Storage Class Memory Market Report

Published Date: 31 January 2026 | Report Code: storage-class-memory

Storage Class Memory Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Storage Class Memory market, covering insights on market trends, size, regional analyses, and forecasts for the period 2023 to 2033.

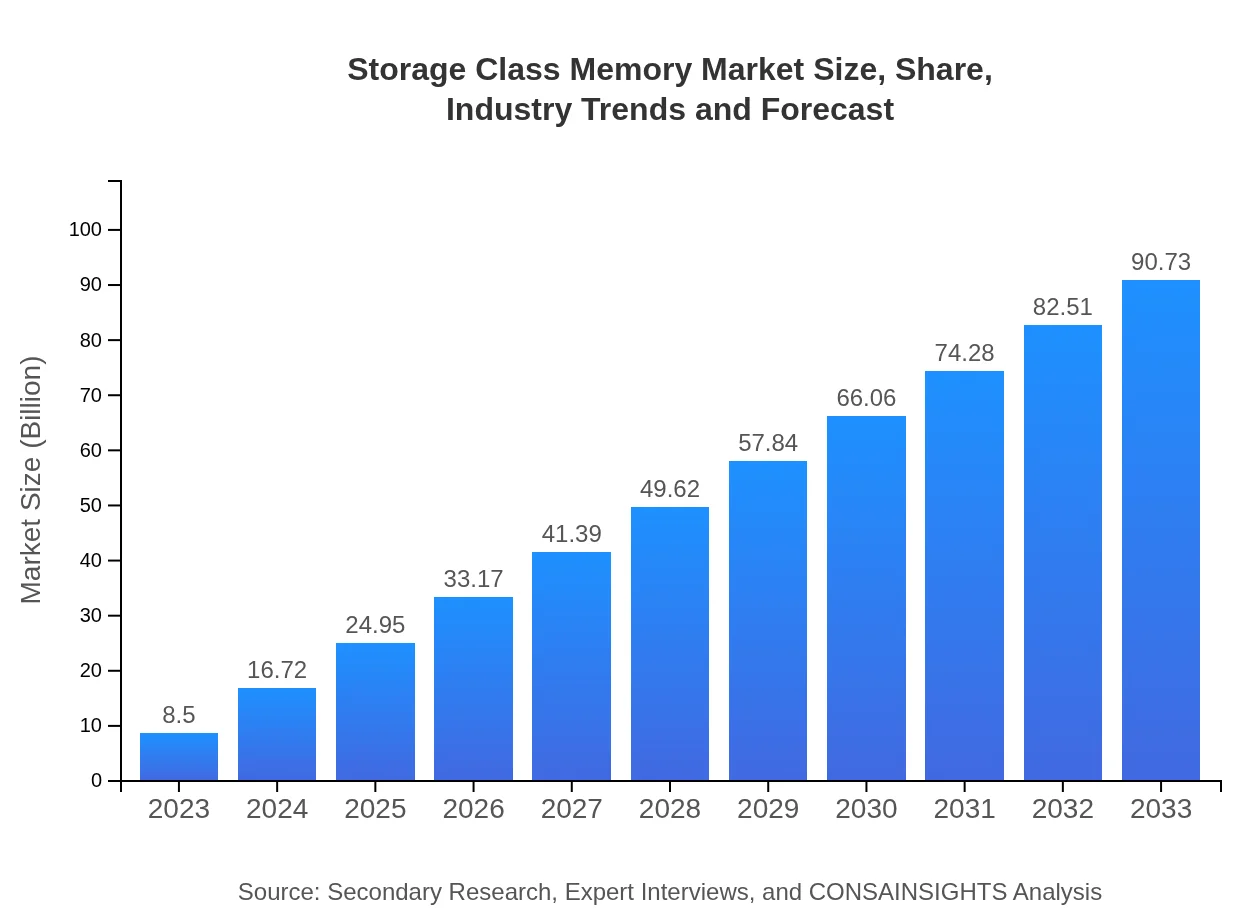

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $8.50 Billion |

| CAGR (2023-2033) | 25% |

| 2033 Market Size | $90.73 Billion |

| Top Companies | Intel Corporation, Micron Technology, Inc., Samsung Electronics, Western Digital Corporation, IBM Corporation |

| Last Modified Date | 31 January 2026 |

Storage Class Memory Market Overview

Customize Storage Class Memory Market Report market research report

- ✔ Get in-depth analysis of Storage Class Memory market size, growth, and forecasts.

