Styrene Butadiene Rubber Sbr Market Report

Published Date: 02 February 2026 | Report Code: styrene-butadiene-rubber-sbr

Styrene Butadiene Rubber Sbr Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Styrene Butadiene Rubber (SBR) market, covering insights on market size, trends, and forecasts for the period 2023 to 2033, along with a regional breakdown and segmentation analysis.

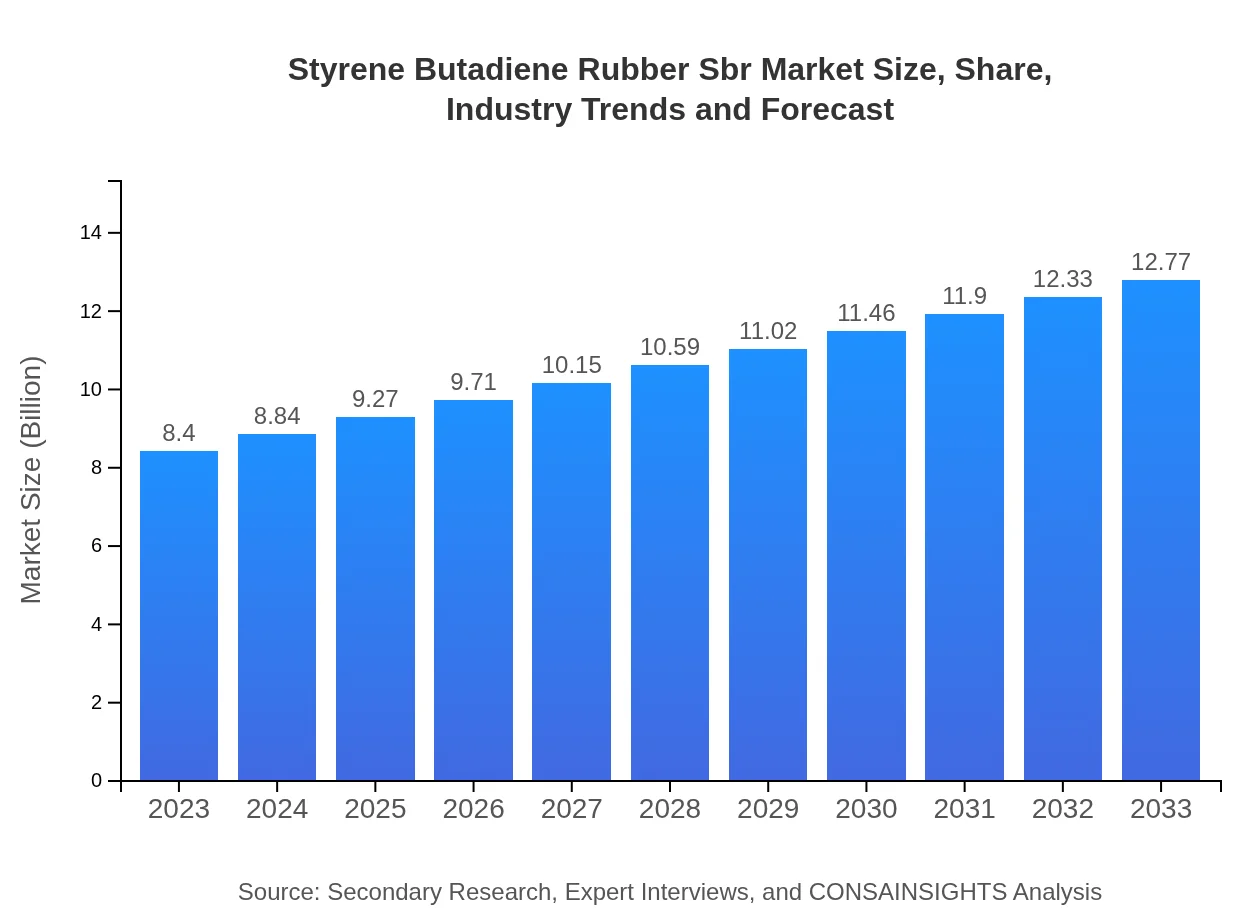

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $8.40 Billion |

| CAGR (2023-2033) | 4.2% |

| 2033 Market Size | $12.77 Billion |

| Top Companies | BASF SE, LyondellBasell Industries Holdings B.V., Hexpol AB, ExxonMobil Chemical, Goodyear Tire & Rubber Company |

| Last Modified Date | 02 February 2026 |

Styrene Butadiene Rubber Sbr Market Overview

Customize Styrene Butadiene Rubber Sbr Market Report market research report

- ✔ Get in-depth analysis of Styrene Butadiene Rubber Sbr market size, growth, and forecasts.

