Start Stop Technology Market Report

Published Date: 31 January 2026 | Report Code: start-stop-technology

Start Stop Technology Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Start Stop Technology market, covering comprehensive insights into market size, growth trends, technology advancements, and forecasts for the period 2023 - 2033.

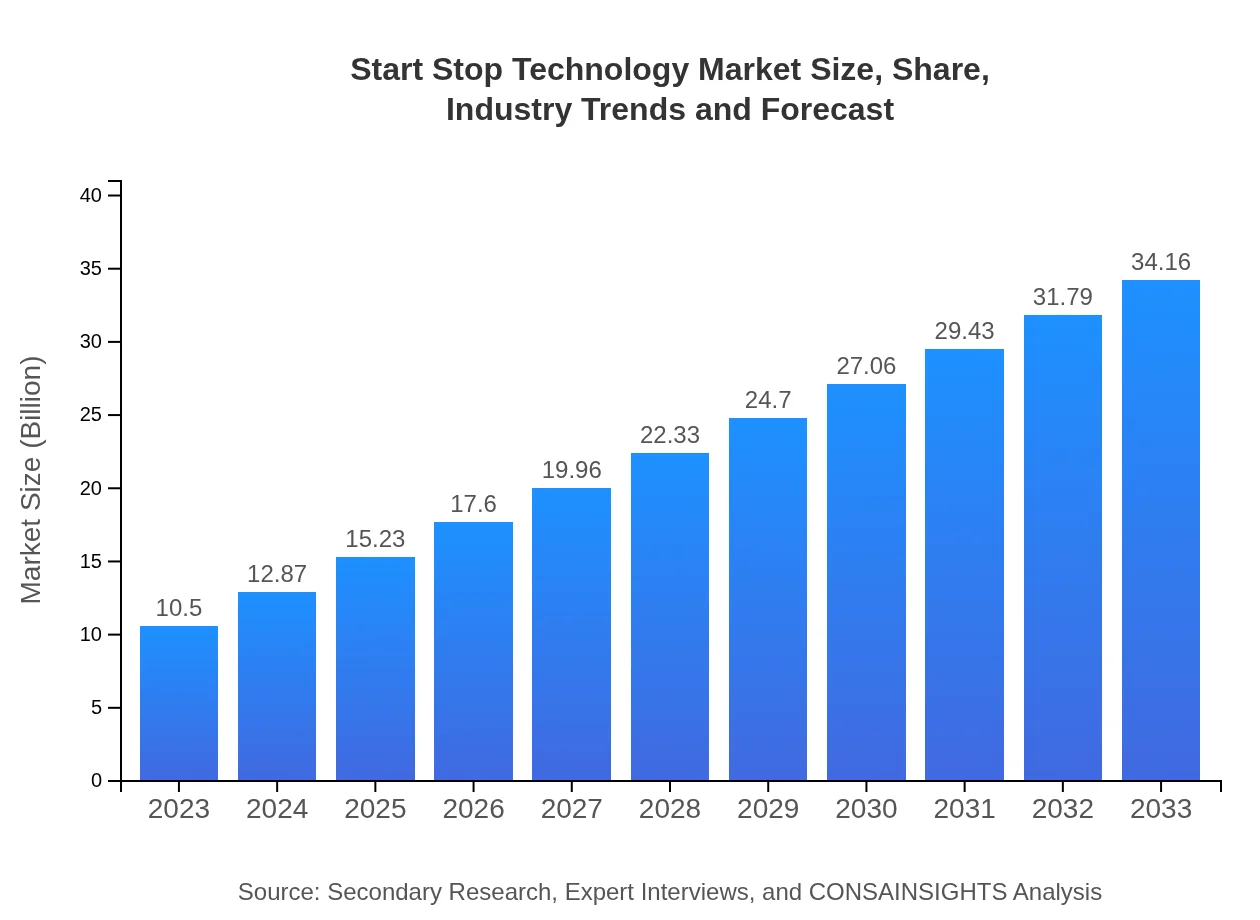

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 12% |

| 2033 Market Size | $34.16 Billion |

| Top Companies | Robert Bosch GmbH, Denso Corporation, Continental AG |

| Last Modified Date | 31 January 2026 |

Start Stop Technology Market Overview

Customize Start Stop Technology Market Report market research report

- ✔ Get in-depth analysis of Start Stop Technology market size, growth, and forecasts.

