Sugar Based Excipients Market Report

Published Date: 31 January 2026 | Report Code: sugar-based-excipients

Sugar Based Excipients Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Sugar Based Excipients market from 2023 to 2033, focusing on market size, growth potential, trends, regional insights, and leading companies in the industry.

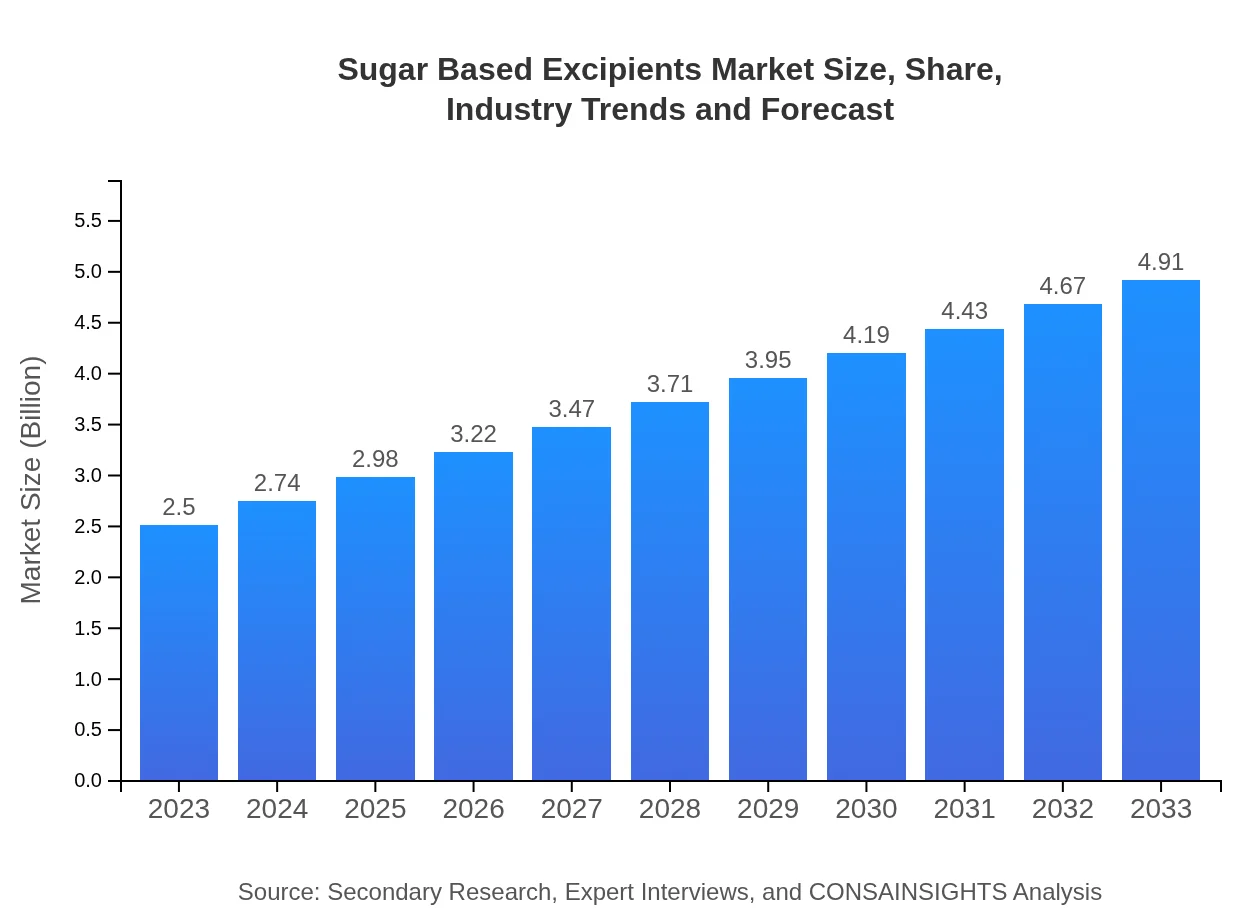

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $4.91 Billion |

| Top Companies | Ashland Global Holdings Inc., BASF SE, Roquette Frères, Evonik Industries AG |

| Last Modified Date | 31 January 2026 |

Sugar Based Excipients Market Overview

Customize Sugar Based Excipients Market Report market research report

- ✔ Get in-depth analysis of Sugar Based Excipients market size, growth, and forecasts.

