Starter Feed Market Report

Published Date: 02 February 2026 | Report Code: starter-feed

Starter Feed Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Starter Feed market, covering market size, industry trends, regional insights, and forecasts from 2023 to 2033. It offers valuable insights into the growth prospects and challenges within the industry.

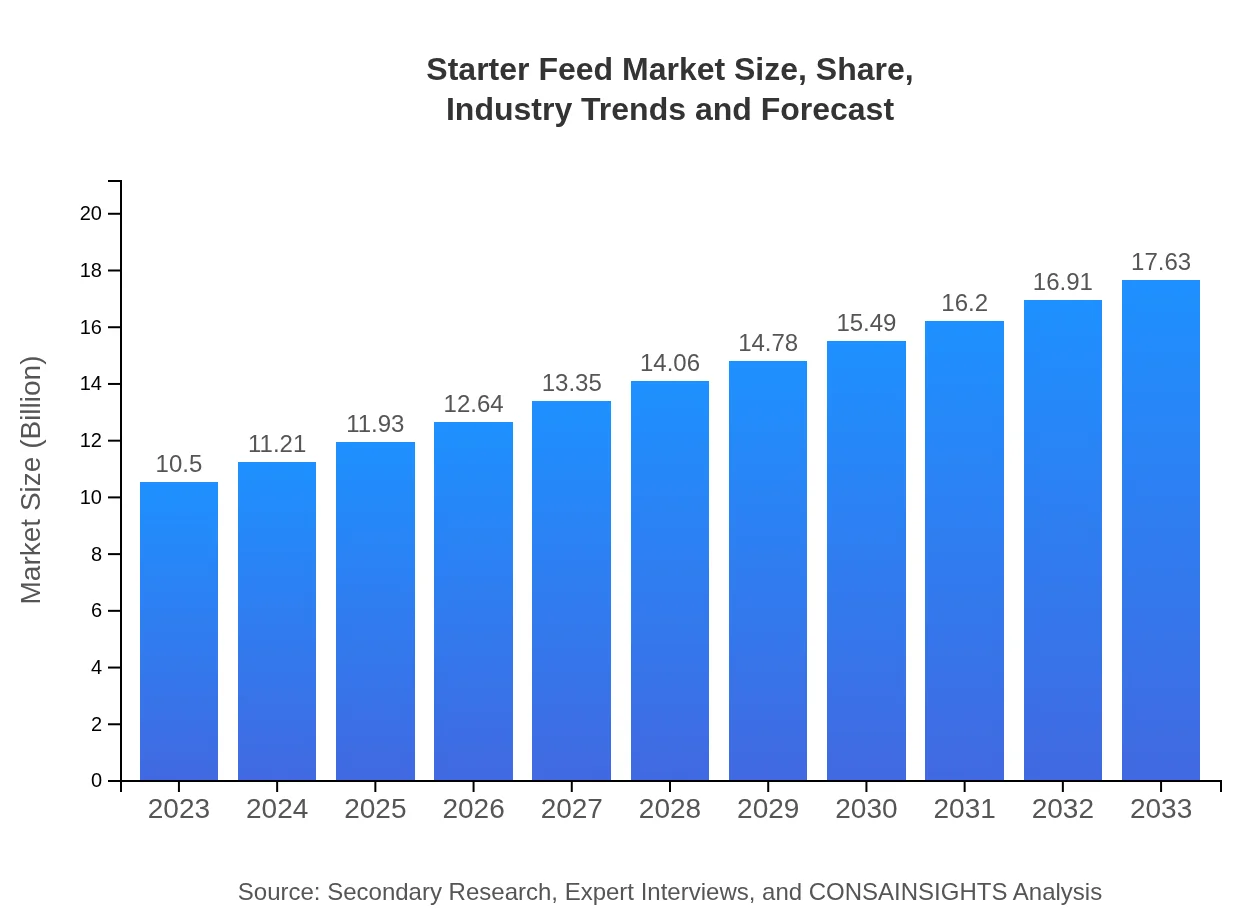

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $17.63 Billion |

| Top Companies | Cargill, Inc., Archer Daniels Midland Company (ADM), Nutreco N.V., Alltech, Inc. |

| Last Modified Date | 02 February 2026 |

Starter Feed Market Overview

Customize Starter Feed Market Report market research report

- ✔ Get in-depth analysis of Starter Feed market size, growth, and forecasts.