- ✔ Understand Start Stop Technology's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Start Stop Technology

What is the Market Size & CAGR of Start Stop Technology market in 2023?

Start Stop Technology Industry Analysis

Start Stop Technology Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Start Stop Technology Market Analysis Report by Region

Europe Start Stop Technology Market Report:

In Europe, the Start Stop Technology market is set to witness substantial growth from $3.11 billion in 2023 to $10.10 billion by 2033. The region's commitment to reducing carbon emissions and promoting electric vehicle adoption ensures a favorable landscape for technology integration in new car models.Asia Pacific Start Stop Technology Market Report:

In the Asia Pacific region, the Start Stop Technology market is expected to grow from $2.26 billion in 2023 to $7.36 billion by 2033, reflecting a strong CAGR driven by rising vehicle production, especially in countries like China and India. Enhanced consumer awareness regarding fuel efficiency and environmental issues further accelerates this growth.North America Start Stop Technology Market Report:

North America's Start Stop Technology market is projected to grow from $3.36 billion in 2023 to $10.93 billion in 2033, benefitting from stringent emission regulations and a strong automotive sector focused on innovative, sustainable solutions. Electric vehicle adoption, driven by government incentives, is also a significant contributor.South America Start Stop Technology Market Report:

The South American market for Start Stop Technology is expected to expand from $1.02 billion in 2023 to $3.32 billion by 2033. The growth is supported by increased automotive production and a growing preference for hybrid vehicles in the region. However, economic fluctuations can impact the pace of development.Middle East & Africa Start Stop Technology Market Report:

The Start Stop Technology market in the Middle East and Africa is projected to rise from $0.75 billion in 2023 to $2.44 billion by 2033. Growth factors include rising automotive sales and energy efficiency drives; however, market penetration is still relatively low compared to other regions.Tell us your focus area and get a customized research report.

