Stealth Technologies Market Report

Published Date: 03 February 2026 | Report Code: stealth-technologies

Stealth Technologies Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Stealth Technologies market, highlighting its current trends, segmentation, regional insights, and future forecasts from 2023 to 2033. Insights include market size, CAGR, and key players impacting the sector.

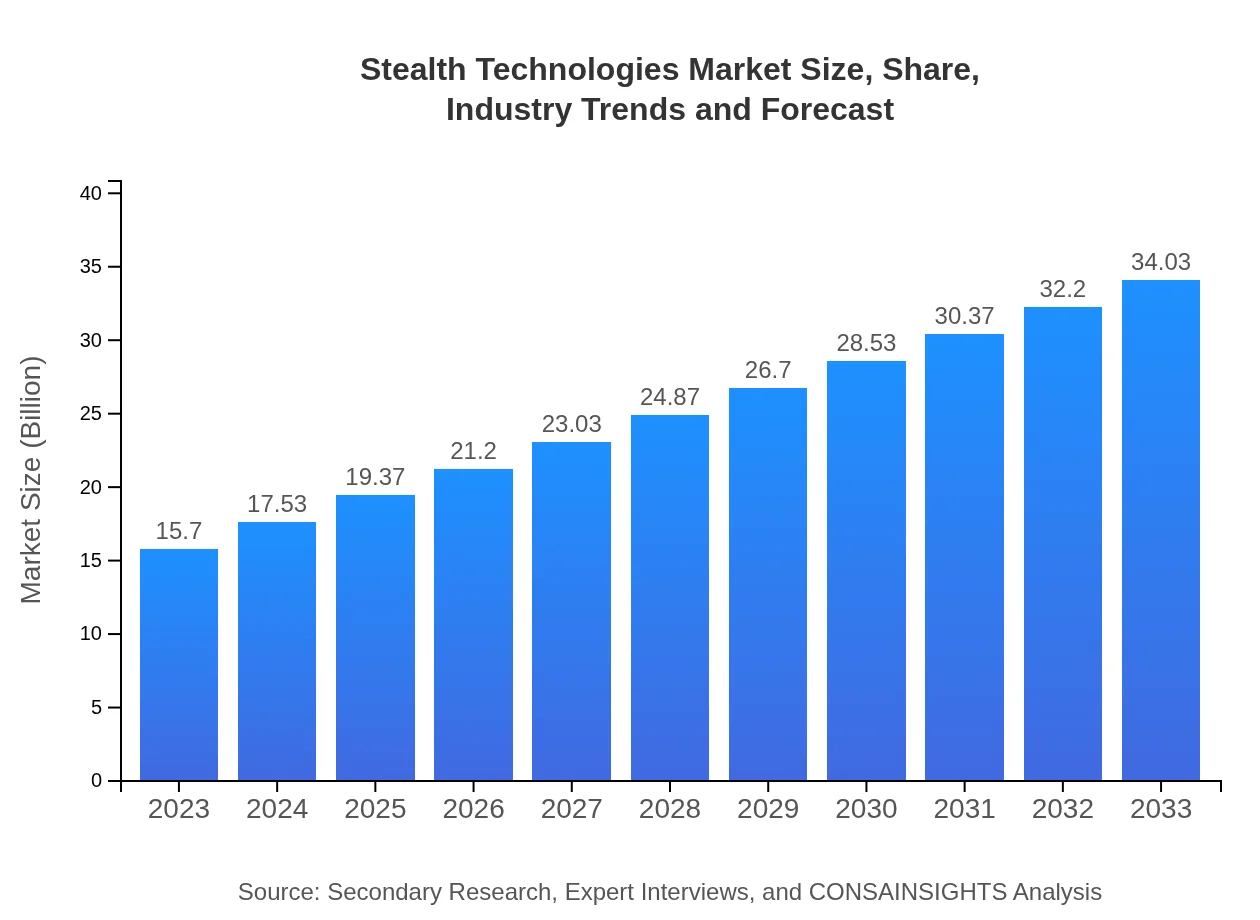

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.70 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $34.03 Billion |

| Top Companies | Lockheed Martin, Raytheon Technologies, Northrop Grumman, Boeing , General Dynamics |

| Last Modified Date | 03 February 2026 |

Stealth Technologies Market Overview

Customize Stealth Technologies Market Report market research report

- ✔ Get in-depth analysis of Stealth Technologies market size, growth, and forecasts.

