Sram And Rom Design Ip Market Report

Published Date: 31 January 2026 | Report Code: sram-and-rom-design-ip

Sram And Rom Design Ip Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Sram and Rom Design IP market, covering insights on market size, growth trends, and forecasts from 2023 to 2033. Key segments, technology advancements, and regional dynamics are explored to provide a holistic view of the industry landscape.

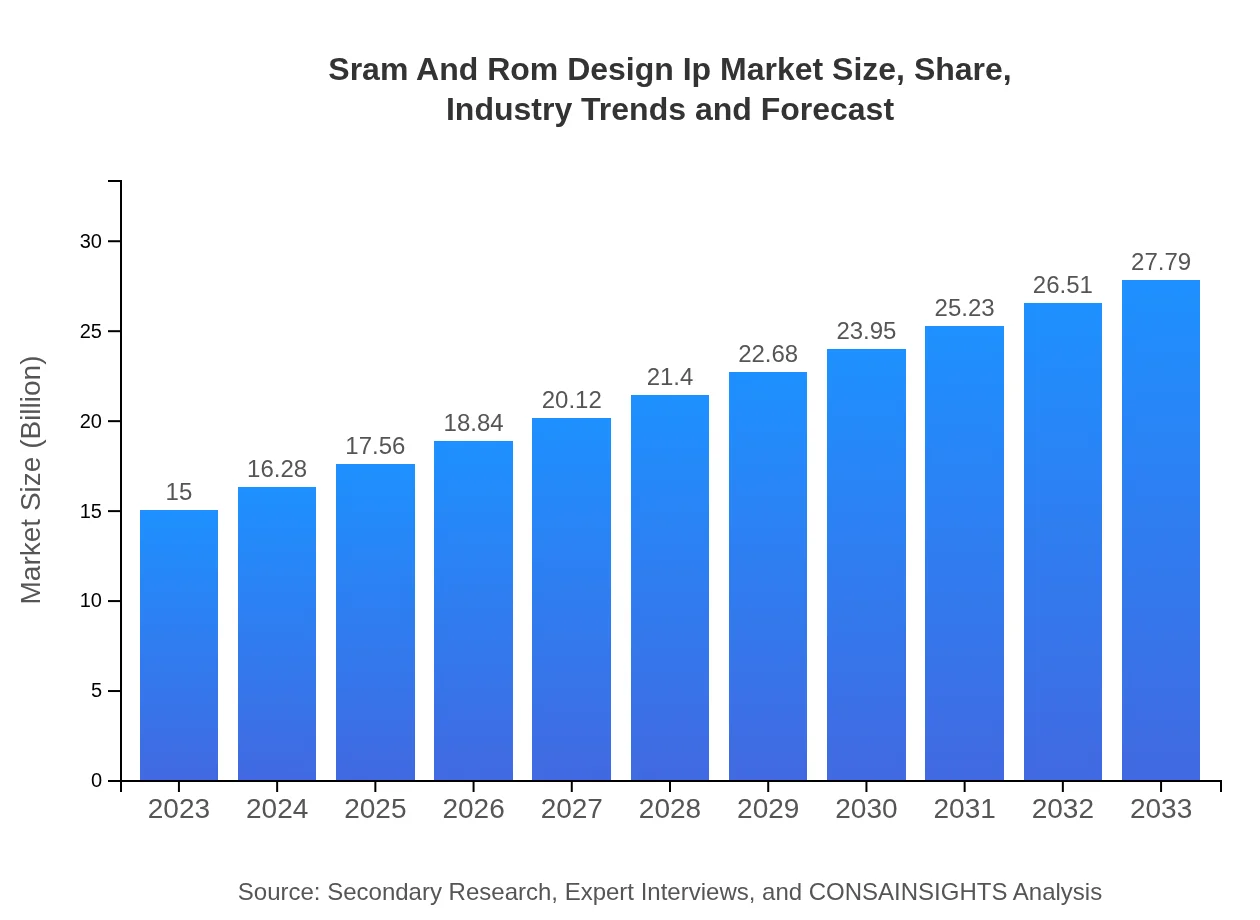

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.00 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $27.79 Billion |

| Top Companies | Synopsys, Inc., ARM Holdings, Cadence Design Systems, Imagination Technologies, GlobalFoundries |

| Last Modified Date | 31 January 2026 |

Sram And Rom Design Ip Market Overview

Customize Sram And Rom Design Ip Market Report market research report

- ✔ Get in-depth analysis of Sram And Rom Design Ip market size, growth, and forecasts.

