Sugar Alcohols Market Report

Published Date: 31 January 2026 | Report Code: sugar-alcohols

Sugar Alcohols Market Size, Share, Industry Trends and Forecast to 2033

This report explores the Sugar Alcohols market, providing insights into market size, industry trends, and regional analysis through 2033. It involves comprehensive segmentation details and forecasts for future growth, equipping stakeholders with essential data and insights.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

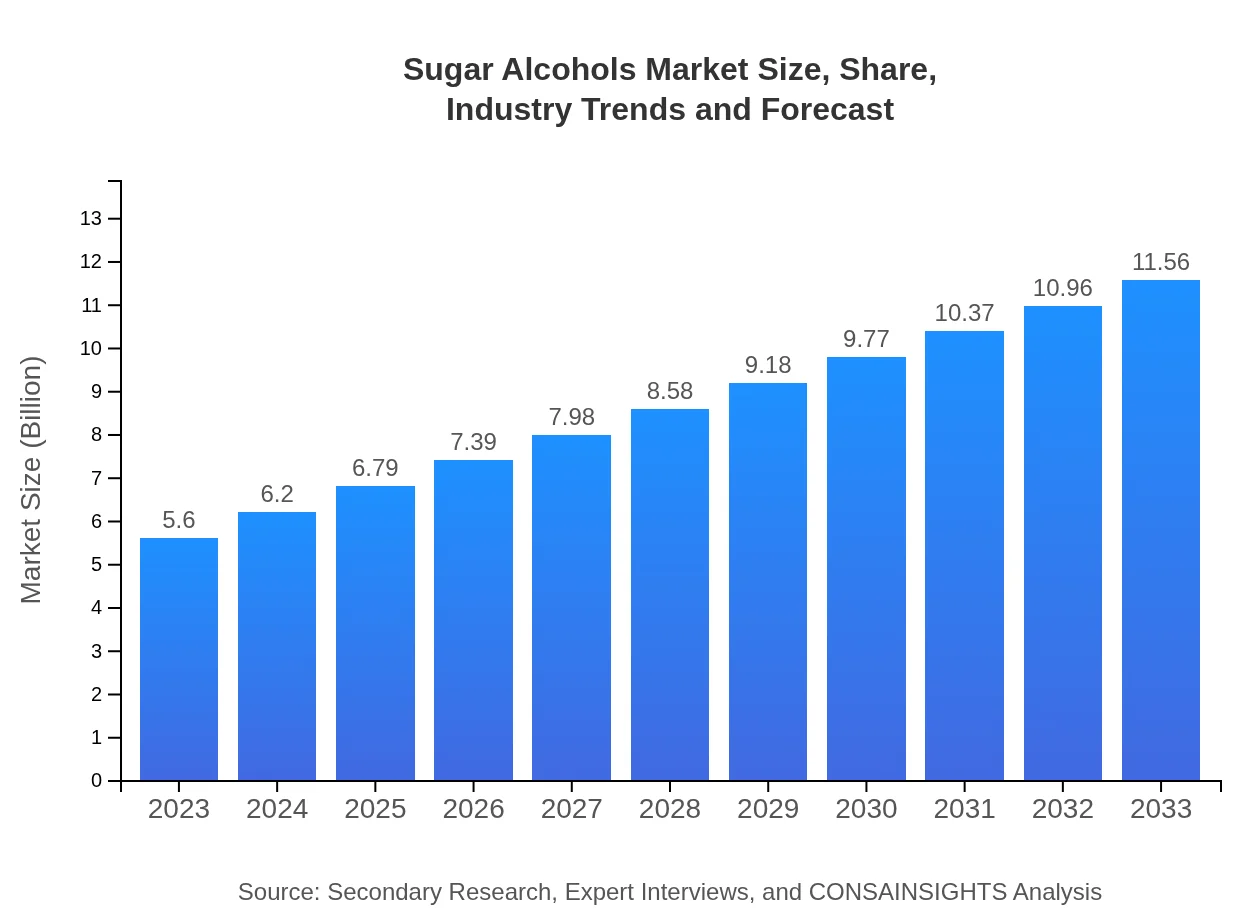

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 7.3% |

| 2033 Market Size | $11.56 Billion |

| Top Companies | Cargill, Incorporated, Ingredion Incorporated, Huangshan Huite Biological Technology Co., Ltd., Roquette Frères |

| Last Modified Date | 31 January 2026 |

Sugar Alcohols Market Overview

Customize Sugar Alcohols Market Report market research report

- ✔ Get in-depth analysis of Sugar Alcohols market size, growth, and forecasts.