- ✔ Understand Stealth Technologies's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Stealth Technologies

What is the Market Size & CAGR of Stealth Technologies market in 2023 and beyond?

Stealth Technologies Industry Analysis

Stealth Technologies Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Stealth Technologies Market Analysis Report by Region

Europe Stealth Technologies Market Report:

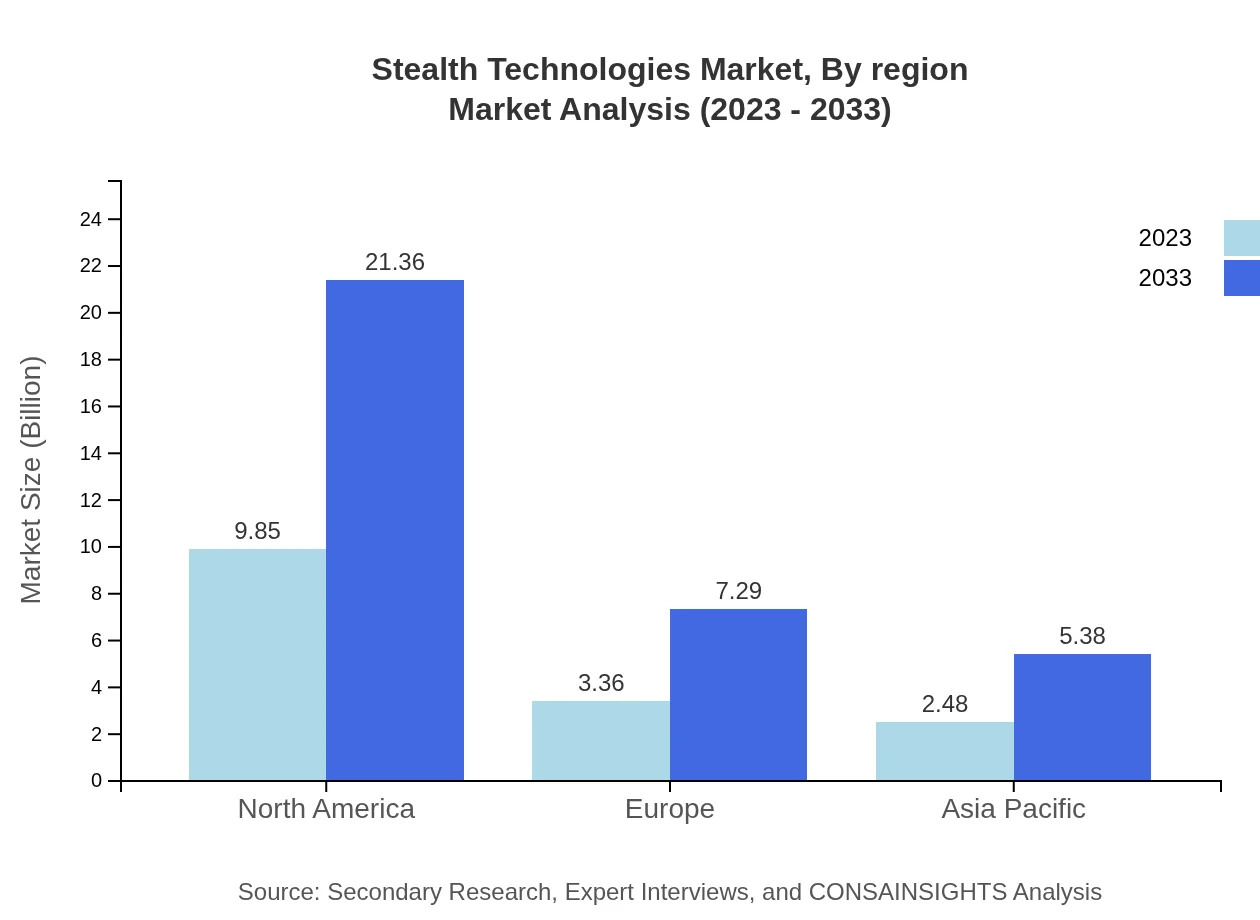

In Europe, the market is estimated to grow from $4.36 billion in 2023 to $9.45 billion by 2033. The European Union’s emphasis on collaborative defense projects and countering hybrid threats is driving investment in stealth technologies.Asia Pacific Stealth Technologies Market Report:

In the Asia Pacific region, the market size is projected to grow from $3.02 billion in 2023 to $6.54 billion by 2033, fueled by rising defense spending from countries like India, China, and Japan, focusing on enhancing their military capabilities and modernizing their armed forces.North America Stealth Technologies Market Report:

North America leads the market with projected growth from $5.90 billion in 2023 to $12.80 billion by 2033. The U.S. continues to lead in R&D investments in stealth technologies, focusing on defense applications and securing its military dominance.South America Stealth Technologies Market Report:

The South America region is expected to see slower growth, from $0.38 billion in 2023 to $0.83 billion in 2033, primarily driven by increasing interest in military modernization programs and partnerships with foreign defense firms.Middle East & Africa Stealth Technologies Market Report:

The Middle East and Africa region is projected to grow from $2.04 billion in 2023 to $4.42 billion by 2033. Heightened geopolitical tensions are pushing countries to invest in advanced military technologies, including stealth capabilities.Tell us your focus area and get a customized research report.