- ✔ Understand Sram And Rom Design Ip's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Sram And Rom Design Ip

What is the Market Size & CAGR of Sram And Rom Design Ip market in 2023?

Sram And Rom Design Ip Industry Analysis

Sram And Rom Design Ip Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Sram And Rom Design Ip Market Analysis Report by Region

Europe Sram And Rom Design Ip Market Report:

Europe is expected to witness significant growth, reaching $7.35 billion by 2033. The region's focus on innovative technologies and smart devices is contributing to rising demand for efficient memory solutions.Asia Pacific Sram And Rom Design Ip Market Report:

The Asia Pacific region represents a robust market for Sram and Rom Design IP, with a projected market size of $5.55 billion by 2033, up from $3.00 billion in 2023. The rapid growth in electronics manufacturing and increasing adoption of advanced technologies in countries like China and Japan are pivotal drivers.North America Sram And Rom Design Ip Market Report:

North America, leading the global market with a size of $10.71 billion by 2033 (up from $5.78 billion), primarily due to its strong technological base and high adoption rates of advanced solutions in consumer electronics and automotive sectors.South America Sram And Rom Design Ip Market Report:

Market growth in South America is steady yet potential, with projections indicating a rise from $0.56 billion in 2023 to $1.04 billion in 2033. Enhancement in telecommunications and consumer electronics sectors are expected to drive demand for memory IP solutions in this region.Middle East & Africa Sram And Rom Design Ip Market Report:

The Middle East and Africa region shows promising growth prospects for Sram and Rom Design IP, with the market expected to grow from $1.69 billion in 2023 to $3.13 billion in 2033 as investments in the electronics sector increase.Tell us your focus area and get a customized research report.

