Stored Grain Insecticide Market Report

Published Date: 02 February 2026 | Report Code: stored-grain-insecticide

Stored Grain Insecticide Market Size, Share, Industry Trends and Forecast to 2033

This report offers a comprehensive analysis of the stored grain insecticide market from 2023 to 2033, highlighting market trends, segmentation, regional insights, and future forecasts to inform stakeholders about growth opportunities and potential challenges.

| Metric | Value |

|---|---|

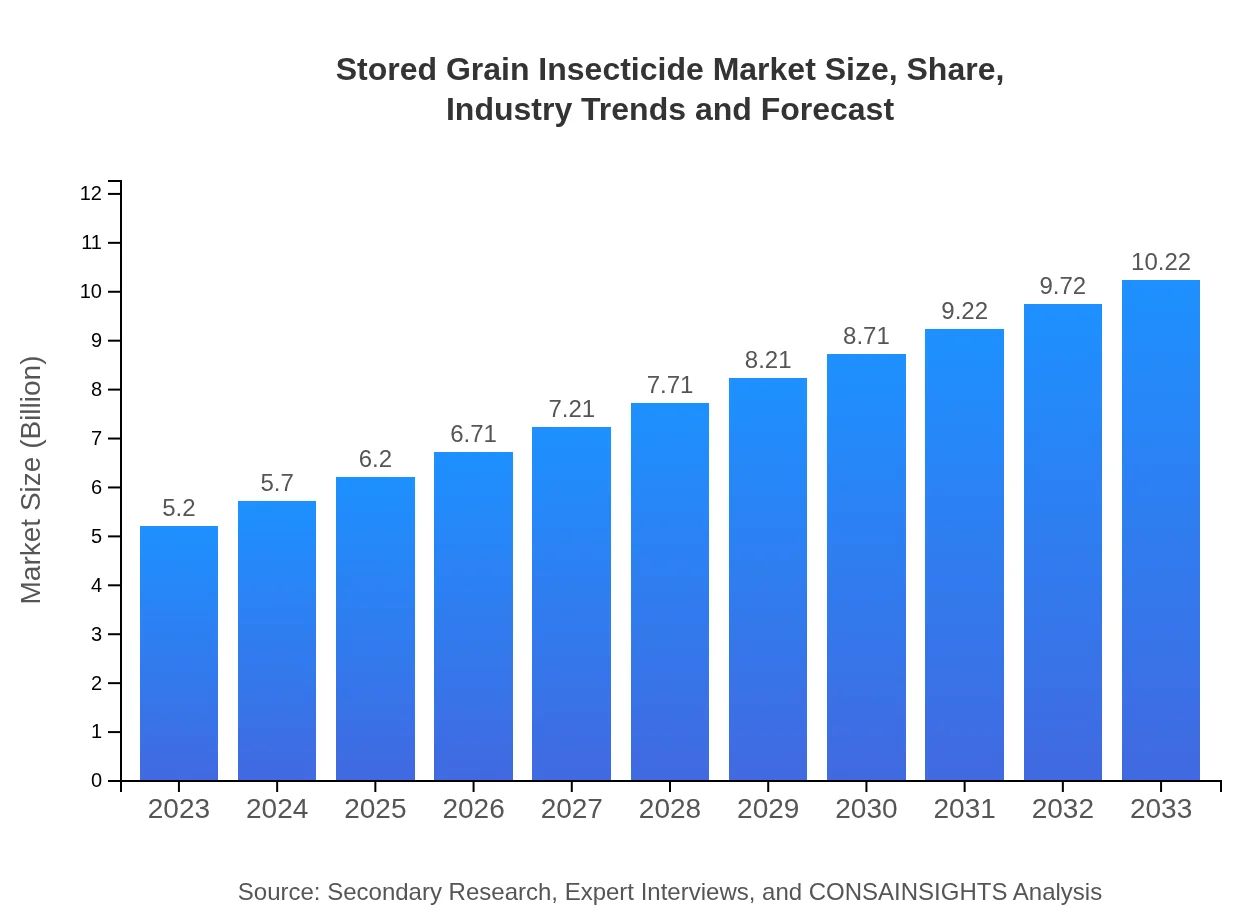

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.20 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $10.22 Billion |

| Top Companies | BASF SE, Syngenta AG, Corteva Agriscience |

| Last Modified Date | 02 February 2026 |

Stored Grain Insecticide Market Overview

Customize Stored Grain Insecticide Market Report market research report

- ✔ Get in-depth analysis of Stored Grain Insecticide market size, growth, and forecasts.

