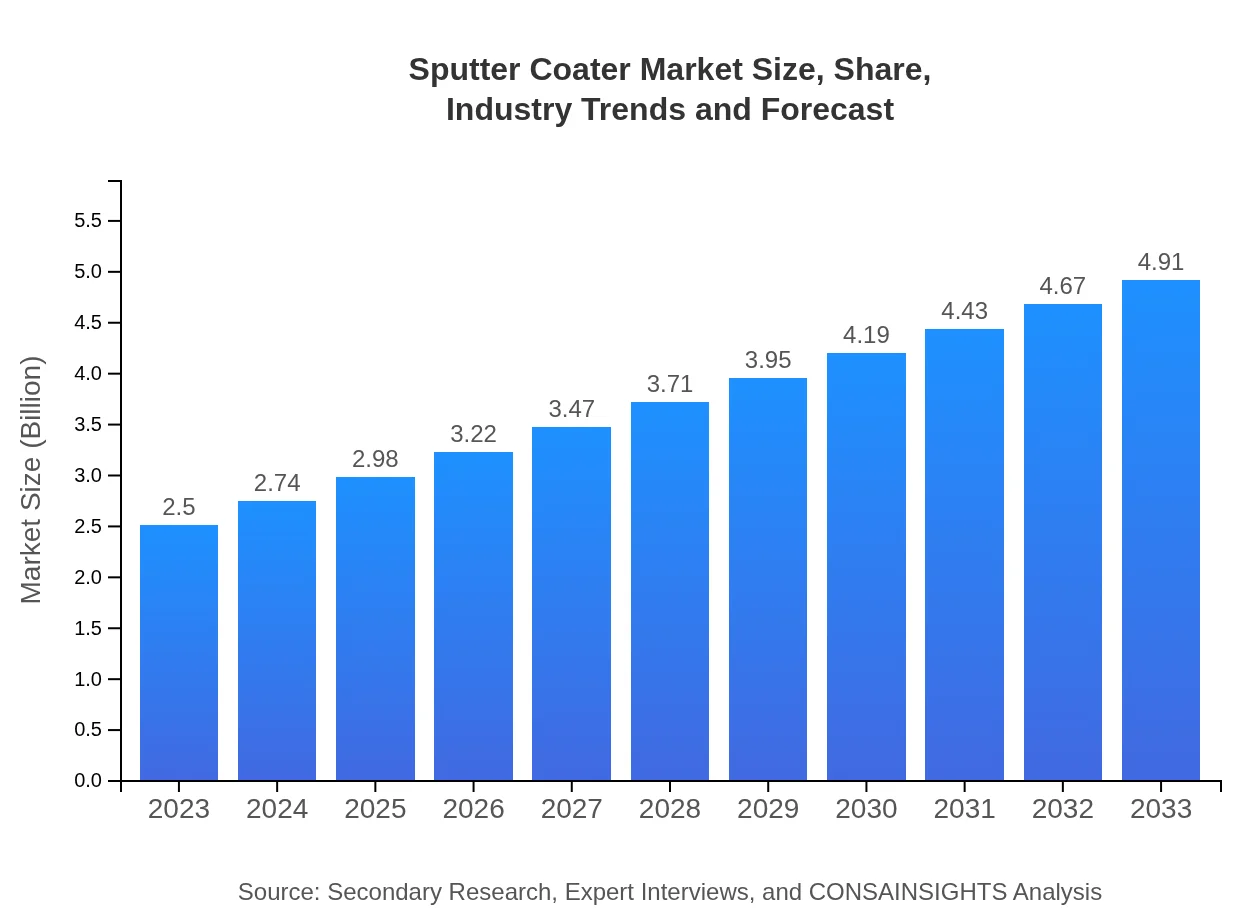

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $4.91 Billion |

| Top Companies | Ulvac, Inc., Veeco Instruments Inc., AJA International, Sputter Tech |

| Last Modified Date | 22 January 2026 |

Sputter Coater Market Overview

Customize Sputter Coater Market Report market research report

- ✔ Get in-depth analysis of Sputter Coater market size, growth, and forecasts.

