Student Information System Market Report

Published Date: 31 January 2026 | Report Code: student-information-system

Student Information System Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Student Information System (SIS) market, covering market size, trends, segmentation, and regional insights for the forecast period from 2023 to 2033.

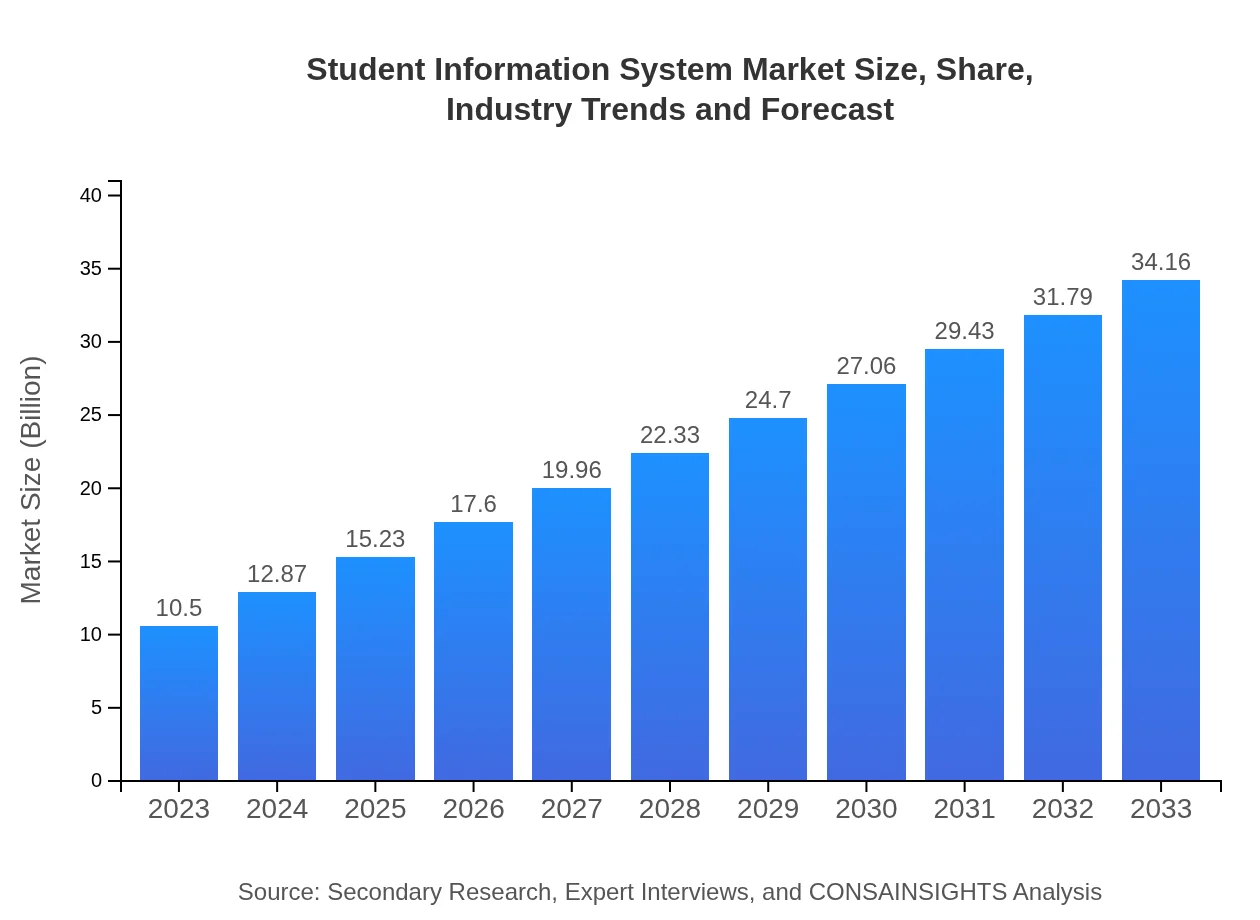

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 12% |

| 2033 Market Size | $34.16 Billion |

| Top Companies | Oracle Corporation, Follett School Solutions, Inc., Ellucian, Blackbaud, Inc., PowerSchool Group LLC |

| Last Modified Date | 31 January 2026 |

Student Information System Market Overview

Customize Student Information System Market Report market research report

- ✔ Get in-depth analysis of Student Information System market size, growth, and forecasts.

