Subscriber Data Management Market Report

Published Date: 31 January 2026 | Report Code: subscriber-data-management

Subscriber Data Management Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Subscriber Data Management market from 2023 to 2033, including insights on market size, growth forecasts, segmentation, regional analyses, technology trends, and key players in the industry.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

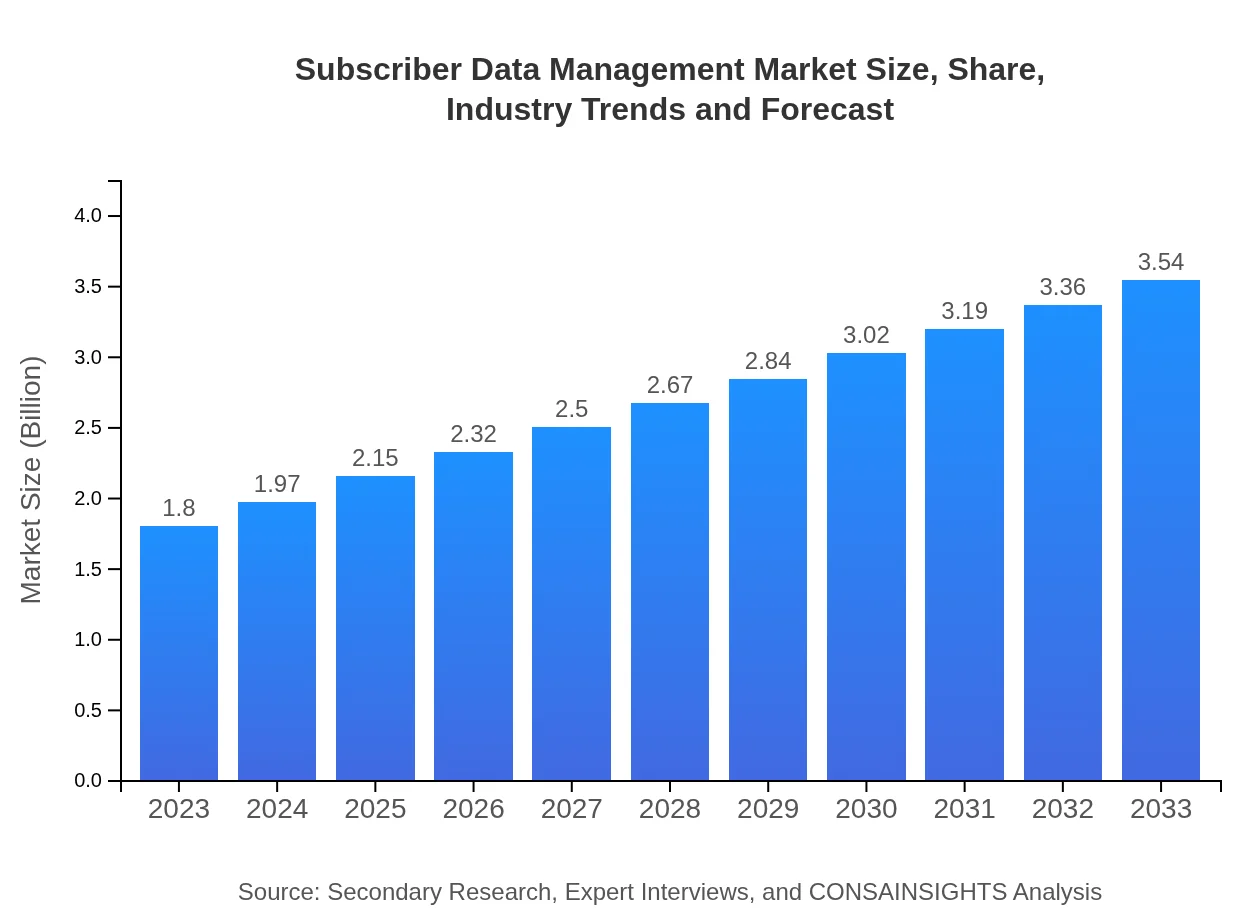

| 2023 Market Size | $1.80 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $3.54 Billion |

| Top Companies | Oracle Corporation, IBM, SAP SE, Amdocs |

| Last Modified Date | 31 January 2026 |

Subscriber Data Management Market Overview

Customize Subscriber Data Management Market Report market research report

- ✔ Get in-depth analysis of Subscriber Data Management market size, growth, and forecasts.

