Storefront Glass Market Report

Published Date: 22 January 2026 | Report Code: storefront-glass

Storefront Glass Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Storefront Glass market from 2023 to 2033, including market size, growth trends, segmentation by product and application, regional insights, technology advancements, and the competitive landscape.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

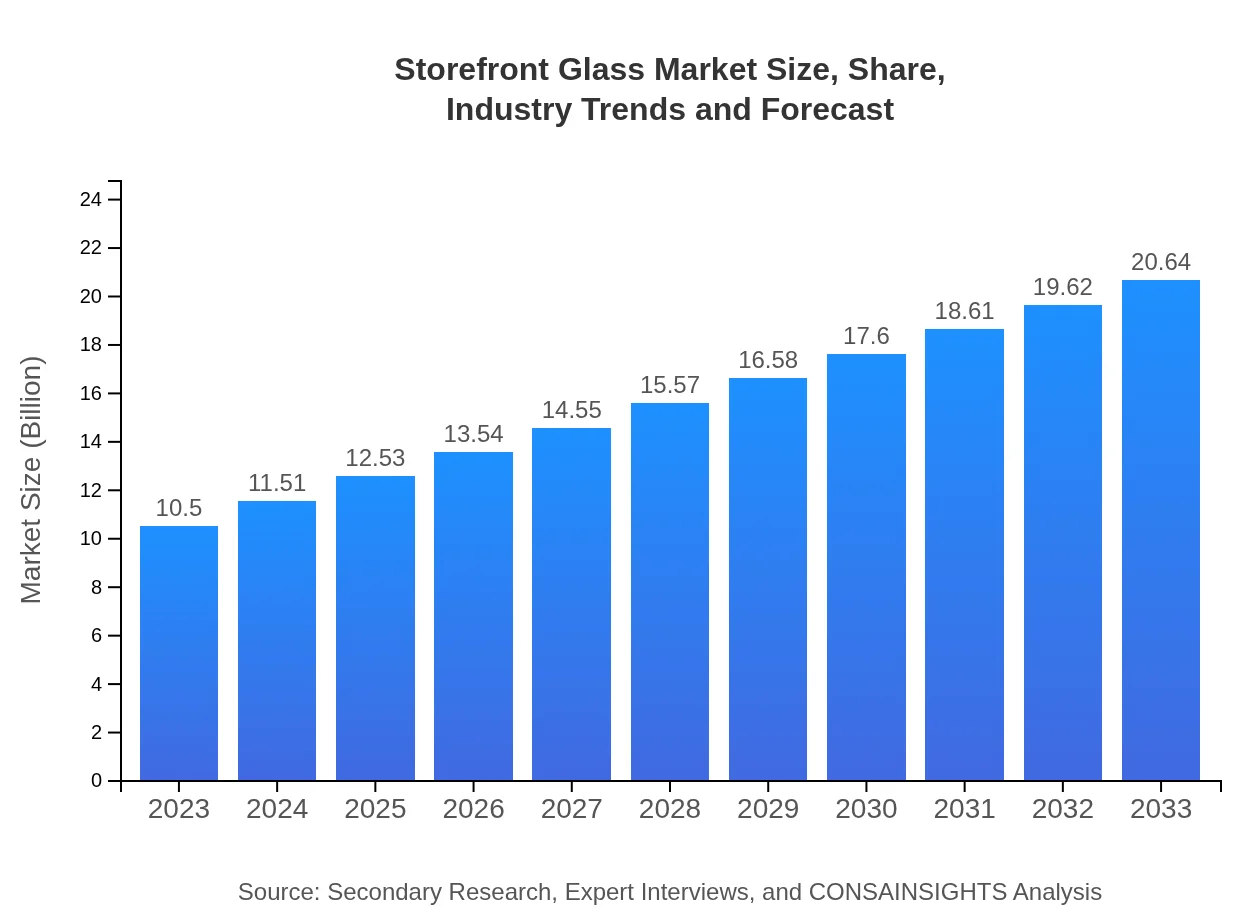

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $20.64 Billion |

| Top Companies | Saint-Gobain, Guardian Industries, NSG Group, Alcoa |

| Last Modified Date | 22 January 2026 |

Storefront Glass Market Overview

Customize Storefront Glass Market Report market research report

- ✔ Get in-depth analysis of Storefront Glass market size, growth, and forecasts.

