Stearic Acid Market Report

Published Date: 02 February 2026 | Report Code: stearic-acid

Stearic Acid Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the stearic acid market, covering market size, trends, regional insights, and industry dynamics for the forecast period 2023 to 2033.

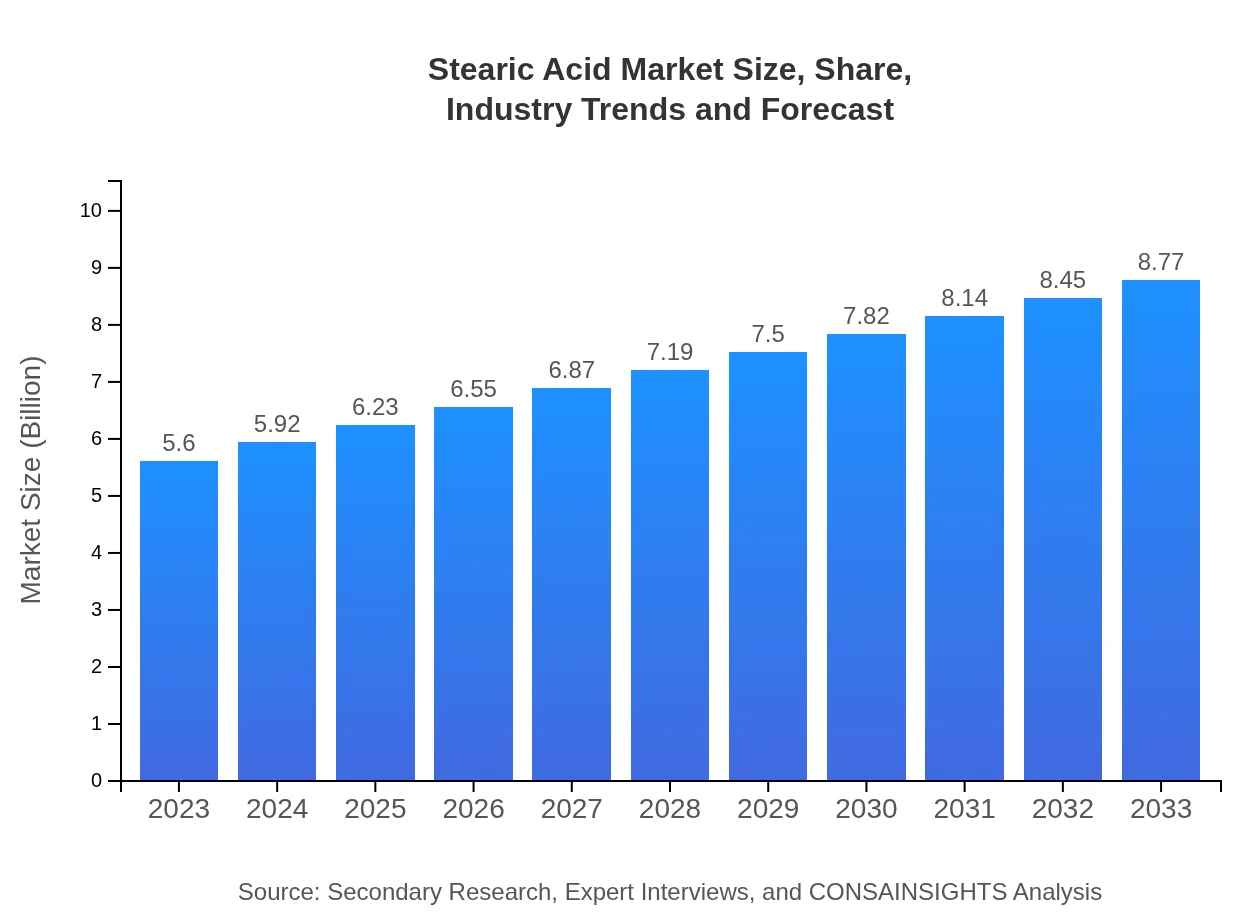

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 4.5% |

| 2033 Market Size | $8.77 Billion |

| Top Companies | BASF SE, IOI Group, Emery Oleochemicals, Wilmar International Limited, Cargill, Incorporated |

| Last Modified Date | 02 February 2026 |

Stearic Acid Market Overview

Customize Stearic Acid Market Report market research report

- ✔ Get in-depth analysis of Stearic Acid market size, growth, and forecasts.