- ✔ Understand Sugar Alcohols's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Sugar Alcohols

What is the Market Size & CAGR of the Sugar Alcohols market in 2023?

Sugar Alcohols Industry Analysis

Sugar Alcohols Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Sugar Alcohols Market Analysis Report by Region

Europe Sugar Alcohols Market Report:

In 2023, Europe’s Sugar Alcohols market is valued at 1.71 billion USD, with projections to reach 3.54 billion USD by 2033. The market is driven by strict regulations regarding sugar consumption and an increasing preference for sugar substitutes.Asia Pacific Sugar Alcohols Market Report:

In 2023, the Asia Pacific Sugar Alcohols market is valued at approximately 1.01 billion USD and is projected to reach 2.09 billion USD by 2033. The region's growth is driven by increasing disposable incomes and a shift towards healthier food options. Major markets within this region include China and India, where rapid urbanization impacts consumption patterns.North America Sugar Alcohols Market Report:

With a current market value of 2.12 billion USD in 2023, North America is anticipated to expand to 4.38 billion USD by 2033. The region is witnessing robust growth due to higher consumer awareness about health and wellness, alongside increasing applications in the food and beverage sector.South America Sugar Alcohols Market Report:

The South America Sugar Alcohols market is estimated at 0.31 billion USD in 2023 and is expected to grow to 0.64 billion USD by 2033. Growth factors include rising health awareness among consumers and an increase in the consumption of low-calorie food products.Middle East & Africa Sugar Alcohols Market Report:

The Middle East and Africa market stands at approximately 0.44 billion USD in 2023 and is poised to grow to 0.92 billion USD by 2033. The market is supported by expanding urban development and increasing awareness of health benefits associated with sugar alternatives.Tell us your focus area and get a customized research report.