- ✔ Understand Storefront Glass's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Storefront Glass

What is the Market Size & CAGR of Storefront Glass market in 2023?

Storefront Glass Industry Analysis

Storefront Glass Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Storefront Glass Market Analysis Report by Region

Europe Storefront Glass Market Report:

With the increasing emphasis on energy efficiency and aesthetic appeal, Europe's Storefront Glass market is estimated to grow from $3.11 billion in 2023 to $6.10 billion in 2033. Innovations in glass technology and heightened regulations regarding energy usage are key growth drivers.Asia Pacific Storefront Glass Market Report:

In the Asia Pacific region, the Storefront Glass market is projected to grow from $1.99 billion in 2023 to $3.91 billion in 2033. Rapid urbanization, an increase in disposable income, and heightening consumer expectations for retail experiences drive significant demand in this market.North America Storefront Glass Market Report:

North America displays a robust market, growing from $3.85 billion in 2023 to $7.57 billion in 2033. This growth is supported by stringent energy codes, increased green building certifications, and a growing preference for sustainable construction materials.South America Storefront Glass Market Report:

The market in South America is expected to expand from $0.61 billion in 2023 to $1.20 billion in 2033. Factors contributing to this growth include urban development, increased investment in infrastructure, and the rising popularity of modern retail spaces.Middle East & Africa Storefront Glass Market Report:

The Storefront Glass market in the Middle East and Africa is expected to rise from $0.94 billion in 2023 to $1.86 billion in 2033. This growth is fueled by investments in commercial projects and infrastructural enhancements aimed at accommodating an expanding population.Tell us your focus area and get a customized research report.