- ✔ Understand Sputter Coater's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Sputter Coater

What is the Market Size & CAGR of Sputter Coater market in 2023?

Sputter Coater Industry Analysis

Sputter Coater Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Sputter Coater Market Analysis Report by Region

Europe Sputter Coater Market Report:

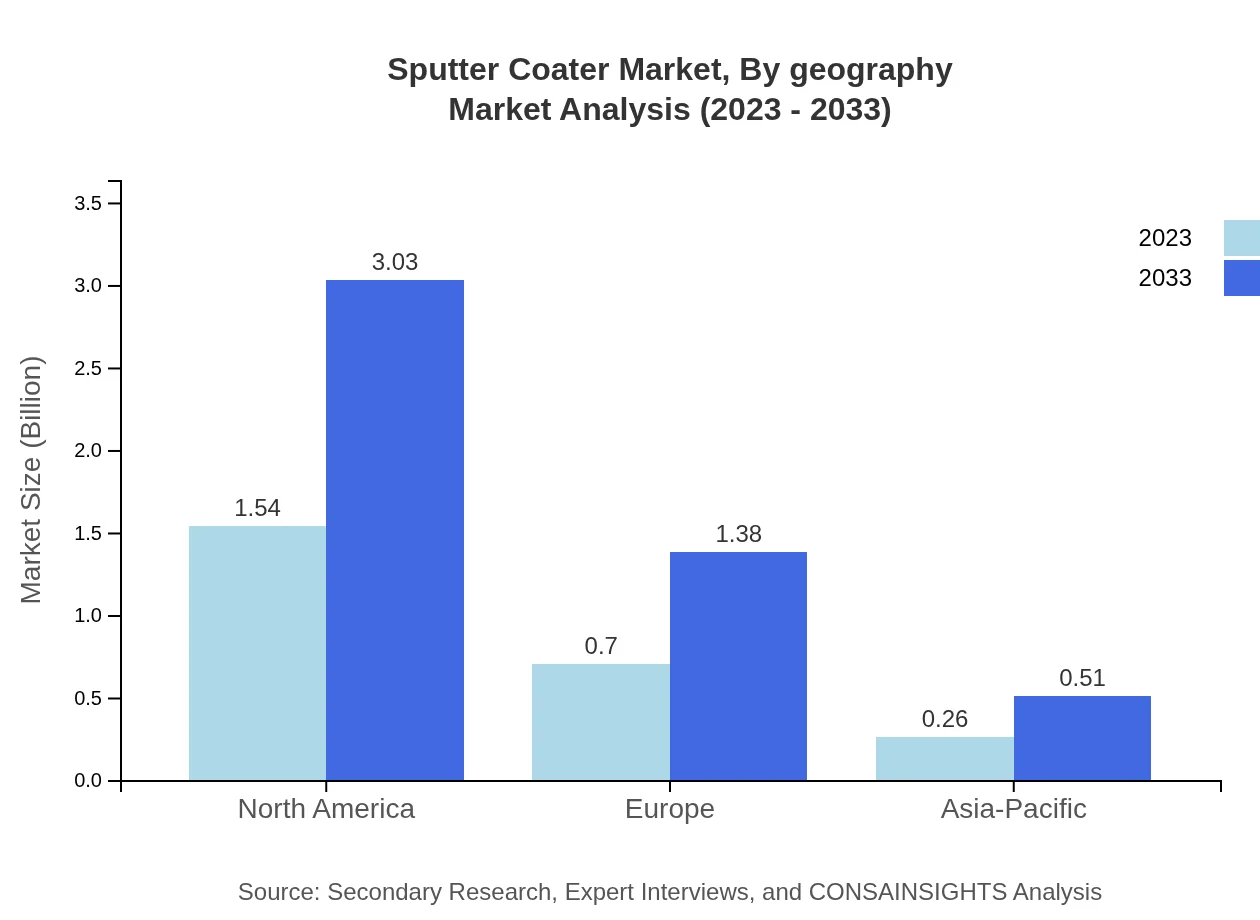

The European market is set to grow from 0.77 in 2023 to 1.51 in 2033, with emphasis on sustainable manufacturing and advanced technology adoption in various industrial sectors.Asia Pacific Sputter Coater Market Report:

