Structural Electronics Market Report

Published Date: 31 January 2026 | Report Code: structural-electronics

Structural Electronics Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Structural Electronics market from 2023 to 2033, detailing market size, growth forecasts, key industry insights, and segmentation trends across various regions, technologies, and applications.

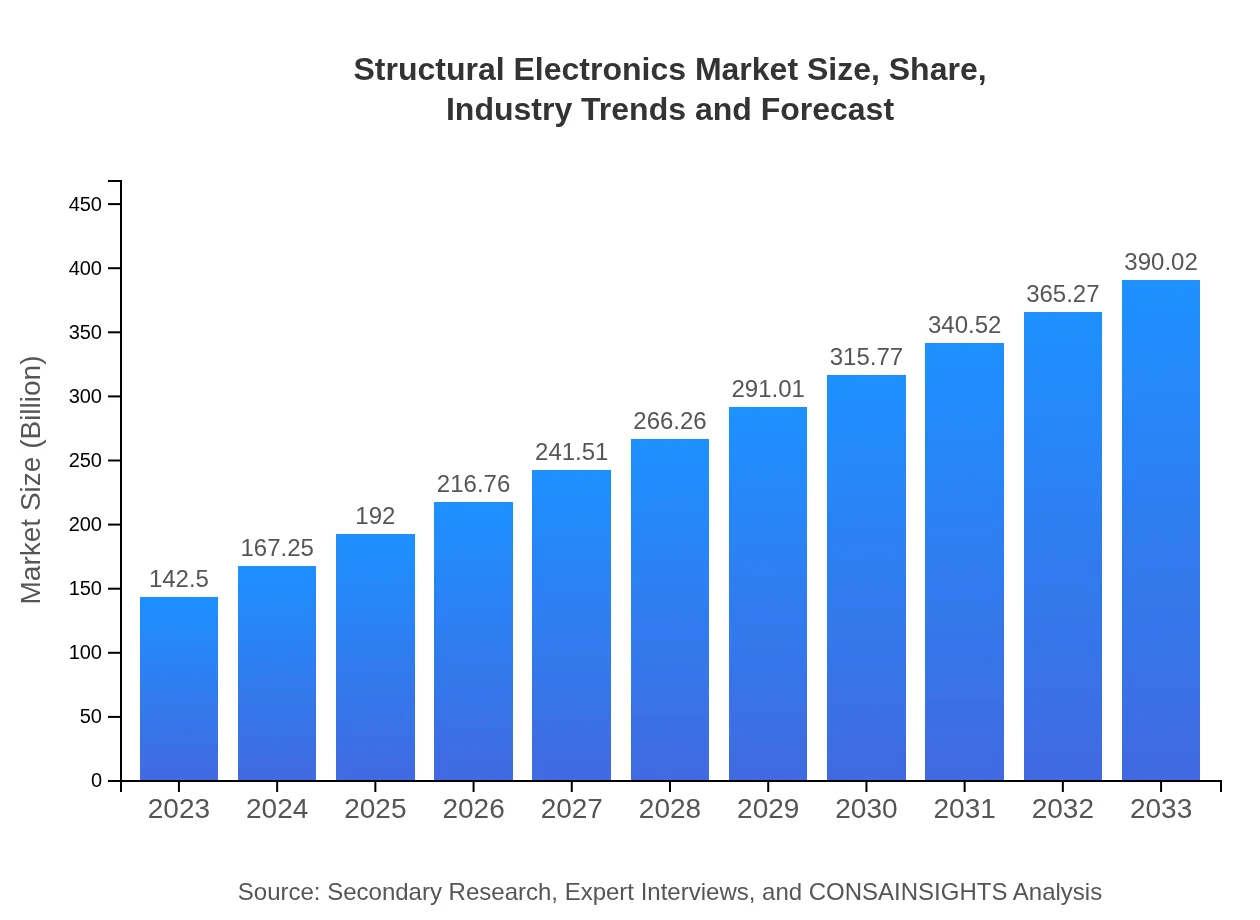

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $142.50 Billion |

| CAGR (2023-2033) | 10.2% |

| 2033 Market Size | $390.02 Billion |

| Top Companies | 3M, DuPont, Samsung Electronics, LG Electronics |

| Last Modified Date | 31 January 2026 |

Structural Electronics Market Overview

Customize Structural Electronics Market Report market research report

- ✔ Get in-depth analysis of Structural Electronics market size, growth, and forecasts.