- ✔ Understand Sugar Based Excipients's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Sugar Based Excipients

What is the Market Size & CAGR of Sugar Based Excipients market in 2023 and 2033?

Sugar Based Excipients Industry Analysis

Sugar Based Excipients Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Sugar Based Excipients Market Analysis Report by Region

Europe Sugar Based Excipients Market Report:

In Europe, the market is expected to increase from $0.84 billion in 2023 to $1.65 billion by 2033. Stringent regulations favoring the safety of excipients and a focus on organic and natural products among consumers have propelled this market forward.Asia Pacific Sugar Based Excipients Market Report:

The Asia Pacific region held a market size of $0.46 billion in 2023 and is expected to reach $0.91 billion by 2033. This growth is driven by the rising demand for pharmaceuticals and food products, particularly in countries like China and India, alongside increasing investments in healthcare infrastructure.North America Sugar Based Excipients Market Report:

North America, valued at $0.83 billion in 2023, is projected to grow to $1.64 billion by 2033, primarily due to the high usage of excipients in drug formulations and a strong preference for natural ingredients among manufacturers. The presence of significant pharmaceutical companies further supports market growth.South America Sugar Based Excipients Market Report:

In South America, the market is expected to grow from $0.07 billion in 2023 to $0.14 billion by 2033. The growth is attributed to improved economic conditions and an increase in pharmaceutical manufacturing, coupled with an expanding food industry embracing sugar-based excipients in formulation.Middle East & Africa Sugar Based Excipients Market Report:

The Middle East and Africa market size is set to grow from $0.29 billion in 2023 to $0.57 billion by 2033, driven by an expanding healthcare sector and increasing awareness of the benefits of sugar-based excipients in product formulations, complemented by economic development in the region.Tell us your focus area and get a customized research report.

