Starch Recovery Systems Market Report

Published Date: 31 January 2026 | Report Code: starch-recovery-systems

Starch Recovery Systems Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Starch Recovery Systems market, detailing its current landscape, future trends, and forecasts from 2023 to 2033. It encompasses market dynamics, segmentation, regional insights, and profiles of leading players within the industry.

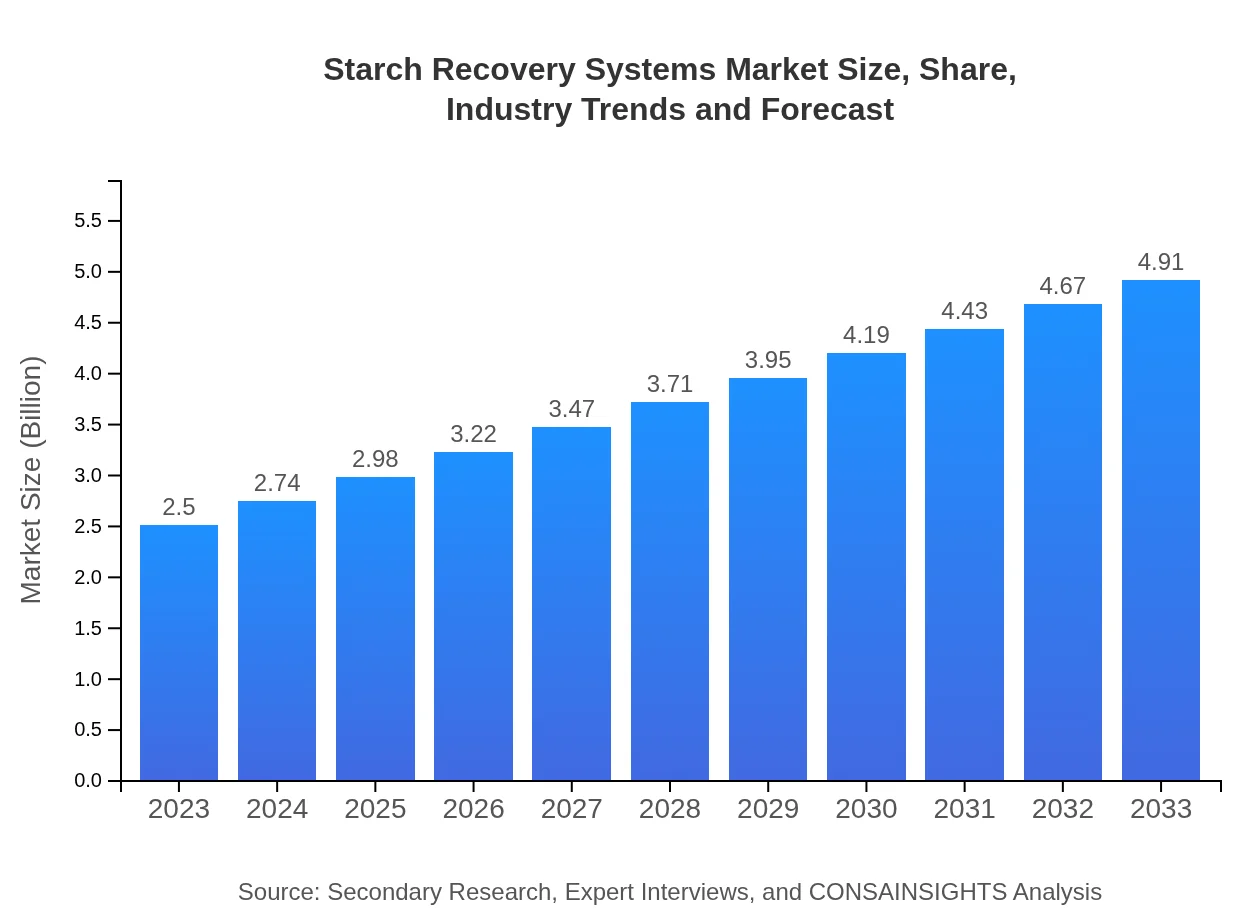

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $4.91 Billion |

| Top Companies | Cargill, Inc., Ingredion Incorporated, Tate & Lyle, Roquette Frères |

| Last Modified Date | 31 January 2026 |

Starch Recovery Systems Market Overview

Customize Starch Recovery Systems Market Report market research report

- ✔ Get in-depth analysis of Starch Recovery Systems market size, growth, and forecasts.