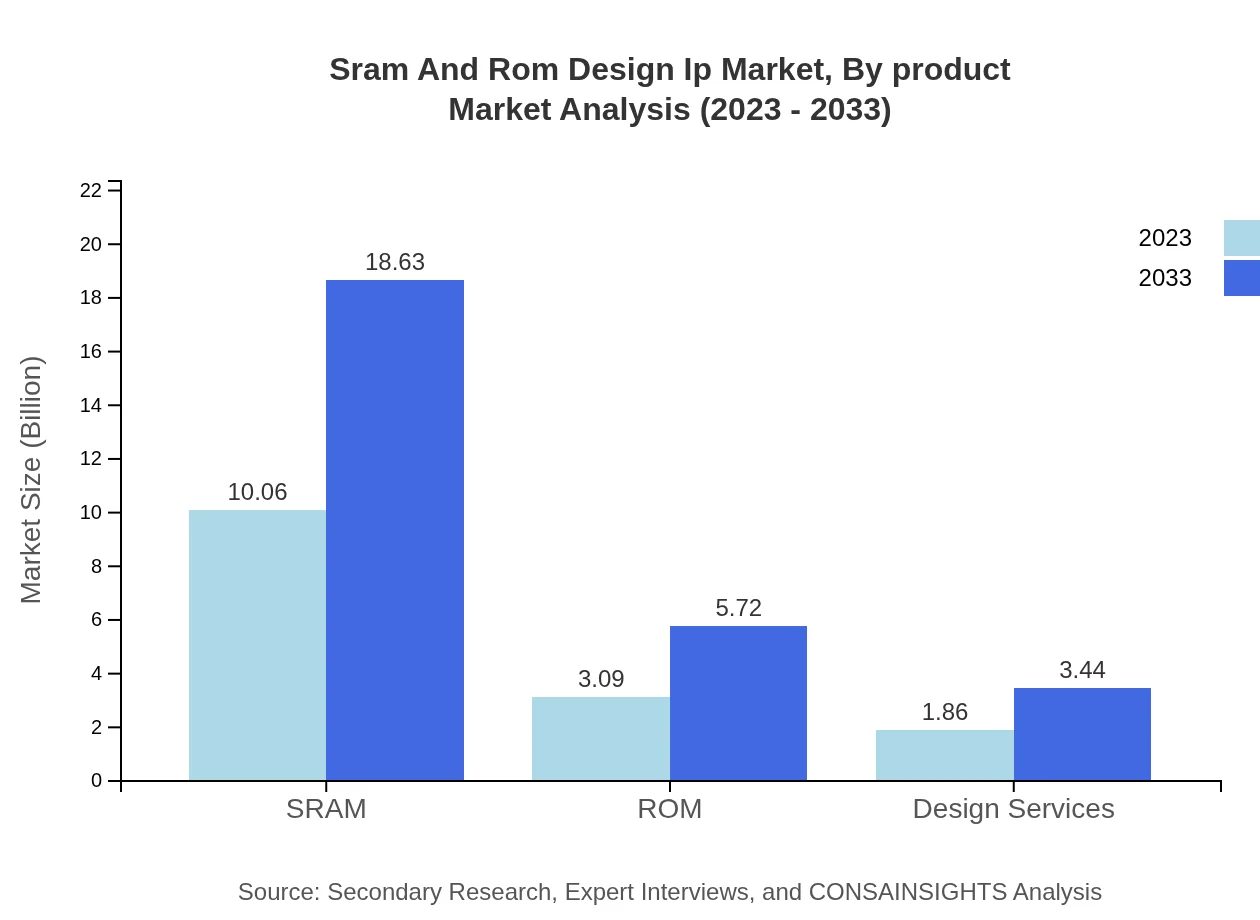

Sram And Rom Design Ip Market Analysis By Product

The SRAM segment dominates the market, with a valuation of $10.06 billion in 2023, projected to reach $18.63 billion by 2033, accounting for 67.05% of the total market share. The ROM segment, although smaller, is also significant, with a size of $3.09 billion in 2023 expected to grow to $5.72 billion by 2033. Design services, while representing a smaller segment currently at $1.86 billion, are forecasted to reach $3.44 billion within the same timeframe, indicating the growing need for specialized design solutions.

