Substrate Like Pcb Market Report

Published Date: 31 January 2026 | Report Code: substrate-like-pcb

Substrate Like Pcb Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Substrate Like PCB market, covering key insights, market size, forecasts from 2023 to 2033, segmentations, regional analyses, and trends impacting the industry's future.

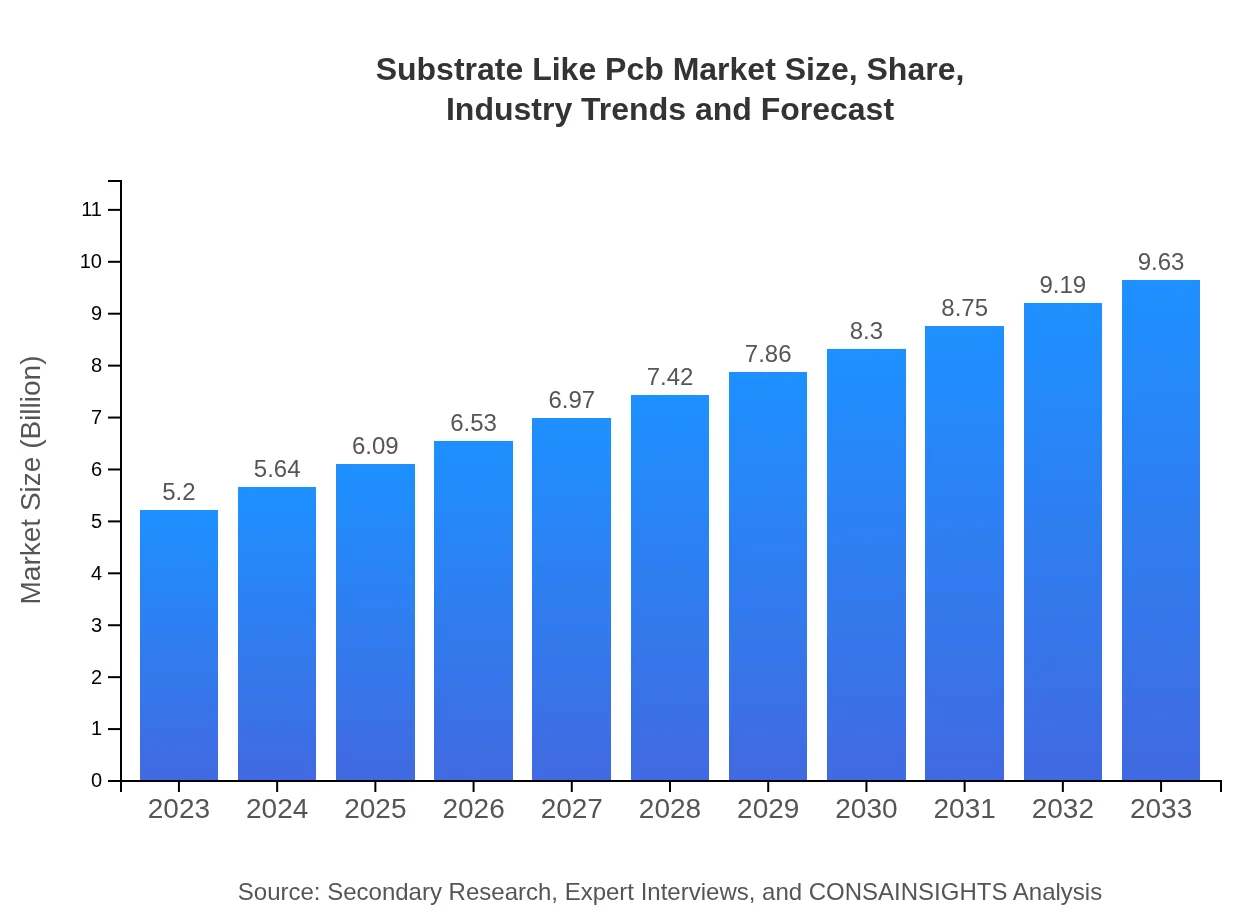

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.20 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $9.63 Billion |

| Top Companies | Kyocera Corporation, Shenzhen Fastprint Circuit Tech Co., Ltd., Nippon Mektron, Ltd., AT&S |

| Last Modified Date | 31 January 2026 |

Substrate Like Pcb Market Overview

Customize Substrate Like Pcb Market Report market research report

- ✔ Get in-depth analysis of Substrate Like Pcb market size, growth, and forecasts.