- ✔ Understand Stored Grain Insecticide's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Stored Grain Insecticide

What is the Market Size & CAGR of Stored Grain Insecticide market in 2023?

Stored Grain Insecticide Industry Analysis

Stored Grain Insecticide Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Stored Grain Insecticide Market Analysis Report by Region

Europe Stored Grain Insecticide Market Report:

In Europe, the stored grain insecticide market is set to increase from $1.70 billion in 2023 to $3.34 billion in 2033, fueled by stringent food safety regulations and the demand for high-quality agricultural products.Asia Pacific Stored Grain Insecticide Market Report:

The Asia Pacific region is witnessing robust growth, with market size expected to rise from $0.95 billion in 2023 to $1.87 billion in 2033. The increase is driven by the region’s extensive agricultural activities and the rising adoption of effective pest control measures.North America Stored Grain Insecticide Market Report:

North America shows a significant market capacity, expanding from $1.81 billion in 2023 to $3.56 billion in 2033. The U.S. leads in implementing innovative pest control technologies, particularly in the production of cereals.South America Stored Grain Insecticide Market Report:

In South America, the market is anticipated to grow from $0.12 billion in 2023 to $0.24 billion in 2033. This growth is attributed to the agricultural sector's reliance on stored grain insecticides to protect vital crops, influenced by climate-related pest pressures.Middle East & Africa Stored Grain Insecticide Market Report:

The Middle East and Africa region is expected to grow from $0.61 billion in 2023 to $1.21 billion in 2033, supported by agricultural development initiatives and the increased focus on improving food security.Tell us your focus area and get a customized research report.