- ✔ Understand Stearic Acid's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Stearic Acid

What is the Market Size & CAGR of Stearic Acid market in 2023?

Stearic Acid Industry Analysis

Stearic Acid Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Stearic Acid Market Analysis Report by Region

Europe Stearic Acid Market Report:

With a market size of USD 1.87 billion in 2023, Europe's stearic acid market is projected to grow to USD 2.92 billion by 2033. The region leads in the adoption of innovative applications and the formulation of natural cosmetics, significantly influencing market dynamics.Asia Pacific Stearic Acid Market Report:

The Asia Pacific region accounted for a market size of approximately USD 1.06 billion in 2023 and is projected to grow to USD 1.66 billion by 2033. The rise is attributed to the increasing demand for personal care products and growing industrial applications, particularly in emerging economies like China and India.North America Stearic Acid Market Report:

The North American market was valued at USD 1.91 billion in 2023 and anticipates growth to USD 2.98 billion by 2033. Here, stringent regulatory standards for ingredient sourcing and usage are pushing manufacturers toward sustainable practices, fueling demand for high-purity stearic acid.South America Stearic Acid Market Report:

In South America, the stearic acid market is sized at USD 0.36 billion in 2023, expected to reach USD 0.56 billion by 2033. The food and personal care segments are driving growth, supported by rising disposable incomes and changing consumer preferences towards natural products.Middle East & Africa Stearic Acid Market Report:

In the Middle East and Africa, the stearic acid market is sized at USD 0.41 billion in 2023, with projections reaching USD 0.65 billion by 2033. Increased investments in manufacturing and a growing consumer base for personal care and cosmetics are central to this growth.Tell us your focus area and get a customized research report.

