Steel Fiber Market Report

Published Date: 02 February 2026 | Report Code: steel-fiber

Steel Fiber Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Steel Fiber market, covering insights on market trends, size, segmentation, and regional dynamics from 2023 to 2033, aiming to inform strategic decisions for stakeholders.

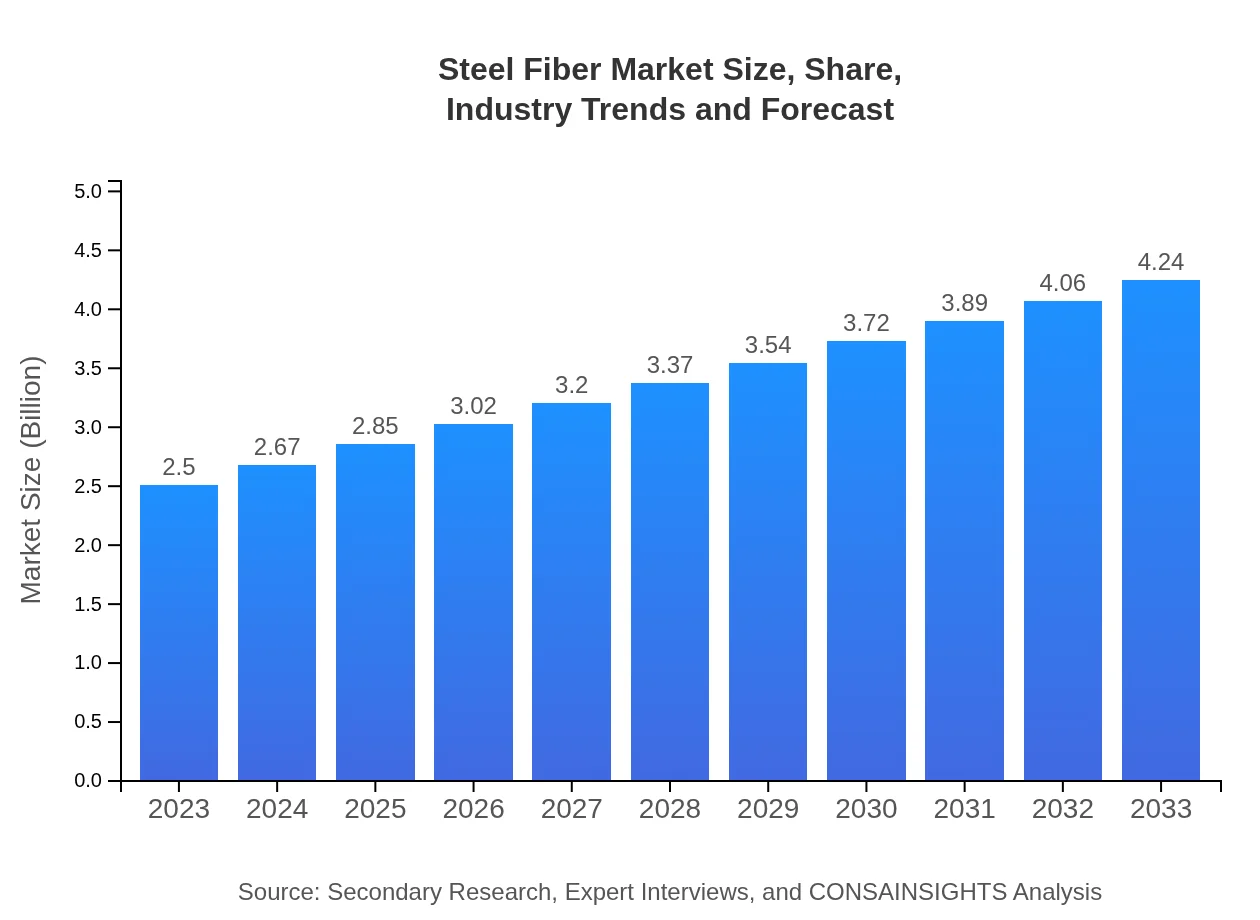

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 5.3% |

| 2033 Market Size | $4.24 Billion |

| Top Companies | Novocon, Bekaert, Sika AG, ArcelorMittal |

| Last Modified Date | 02 February 2026 |

Steel Fiber Market Overview

Customize Steel Fiber Market Report market research report

- ✔ Get in-depth analysis of Steel Fiber market size, growth, and forecasts.

