Stents Market Report

Published Date: 31 January 2026 | Report Code: stents

Stents Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the global stents market from 2023 to 2033, discussing market size, trends, and the competitive landscape. Insights into segmentation, regional performance, and future forecasts are also included.

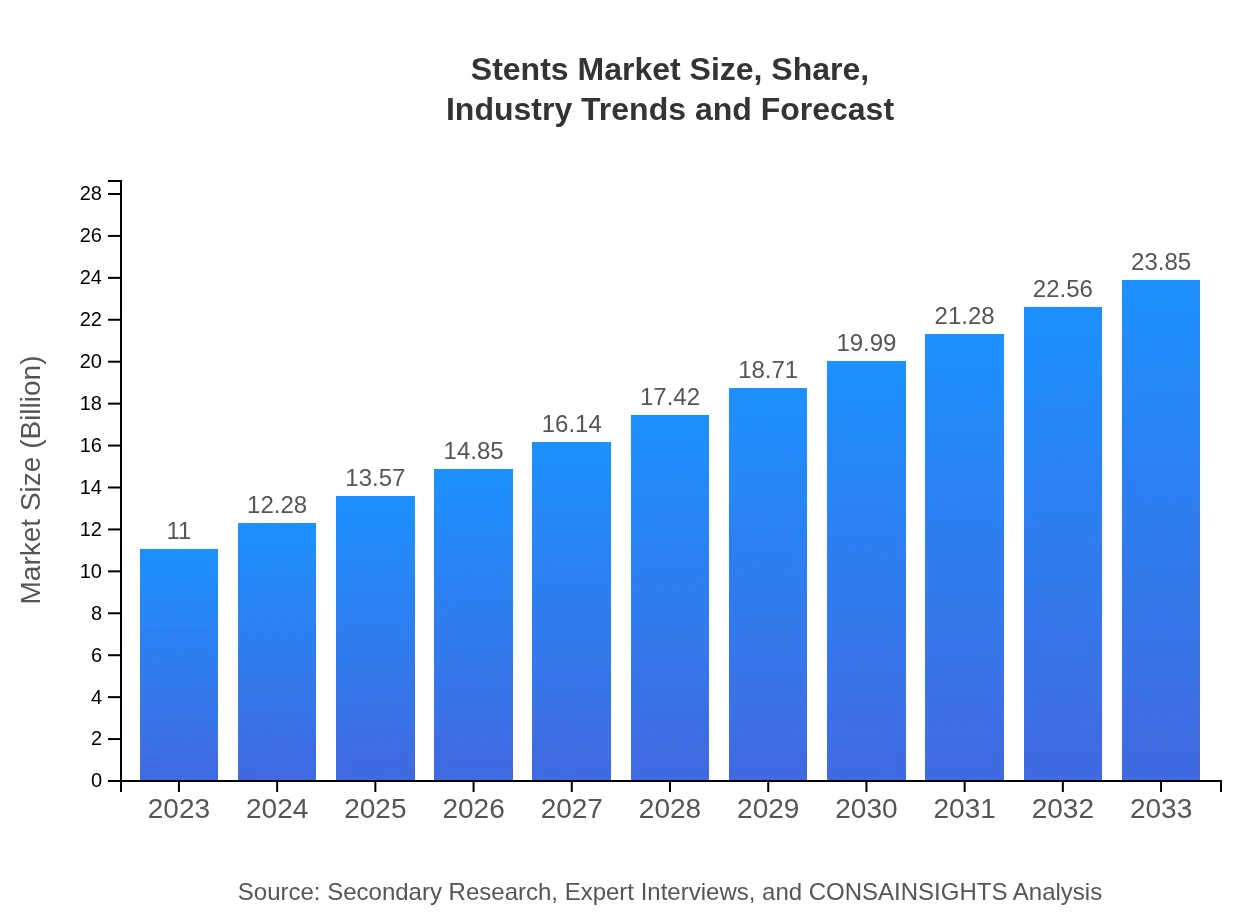

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $11.00 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $23.85 Billion |

| Top Companies | Boston Scientific Corporation, Abbott Laboratories, Medtronic Plc, B. Braun Melsungen AG, Terumo Corporation |

| Last Modified Date | 31 January 2026 |

Stents Market Overview

Customize Stents Market Report market research report

- ✔ Get in-depth analysis of Stents market size, growth, and forecasts.