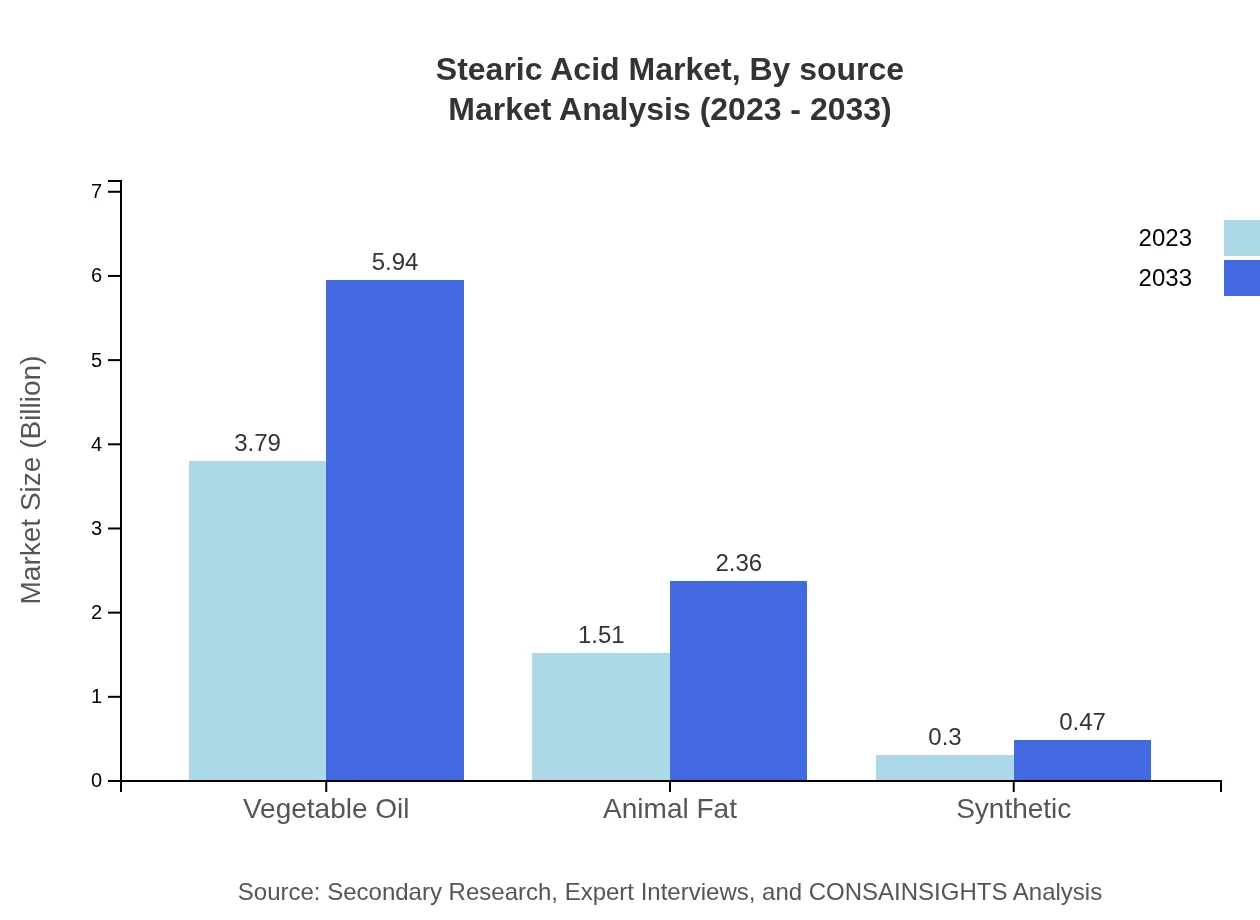

Stearic Acid Market Analysis By Source

The stearic acid market is characterized by notable segments based on the source of production, including vegetable oils, animal fats, and synthetic sources. In 2023, the vegetable oil segment leads with a market size of USD 3.79 billion and is projected to grow to USD 5.94 billion by 2033, accounting for approximately 67.69% market share. This demonstrates a persistent preference for plant-derived options in line with sustainability trends. Animal fats represent the second-largest share, forecasted at USD 1.51 billion in 2023 with growth to USD 2.36 billion by 2033, while synthetic sources remain minor but relevant, scaling from USD 0.30 billion to USD 0.47 billion in the same period.