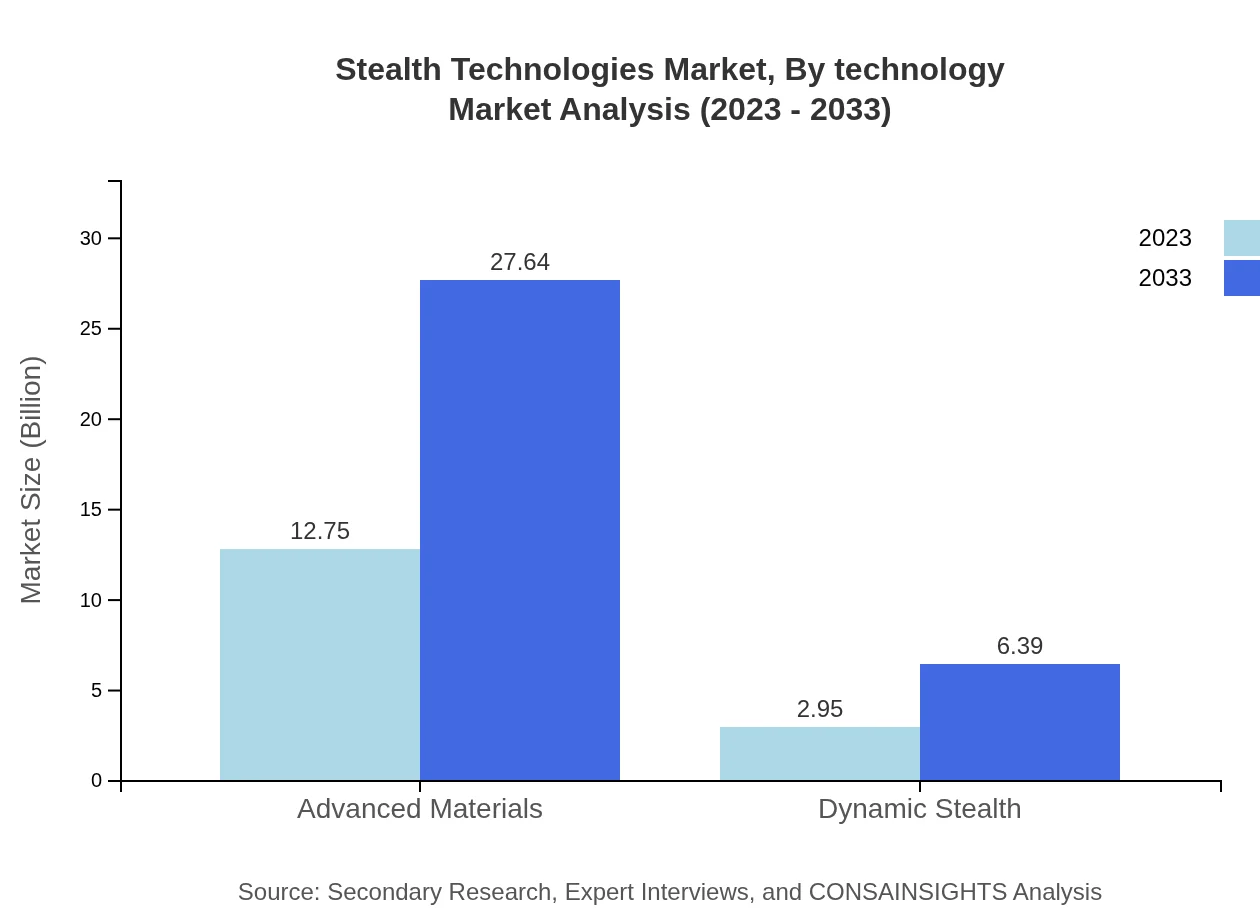

Stealth Technologies Market Analysis By Technology

The technology segment of the Stealth Technologies market includes advanced materials, dynamic stealth technology, and electronics that enhance stealth capabilities. Advanced materials account for a significant share of the market, focusing on radar-absorbing technologies, while dynamic stealth technologies are emerging as key innovations expected to shape future applications.

