Strategic Mineral Materials Market Report

Published Date: 02 February 2026 | Report Code: strategic-mineral-materials

Strategic Mineral Materials Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Strategic Mineral Materials market, highlighting key insights, trends, and forecasts from 2023 to 2033. It covers market size, segmentation, regional analyses, technological advancements, and competitive landscape to aid stakeholders in strategic decision-making.

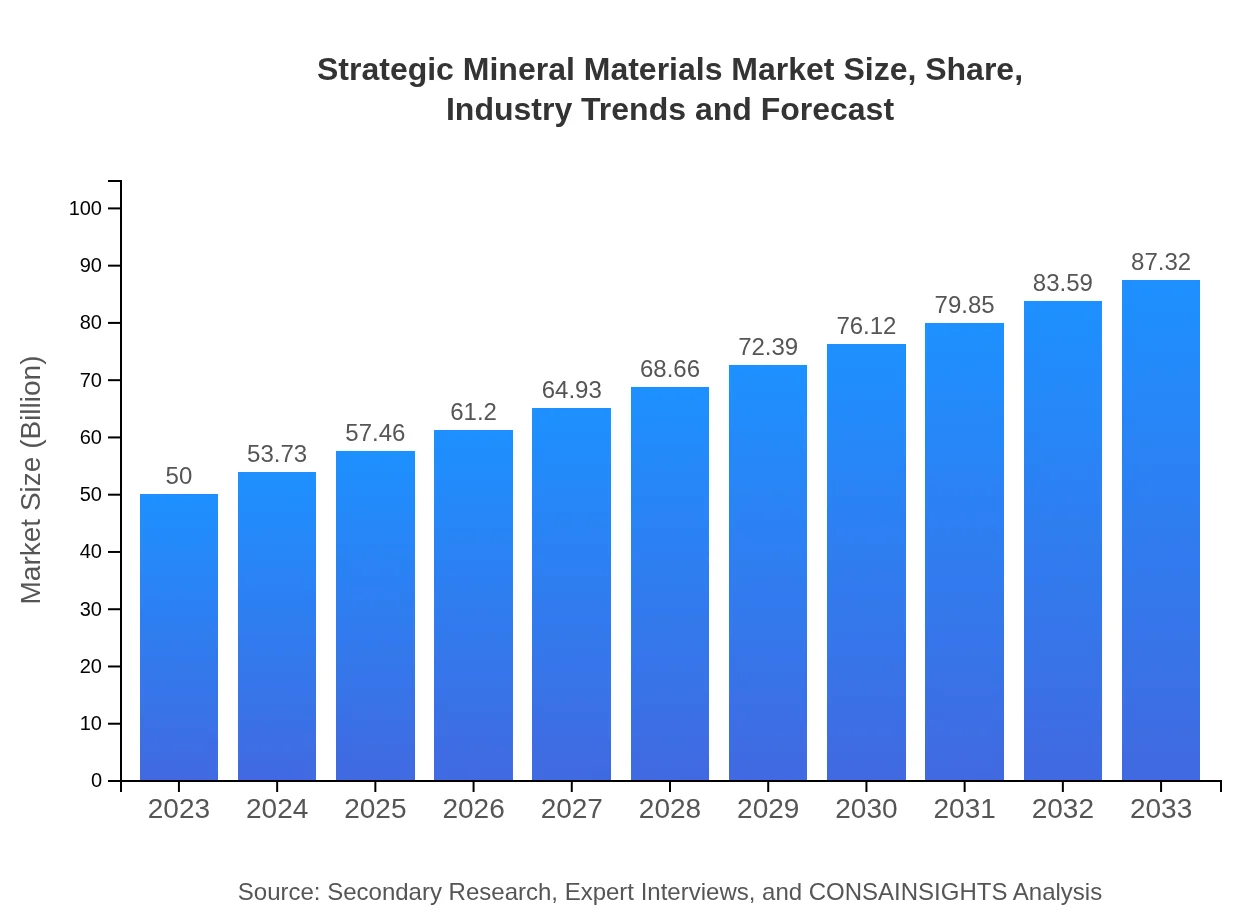

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $50.00 Billion |

| CAGR (2023-2033) | 5.6% |

| 2033 Market Size | $87.32 Billion |

| Top Companies | Livent Corporation, Albemarle Corporation, Rare Element Resources Ltd., Glencore, American Battery Technology Company |

| Last Modified Date | 02 February 2026 |

Strategic Mineral Materials Market Overview

Customize Strategic Mineral Materials Market Report market research report

- ✔ Get in-depth analysis of Strategic Mineral Materials market size, growth, and forecasts.