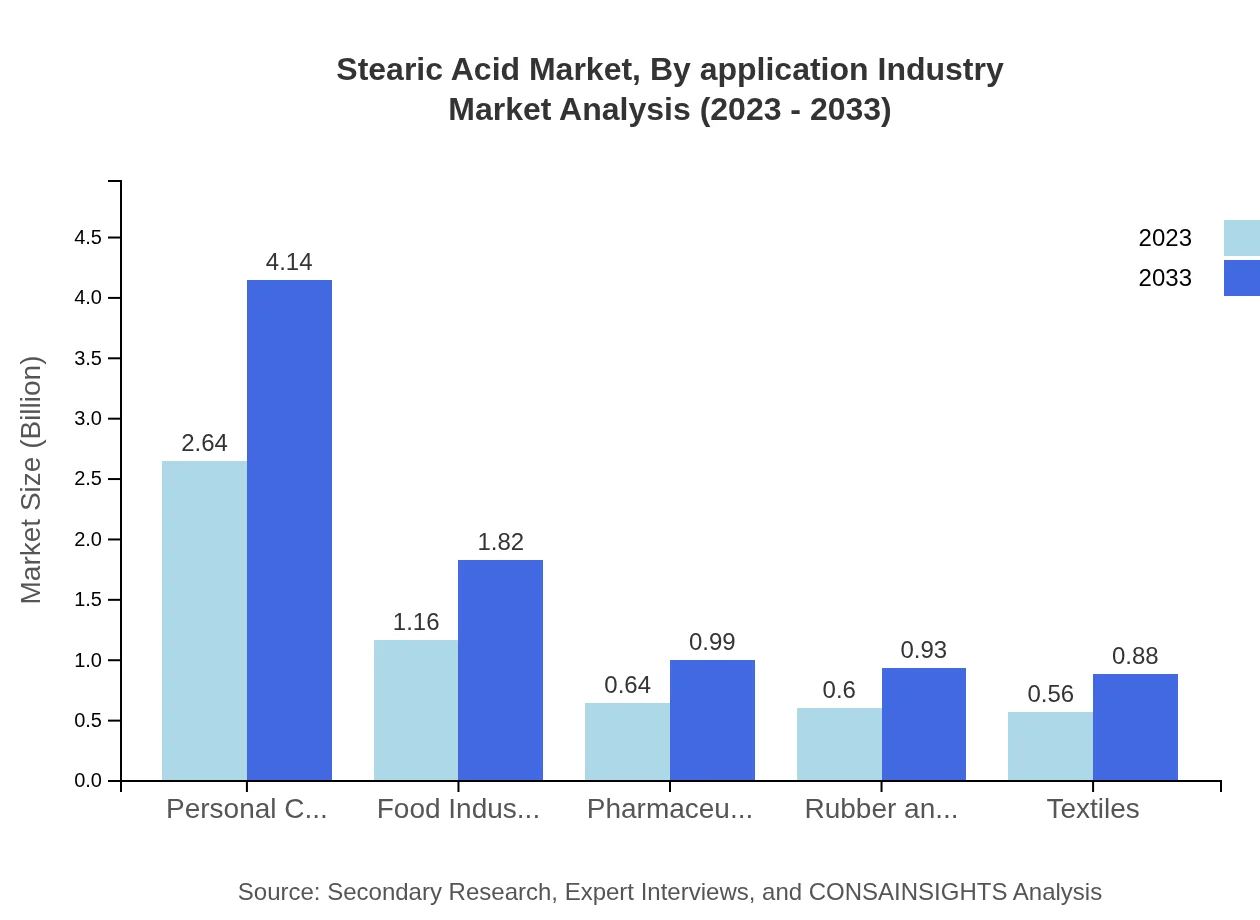

Stearic Acid Market Analysis By Application Industry

Applications of stearic acid span multiple industries with personal care leading at USD 2.64 billion in 2023, expected to reach USD 4.14 billion by 2033, accounting for 47.18% market share. The food industry follows, with market values of USD 1.16 billion in 2023 and USD 1.82 billion in 2033, while pharmaceuticals contribute USD 0.64 billion, growing to USD 0.99 billion, maintaining 11.34% market share. Industries like textiles and rubber are emerging as significant contributors, emphasizing stearic acid's multifaceted utility.