The Asia Pacific region is anticipated to witness substantial growth from 0.46 in 2023 to 0.90 by 2033, driven by rising manufacturing activities in electronics and automotive sectors.North America Sputter Coater Market Report:

North America represents a strong market for Sputter Coaters, with a size increasing from 0.92 in 2023 to 1.80 in 2033, fueled by innovation in electronics manufacturing and aerospace applications.South America Sputter Coater Market Report:

In South America, the market is expected to grow from 0.12 in 2023 to 0.25 in 2033, reflecting increasing investment in technological advancements and manufacturing capabilities.Middle East & Africa Sputter Coater Market Report:

The Middle East and Africa region is expected to grow from 0.24 in 2023 to 0.46 in 2033, driven by increasing investments in electronics and automotive sectors in the region.Tell us your focus area and get a customized research report.

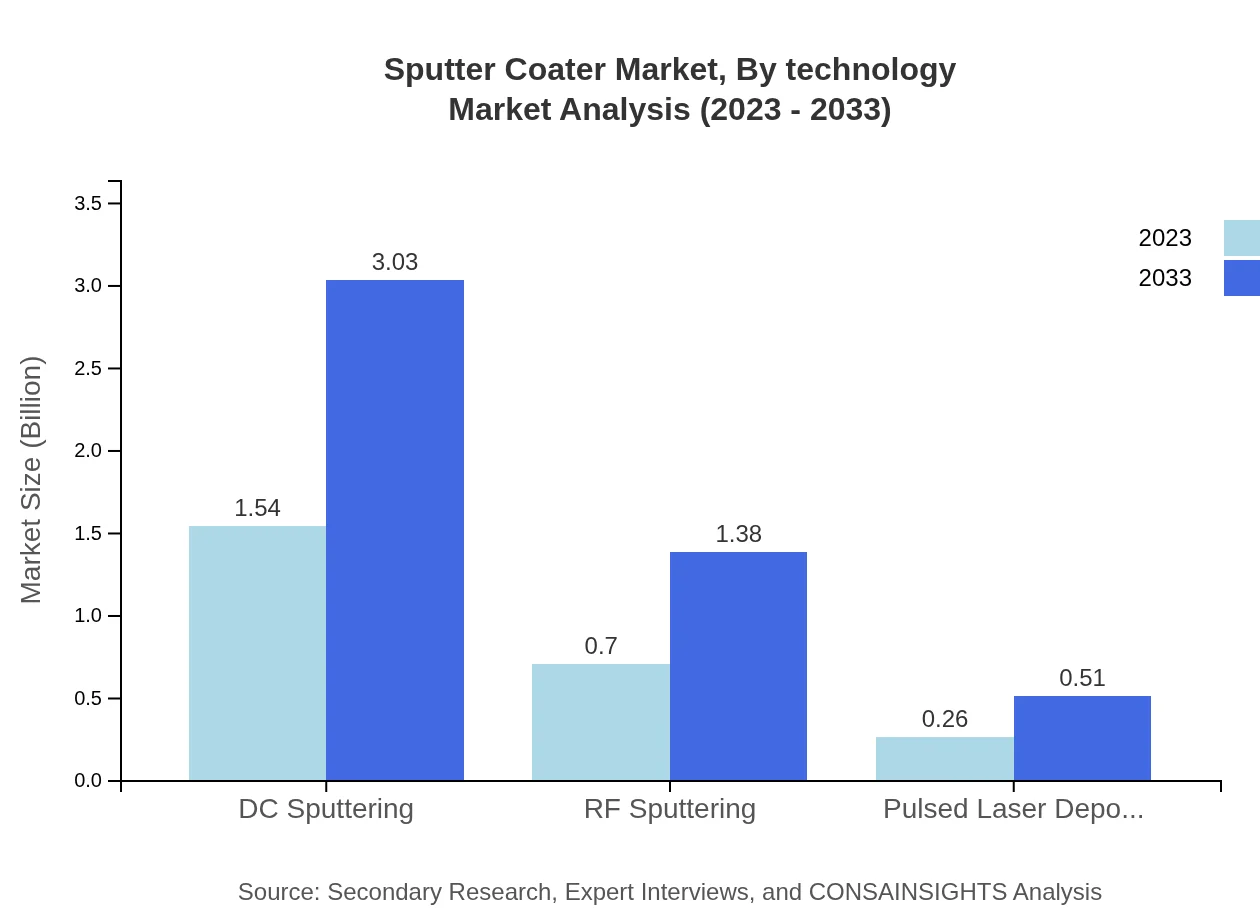

Sputter Coater Market Analysis By Technology

The technological segment includes DC Sputtering, RF Sputtering, and Pulsed Laser Deposition. DC Sputtering dominates the market owing to its efficiency and flexibility across applications. RF Sputtering is gaining traction in thin-film applications, while Pulsed Laser Deposition is emerging for high-quality films in specialized applications.