- ✔ Understand Starter Feed's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Starter Feed

What is the Market Size & CAGR of Starter Feed market in 2023?

Starter Feed Industry Analysis

Starter Feed Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Starter Feed Market Analysis Report by Region

Europe Starter Feed Market Report:

In Europe, the market size is expected to rise from 2.56 billion USD in 2023 to 4.30 billion USD by 2033. The region is witnessing a surge in demand for organic and specialty feeds, driven by consumer health-consciousness and strict regulations on livestock health and welfare.Asia Pacific Starter Feed Market Report:

The Asia Pacific region is projected to grow significantly, with the market expected to rise from 2.28 billion USD in 2023 to 3.83 billion USD by 2033. This growth is fueled by increasing livestock production and high meat consumption rates, particularly in countries like China and India. Additionally, the adoption of modern agricultural practices is enhancing feed production efficiency.North America Starter Feed Market Report:

The North American Starter Feed market, valued at 3.77 billion USD in 2023, is forecasted to reach 6.32 billion USD by 2033. This growth is attributed to advanced agricultural technologies and a shift towards high-quality protein production. The United States is a major player in this market, driven by its expansive poultry and swine industries.South America Starter Feed Market Report:

In South America, the Starter Feed market is expected to grow from 0.59 billion USD in 2023 to 0.98 billion USD by 2033. The region's growth is driven by rising meat exports and increasing investments in animal husbandry practices. Brazil is the key contributor, owing to its large livestock sector.Middle East & Africa Starter Feed Market Report:

In the Middle East and Africa, the market will grow from 1.30 billion USD in 2023 to 2.19 billion USD by 2033. Increasing urbanization and rising disposable incomes are propelling demand for poultry and other livestock products, thereby influencing the Starter Feed market.Tell us your focus area and get a customized research report.