- ✔ Understand Storage Class Memory's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Storage Class Memory

What is the Market Size & CAGR of Storage Class Memory market in 2023?

Storage Class Memory Industry Analysis

Storage Class Memory Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Storage Class Memory Market Analysis Report by Region

Europe Storage Class Memory Market Report:

The European market for Storage Class Memory is projected to grow from $2.06 billion in 2023 to $21.98 billion in 2033, fueled by significant investments in data centers and regulatory pressures for enhanced data handling capabilities in various sectors.Asia Pacific Storage Class Memory Market Report:

The Asia Pacific region is witnessing significant investment in Storage Class Memory technologies, driven by rapid industrialization and the digital transformation of enterprises. The market size is projected to grow from $1.70 billion in 2023 to $18.14 billion in 2033, supported by increasing data demands and investments in AI applications.North America Storage Class Memory Market Report:

North America leads the global market for Storage Class Memory, with the market expected to expand from $2.80 billion in 2023 to $29.89 billion by 2033. The region's strong IT infrastructure, coupled with advanced technological research, positions it at the forefront of SCM adoption across sectors.South America Storage Class Memory Market Report:

In South America, the Storage Class Memory market is relatively emerging, with forecasts indicating growth from $0.77 billion in 2023 to $8.17 billion in 2033. Increased adoption of cloud services and data-centric applications across various industries are key drivers of this growth.Middle East & Africa Storage Class Memory Market Report:

The Middle East and Africa region is gradually embracing Storage Class Memory technology, anticipating growth from $1.18 billion in 2023 to $12.56 billion by 2033. Factors such as increased reliance on digital solutions and regional initiatives to boost IT infrastructure are contributing to this market evolution.Tell us your focus area and get a customized research report.