- ✔ Understand Stents's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Stents

What is the Market Size & CAGR of Stents market in 2033?

Stents Industry Analysis

Stents Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Stents Market Analysis Report by Region

Europe Stents Market Report:

With a market size projected at $3.61 billion in 2023 and an anticipated $7.83 billion by 2033, Europe remains a significant market for stents, driven by robust healthcare systems and high awareness regarding cardiovascular diseases.Asia Pacific Stents Market Report:

In 2023, the stents market in the Asia Pacific region is valued at approximately $2.11 billion, anticipated to grow to about $4.58 billion by 2033. An increase in cardiovascular diseases and healthcare access improvements are key drivers of growth.North America Stents Market Report:

The North American market for stents is projected to rise from $3.62 billion in 2023 to $7.85 billion by 2033. High prevalence rates of coronary artery diseases and technological advancements play significant roles in this market segment.South America Stents Market Report:

South America’s stents market is estimated at $0.60 billion in 2023, expected to grow to $1.29 billion by 2033. Challenges remain due to varying healthcare infrastructure across different countries, but increasing investments in healthcare are fostering growth.Middle East & Africa Stents Market Report:

The Middle East and Africa stents market is expected to grow from $1.06 billion in 2023 to $2.29 billion by 2033, driven by improved healthcare facilities and increasing health insurance coverage across the region.Tell us your focus area and get a customized research report.