- ✔ Understand Starch Recovery Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Starch Recovery Systems

What is the Market Size & CAGR of Starch Recovery Systems market in 2023?

Starch Recovery Systems Industry Analysis

Starch Recovery Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Starch Recovery Systems Market Analysis Report by Region

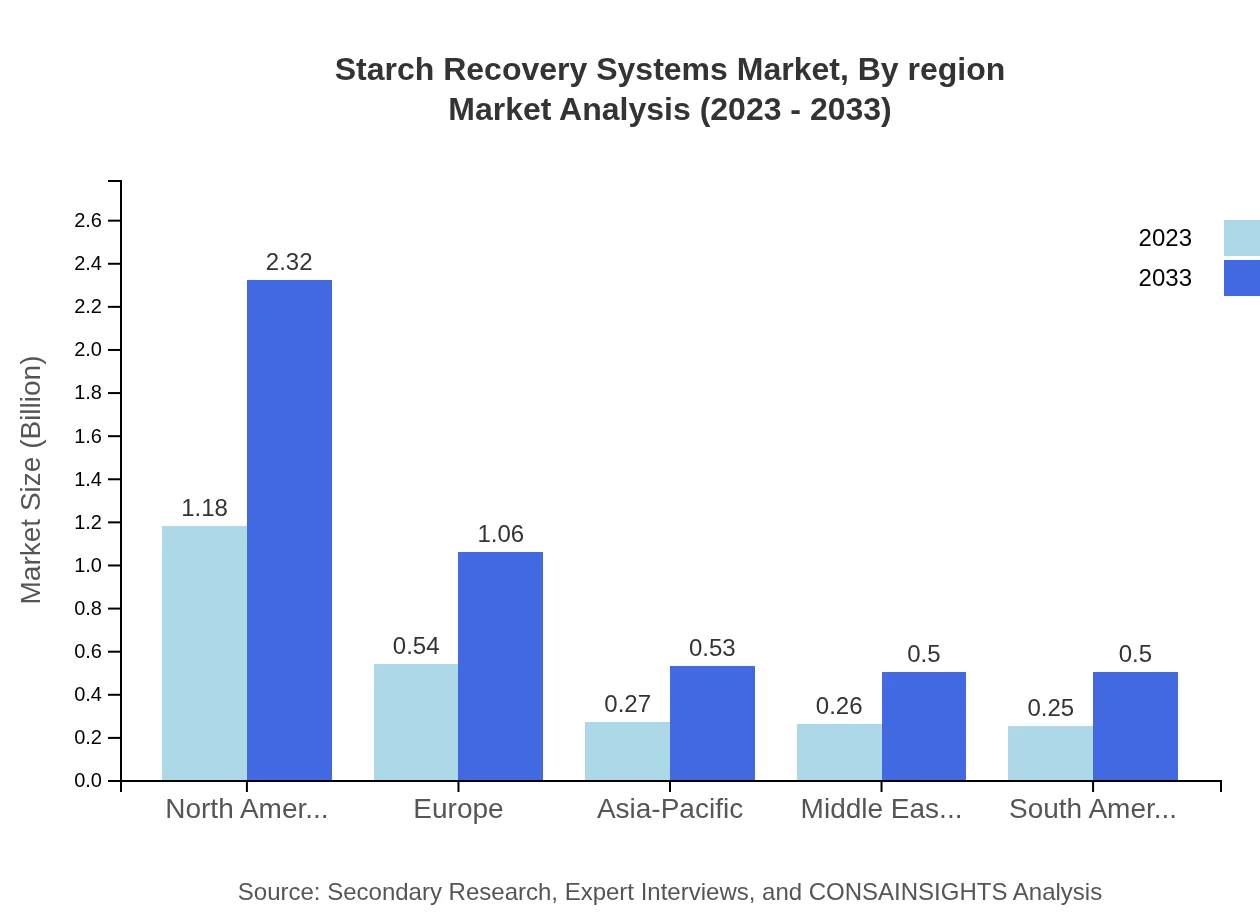

Europe Starch Recovery Systems Market Report:

In Europe, the market is projected to grow from $0.92 billion in 2023 to $1.80 billion by 2033, supported by stringent regulations on food quality standards which promote refined starch applications.Asia Pacific Starch Recovery Systems Market Report:

In the Asia-Pacific region, the Starch Recovery Systems market is anticipated to grow from $0.44 billion in 2023 to $0.86 billion by 2033, driven by the rising food processing industries and increased production of starch-based products in countries like China and India.North America Starch Recovery Systems Market Report:

North America, valued at $0.80 billion in 2023, is expected to reach $1.58 billion by 2033, driven by advancements in food technology and increasing consumption of processed food products.South America Starch Recovery Systems Market Report:

The South America market is projected to increase from $0.05 billion in 2023 to $0.09 billion by 2033. This growth is attributed to improved agricultural practices and the growing trend of organic food production promoting the use of starch.Middle East & Africa Starch Recovery Systems Market Report:

The Middle East and Africa market is expected to rise from $0.29 billion in 2023 to $0.58 billion by 2033, largely due to increased investments in the food processing sector and emerging markets focusing on improving their production capabilities.Tell us your focus area and get a customized research report.

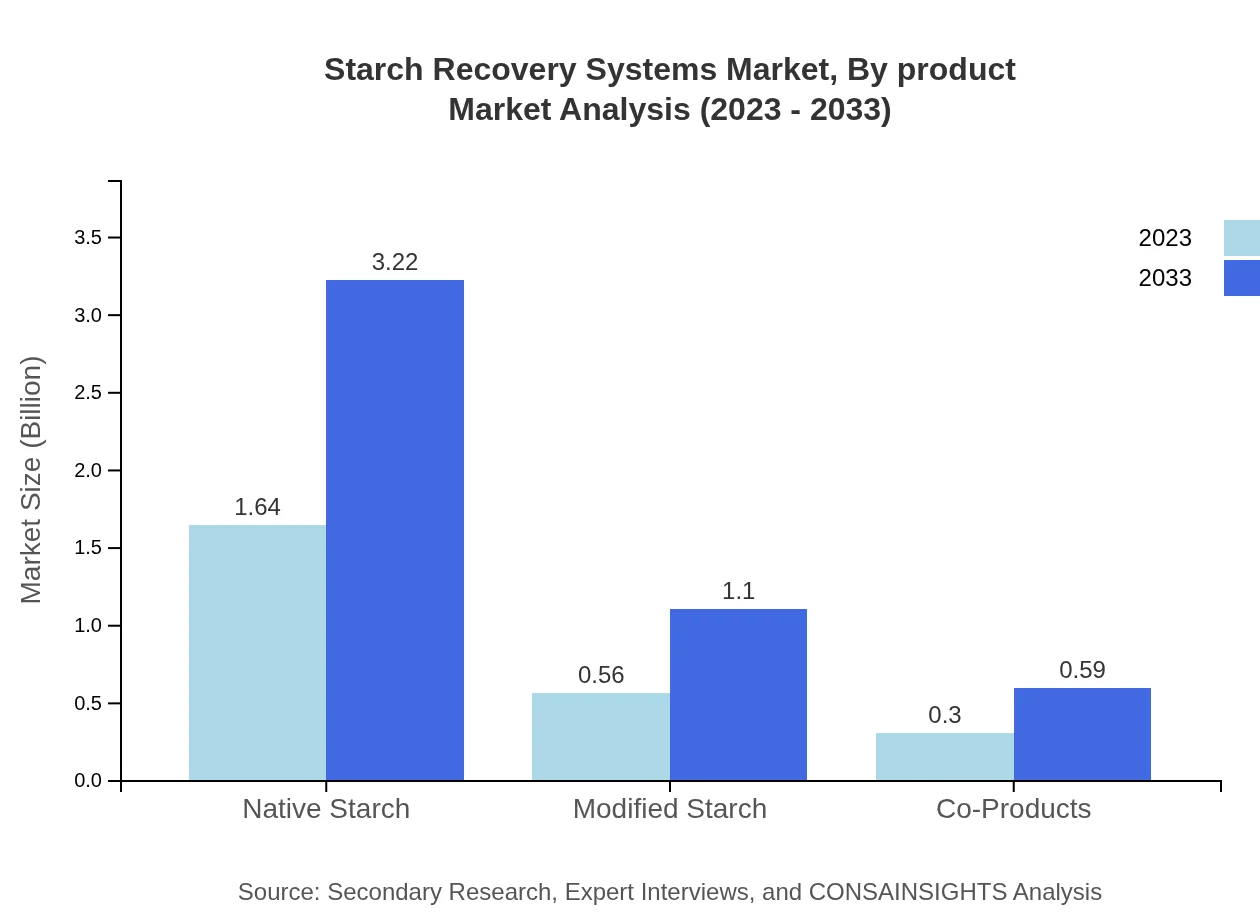

Starch Recovery Systems Market Analysis By Product

The product segment analysis highlights the dominance of Native Starch, accounting for approximately 65.53% of the market in 2023 and projected to maintain a similar share by 2033. Modified Starch, holding 22.46%, is increasingly being used for its functional benefits across various sectors, while Co-Products are also significant, contributing 12.01%.