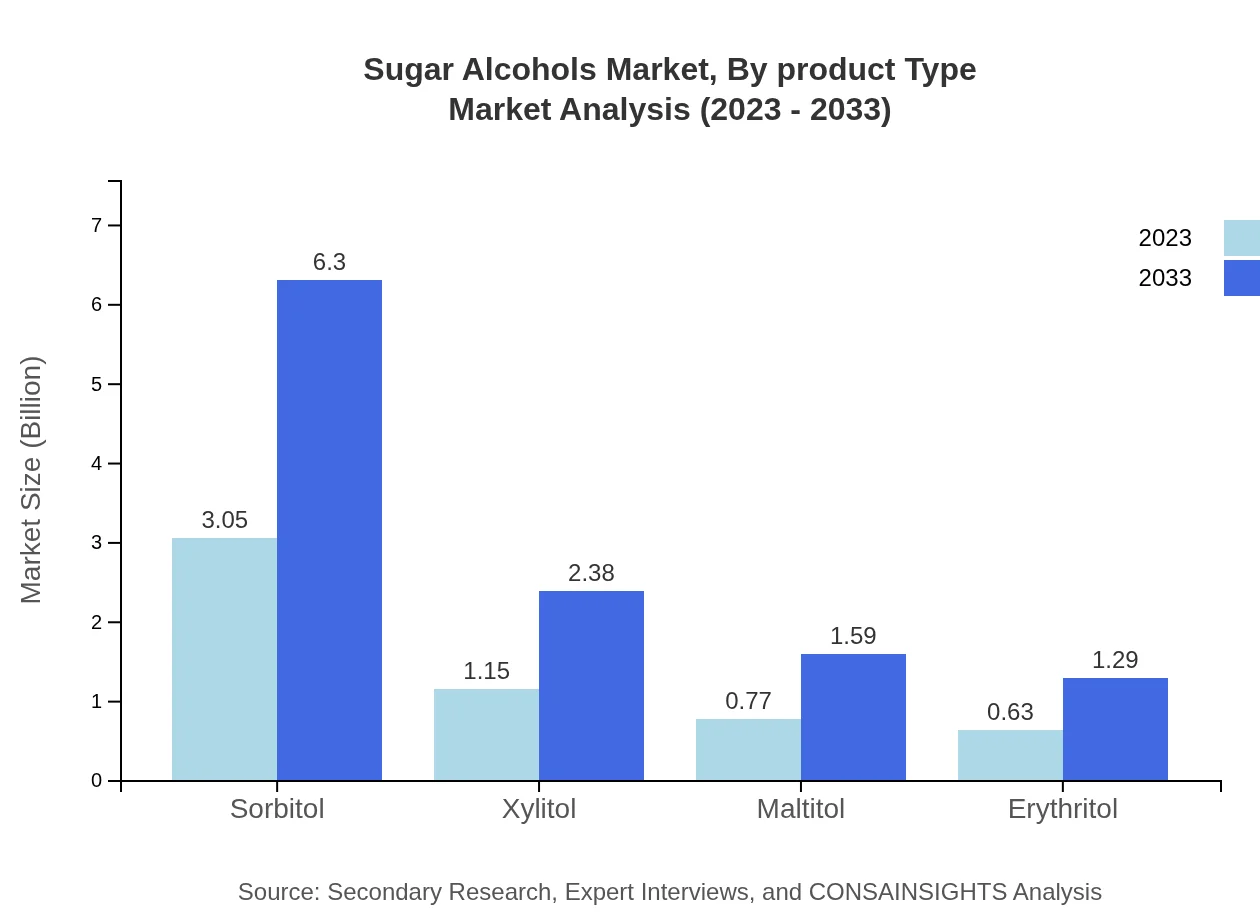

Sugar Alcohols Market Analysis By Product Type

The product type analysis reveals a dominant market share held by sorbitol, contributing a size of 3.05 billion USD in 2023 and expected to rise to 6.30 billion USD by 2033. Xylitol and maltitol follow, with sizes of 1.15 billion USD and 0.77 billion USD in 2023, growing to 2.38 billion USD and 1.59 billion USD respectively over the forecast period.