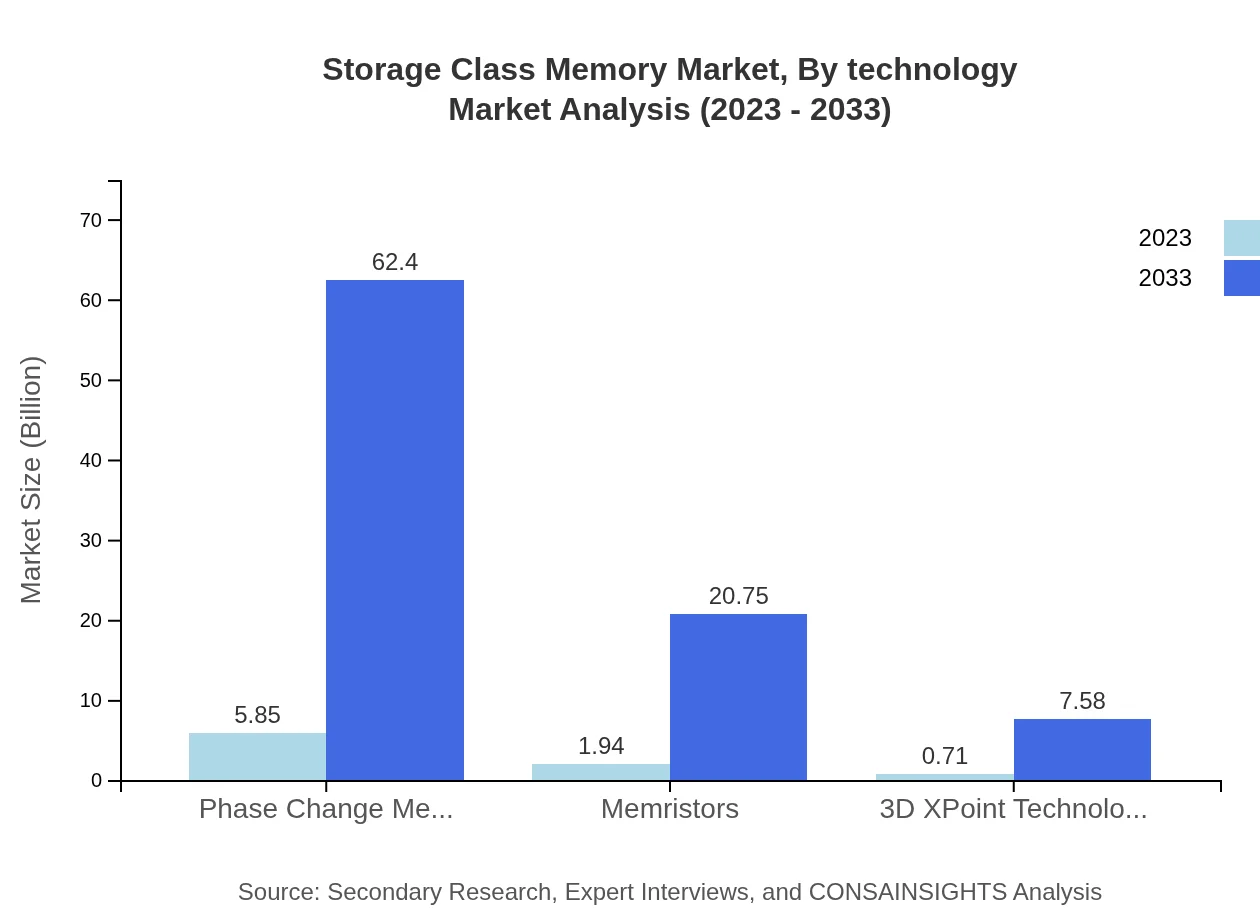

Storage Class Memory Market Analysis By Technology

Phase Change Memory (PCM), comprising the largest share at 68.78% in 2023, is forecasted to see growth from $5.85 billion to $62.40 billion by 2033. Other significant technologies include Memristors, projected to grow from $1.94 billion to $20.75 billion, and 3D XPoint Technology, growing from $0.71 billion to $7.58 billion.