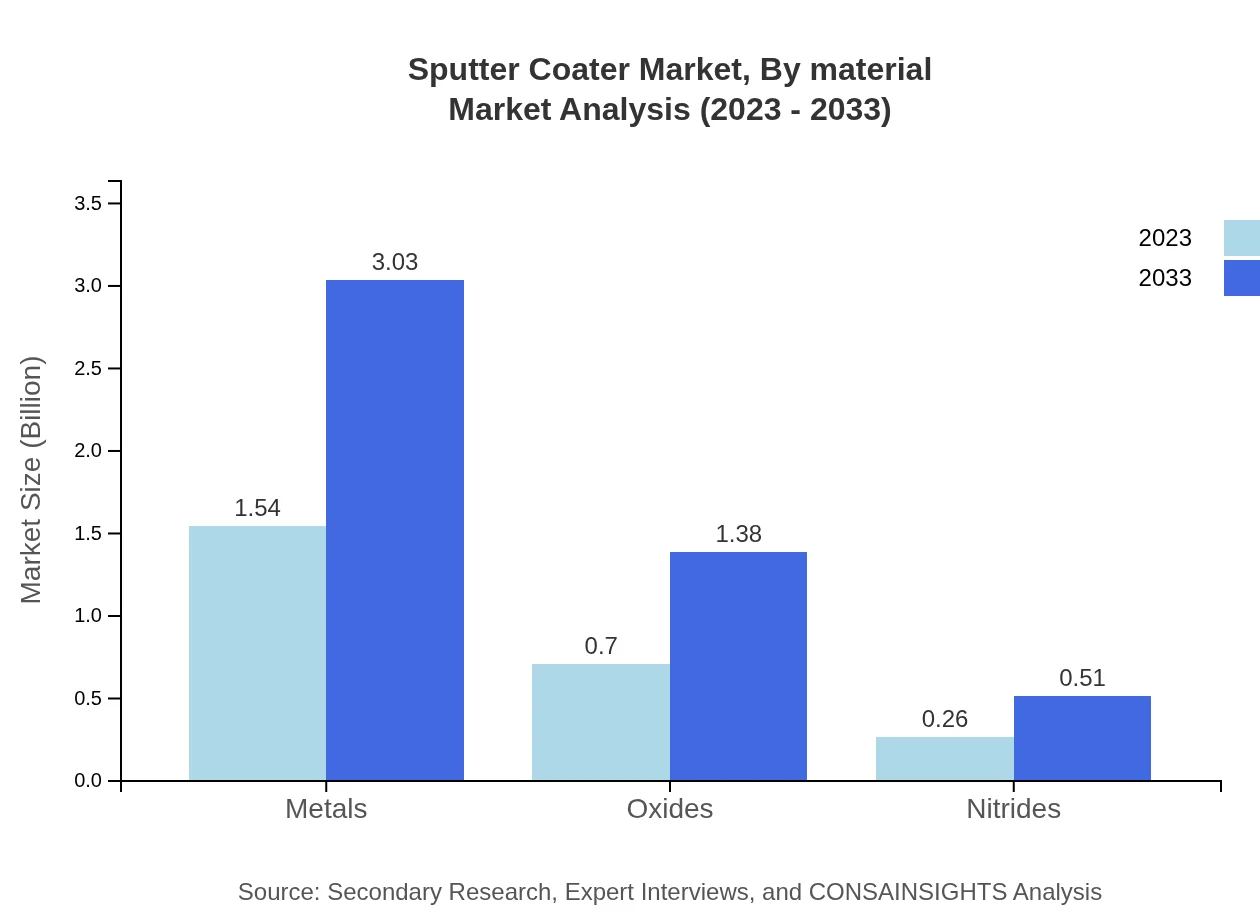

Sputter Coater Market Analysis By Material

Metals remain the leading material segment, with a market size of 1.54 anticipated to grow significantly. Oxides and nitrides are also crucial, with rising demand in optics and electronics driving their growth. The continuous evolution in materials science is expected to open new avenues for the market.