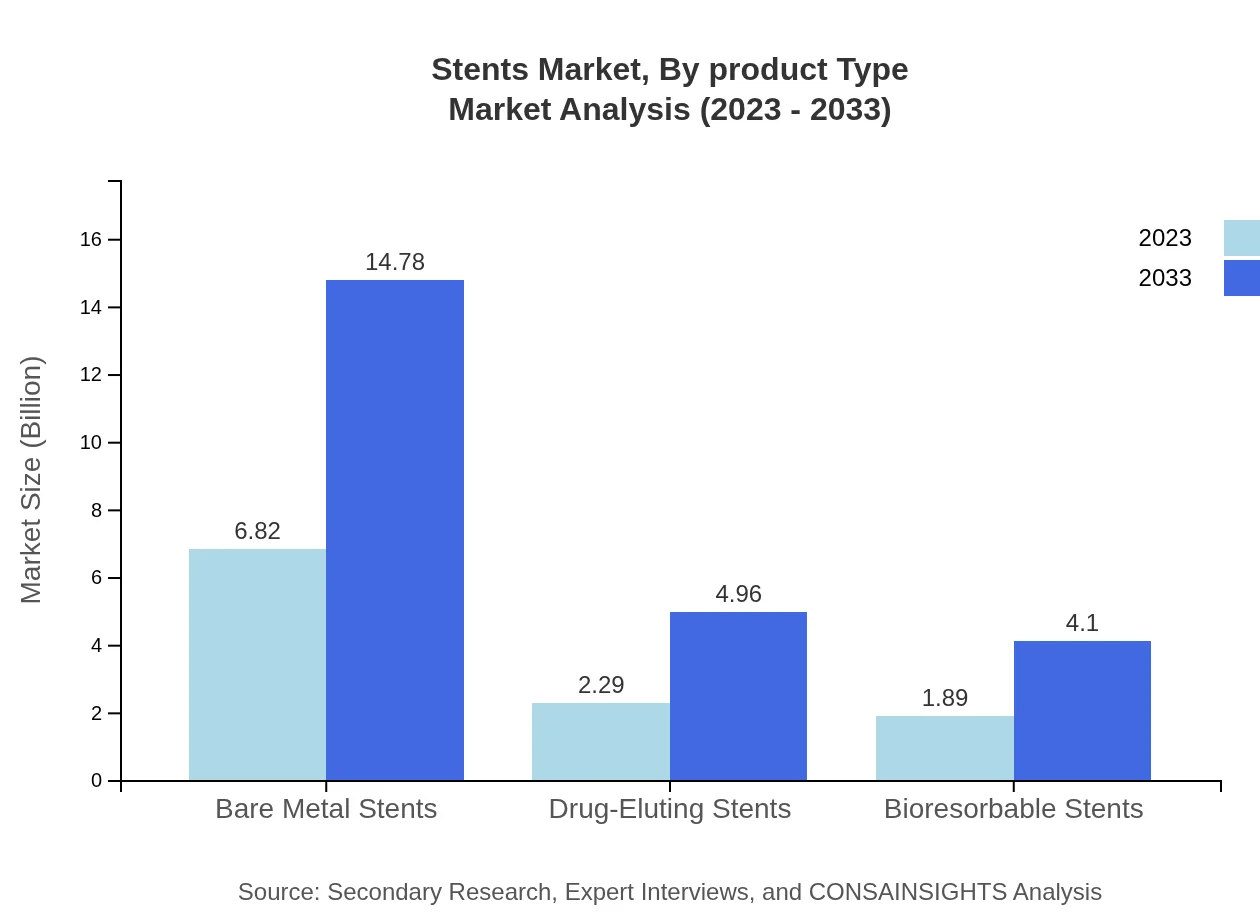

Stents Market Analysis By Product Type

Within the product type segmentation, metal stents hold a significant share, valued at $6.82 billion in 2023, projected to reach $14.78 billion by 2033. Drug-eluting stents, valued at $2.29 billion in 2023, are expected to achieve $4.96 billion by 2033. Bioresorbable stents also exhibit rapid growth, moving from $1.89 billion in 2023 to $4.10 billion in 2033.