- ✔ Understand Structural Electronics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Structural Electronics

What is the Market Size & CAGR of Structural Electronics market in 2023?

Structural Electronics Industry Analysis

Structural Electronics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Structural Electronics Market Analysis Report by Region

Europe Structural Electronics Market Report:

The European Structural Electronics market will grow from $39.23 billion in 2023 to $107.37 billion by 2033, propelled by stringent regulations promoting sustainable materials and the continent's robust automotive industry, which emphasizes innovation and smart manufacturing processes.Asia Pacific Structural Electronics Market Report:

The Asia Pacific region is projected to exhibit significant growth in the Structural Electronics market, with its market size expected to grow from $27.60 billion in 2023 to $75.55 billion by 2033. Key drivers include rising investments in electronics manufacturing, a strong demand for consumer electronics, and advancements in smart technologies across countries like China, Japan, and South Korea.North America Structural Electronics Market Report:

North America leads the market, with an expected rise from $54.08 billion in 2023 to $148.01 billion by 2033. The growth is driven by advanced technological infrastructure, a strong automotive sector focusing on electric vehicles, and significant investment in aerospace and defense sectors.South America Structural Electronics Market Report:

In South America, the Structural Electronics market is estimated to grow from $8.64 billion in 2023 to $23.64 billion by 2033. The region is witnessing an increase in electronic applications in agriculture and healthcare, spurring demand for innovative electronic solutions integrated into structural applications.Middle East & Africa Structural Electronics Market Report:

The Middle East and Africa market is poised to expand from $12.95 billion in 2023 to $35.45 billion by 2033, with growth spurred by increasing urbanization, investment in infrastructure development, and the push for renewable energy applications.Tell us your focus area and get a customized research report.

