Starter Fertilizers Market Report

Published Date: 02 February 2026 | Report Code: starter-fertilizers

Starter Fertilizers Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the Starter Fertilizers market, providing insights on market size, trends, and forecasts from 2023 to 2033, alongside regional analyses and competitive landscapes.

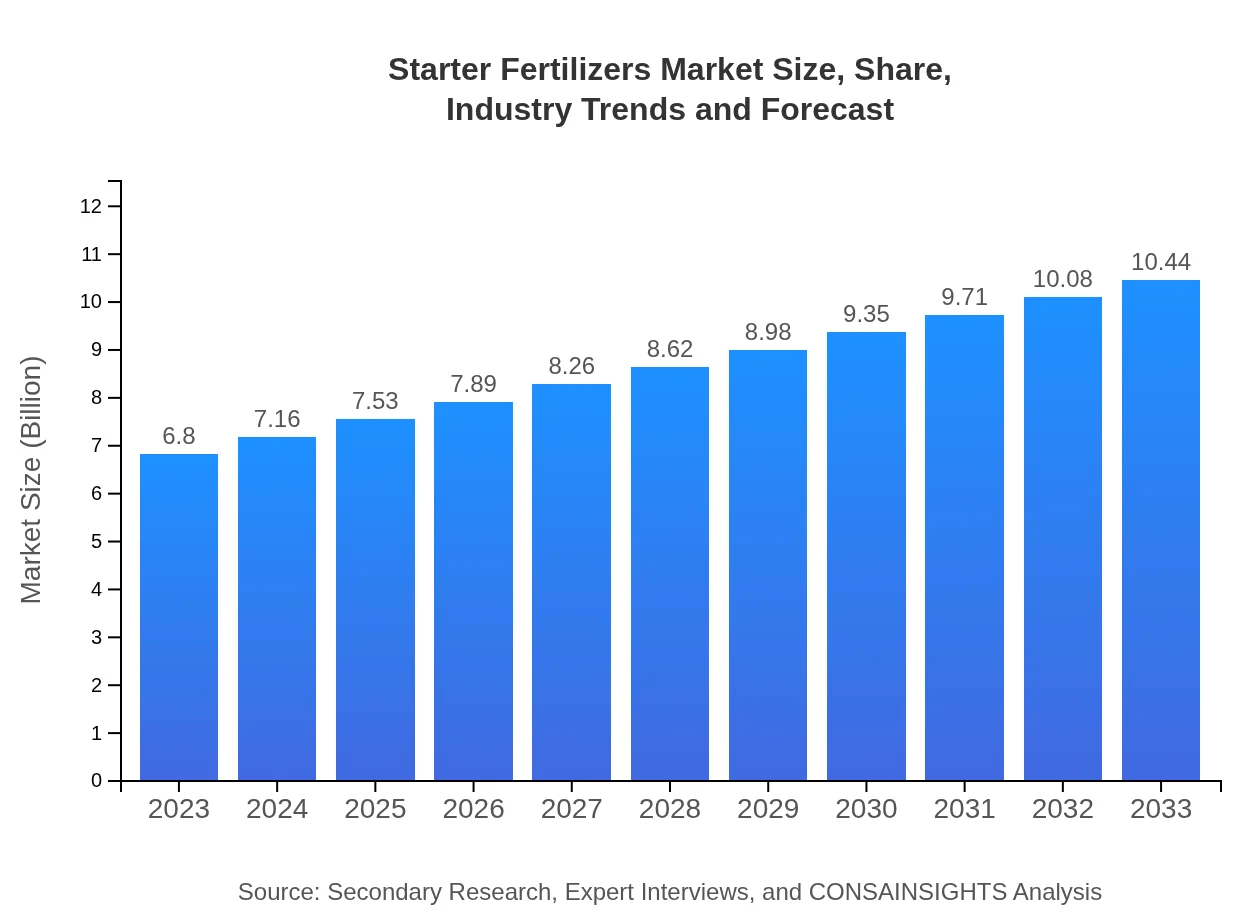

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $6.80 Billion |

| CAGR (2023-2033) | 4.3% |

| 2033 Market Size | $10.44 Billion |

| Top Companies | Yara International, Nutrien Ltd., BASF SE, Syngenta AG, The Mosaic Company |

| Last Modified Date | 02 February 2026 |

Starter Fertilizers Market Overview

Customize Starter Fertilizers Market Report market research report

- ✔ Get in-depth analysis of Starter Fertilizers market size, growth, and forecasts.