- ✔ Understand Substrate Like Pcb's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Substrate Like Pcb

What is the Market Size & CAGR of Substrate Like Pcb market in 2023?

Substrate Like Pcb Industry Analysis

Substrate Like Pcb Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Substrate Like Pcb Market Analysis Report by Region

Europe Substrate Like Pcb Market Report:

Europe's market size was $1.63 billion in 2023, expected to rise to $3.02 billion by 2033. Innovation in automotive technologies and strong regulations promoting sustainable practices support market growth.Asia Pacific Substrate Like Pcb Market Report:

In 2023, the Asia Pacific region accounted for a market size of $0.98 billion, expected to grow to $1.81 billion by 2033, driven by increasing electronic manufacturing and demand for consumer products. Countries like China and Japan are leading in technology adoption and manufacturing capabilities.North America Substrate Like Pcb Market Report:

North America held a market size of $1.92 billion in 2023 with a forecasted growth to $3.56 billion in 2033. The growth is propelled by the presence of major electronics manufacturers and an uptick in smart device production.South America Substrate Like Pcb Market Report:

South America saw a market size of $0.06 billion in 2023, projected to reach $0.10 billion by 2033. The region's growth is hindered by economic factors but is supported by increasing digitalization and mobile phone penetration.Middle East & Africa Substrate Like Pcb Market Report:

The Middle East and Africa region's market size was $0.62 billion in 2023, anticipated to grow to $1.14 billion by 2033. Investment in telecommunications infrastructure and growing electronics markets in urban areas are key drivers.Tell us your focus area and get a customized research report.