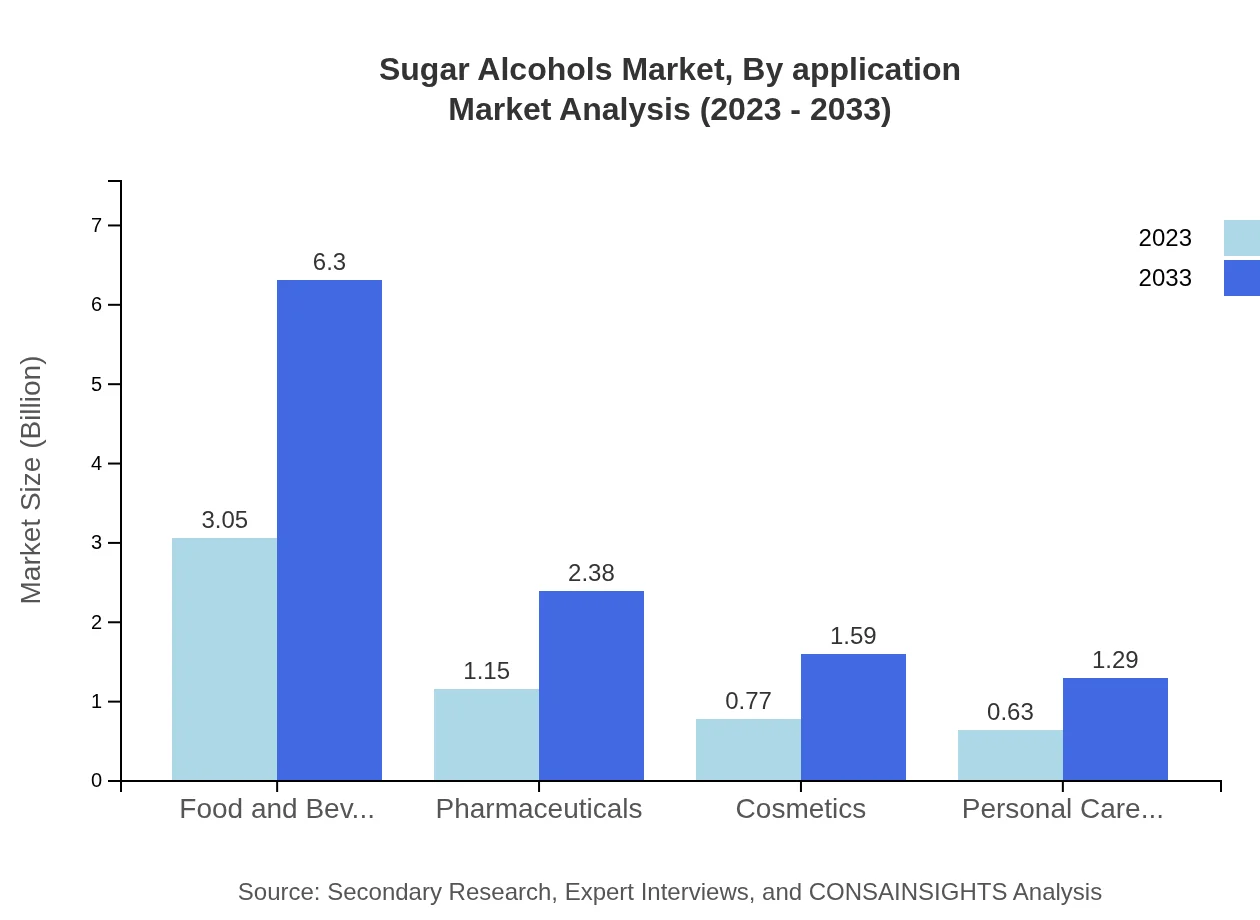

Sugar Alcohols Market Analysis By Application

The food and beverages sector dominates, with a market size of 3.05 billion USD in 2023, projected to reach 6.30 billion USD by 2033. Other applications such as pharmaceuticals and cosmetics also showcase significant growth, driven by health-oriented consumer trends.

