Stationary Emission Control Catalyst Market Report

Published Date: 02 February 2026 | Report Code: stationary-emission-control-catalyst

Stationary Emission Control Catalyst Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Stationary Emission Control Catalyst market from 2023 to 2033, focusing on market trends, growth potential, segmentation, and key industry players.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

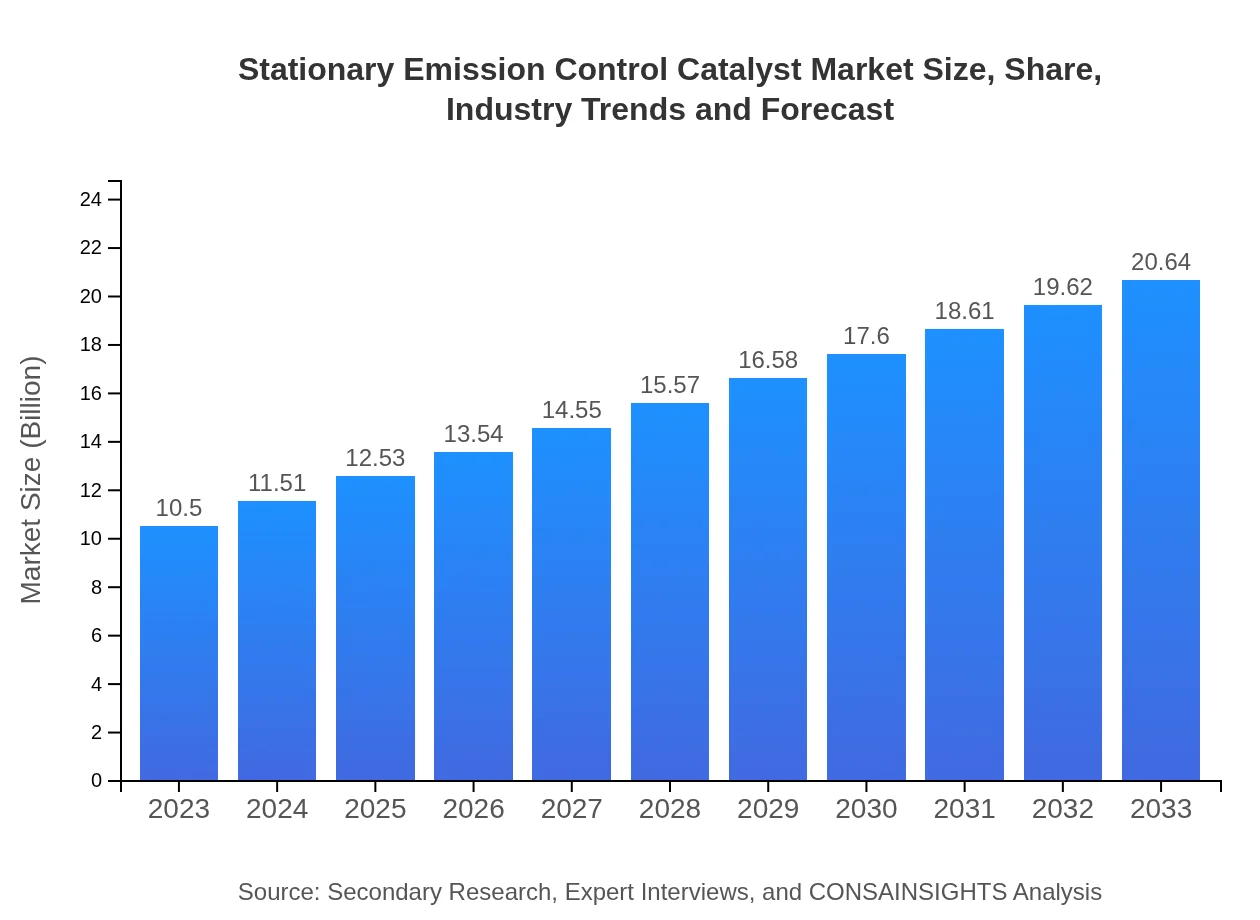

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $20.64 Billion |

| Top Companies | BASF SE, Johnson Matthey, Haldor Topsoe, Honeywell , Umicore |

| Last Modified Date | 02 February 2026 |

Stationary Emission Control Catalyst Market Overview

Customize Stationary Emission Control Catalyst Market Report market research report

- ✔ Get in-depth analysis of Stationary Emission Control Catalyst market size, growth, and forecasts.