- ✔ Understand Student Information System's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Student Information System

What is the Market Size & CAGR of Student Information System market in 2023?

Student Information System Industry Analysis

Student Information System Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Student Information System Market Analysis Report by Region

Europe Student Information System Market Report:

The European SIS market is expected to experience significant growth, expanding from $2.89 billion in 2023 to $9.39 billion by 2033. The emphasis on data management, compliance with privacy regulations, and the shift towards online learning models are influential factors contributing to this growth.Asia Pacific Student Information System Market Report:

The Asia Pacific SIS market is projected to grow from $1.98 billion in 2023 to approximately $6.44 billion by 2033, with a significant CAGR of over 12.5%. Increasing government initiatives to enhance educational systems and rising internet penetration are driving this growth in countries like India and China.North America Student Information System Market Report:

North America remains the largest SIS market, with a size of $4.09 billion in 2023, projected to reach $13.30 billion in 2033. The strong presence of key players, high investments in educational technology, and the continuous push towards digital transformation within institutions facilitate this growth.South America Student Information System Market Report:

In South America, the SIS market is anticipated to expand from $0.33 billion in 2023 to $1.09 billion by 2033. Growth will be driven by increasing investments in education technology and the growing importance of digitization in educational institutions.Middle East & Africa Student Information System Market Report:

In the Middle East and Africa, the SIS market is forecasted to grow from $1.21 billion in 2023 to $3.95 billion by 2033. The rising enrollment rates and governmental efforts to modernize educational infrastructure enhance the SIS adoption across the region.Tell us your focus area and get a customized research report.