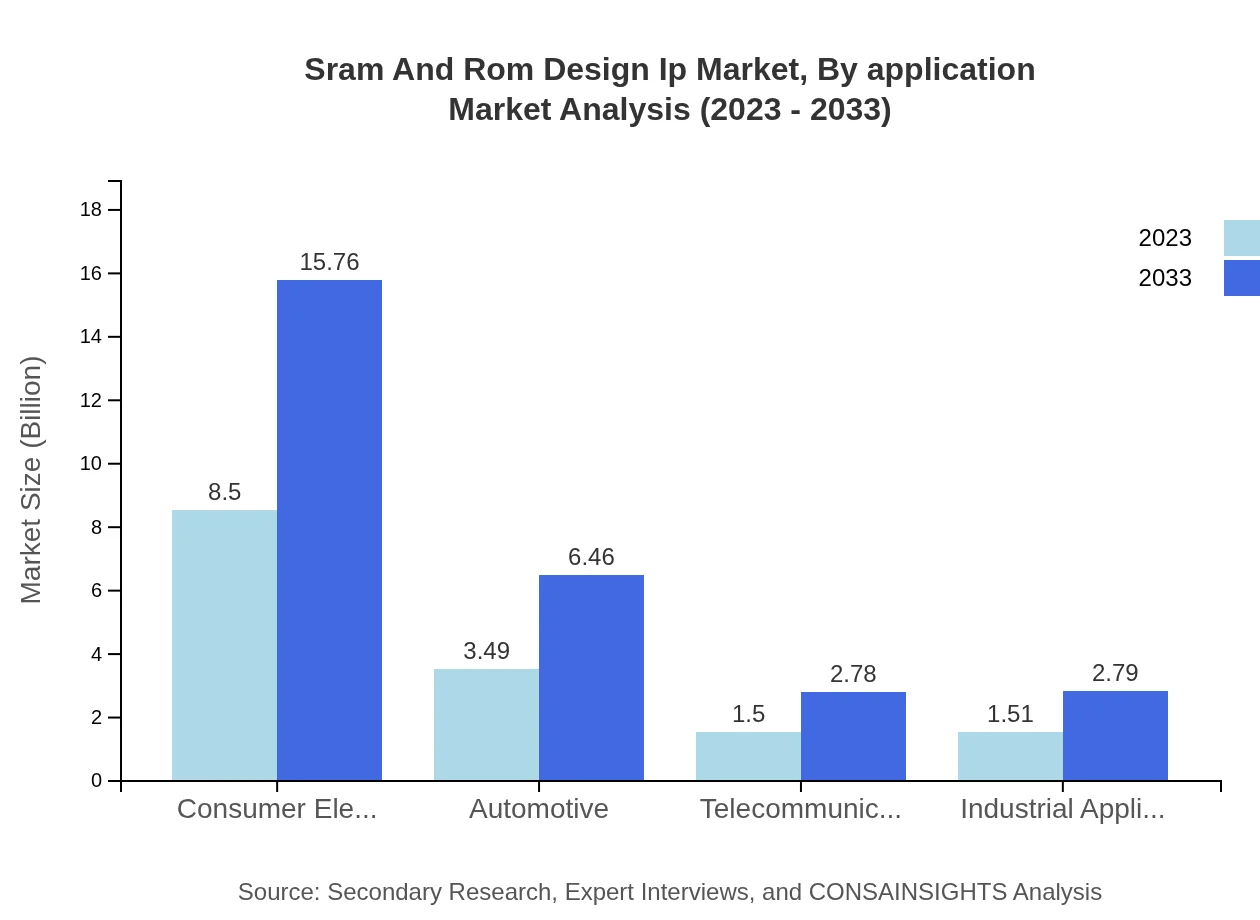

Sram And Rom Design Ip Market Analysis By Application

Applications in consumer electronics dominate the market, represented by a size of $8.50 billion in 2023, growing to $15.76 billion by 2033, capturing 56.69% of the market share. The automotive segment also shows promise, with expected growth from $3.49 billion to $6.46 billion, while industrial applications and telecommunications remain crucial, presenting sizes of $1.51 billion and $1.50 billion, respectively.

