Structural Insulated Panels Market Report

Published Date: 22 January 2026 | Report Code: structural-insulated-panels

Structural Insulated Panels Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the Structural Insulated Panels market, providing insights on market size, trends, and forecasts from 2023 to 2033. It covers market segments, regional analysis, and assesses key players, technology impacts, and future growth expectations.

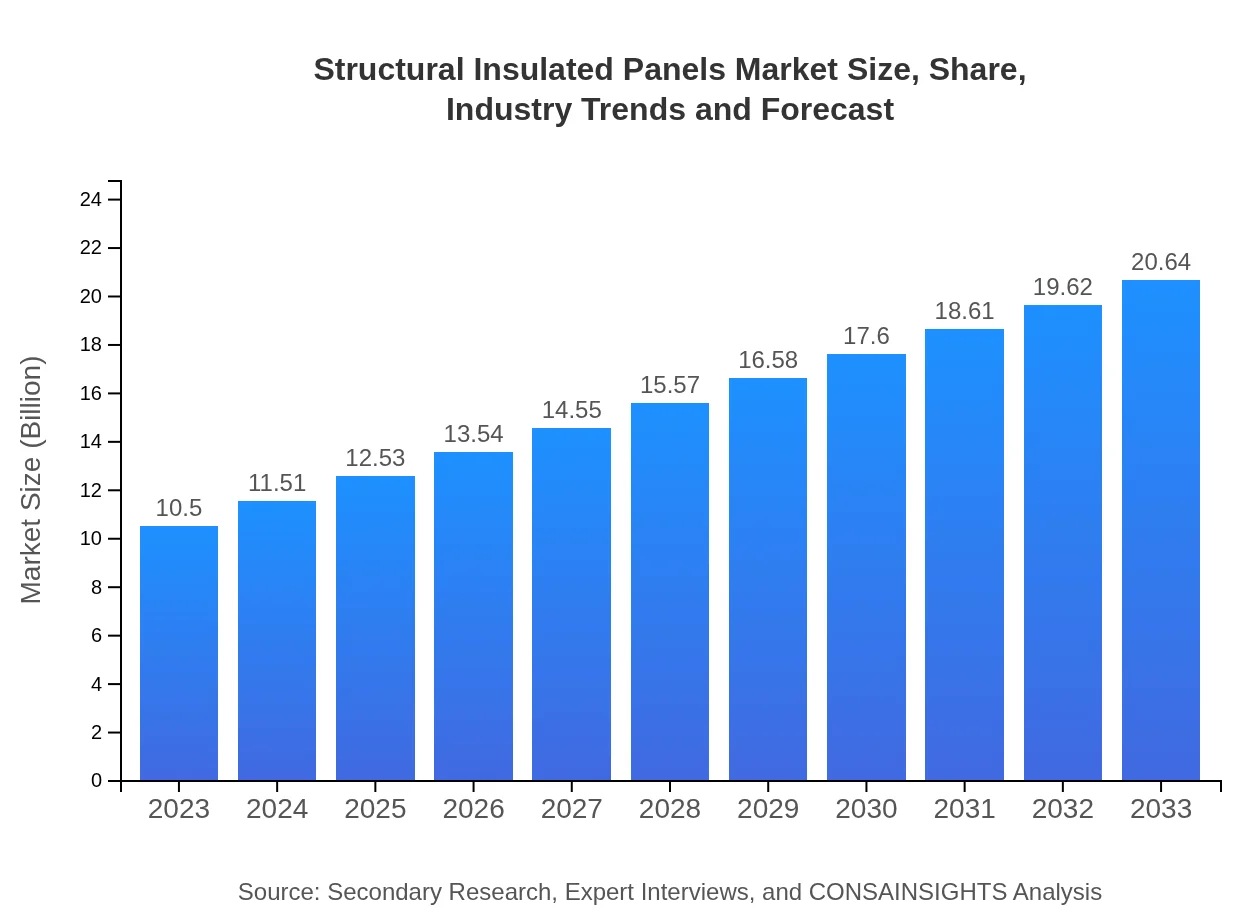

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $20.64 Billion |

| Top Companies | Structurlam Mass Timber Corporation, Kingspan Group, SIPS Industries USA, Nucor Corporation, Energy Panel Structures |

| Last Modified Date | 22 January 2026 |

Structural Insulated Panels Market Overview

Customize Structural Insulated Panels Market Report market research report

- ✔ Get in-depth analysis of Structural Insulated Panels market size, growth, and forecasts.