- ✔ Understand Strategic Mineral Materials's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Strategic Mineral Materials

What is the Market Size & CAGR of Strategic Mineral Materials market in 2023?

Strategic Mineral Materials Industry Analysis

Strategic Mineral Materials Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Strategic Mineral Materials Market Analysis Report by Region

Europe Strategic Mineral Materials Market Report:

In Europe, the market is growing rapidly from 14.85 billion USD in 2023 to 25.93 billion USD by 2033, driven by stringent environmental regulations and a push for sustainability within industries. The European Union’s focus on reducing dependence on rare earth imports further accelerates local mining projects.Asia Pacific Strategic Mineral Materials Market Report:

The Asia Pacific market is a significant contributor, with a market size of 9.13 billion USD in 2023, projected to grow to 15.94 billion USD by 2033. China remains a dominant player, capitalizing on its vast mineral resources and industrial technology advancements, while Japan and South Korea’s technological sectors further boost demand.North America Strategic Mineral Materials Market Report:

North America is expected to see robust growth, beginning at 18.74 billion USD in 2023, projected to reach 32.73 billion USD by 2033. The resurgence of domestic mining initiatives, combined with increasing demand from electric vehicle and renewable energy sectors, is shaping a favorable landscape for the strategic minerals market.South America Strategic Mineral Materials Market Report:

In South America, the market size is modest, standing at 0.65 billion USD in 2023 and forecasted to grow to 1.13 billion USD by 2033. Key countries like Chile and Brazil are focusing on lithium and rare earth mineral extraction, essential for global supply chains.Middle East & Africa Strategic Mineral Materials Market Report:

The Middle East and Africa market is projected to expand from 6.64 billion USD in 2023 to 11.60 billion USD by 2033. With ongoing investments in mining infrastructure and the pursuit of strategic mineral exploration, this region is poised to enhance its role in global supply chains.Tell us your focus area and get a customized research report.

