Sputtering Equipment Cathode Market Report

Published Date: 31 January 2026 | Report Code: sputtering-equipment-cathode

Sputtering Equipment Cathode Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Sputtering Equipment Cathode market, covering current trends, market size forecasts, and regional insights from 2023 to 2033.

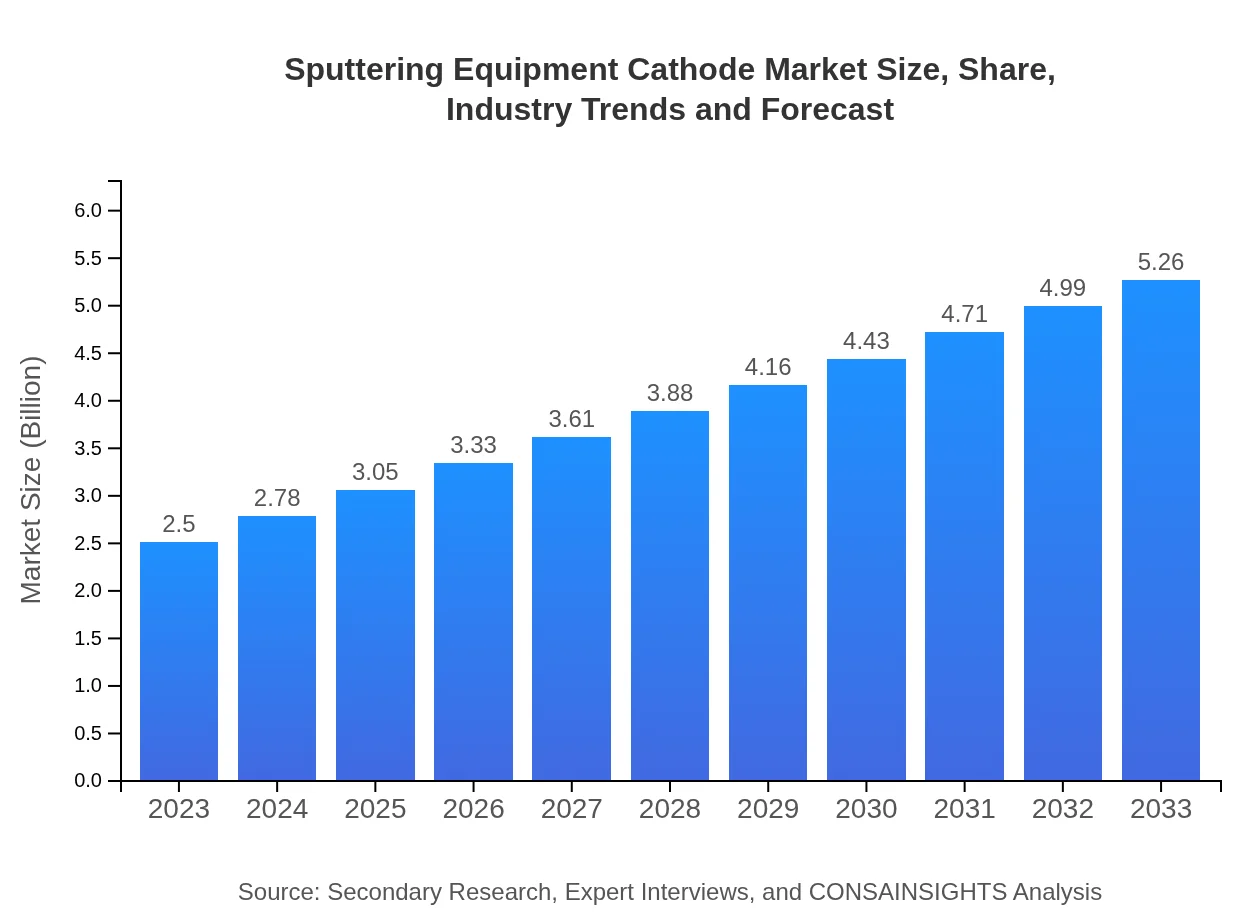

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 7.5% |

| 2033 Market Size | $5.26 Billion |

| Top Companies | Applied Materials, Inc., Tokyo Electron Limited, Veeco Instruments Inc. |

| Last Modified Date | 31 January 2026 |

Sputtering Equipment Cathode Market Overview

Customize Sputtering Equipment Cathode Market Report market research report

- ✔ Get in-depth analysis of Sputtering Equipment Cathode market size, growth, and forecasts.