- ✔ Understand Structural Insulated Panels's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Structural Insulated Panels

What is the Market Size & CAGR of Structural Insulated Panels market in 2023?

Structural Insulated Panels Industry Analysis

Structural Insulated Panels Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Structural Insulated Panels Market Analysis Report by Region

Europe Structural Insulated Panels Market Report:

The European SIP market is expected to rise from USD 3.25 billion in 2023 to USD 6.39 billion by 2033. Europe has witnessed increasing adoption of SIPs driven by strict environmental regulations and a strong emphasis on sustainable housing, especially in Western and Northern European countries.Asia Pacific Structural Insulated Panels Market Report:

In the Asia Pacific region, the SIP market is expected to grow from USD 1.88 billion in 2023 to USD 3.69 billion by 2033. The growth is driven by rapid urbanization, increased infrastructure development, and a governmental push for energy-efficient construction practices, especially in countries like China and India.North America Structural Insulated Panels Market Report:

North America dominates the SIP market with a value of USD 3.82 billion in 2023 and a forecasted increase to USD 7.50 billion by 2033. The U.S. leads in this growth due to a robust construction sector focusing on sustainable building solutions and stringent building codes favoring SIP usage.South America Structural Insulated Panels Market Report:

The South American SIP market, valued at USD 0.44 billion in 2023 with a projected growth to USD 0.86 billion by 2033, is gradually gaining traction. Factors contributing to this growth include rising construction activities and improved awareness of efficient building technologies. Brazil and Argentina are leading markets in this region due to rising construction demands.Middle East & Africa Structural Insulated Panels Market Report:

The Middle East and Africa SIP market is anticipated to grow from USD 1.12 billion in 2023 to USD 2.20 billion by 2033. Increased investments in infrastructure and a rising number of green building projects are likely to drive this growth, particularly in the UAE and South Africa.Tell us your focus area and get a customized research report.