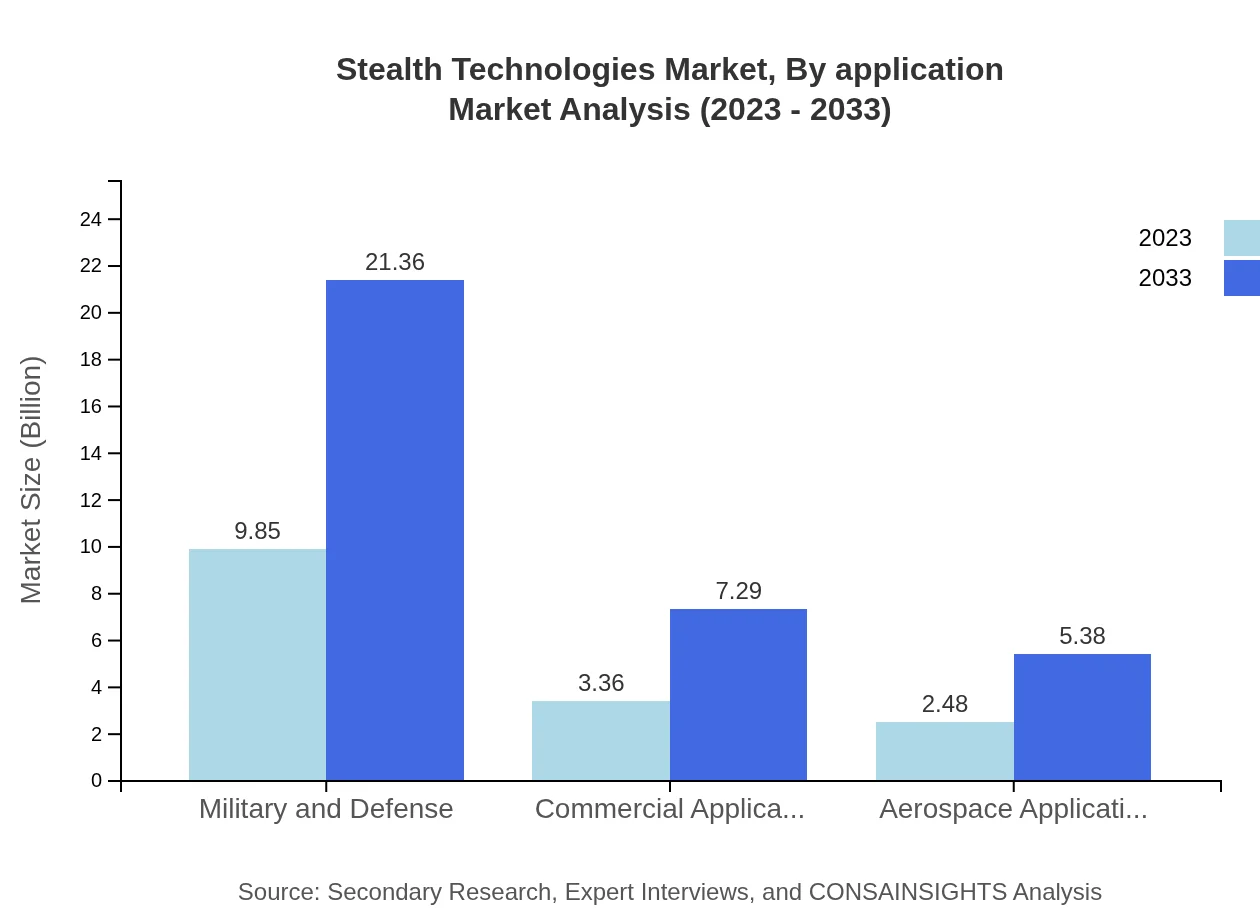

Stealth Technologies Market Analysis By Application

The market is primarily driven by military and defense applications, which contribute about 62.77% of the total market share. Aerospace applications are also significant, accounting for 15.8%, with a focus on reducing detection in aircraft and spacecraft operations.

Stealth Technologies Market Analysis By Region

Regionally, North America dominates the market with a share of 62.77% in 2023. Europe follows with 21.43%, and the Asia Pacific holds 15.8% in 2023. This distribution reflects the differing levels of military spending and technological investments across regions.