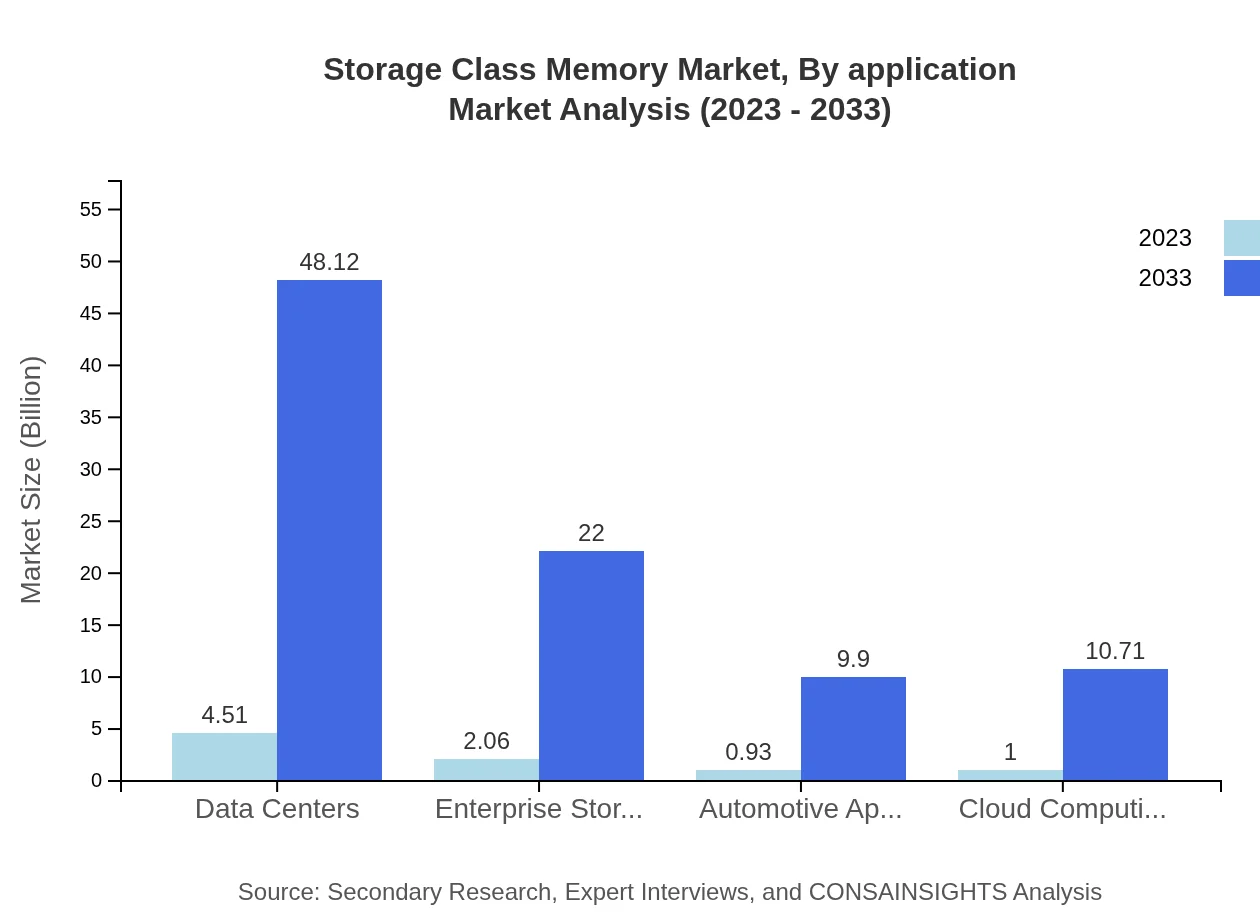

Storage Class Memory Market Analysis By Application

The Data Centers application segment remains dominant with a market share of 53.04%, expected to increase significantly from $4.51 billion in 2023 to $48.12 billion by 2033. The IT and telecom sector also presents strong growth prospects, with a similar trajectory projected.