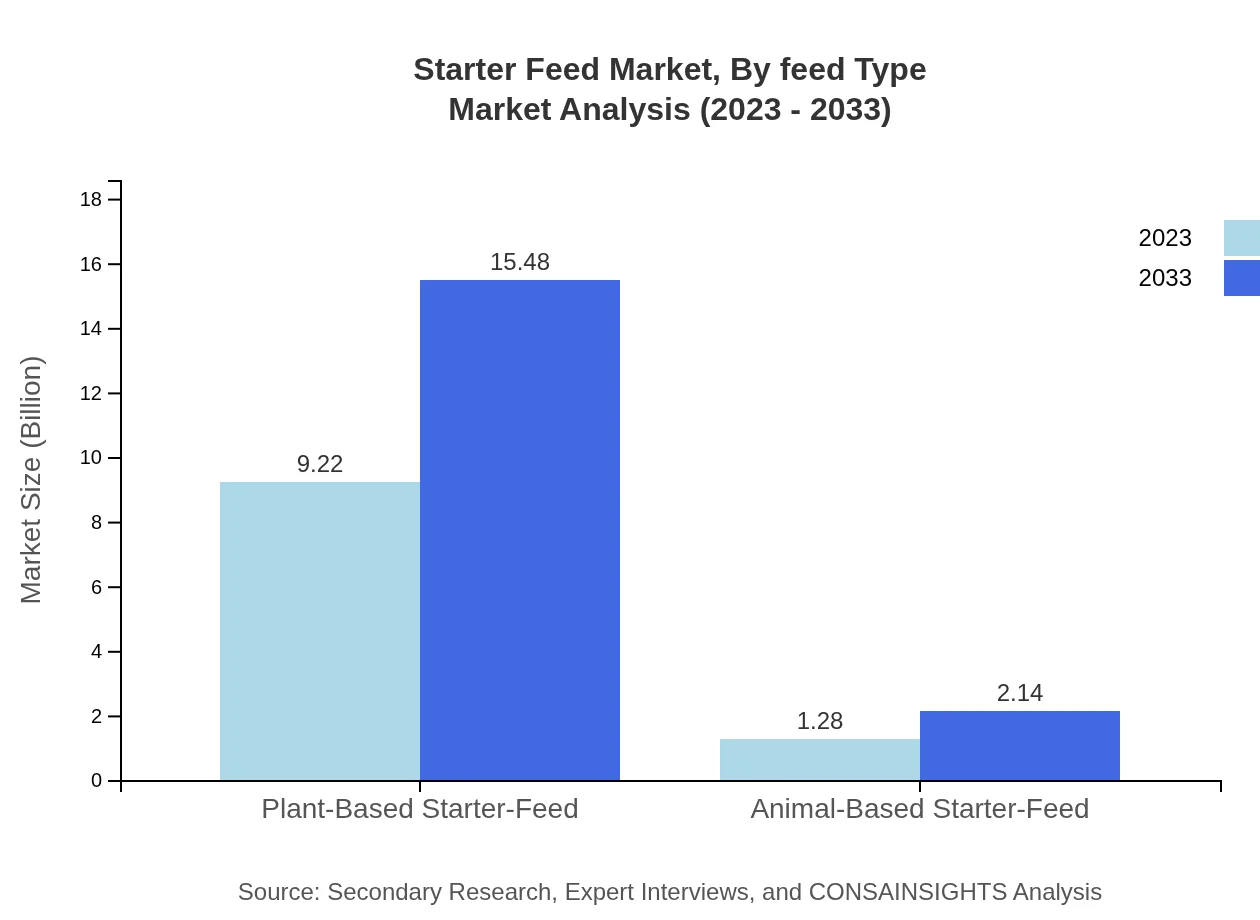

Starter Feed Market Analysis By Feed Type

The Starter Feed market by feed type is dominated by plant-based starter feeds, which accounted for 87.85% share in 2023. This segment's market size is expected to grow from 9.22 billion USD in 2023 to 15.48 billion USD by 2033. In contrast, animal-based starter feeds contributed with a share of 12.15% and are projected to grow significantly due to an increase in aquaculture and exotic livestock farming.