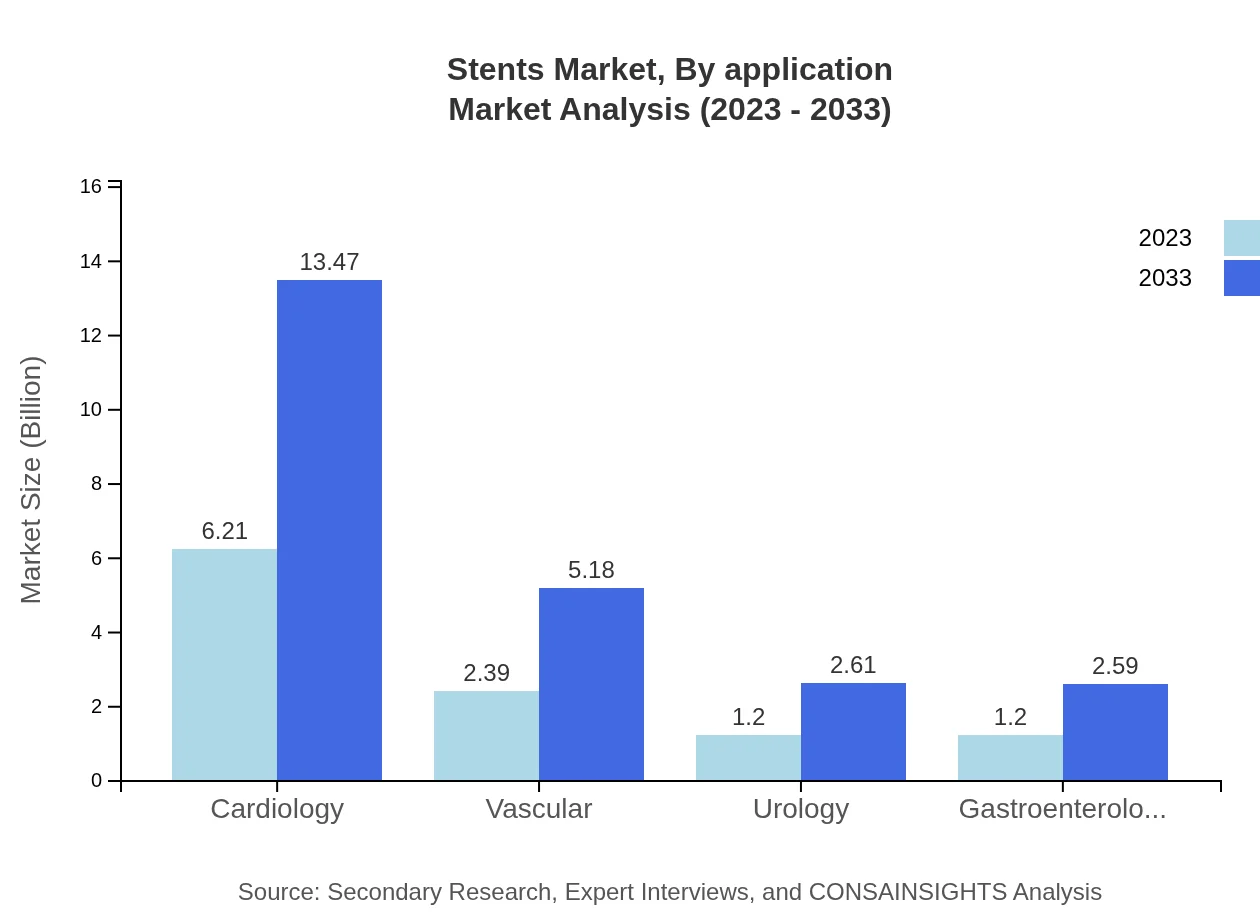

Stents Market Analysis By Application

In terms of applications, the cardiology segment dominates with a market size of $6.21 billion in 2023, set to grow to $13.47 billion by 2033. The vascular application segment follows, expected to rise from $2.39 billion to $5.18 billion. Other critical applications include urology and gastroenterology.