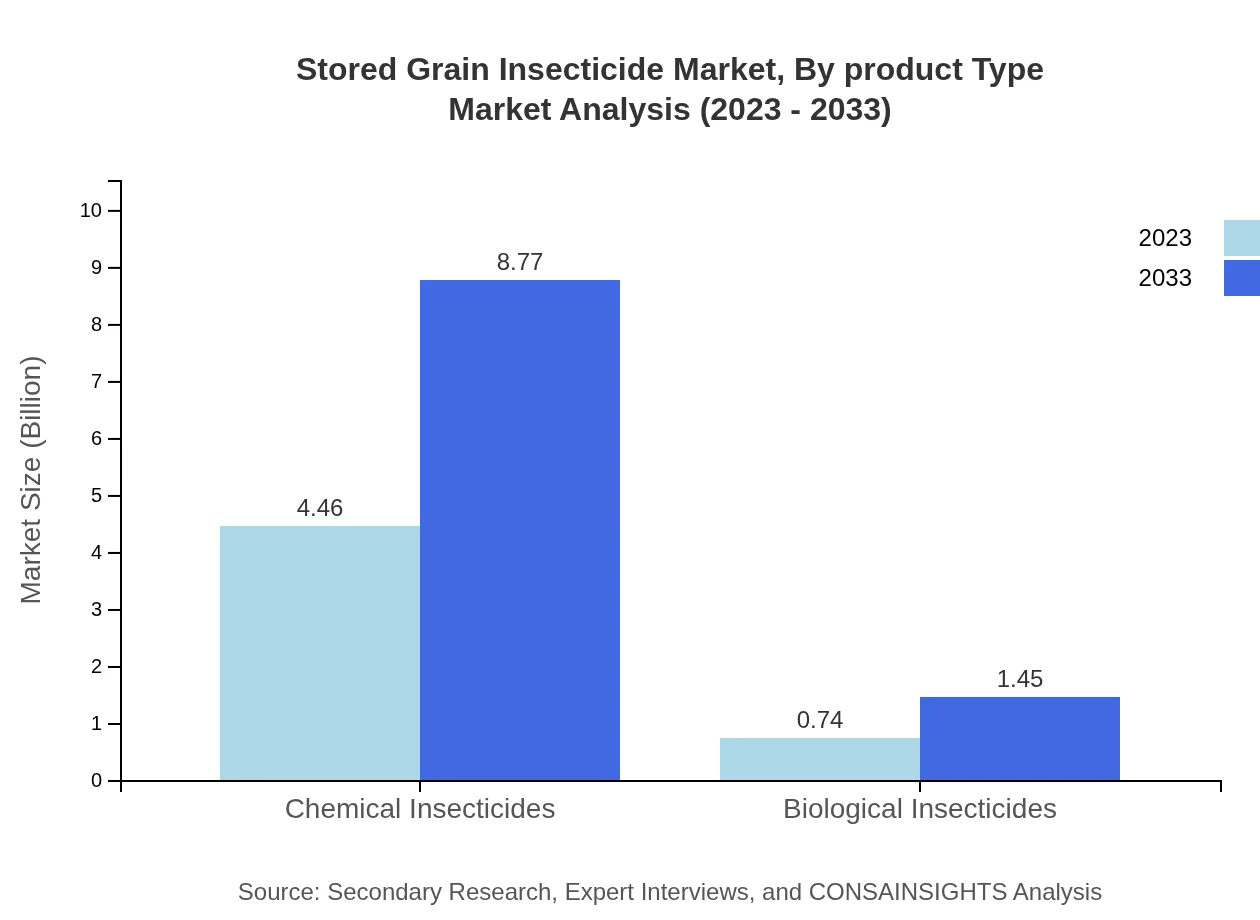

Stored Grain Insecticide Market Analysis By Product Type

The analysis reveals that the granules segment dominates the market, with market sizes projected to increase from $3.40 billion in 2023 to $6.69 billion in 2033. Chemical insecticides lead with a market share of 85.84% in 2023, anticipated to maintain similar levels, contributing significantly to overall market growth.