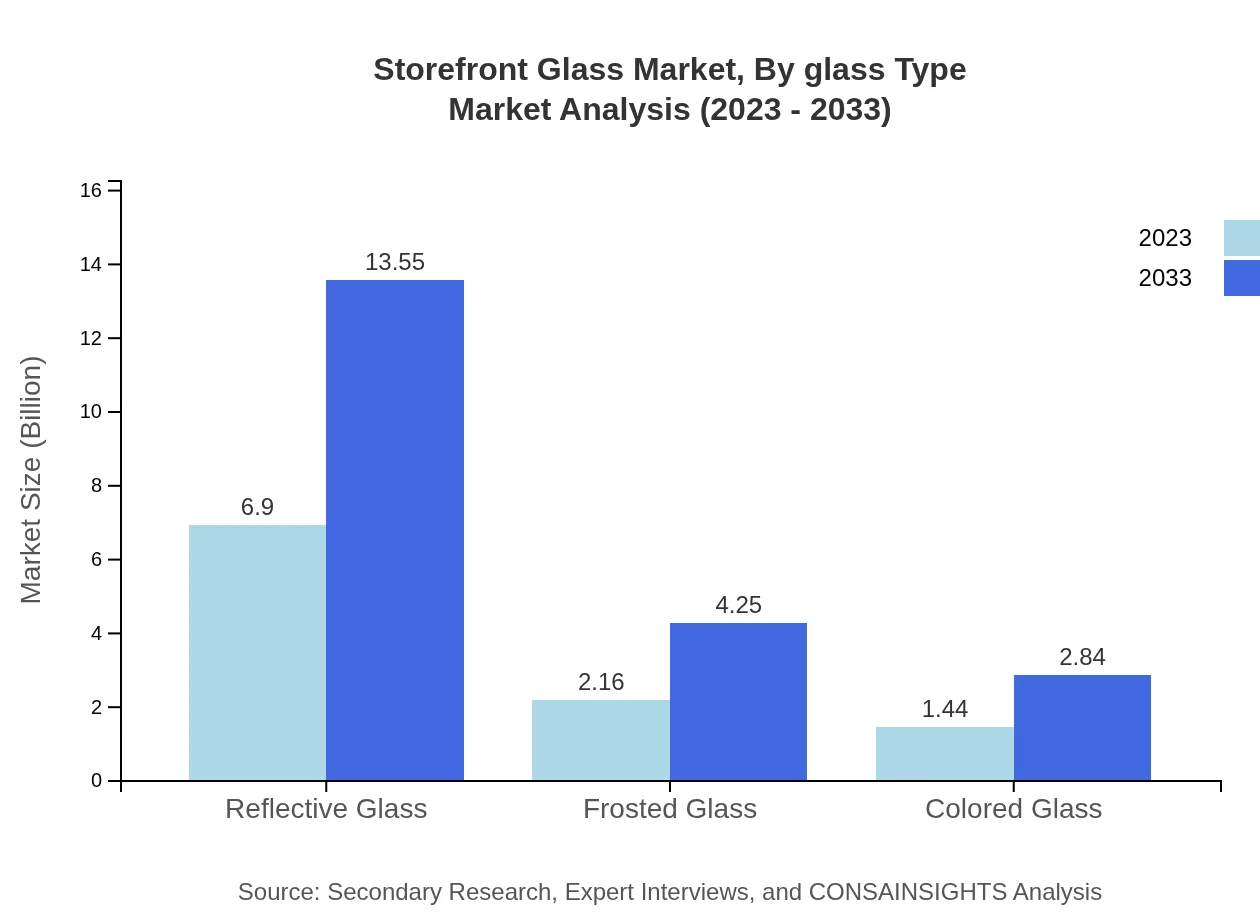

Storefront Glass Market Analysis By Product Type

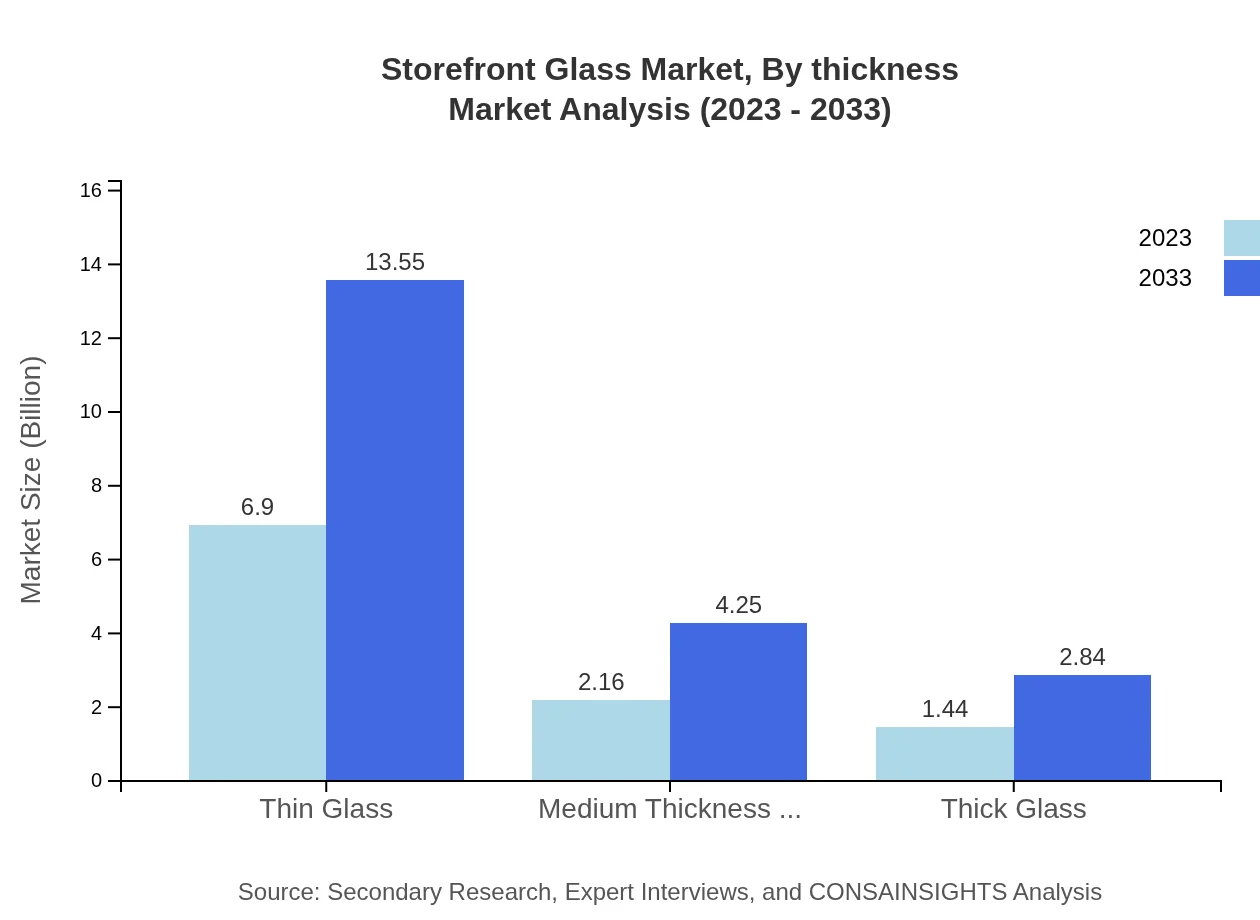

The Storefront Glass market is segmented into Thin Glass, Medium Thickness Glass, and Thick Glass. Thin Glass is projected to dominate the market, with a size of $6.90 billion in 2023, expected to reach $13.55 billion by 2033, due to its popularity in contemporary architectural designs. Medium Thickness Glass is anticipated to grow from $2.16 billion to $4.25 billion in the same period, making it essential for various applications. Thick Glass, while smaller in market size, is crucial for structural applications, growing from $1.44 billion to $2.84 billion.