- ✔ Understand Starter Fertilizers's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Starter Fertilizers

What is the Market Size & CAGR of Starter Fertilizers market in 2023?

Starter Fertilizers Industry Analysis

Starter Fertilizers Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Starter Fertilizers Market Analysis Report by Region

Europe Starter Fertilizers Market Report:

Europe's Starter Fertilizers market is expected to grow from $2.23 billion in 2023 to $3.42 billion by 2033. The EU's stringent regulations on agricultural chemicals, combined with consumer pressure for organic produce, is pushing farmers to utilize sustainable and efficient fertilization practices. Research and development funded by the EU also contributes to advancements in starter fertilizer technologies.Asia Pacific Starter Fertilizers Market Report:

The Asia-Pacific region is witnessing considerable growth due to its large agricultural base. In 2023, the market size is approximately $1.15 billion, expected to increase to $1.76 billion by 2033. Increased population density, coupled with limited arable land, has shifted focus towards optimizing production through effective fertilizer usage. Government initiatives aimed at increasing food security and improving crop productivity are fueling demand.North America Starter Fertilizers Market Report:

North America, particularly the United States, accounted for a market size of $2.51 billion in 2023, set to grow to $3.85 billion by 2033. The region's focus on technologically advanced farming techniques and emphasis on sustainable practices drives the adoption of starter fertilizers. The presence of leading agribusiness firms and research institutions further enhances innovation and market growth.South America Starter Fertilizers Market Report:

In South America, the Starter Fertilizers market was valued at $0.15 billion in 2023 and is projected to grow to $0.24 billion by 2033. With countries like Brazil and Argentina investing heavily in agriculture, there is an uptrend for starter fertilizers to ensure better yields. The acceptance of modern agricultural practices is also enhancing this region's market dynamics.Middle East & Africa Starter Fertilizers Market Report:

In the Middle East and Africa, the market size is projected to grow from $0.76 billion in 2023 to $1.16 billion by 2033. The growing emphasis on food security, alongside government initiatives to enhance agricultural productivity in the face of climate challenges, is propelling the market for starter fertilizers in this region.Tell us your focus area and get a customized research report.