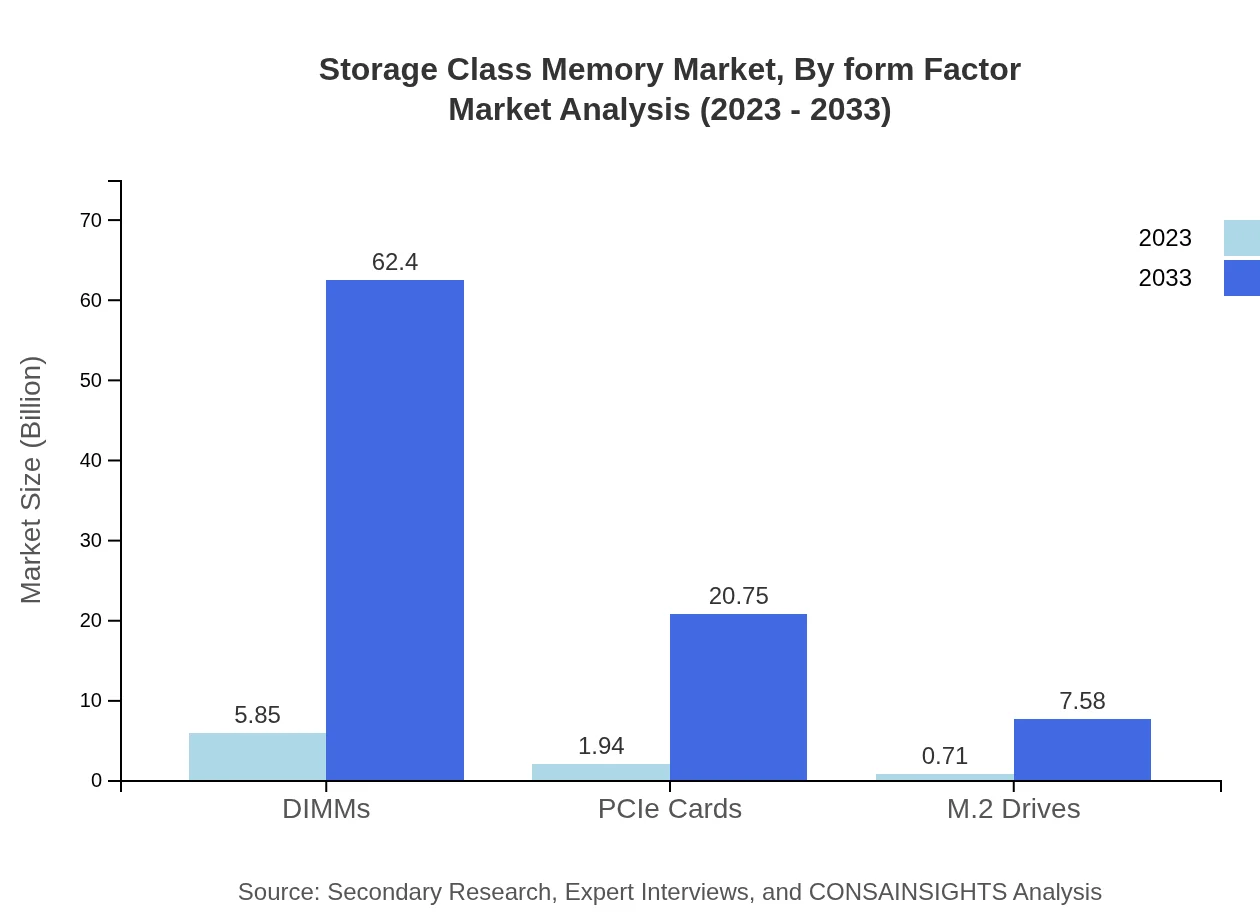

Storage Class Memory Market Analysis By Form Factor

The DIMMs form factor accounts for a substantial share of the market at 68.78%, with advancements in efficient designs expected to drive the segment from $5.85 billion to $62.40 billion across the forecast period.