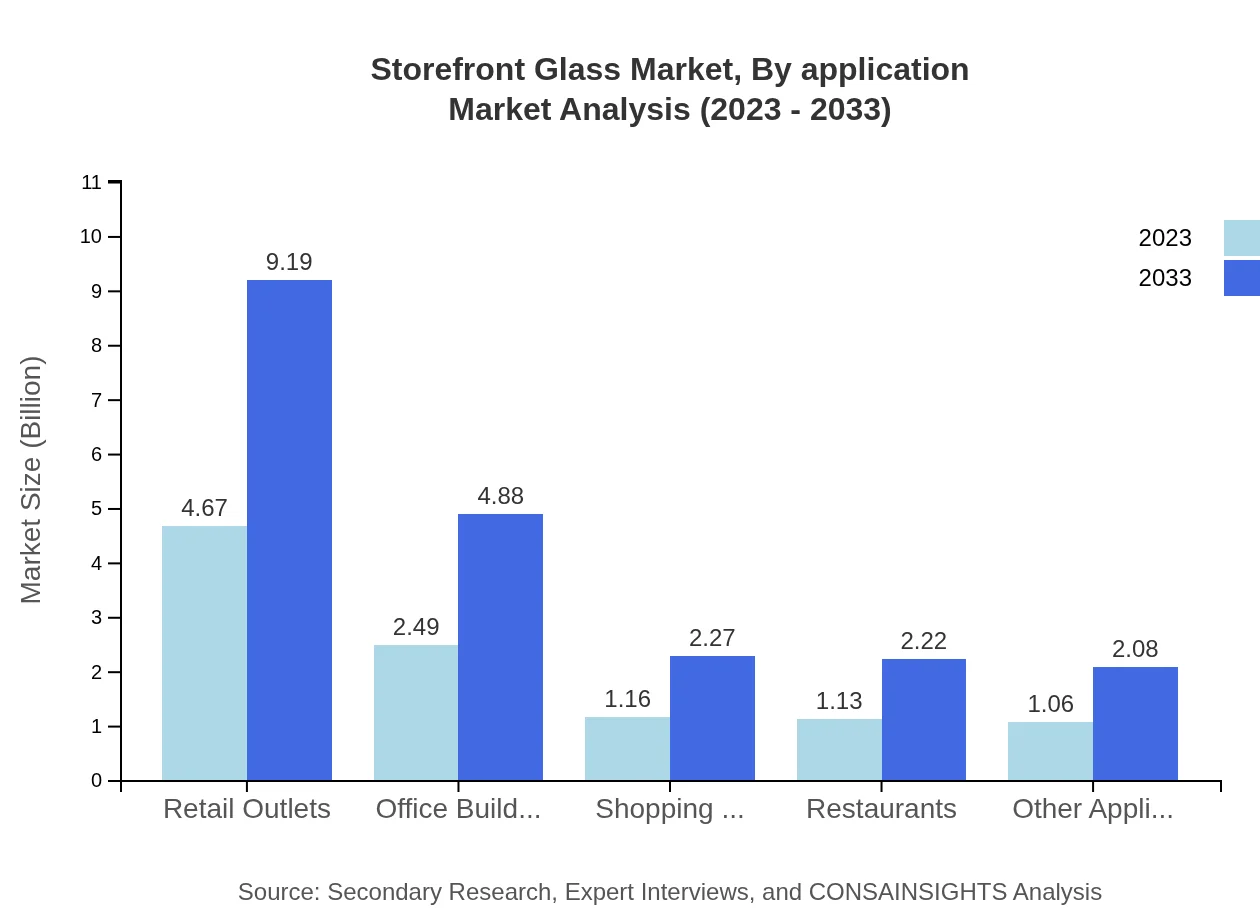

Storefront Glass Market Analysis By Application

Applications within the Storefront Glass market include Retail Outlets, Office Buildings, Shopping Malls, and Restaurants. Retail Outlets command a significant share, with a market size of $4.67 billion in 2023, growing to $9.19 billion by 2033. Office Buildings follow with a size of $2.49 billion expected to increase to $4.88 billion. Shopping Malls and Restaurants have notable roles, with market sizes expanding to $2.27 billion and $2.22 billion respectively.

Storefront Glass Market Analysis By Thickness

The market can also be analyzed by thickness: Thin, Medium, and Thick Glass. Thin Glass dominates both in size and share, serving a wide range of architectural deployments. Medium Thickness Glass stands as a versatile option for buildings requiring enhanced durability yet retaining aesthetics. Thick Glass, crucial for safety and structural integrity, while lower in demand compared to the other segments, remains significant for specific applications.