- ✔ Understand Stationary Emission Control Catalyst's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Stationary Emission Control Catalyst

What is the Market Size & CAGR of Stationary Emission Control Catalyst market in 2023?

Stationary Emission Control Catalyst Industry Analysis

Stationary Emission Control Catalyst Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Stationary Emission Control Catalyst Market Analysis Report by Region

Europe Stationary Emission Control Catalyst Market Report:

The European market is anticipated to grow from $3.33 billion in 2023 to $6.55 billion by 2033. Europe leads in stringent emission regulations and innovative technologies, positioning it as a front-runner in adopting advanced stationary emission control catalysts.Asia Pacific Stationary Emission Control Catalyst Market Report:

The Asia Pacific region, with a market size of $1.97 billion in 2023, is projected to reach $3.88 billion by 2033, fueled by industrialization and rising energy needs. Governments are implementing stricter environmental regulations, pushing industries to invest heavily in emission control technologies.North America Stationary Emission Control Catalyst Market Report:

North America presents a robust market environment with a value of $3.72 billion in 2023, expected to surge to $7.32 billion by 2033. The U.S. and Canada’s commitment to reducing greenhouse gas emissions and investing in clean technologies is significant in driving this market's expansion.South America Stationary Emission Control Catalyst Market Report:

In South America, the market size is expected to grow from $1.01 billion in 2023 to $1.98 billion by 2033. The increasing focus on sustainable development and compliance with international emission standards are key factors propelling market growth in this region.Middle East & Africa Stationary Emission Control Catalyst Market Report:

In the Middle East and Africa, the market is relatively smaller, starting at $0.46 billion in 2023 but expected to grow to $0.90 billion by 2033. Increased industrial activities along with emerging regulations will likely stimulate market development.Tell us your focus area and get a customized research report.