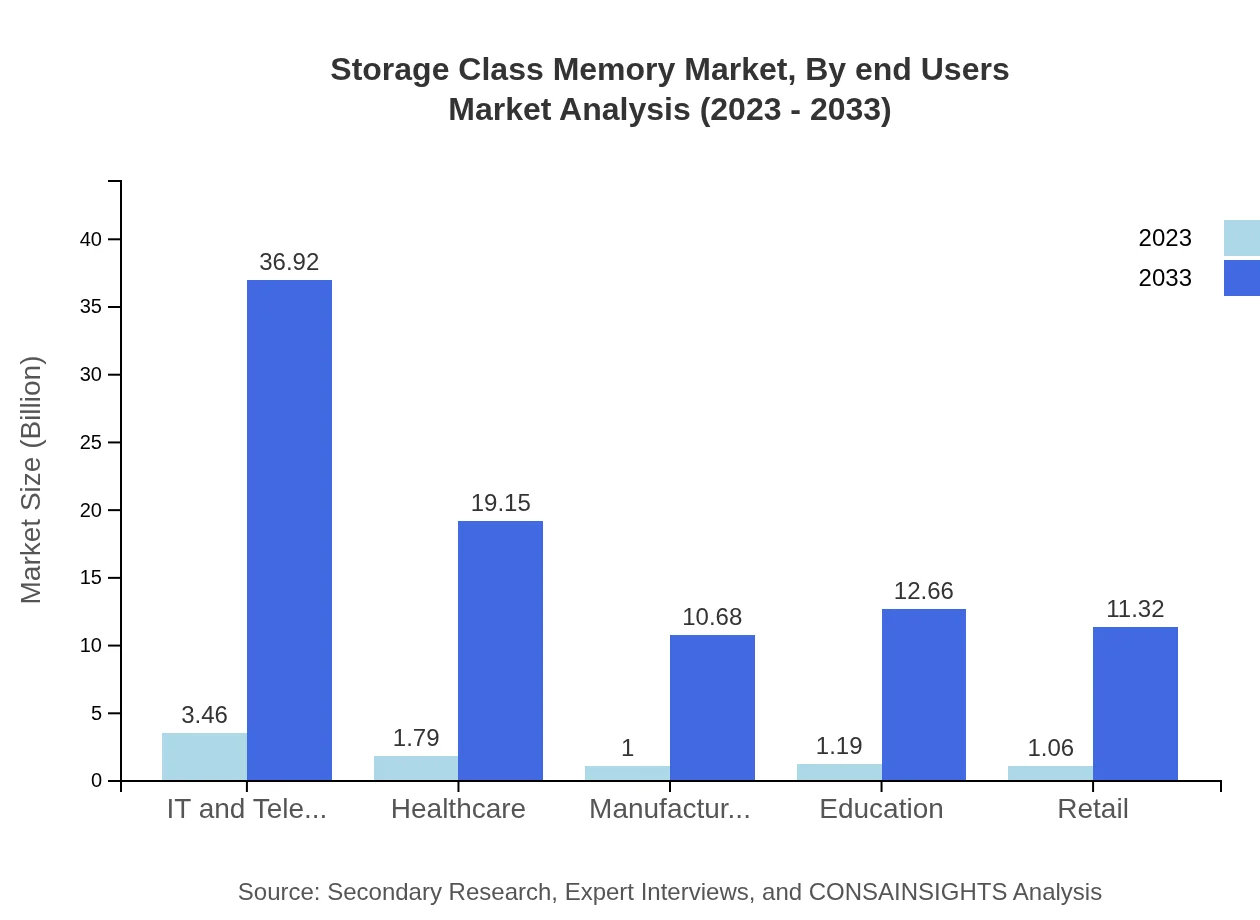

Storage Class Memory Market Analysis By End Users

Healthcare and automotive industries are emerging as key users of Storage Class Memory. The healthcare sector is expected to grow from $1.79 billion in 2023 to $19.15 billion by 2033, driven by the need for real-time data usage in medical applications.

Storage Class Memory Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Storage Class Memory Industry

Intel Corporation:

Intel has been a pioneer in memory technology, including 3D XPoint products, significantly impacting the Storage Class Memory landscape.Micron Technology, Inc.:

Micron is known for its innovations in flash storage and is expanding its portfolio to include advanced Storage Class Memory solutions.Samsung Electronics:

Samsung has developed proprietary memory technologies and remains a dominant player in the SCM market through extensive research and product development.Western Digital Corporation:

Western Digital focuses on data storage solutions and currently invests in SCM innovations to enhance performance and reliability.IBM Corporation:

IBM is heavily invested in advanced computing solutions and has integrated Storage Class Memory into its latest data systems for enhanced efficiency.We're grateful to work with incredible clients.

FAQs

What is the market size of storage Class Memory?

The global storage-class memory market is projected to reach $8.5 billion by 2033, growing at a remarkable CAGR of 25%. This growth signifies increasing adoption across various sectors due to the need for faster data access and improved performance.

What are the key market players or companies in the storage Class Memory industry?

Key players in the storage-class memory market include major technology firms such as Intel, Micron Technology, Samsung Electronics, and Western Digital. These companies are leading the innovation in storage technology, driving competitive advancements in performance and functionality.

What are the primary factors driving the growth in the storage Class Memory industry?

The key drivers of growth in the storage-class memory industry include the increasing demand for faster data processing, the rise of cloud computing, and advancements in data center technologies. Additionally, the proliferation of IoT devices necessitates higher storage speeds and efficiencies.

Which region is the fastest Growing in the storage Class Memory market?

North America is the fastest-growing region in the storage-class memory market, expected to grow from $2.80 billion in 2023 to $29.89 billion by 2033. This growth is fueled by high investments in cloud infrastructure and data centers.

Does ConsaInsights provide customized market report data for the storage Class Memory industry?

Yes, ConsaInsights offers customized market report data for the storage-class memory industry. Clients can request specific analyses tailored to their strategic needs, including market size, trends, and competitive insights.

What deliverables can I expect from this storage Class Memory market research project?

From this market research project, you can expect comprehensive reports, detailed market size analysis, segmentation insights, and regional forecasts. The report will also include competitive analysis and trends shaping the future of the storage-class memory market.

What are the market trends of storage Class Memory?

Key market trends in storage-class memory include the shift towards higher data speeds and capacities, increased adoption of 3D XPoint technology, and growing integration into data centers and cloud applications. These trends indicate an evolving landscape focused on performance and efficiency.