- ✔ Understand Subscriber Data Management's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Subscriber Data Management

What is the Market Size & CAGR of Subscriber Data Management market in 2023?

Subscriber Data Management Industry Analysis

Subscriber Data Management Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Subscriber Data Management Market Analysis Report by Region

Europe Subscriber Data Management Market Report:

Europe presents a balanced growth opportunity in the Subscriber Data Management sector, with a market size of $0.58 billion in 2023, projected to double to $1.14 billion by 2033. European companies are increasingly motivated by the GDPR and other data protection regulations, spearheading investments in compliant SDM solutions.Asia Pacific Subscriber Data Management Market Report:

The Asia Pacific region is experiencing significant growth in the Subscriber Data Management market, with an estimated market size of $0.33 billion in 2023, projected to reach $0.66 billion by 2033. The increase is driven by major telecom operators adopting advanced SDM solutions to enhance customer experience and comply with evolving data governance regulations.North America Subscriber Data Management Market Report:

North America leads the Subscriber Data Management market, with a market valuation of $0.65 billion in 2023, projected to expand to $1.27 billion by 2033. The region benefits from high technological adoption rates and a strong focus on data privacy, pushing companies to enhance their SDM capabilities to retain competitive advantages.South America Subscriber Data Management Market Report:

In South America, the Subscriber Data Management market faces unique challenges, reflected in a small market size projected at approximately $-0.01 billion in 2023, expected to drop to $-0.02 billion by 2033. This decline indicates a need for improved service offerings and investments in data management infrastructure to harness subscriber data effectively.Middle East & Africa Subscriber Data Management Market Report:

The Middle East and Africa's Subscriber Data Management market is projected to grow from $0.25 billion in 2023 to $0.49 billion by 2033. This growth is propelled by expanding telecommunications services and the increasing importance of data management strategies among service providers in the region.Tell us your focus area and get a customized research report.