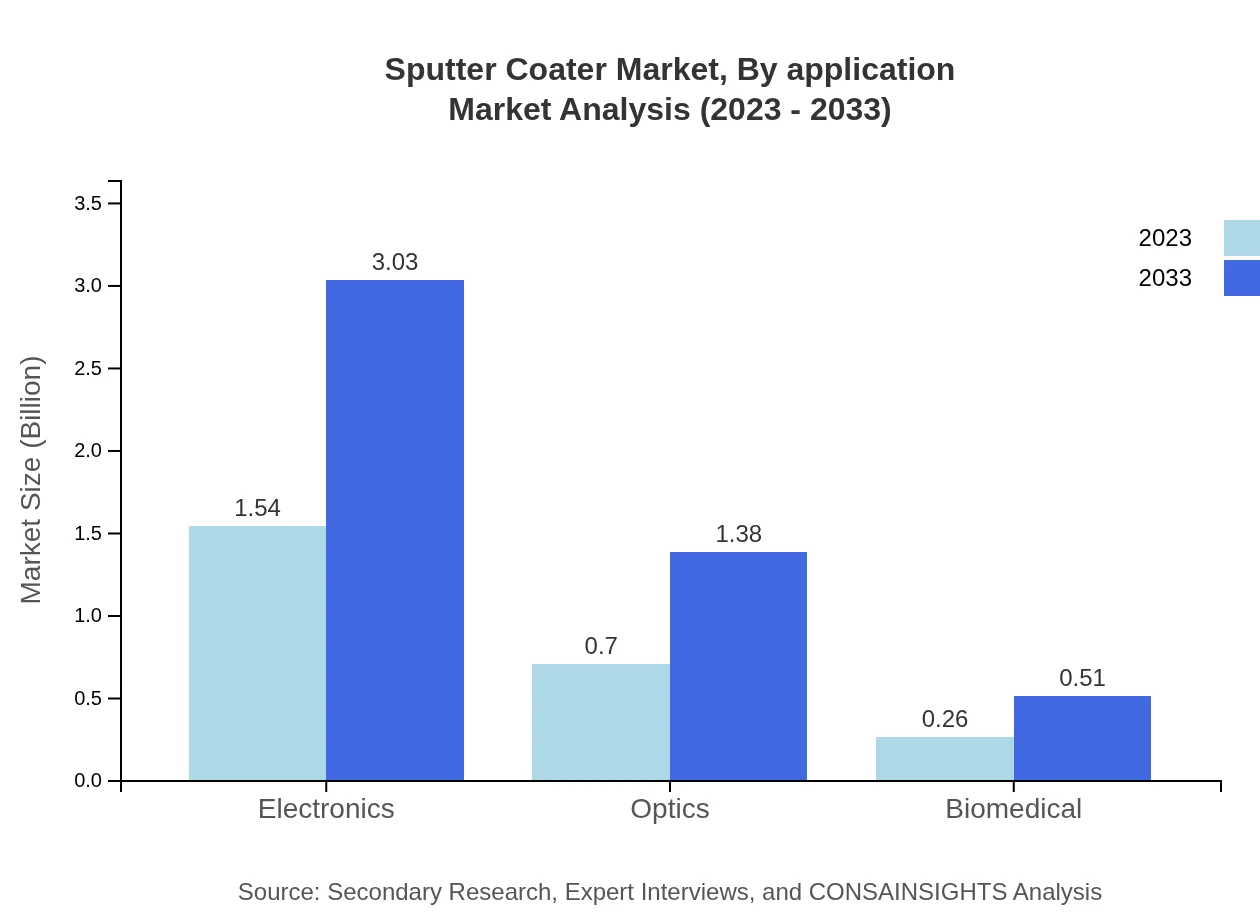

Sputter Coater Market Analysis By Application

Applications in electronics lead the market, with a size of 1.54 in 2023 growing significantly by 2033. The aerospace and automotive sectors follow, indicating diversified growth trends based on technological advancements in these industries.