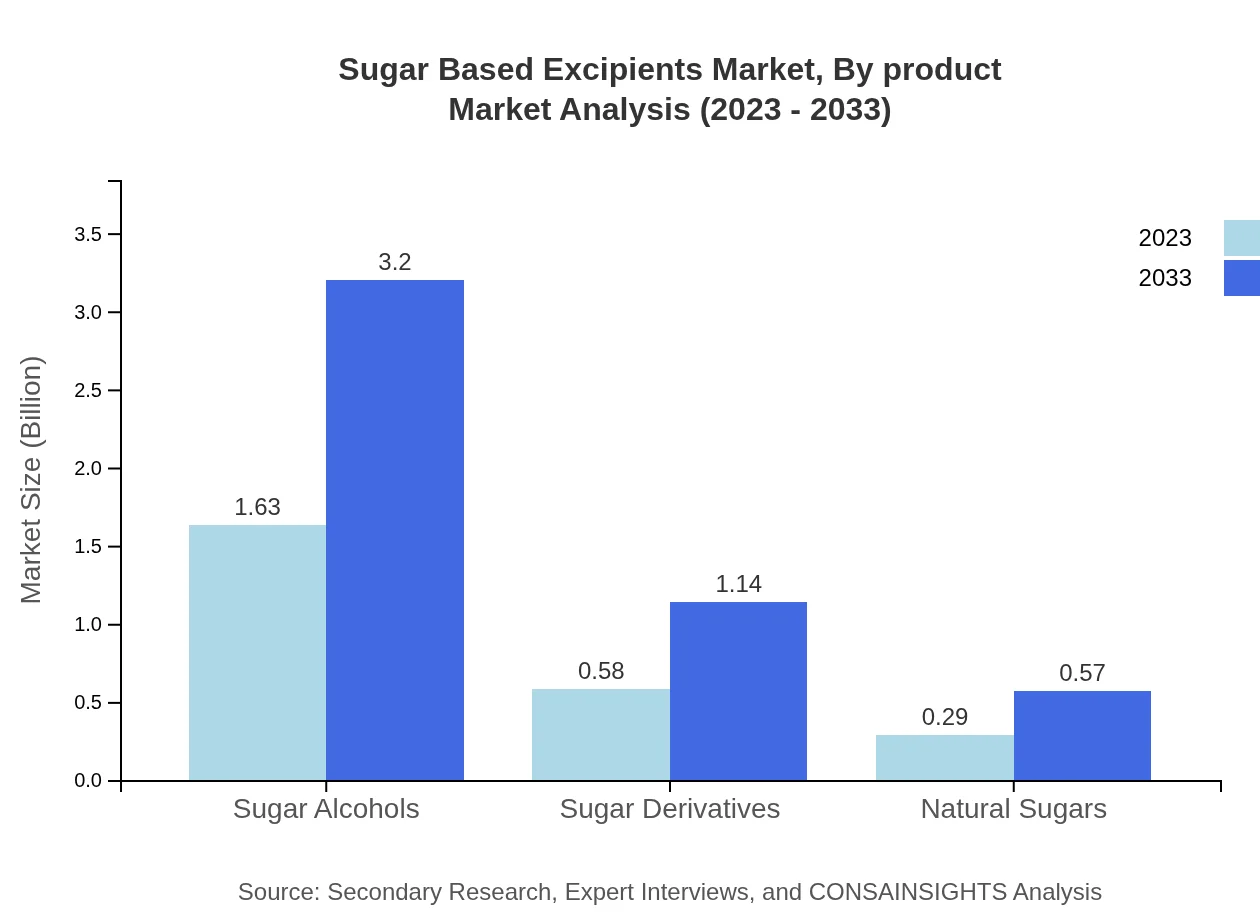

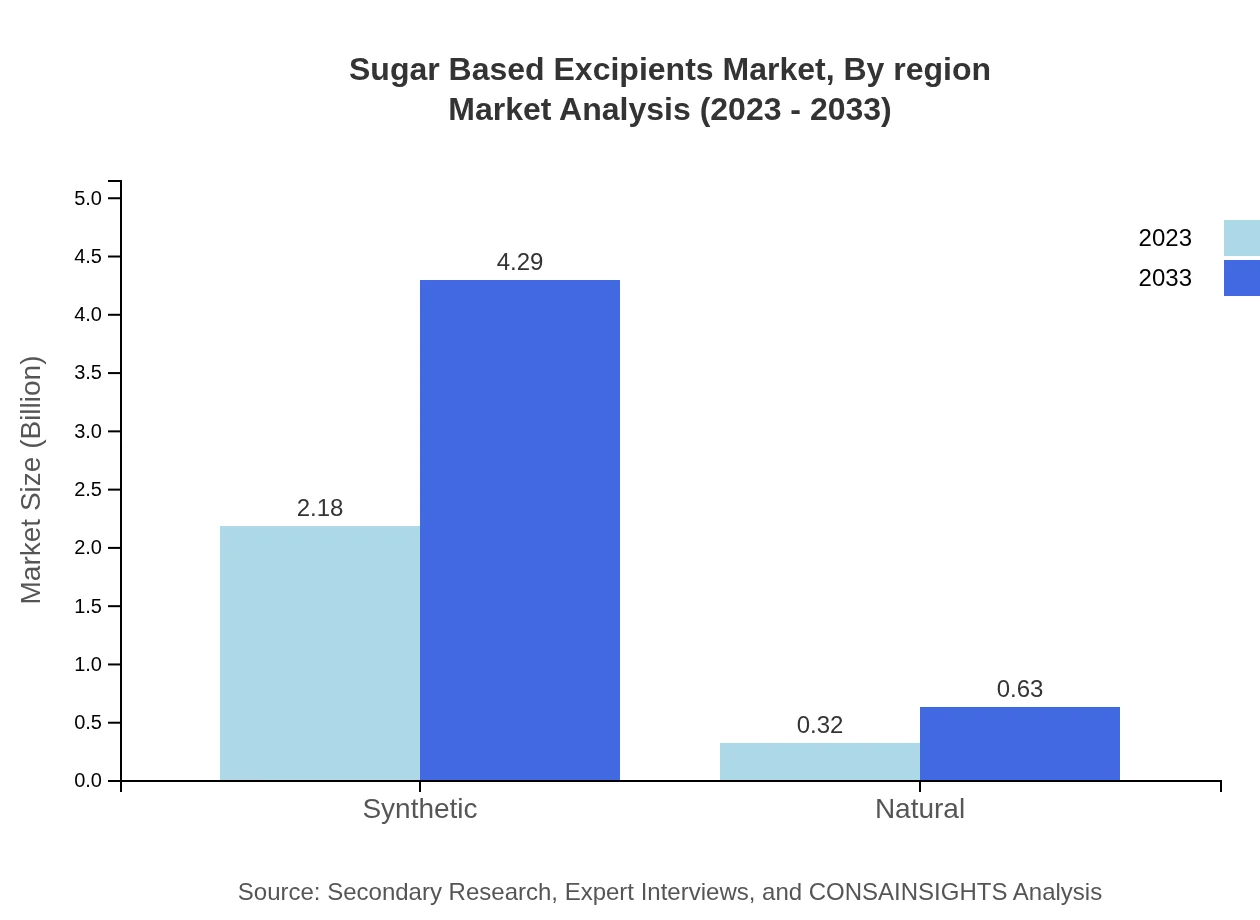

Sugar Based Excipients Market Analysis By Product

The Sugar-based Excipients market by product is dominated by synthetic excipients, which contribute approximately 87.28% in market share, equating to a size of $2.18 billion in 2023, and expected to grow to $4.29 billion by 2033. Sugar alcohols, comprising 65.13% of the market, will grow significantly, reflecting a shift toward multifunctional excipients. Natural sugars and derivatives also maintain a notable share, indicating a balanced demand across product types.