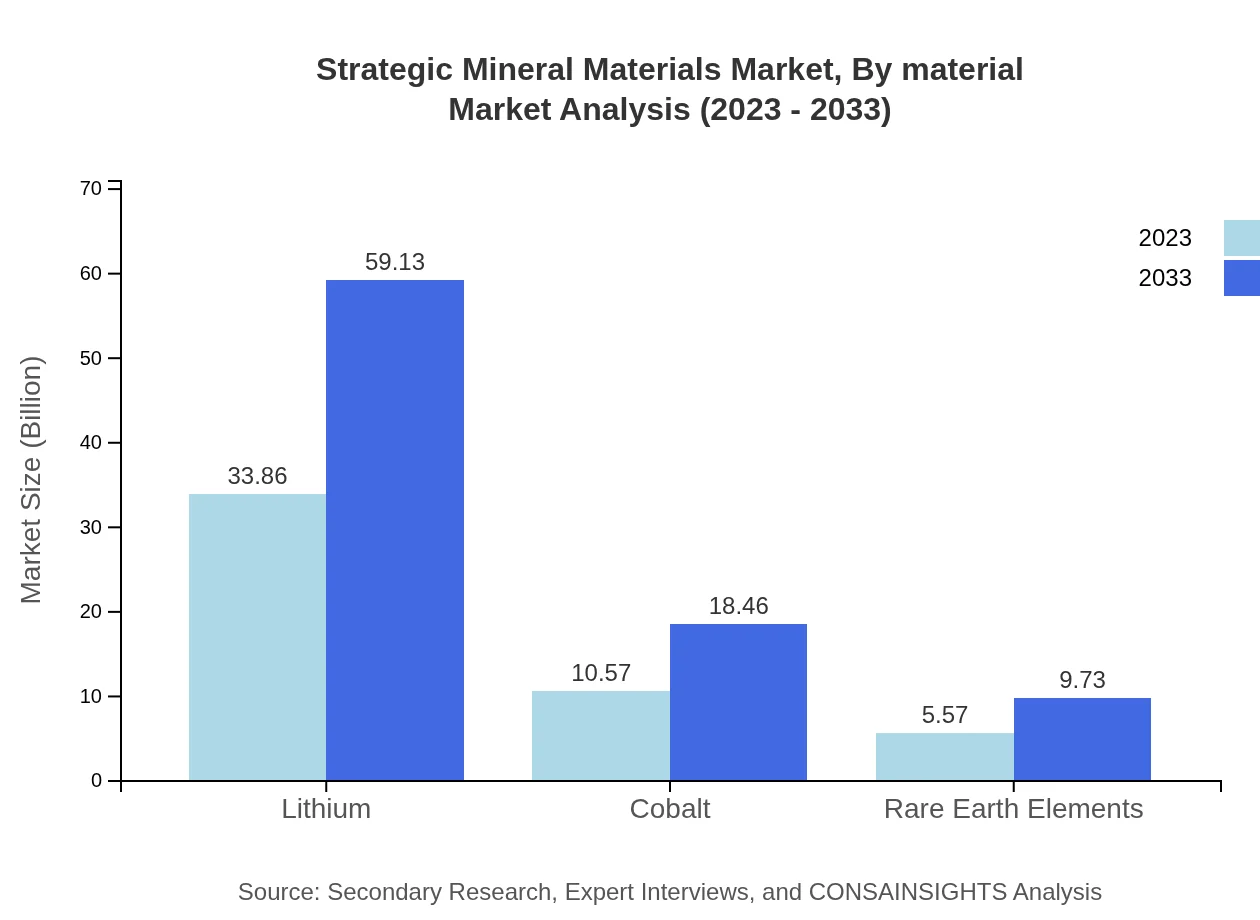

Strategic Mineral Materials Market Analysis By Material

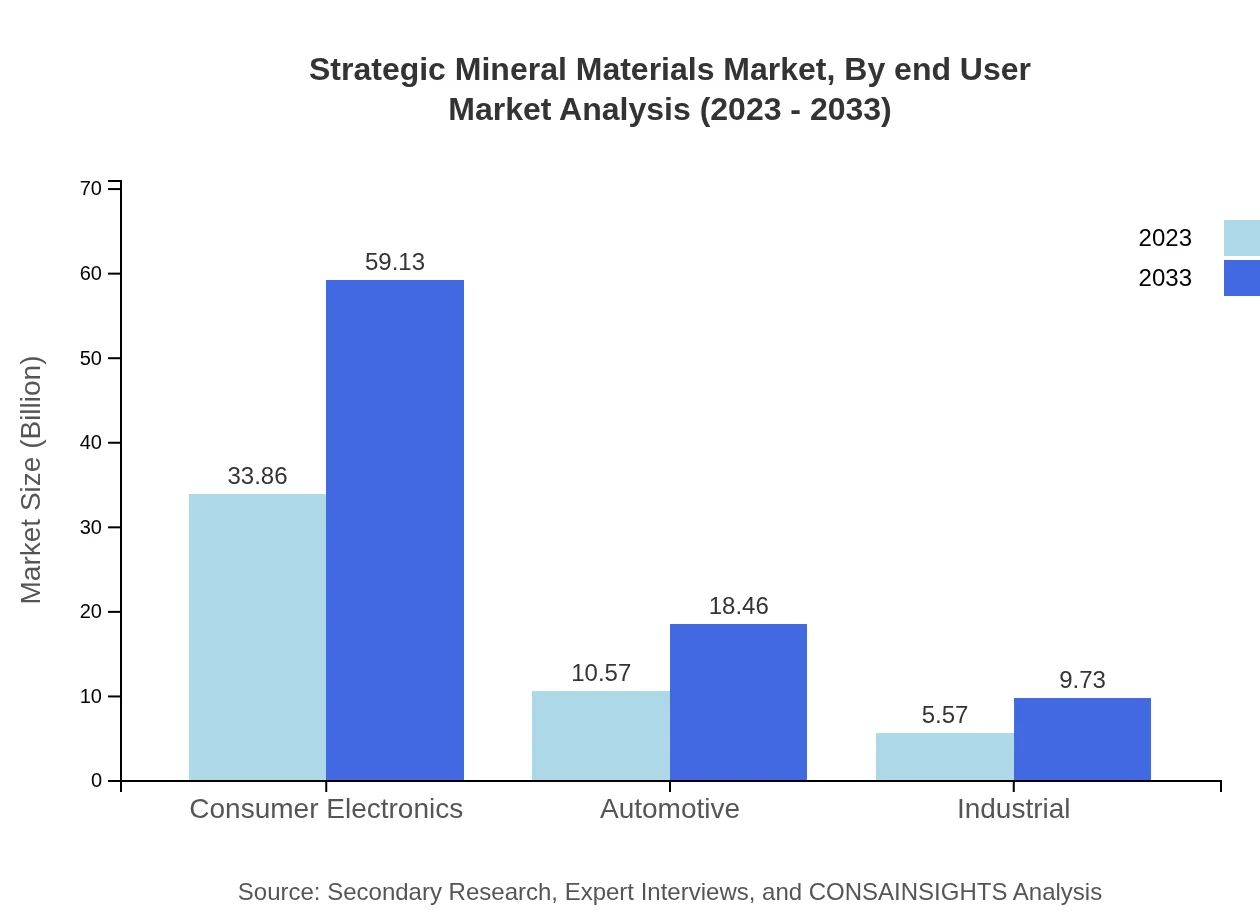

The segment for Lithium is projected to grow from 33.86 billion USD in 2023 to 59.13 billion USD by 2033. Cobalt, which is crucial for battery technology, is expected to increase from 10.57 billion USD to 18.46 billion USD over the same period. Rare earth elements, vital for numerous high-tech applications, are anticipated to grow from 5.57 billion USD to 9.73 billion USD.

