Stevia Market Report

Published Date: 31 January 2026 | Report Code: stevia

Stevia Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Stevia market from 2023 to 2033, highlighting market trends, insights, size, and growth projections. It covers industry segmentation, technological advancements, regional performance, and profiles of leading companies in the sector.

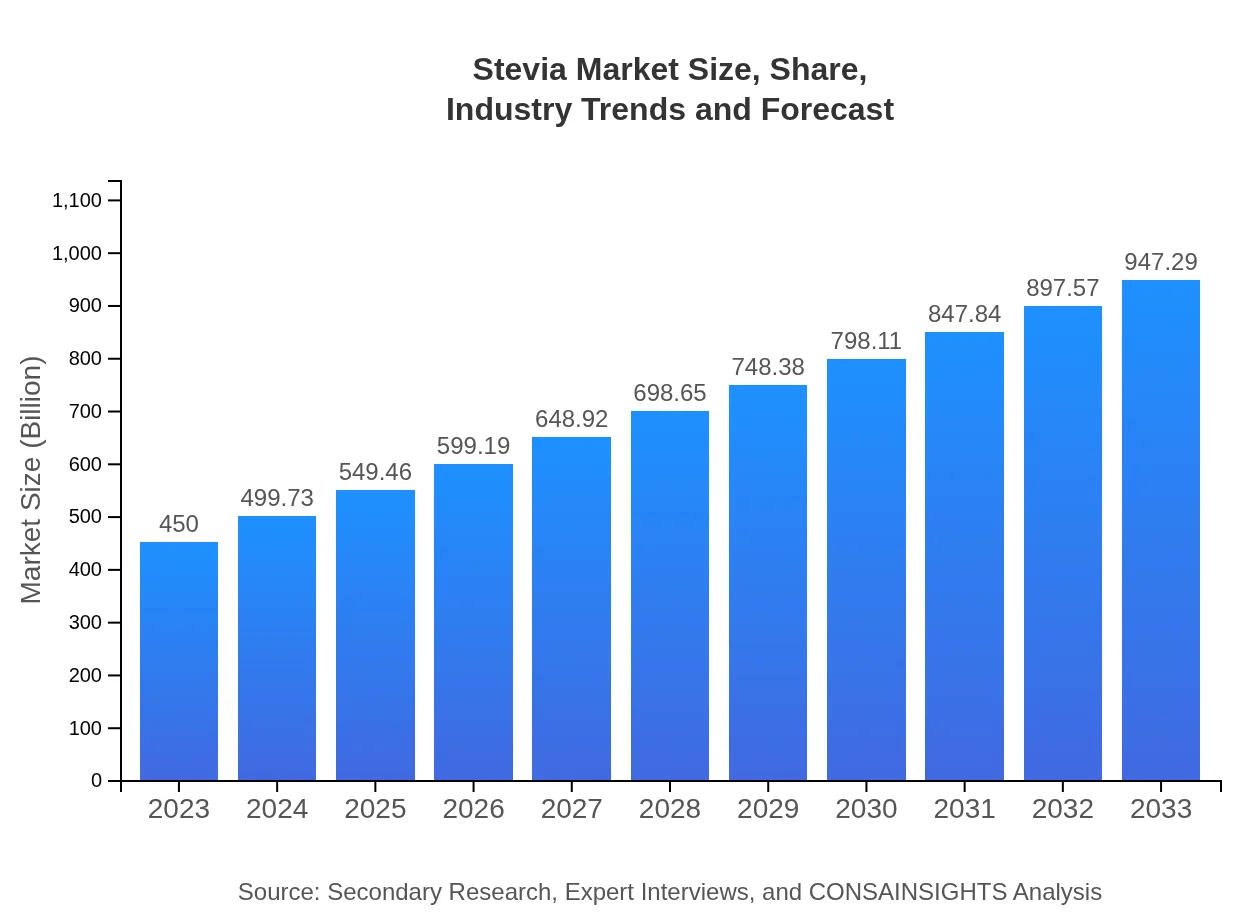

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $450.00 Million |

| CAGR (2023-2033) | 7.5% |

| 2033 Market Size | $947.29 Million |

| Top Companies | PureCircle Ltd., Cargill, Inc., Stevia First Corporation |

| Last Modified Date | 31 January 2026 |

Stevia Market Overview

Customize Stevia Market Report market research report

- ✔ Get in-depth analysis of Stevia market size, growth, and forecasts.