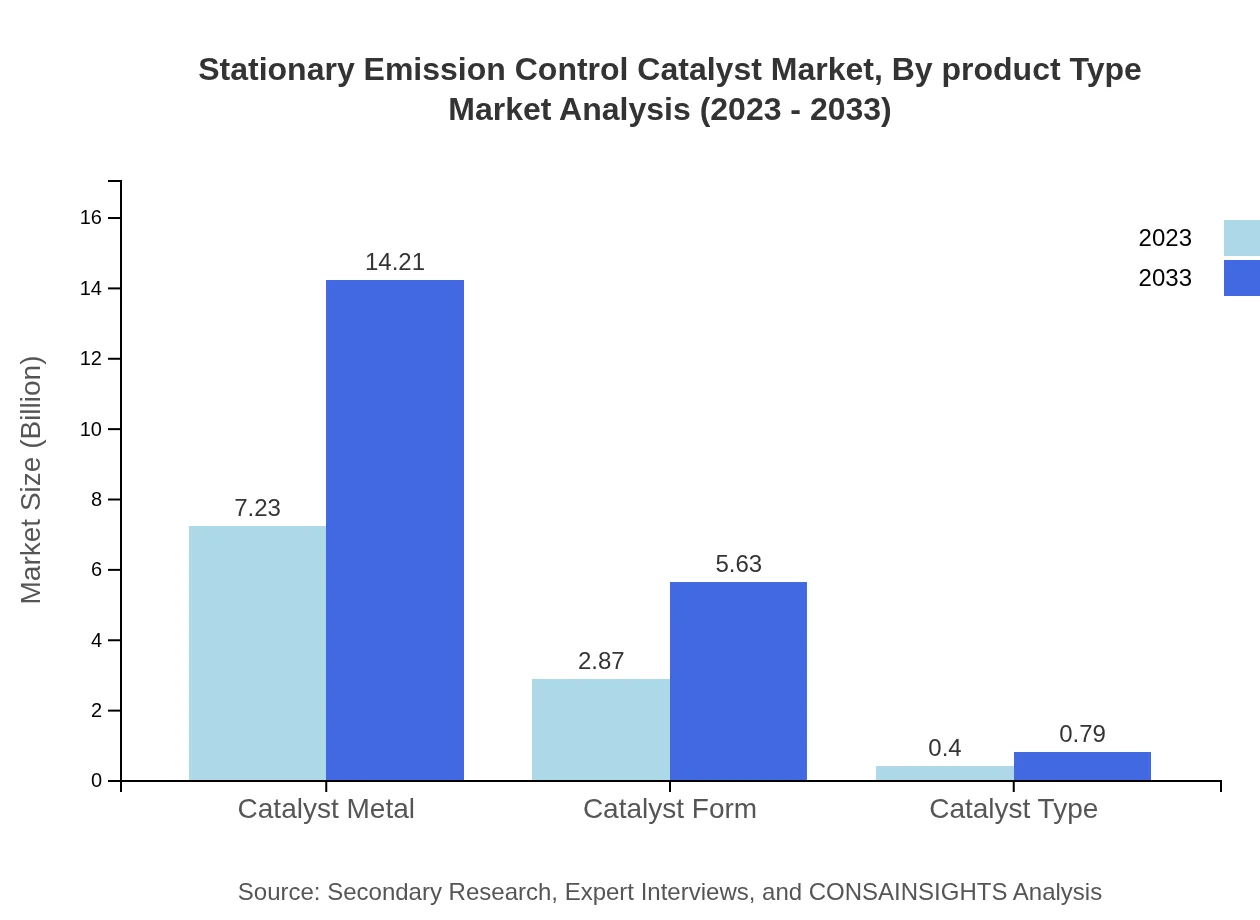

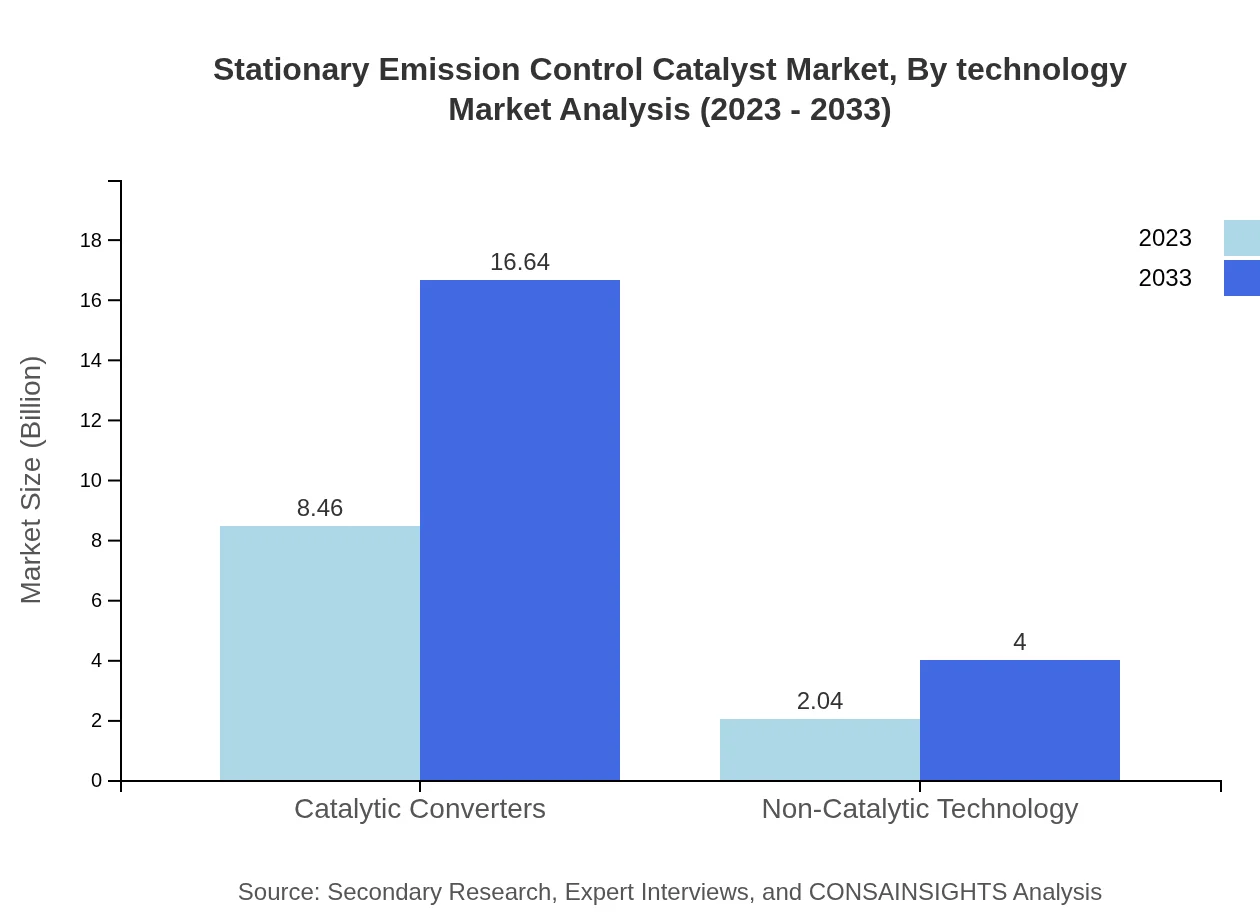

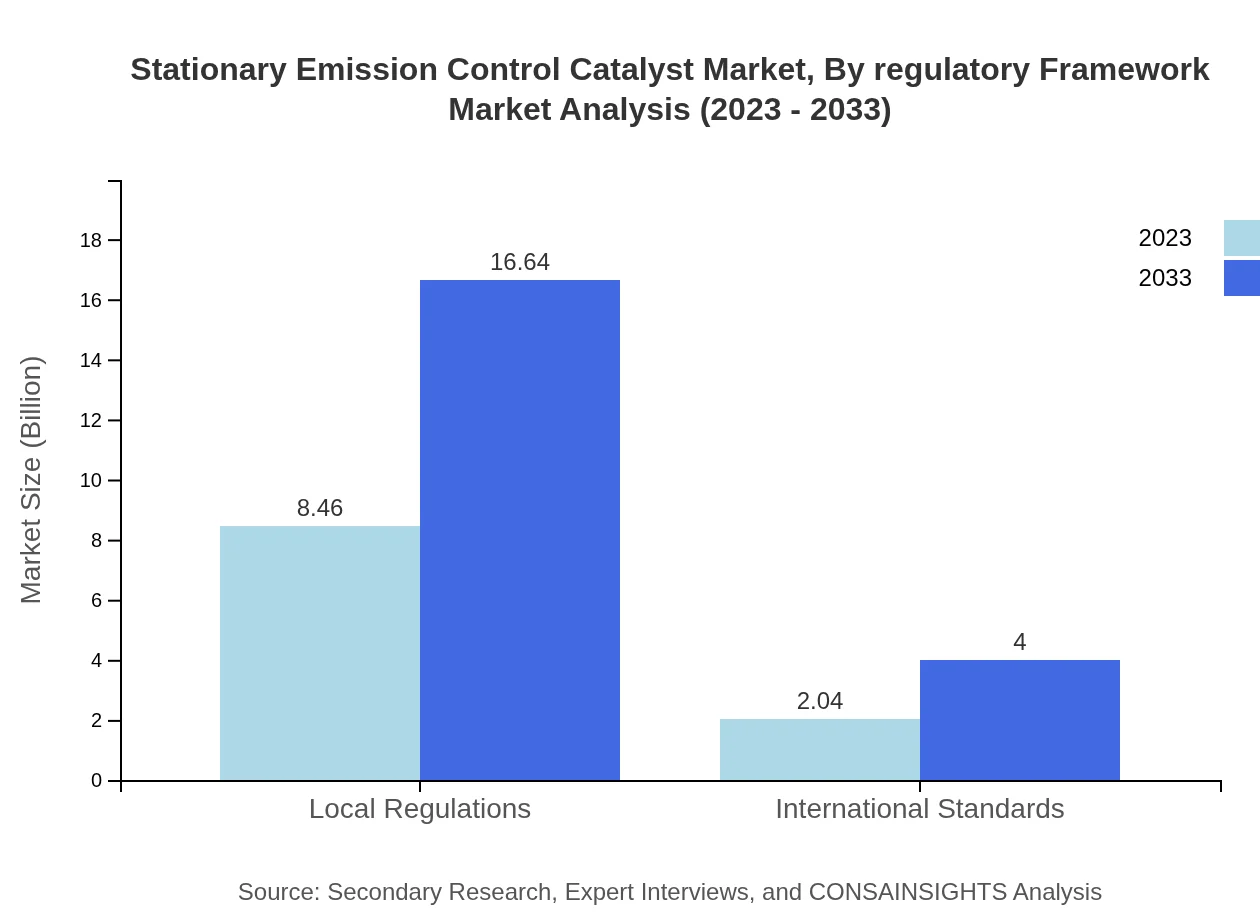

Stationary Emission Control Catalyst Market Analysis By Product Type

Catalytic converters dominate the market due to their essential role in reducing harmful emissions. In 2023, the market size for catalytic converters stood at $8.46 billion, anticipating an increase to $16.64 billion by 2033, with an 80.61% market share. Catalyst metals followed as the second crucial segment, valued at $7.23 billion in 2023, projected to double by 2033. Non-catalytic technologies, although smaller, are also important with advancements that contribute to emissions control solutions.