- ✔ Understand Sputtering Equipment Cathode's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Sputtering Equipment Cathode

What is the Market Size & CAGR of Sputtering Equipment Cathode market in 2023?

Sputtering Equipment Cathode Industry Analysis

Sputtering Equipment Cathode Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Sputtering Equipment Cathode Market Analysis Report by Region

Europe Sputtering Equipment Cathode Market Report:

The European market for Sputtering Equipment Cathode is estimated at $0.64 billion in 2023 and is projected to reach $1.36 billion by 2033. Strong investments in renewable energy technologies and established semiconductor industries in Germany and France contribute to this growth.Asia Pacific Sputtering Equipment Cathode Market Report:

In 2023, the Asia Pacific region's market for Sputtering Equipment Cathode is valued at $0.53 billion and is expected to grow to $1.12 billion by 2033. This growth is driven by booming electronics production in countries like China, which remains a global manufacturing hub, alongside rising investments in semiconductor fabrication.North America Sputtering Equipment Cathode Market Report:

North America, with a 2023 market size of $0.92 billion, anticipates reaching $1.93 billion by 2033. The presence of major semiconductor manufacturers and advancements in aerospace and automotive sectors in the U.S. drive demand for sputtering equipment.South America Sputtering Equipment Cathode Market Report:

The South American market is relatively smaller, projected at $0.20 billion in 2023 with a growth forecast to $0.42 billion by 2033. Increasing smartphone adoption and emerging tech startups in Brazil and Argentina are expected to support market growth.Middle East & Africa Sputtering Equipment Cathode Market Report:

The Middle East and Africa region has a nascent market, valued at $0.21 billion in 2023 and expected to grow to $0.44 billion by 2033. The increasing focus on technological adoption and the burgeoning electronics sector in the UAE and South Africa are fostering market growth.Tell us your focus area and get a customized research report.