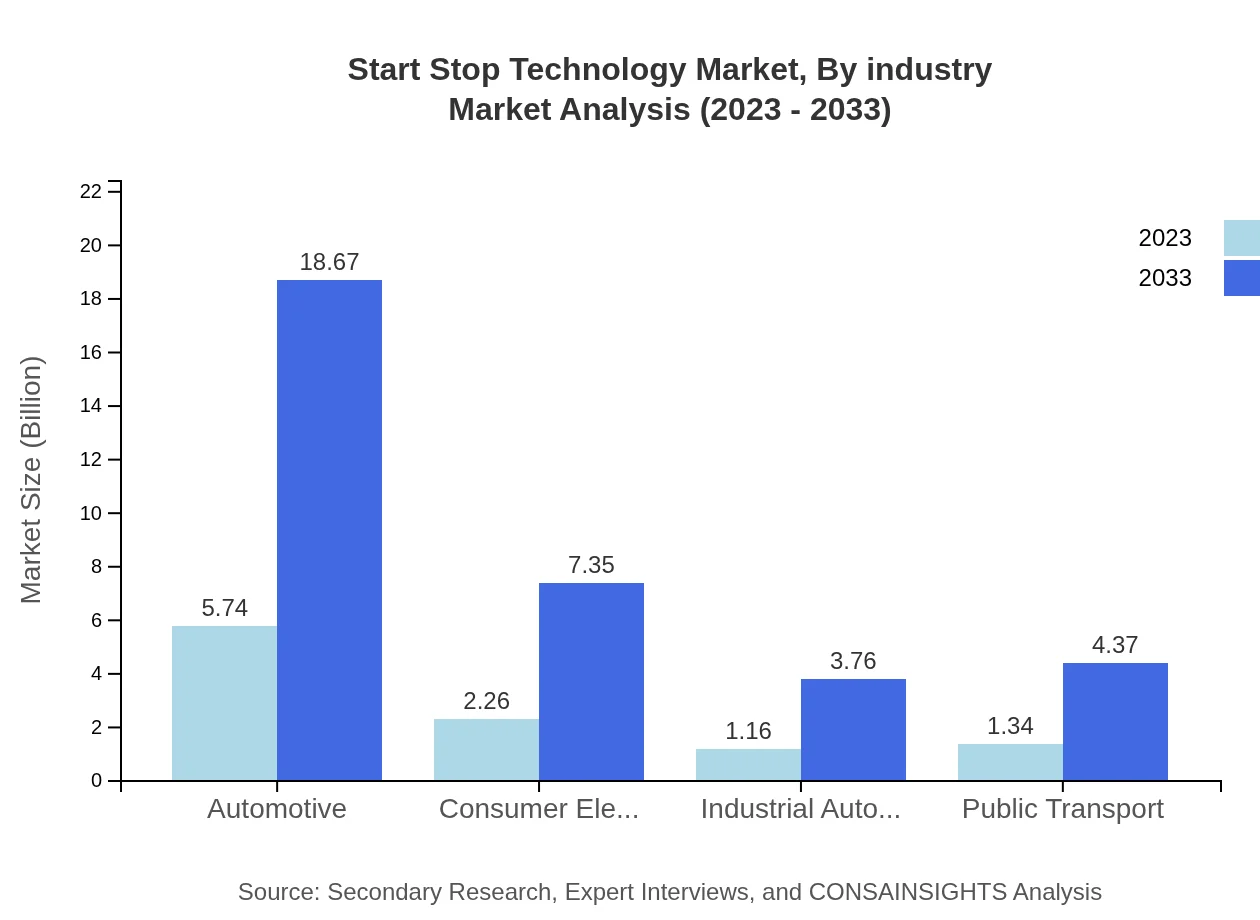

Start Stop Technology Market Analysis By Industry

The Start Stop Technology market by industry is dominated by Automotive applications, estimated to grow from $5.74 billion in 2023 to $18.67 billion by 2033, attributed to the increasing incorporation of these systems in vehicles to enhance fuel efficiency and comply with regulations.