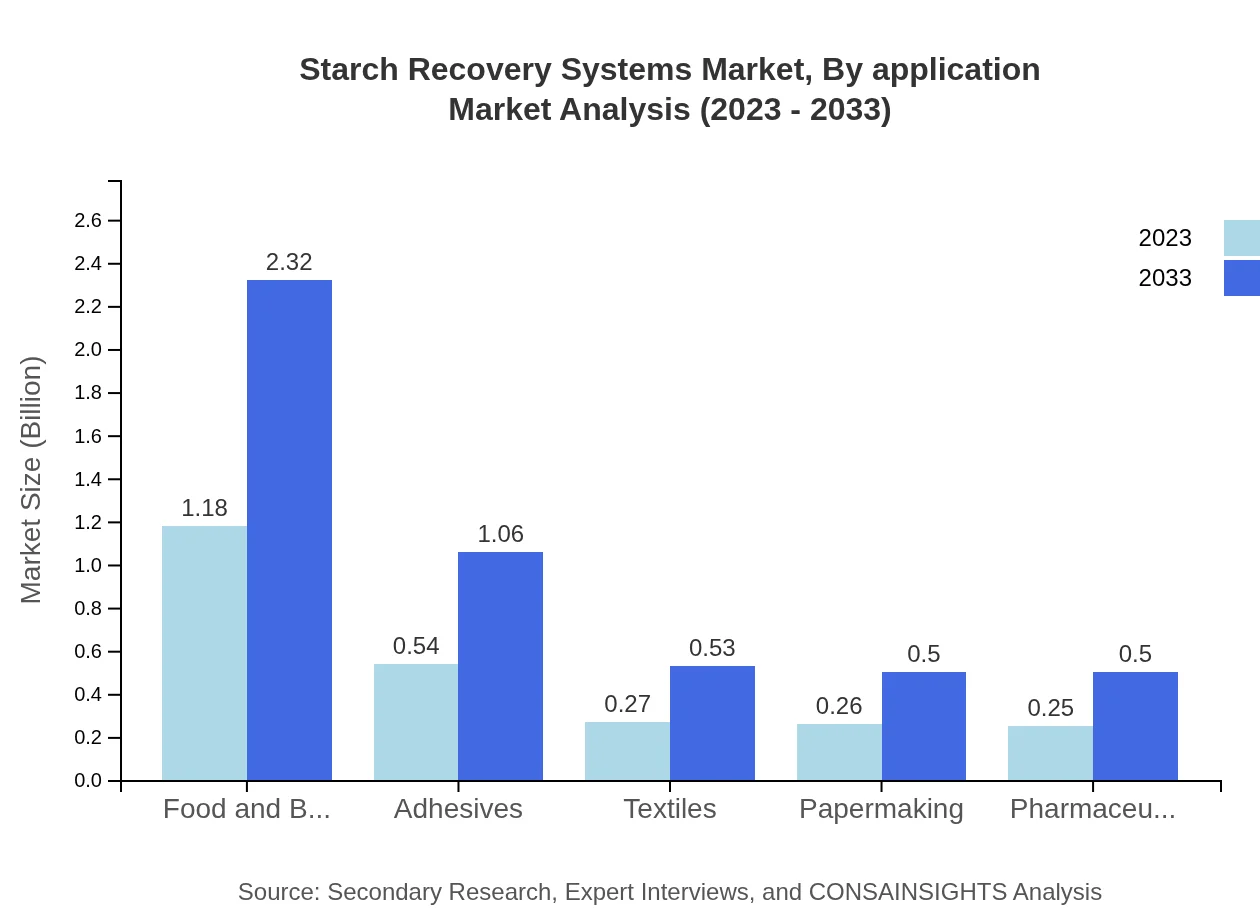

Starch Recovery Systems Market Analysis By Application

By application, the food processing sector is the largest consumer of starch, representing about 65.53% of the market in 2023. This is followed by pharmaceuticals at 22.46% and various industrial applications at 12.01%. The diverse applicability of starch in these sectors emphasizes its critical role in product formulations and operational methodologies.

Starch Recovery Systems Market Analysis By Region

The regional analysis indicates strong growth across all regions, with North America leading in market size and share. Europe follows closely, showing robust demand due to high-quality standards. The growth in Asia-Pacific indicates a shift towards increased starch utilization in rapidly growing economies, while emerging markets in the Middle East and Africa are also witnessing a positive trend.