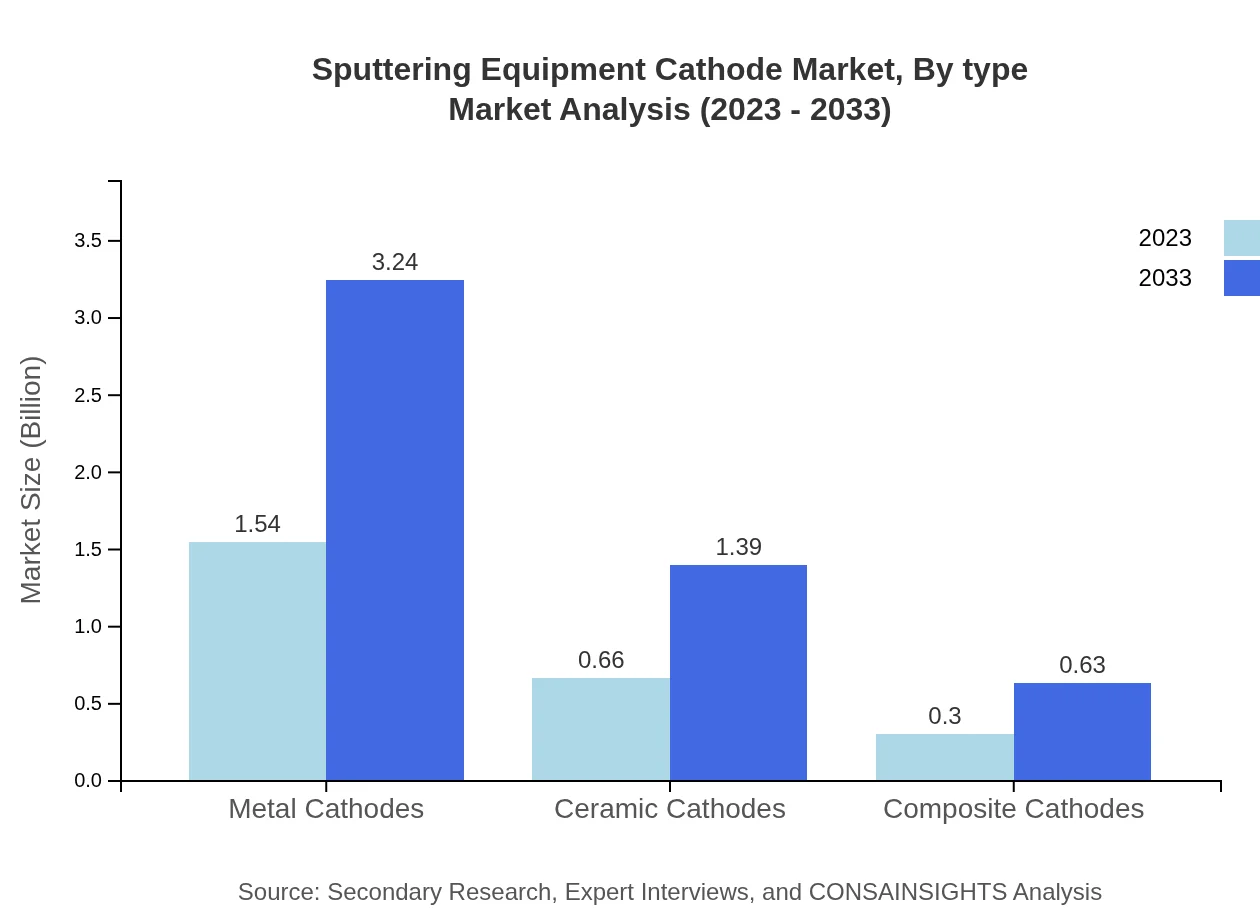

Sputtering Equipment Cathode Market Analysis By Type

The market can be classified into three primary types: Metal Cathodes, Ceramic Cathodes, and Composite Cathodes. Metal Cathodes dominate the market with a share of 61.56% in 2023, projected to increase to 61.56% by 2033, driven by their extensive use in semiconductor manufacturing, forecasted to grow from $1.54 billion to $3.24 billion. Ceramic Cathodes, accounting for 26.42% of the market, are expected to grow from $0.66 billion to $1.39 billion over the same period, influenced by their application in optics and electronics. Composite Cathodes, though smaller, are also expected to see growth from $0.30 billion to $0.63 billion, maintaining a 12.02% market share.