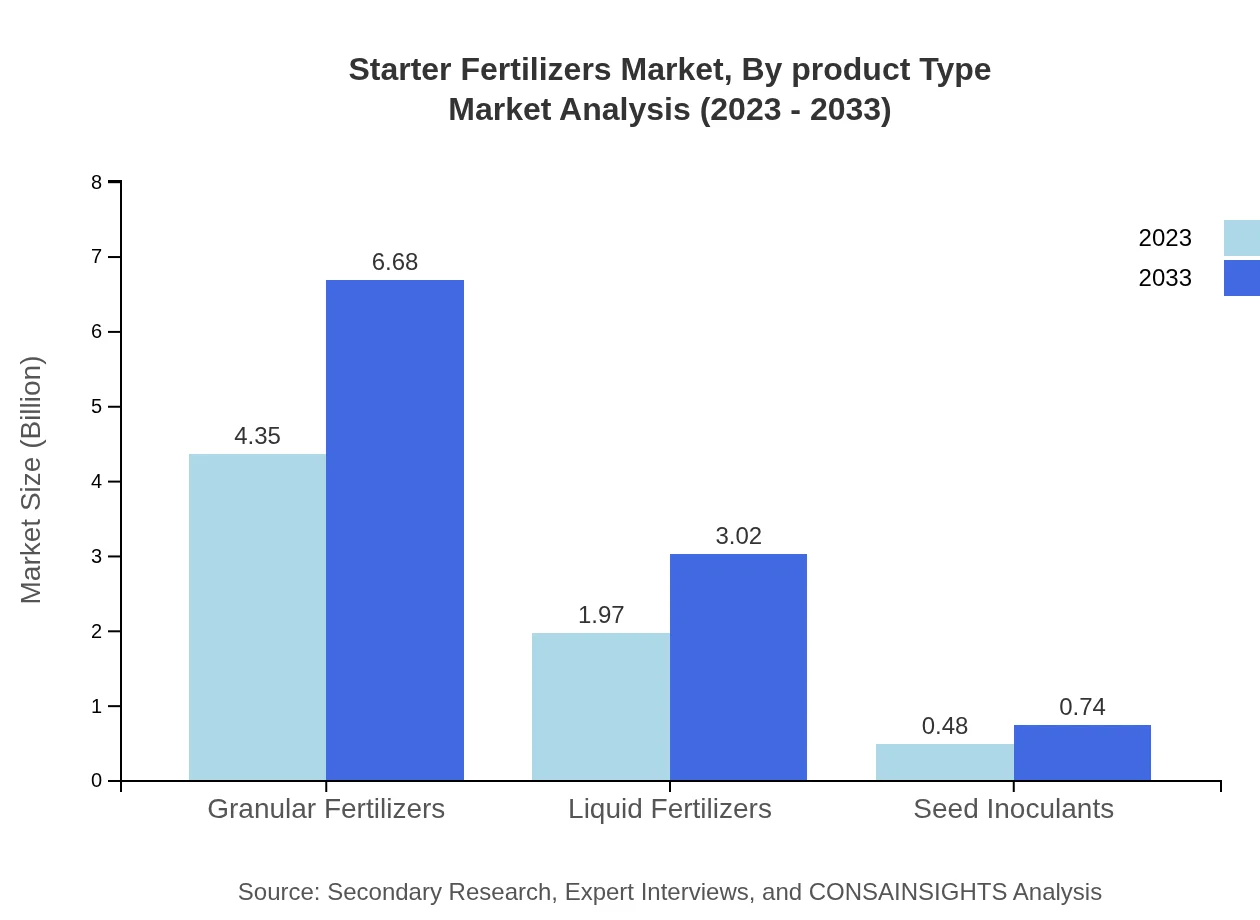

Starter Fertilizers Market Analysis By Product Type

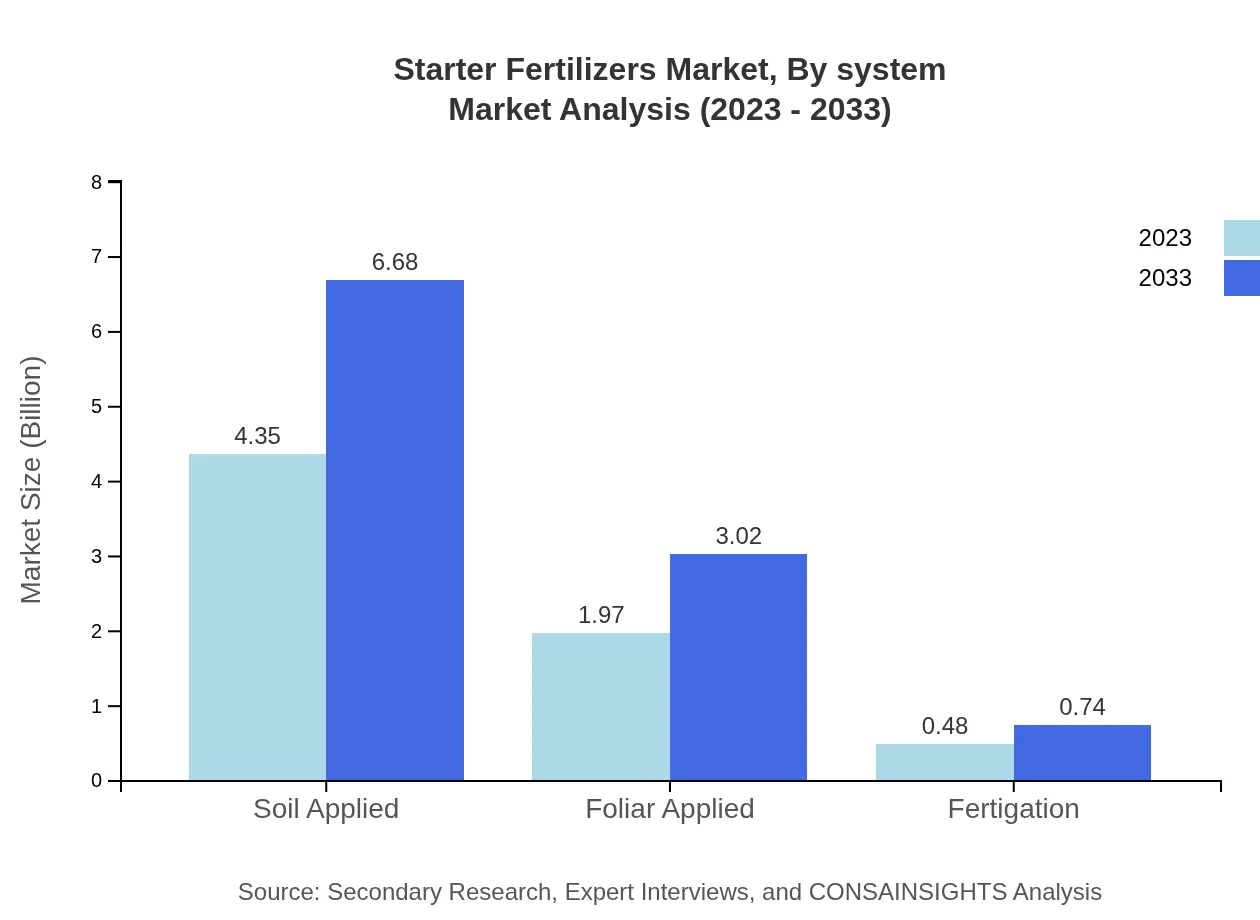

In 2023, the Soil Applied segment dominates with a market size of $4.35 billion, expected to reach $6.68 billion by 2033, holding a 63.99% market share. Foliar Applied fertilizers follow with a 28.92% share and a market size rising from $1.97 billion to $3.02 billion in the same period. Fertigation, though smaller, shows growth potential from $0.48 billion to $0.74 billion.