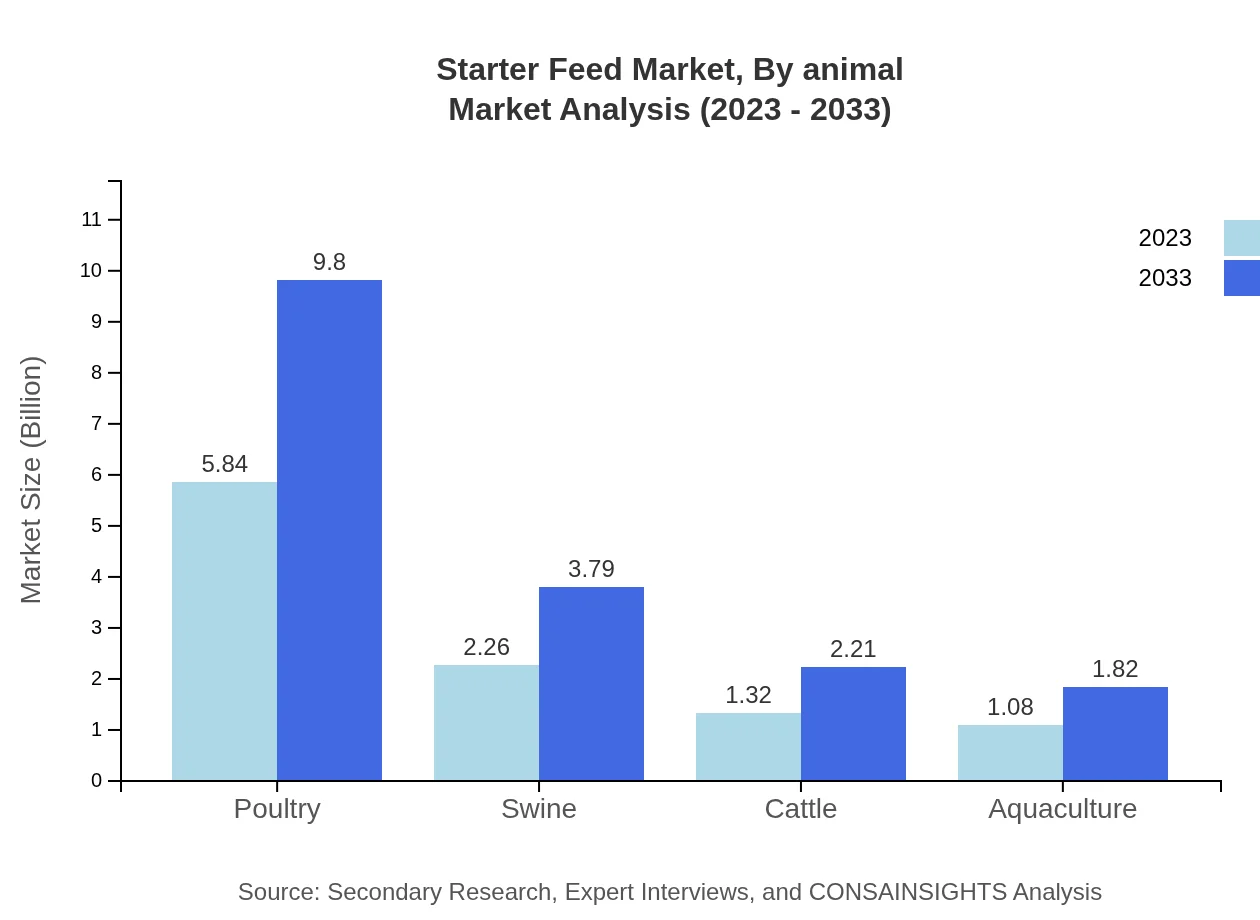

Starter Feed Market Analysis By Animal

In the nutritional segment by animal type, poultry remains the largest segment with a market size of 5.84 billion USD in 2023, expected to grow to 9.80 billion USD by 2033. Swine, with a market size of 2.26 billion USD, is also noteworthy, showing an expected rise to 3.79 billion USD in the same period. The cattle segment, while smaller, also indicates substantial growth potential.