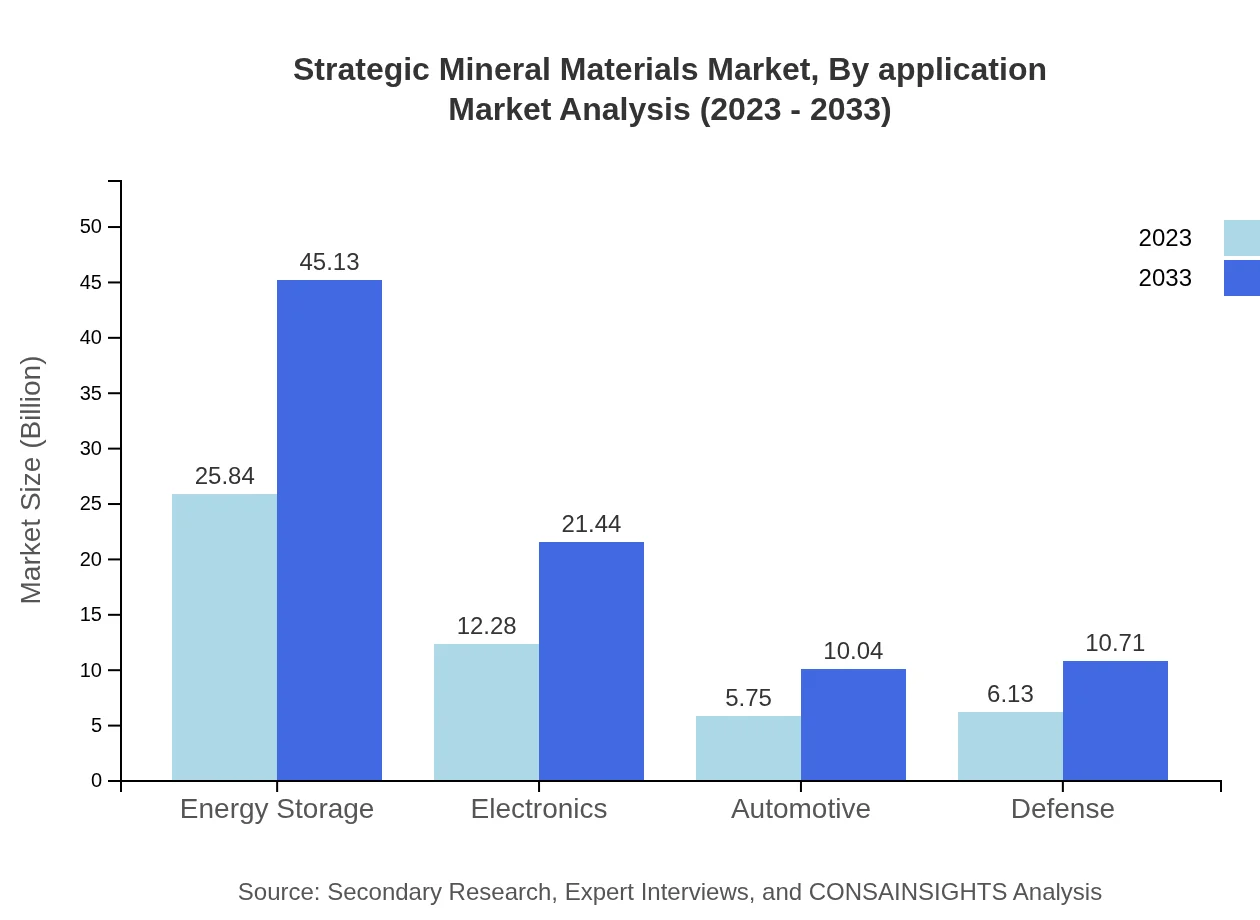

Strategic Mineral Materials Market Analysis By Application

Consumer Electronics will maintain a significant share, expanding from 33.86 billion USD in 2023 to 59.13 billion USD by 2033. The automotive segment will see growth from 10.57 billion USD to 18.46 billion USD, driven by the transition to electric vehicles, while industrial applications are expected to rise from 5.57 billion USD to 9.73 billion USD.