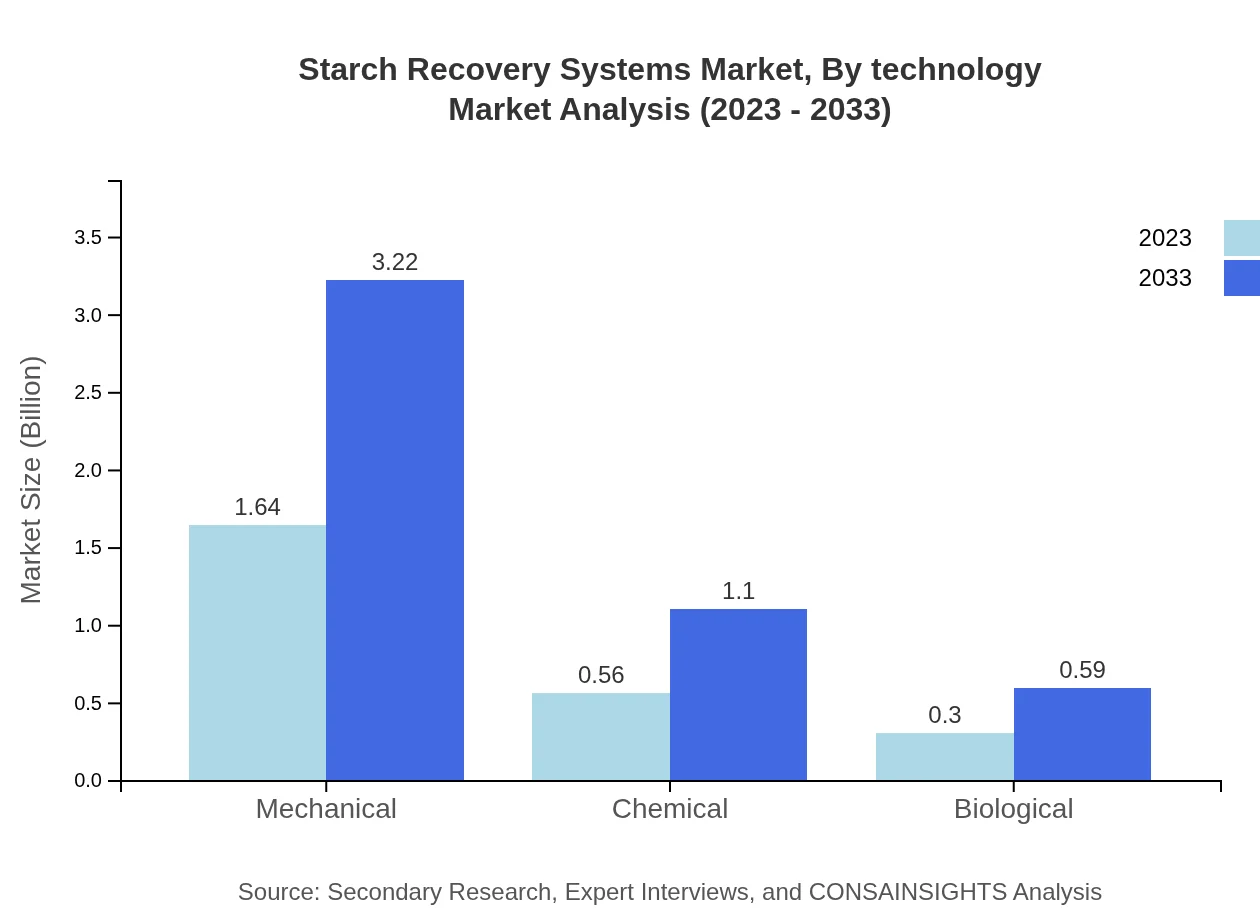

Starch Recovery Systems Market Analysis By Technology

Technological advancements such as enzymatic processing and ultra-filtration systems are gaining traction, helping to enhance yield and quality. Innovations in mechanical processes are also improving efficiency, resulting in lower operational costs and better sustainability outcomes for manufacturers.