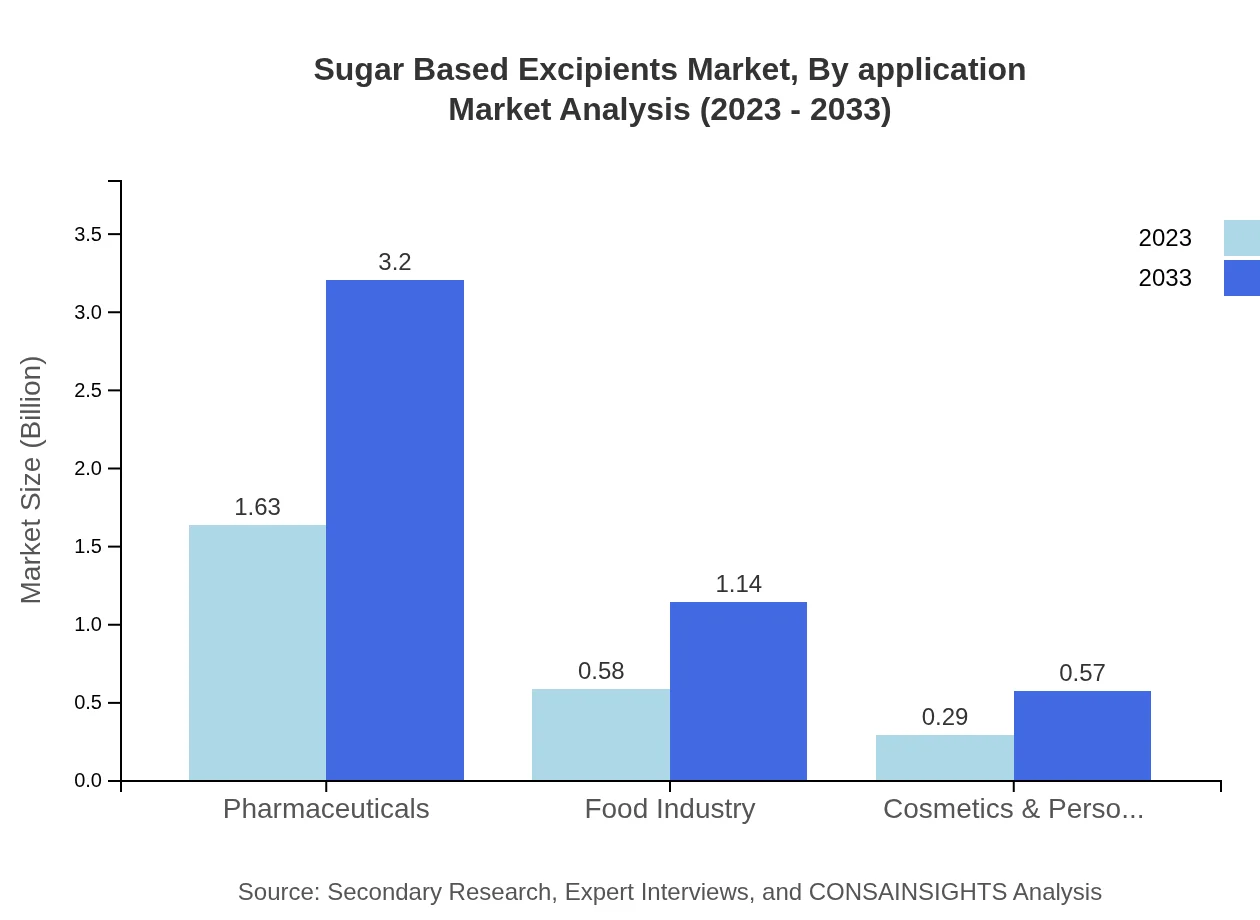

Sugar Based Excipients Market Analysis By Application

In the application segment, the pharmaceutical industry represents the largest market share, accounting for 65.13% in 2023, and expanding significantly to $3.20 billion by 2033. The food industry follows closely, while cosmetics and personal care applications also reflect growth due to increasing consumer demand for natural products and clean labels, illustrating the versatility of sugar-based excipients across various sectors.