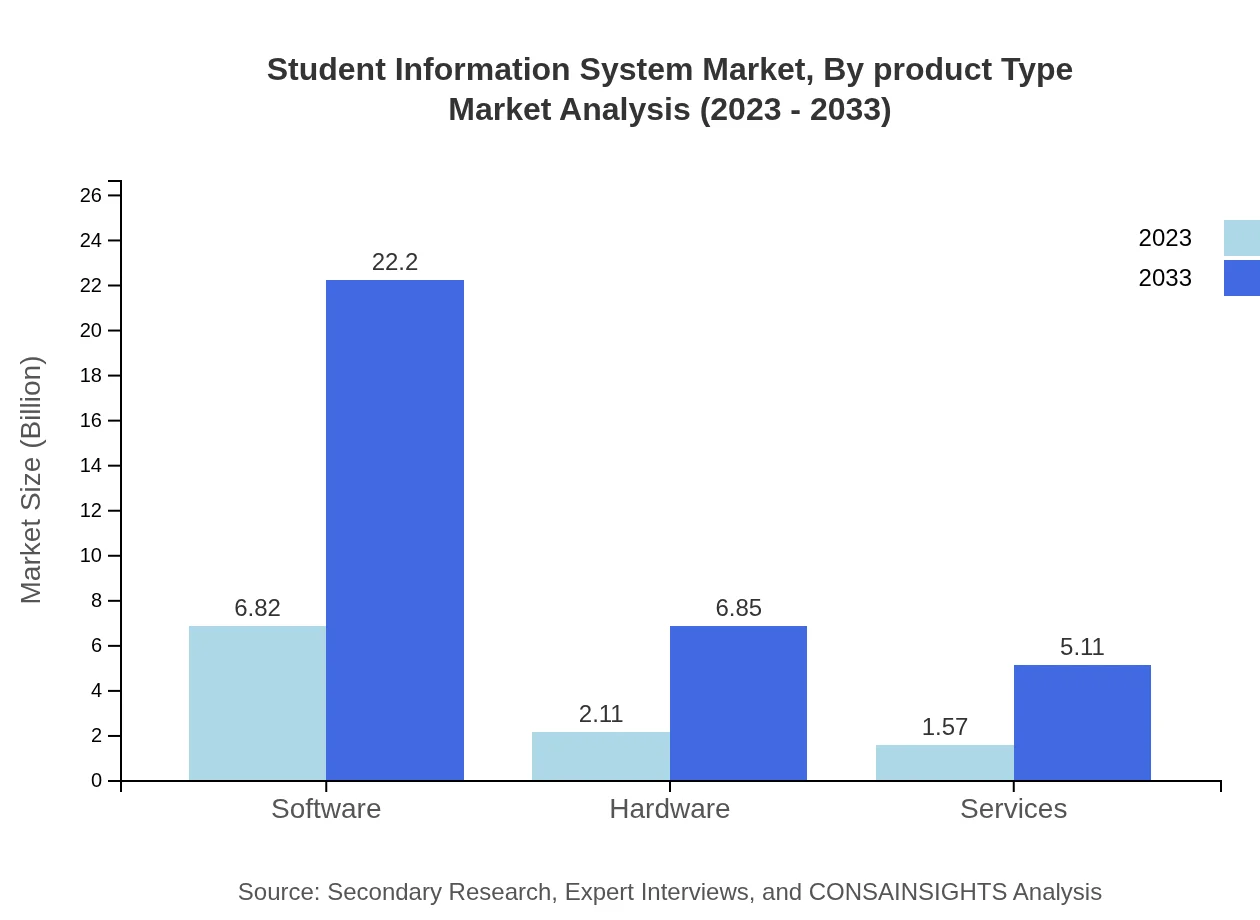

Student Information System Market Analysis By Product Type

The Student Information System can be categorized into three main product types: cloud-based, on-premises, and hybrid systems. Cloud-based systems dominate the market with an 80.22% share in 2023, widely preferred for their flexibility and lower maintenance costs. In contrast, on-premises solutions account for 19.78%, catering mainly to institutions requiring strict data control.