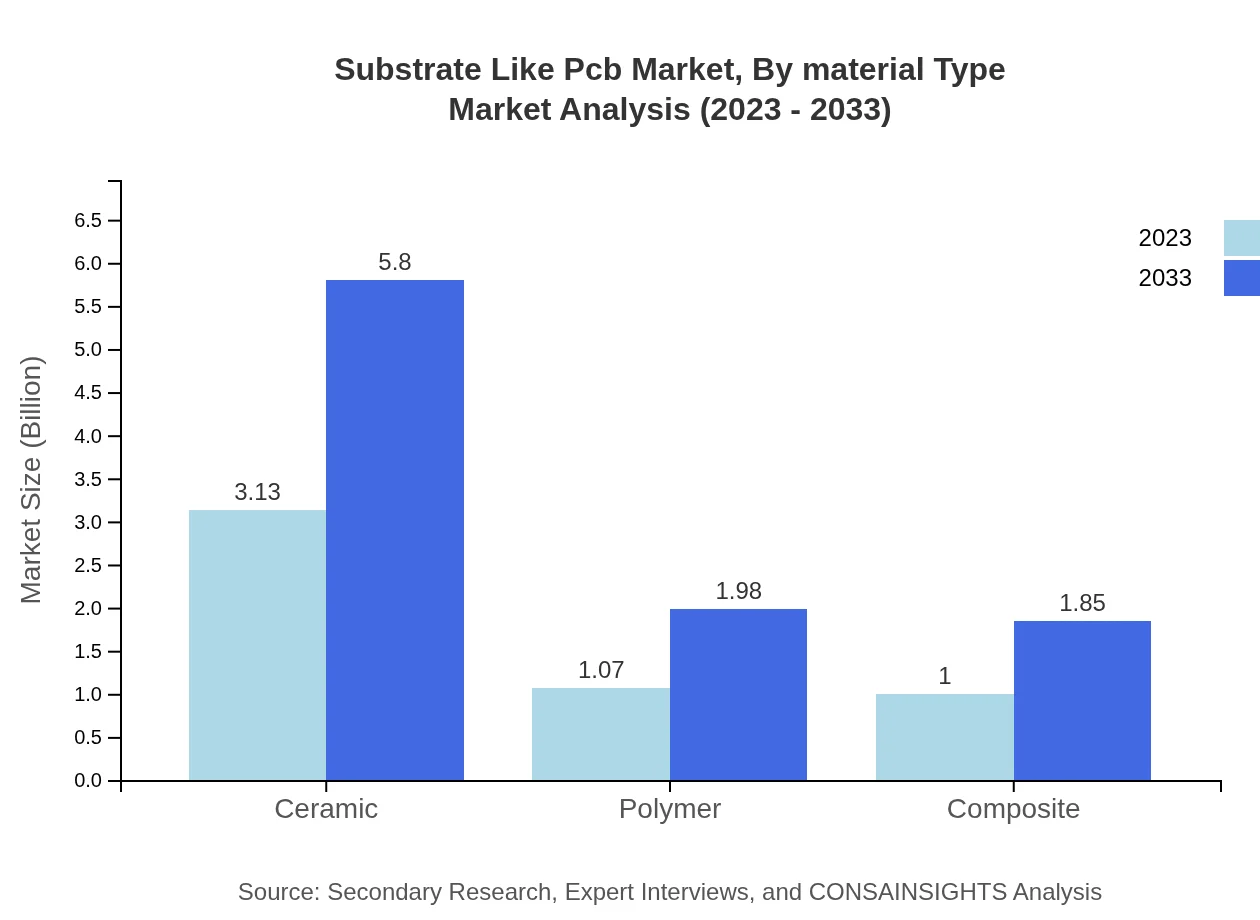

Substrate Like Pcb Market Analysis By Material Type

The Substrate Like PCB market, by material type, is dominated by ceramic substrates, which held a market size of $3.13 billion in 2023, projected to reach $5.80 billion by 2033. Polymer substrates also show growth from $1.07 billion to $1.98 billion, capitalizing on their lightweight and flexible nature, while composite materials are expected to grow slightly but retain a significant share due to their cost-effectiveness.