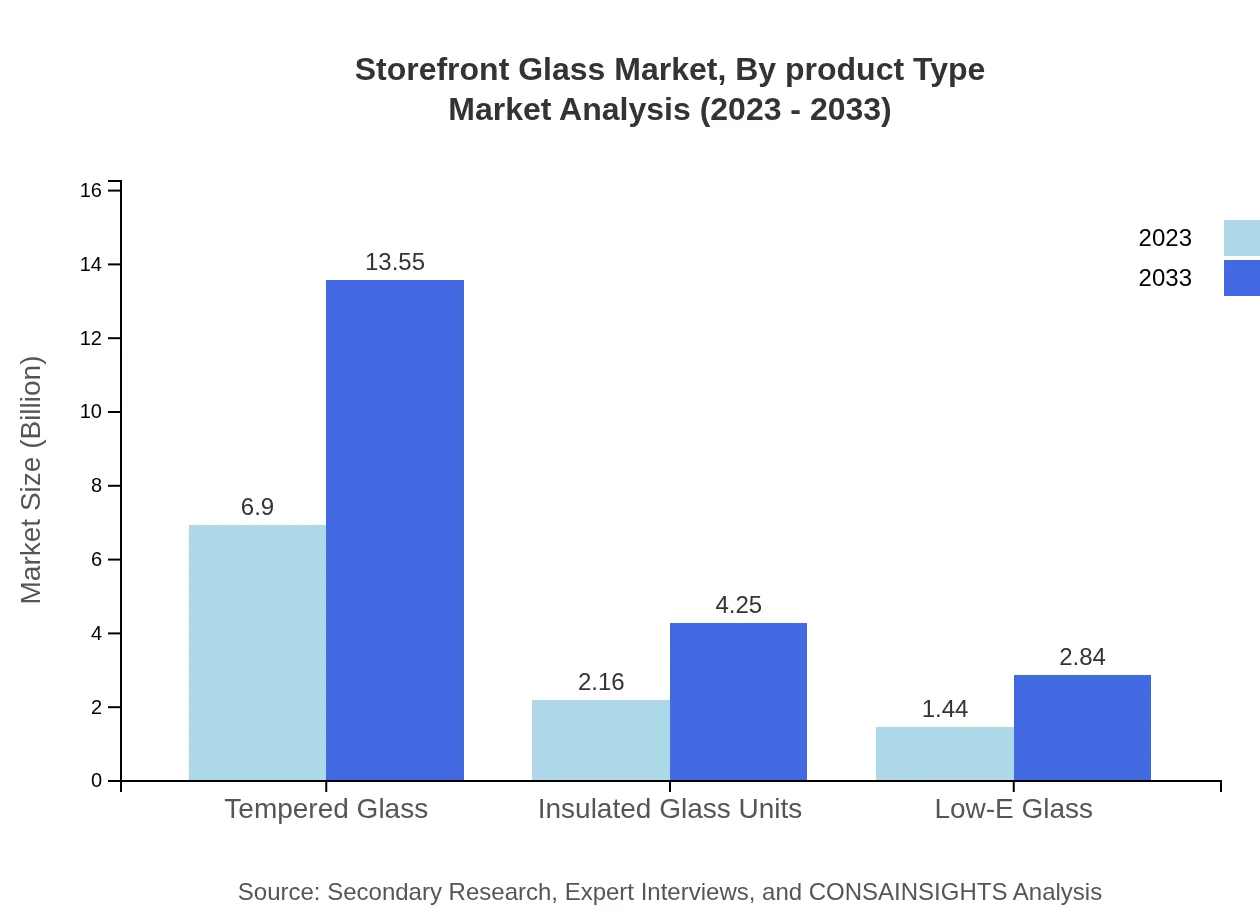

Storefront Glass Market Analysis By Glass Type

The Storefront Glass market further divides into categories like Tempered Glass, Insulated Glass Units, Low-E Glass, Reflective Glass, and Frosted Glass. Tempered Glass retains the largest market share due to its safety features and thermal resistance. Insulated Glass Units are critical for energy efficiency in buildings. Low-E Glass is gaining traction as energy-saving initiatives drive demand, while Reflective and Frosted Glass provide aesthetic diversity.