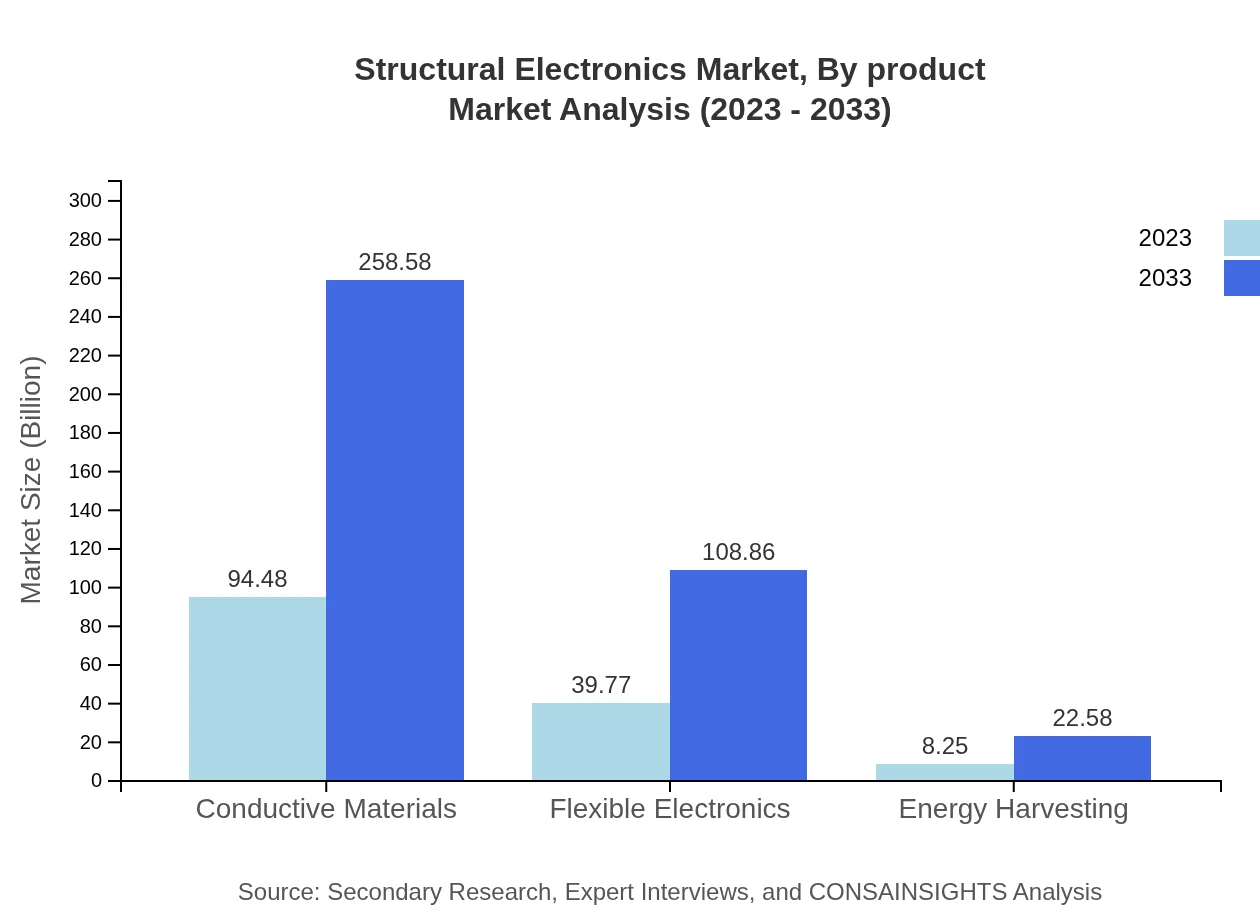

Structural Electronics Market Analysis By Product

The Structural Electronics market by product showcases strong potential with conductive materials projected to increase from $94.48 billion in 2023 to $258.58 billion by 2033. Flexible electronics also show significant growth from $39.77 billion to $108.86 billion during the forecast period. Other segments include Energy Harvesting, Consumer Electronics, Automotive, Aerospace and Defense, Healthcare, Industrial Applications, Sensors, Actuators, 3D Printing, and Nanotechnology, all contributing to the diverse functionalities of structural electronics.