- ✔ Understand Steel Fiber's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Steel Fiber

What is the Market Size & CAGR of Steel Fiber market in 2023?

Steel Fiber Industry Analysis

Steel Fiber Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Steel Fiber Market Analysis Report by Region

Europe Steel Fiber Market Report:

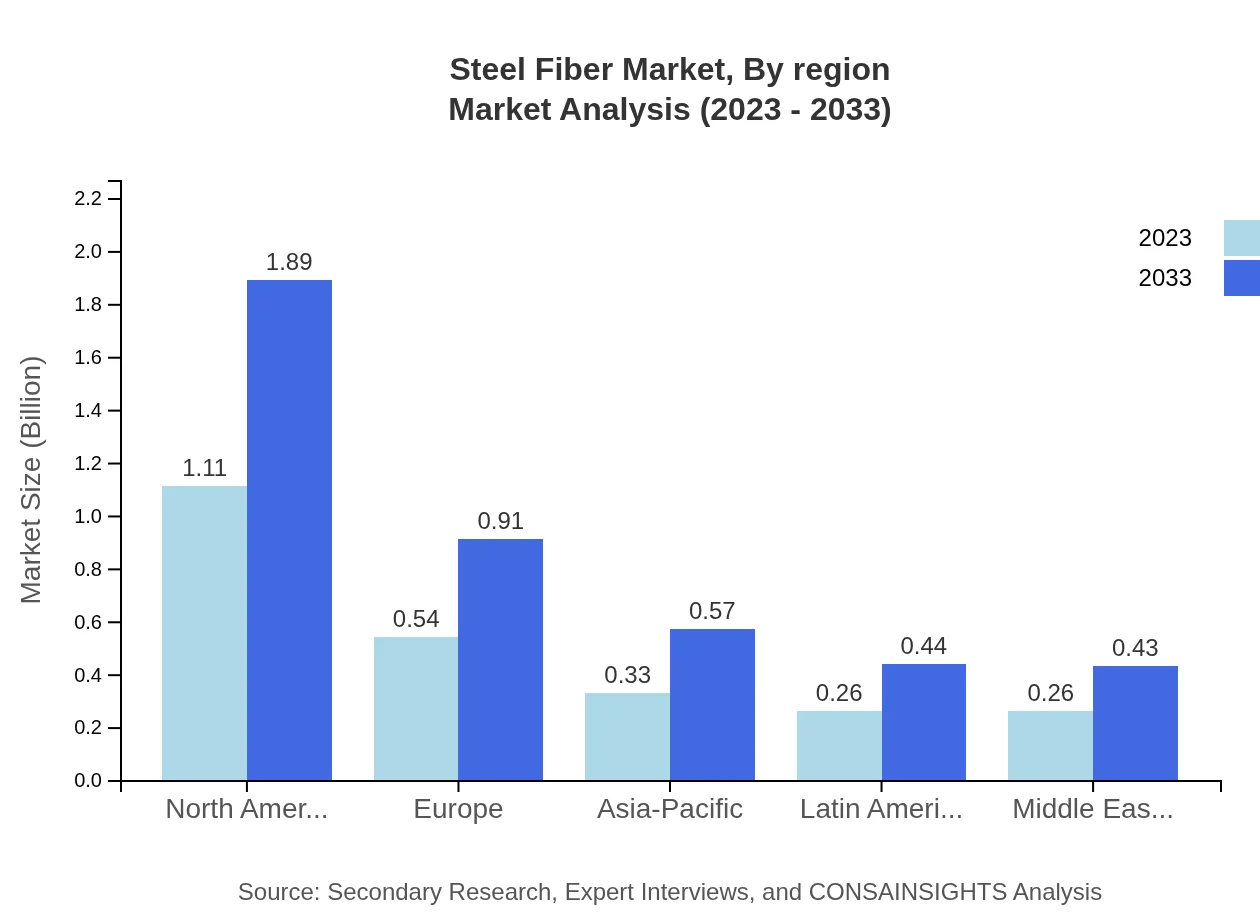

Europe shows a strong market in Steel Fiber, anticipating growth from 0.80 billion USD in 2023 to around 1.36 billion USD by 2033. The adoption of advanced construction techniques and increasing demands for durable concrete solutions, particularly in Western European countries, continue to be pivotal factors in this growth.Asia Pacific Steel Fiber Market Report:

The Asia-Pacific region is expected to witness significant growth, anticipated to reach approximately 0.74 billion USD by 2033, supported by robust infrastructure projects and urbanization trends. Key countries such as China and India are set to dominate this market due to their massive construction industries and increasing investment in public infrastructure.North America Steel Fiber Market Report:

North America’s market for Steel Fiber is projected to expand from 0.90 billion USD in 2023 to approximately 1.53 billion USD by 2033. The growth is driven by significant investments in the construction sector and heightened demand for high-performance materials due to evolving building standards.South America Steel Fiber Market Report:

In South America, the Steel Fiber market is projected to grow modestly, from 0.03 billion USD in 2023 to 0.05 billion USD by 2033. The growth is primarily fostered by government initiatives aimed at enhancing infrastructure and promoting sustainable building practices, notably in countries like Brazil and Argentina.Middle East & Africa Steel Fiber Market Report:

In the Middle East and Africa, the Steel Fiber market is expected to grow from 0.32 billion USD in 2023 to 0.55 billion USD by 2033. The ongoing development of smart cities and urban infrastructure projects plays a crucial role in enhancing market demand within this region.Tell us your focus area and get a customized research report.

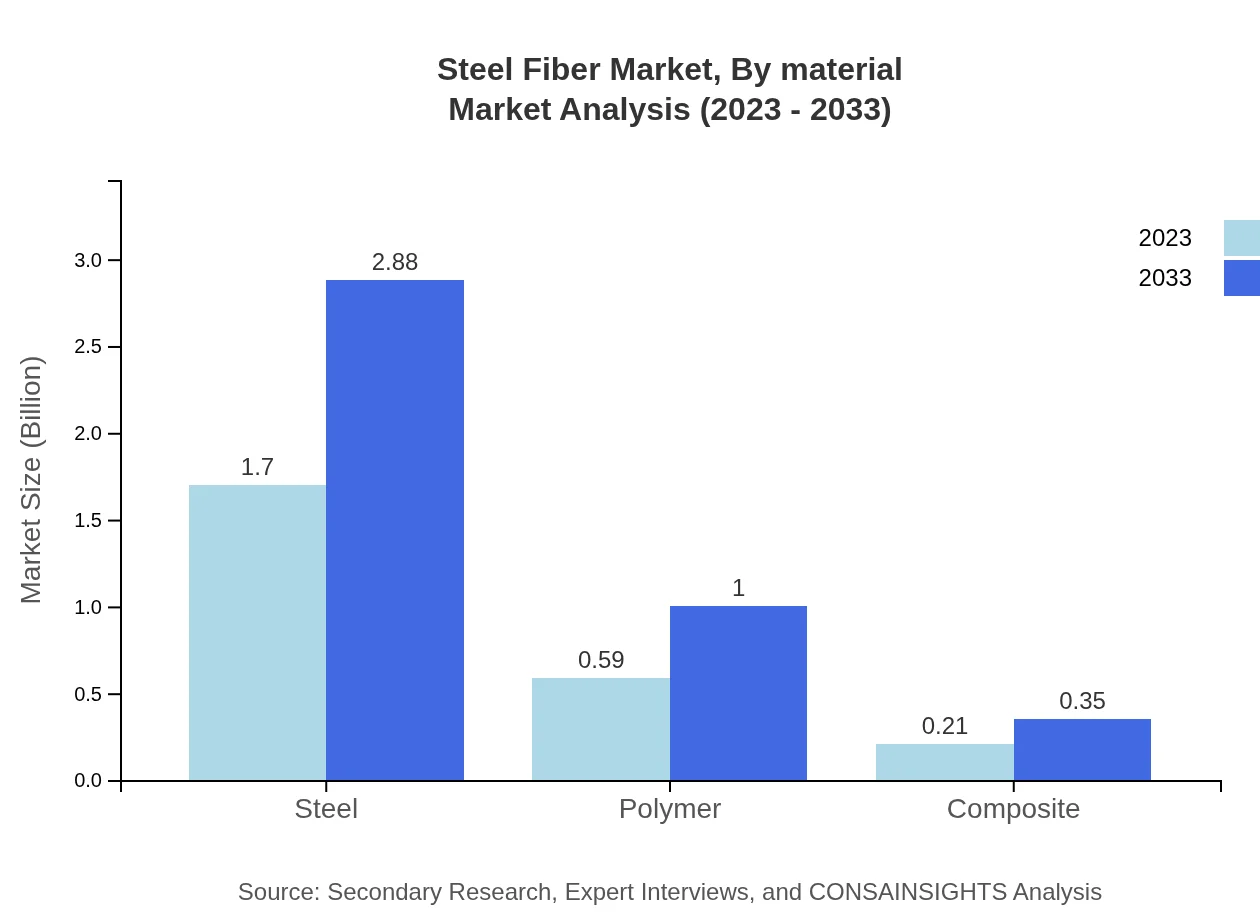

Steel Fiber Market Analysis By Material

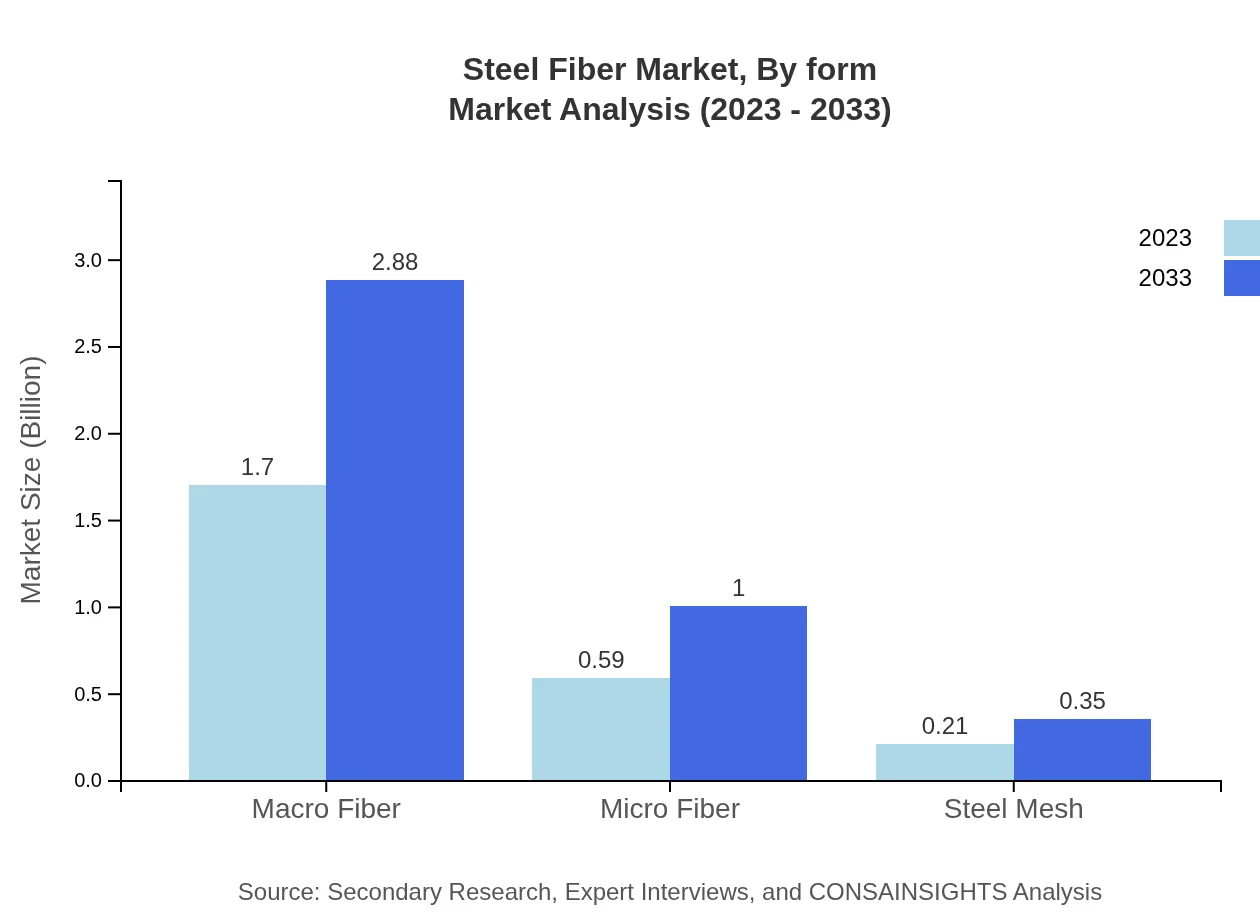

The Steel Fiber market, segmented by material type, primarily comprises Macro Fiber, Micro Fiber, and Steel Mesh. Macro Fiber dominates the market significantly, anticipated to grow from 1.70 billion USD in 2023 to 2.88 billion USD by 2033, representing a substantial market share of 68.06%. Micro Fiber follows, projected to grow from 0.59 billion USD to around 1.00 billion USD, holding a 23.57% market share. Steel Mesh, while smaller, is experiencing growth due to its niche applications in various construction methodologies.