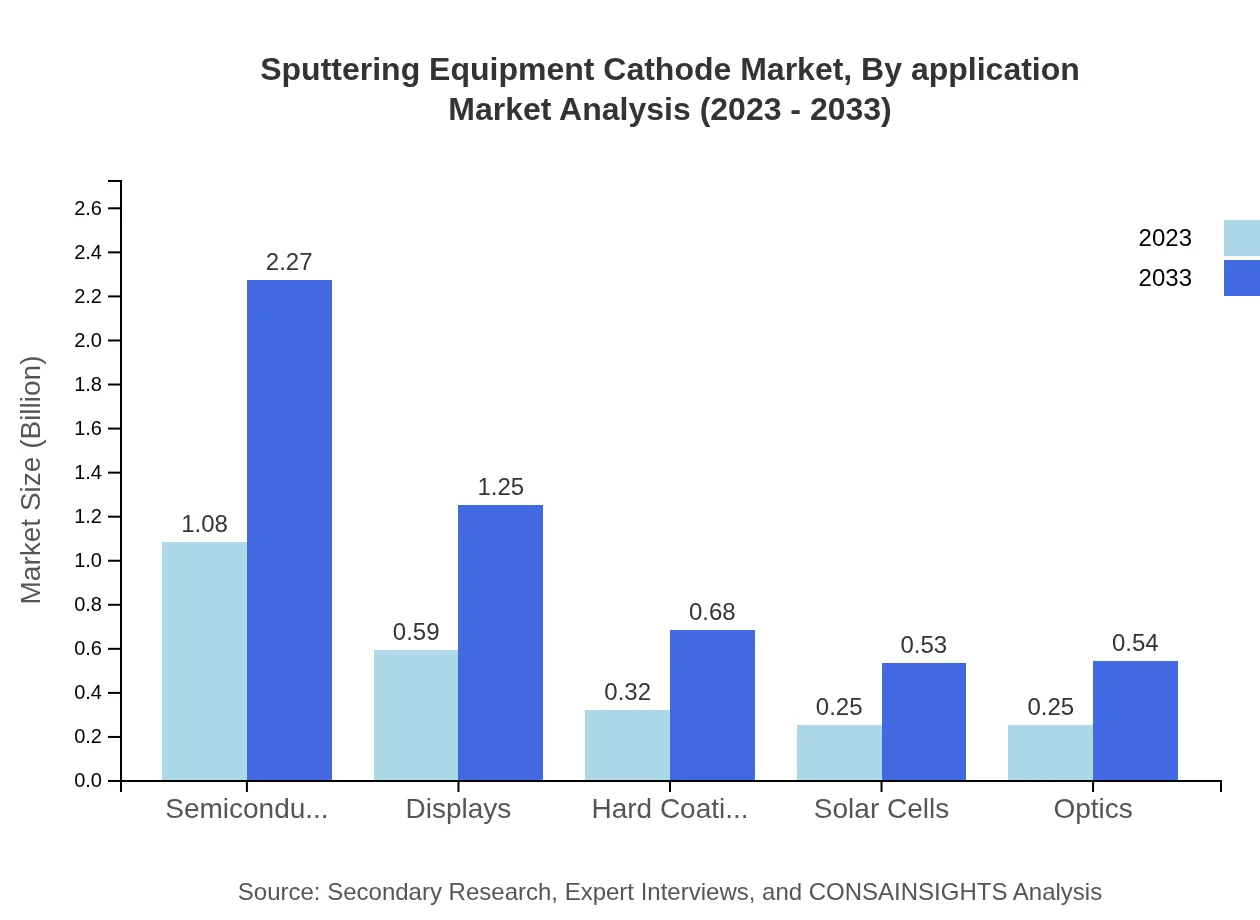

Sputtering Equipment Cathode Market Analysis By Application

Key applications of Sputtering Equipment Cathode include Semiconductors, Electronics, Automotive, Optical Coatings, and Renewable Energy. The Semiconductors sector leads with a market share of 43.17%, anticipated to grow from $1.08 billion to $2.27 billion. The Electronics application follows closely, expected to expand from $1.08 billion to $2.27 billion, also holding a significant portion of the market, representing a 43.17% share. Automotive and Aerospace, with shares of 23.75% and 12.89%, respectively, are also important sectors showing promising growth driven by innovations in electric vehicles and aerospace technologies.