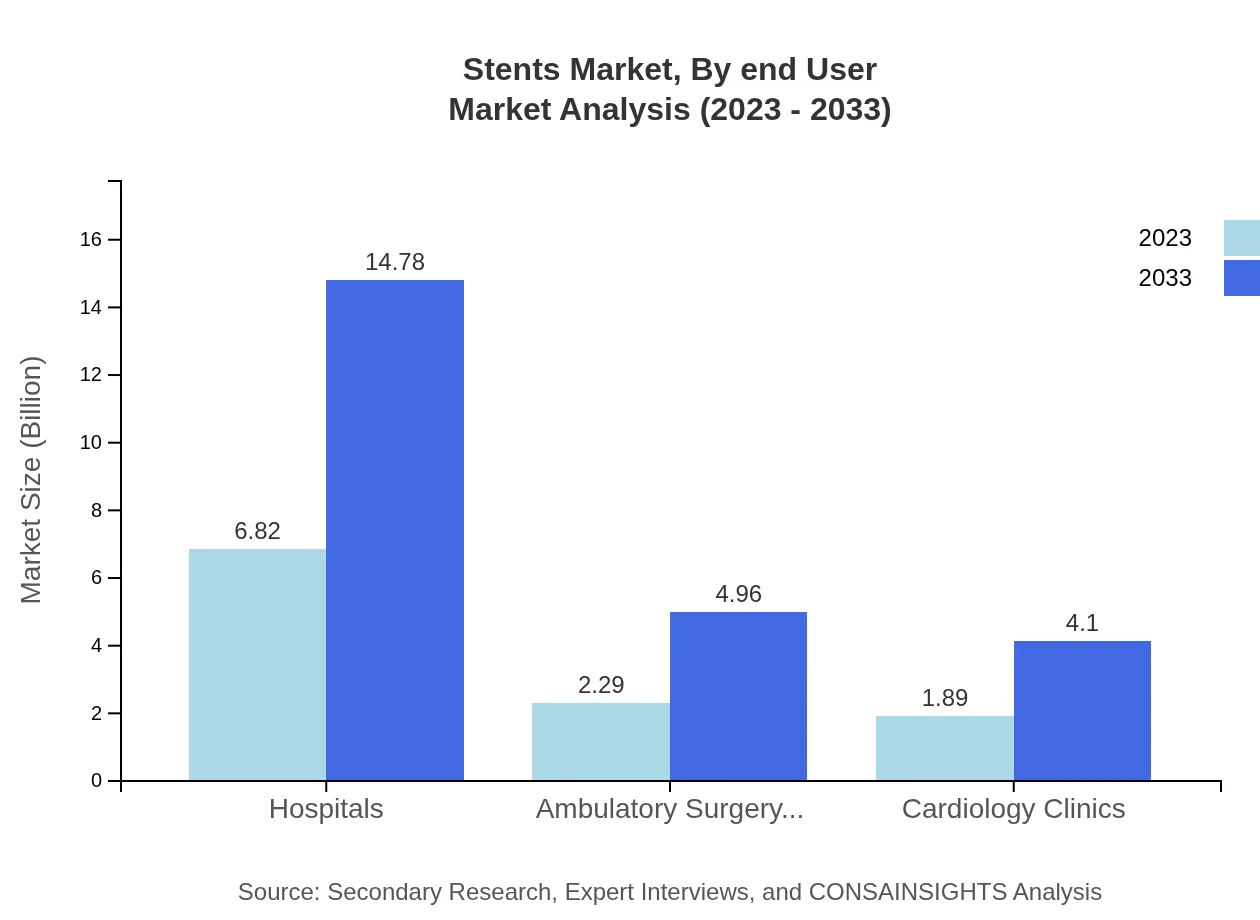

Stents Market Analysis By End User

Hospitals play a critical role in the distribution of stents, accounting for 62% of the market share in 2023, with a market size of $6.82 billion. Ambulatory surgery centers follow closely, representing 20.82% share. The need for efficient surgical interventions drives demand in these facilities.