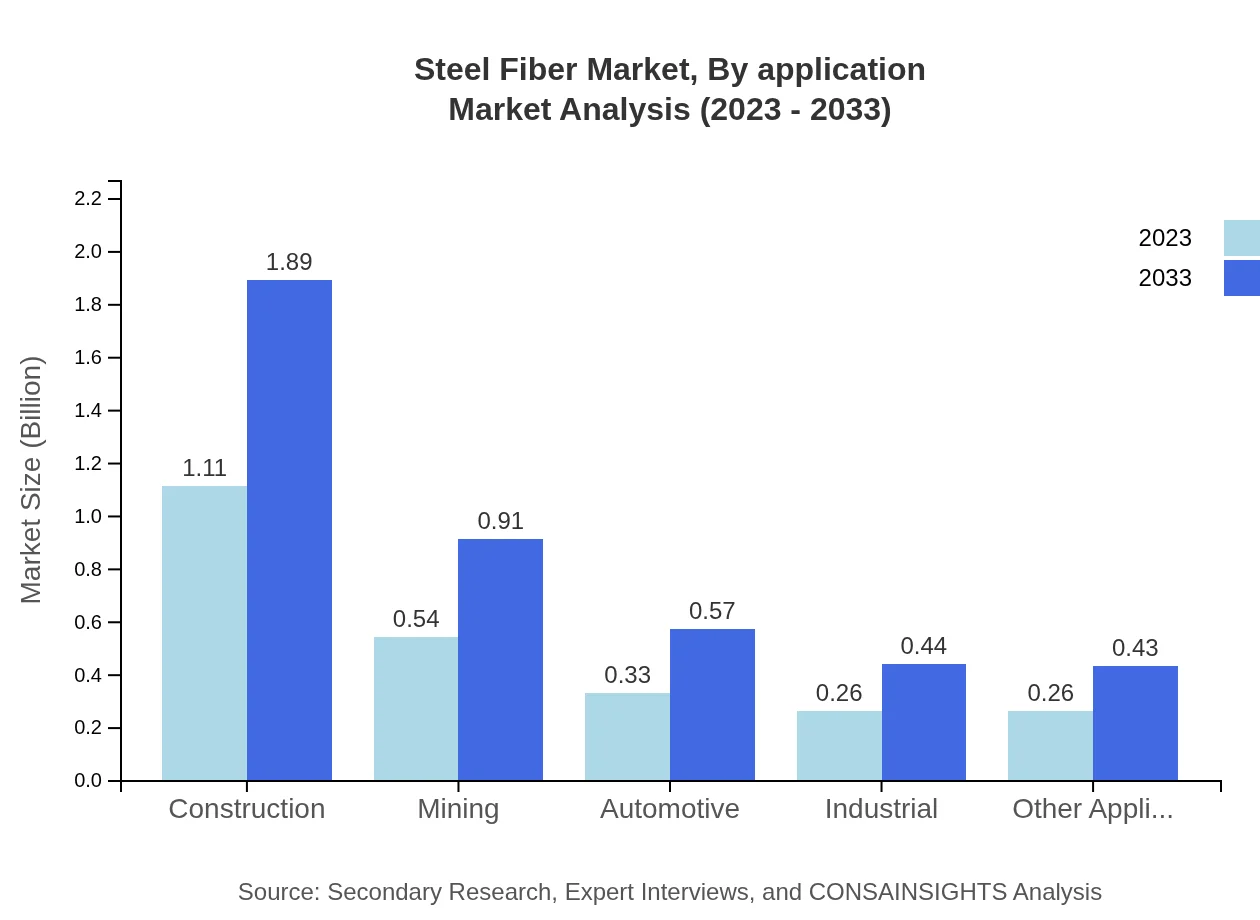

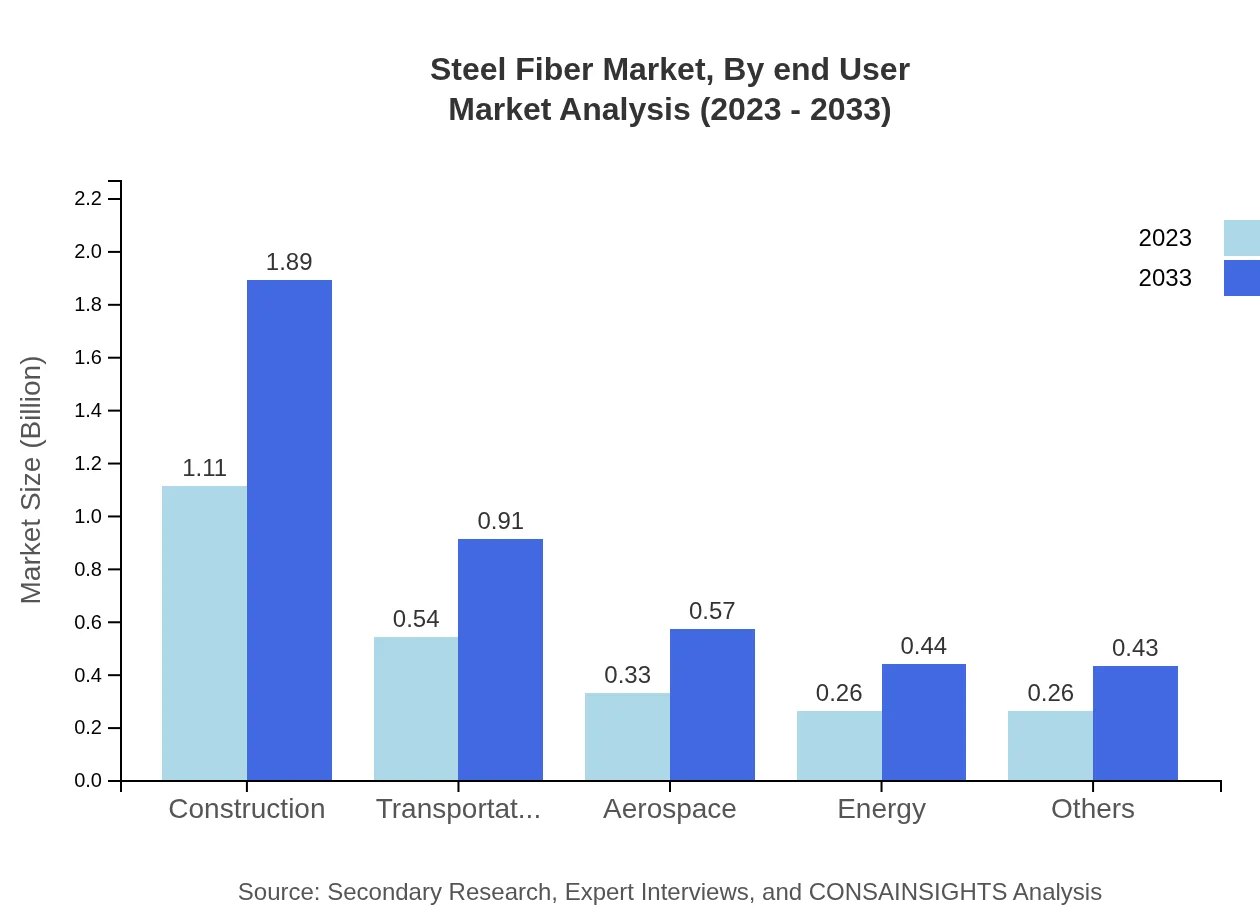

Steel Fiber Market Analysis By Application

The Steel Fiber market's application segmentation includes Construction, Transportation, Aerospace, Energy, and Others. The Construction sector remains the largest application area, showing growth from 1.11 billion USD to 1.89 billion USD, equating to a 44.53% market share. Transportation also presents growth opportunities, growing from 0.54 billion USD to 0.91 billion USD, while Aerospace and Energy applications are rising, driven by the need for durable materials in demanding operational environments.

Steel Fiber Market Analysis By Form

The Steel Fiber market can also be analyzed based on form factors. These typically include both pre-cut and loose forms, with pre-cut steel fibers gaining traction among manufacturers for ease of incorporation into concrete mixes. The significance of steel fiber forms lies in their influence on properties like homogeneity in distribution and ease of application within various concrete and industrial processes.

Steel Fiber Market Analysis By End User

End-user industries utilizing Steel Fiber include Construction, Mining, Automotive, Industrial, and Others. Construction commands the largest share, with the mining sector also contributing significantly due to the need for robust reinforcement solutions under various conditions. Automotive features a growing demand due to the incorporation of composite materials containing steel fibers, which enhance vehicle durability and performance.

Steel Fiber Market Analysis By Region