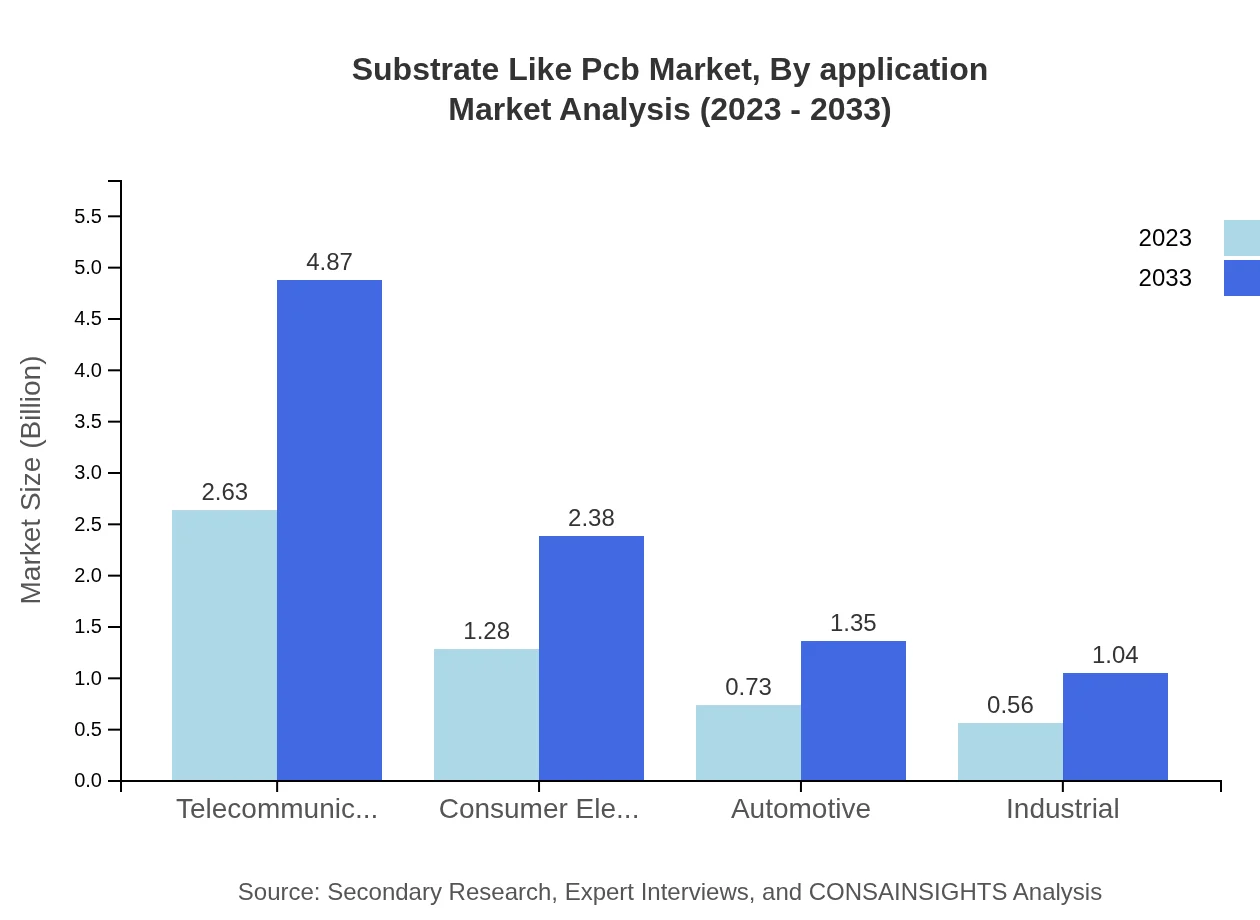

Substrate Like Pcb Market Analysis By Application

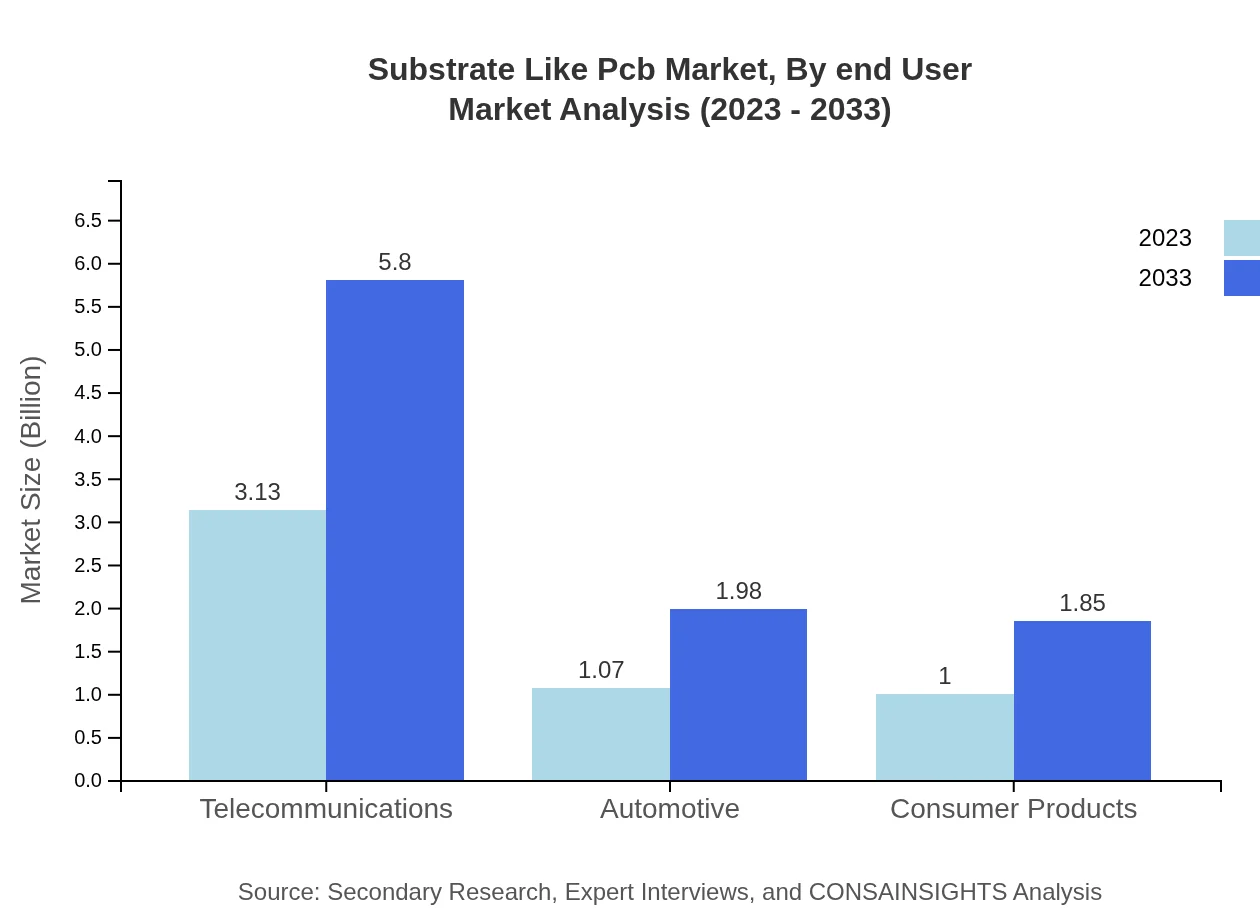

The telecommunications sector is a major driver for the Substrate Like PCB market, with sizes projected to increase from $3.13 billion in 2023 to $5.80 billion by 2033, maintaining a market share of 60.23%. The automotive sector shows strong growth potential, doubling from $1.07 billion to $1.98 billion over the same period, supported by advances in electric vehicle technologies.