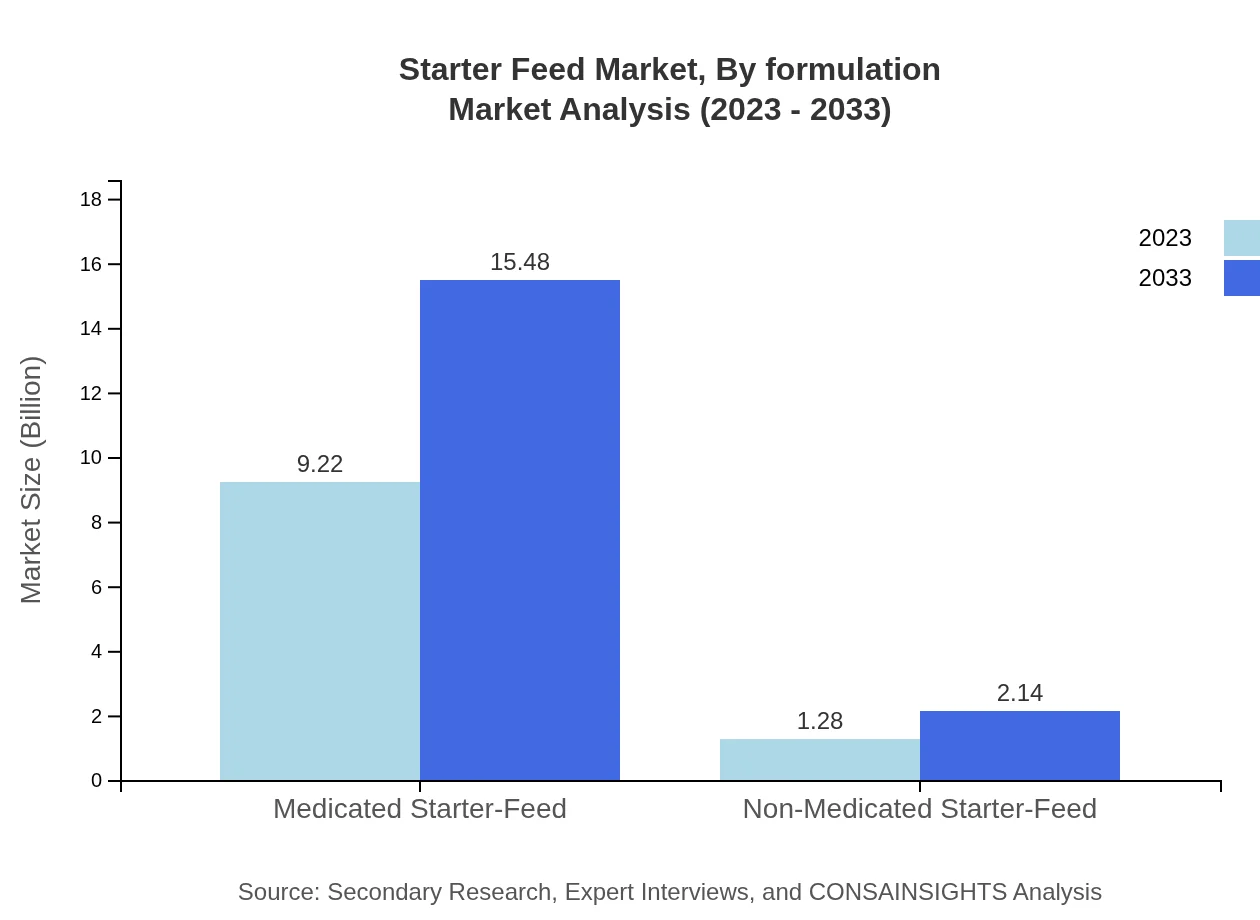

Starter Feed Market Analysis By Formulation

The Starter Feed market by formulation is split between medicated and non-medicated feeds. Medicated starter feeds hold a significant market share of 87.85%, reflecting the industry's focus on preventing diseases and promoting better health outcomes in young animals. This segment is expected to reach a market size of 15.48 billion USD by 2033.