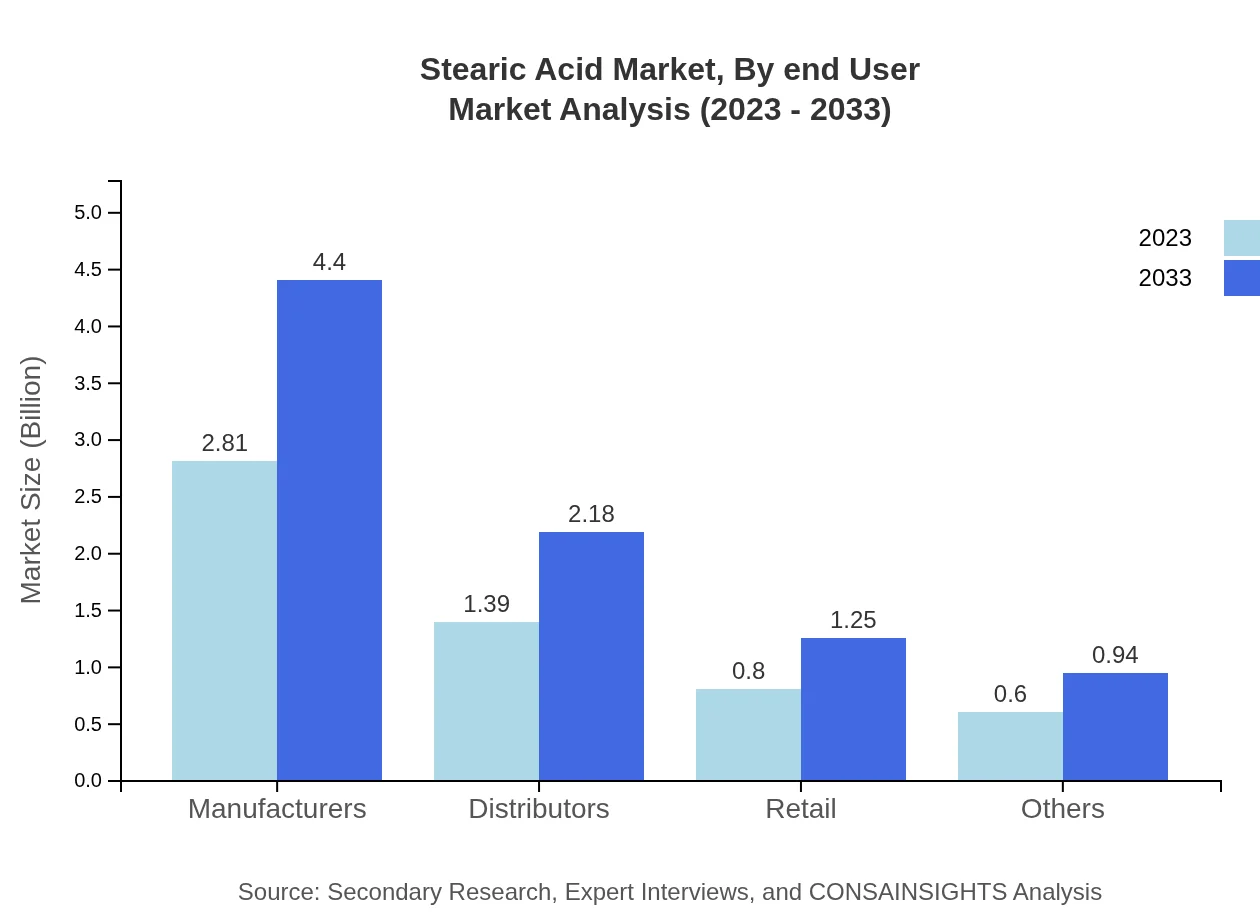

Stearic Acid Market Analysis By End User

The end-user analysis of the stearic acid market reveals significant consumption across various sectors. Manufacturers dominate the end-user segment with USD 2.81 billion in 2023 and expectations of reaching USD 4.40 billion by 2033, holding a market share of 50.19%. Distributors and retail contribute USD 1.39 billion and USD 0.80 billion respectively in 2023, with anticipated growth reflecting ongoing industrial expansions and consumer interest in cosmetic products.