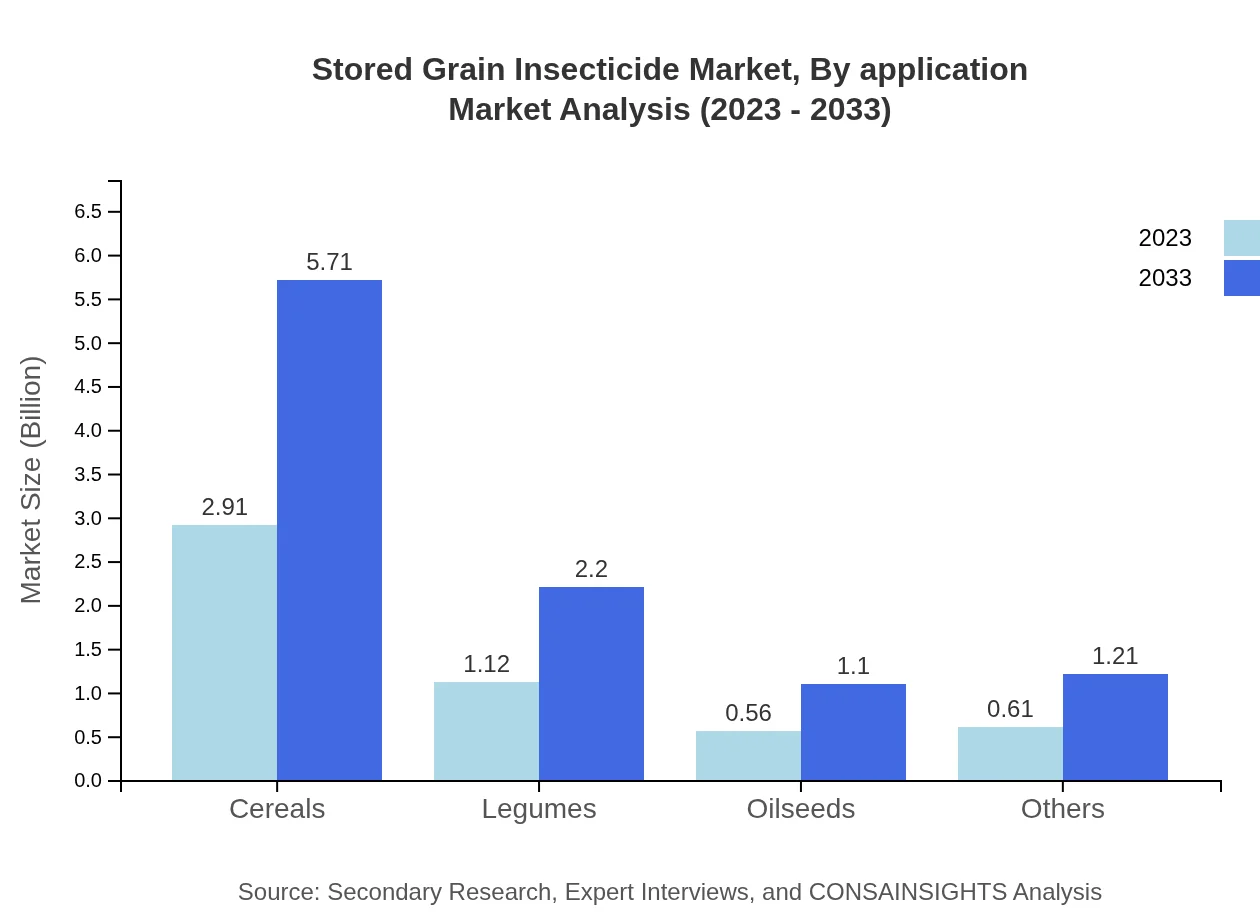

Stored Grain Insecticide Market Analysis By Application

Cereals occupy a major share of the application segment, with sizes expected to grow from $2.91 billion in 2023 to $5.71 billion in 2033. This reflects the critical need for effective insecticides in protecting essential crops.