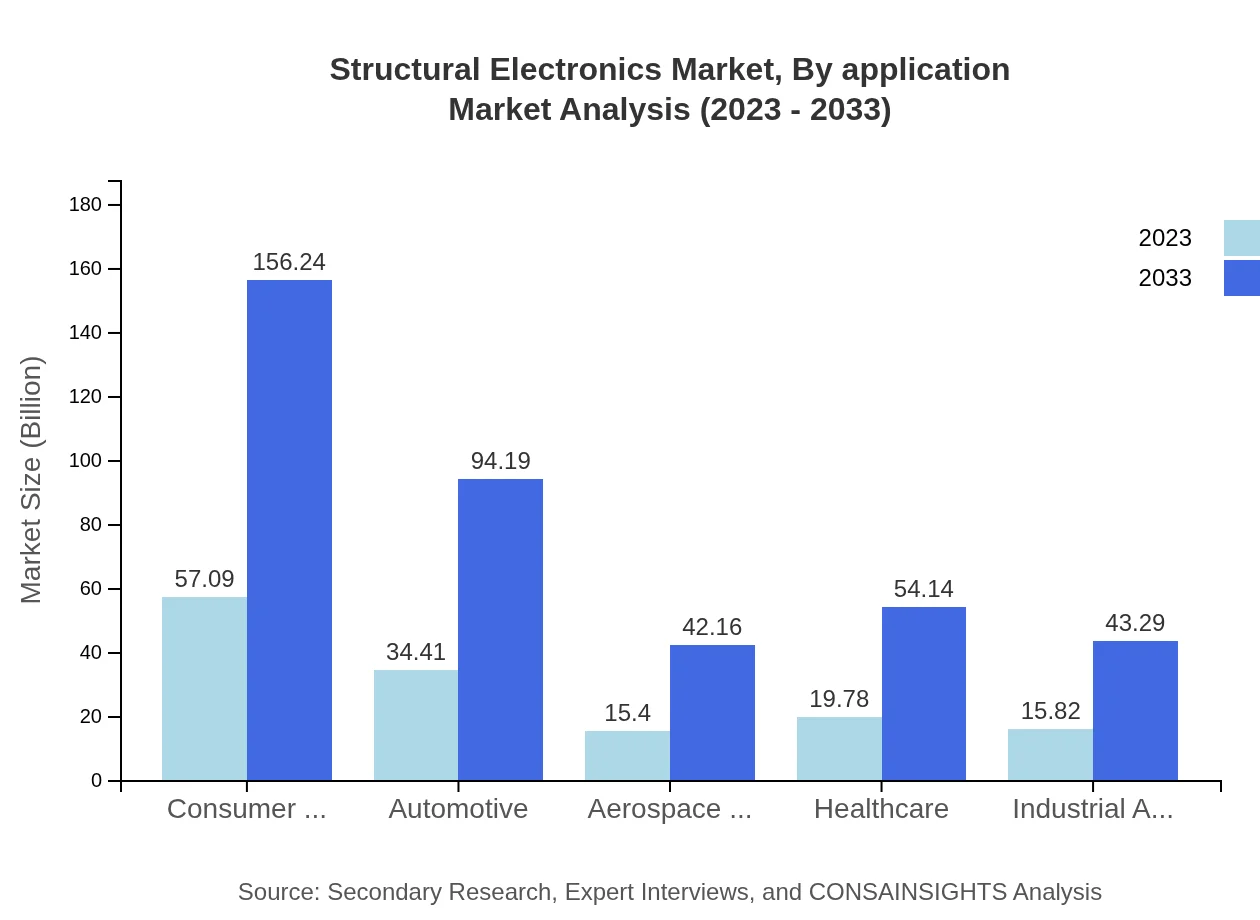

Structural Electronics Market Analysis By Application

The Structural Electronics market by application is diverse, with Consumer Electronics holding a significant market share of 40.06% in 2023 and projected to grow to 156.24 billion by 2033. Other key applications include Automotive, Aerospace and Defense, Healthcare, and Industrial Applications, each demonstrating notable growth and innovation in integrating structural electronics into their processes.