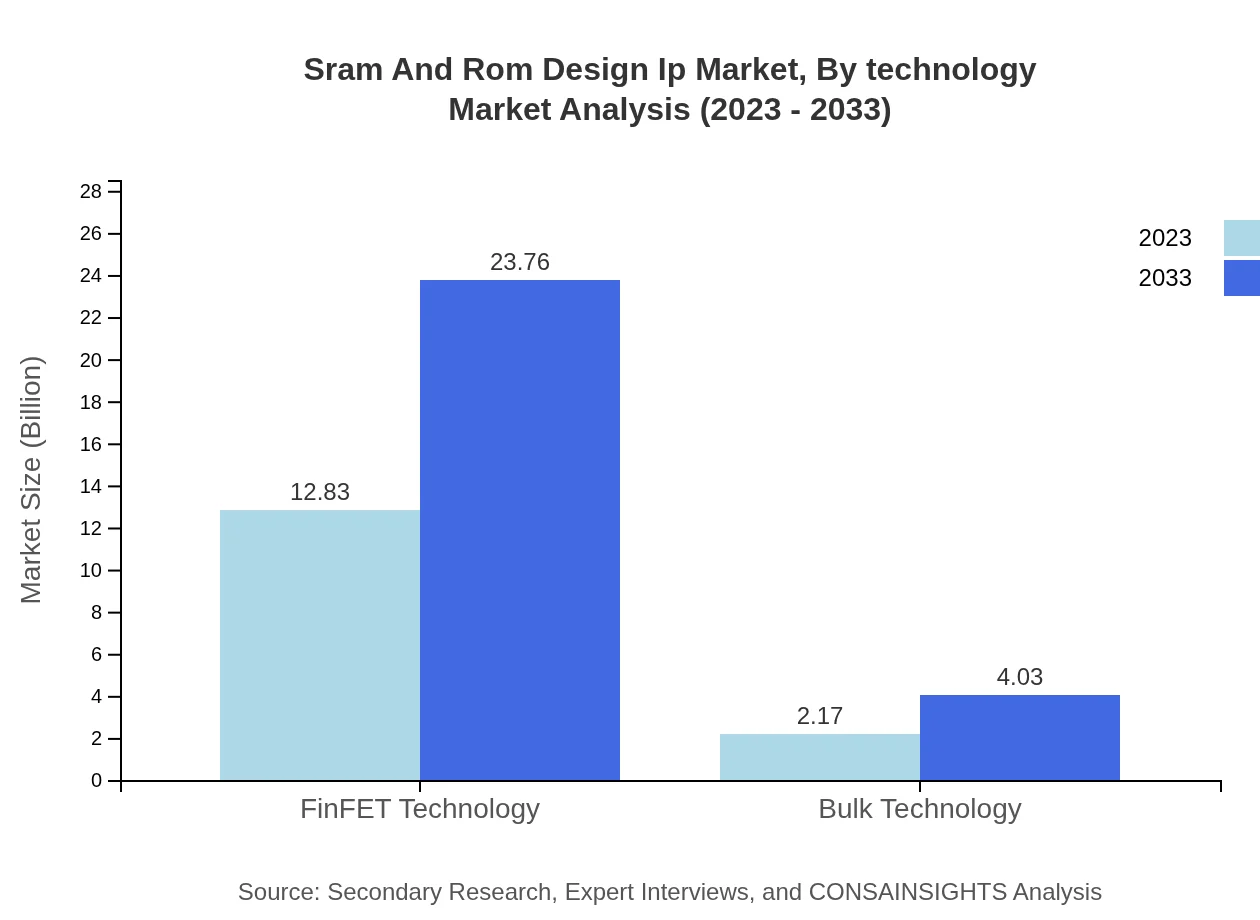

Sram And Rom Design Ip Market Analysis By Technology

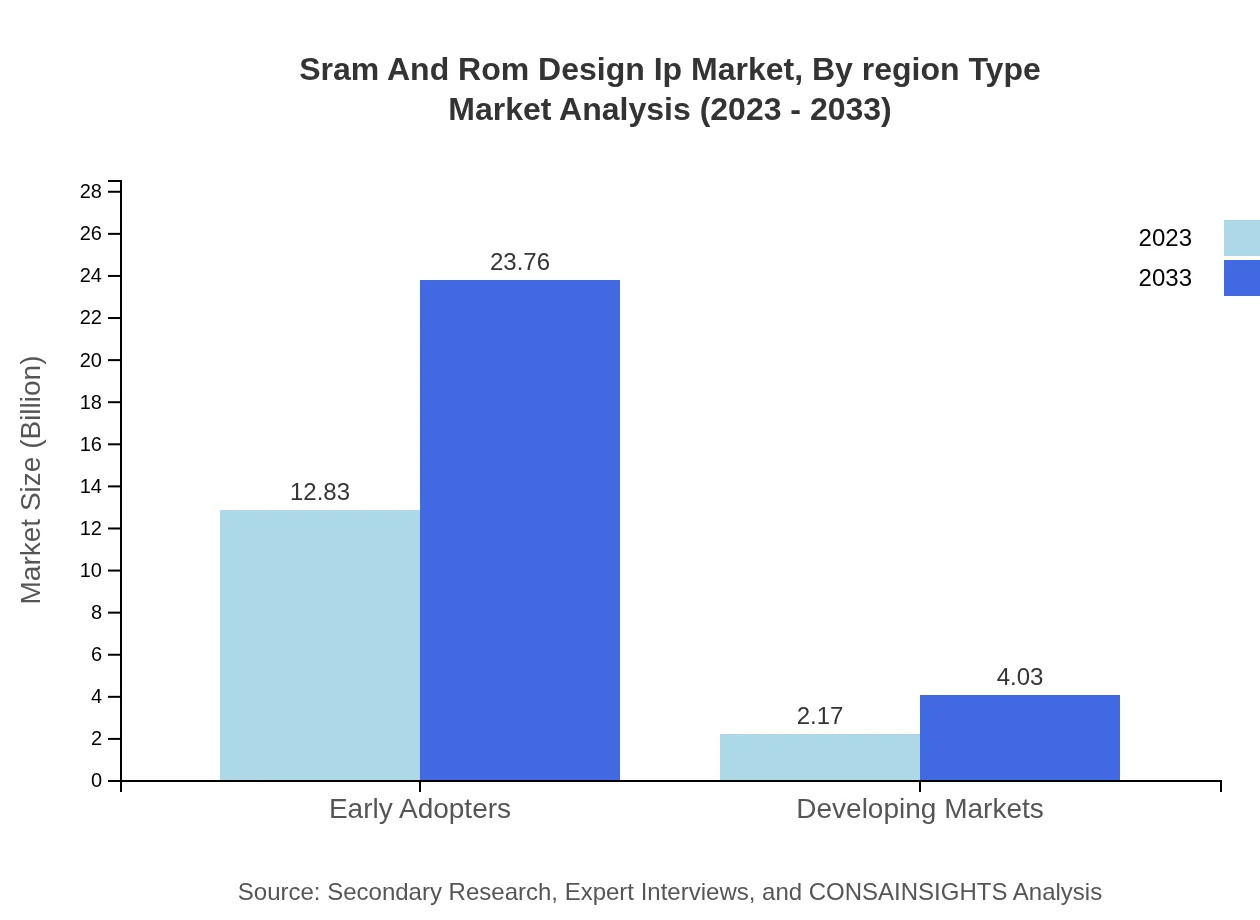

FinFET technology is leading the market, representing 85.51% of market share currently, with a market size of $12.83 billion in 2023, projected to grow to $23.76 billion by 2033. Bulk technology, while sharing the remaining market, shows steady growth from $2.17 billion to $4.03 billion, indicating sustained interest in various manufacturing processes.