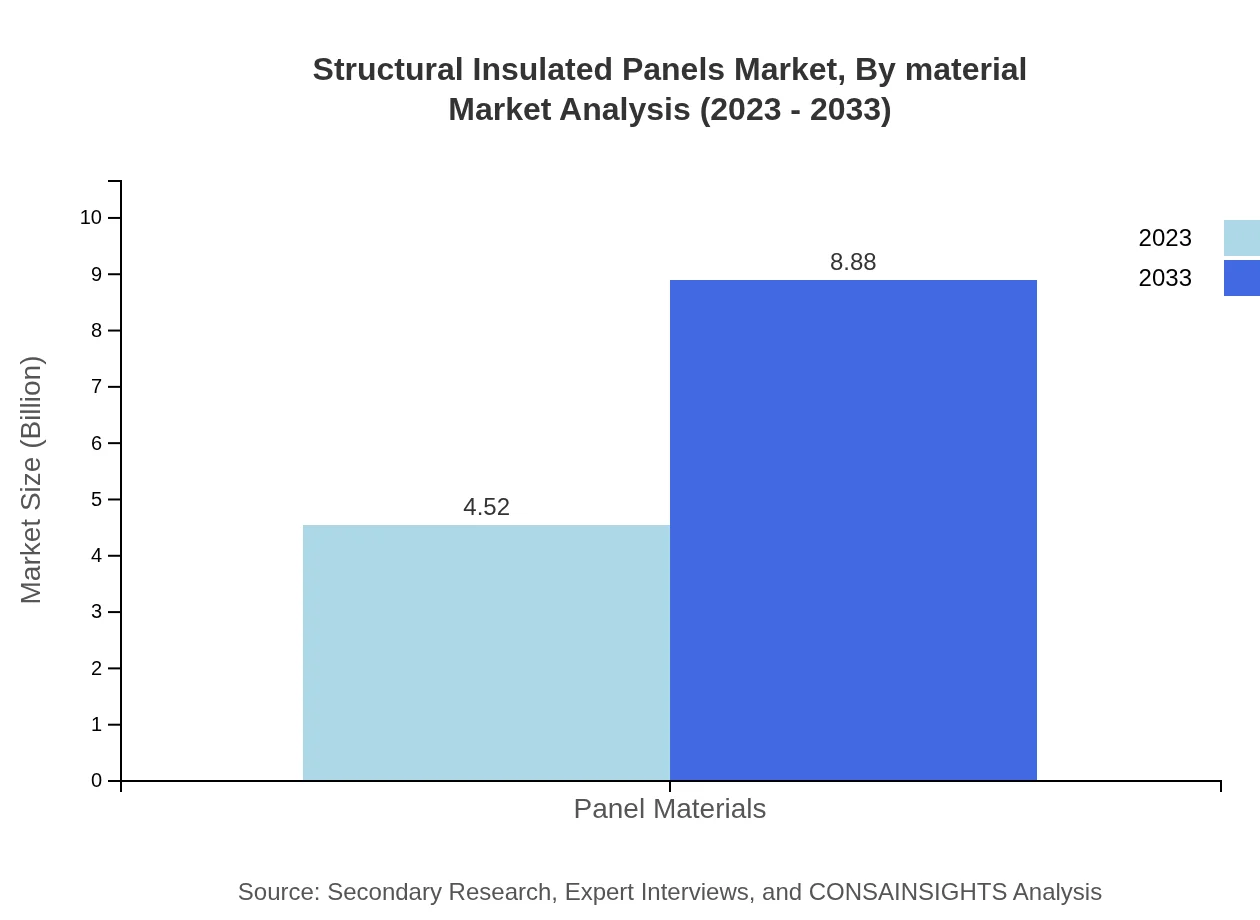

Structural Insulated Panels Market Analysis By Material

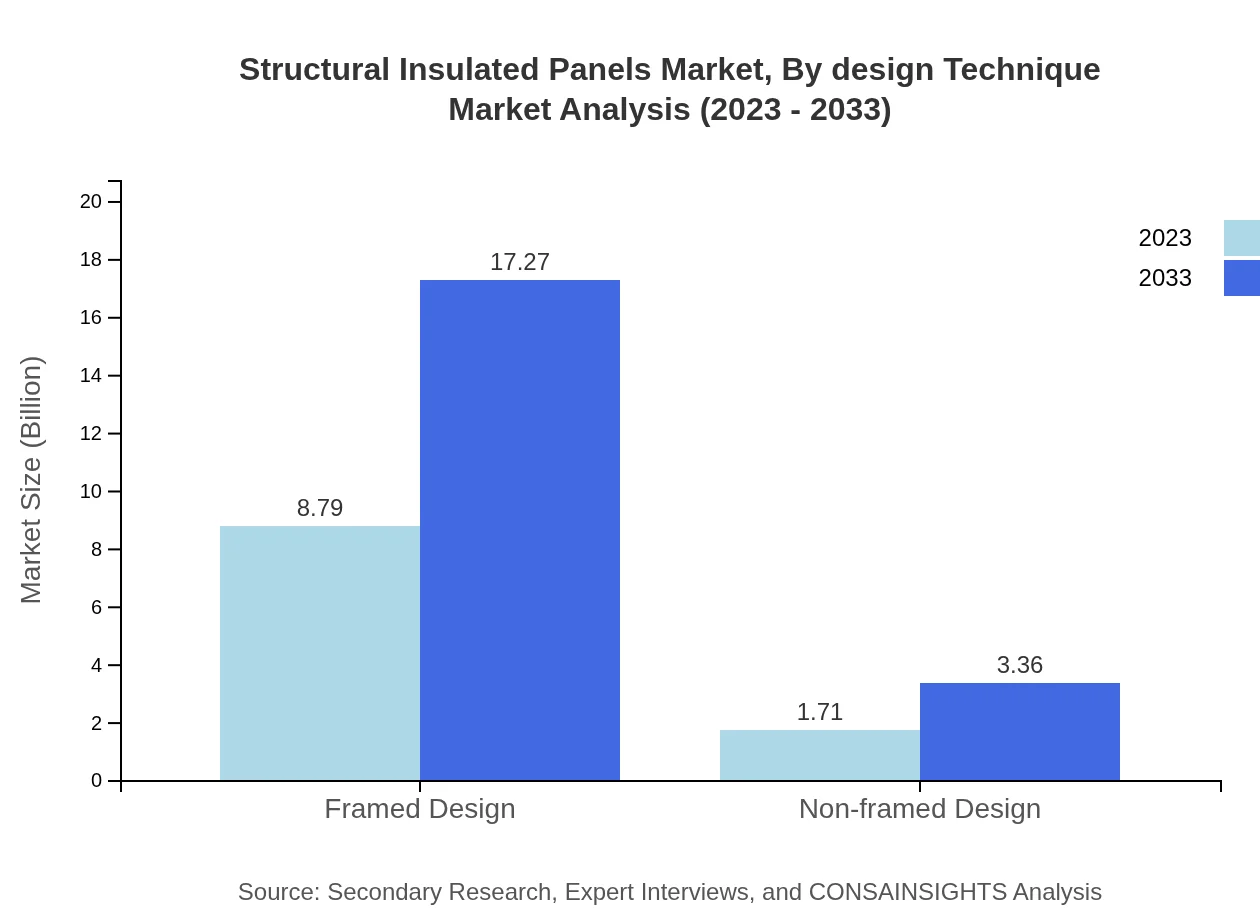

The SIP market can be segmented by material, with key segments including framed and non-framed designs. Framed designs account for a significant portion of the market share, comprising 83.7% in 2023. Non-framed designs, while a smaller segment at 16.3%, are gaining popularity in specific applications where flexibility in design is critical.