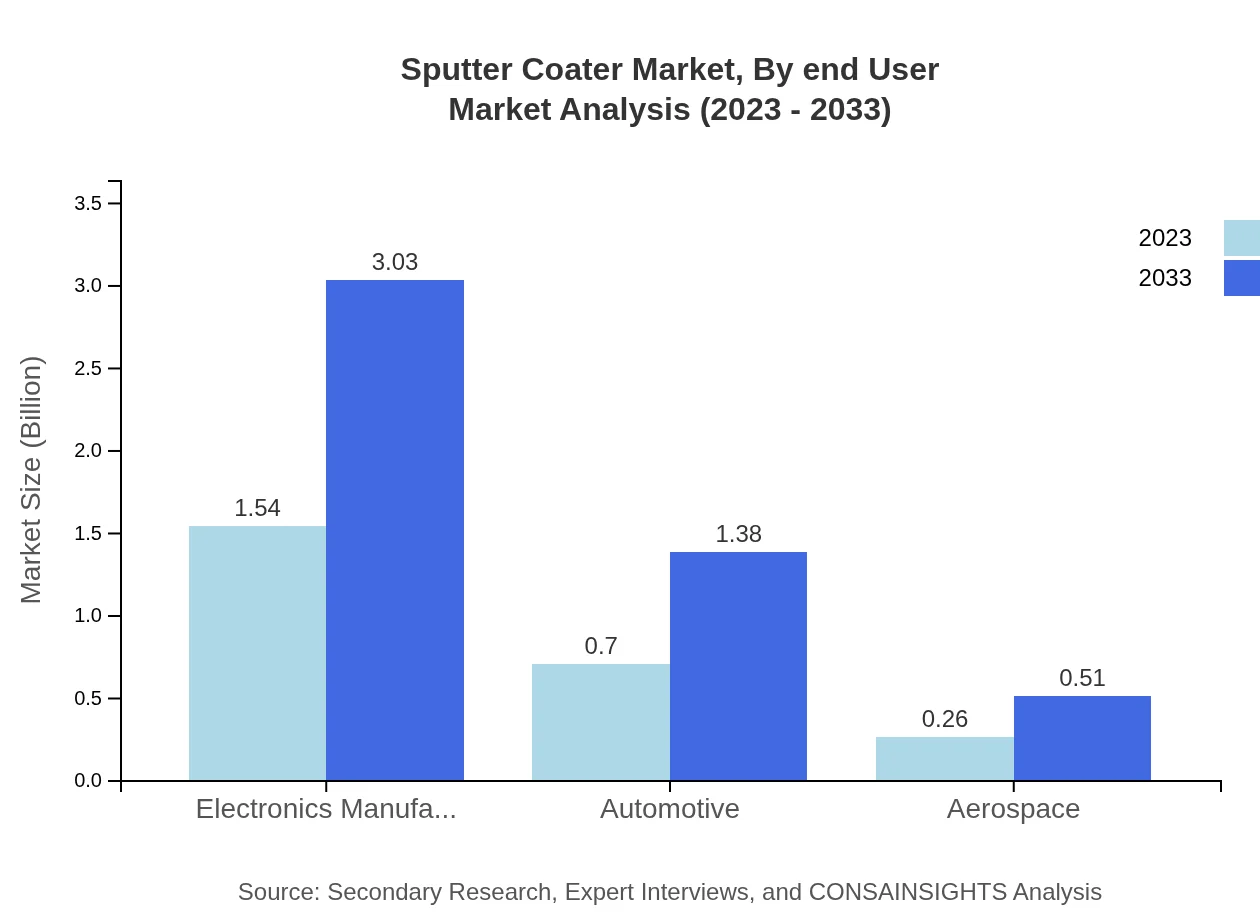

Sputter Coater Market Analysis By End User

The electronics industry constitutes the largest share, reflecting 61.65% in 2023, followed by automotive and aerospace sectors, indicating the technology's indispensable role across many fields.

Sputter Coater Market Analysis By Geography

Geographic analysis reveals North America and Europe as leading markets, with robust growth in Asia-Pacific, highlighting varying regional demands and the presence of major manufacturing hubs.

Sputter Coater Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Sputter Coater Industry

Ulvac, Inc.:

Ulvac specializes in vacuum technology and offers advanced sputter coating solutions used in various industries, including electronics and semiconductors.Veeco Instruments Inc.:

Veeco provides innovative deposition and etch solutions for the semiconductor and data storage industries, making significant contributions to sputter coating technology.AJA International:

AJA International is known for its high-quality sputter coaters that cater to research, semiconductor, and optics applications.Sputter Tech:

Sputter Tech offers a range of customizable sputtering systems, focusing on performance and reliability for both industrial and research applications.We're grateful to work with incredible clients.

FAQs

What is the market size of sputter Coater?

The global sputter coater market is currently valued at approximately $2.5 billion as of 2023, with an expected compound annual growth rate (CAGR) of 6.8%. This growth reflects increasing demand across various sectors such as electronics and automotive.

What are the key market players or companies in the sputter Coater industry?