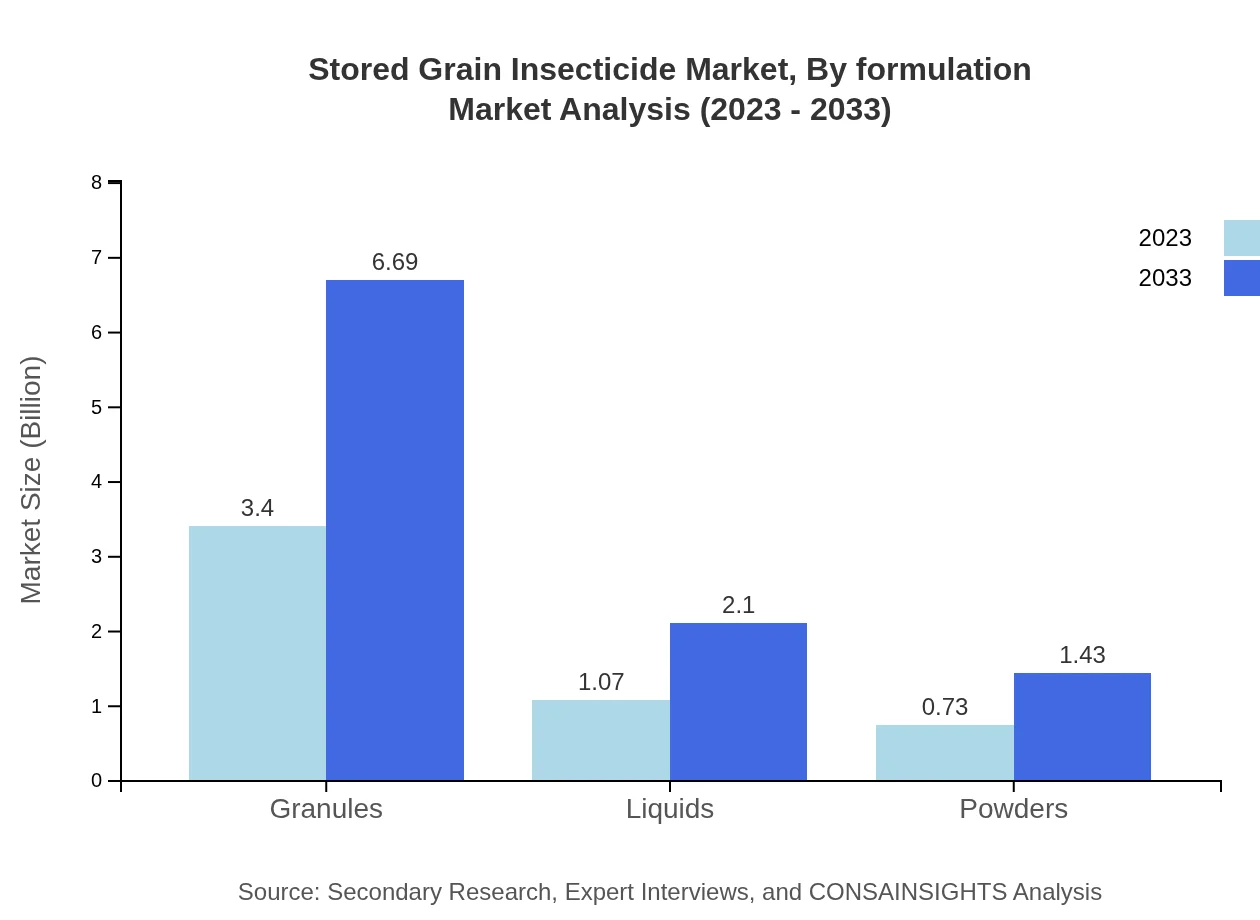

Stored Grain Insecticide Market Analysis By Formulation

In terms of formulation, granules hold the largest market share with 65.42% in 2023, signifying a preference among consumers for easy-to-apply products. Liquid formulations are also gaining traction due to their versatility and effectiveness.