When analyzed regionally, the Steel Fiber market distinguishes itself across continents, with North America leading in innovation and deployment. Europe follows closely with stringent regulations promoting high-performance materials, while Asia-Pacific’s rapid urbanization presents vast commercialization opportunities. The Middle East and Africa continue to evolve with infrastructure demands that necessitate durable construction solutions, making all regions critical to the future growth of the steel fiber market.

Steel Fiber Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Steel Fiber Industry

Novocon:

Leading in high-performance steel fiber reinforcement, Novocon specializes in innovations that enhance concrete durability while reducing overall costs in construction projects globally.Bekaert:

Bekaert is a key player in developing and supplying advanced steel fibers for construction and industrial applications, emphasizing sustainability and efficiency in product delivery.Sika AG:

Sika AG focuses on construction chemicals and materials, producing a wide range of steel fibers aimed at improving the mechanical properties of concrete.ArcelorMittal:

As one of the largest steel manufacturers, ArcelorMittal is involved in steel fiber production, promoting innovations in material strength and application.We're grateful to work with incredible clients.

FAQs

What is the market size of the steel Fiber industry?

The global steel fiber market was valued at approximately $2.5 billion in 2023, with a projected CAGR of 5.3% expected to reach around $4.2 billion by 2033. This growth signals a strengthening demand in construction and other sectors.

What are the key market players or companies in the steel Fiber industry?