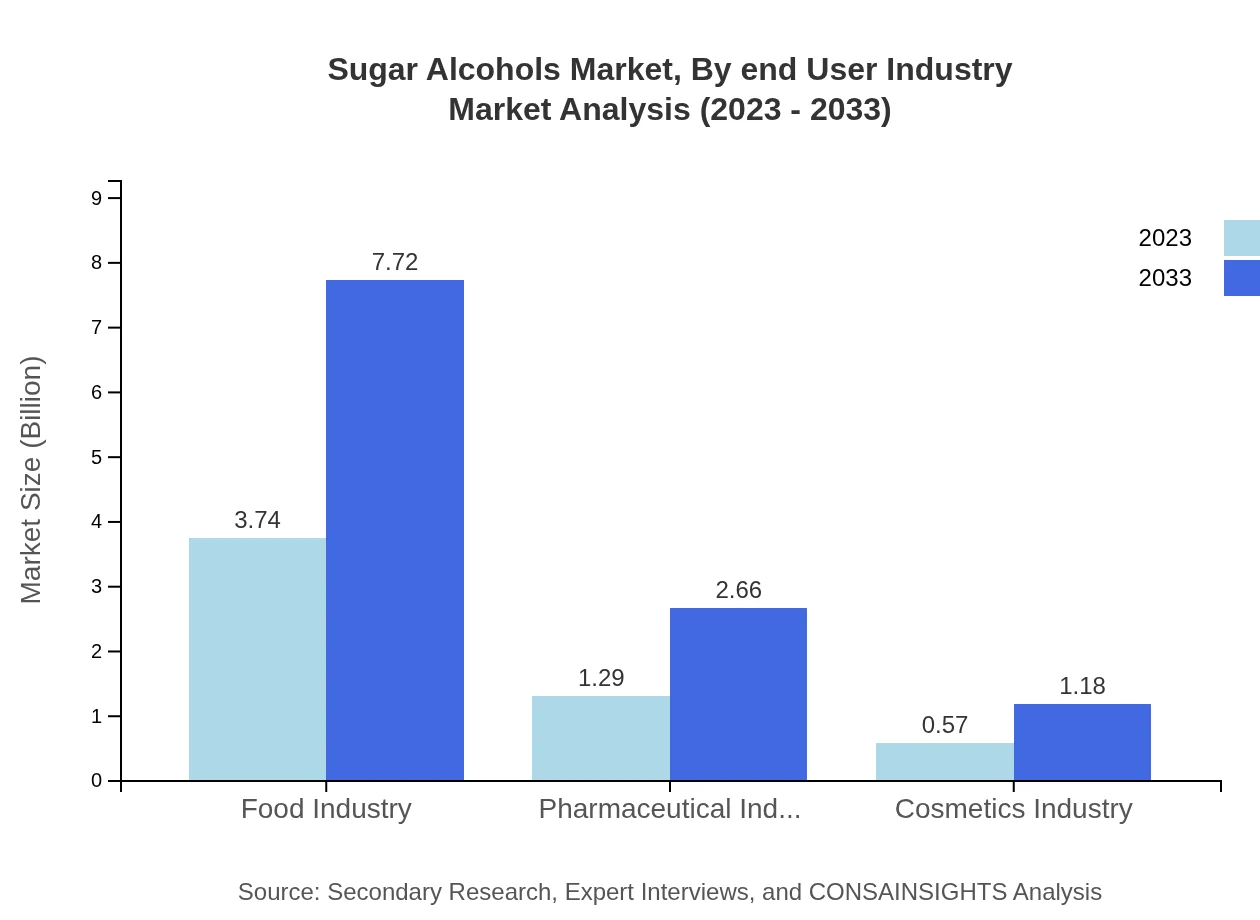

Sugar Alcohols Market Analysis By End User Industry

The Sugar Alcohols market finds substantial utilization in the food and pharmaceutical industries, comprising shares of 66.75% and 23.02% respectively as of 2023, indicating a robust demand foundation in these segments driven by health-focused products.