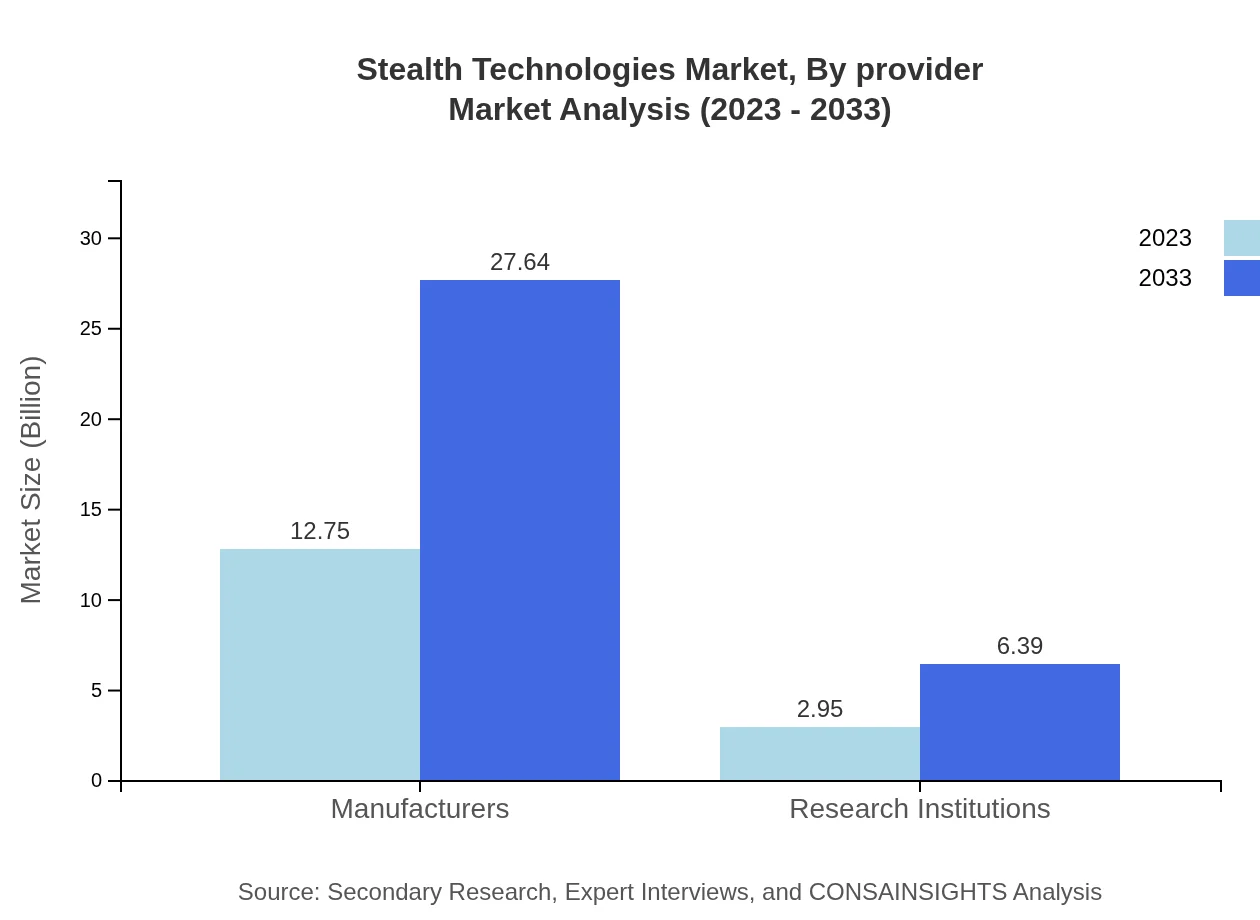

Stealth Technologies Market Analysis By Provider

The market features a mix of large defense contractors and emerging tech startups focused on stealth technologies. Major defense contractors dominate the market due to their extensive capabilities in R&D and government contracting.