- ✔ Understand Stevia's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Stevia

What is the Market Size & CAGR of Stevia market in 2023?

Stevia Industry Analysis

Stevia Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Stevia Market Analysis Report by Region

Europe Stevia Market Report:

Europe's Stevia market is expected to grow from USD 137.93 million in 2023 to USD 290.35 million by 2033. The demand is driven by regulatory frameworks favoring reduced sugar consumption and an increase in consumer preference for plant-based products. Countries like Germany and the UK are at the forefront of adopting Stevia in their food systems.Asia Pacific Stevia Market Report:

In the Asia Pacific region, the Stevia market was valued at approximately USD 92.07 million in 2023 and is expected to grow to USD 193.82 million by 2033. The region benefits from a well-established agricultural framework for Stevia cultivation, particularly in countries like China, which dominates the production. Increased consumer awareness and government initiatives supporting sugar reduction in diets further bolster market growth.North America Stevia Market Report:

North America leads the Stevia market, with a valuation of USD 148.05 million in 2023, projected to reach USD 311.66 million by 2033. The rising prevalence of obesity and diabetes has propelled the demand for healthier sweeteners. Sustainability trends among manufacturers seeking natural ingredients are also contributing factors.South America Stevia Market Report:

Latin America, starting at USD 24.84 million in 2023, is set to grow to about USD 52.29 million by 2033. The region exhibits a growing interest in organic products, and the native cultivation of Stevia enhances its relevance in local markets. Environmental sustainability concerns drive growth as consumers demand eco-friendly sweeteners.Middle East & Africa Stevia Market Report:

The Middle East and Africa Stevia market, valued at USD 47.12 million in 2023, anticipates growth to USD 99.18 million by 2033. Despite being a nascent market, consumer interest in health-oriented products is increasing. There is a growing realization of the benefits of using natural sweeteners, which boosts sales channels like supermarkets and online platforms.Tell us your focus area and get a customized research report.