Key players in the steel fiber market include major companies like Bekaert, ArcelorMittal, and Nycon. These companies are pivotal in developing and supplying innovative steel fiber products for various applications across construction, mining, and other industries.

What are the primary factors driving the growth in the steel Fiber industry?

Growth in the steel-fiber industry is driven by increasing construction activities, urbanization, and the demand for lightweight concrete solutions. Additionally, the rising focus on durability and sustainability in building materials boosts market expansion.

Which region is the fastest Growing in the steel Fiber industry?

The Asia-Pacific region is anticipated to grow rapidly in the steel-fiber market, projected to reach approximately $0.74 billion by 2033, up from $0.44 billion in 2023. This growth is largely due to booming infrastructure development.

Does ConsaInsights provide customized market report data for the steel Fiber industry?

Yes, ConsaInsights offers customized market reports tailored to specific client needs. These reports can include detailed analyses on growth forecasts, market segmentation, and competitive landscape specific to the steel-fiber industry.

What deliverables can I expect from this steel Fiber market research project?

From the steel-fiber market research project, expect comprehensive deliverables including detailed market analysis, growth trends, competitive profiles of key players, and insights into regional markets and industry forecasts through 2033.

What are the market trends of steel Fiber?

Current market trends in steel-fiber include a shift towards sustainable construction materials, advancements in manufacturing technology, and increased adoption in various sectors like transportation and aerospace, reflecting the versatility of steel fibers.