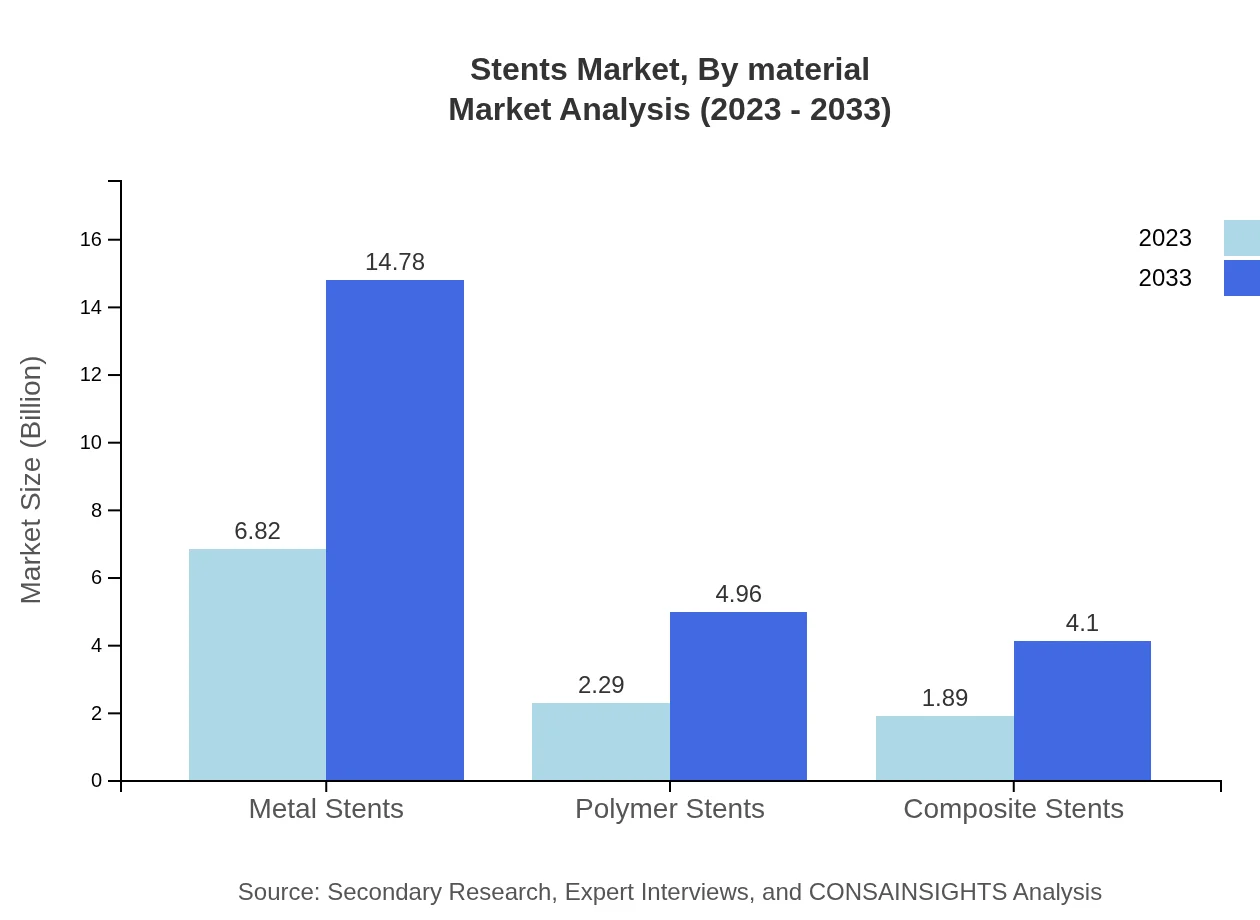

Stents Market Analysis By Material

Analyzing material types, bare metal stents have a significant presence in the market with a share of 62% and a size of $6.82 billion in 2023. Drug-eluting stents, made of polymers, also hold a substantial piece of the market, with forecasts suggesting continued demand in surgical settings.