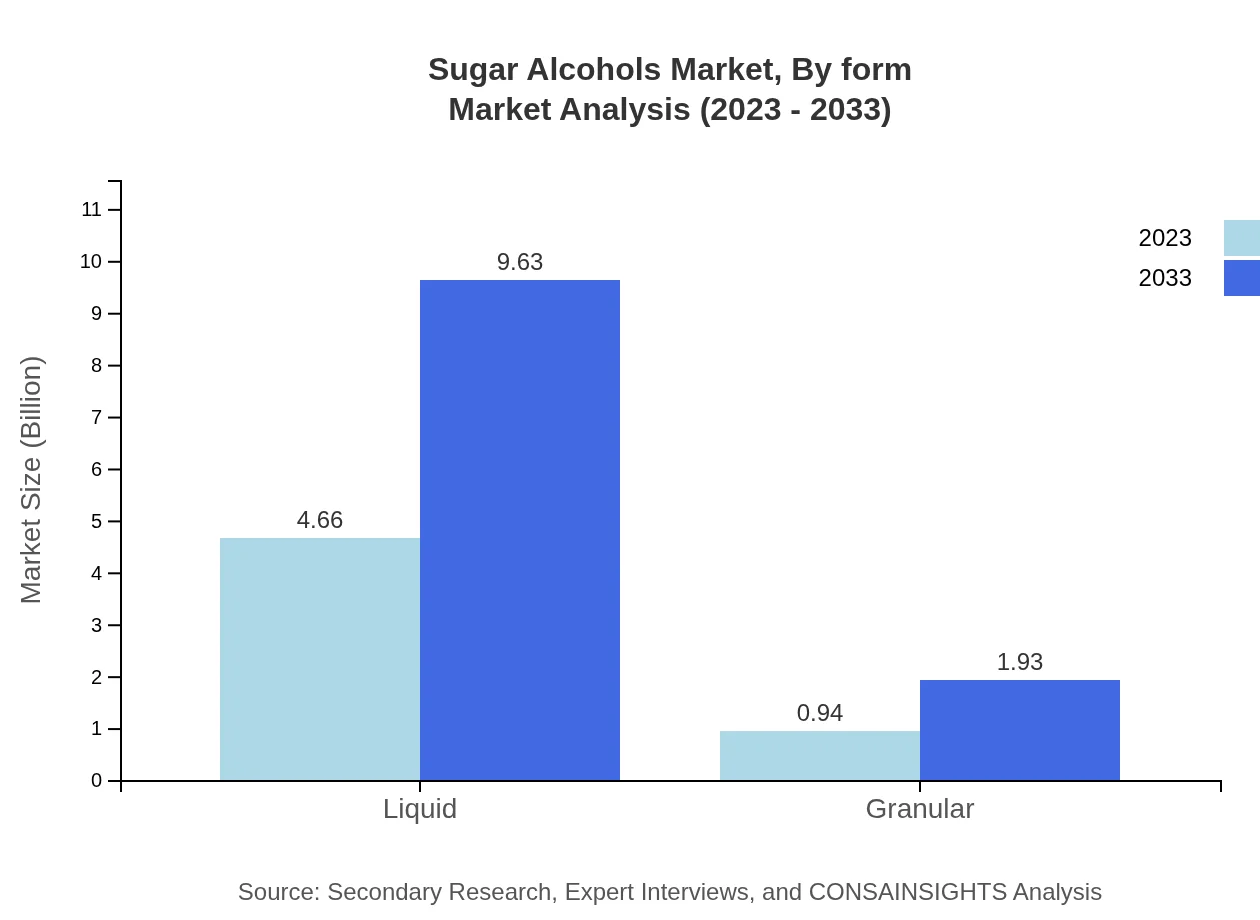

Sugar Alcohols Market Analysis By Form

The liquid form of sugar alcohols continues to lead the market, representing a significant portion of market participation. As of 2023, liquid sugar alcohols account for 83.27% of the market share.