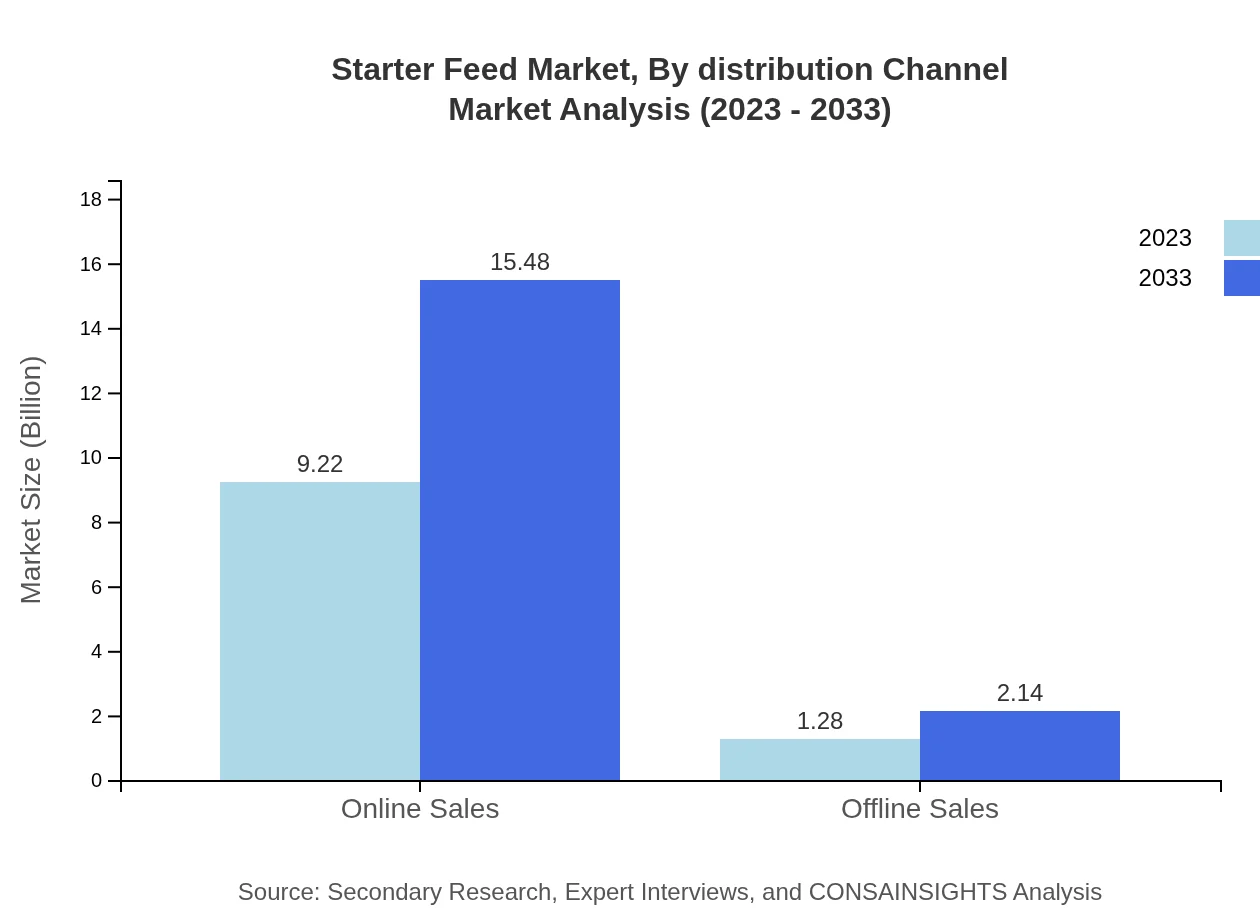

Starter Feed Market Analysis By Distribution Channel

The Starter Feed market distribution channels are trending towards online sales, which dominate with a share of 87.85% in 2023, rising steadily towards 15.48 billion USD by 2033. Offline sales, while smaller, remain essential particularly in rural markets, projected to grow to 2.14 billion USD by 2033.