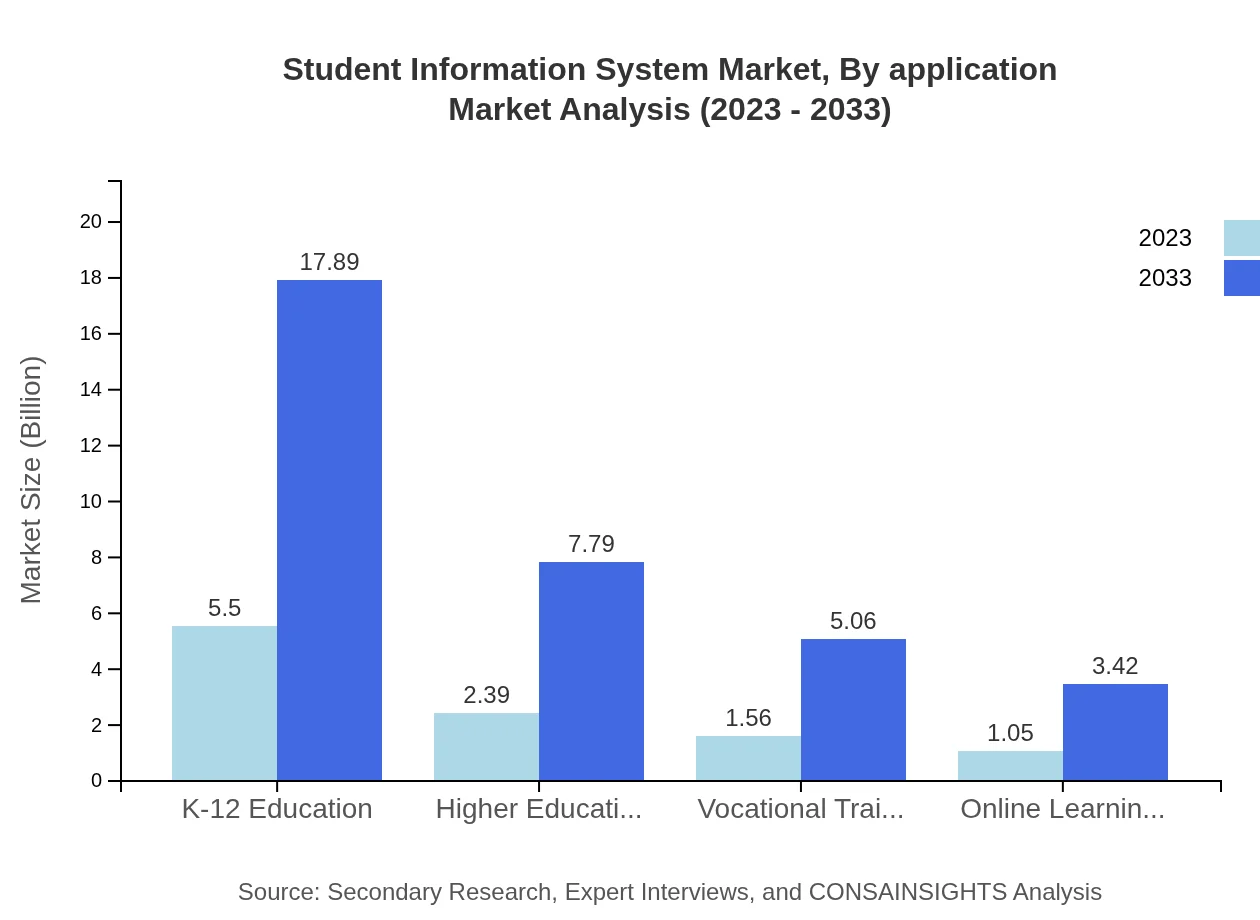

Student Information System Market Analysis By Application

The applications of SIS can be segmented into K-12 education, higher education, and vocational training. K-12 education leads with a market share of 52.38% in 2023 due to the increasing emphasis on early education technology. Higher education represents 22.8%, with institutions aiming to enhance administrative efficiency in student enrollment and management.