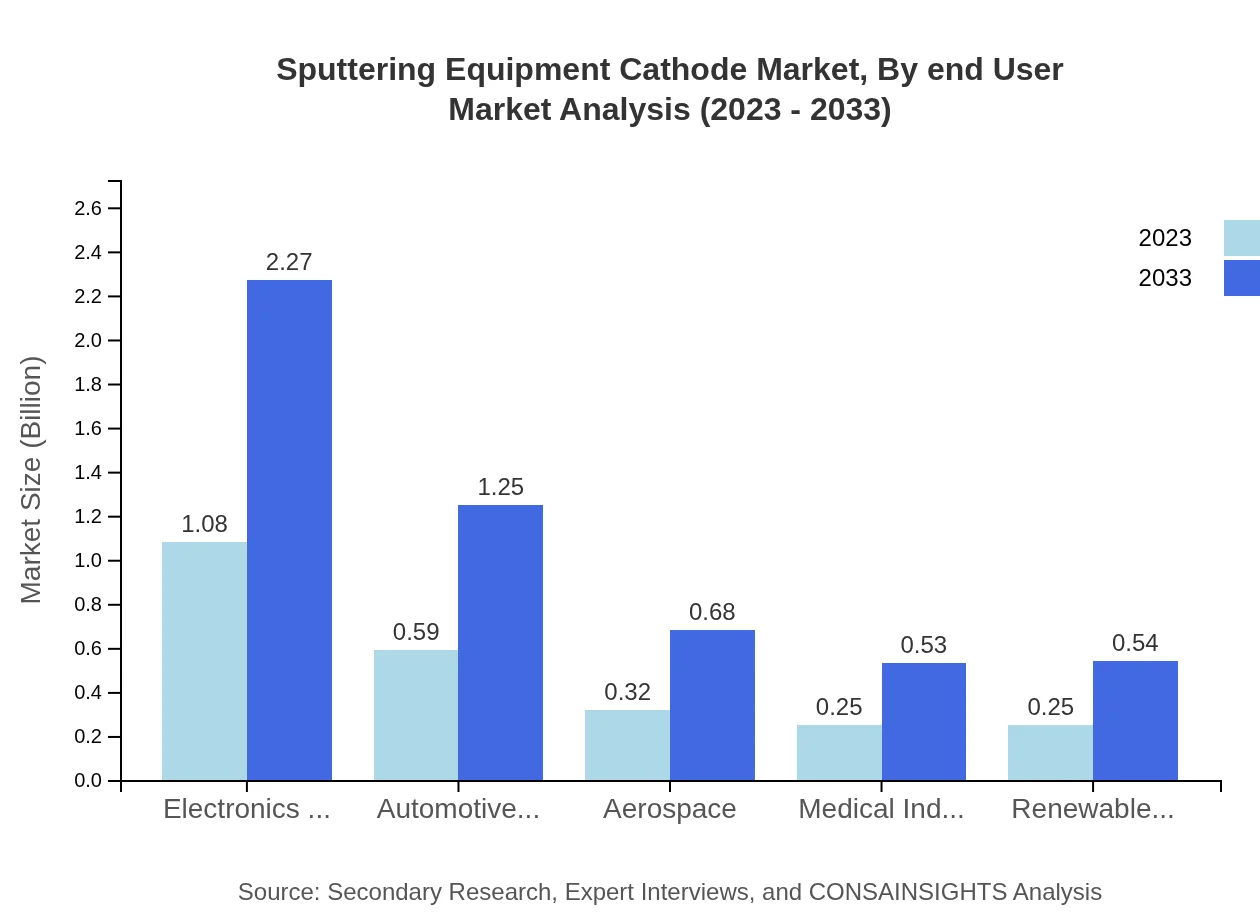

Sputtering Equipment Cathode Market Analysis By End User

End-users of sputtering equipment include Electronics Manufacturers, Automotive Industry, and Aerospace. The Electronics Manufacturers segment represents the largest share at 43.17%, projected to grow significantly, driven by demands from the consumer electronics and computing sectors. The Automotive segment, accounting for 23.75%, will see growth propelled by the rising trend of electric and autonomous vehicles demanding sophisticated coatings. The Aerospace sector, contributing 12.89%, continues to require advanced materials for efficiency and performance improvements.