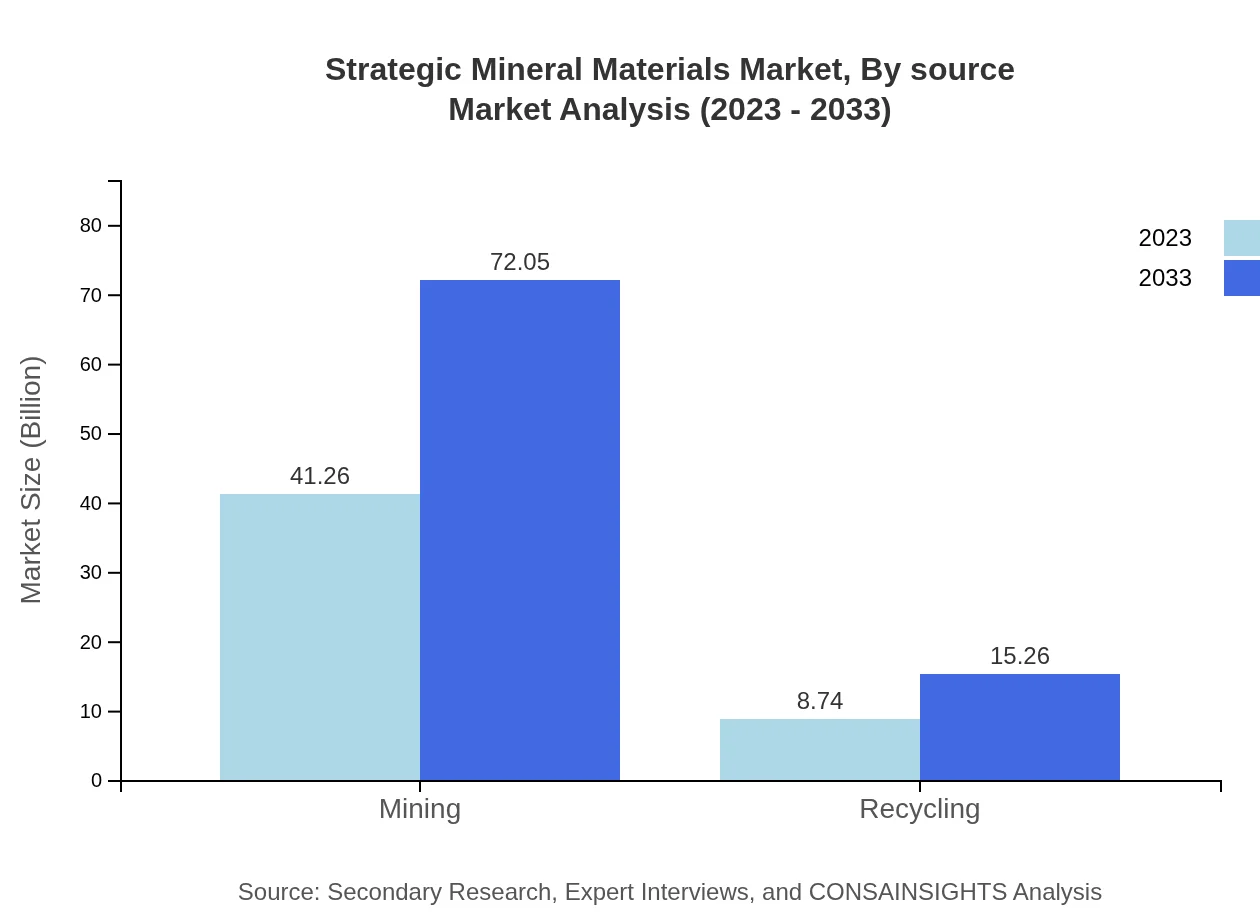

Strategic Mineral Materials Market Analysis By Source

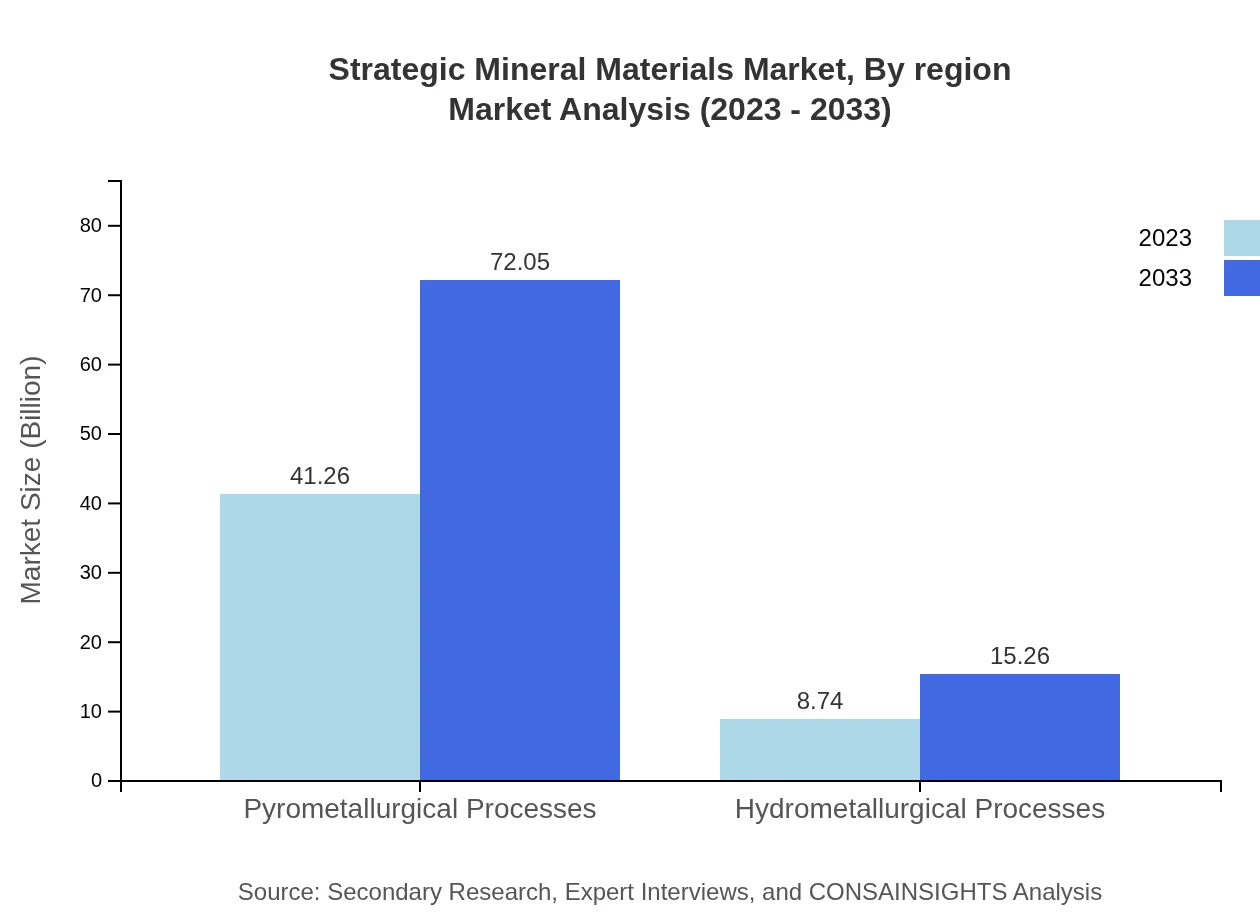

Mining remains the dominant source for strategic minerals, with a market size from 41.26 billion USD in 2023 to 72.05 billion USD by 2033, representing 82.52% of the market share. Recycling activities are also anticipated to increase, moving from 8.74 billion USD to 15.26 billion USD, reflecting a trend towards sustainability.

Strategic Mineral Materials Market Analysis By Region

The pyrometallurgical processes segment is expected to see extensive growth, increasing from 41.26 billion USD in 2023 to 72.05 billion USD by 2033, representing a vast majority of the market share at 82.52%. Meanwhile, hydrometallurgical processes will likely grow from 8.74 billion USD to 15.26 billion USD, responsible for 17.48% of the current market share.

Strategic Mineral Materials Market Analysis By End User

The Energy Storage segment is anticipated to exhibit considerable growth, increasing from 25.84 billion USD in 2023 to 45.13 billion USD by 2033. Other sectors like Defense and Electronics will also grow significantly, with Defense expanding from 6.13 billion USD to 10.71 billion USD.

Strategic Mineral Materials Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Strategic Mineral Materials Industry

Livent Corporation:

A leading producer of lithium compounds, Livent is recognized for its sustainable extraction technologies, making it a key player in the evolving battery materials market.Albemarle Corporation:

Known for its extensive portfolio in lithium and bromine, Albemarle is at the forefront of supplying materials for batteries and catalysts, contributing to the renewable energy sector.Rare Element Resources Ltd.:

Specializes in rare earth elements, Rare Element Resources plays a vital role in mining and providing critical minerals to support high technology and defense sectors.Glencore:

As one of the largest natural resource companies, Glencore operates in multiple segments, including cobalt and copper, essential for electric vehicle battery production.American Battery Technology Company:

Innovator in lithium-ion battery recycling and resource recovery, focusing on sustainable solutions to meet growing demand for strategic minerals.We're grateful to work with incredible clients.