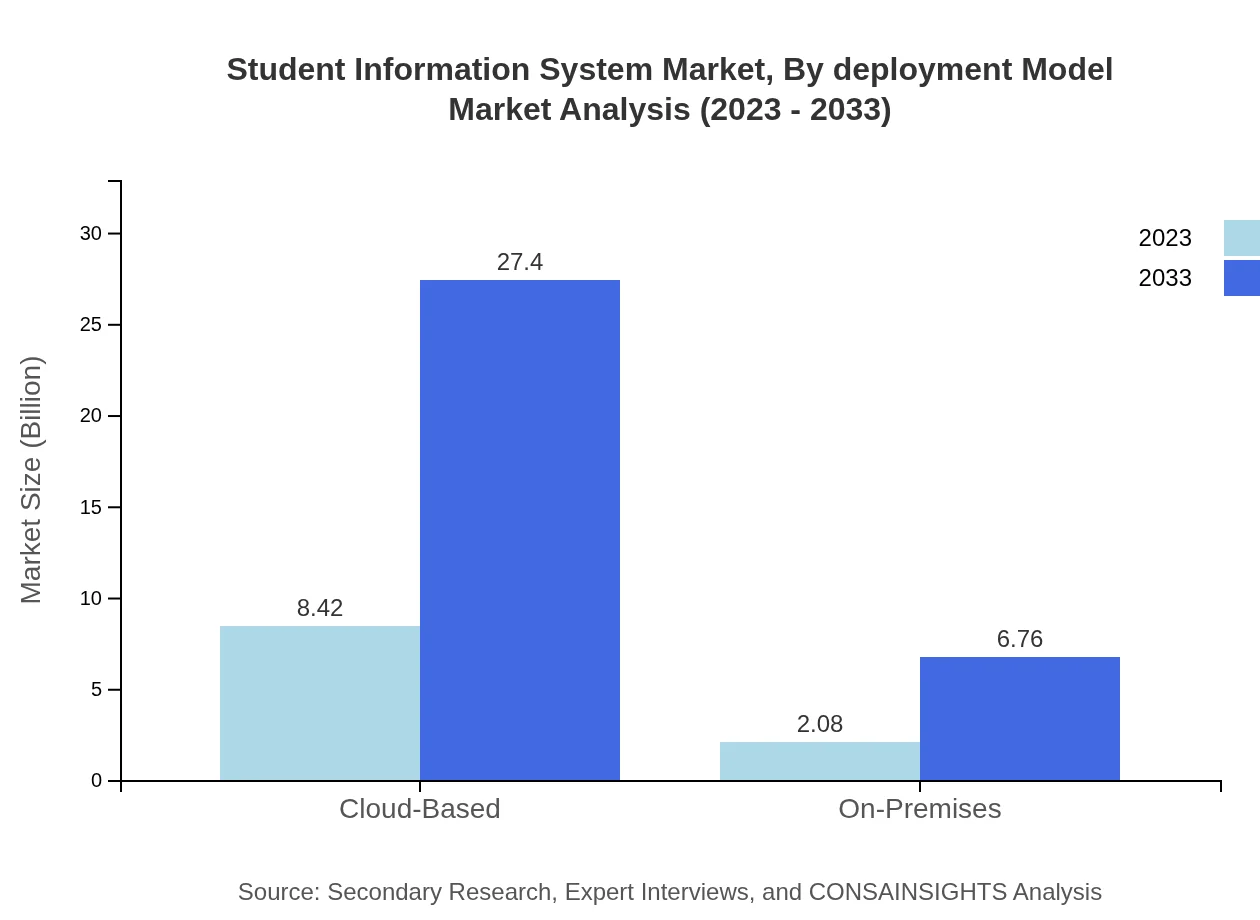

Student Information System Market Analysis By Deployment Model

The deployment model is classified into cloud-based and on-premises solutions. The cloud-based deployment continues to lead the market, expected to grow from $8.42 billion in 2023 to $27.40 billion in 2033. On-premises models, while providing increased control over data management, are anticipated to grow at a slower pace, limited by higher initial investments.