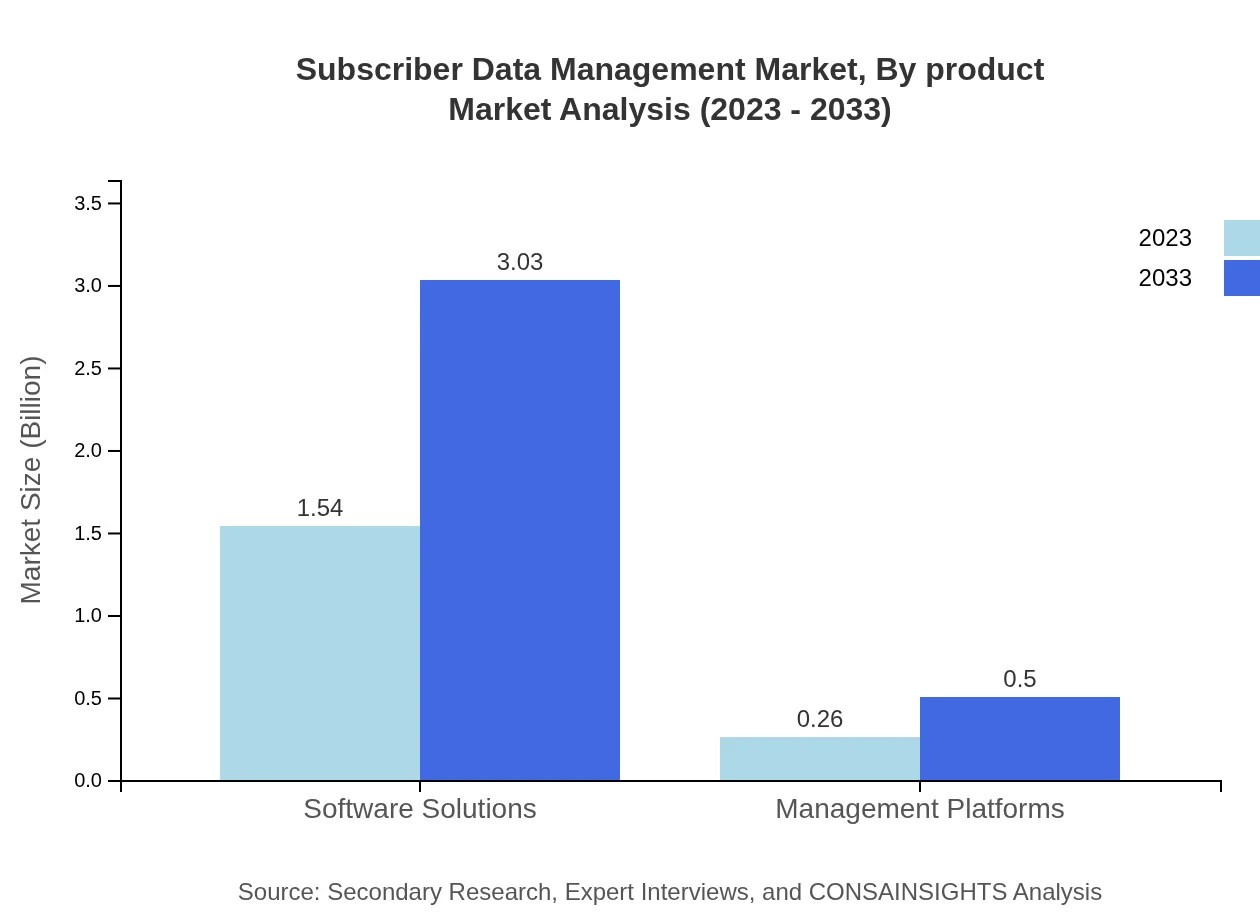

Subscriber Data Management Market Analysis By Product

The Subscriber Data Management market's key products include Cloud Technologies, Big Data Technologies, and Artificial Intelligence solutions. In 2023, the market size for Cloud Technologies stood at $1.20 billion, expected to grow to about $2.36 billion by 2033. Software Solutions are also predominant, with a current market value of $1.54 billion, anticipated to rise to $3.03 billion. Management Platforms and Service Providers are critical segments as enterprises seek comprehensive solutions that bolster their data strategy.