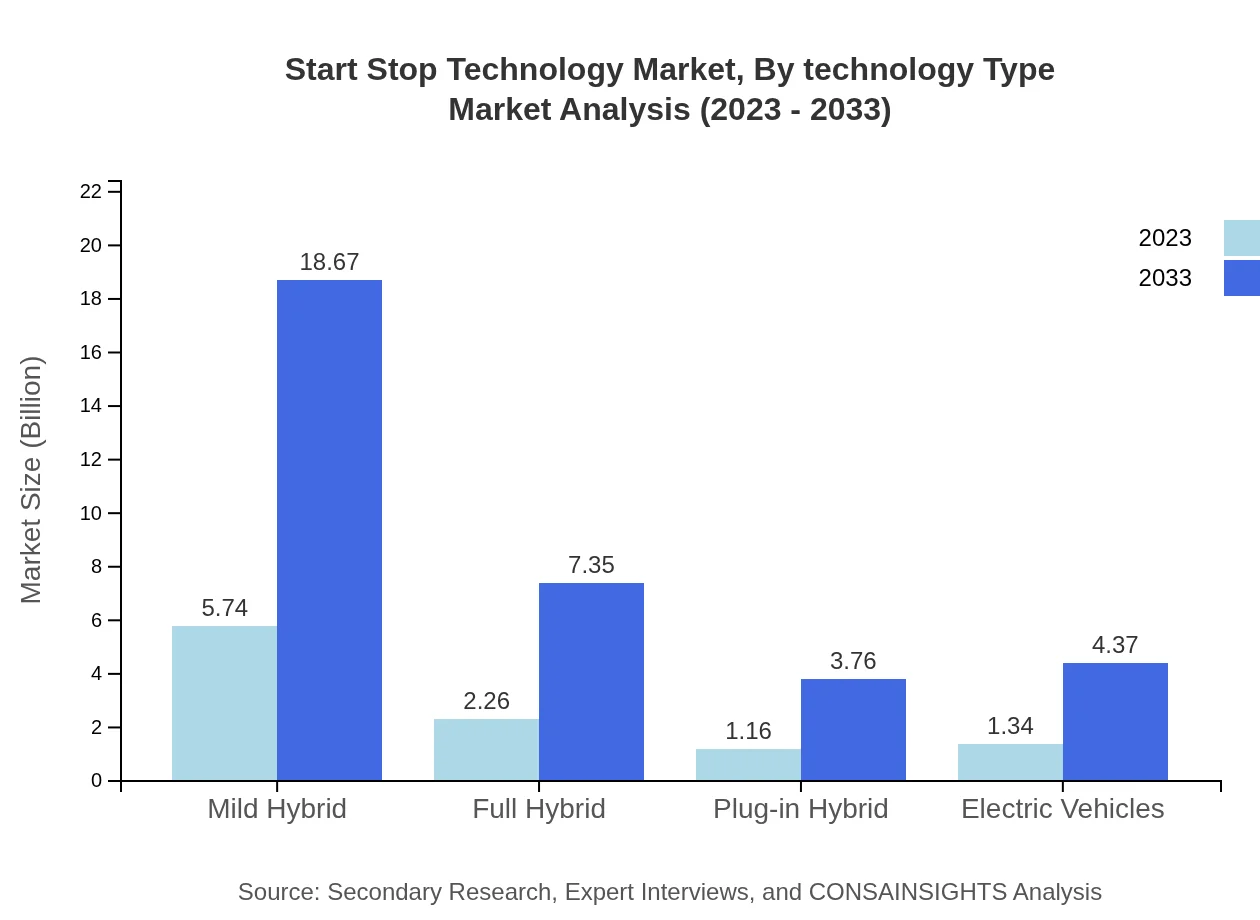

Start Stop Technology Market Analysis By Technology Type

Mild Hybrid technology leads in market share, comprising 54.67% in 2023, with projections of sustaining this share by 2033, driven by the growing preference for hybrids among consumers. Other types like Full Hybrid and Plug-in Hybrid also show considerable growth.