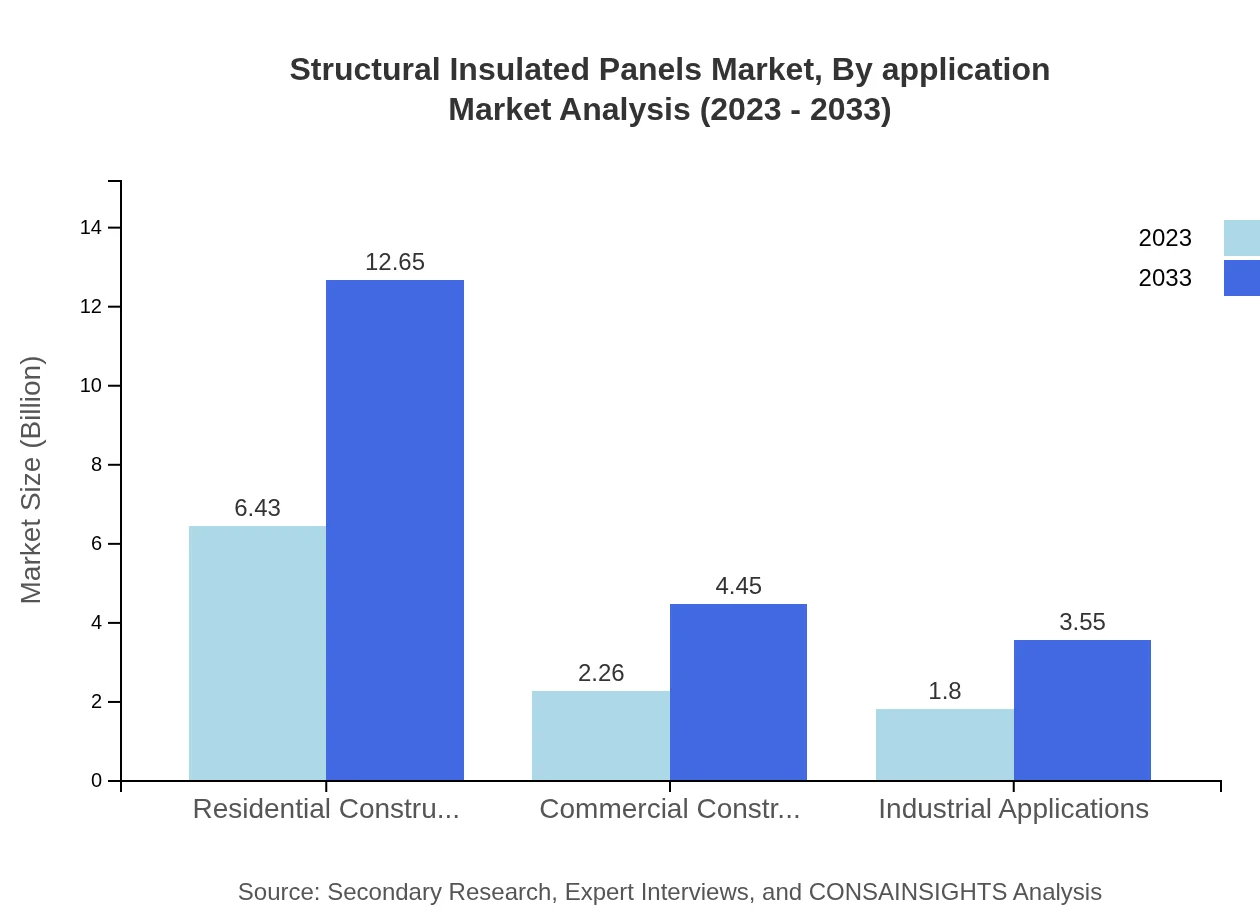

Structural Insulated Panels Market Analysis By Application

The application of SIPs spans residential, commercial, and industrial sectors. The residential construction segment shows strong performance, valued at USD 6.43 billion in 2023 and projected to reach USD 12.65 billion by 2033. Commercial construction follows with significant opportunities, projected to grow to USD 4.45 billion by 2033, bolstered by the rise in eco-friendly building demands.

Structural Insulated Panels Market Analysis By Design Technique

Design technique significantly influences the performance of SIPs. Framed designs are the most common, while non-framed designs cater to niche applications emphasizing aesthetic considerations and unique architectural needs. The segment analysis indicates a growing market for innovative designs that incorporate sustainable materials.