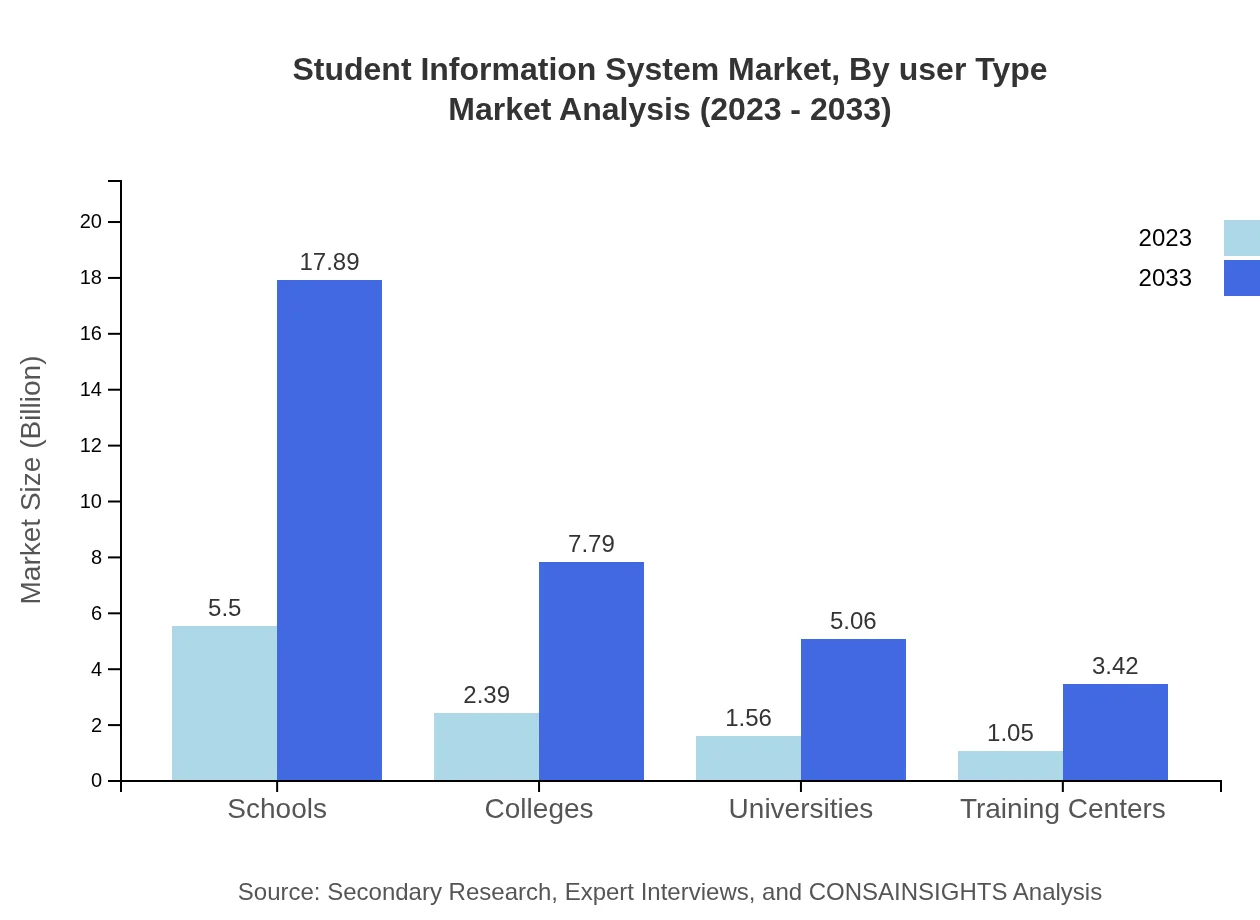

Student Information System Market Analysis By User Type

End-users of SIS include various educational institutions ranging from K-12 schools to universities. K-12 institutions represent a significant portion of the user base, driven by the need for comprehensive management systems and analytics capabilities that allow for tracking student performance and outcomes.