Major players in the sputter coater market include companies like AJA International, Denton Vacuum, and ULVAC. These firms are known for their innovative technologies and extensive product portfolios, positioning them strategically in the global market.

What are the primary factors driving the growth in the sputter Coater industry?

Key factors driving growth in the sputter coater market include advancements in electronics manufacturing, increasing demand for semiconductors, and the rising adoption of thin-film coatings in various industries. These elements collectively stimulate market expansion.

Which region is the fastest Growing in the sputter Coater market?

The Asia-Pacific region is currently the fastest-growing market for sputter coaters, projected to increase from $0.46 billion in 2023 to $0.90 billion by 2033, driven by booming electronics and technology sectors.

Does ConsaInsights provide customized market report data for the sputter Coater industry?

Yes, ConsaInsights offers customized market reports for the sputter-coater industry, allowing clients to access tailored insights based on specific needs, market segments, or regional trends to enhance decision-making processes.

What deliverables can I expect from this sputter Coater market research project?

Deliverables typically include comprehensive market analysis reports, segmentation data, competitive landscape assessments, and region-specific growth projections, providing actionable insights for strategic planning and investment.

What are the market trends of sputter Coater?

Current market trends include the rise of advanced sputtering technologies, increasing investment in clean energy applications, and growing demand for nanotechnology products, which collectively drive innovation and enhance market dynamics.