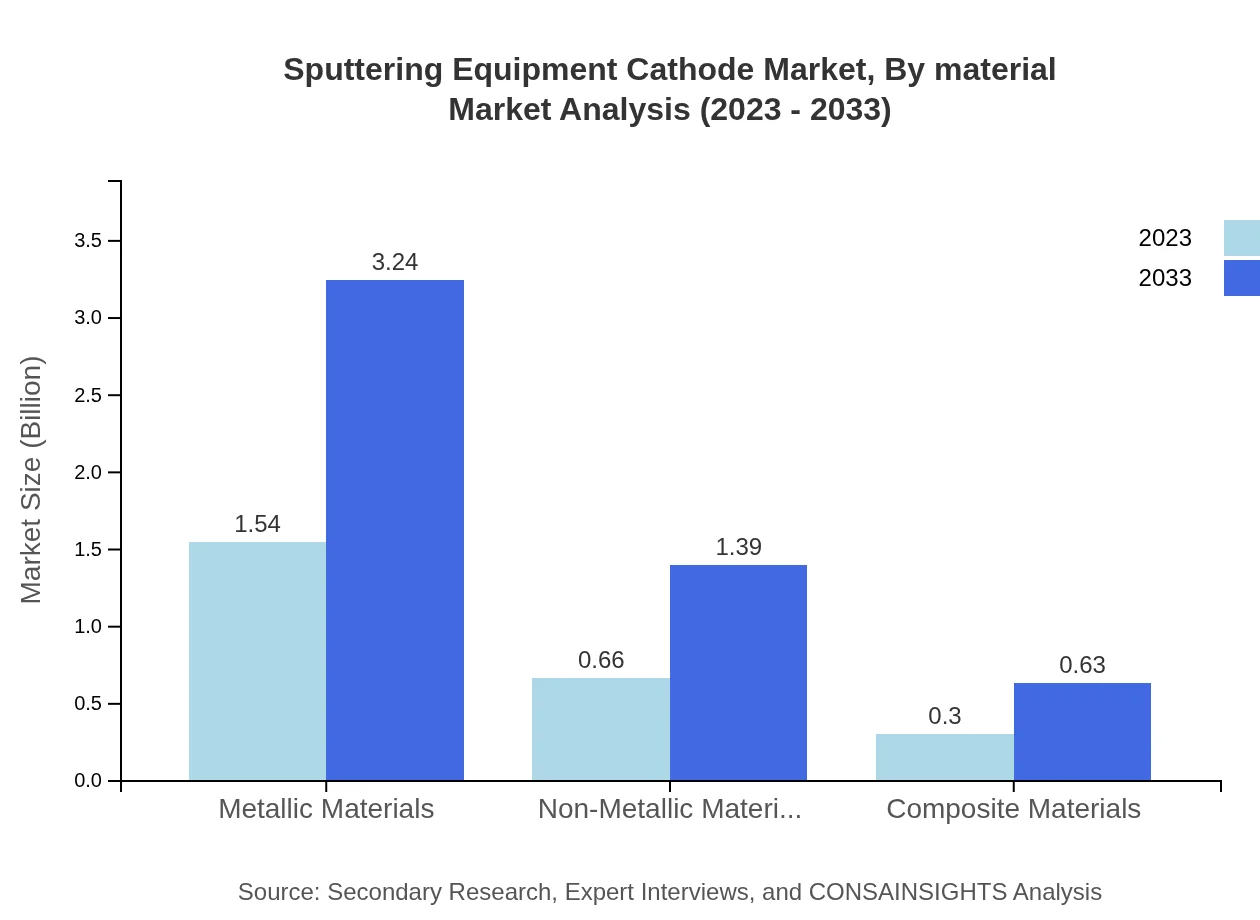

Sputtering Equipment Cathode Market Analysis By Material

The market can be divided based on materials utilized: Metallic Materials, Non-Metallic Materials, and Composite Materials. Metallic Materials dominate with a market share of 61.56%, which is growing from $1.54 billion to $3.24 billion. Non-Metallic Materials, holding a 26.42% share, are anticipated to expand from $0.66 billion to $1.39 billion, driven by their application in glass and fiber optics. Composite Materials represent 12.02% of the market with projected growth from $0.30 billion to $0.63 billion, being leveraged for unique properties in diverse applications.

Sputtering Equipment Cathode Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Sputtering Equipment Cathode Industry

Applied Materials, Inc.:

Applied Materials is a leading provider of equipment, services, and software to the semiconductor, flat panel display, and solar industries. The company plays a crucial role in developing advanced sputtering technologies.Tokyo Electron Limited:

Tokyo Electron is a global manufacturer that offers integrated semiconductor production equipment, including sputtering systems, significantly contributing to advancements in device fabrication.Veeco Instruments Inc.:

Veeco provides process equipment solutions for LED, solar, and consumer electronics manufacturing, focusing on innovation in sputtering technologies to enhance performance.We're grateful to work with incredible clients.

FAQs

What is the market size of sputtering Equipment Cathode?

The global sputtering equipment cathode market is projected to reach $2.5 billion by 2033, with a compound annual growth rate (CAGR) of 7.5% from 2023. This growth reflects the increasing demand across various industries for advanced sputtering technology.

What are the key market players or companies in this sputtering Equipment Cathode industry?

Key market players in the sputtering equipment cathode industry include established companies such as Applied Materials, Veeco Instruments, and Tokio Electron. These companies lead through innovation and strong customer relationships, significantly impacting market dynamics.

What are the primary factors driving the growth in the sputtering equipment cathode industry?

Growth in the sputtering equipment cathode industry is primarily driven by rising demand for semiconductor devices, advancements in nanotechnology, and increased applications in industries such as electronics, aerospace, and renewable energy, all requiring sophisticated coating technologies.

Which region is the fastest Growing in the sputtering equipment cathode?

The fastest-growing region in the sputtering equipment cathode market is Asia Pacific, projected to grow from $0.53 billion in 2023 to $1.12 billion by 2033, driven by surging semiconductor manufacturing and electronics production in countries like China and Japan.

Does ConsaInsights provide customized market report data for the sputtering equipment cathode industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the sputtering equipment cathode industry, allowing clients to gain insights based on unique parameters, ensuring effective strategic decision-making.

What deliverables can I expect from this sputtering equipment cathode market research project?

Deliverables from the sputtering equipment cathode market research project include detailed market analysis, forecasts, regional breakdowns, competitive landscapes, and strategic recommendations, providing a comprehensive view necessary for informed investment decisions.

What are the market trends of sputtering equipment cathode?

Market trends in the sputtering equipment cathode industry indicate a shift towards automation, the rise of eco-friendly materials, and increased focus on R&D for next-gen materials. The expansion of the semiconductor sector further solidifies the market's growth trajectory.