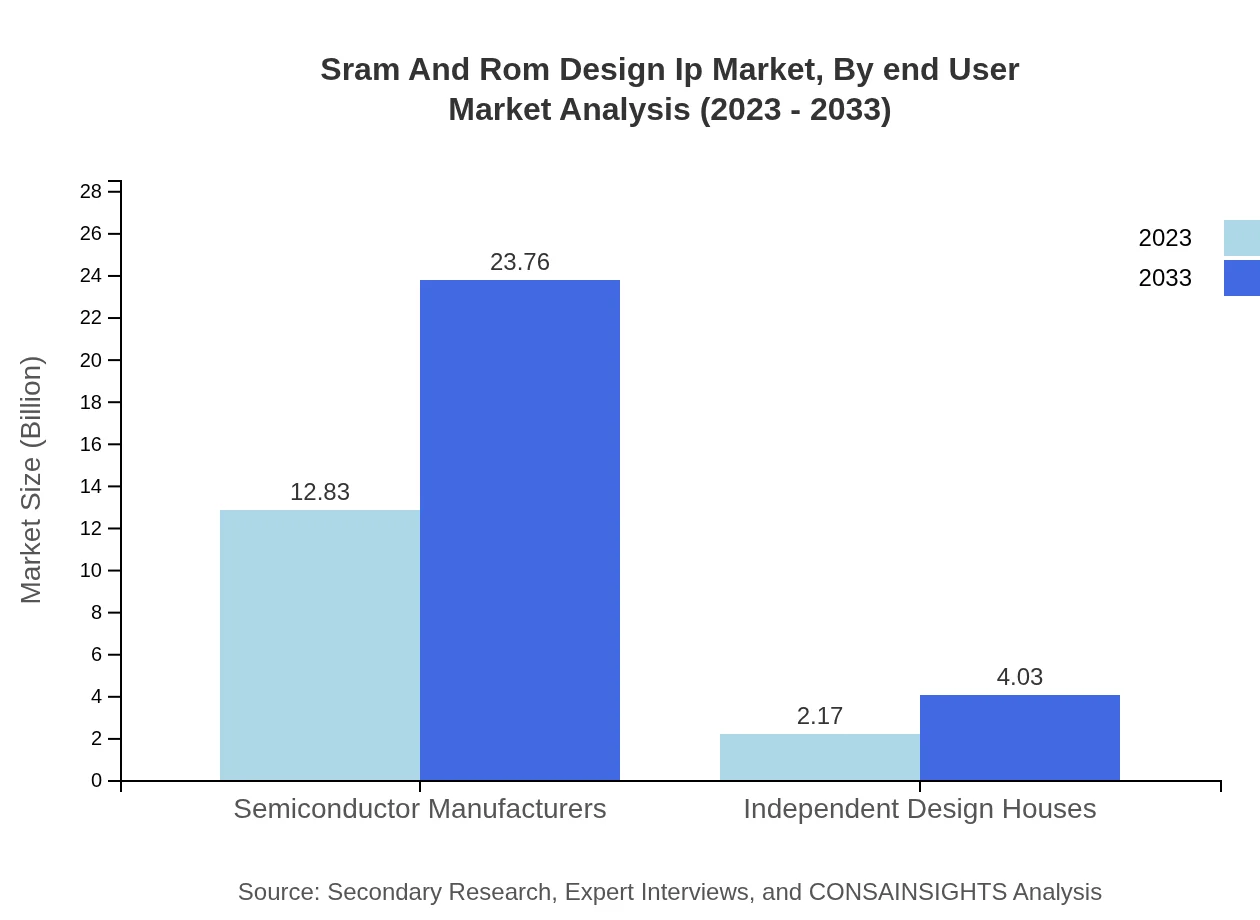

Sram And Rom Design Ip Market Analysis By End User

The end-user landscape includes semiconductor manufacturers, which currently dominate the sector with $12.83 billion in size, expected to rise to $23.76 billion by 2033. Independent design houses contribute a smaller portion, with $2.17 billion today growing to $4.03 billion, thus showing the dual nature of the market between large manufacturers and emerging design firms.

Sram And Rom Design Ip Market Analysis By Region Type

The market is segmented regionally, reflecting distinct growth patterns in Asia Pacific, North America, and Europe. Each region demonstrates unique demands conditioned by technological adoption rates, industrial policies, and market maturity levels. The integration of local players also influences competitive dynamics.

Sram And Rom Design Ip Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Sram And Rom Design Ip Industry

Synopsys, Inc.:

A leading company offering advanced design IP solutions and software for semiconductor design and verification, catering to a global clientele.ARM Holdings:

Renowned for its processor architecture and multi-purpose design IP solutions, ARM plays a critical role in mobile and embedded systems.Cadence Design Systems:

Providing comprehensive design and verification solutions, Cadence enhances productivity for semiconductor and PCB design.Imagination Technologies:

Known for its graphics and multimedia solutions, Imagination also delivers various memory IPs for multiple applications.GlobalFoundries:

As a semiconductor manufacturer, GlobalFoundries partners with several design houses to integrate memory solutions into diverse products.We're grateful to work with incredible clients.

FAQs

What is the market size of sram And Rom Design Ip?

The SRAM and ROM Design IP market is currently valued at approximately $15 billion as of 2023, with a projected compound annual growth rate (CAGR) of 6.2%, indicating robust growth leading up to 2033.

What are the key market players or companies in this sram And Rom Design Ip industry?

Key players in the SRAM and ROM Design IP market include major semiconductor manufacturers and independent design houses. These organizations focus on providing innovative solutions in memory design and integration for various applications.

What are the primary factors driving the growth in the sram And Rom Design Ip industry?

The growth of the SRAM and ROM Design IP industry is predominantly driven by the increasing demand for high-performance memory solutions in consumer electronics, automotive applications, and the rise of IoT devices, enhancing overall market momentum.

Which region is the fastest Growing in the sram And Rom Design Ip?

Asia Pacific is projected to be the fastest-growing region in the SRAM and ROM Design IP market, expanding from $3.00 billion in 2023 to $5.55 billion by 2033, reflecting strong regional demand and technological advancements.

Does ConsaInsights provide customized market report data for the sram And Rom Design Ip industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the SRAM and ROM Design IP industry, ensuring relevant insights and detailed analysis according to client requirements.

What deliverables can I expect from this sram And Rom Design Ip market research project?

From this market research project, clients can expect detailed reports, market forecasts, competitive analysis, regional insights, and tailored recommendations that support strategic decision-making in the SRAM and ROM Design IP sector.

What are the market trends of sram And Rom Design Ip?

Current market trends in the SRAM and ROM Design IP sector indicate a shift towards increasing integration of advanced memory technologies, the rise of FinFET technology underlining performance improvements, and a focus on energy-efficient solutions across the industry.