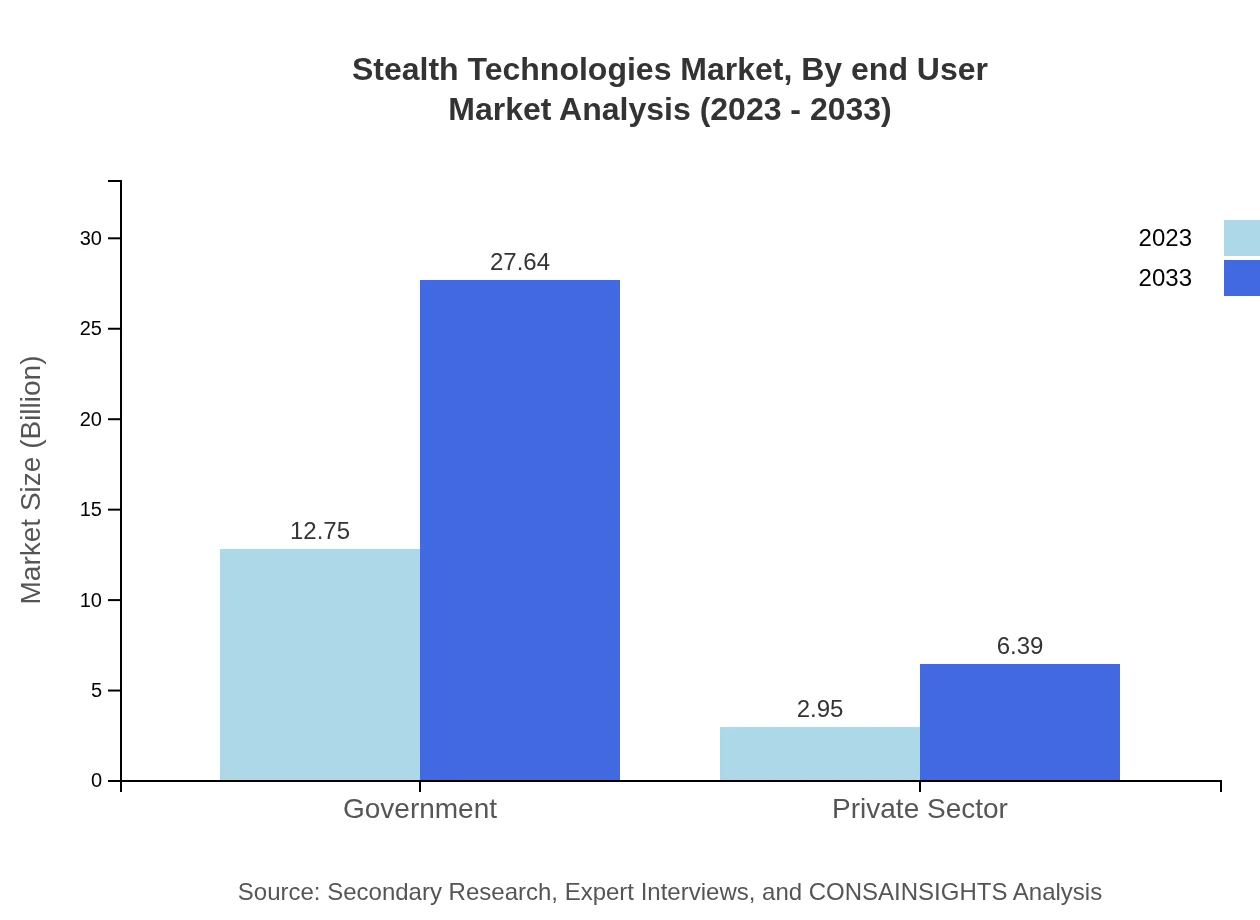

Stealth Technologies Market Analysis By End User

End-users of stealth technologies primarily include government defense agencies, research institutions, and private sector firms. Government sectors dominate the market with an 81.22% share, reflecting their heavy investment in defense and national security applications.

Stealth Technologies Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Stealth Technologies Industry

Lockheed Martin:

A leading defense contractor known for its advanced stealth technologies in military aircraft including the F-22 and F-35 fighter jets.Raytheon Technologies:

Specializes in aerospace systems that incorporate stealth technologies, contributing greatly to radar and electronic warfare capabilities.Northrop Grumman:

Recognized for its cutting-edge stealth aircraft technologies and innovative materials that enhance stealth capabilities.Boeing :

Engaged in the development of military and commercial applications of stealth technologies, notably through its defense segment.General Dynamics:

Provides technology solutions and services that integrate advanced stealth capabilities into various defense systems.We're grateful to work with incredible clients.

FAQs

What is the market size of stealth Technologies?

The stealth technologies market is estimated to reach $15.7 billion in 2023, growing at a CAGR of 7.8%. By 2033, it is projected to continue expanding significantly. This growth reflects the increasing demand for advanced stealth systems globally.

What are the key market players or companies in this stealth Technologies industry?