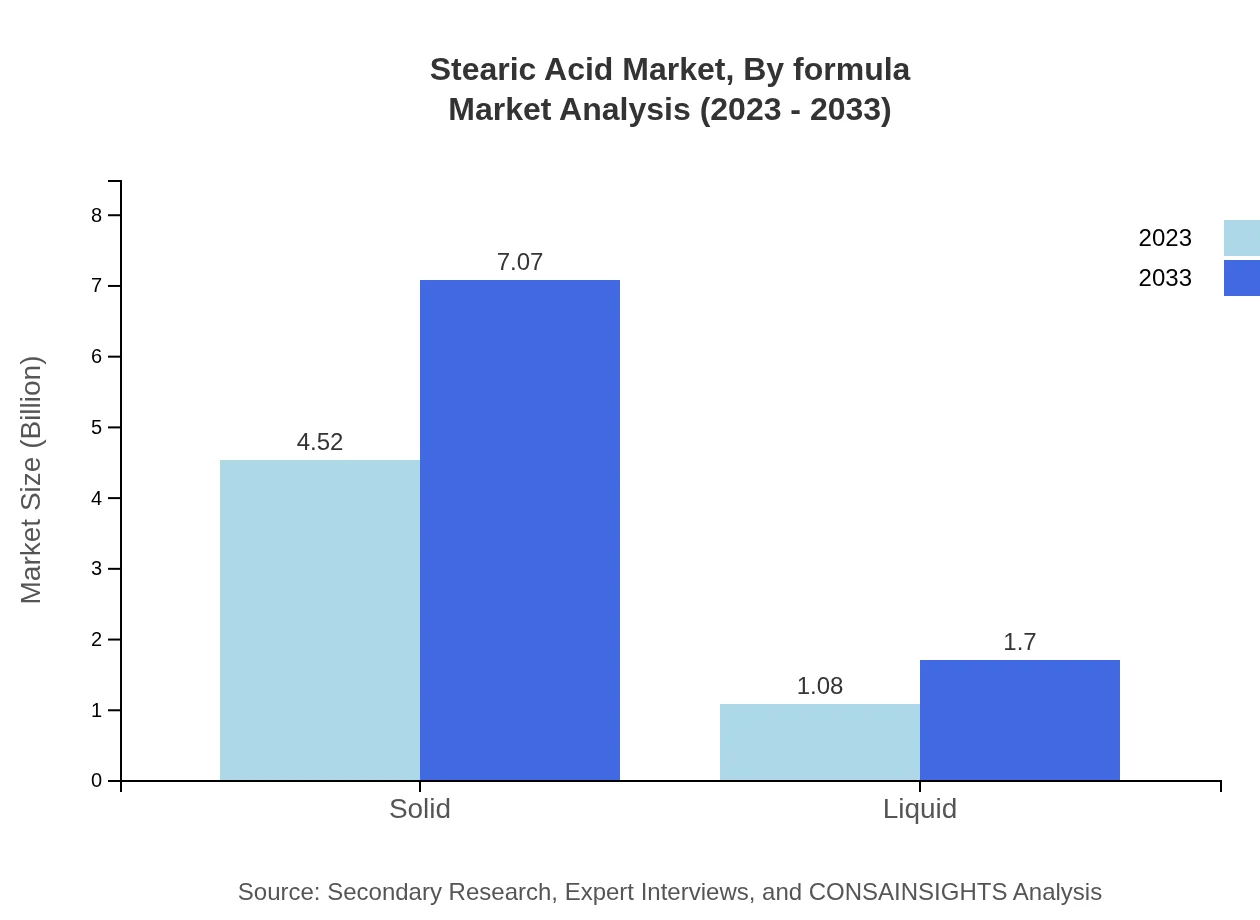

Stearic Acid Market Analysis By Formula

Market dynamics reveal a clear distinction between solid and liquid forms of stearic acid. The solid form's market size stands at USD 4.52 billion in 2023, forecasted to rise to USD 7.07 billion, commanding a substantial 80.63% market share. The liquid form, valued at USD 1.08 billion in 2023, is expected to grow to USD 1.70 billion, capturing 19.37% market share. This disparity showcases solid stearic acid's entrenched position in manufacturing and industrial applications, while liquid formulations increasingly cater to emerging cosmetic trends.