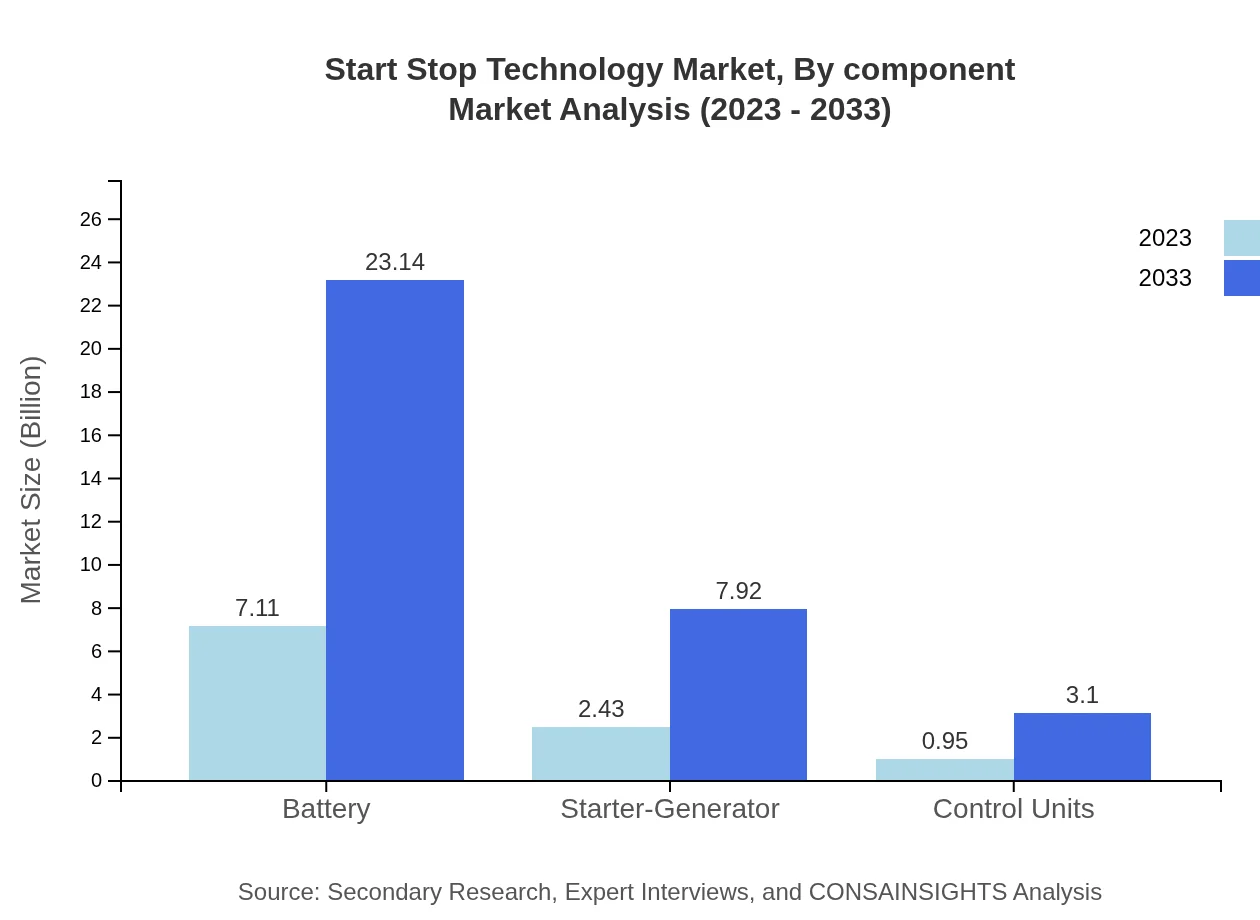

Start Stop Technology Market Analysis By Component

The Battery segment dominates with a substantial share of 67.73% in 2023 and is projected to maintain a significant share through 2033, highlighting the critical role of efficient battery systems in enhancing start-stop functionalities.