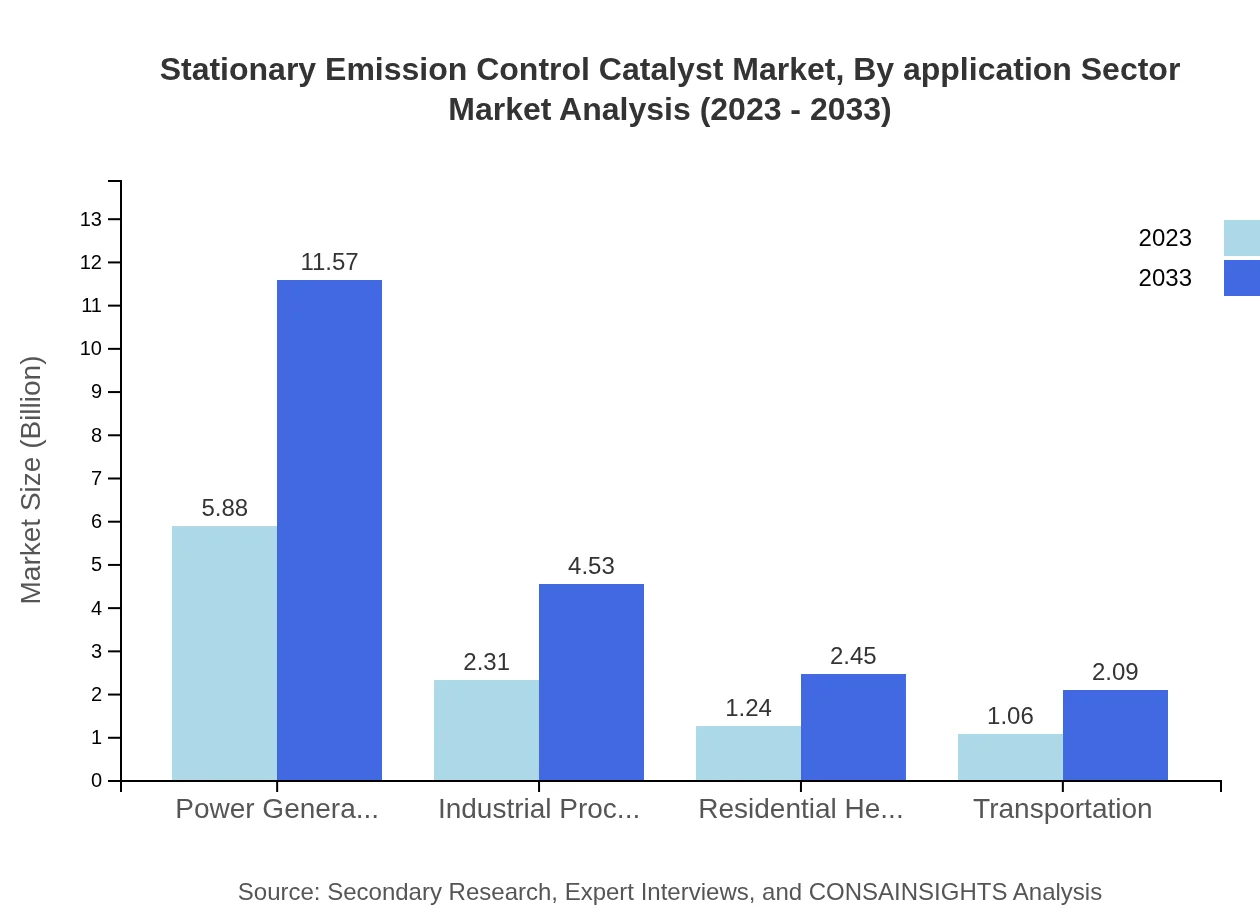

Stationary Emission Control Catalyst Market Analysis By Application Sector

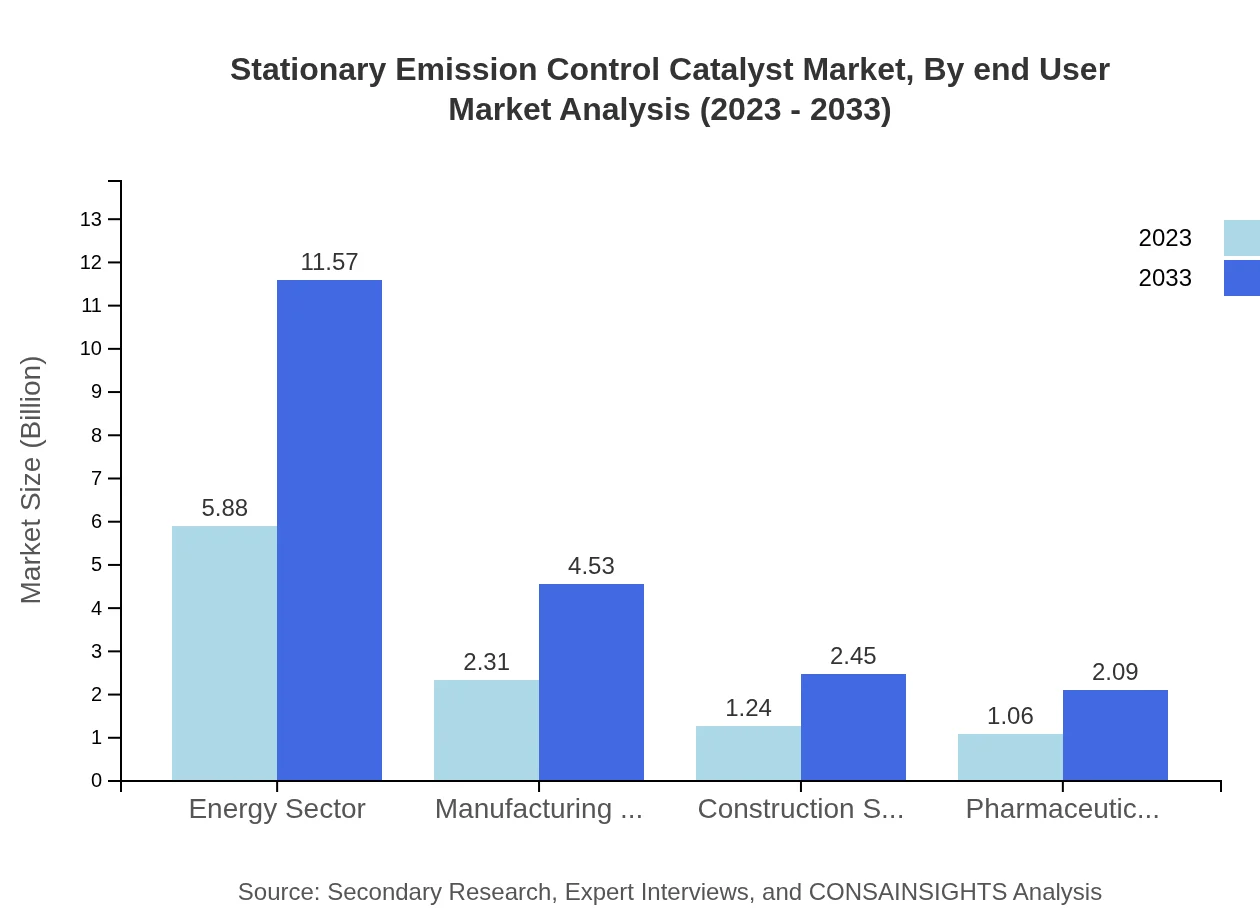

The power generation sector takes the lead with a market size of $5.88 billion in 2023, set to rise to $11.57 billion by 2033. Manufacturing and industrial processes also hold significant shares, contributing $2.31 billion and expected to reach $4.53 billion. Residential heating systems contribute $1.24 billion, projected to rise progressively. The importance of local and international regulatory frameworks is critical as sectors strive for compliance with emission standards.

Stationary Emission Control Catalyst Market Analysis By Technology

Factors such as advancements in catalyst formulations and the integration of smart technologies are key players in the market. The continuous innovations lead to enhanced performance, durability, and efficiency, ensuring sustainable development in various sectors. Trends indicate a significant shift towards utilizing more efficient catalytic materials that can successfully meet regulatory demands while maximizing efficiency.

Stationary Emission Control Catalyst Market Analysis By End User

Key end-user industries include energy, manufacturing, and construction. Energy production remains the largest consumer of stationary emission control catalysts due to regulatory requirements. Manufacturing processes are also significant, focusing on compliance with emissions standards while enhancing production efficiency. Construction is gradually emphasizing the use of clean technologies, indicating shifts towards greener practices.

Stationary Emission Control Catalyst Market Analysis By Regulatory Framework

Regulatory frameworks encompass numerous local and international directives that govern emissions. The stringent regulations in North America and Europe serve as a model for many regions. Compliance with these frameworks is crucial for industries, ensuring that the market for stationary emission control catalysts thrives in synergy with regulatory demands.

Stationary Emission Control Catalyst Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Stationary Emission Control Catalyst Industry

BASF SE:

A leading chemical company, BASF develops high-performance catalytic solutions emphasizing sustainability and efficiency across various applications.Johnson Matthey:

Specializing in sustainable technologies, Johnson Matthey supplies catalysts and emission control solutions globally, known for their innovative approach to reducing vehicle emissions.Haldor Topsoe:

Haldor Topsoe is renowned for their catalyst technology and provides solutions that optimize performance while minimizing environmental impact.Honeywell :

Honeywell offers diverse emission control products, leveraging its technology and expertise in providing sustainable environmental solutions across multiple industries.Umicore:

Umicore is a global materials technology company focusing on catalysis, recycling, and precious metals, dedicated to developing breakthrough materials for environmental sustainability.We're grateful to work with incredible clients.

FAQs

What is the market size of stationary Emission Control Catalyst?

The global market size for stationary emission control catalysts is projected to reach approximately $10.5 billion by 2033, reflecting a compound annual growth rate (CAGR) of 6.8% from 2023.

What are the key market players or companies in this stationary Emission Control Catalyst industry?

Key players in the stationary emission control catalyst market include major chemical manufacturers and technology firms that specialize in catalytic solutions, enhancing performance across various sectors, though specific company names are not provided.

What are the primary factors driving the growth in the stationary Emission Control Catalyst industry?

Growth is driven by stricter environmental regulations, increased demand for cleaner technologies, and advancements in catalyst technologies that improve efficiency and effectiveness in reducing emissions.

Which region is the fastest Growing in the stationary Emission Control Catalyst?

The fastest-growing region in the stationary emission control catalyst market is Europe, with the market expected to expand from $3.33 billion in 2023 to $6.55 billion by 2033.

Does ConsaInsights provide customized market report data for the stationary Emission Control Catalyst industry?

Yes, ConsaInsights offers tailored market reports for the stationary emission control catalyst industry, allowing clients to focus on specific areas or segments that meet their unique requirements.

What deliverables can I expect from this stationary Emission Control Catalyst market research project?

Deliverables include comprehensive market analysis reports, segment profiles, competitive landscape insights, and strategic recommendations based on the latest market trends and data.

What are the market trends of stationary Emission Control Catalyst?

Current trends include the transition to sustainable materials, enhanced regulatory factors driving innovation, and the rise of hybrid technologies that leverage both catalytic and non-catalytic methods for emissions control.