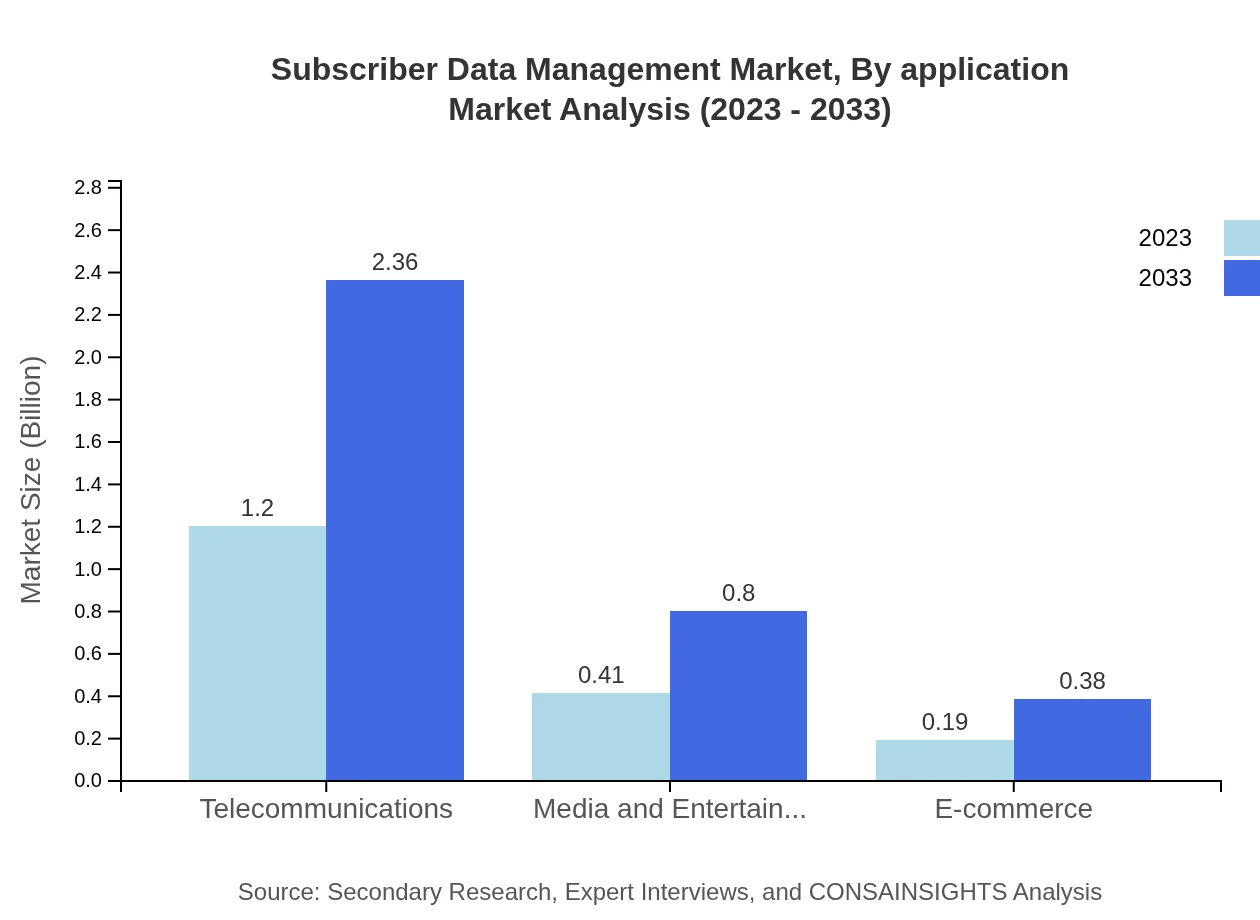

Subscriber Data Management Market Analysis By Application

Applications of Subscriber Data Management span across Telecommunications, Media and Entertainment, and E-commerce sectors. Telecommunications leads significantly with a market size of $1.20 billion in 2023, projected to grow to $2.36 billion by 2033, reflecting its critical role in managing subscriber interactions. Media and Entertainment follow closely with a market size projected at $0.41 billion and expected to reach $0.80 billion.