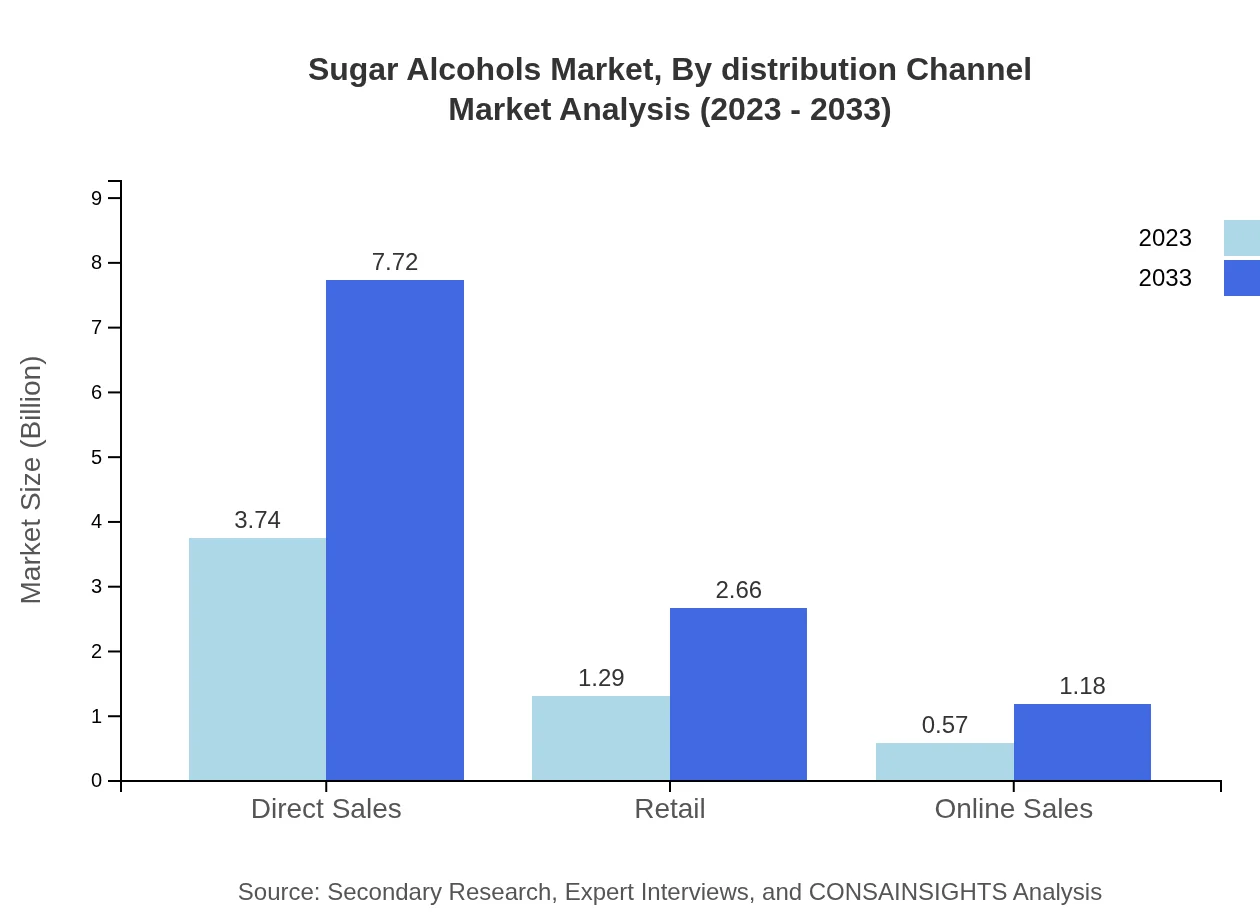

Sugar Alcohols Market Analysis By Distribution Channel

Direct sales channels dominate, capturing 66.75% of the Sugar Alcohols market share in 2023. This is aided by the trend of health-conscious consumers seeking direct purchasing options from manufacturers.

Sugar Alcohols Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Sugar Alcohols Industry

Cargill, Incorporated:

Cargill is a global leader in the sugar alcohols market, providing a broad range of sweetening products tailored for food and beverage applications, focusing on health-oriented formulations.Ingredion Incorporated:

Ingredion offers innovative solutions in the sugar alcohols segment, focusing on product development for low-calorie food products, beverages, and nutritional applications.Huangshan Huite Biological Technology Co., Ltd.:

Huangshan Huite is a recognized producer of sugar alcohols, supplying various products such as sorbitol and erythritol for diverse applications across global markets.Roquette Frères:

A key player in the food ingredient sector, Roquette offers a variety of sugar alcohols and promotes their applications in various sectors, including food, nutrition, and cosmetics.We're grateful to work with incredible clients.

FAQs

What is the market size of sugar Alcohols?

The global sugar-alcohols market was valued at approximately 5.6 billion in 2023 and is projected to grow with a CAGR of 7.3%, reaching significant growth by 2033.

What are the key market players or companies in the sugar Alcohols industry?

Key players in the sugar-alcohols market include companies such as Cargill, Archer Daniels Midland Company, and DuPont, which lead in production and distribution across various segments.

What are the primary factors driving the growth in the sugar Alcohols industry?

The growth in the sugar-alcohols market is driven by rising health consciousness, increasing demand for sugar substitutes, and the expansion of end-use sectors like food, beverages, and pharmaceuticals.

Which region is the fastest Growing in the sugar Alcohols market?

The fastest-growing region in the sugar-alcohols market is North America, where market size is expected to increase from 2.12 billion in 2023 to 4.38 billion by 2033.

Does ConsaInsights provide customized market report data for the sugar Alcohols industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs and queries in the sugar-alcohols industry, ensuring rich insights for stakeholders.

What deliverables can I expect from this sugar Alcohols market research project?

Expect comprehensive reports, market forecasts, segment analysis, and competitive landscape details regarding the sugar-alcohols market, along with actionable insights and strategic recommendations.

What are the market trends of sugar Alcohols?

Current trends in the sugar-alcohols market include increasing consumer preference for healthier options and innovations in product formulations, particularly in the food and beverage sectors.