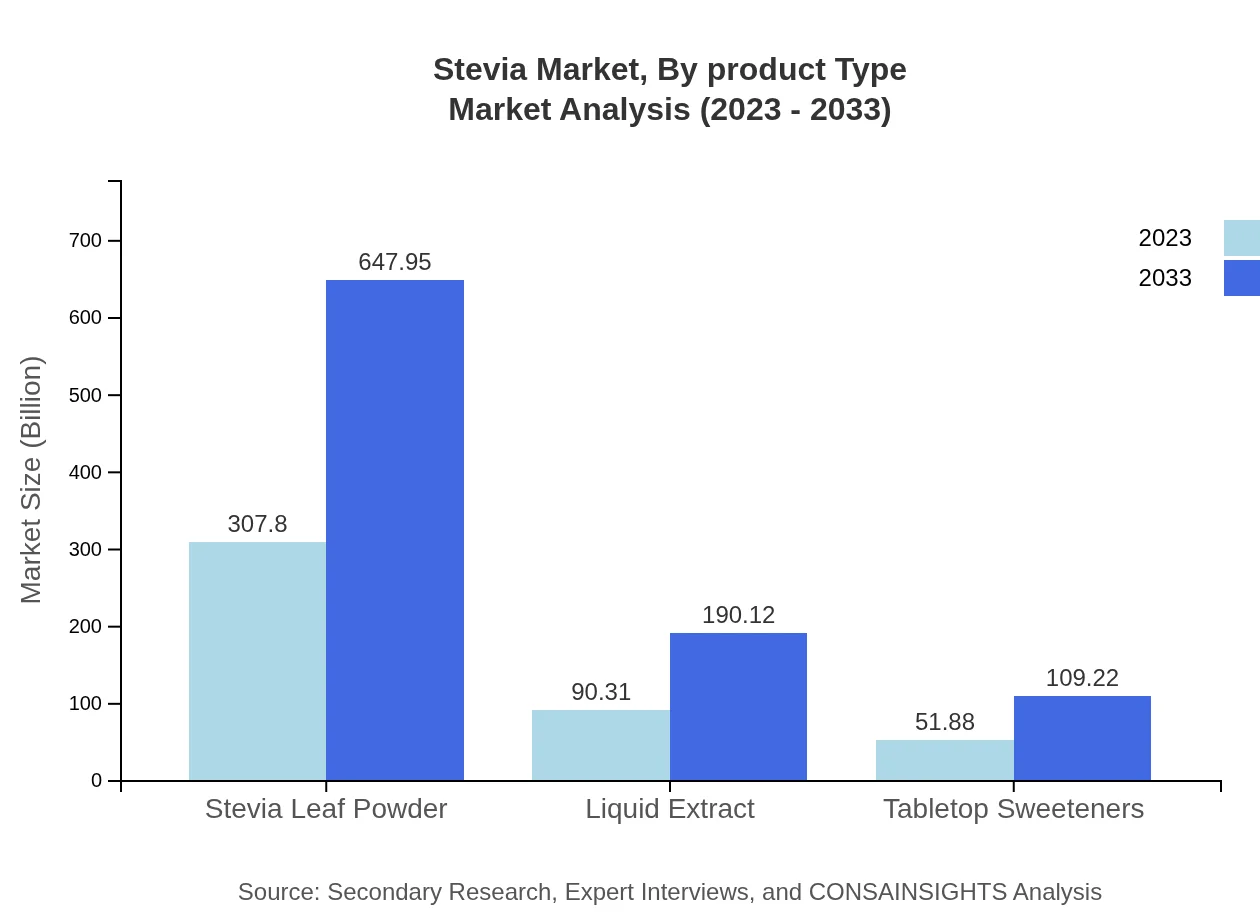

Stevia Market Analysis By Product Type

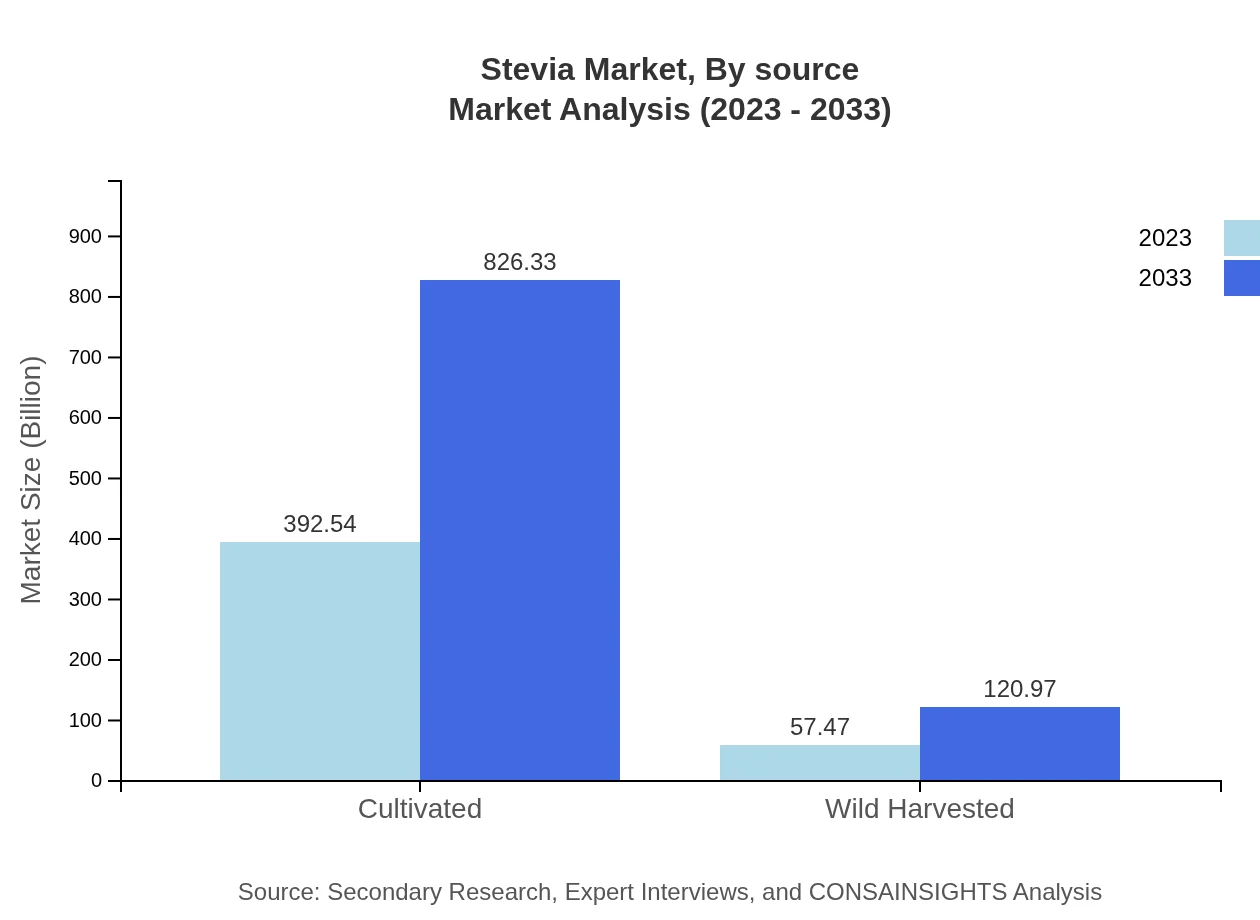

The product segmentation of the Stevia market identifies Cultivated and Wild Harvested Stevia. The cultivated segment dominates, starting at USD 392.54 million in 2023 and expected to reach USD 826.33 million by 2033, while Wild Harvested is projected to grow from USD 57.47 million to USD 120.97 million in the same period.