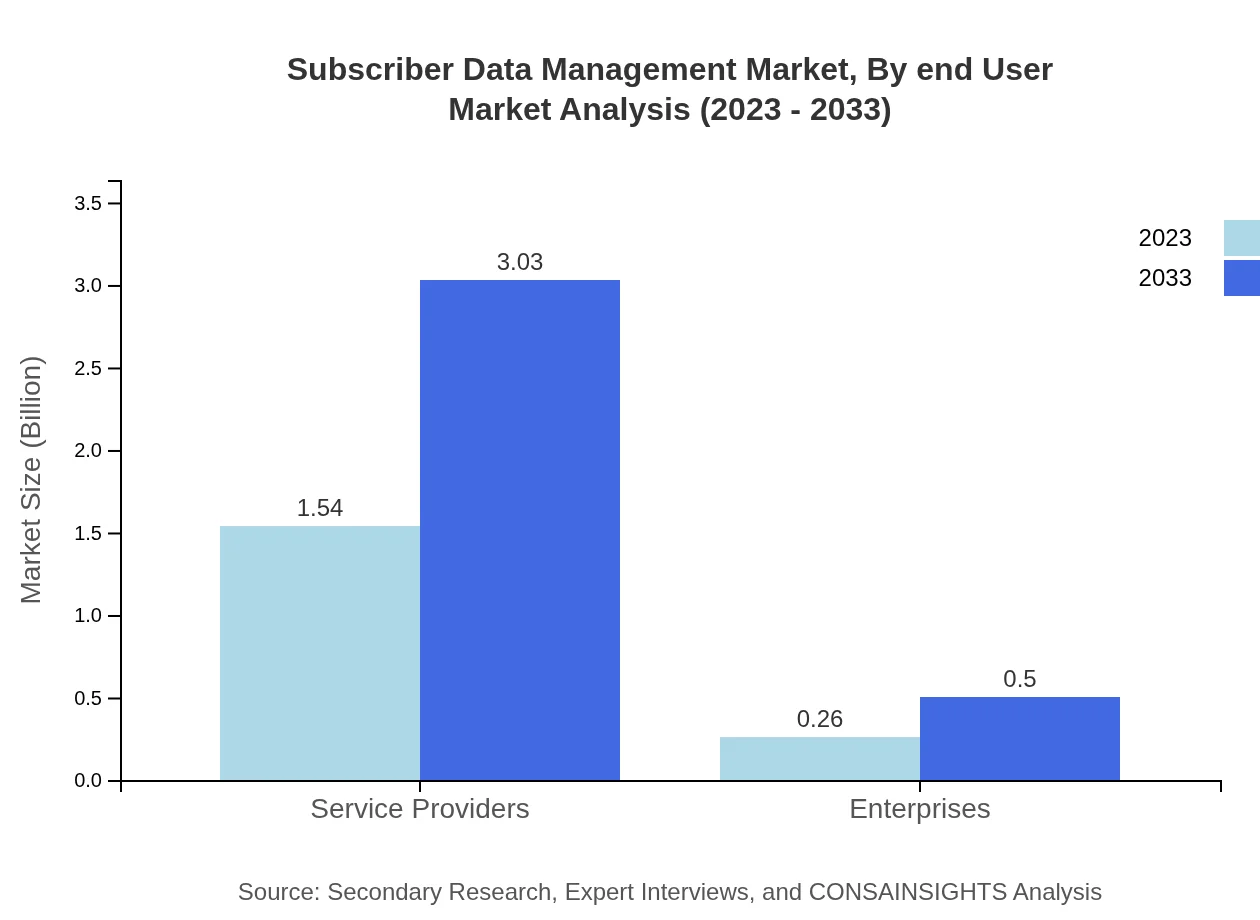

Subscriber Data Management Market Analysis By End User

Telecommunications remains the largest end-user of SDM solutions, capturing a significant market share driven by the essential nature of subscriber data management capabilities. The segment continues to expand as mobile and internet service providers seek ways to optimize their data processing and compliance mechanisms, while other industries such as media and e-commerce gradually increase their adoption rates.

Subscriber Data Management Market Analysis By Technology

Global Subscriber Data Management Market, By Technology Market Analysis (2023 - 2033)

Emerging technologies such as Artificial Intelligence and Big Data play vital roles in the Subscriber Data Management landscape. AI facilitates predictive analytics and personalized customer service, while Big Data technologies provide robust data management capabilities essential for analyzing extensive subscriber data volumes efficiently. Cloud-based solutions are increasingly favored for their agility and cost-effectiveness, enabling organizations to scale their SDM operations effectively.

Subscriber Data Management Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Subscriber Data Management Industry

Oracle Corporation:

A leading player in the SDM market, Oracle offers a suite of solutions designed to optimize subscriber data management, emphasizing security and compliance.IBM:

IBM's commitment to AI and big data analytics empowers telecommunications companies to leverage their subscriber data for advanced analytics and insights.SAP SE:

SAP provides robust data management solutions, focusing on analytics and business intelligence tailored for the telecommunications sector.Amdocs:

Amdocs specializes in software and services for communications and media companies, focusing on enhancing customer experience through effective subscriber data management.We're grateful to work with incredible clients.

FAQs

What is the market size of Subscriber Data Management?

The Subscriber Data Management market is projected to reach approximately $1.8 billion in 2023, with a compound annual growth rate (CAGR) of 6.8% over the next decade.

What are the key market players or companies in the Subscriber Data Management industry?

The Subscriber Data Management industry features notable players including Oracle, IBM, SAP, Salesforce, and Microsoft, recognized for their innovative solutions and strategic partnerships driving market competition.

What are the primary factors driving the growth in the Subscriber Data Management industry?

Key growth drivers include the increasing demand for personalized marketing, the need for data security compliance, and advancements in cloud technology facilitating better data management practices.

Which region is the fastest Growing in the Subscriber Data Management?

North America is the fastest-growing region, with market growth from $0.65 billion in 2023 to $1.27 billion by 2033, driven by high technology adoption and investment in data management solutions.

Does ConsaInsights provide customized market report data for the Subscriber Data Management industry?

Yes, ConsaInsights offers tailored market report data, ensuring detailed insights that meet specific client needs within the Subscriber Data Management industry.

What deliverables can I expect from this Subscriber Data Management market research project?

Deliverables typically include comprehensive reports, market forecasts, competitive analysis, insights on key trends, and segmented data covering various geographical regions.

What are the market trends of Subscriber Data Management?

Current trends include growing reliance on cloud technologies, increasing integration of artificial intelligence, and enhanced focus on customer data privacy and compliance in regulatory environments.