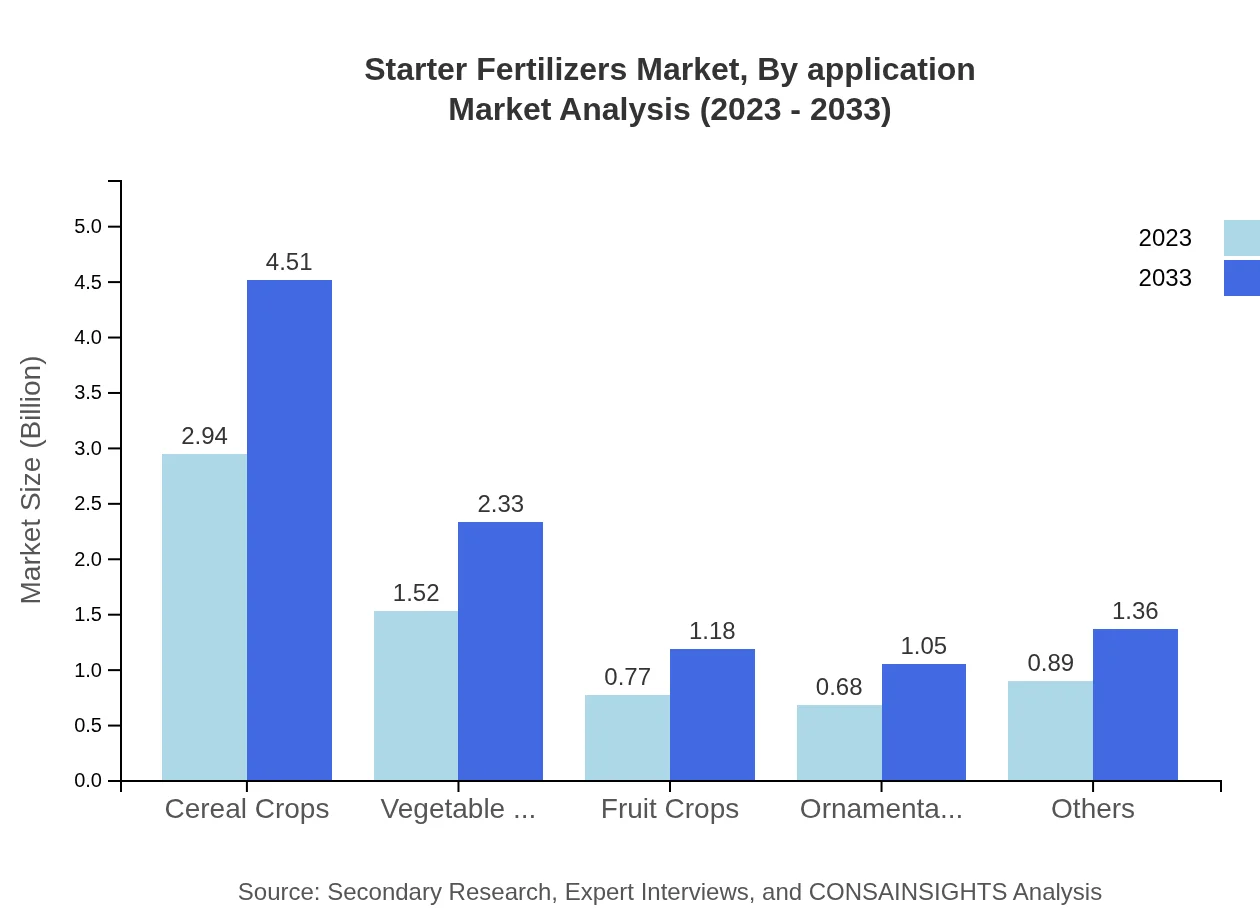

Starter Fertilizers Market Analysis By Application

Cereal crops lead the application segment, accounting for 43.24% of the market share in 2023, valued at $2.94 billion and rising to $4.51 billion by 2033. The vegetable and fruit segment follow, capturing significant shares at 22.35% and 11.28%, respectively. Their growth emphasizes the need for specialized fertilizers to meet yield and quality demands.