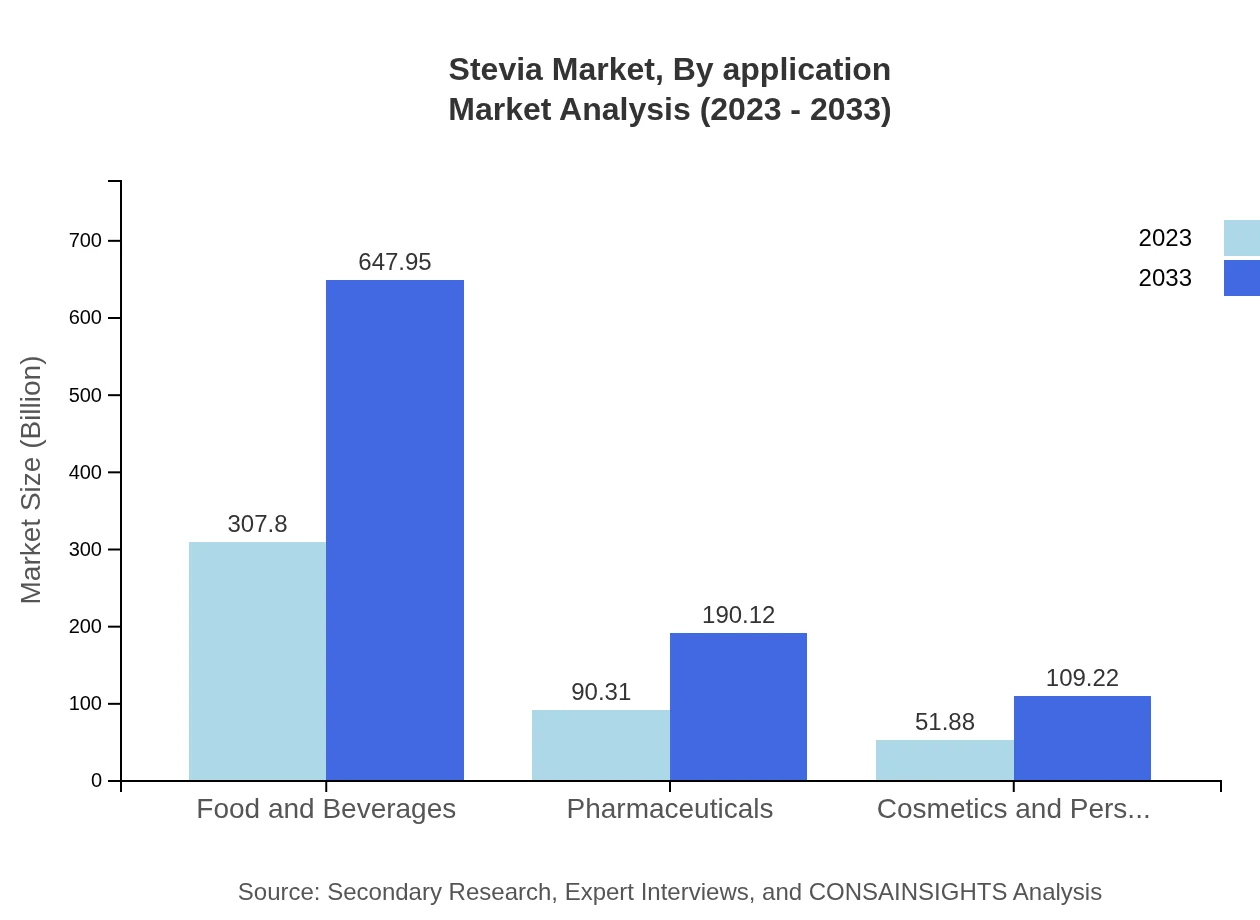

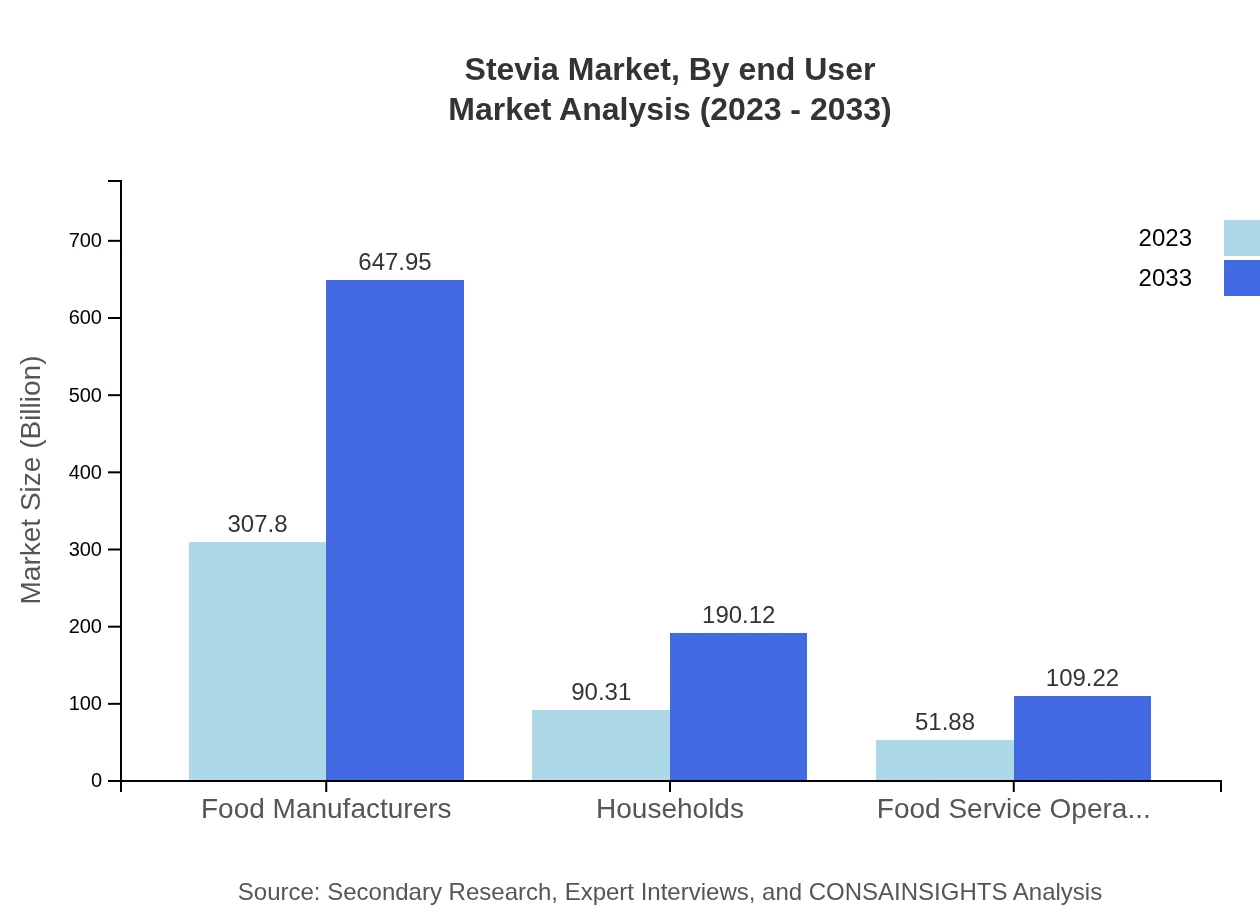

Stevia Market Analysis By Application

Key applications for Stevia include Food Manufacturers, Households, and Food Service Operators. In 2023, Food Manufacturers account for USD 307.80 million, projected to expand to USD 647.95 million by 2033. Households will grow from USD 90.31 million to USD 190.12 million, emphasizing greater home usage.