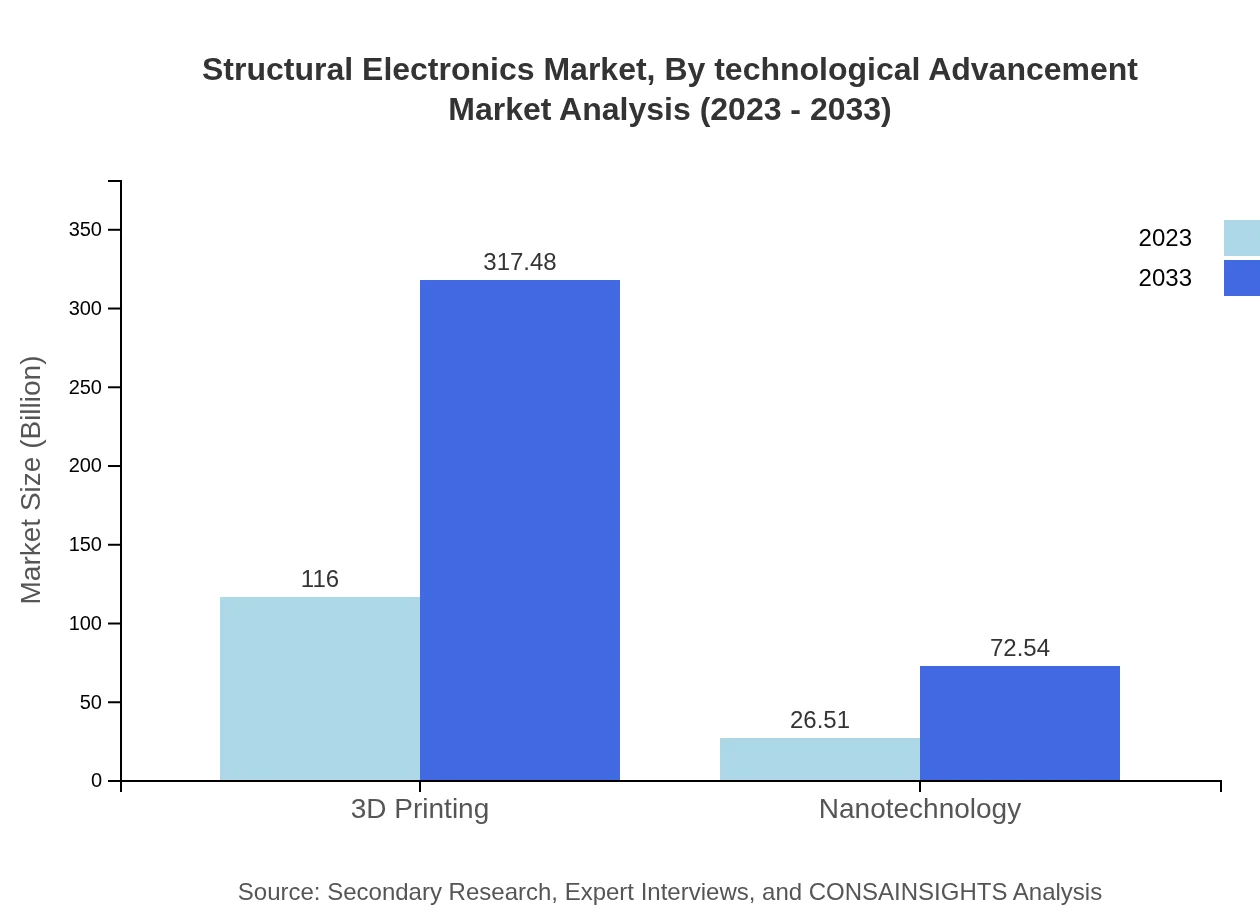

Structural Electronics Market Analysis By Technological Advancement

Technological advancement in Structural Electronics is marked by innovations such as nanotechnology, which is expected to grow from $26.51 billion in 2023 to $72.54 billion by 2033. Other technologies, including 3D printing and energy harvesting, also play crucial roles in enhancing product functionality, offering advanced manufacturing solutions and efficient energy systems.