- ✔ Understand Styrene Butadiene Rubber Sbr's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Styrene Butadiene Rubber Sbr

What is the Market Size & CAGR of Styrene Butadiene Rubber Sbr market in 2023?

Styrene Butadiene Rubber Sbr Industry Analysis

Styrene Butadiene Rubber Sbr Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Styrene Butadiene Rubber Sbr Market Analysis Report by Region

Europe Styrene Butadiene Rubber Sbr Market Report:

The Styrene Butadiene Rubber market in Europe is projected to grow from USD 2.43 billion in 2023 to USD 3.70 billion by 2033, achieving a CAGR of 4.4%. The region's stringent environmental regulations and the automotive industry's shift to greener alternatives play significant roles in this growth.Asia Pacific Styrene Butadiene Rubber Sbr Market Report:

In 2023, the Styrene Butadiene Rubber market in the Asia-Pacific region is valued at USD 1.60 billion and is projected to reach USD 2.44 billion by 2033, with a CAGR of 4.6%. Rapid industrialization and increasing vehicle production in countries like China and India are significant factors fueling market growth.North America Styrene Butadiene Rubber Sbr Market Report:

In North America, the market is set to increase from USD 3.04 billion in 2023 to USD 4.63 billion by 2033, growing at a CAGR of 4.4%. The growth is attributed to technological advancements in tire manufacturing and a shift towards sustainable materials.South America Styrene Butadiene Rubber Sbr Market Report:

The South America market for Styrene Butadiene Rubber is expected to grow from USD 0.47 billion in 2023 to USD 0.72 billion by 2033, reflecting a CAGR of 4.4%. Increasing demand from the automotive sector and expanding construction activities in Brazil are key growth drivers.Middle East & Africa Styrene Butadiene Rubber Sbr Market Report:

This market segment is expected to grow from USD 0.85 billion in 2023 to USD 1.29 billion by 2033, with a CAGR of 4.5%. The expanding construction sector and increasing automotive production are key factors supporting market growth in the region.Tell us your focus area and get a customized research report.