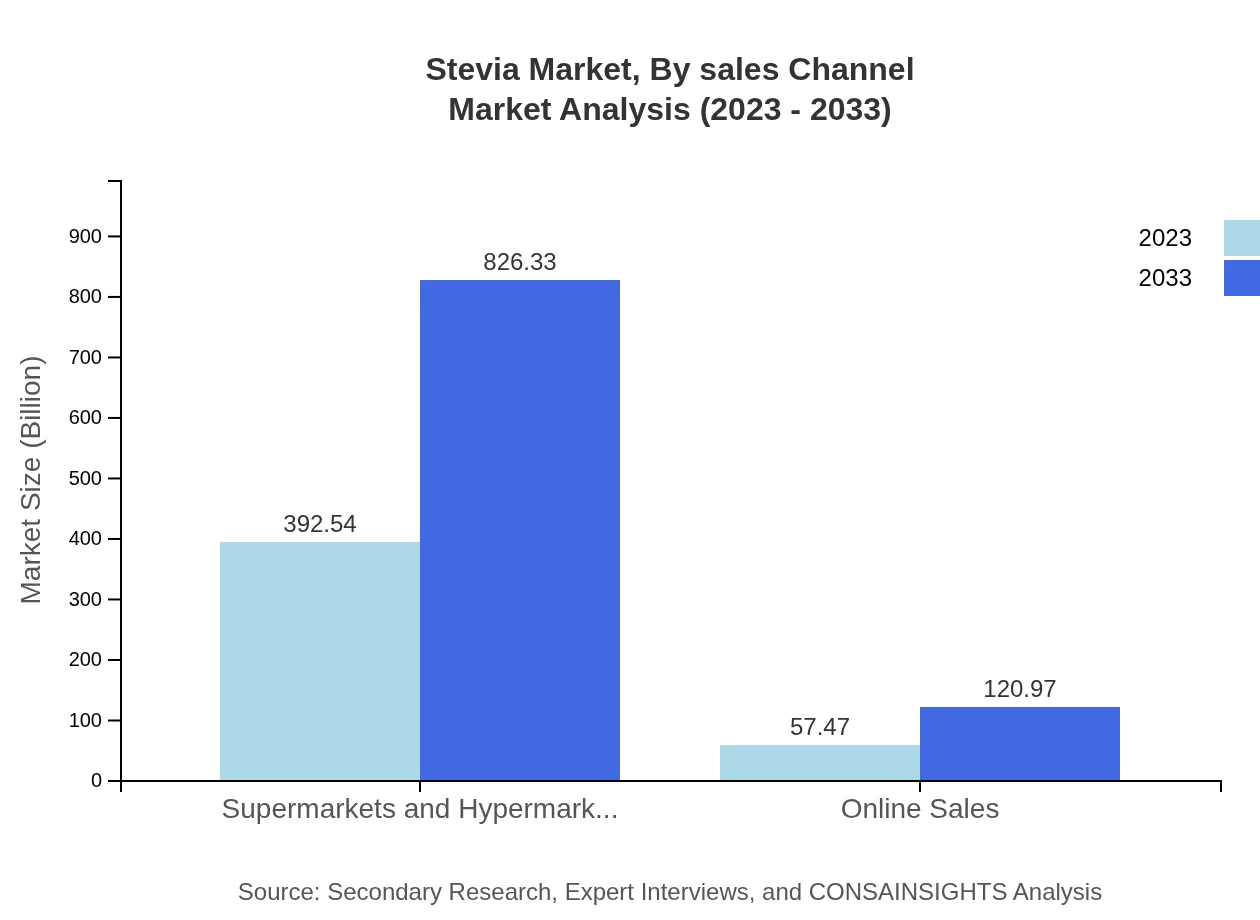

Stevia Market Analysis By Sales Channel

Sales channels for Stevia like Supermarkets/Hypermarkets and Online Sales reflect growing consumer access. Supermarkets/Hypemarket segment is projected to grow from USD 392.54 million to USD 826.33 million, while Online Sales will grow from USD 57.47 million to USD 120.97 million, indicating a shift towards digital retail.

Stevia Market Analysis By Source

Cultivated Stevia is the primary source, dominating the market with a prominent share of 87.23% in 2023 and maintaining the same proportion by 2033. Wild harvested Stevia maintains a smaller share of about 12.77%.

Stevia Market Analysis By End User

By end-user, the Food and Beverages sector remains the largest segment, starting at USD 307.80 million in 2023 and expected to double by 2033. Additional sectors like Pharmaceuticals and Cosmetics also exhibit growth, particularly with increasing natural product formulations.

Stevia Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Stevia Industry

PureCircle Ltd.:

A pioneer in the production of Stevia-based ingredients, PureCircle leads with innovations in extraction and cultivation techniques, and provides high-quality Stevia products to major food manufacturers.Cargill, Inc.:

Cargill offers a wide range of food and beverage ingredients, including Stevia. Their strategic investments in sustainability and innovation enable them to meet the growing needs for natural sweeteners.Stevia First Corporation:

Focused on providing a sustainable source of Stevia, Stevia First Corporation is recognized for its efforts in R&D and product development within the natural sweetener space.We're grateful to work with incredible clients.

FAQs

What is the market size of stevia?

The stevia market was valued at $450 million in 2023, with a projected CAGR of 7.5%. This growth indicates an increase in consumer acceptance and demand for natural sweeteners over the next decade.

What are the key market players or companies in the stevia industry?

Key players in the stevia market include prominent companies involved in the production and distribution of stevia products. Market leaders focus on innovating stevia formulations and expanding global distribution networks to capture increasing consumer demand.

What are the primary factors driving the growth in the stevia industry?

Key growth drivers for the stevia industry include rising health consciousness among consumers, increased demand for natural and low-calorie sweeteners, and the growing food and beverage industry prioritizing healthier ingredients in product formulations.

Which region is the fastest Growing in the stevia market?

The fastest-growing region in the stevia market is North America, with market growth from $148.05 million in 2023 to $311.66 million in 2033. This growth reflects the high demand for health-oriented products in U.S. consumer markets.

Does ConsaInsights provide customized market report data for the stevia industry?

Yes, ConsaInsights offers customized market reports tailored to the specific needs of stakeholders in the stevia industry, ensuring insights are relevant for strategic planning and decision-making.

What deliverables can I expect from this stevia market research project?

Deliverables from the stevia market research project include detailed market analyses, competitive landscape assessments, segment-wise growth forecasts, and actionable insights based on industry trends and consumer behaviors.

What are the market trends of stevia?

Current trends in the stevia market include a shift towards organic labeling, growth in online sales channels, product innovation in food and beverages, and increasing consumer preference for sustainable and health-focused alternatives.