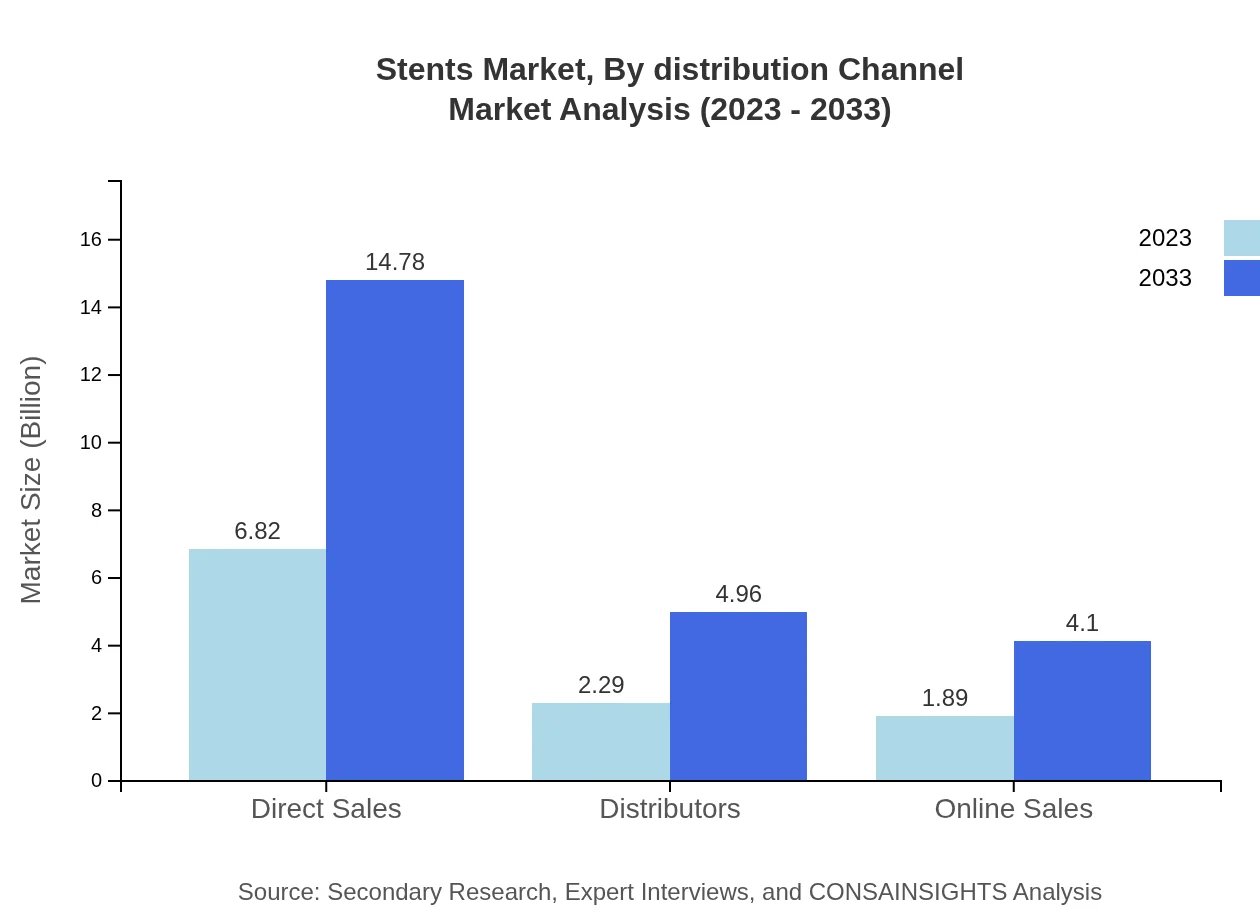

Stents Market Analysis By Distribution Channel

Direct sales dominate the distribution channel for stents, maintaining a 62% share with a market size reaching $6.82 billion. The online distribution channel is emerging, with growing penetration, signaling shifts in purchasing behaviors.

Stents Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Stents Industry

Boston Scientific Corporation:

Boston Scientific is a leading medical device manufacturer known for its innovative stent technologies, particularly in cardiology and vascular interventions.Abbott Laboratories:

Abbott is a global healthcare leader, with a strong presence in the stents market, offering a range of drug-eluting and bare metal stents.Medtronic Plc:

Medtronic specializes in medical technology, providing advanced stenting solutions for various applications including drug-eluting and vascular stents.B. Braun Melsungen AG:

B. Braun offers a diverse portfolio of stenting solutions and emphasizes patient safety in its innovative designs.Terumo Corporation:

Terumo is well-known for its innovative vascular interventions and has a strong focus on delivering high-quality stenting products.We're grateful to work with incredible clients.

FAQs

What is the market size of stents?

The global stents market is valued at approximately $11 billion in 2023, with expectations to grow at a CAGR of 7.8%. Projections indicate a substantial increase, reaching around $23 billion by 2033, driven by advancements in medical technologies.

What are the key market players or companies in the stents industry?

Key players in the stents market include Boston Scientific, Abbott Laboratories, Medtronic, Terumo Corporation, and B. Braun Melsungen AG. These companies play significant roles in innovation, manufacturing, and distribution of various stent types, contributing to market competitiveness.

What are the primary factors driving the growth in the stents industry?

Major growth drivers for the stents market include the rising prevalence of cardiovascular diseases, technological advancements in stent designs, increasing healthcare expenditure, and growing geriatric populations. Enhanced awareness regarding minimally invasive procedures also fuels market demand.

Which region is the fastest Growing in the stents market?

The Asia Pacific region is poised to be the fastest-growing area in the stents market. With a market size projected to grow from $2.11 billion in 2023 to $4.58 billion by 2033, this region benefits from expanding healthcare access and investment in medical innovations.

Does ConsaInsights provide customized market report data for the stents industry?

Yes, ConsaInsights offers customized market report data tailored to client needs within the stents industry. This includes in-depth analyses specific to regional markets, competitive landscapes, and trending technologies to aid strategic decision-making.

What deliverables can I expect from this stents market research project?

Delivers from the stents market research project typically include comprehensive market analysis, competitor profiling, segmentation data, regional insights, and forecast models. Clients receive actionable insights necessary for informed strategic planning and investment decisions.

What are the market trends of stents?

Current market trends in the stents industry highlight a shift towards drug-eluting and bioresorbable stents, driven by their superior performance and reduced complications. Additionally, increasing adoption of ambulatory surgery centers is reshaping treatment delivery models.