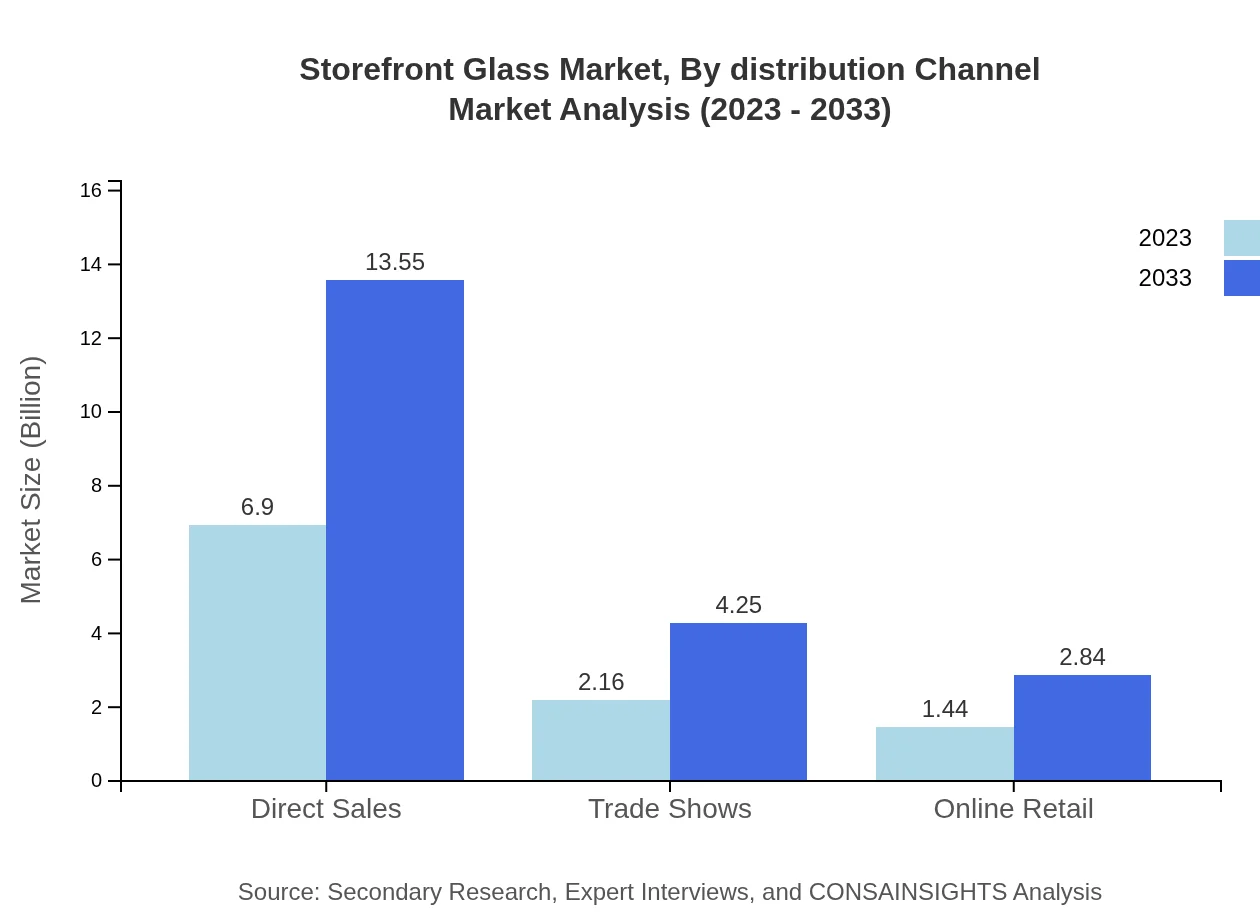

Storefront Glass Market Analysis By Distribution Channel

Distribution channels in the Storefront Glass market include Direct Sales, Trade Shows, and Online Retail. Direct Sales represent the leading distribution method given their substantial size of $6.90 billion in 2023, anticipated to grow to $13.55 billion. Trade Shows and Online Retail are vital for reaching niche markets and increasing market penetration, with projected growth in line with overall market trends.

Storefront Glass Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Storefront Glass Industry

Saint-Gobain:

Saint-Gobain is a multinational corporation known for its innovative glass manufacturing solutions, focusing on sustainability and performance in building materials.Guardian Industries:

Guardian Industries, a leader in glass and plastic manufacturing, specializes in energy-efficient products for construction and architecture, contributing significantly to storefront glass advancements.NSG Group:

NSG Group is a global leader in glass manufacturing, known for its wide range of products targeted at various industry applications, including architectural glass solutions.Alcoa:

Alcoa, while primarily known for aluminum production, has significant interests in energy-efficient building materials, contributing to innovative storefront solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of storefront Glass?

The storefront glass market is valued at approximately $10.5 billion in 2023 and is projected to grow at a CAGR of 6.8% through 2033, indicating a significant expansion in the industry over the next decade.

What are the key market players or companies in this storefront Glass industry?

Key players in the storefront glass market include major manufacturers and suppliers that dominate the sector, contributing to innovation and quality improvements in their products.

What are the primary factors driving the growth in the storefront Glass industry?

Driving factors include increasing urbanization, the demand for energy-efficient buildings, and the rise in retail establishments requiring enhanced aesthetics and visibility via storefront glass.

Which region is the fastest Growing in the storefront Glass?

North America leads with a market size of $3.85 billion in 2023, projected to reach $7.57 billion by 2033, followed by Europe and Asia-Pacific, indicating strong regional demand and growth opportunities.

Does ConsaInsights provide customized market report data for the storefront Glass industry?

Yes, ConsaInsights offers tailored market report data with specific insights and analyses based on unique client requirements, ensuring relevant and actionable market intelligence.

What deliverables can I expect from this storefront Glass market research project?

Deliverables include comprehensive market analysis reports, growth forecasts, competitive landscape assessments, and strategic recommendations tailored to the storefront glass industry.

What are the market trends of storefront Glass?

Current trends include the rise of sustainable glass solutions, innovations in reflective and insulated glass, and an increasing preference for aesthetic designs in commercial spaces.