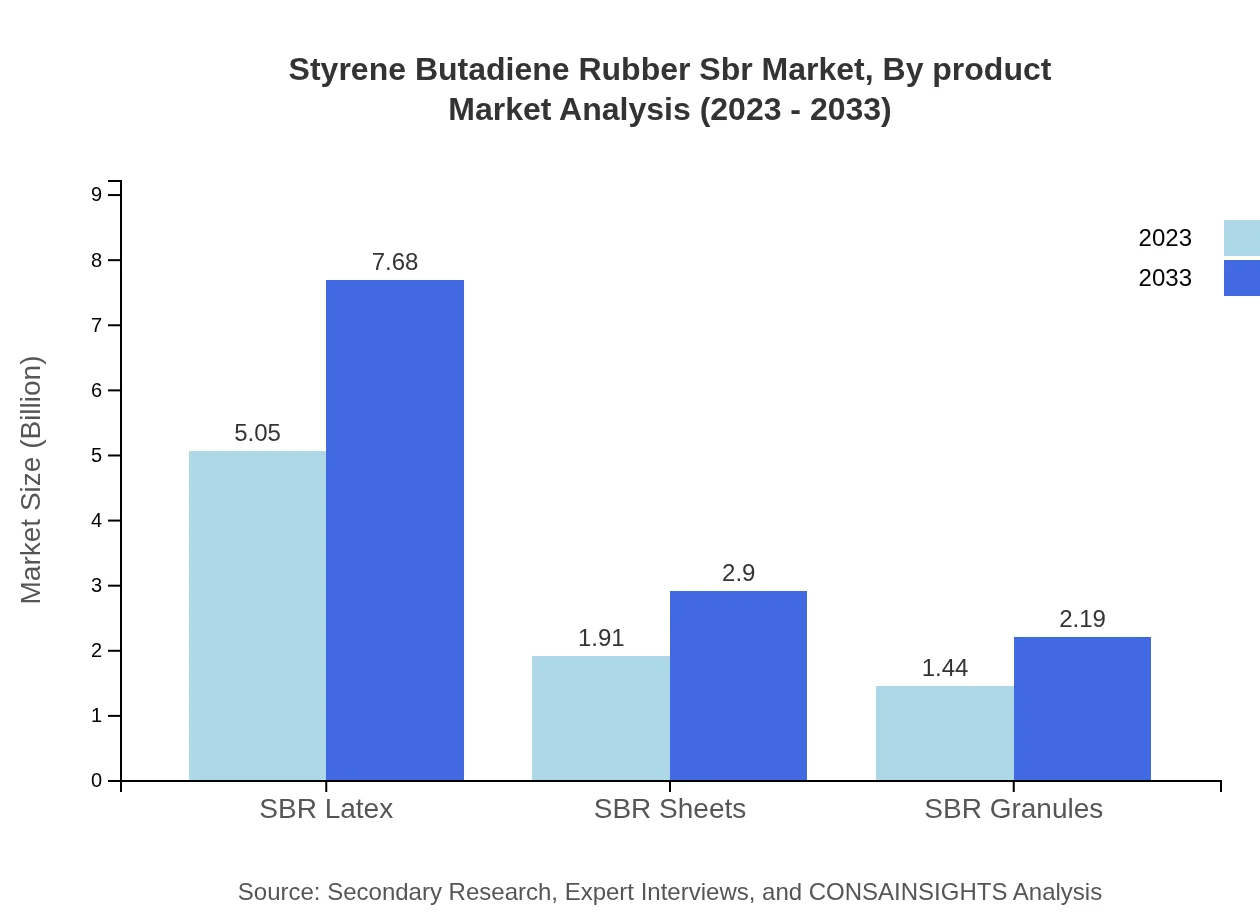

Styrene Butadiene Rubber Sbr Market Analysis By Product

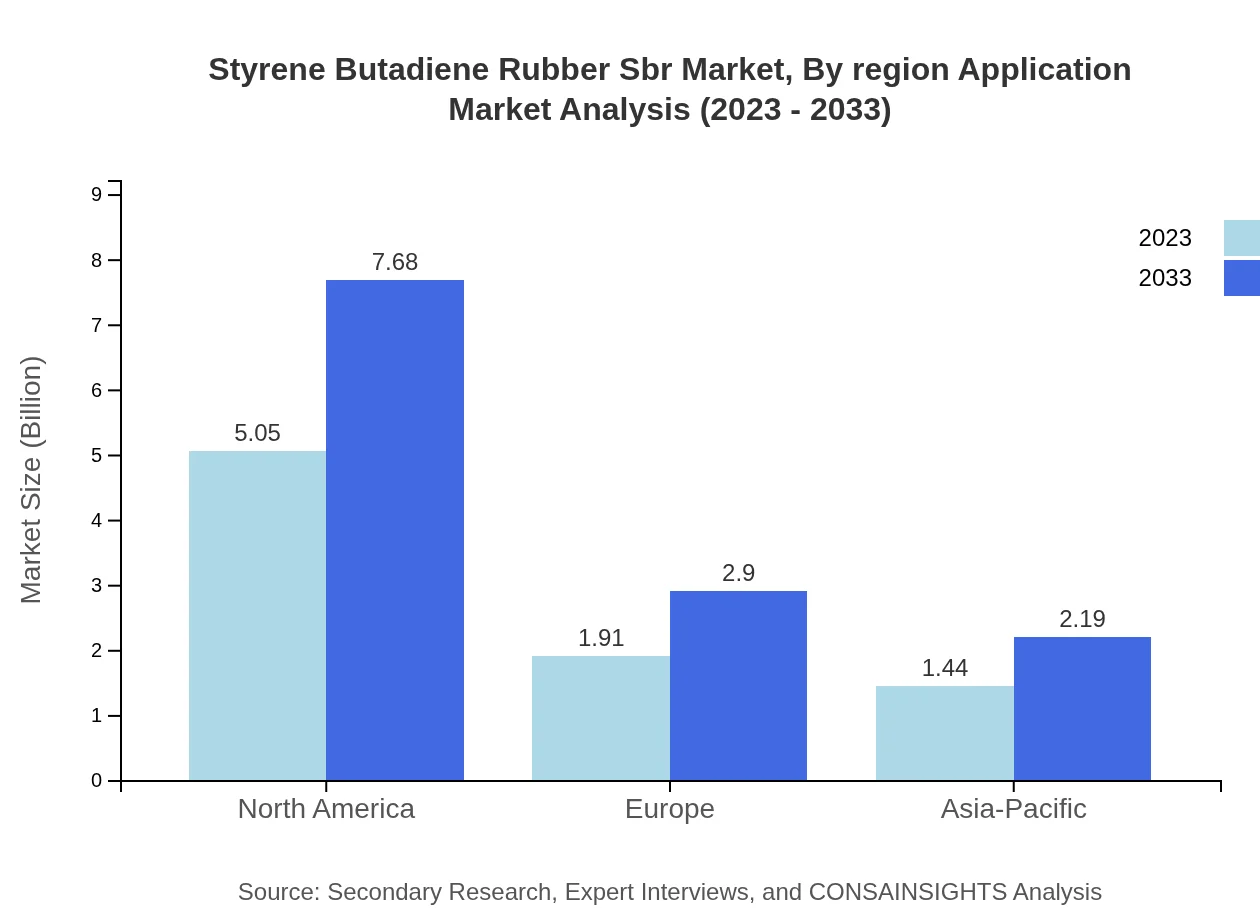

The SBR market by product is primarily divided into SBR latex, SBR sheets, and SBR granules. SBR latex leads the market with a size of USD 5.05 billion in 2023, projected to reach USD 7.68 billion by 2033, maintaining a share of 60.14%. SBR sheets are valued at USD 1.91 billion in 2023 and expected to reach USD 2.90 billion by 2033, capturing a share of 22.69%. SBR granules will see growth from USD 1.44 billion to USD 2.19 billion, holding 17.17% market share.