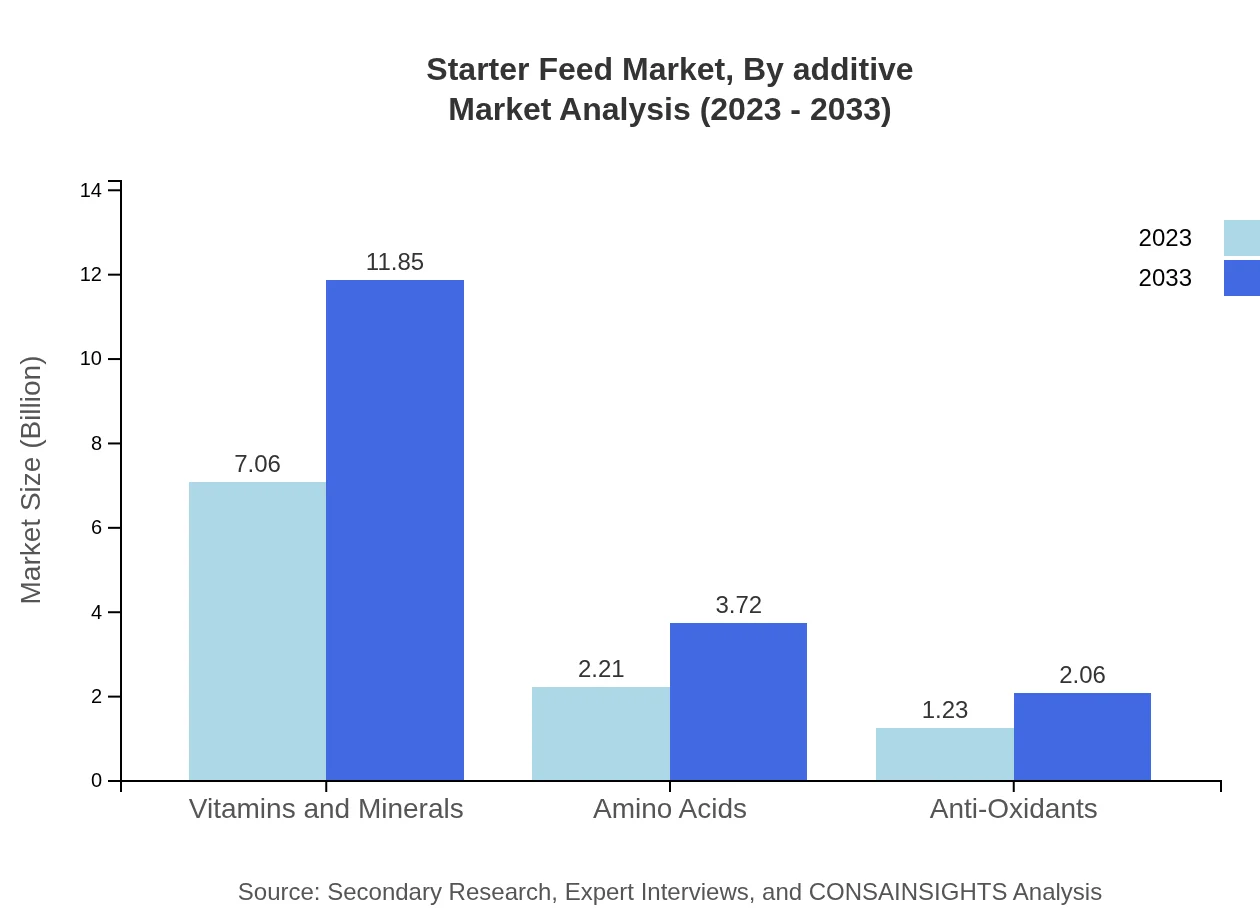

Starter Feed Market Analysis By Additive

The additives market segment reveals that vitamins and minerals dominated the Starter Feed market with a notable share of 67.25% in 2023. The additives market is projected to experience growth, driven by increasing awareness of animal nutrition and health.

Starter Feed Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Starter Feed Industry

Cargill, Inc.:

Cargill is a global leader in animal nutrition, providing a wide range of starter feeds and innovative solutions to optimize livestock growth and health.Archer Daniels Midland Company (ADM):

ADM is a significant player in the animal nutrition space, offering high-quality feed products and ingredients designed to support animal health and performance.Nutreco N.V.:

Nutreco specializes in animal nutrition and aquaculture, delivering tailored and innovative starter feeds to meet the distinct needs of various livestock sectors.Alltech, Inc.:

Alltech is renowned for its innovative animal nutrition solutions, focusing on gut health and nutritional efficiency to enhance the overall wellness of livestock.We're grateful to work with incredible clients.

FAQs

What is the market size of starter Feed?

The global starter-feed market size is estimated at $10.5 billion in 2023, with a compound annual growth rate (CAGR) of 5.2%, expected to reach approximately $17 billion by 2033.

What are the key market players or companies in the starter Feed industry?

Key players in the starter-feed industry include industry giants such as Cargill, Archer Daniels Midland Company, and Nutreco, along with various regional entities contributing to market dynamics.

What are the primary factors driving the growth in the starter Feed industry?

The growth of the starter-feed industry is driven by rising livestock population, increasing demand for animal protein, and advancements in feed formulations that ensure better growth rates and health in young animals.

Which region is the fastest Growing in the starter Feed market?

The fastest-growing region in the starter-feed market is North America, projected to grow from $3.77 billion in 2023 to $6.32 billion by 2033, driven by high demand for poultry and swine feed.

Does ConsaInsights provide customized market report data for the starter Feed industry?

Yes, ConsaInsights offers customized market report data for the starter-feed industry, tailored to meet specific client requirements and provide deeper insights into niche markets.

What deliverables can I expect from this starter Feed market research project?

Expect comprehensive deliverables including detailed market reports, trend analysis, regional insights, competitive analysis, and projections for various segments within the starter-feed industry.

What are the market trends of starter Feed?

Current market trends in the starter-feed industry include increased demand for plant-based formulations, heightened focus on nutritional additives, and a shift towards online sales channels for product distribution.