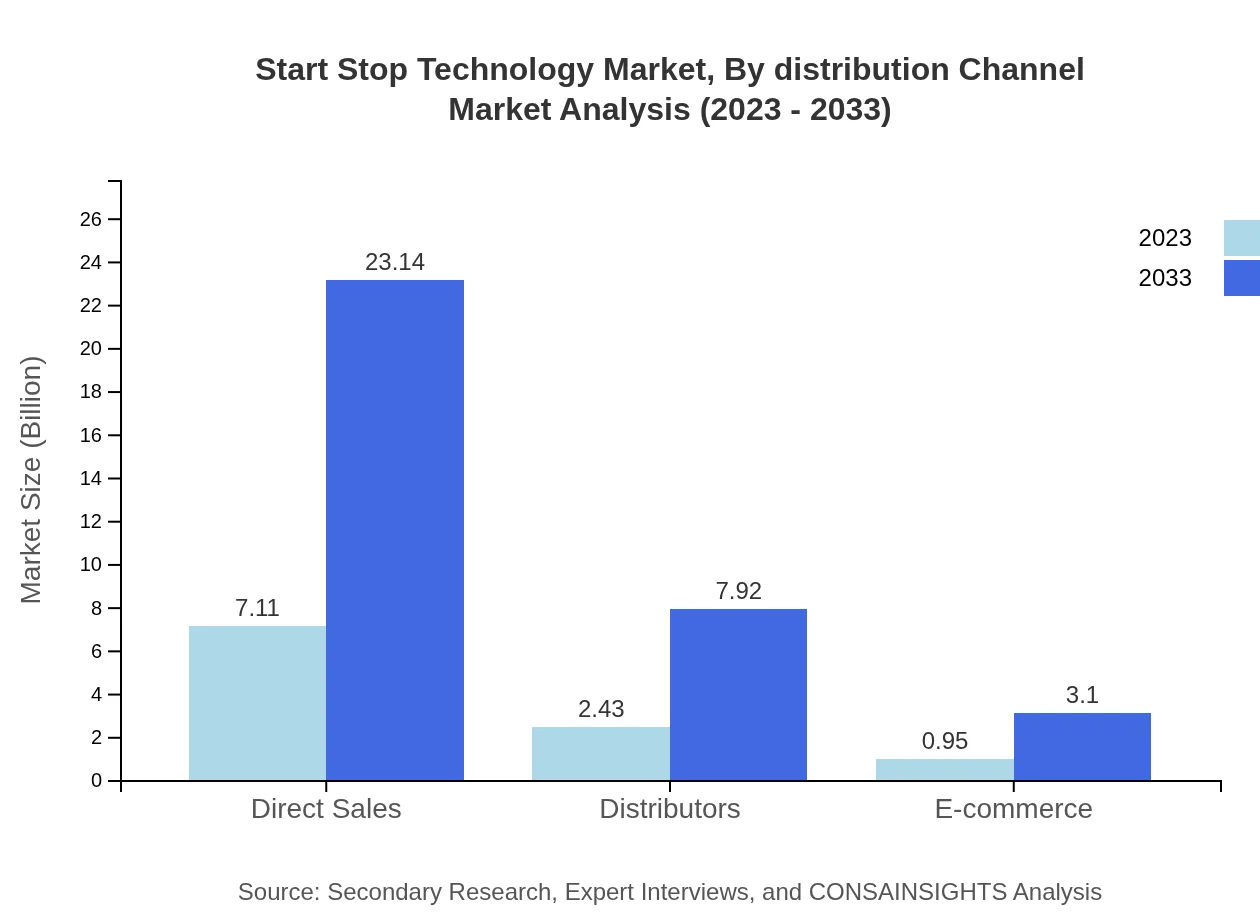

Start Stop Technology Market Analysis By Distribution Channel

Direct Sales channels are leading, accounting for 67.73% in 2023, emphasizing the importance of manufacturer-to-consumer strategies. E-commerce is anticipated to grow significantly due to changing shopping behaviors and increased online automotive parts sales.

Start Stop Technology Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Start Stop Technology Industry

Robert Bosch GmbH:

Bosch is a leading global supplier of technology and services, known for its innovative automotive components, including advanced start-stop systems that improve efficiency and reduce emissions.Denso Corporation:

Denso is a prominent automotive components manufacturer known for its contributions to electronic systems and fuel-efficient technologies, including advanced start-stop solutions that cater to changing market demands.Continental AG:

Continental AG is a tier-one automotive supplier that develops and produces automotive safety systems, including advanced start-stop technology, enhancing both efficiency and user experience.We're grateful to work with incredible clients.

FAQs

What is the market size of Start-Stop Technology?

The Start-Stop Technology market is projected to reach approximately $10.5 billion by 2033, growing at a robust CAGR of 12% from its current valuation. This notable expansion reflects increasing automotive adoption and efficiency demands.

What are the key market players or companies in the Start-Stop Technology industry?

Key players in the Start-Stop Technology industry include major automotive manufacturers and component suppliers specializing in hybrid systems. Leading companies such as Bosch, Continental, and Delphi are pivotal to advancing this technology and securing market presence.

What are the primary factors driving the growth in the Start-Stop Technology industry?

Growth in the Start-Stop Technology market is driven by rising environmental concerns, regulatory mandates for emissions reduction, and advancements in automobile electronic systems. Consumer demand for fuel-efficient vehicles further propels market expansion.

Which region is the fastest Growing in the Start-Stop Technology?

Asia-Pacific is anticipated to be the fastest-growing region in the Start-Stop Technology market, projected to expand from $2.26 billion in 2023 to $7.36 billion by 2033. This growth is fueled by booming automotive markets and enhanced production capacities.

Does ConsaInsights provide customized market report data for the Start-Stop Technology industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs in the Start-Stop Technology industry. Clients can request insights by market segment, region, or key trends to align with their strategic goals.

What deliverables can I expect from this Start-Stop Technology market research project?

Deliverables from the Start-Stop Technology market research project include comprehensive reports detailing market size, CAGR, forecasts by region, and segment data analysis. This enables informed decision-making for stakeholders.

What are the market trends of Start-Stop Technology?

Current trends in the Start-Stop Technology market include increasing adoption of mild and full hybrid vehicles, enhanced battery efficiency, and growth in electric vehicle segments. These trends reflect a shift towards sustainability in the automotive sector.