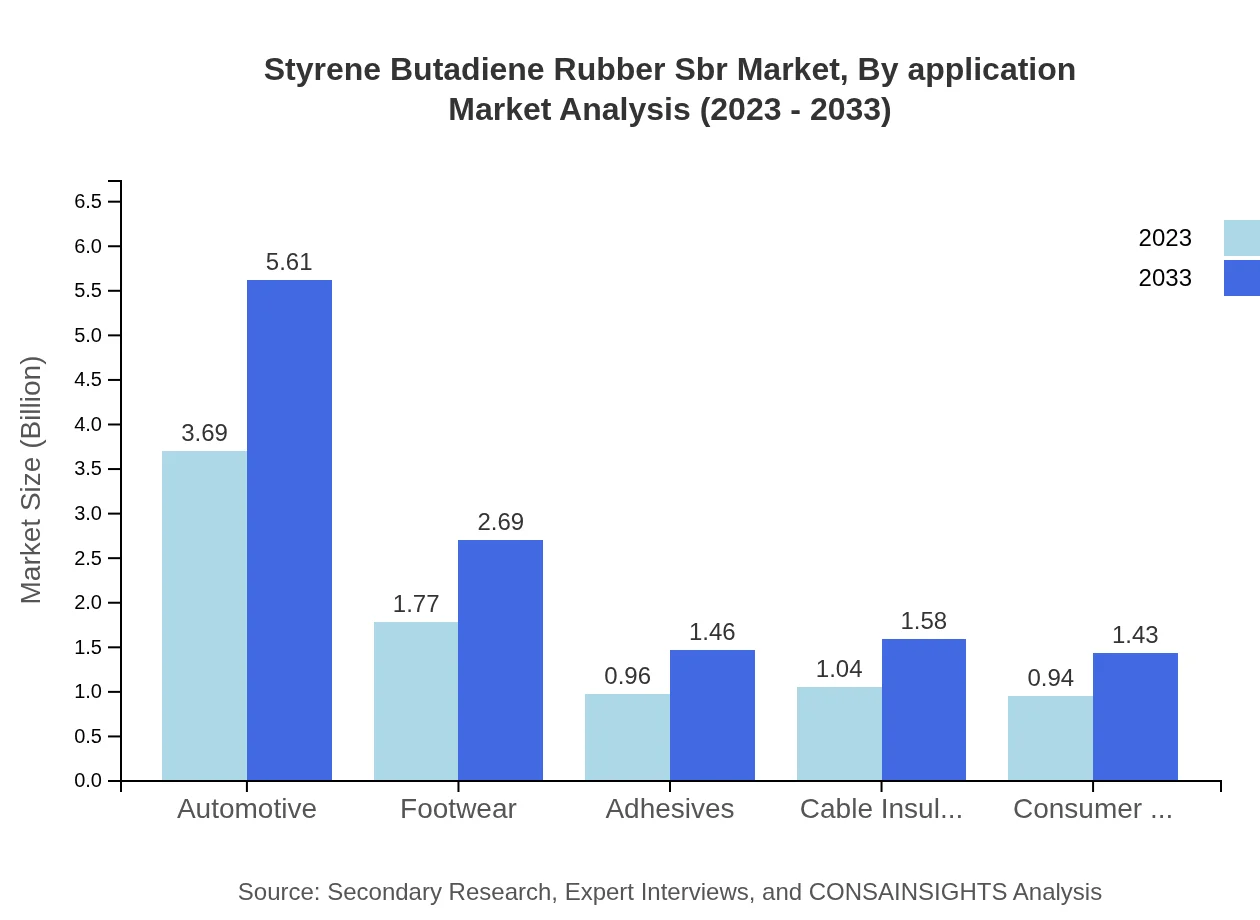

Styrene Butadiene Rubber Sbr Market Analysis By Application

The primary applications of SBR include automotive, footwear, adhesives, cable insulation, and consumer goods. The automotive sector dominates with a market size of USD 3.69 billion in 2023, expected to rise to USD 5.61 billion by 2033, representing 43.93% market share. Footwear and consumer goods will also show strong performance, reflecting increasing consumer demand.