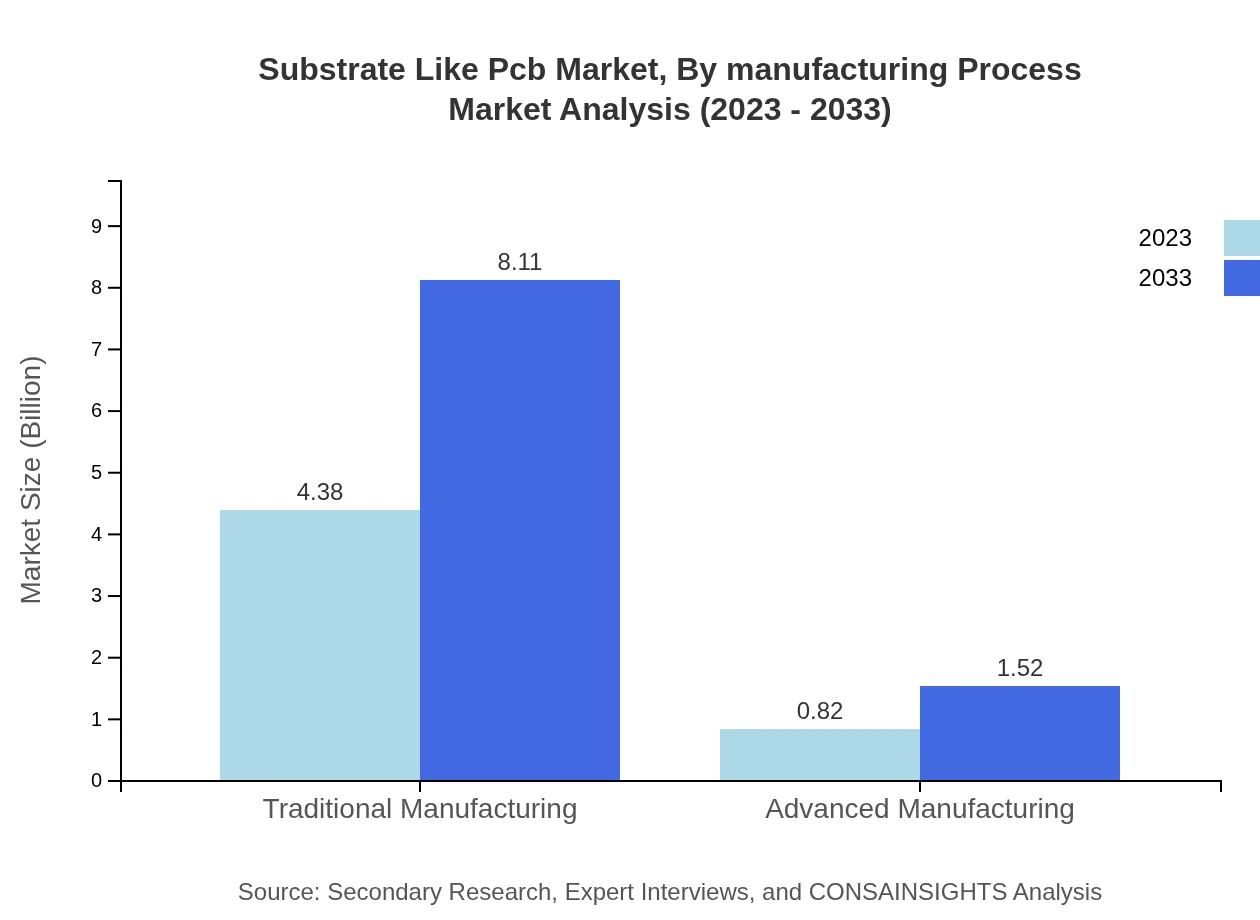

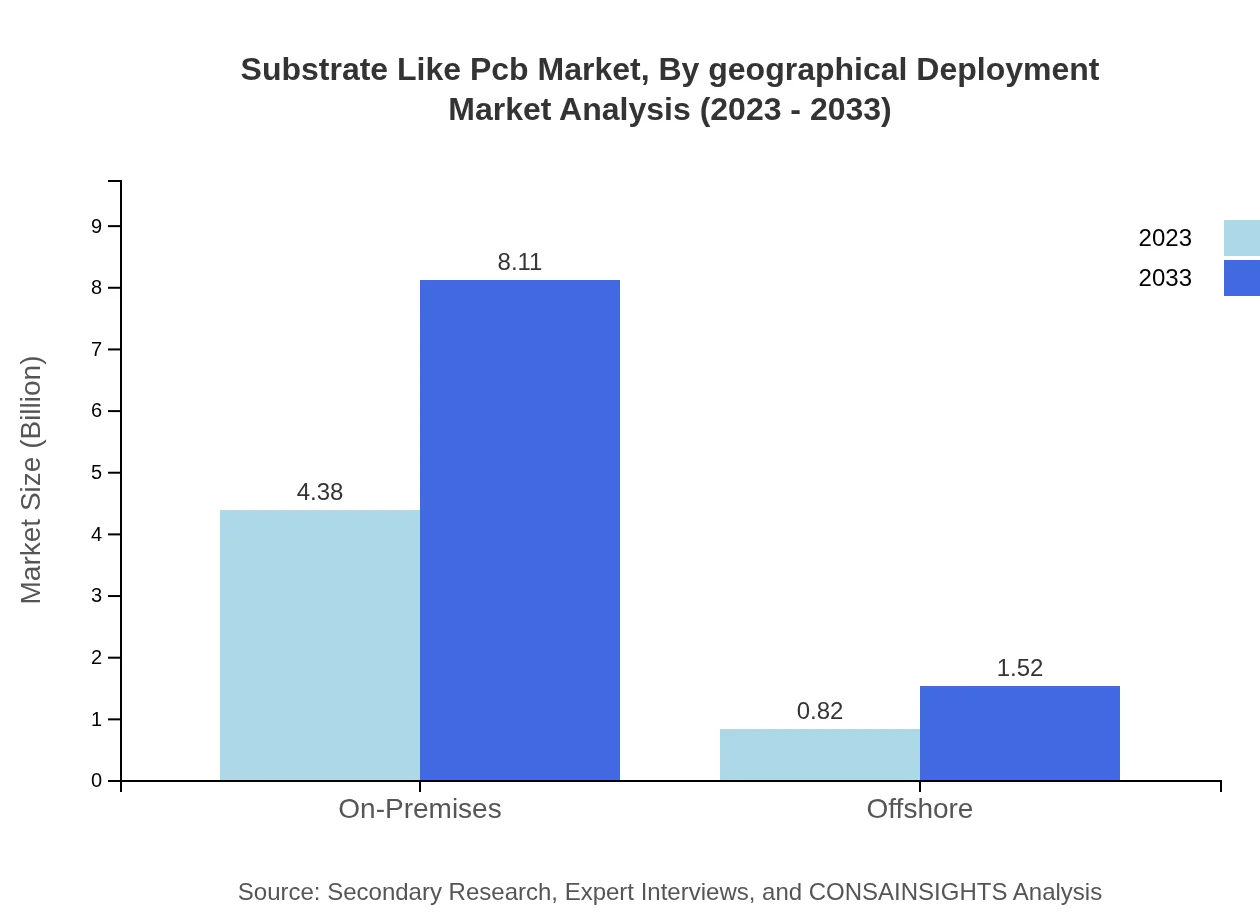

Substrate Like Pcb Market Analysis By Manufacturing Process

Traditional manufacturing processes account for 84.2% share of the Substrate Like PCB market in 2023, expected to remain dominant with steady growth from $4.38 billion to $8.11 billion through 2033. However, advanced manufacturing processes are gaining traction, set to grow from $0.82 billion to $1.52 billion as companies seek efficiency and precision.

Substrate Like Pcb Market Analysis By End User

The consumer electronics industry is a significant end-user of Substrate Like PCBs, projected to grow from $2.63 billion in 2023 to $4.87 billion by 2033. Automotive applications also have increasing demand, particularly for safety and infotainment systems, showcasing importance in the overall market structure.

Substrate Like Pcb Market Analysis By Geographical Deployment

Geographically, North America holds a prominent position, with a transition expected from $1.92 billion to $3.56 billion by 2033. The Asia Pacific market, while currently smaller, is projected to show fast growth due to manufacturing hubs and innovation in technology. Efforts to reduce dependency on imports will further benefit local suppliers.

Substrate Like Pcb Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Substrate Like Pcb Industry

Kyocera Corporation:

Kyocera specializes in advanced ceramics and produces high-quality substrate materials suitable for various electronic applications.Shenzhen Fastprint Circuit Tech Co., Ltd.:

Fastprint is a leading manufacturer of PCBs, offering innovative and efficient solutions tailored to the electronics industry's demands.Nippon Mektron, Ltd.:

Mektron is well-known for high-density interconnect substrates, playing a pivotal role in the telecommunications and consumer electronics sectors.AT&S:

Austrian technology company, AT&S produces high-end PCBs for automotive and industrial applications, focusing on R&D to meet future needs.We're grateful to work with incredible clients.

FAQs

What is the market size of substrate Like-PCB?