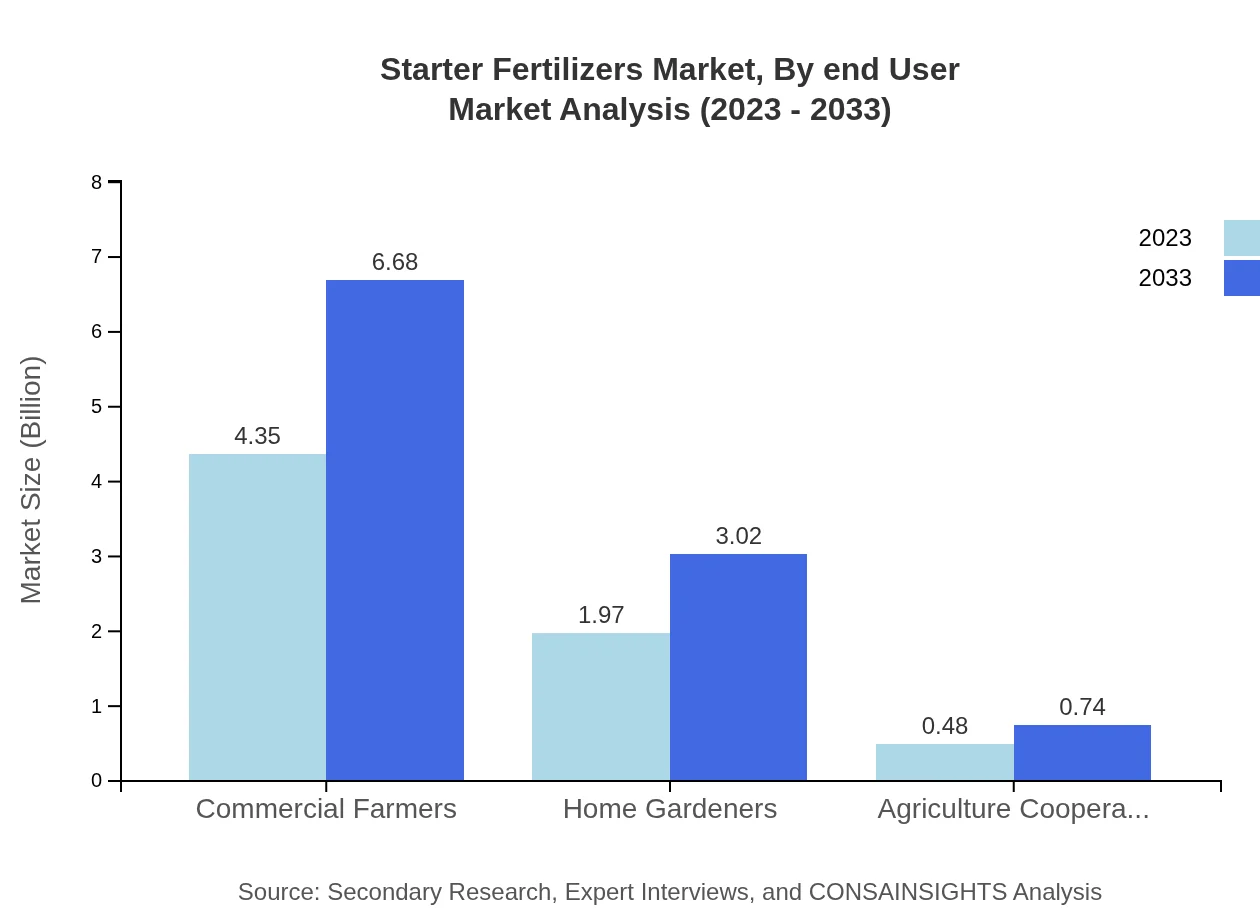

Starter Fertilizers Market Analysis By System

Commercial farmers constitute the primary end-user segment, with a market size of $4.35 billion in 2023, expected to grow to $6.68 billion by 2033, maintaining a 63.99% market share. Home gardeners and agricultural cooperatives also play essential roles, contributing to market diversity, with home gardeners alone expected to expand from $1.97 billion to $3.02 billion.