Stearic Acid Market Analysis By Specification

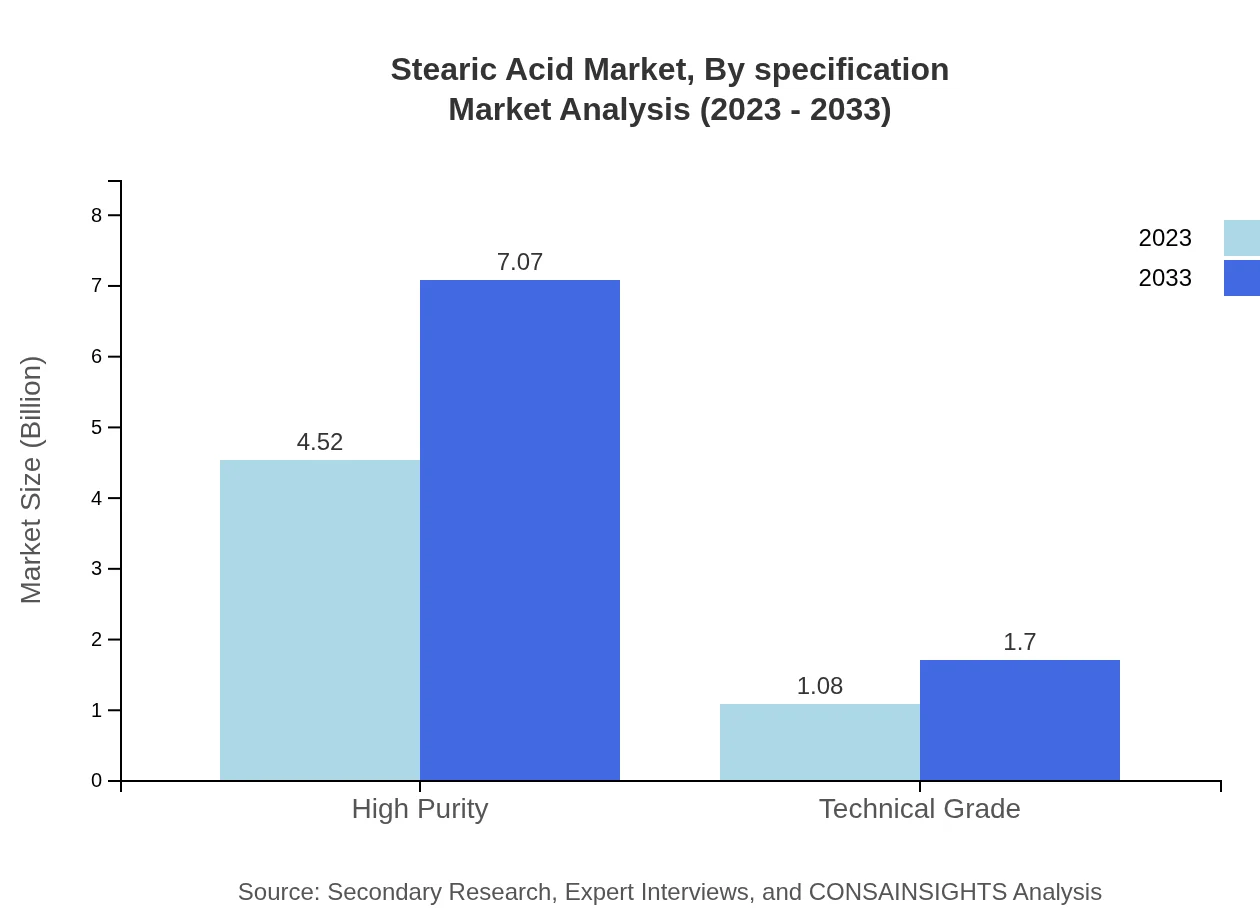

The stearic acid market is categorized based on specifications into high purity and technical grades. High purity grades, valued at USD 4.52 billion in 2023 with projections of USD 7.07 billion by 2033, make up 80.63% of the market share. Technical grades, starting at USD 1.08 billion and expected to grow to USD 1.70 billion, encapsulate 19.37% market share and are crucial for various industrial applications, showcasing the market's flexibility and adaptation to varying quality requirements.

Stearic Acid Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Stearic Acid Industry

BASF SE:

A global leader in chemicals, BASF produces a wide range of stearic acid products, focusing on sustainable development and innovation in formulations.IOI Group:

A leading player in the palm oil industry, IOI Group is recognized for producing high-quality vegetable-based stearic acid whilst committing to sustainable practices.Emery Oleochemicals:

Specializing in oleochemical solutions, Emery Oleochemicals offers a diverse portfolio of stearic acid products tailored to industrial applications.Wilmar International Limited:

Based in Singapore, Wilmar is one of the largest agribusiness groups, also a major player in the production of stearic acid derived from palm oil.Cargill, Incorporated:

Cargill is a global corporation that develops stearic acid from renewable sources, aligning with market trends towards bio-based products.We're grateful to work with incredible clients.

FAQs

What is the market size of stearic acid?

The global stearic acid market is projected to reach approximately $5.6 billion by 2033, growing at a CAGR of 4.5% during this period. In 2023, the market size stands robustly, indicating strong demand across various sectors.

What are the key market players or companies in the stearic acid industry?

Key players in the stearic acid industry include prominent manufacturers such as BASF, Eastman Chemical Company, and IOI Oleochemicals. These companies contribute significantly to the production and distribution of stearic acid on a global scale.

What are the primary factors driving the growth in the stearic acid industry?

Growth in the stearic acid industry is driven by increasing demand in sectors such as personal care, food processing, and pharmaceuticals. The rise of sustainable and bio-based products is also fostering innovation and expanding market opportunities.

Which region is the fastest Growing in the stearic acid market?

The Asia Pacific region is currently the fastest-growing market for stearic acid, with a projected growth from $1.06 billion in 2023 to $1.66 billion by 2033. This growth is fueled by industrial expansion and rising consumer demands.

Does ConsaInsights provide customized market report data for the stearic acid industry?

Yes, ConsaInsights offers tailored market report data for the stearic acid industry. Clients can request specific segment insights, regional forecasts, and customized analyses to meet their unique business needs.

What deliverables can I expect from this stearic acid market research project?

Deliverables from the stearic acid market research project include comprehensive reports, detailed market analysis, regional market studies, and insights on competitive landscape and pricing strategies to inform strategic decision-making.

What are the market trends of stearic acid?

Current trends in the stearic acid market include a shift towards bio-based sources, growing applications in personal care, and rising demand from the food and textile industries. Innovations in synthesis processes are also noteworthy.