The substrate-like PCB market is projected to reach $5.2 billion by 2033, with a CAGR of 6.2% from 2023. The growing demand for advanced electronics significantly influences this growth, aligning with the overall technological advancements in various industries.

What are the key market players or companies in the substrate Like-PCB industry?

Key players in the substrate-like PCB market include established firms specializing in high-tech PCB manufacturing and innovation. These companies drive advancements in technology and compete on product quality, service, and pricing strategies.

What are the primary factors driving the growth in the substrate Like-PCB industry?

The growth in the substrate-like PCB industry is primarily driven by increasing demand for high-performance electronics, miniaturization trends in consumer devices, and the continual expansion of telecommunications and automotive sectors requiring advanced PCB substrates.

Which region is the fastest Growing in the substrate Like-PCB market?

Asia-Pacific is the fastest-growing region for substrate-like PCBs, with market projections soaring from $0.98 billion in 2023 to $1.81 billion by 2033. This growth reflects increased manufacturing capabilities and rising electronics consumption in the region.

Does ConsInsights provide customized market report data for the substrate Like-PCB industry?

Yes, ConsInsights offers customized market report data for the substrate-like PCB industry. Clients can tailor reports to their specific needs, including detailed market analysis and region-specific insights to better inform strategic decisions.

What deliverables can I expect from the substrate Like-PCB market research project?

From a substrate-like PCB market research project, expect comprehensive deliverables such as in-depth market analysis, regional insights, competitive landscape evaluations, and future growth trend forecasts, all designed to support informed decision-making.

What are the market trends of substrate Like-PCB?

Key trends in the substrate-like PCB market include advancements in manufacturing technologies, an increased focus on high-reliability applications, and the growing adoption of eco-friendly materials, reflecting the industry's response to environmental sustainability demands.