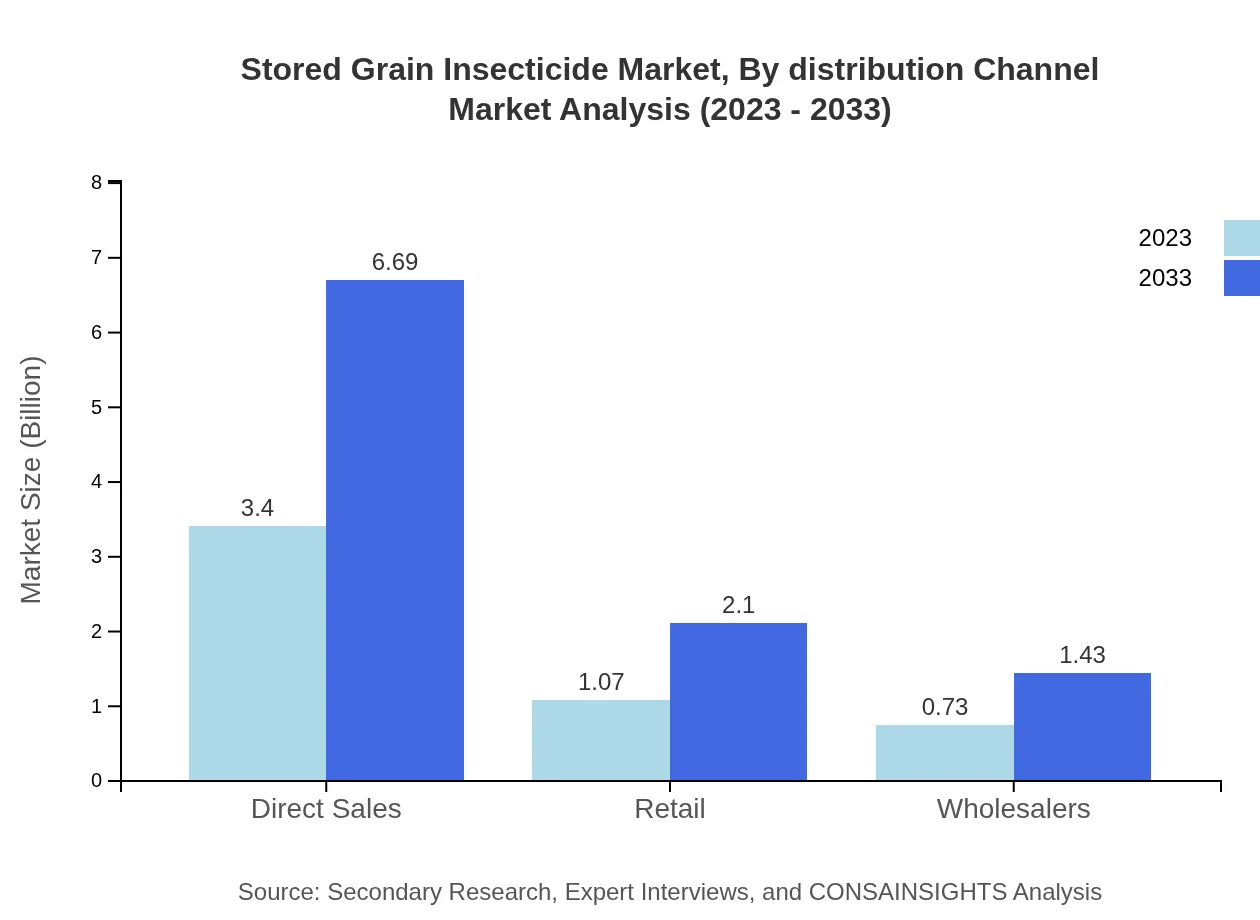

Stored Grain Insecticide Market Analysis By Distribution Channel

Direct sales dominate distribution channels, indicating the effectiveness of farm-level marketing strategies. In 2023, direct sales comprised 65.42% of the channel share, which is poised to continue as critical for direct consumer engagement.

Stored Grain Insecticide Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Stored Grain Insecticide Industry

BASF SE:

A global leader in chemical production, BASF SE offers a wide range of agricultural solutions, including advanced stored grain insecticides that adhere to rigorous environmental standards.Syngenta AG:

Syngenta AG specializes in crop protection products, focusing on innovation in stored grain insecticides, providing sustainable solutions aimed at enhancing agricultural productivity.Corteva Agriscience:

Corteva offers a comprehensive portfolio of pest control products, featuring effective stored grain insecticides tailored for diverse agricultural needs worldwide.We're grateful to work with incredible clients.

FAQs

What is the market size of stored Grain Insecticide?

The stored grain insecticide market is currently valued at approximately $5.2 billion, with projections indicating a compound annual growth rate (CAGR) of 6.8%. This growth trajectory is driven by increasing agricultural practices and the need for effective pest management.

What are the key market players or companies in this stored Grain Insecticide industry?

Key players in the stored grain insecticide market include major agricultural chemical companies specializing in pest control solutions. Prominent companies are engaged in innovation, focusing on biological as well as chemical insecticides to enhance crop protection and efficiency.

What are the primary factors driving the growth in the stored Grain Insecticide industry?

The growth in the stored grain insecticide industry is primarily driven by rising global food demand, the need for enhanced food security, and increasing storage capacities. Additionally, regulatory support for pest management solutions fosters innovation in this sector.

Which region is the fastest Growing in the stored Grain Insecticide market?

The fastest-growing region in the stored-grain insecticide market is Europe. The projected market growth from $1.70 billion in 2023 to $3.34 billion by 2033 indicates a robust CAGR as agricultural practices and storage facilities expand in this region.

Does ConsaInsights provide customized market report data for the stored Grain Insecticide industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the stored-grain insecticide industry. Clients can access personalized insights and analyses to inform decisions regarding investments and strategic planning.

What deliverables can I expect from this stored Grain Insecticide market research project?

From the stored-grain insecticide market research project, clients can expect detailed reports including market size, growth trends, competitive landscape, segment analysis, and regional insights that facilitate strategic business decisions and market entry planning.

What are the market trends of stored Grain Insecticide?

Market trends in the stored-grain insecticide sector include a shift towards environmentally sustainable products such as biological insecticides, advancements in pest control technology, and increased adoption of integrated pest management strategies among farmers.