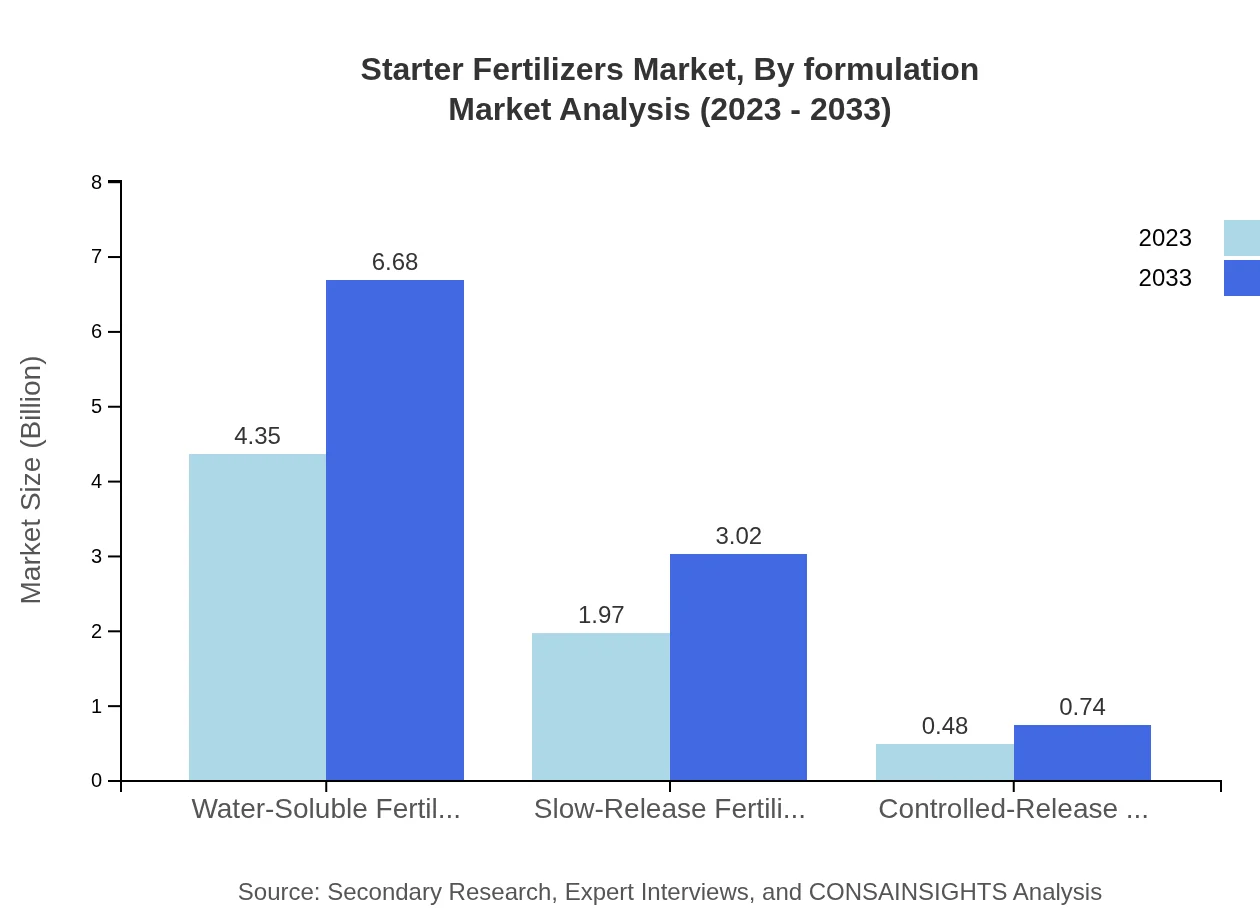

Starter Fertilizers Market Analysis By Formulation

Regarding formulation, water-soluble fertilizers dominate the market with substantial share and growth. Granular fertilizers remain popular due to their ease of use, while liquid fertilizers are gaining traction among specialty crops due to their application flexibility.

Starter Fertilizers Market Analysis By End User

Commercial and cooperative agriculture settings show robust demand for starter fertilizers, increasingly adopting sustainable and efficient practices. Home gardening as a segment reflects burgeoning interest, with more urban consumers looking to optimize food production in limited spaces.

Starter Fertilizers Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Starter Fertilizers Industry

Yara International:

A global leader in the production of mineral fertilizers and sustainable agriculture, Yara focuses on innovative nitrogen products and technologies that enhance crop yield while minimizing environmental impacts.Nutrien Ltd.:

As one of the largest providers of crop inputs and services, Nutrien is known for its extensive product portfolio, including starter fertilizers designed for various agricultural applications and environmental stewardship.BASF SE:

BASF is a leader in chemical production and a significant player in the fertilizer market, offering innovative starter fertilizer solutions for nutrient management in farming.Syngenta AG:

Syngenta is renowned for its commitment to sustainable agriculture solutions, providing a variety of starter fertilizers that enhance crop health and agricultural productivity.The Mosaic Company:

The Mosaic Company is a leading producer of potash and phosphate fertilizers, emphasizing sustainable product development and efficient agricultural practices in starter fertilizer applications.We're grateful to work with incredible clients.

FAQs

What is the market size of Starter Fertilizers?

The starter fertilizers market is valued at approximately $6.8 billion in 2023, with a projected CAGR of 4.3% through 2033. This growth is driven by increasing agricultural productivity demands and sustainable farming practices.

What are the key market players or companies in the Starter Fertilizers industry?

Key players in the starter fertilizers market include major agribusiness companies such as Nutrien, Yara International, and The Mosaic Company. These firms are prominent for their innovative products and global distribution networks.

What are the primary factors driving the growth in the Starter Fertilizers industry?

Growth factors include the rising demand for increased crop yields, advancements in fertilizer technology, and a shift towards sustainable agriculture practices. Government policies promoting agricultural efficiency also propel market expansion.

Which region is the fastest Growing in the Starter Fertilizers market?

The fastest-growing region in the starter fertilizers market is Europe, projected to grow from $2.23 billion in 2023 to $3.42 billion by 2033. This growth reflects increasing agricultural investments and heightened demand for food security.

Does ConsaInsights provide customized market report data for the Starter Fertilizers industry?

Yes, ConsaInsights offers tailored market research reports for the starter fertilizers industry. Customization options include specific geographic, technological, and segment-focused insights to meet diverse client needs.

What deliverables can I expect from this Starter Fertilizers market research project?

Expect comprehensive reports including market analysis, trend forecasts, competitive landscape assessments, and regional insights. Additionally, you'll receive tailored recommendations based on your specific business objectives and market challenges.

What are the market trends of Starter Fertilizers?

Current market trends include a focus on precision agriculture, increasing adoption of organic fertilizers, and technological advancements in fertilizer application methods, such as fertigation and foliar feeding, enhancing overall crop productivity.