Key players in the stealth technologies industry include leading defense contractors and technology firms that specialize in military applications. These companies are continuously innovating to enhance stealth capabilities, aligning with global security needs.

What are the primary factors driving the growth in the stealth technologies industry?

The growth in stealth technologies is driven by increasing military expenditures, advancements in materials science, and heightened demand for advanced aerial and naval warfare systems. Additionally, geopolitical tensions necessitate enhanced stealth capabilities.

Which region is the fastest Growing in the stealth technologies market?

North America is the fastest-growing region in the stealth technologies market, with a projected size increase from $5.90 billion in 2023 to $12.80 billion by 2033, driven by significant military investments and technological innovations.

Does ConsaInsights provide customized market report data for the stealth technologies industry?

Yes, ConsaInsights offers customized market report data tailored to client specifications in the stealth technologies industry. This includes detailed insights regarding specific market segments, regional analysis, and competitive landscape assessments.

What deliverables can I expect from this stealth Technologies market research project?

Deliverables from the stealth technologies market research project include comprehensive reports, market analysis, trend forecasts, competitive segmentation data, and actionable insights tailored to strategic business decisions.

What are the market trends of stealth technologies?

Current trends in the stealth technologies market include an increased focus on R&D for advanced stealth materials, integration of AI in stealth systems, and growing collaboration between government and private sectors to enhance capabilities.