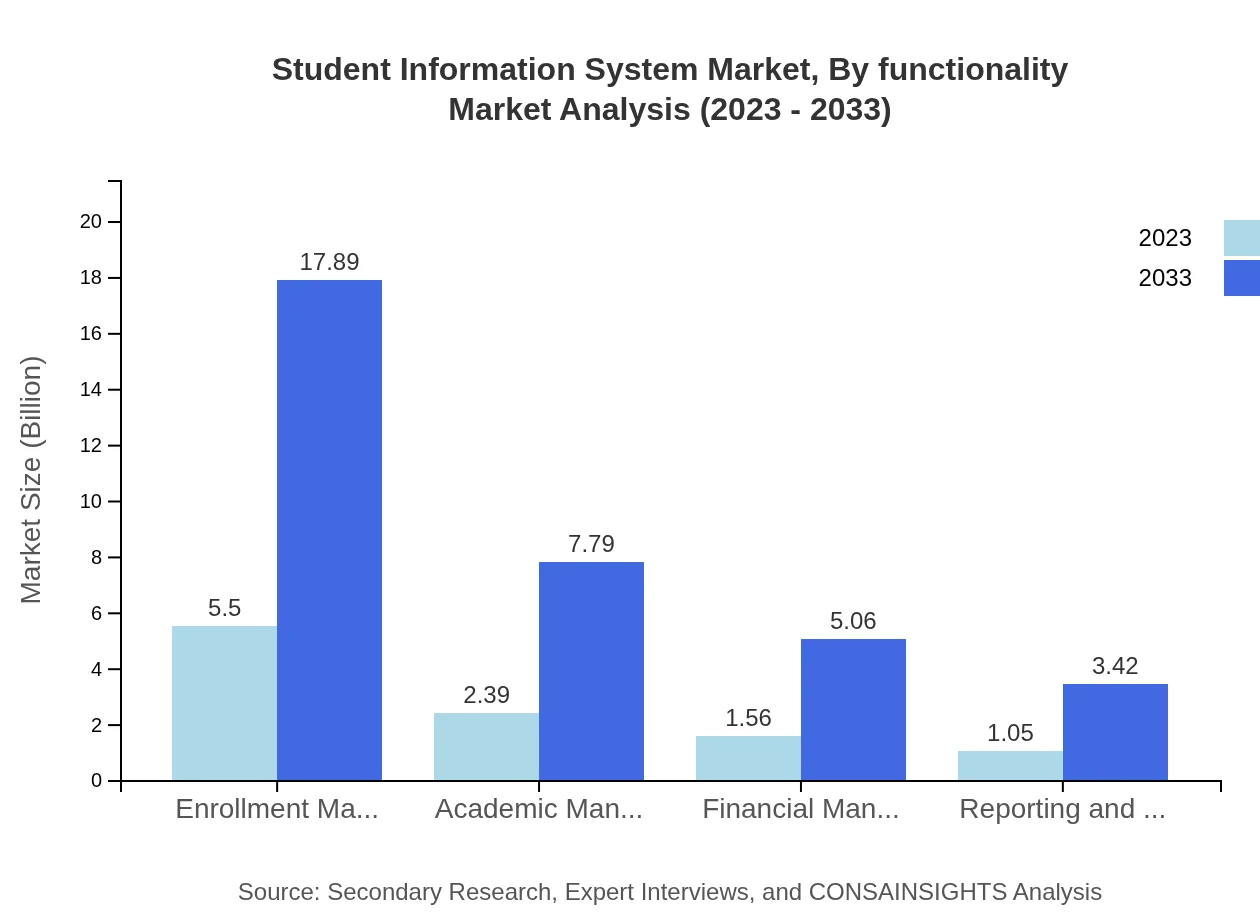

Student Information System Market Analysis By Functionality

Key functionalities of SIS include enrollment management, academic management, reporting and analytics, and financial management. Enrollment management is a critical function, representing a significant share of the market. Institutions increasingly seek integrated solutions that encompass various functionalities while providing real-time data for improved decision-making.

Student Information System Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Student Information System Industry

Oracle Corporation:

Oracle offers a robust suite of cloud applications including the Student Information System that optimizes administrative tasks and enhances student engagement.Follett School Solutions, Inc.:

Follett provides integrated solutions that cater to the K-12 market, emphasizing digital education resources and information management tools.Ellucian:

As a leading provider of software and services for higher education, Ellucian's SIS solutions support academic management and institutional effectiveness.Blackbaud, Inc.:

Blackbaud specializes in software solutions for nonprofit organizations and educational institutions, providing innovative SIS platforms for managing student data.PowerSchool Group LLC:

PowerSchool offers cloud-based SIS solutions primarily focused on K-12 education, driving efficiencies in enrollment and student data management.We're grateful to work with incredible clients.

FAQs

What is the market size of Student Information System?

The Student Information System market is valued at approximately $10.5 billion in 2023, with a robust projected CAGR of 12% over the next decade. This growth reflects the increasing demand for efficient educational management tools across various educational institutions.

What are the key market players or companies in the Student Information System industry?

Key players in the Student Information System industry include major companies like Oracle, SAP, Ellucian, and Blackboard. These companies are leading the sector by offering innovative technologies and comprehensive solutions that cater to educational institutions' needs.

What are the primary factors driving the growth in the Student Information System industry?

Growth in the Student Information System industry is driven by the increasing digitization of education, a rising student population, and the need for improved management of educational data. Additionally, the shift to online education enhances demand for adaptable systems that can accommodate diverse learning formats.

Which region is the fastest Growing in the Student Information System market?

The fastest-growing region in the Student Information System market is North America, with a market size projected to expand from $4.09 billion in 2023 to $13.30 billion by 2033. This growth illustrates the region's commitment to educational technology advancements.

Does ConsaInsights provide customized market report data for the Student Information System industry?

Yes, ConsaInsights offers customized market report data tailored to the Student Information System industry. Clients can receive insights that cater specifically to their unique requirements, ensuring they have the most relevant and actionable information available.

What deliverables can I expect from this Student Information System market research project?

Deliverables from a Student Information System market research project include a comprehensive report featuring market analysis, trends, key players, and growth projections. Additionally, visual data representations and segment analyses are provided to facilitate strategic decision-making.

What are the market trends of Student Information System?

Current market trends in the Student Information System sector include a shift towards cloud-based solutions, increasing integration of AI technologies, and a growing focus on data security and privacy. These trends help institutions enhance educational experiences and operational efficiencies.