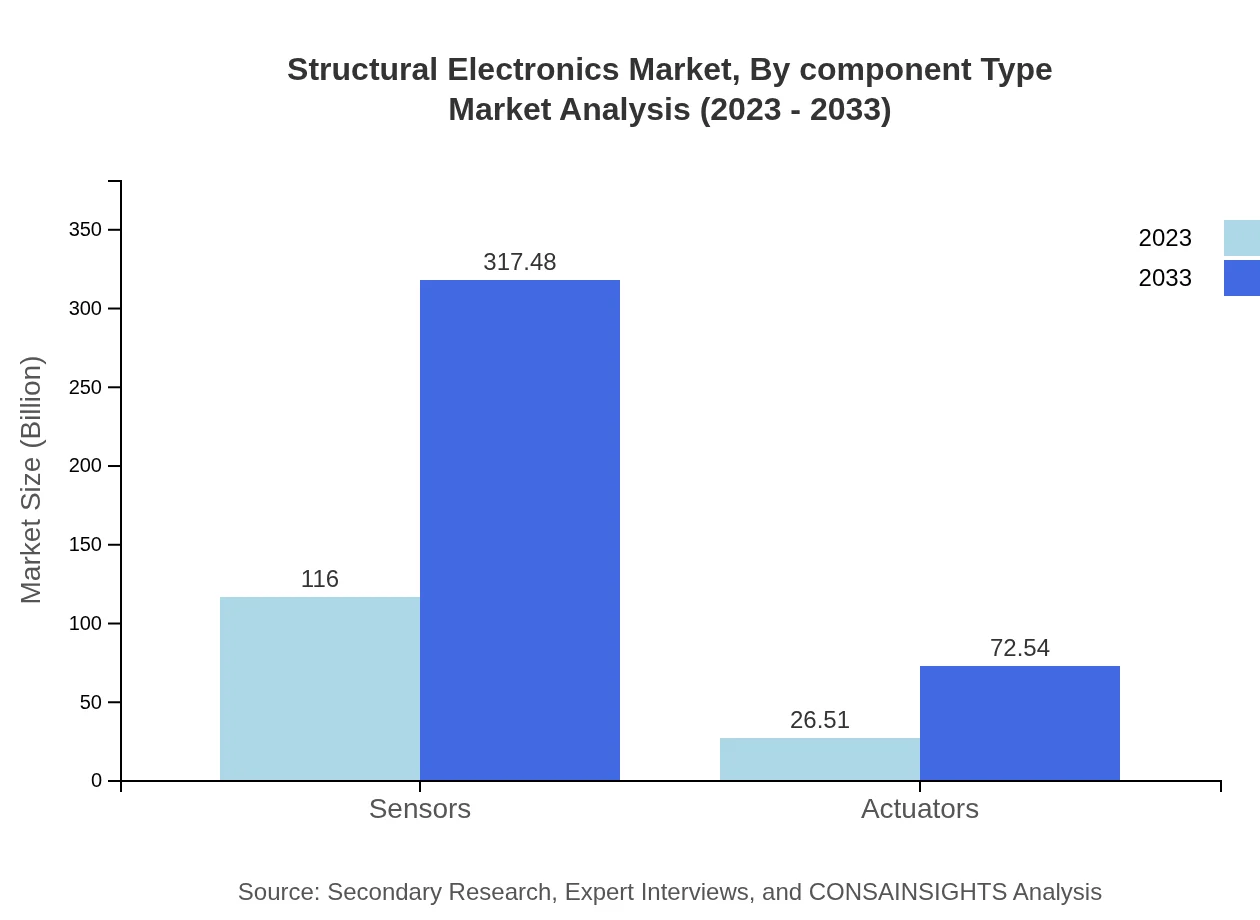

Structural Electronics Market Analysis By Component Type

The market dynamics of Structural Electronics components highlight a growing emphasis on sensors, which dominate with a market size of $116 billion in 2023, growing to $317.48 billion by 2033. Actuators and advanced materials also represent core elements, reflecting the interconnectedness of structural electronics across various applications.

Structural Electronics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Structural Electronics Industry

3M:

A leading multinational corporation involved in the research and development of innovative materials, including conductive adhesives and flexible electronics.DuPont:

Known for its high-performance materials and solutions, DuPont significantly contributes to the development of materials in the Structural Electronics sector.Samsung Electronics:

A key player in consumer electronics and advanced modules that integrate structural electronic designs to enhance product functionality.LG Electronics:

Major contributor in flexible electronics and innovative materials, focusing on sustainable solutions for consumer electronics and automotive applications.We're grateful to work with incredible clients.

FAQs

What is the market size of structural electronics?

The structural electronics market is valued at approximately $142.5 billion in 2023, with a projected CAGR of 10.2% through 2033, indicating significant growth driven by advancements in technology and increased applications.

What are the key market players or companies in this structural electronics industry?

Key players in the structural electronics industry include market leaders known for their innovative approaches and advanced technologies. While the specific companies are detailed in the full report, they primarily focus on integrating electronics with structural materials.

What are the primary factors driving the growth in the structural electronics industry?

Growth in the structural electronics industry is spurred by rising demand for smart materials, increased investment in R&D, and applications across consumer electronics, automotive, and healthcare sectors supporting innovative technology integration.

Which region is the fastest Growing in the structural electronics?

The Asia Pacific region is the fastest-growing in structural electronics, growing from $27.60 billion in 2023 to $75.55 billion in 2033, driven by rapid technological advancements and increased demand for electronics in various applications.

Does ConsaInsights provide customized market report data for the structural electronics industry?

Yes, ConsaInsights offers customized market report data tailored specifically for the structural electronics industry, catering to unique client needs and providing in-depth insights to make informed business decisions.

What deliverables can I expect from this structural electronics market research project?

Clients can expect comprehensive market analysis including market size, growth forecasts, competitive landscape, and regional insights, alongside detailed segment data covering various applications and technological advancements.

What are the market trends of structural electronics?

Current trends in structural electronics include the integration of flexible electronics, advancements in nanotechnology, and a focus on energy-efficient solutions, all contributing to enhanced product capabilities and market expansion.