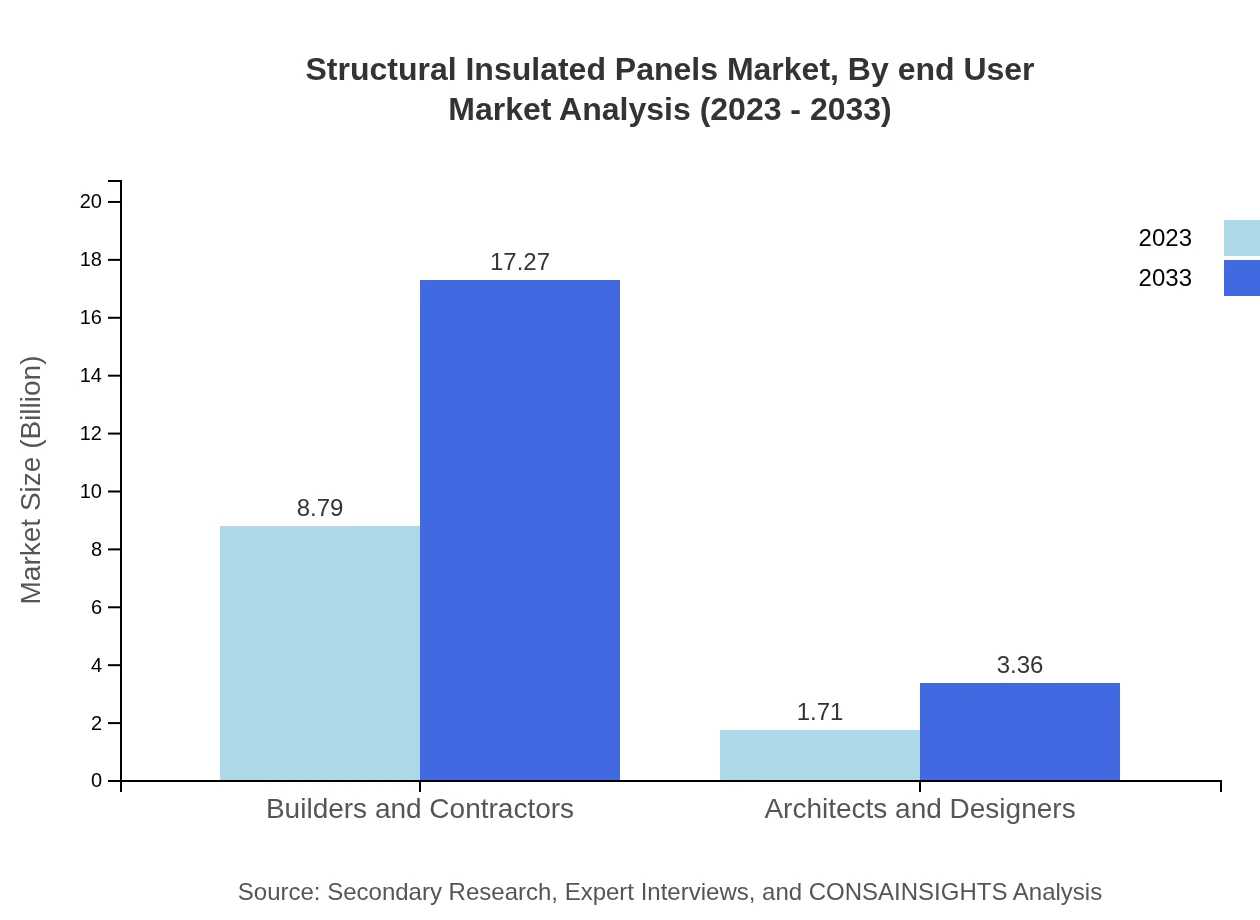

Structural Insulated Panels Market Analysis By End User

The end-user segment includes builders and contractors as the major stakeholders in SIP utilization. Their share in terms of market size is substantial, emphasizing the critical role they play in advancing the adoption of SIPs, showcasing a remarkable shift towards more sustainable building practices.

Structural Insulated Panels Market Analysis By Region

Global Structural Insulated Panels Market, By Region Market Analysis (2023 - 2033)

Regional analysis indicates varying trends in SIP adoption, with North America leading, followed by Europe, which is experiencing rapid growth due to regulatory factors. Asia Pacific is on the rise, indicating a promising future for SIP applications in residential and commercial construction.

Structural Insulated Panels Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Structural Insulated Panels Industry

Structurlam Mass Timber Corporation:

A leader in sustainable engineered wood products, Structurlam specializes in the manufacturing of SIPs and advocacy for environmentally conscious building solutions.Kingspan Group:

Kingspan is an international company noted for its innovative insulation and building envelope solutions, including high-performance structural insulated panels aimed at improving energy efficiency.SIPS Industries USA:

SIPS Industries is a notable manufacturer of structural insulated panels, known for its commitment to quality and energy-efficient building systems.Nucor Corporation:

Nucor is a major player in the construction materials market, offering a vast range of insulated panel solutions that cater to various building needs.Energy Panel Structures:

Focusing on high-quality construction materials, Energy Panel Structures specializes in the production of SIPs, particularly for the residential sector.We're grateful to work with incredible clients.

FAQs

What is the market size of structural Insulated Panels?

The structural insulated panels market is projected to reach a size of $10.5 billion by 2033, growing at a CAGR of 6.8% from the current valuation in 2023.

What are the key market players or companies in this structural Insulated Panels industry?

Key players in the structural insulated panels industry include major manufacturers known for their innovative solutions. These companies leverage advanced technology and sustainable practices to enhance product offerings and capture market share.

What are the primary factors driving the growth in the structural Insulated Panels industry?

Growth in the structural insulated panels industry is driven by the demand for energy-efficient construction, rising awareness of sustainability, and increasing preferences for prefabricated structures in the housing market.

Which region is the fastest Growing in the structural Insulated Panels?

North America is the fastest-growing region in the structural insulated panels market, projected to expand from $3.82 billion in 2023 to $7.50 billion by 2033, indicating significant regional demand.

Does ConsaInsights provide customized market report data for the structural Insulated Panels industry?

Yes, ConsaInsights offers tailored market report data for the structural insulated panels industry, allowing businesses to gain insights specific to their strategic needs and market conditions.

What deliverables can I expect from this structural Insulated Panels market research project?

Deliverables include comprehensive market analysis reports, regional market insights, segment-specific data, competitive landscape reviews, and trend identification across the structural insulated panels industry.

What are the market trends of structural Insulated Panels?

Current trends in the structural insulated panels market focus on increasing energy efficiency, integration of smart technologies, and the growing adoption of eco-friendly building materials, shaping industry practices and consumer preferences.