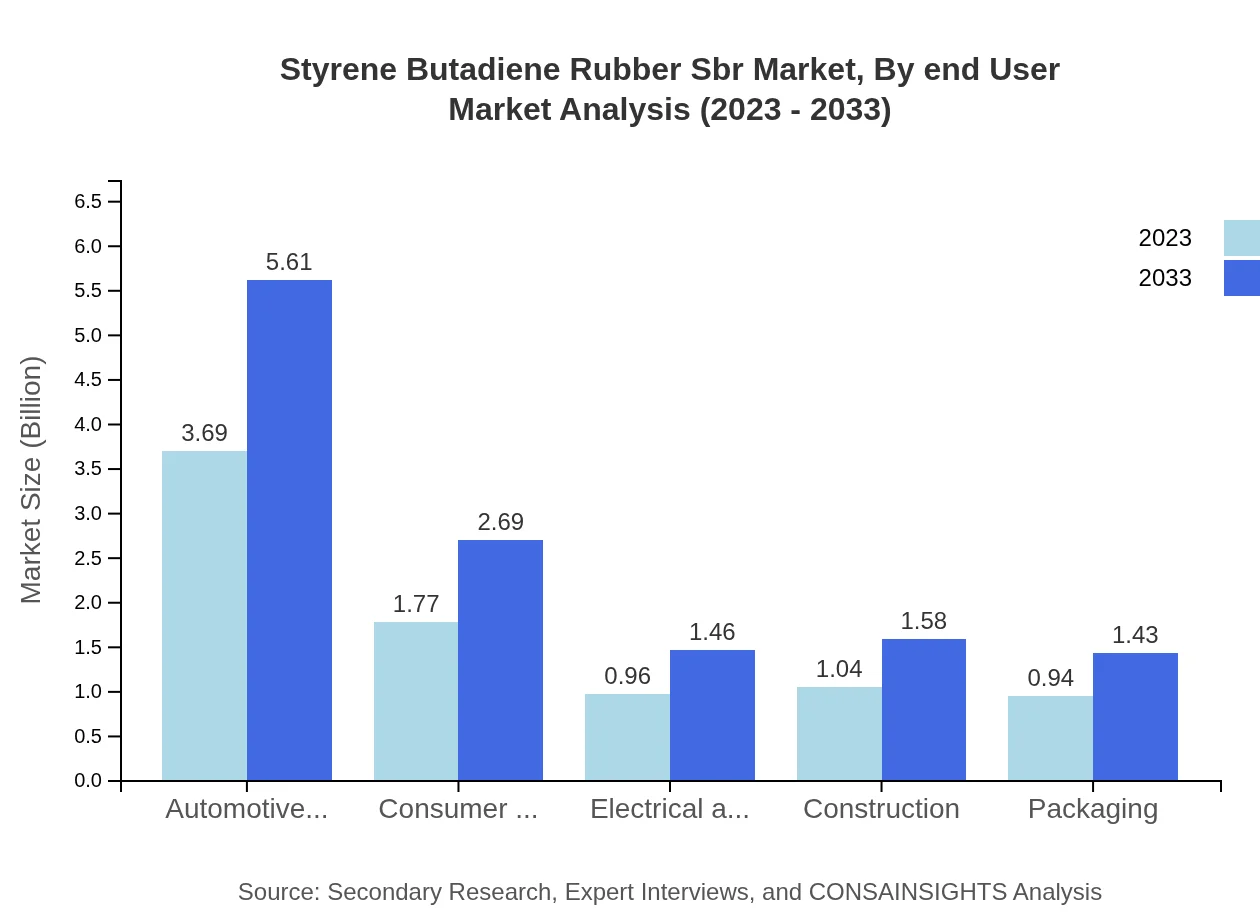

Styrene Butadiene Rubber Sbr Market Analysis By End User

Key end-user industries utilizing SBR include automotive manufacturers, consumer goods manufacturers, electrical and electronics, construction, and packaging. The automotive manufacturing sector accounts for USD 3.69 billion in 2023, projected to grow significantly due to rising car production.

Styrene Butadiene Rubber Sbr Market Analysis By Region Application

Region-wise, the automotive segment shows the highest demand in North America and Europe, whereas Asia-Pacific is witnessing an emerging trend in consumer goods applications. The construction application is gaining traction in Latin America due to increased infrastructure projects.

Styrene Butadiene Rubber Sbr Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Styrene Butadiene Rubber Sbr Industry

BASF SE:

BASF is one of the largest chemical producers globally, known for its innovation in rubber synthesis and commitment to sustainable development in SBR applications.LyondellBasell Industries Holdings B.V.:

LyondellBasell is a leading producer of specialty elastomers and high-performance resins, contributing significantly to SBR advancements in the automotive sector.Hexpol AB:

Hexpol specializes in rubber compounds and is involved in the production of SBR rubber for various industrial applications.ExxonMobil Chemical:

A key player in the global SBR market, ExxonMobil Chemical focuses on innovation and performance enhancement in rubber manufacturing.Goodyear Tire & Rubber Company:

A leading tire manufacturer that extensively uses SBR in its products, Goodyear drives R&D in rubber technology for improved vehicle performance.We're grateful to work with incredible clients.

FAQs

What is the market size of styrene Butadiene Rubber Sbr?

The global Styrene-Butadiene Rubber (SBR) market is projected to reach $8.4 billion by 2033, with a CAGR of 4.2%. In 2023, the market is valued at $8.4 billion, indicating a steady growth trajectory for this segment.

What are the key market players or companies in this styrene Butadiene Rubber Sbr industry?

Key players in the Styrene-Butadiene Rubber market include prominent companies such as Synthos, Trinseo, and ExxonMobil. These manufacturers drive innovation and competition within the market, contributing to its overall growth and development.

What are the primary factors driving the growth in the styrene Butadiene Rubber Sbr industry?

Growth in the Styrene-Butadiene Rubber market is driven by increasing demand from the automotive sector, advancements in manufacturing technologies, and expanding applications across various industries, particularly in consumer goods and construction.

Which region is the fastest Growing in the styrene Butadiene Rubber Sbr?

The Asia-Pacific region is poised to be the fastest-growing market for Styrene-Butadiene Rubber, with market size expected to grow from $1.60 billion in 2023 to $2.44 billion by 2033, due to rising industrial activities and consumer demand.

Does Consainsights provide customized market report data for the styrene Butadiene Rubber Sbr industry?

Yes, Consainsights offers customized market report data tailored to specific needs and inquiries regarding the Styrene-Butadiene Rubber market. Clients can benefit from personalized insights and detailed analyses tailored to their business objectives.

What deliverables can I expect from this styrene Butadiene Rubber Sbr market research project?

Deliverables from the Styrene-Butadiene Rubber market research project typically include comprehensive market analysis reports, segmentation data, competitive landscape insights, and future growth forecasts, ensuring informed decision-making.

What are the market trends of styrene Butadiene Rubber Sbr?

Current trends in the Styrene-Butadiene Rubber market include a shift towards sustainable materials, increased R&D for enhanced properties, and growing demand in sectors like automotive, healthcare, and construction, reflecting a dynamic and evolving market landscape.