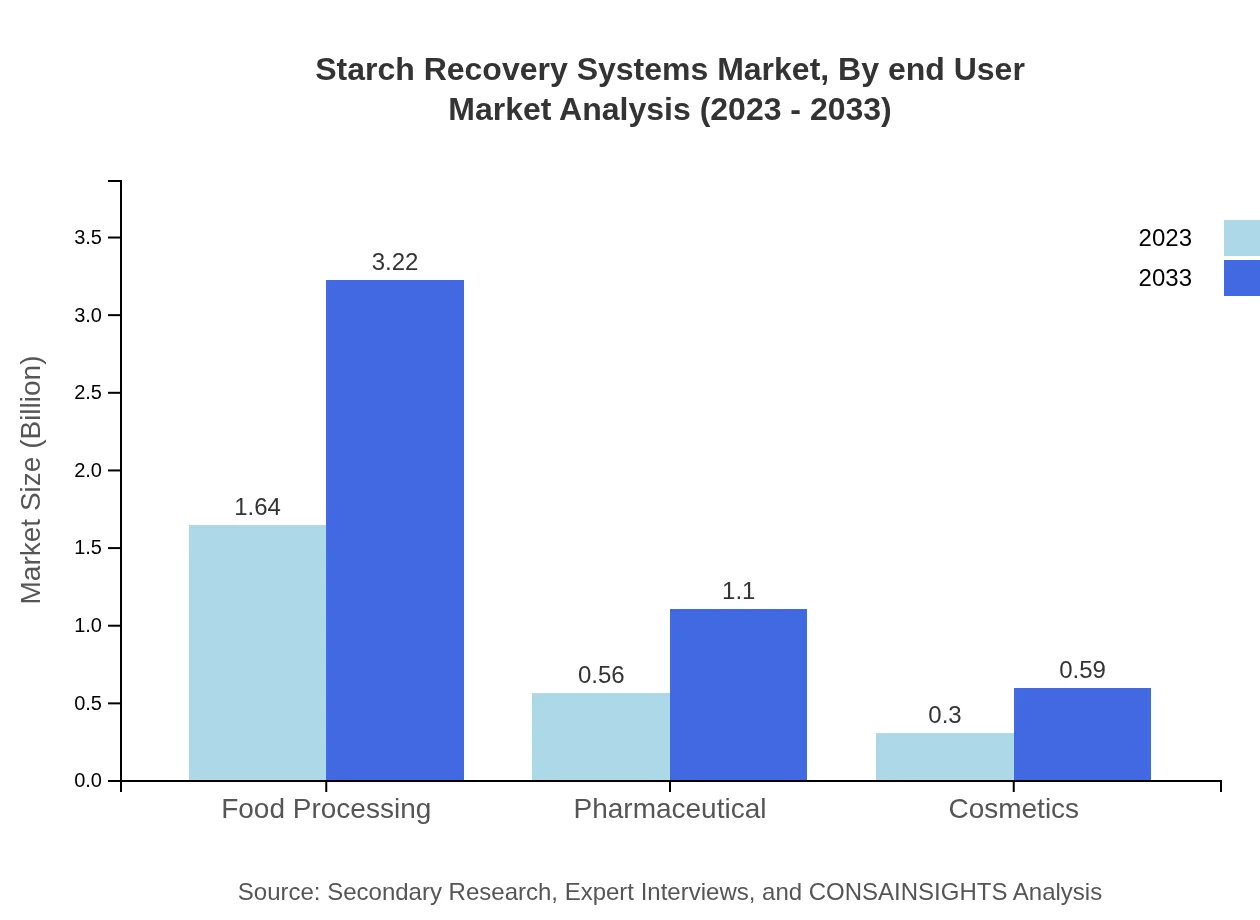

Starch Recovery Systems Market Analysis By End User

Food and beverage industries represent the largest end-user segment within the Starch Recovery Systems market, capitalizing on the demand for natural and functional food ingredients. Pharmaceuticals and cosmetics are also gaining shares due to the increasing preference for organic and chemical-free products.

Starch Recovery Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Starch Recovery Systems Industry

Cargill, Inc.:

A global leader in the food industry known for its innovations in starch processing, Cargill emphasizes sustainability and has a diverse range of starch products.Ingredion Incorporated:

A major player in the starch solutions market, Ingredion specializes in creating customized solutions for food, beverage, and industrial applications.Tate & Lyle:

Tate & Lyle is internationally recognized for its advanced starch technologies and has a strong focus on food ingredient solutions.Roquette Frères:

Roquette specializes in producing plant-based ingredients and focuses heavily on research and innovation. Their starch recovery systems are tailored for a variety of applications.We're grateful to work with incredible clients.

FAQs

What is the market size of starch Recovery Systems?

The starch recovery systems market is estimated to be worth approximately $2.5 billion in 2023, with a projected compound annual growth rate (CAGR) of 6.8% from 2023 to 2033. This growth reflects increasing demand for starch in various industries and advancements in recovery technology.

What are the key market players or companies in this starch Recovery Systems industry?

The key market players in the starch recovery systems industry include prominent companies known for their technological innovations and production capabilities. These companies are pivotal in driving market growth and enhancing efficiencies within their operations.

What are the primary factors driving the growth in the starch recovery systems industry?

Factors influencing growth in the starch recovery systems industry include rising demand for processed foods, innovations in processing technologies, and increasing applications in pharmaceuticals and biodegradable materials. These elements collectively contribute to robust market expansion.

Which region is the fastest Growing in the starch recovery systems?

The fastest-growing region in the starch recovery systems market is projected to be Europe, with market size increasing from $0.92 billion in 2023 to $1.80 billion by 2033. This region benefits from a strong food and beverage sector and demand for innovative processing solutions.

Does ConsaInsights provide customized market report data for the starch Recovery Systems industry?

Yes, ConsaInsights offers customized market report data tailored to specific requirements in the starch recovery systems industry. Clients can gain insights into market dynamics, trends, and forecasts that align with their unique needs.

What deliverables can I expect from this starch Recovery Systems market research project?

Deliverables from a starch recovery systems market research project include a comprehensive report featuring market size, trends, competitive analysis, and forecasts for various segments. The report provides actionable insights for strategic decision-making.

What are the market trends of starch Recovery Systems?

Market trends in the starch recovery systems sector include advancements in processing technologies, growth in demand for clean-label products, and an increase in sustainable manufacturing practices. These trends drive innovation and market competitiveness.