FAQs

What is the market size of strategic Mineral Materials?

The strategic mineral materials market is valued at approximately $50 billion in 2023, with a projected CAGR of 5.6% through 2033, indicating robust growth as demand escalates globally.

What are the key market players or companies in this strategic Mineral Materials industry?

Key players in the strategic mineral materials industry include companies specializing in mining, metallurgy, and recycling, which collectively contribute to the growing supply chain essential for various applications in technology, automotive, and renewable energy sectors.

What are the primary factors driving the growth in the strategic Mineral Materials industry?

Growth in the strategic mineral materials industry is driven by increasing demand for consumer electronics, automotive applications, and advancements in energy storage technologies, pushing innovation and investment in sustainable mining and recycling methods.

Which region is the fastest Growing in the strategic Mineral Materials?

North America is the fastest-growing region in the strategic mineral materials market, expected to rise from $18.74 billion in 2023 to $32.73 billion by 2033, reflecting an annual growth driven by technological advancements and industry investments.

Does ConsaInsights provide customized market report data for the strategic Mineral Materials industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs in the strategic mineral materials industry, ensuring actionable insights that align with unique business goals and market dynamics.

What deliverables can I expect from this strategic Mineral Materials market research project?

Expect comprehensive deliverables, including detailed market analysis, competitive landscape overview, regional breakdowns, segment insights, and trend forecasts tailored to strategic mineral materials, supporting informed decision-making.

What are the market trends of strategic Mineral Materials?

Current market trends in strategic mineral materials focus on sustainable sourcing, technological advancements in extraction, increasing recycling initiatives, and the growing importance of rare earths in high-tech applications, driving future investments.