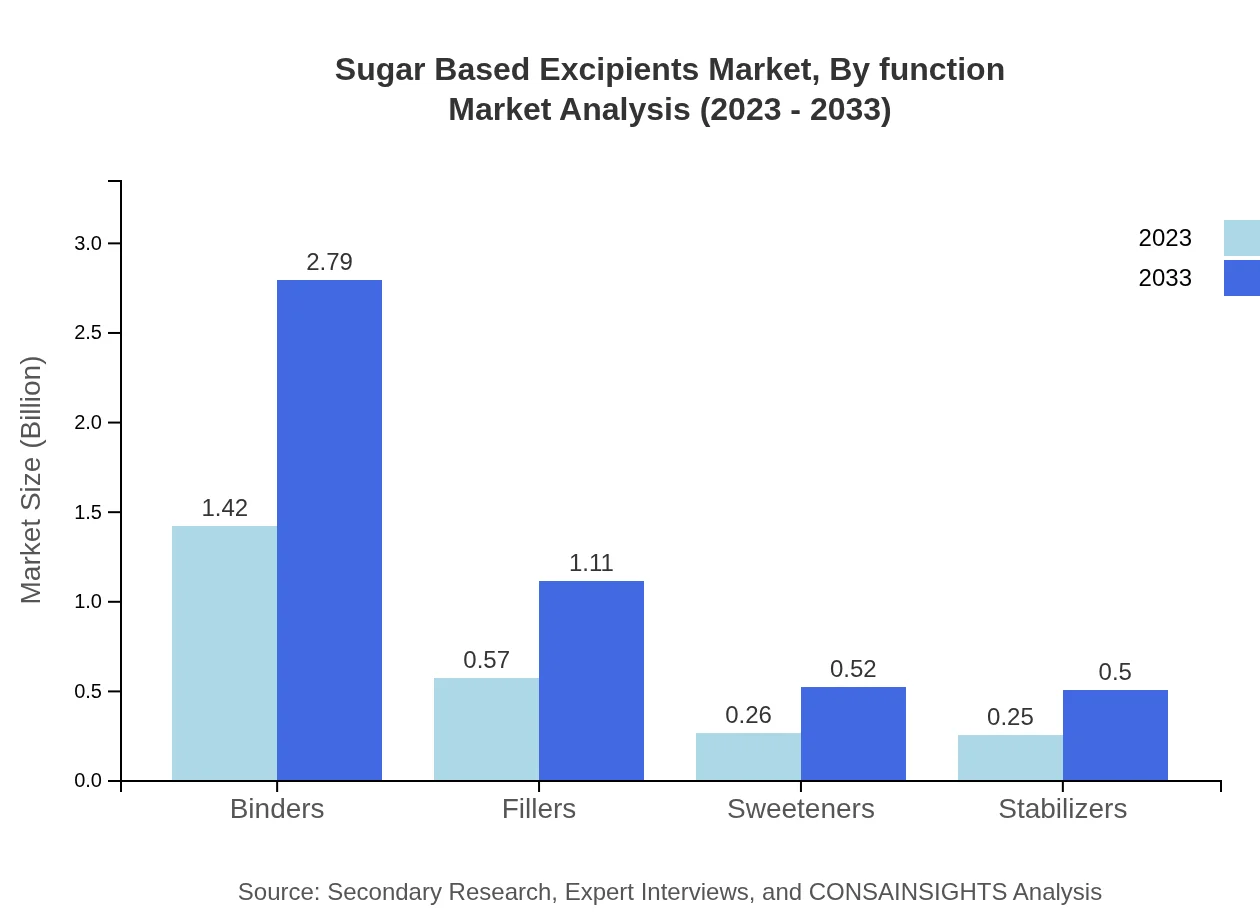

Sugar Based Excipients Market Analysis By Function

In terms of function, binders dominate with a market share of 56.79% in 2023, reputed for their essential role in tablet formulations. Fillers and stabilizers capture significant shares, enhancing product stability and user acceptance. The increasing demand for multifunctional excipients signifies a trend toward combining functionalities in fewer compounds, showcasing the market's evolution.

Sugar Based Excipients Market Analysis By Region

Segmentation by region highlights North America and Europe as key markets, propelled by regulatory frameworks favoring quality excipients and innovative applications in pharmaceuticals. Asia Pacific shows rapid growth potential driven by increasing healthcare investments and a rising middle-class population, widening the scope and acceptance of sugar-based excipients.

Sugar Based Excipients Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Sugar Based Excipients Industry

Ashland Global Holdings Inc.:

Ashland is a leading global specialty chemicals company known for its portfolio of excipients used in pharmaceuticals and other consumer industries, focusing on innovative formulations.BASF SE:

BASF is a major player in the excipients market, offering a wide array of sugar-based excipients that enhance drug formulations and food products, committed to sustainability.Roquette Frères:

Roquette is recognized for its extensive product line in sugar excipients, particularly in the pharmaceutical and food sectors, renowned for quality and innovation.Evonik Industries AG:

Evonik provides tailored excipients solutions, emphasizing functionality and user experience in pharmaceuticals and food products, advancing industry practices.We're grateful to work with incredible clients.

FAQs

What is the market size of sugar Based excipients?

The sugar-based excipients market is projected to reach approximately $2.5 billion by 2033, exhibiting a robust CAGR of 6.8% from 2023 to 2033, driven by increasing demand in pharmaceuticals and food industries.

What are the key market players or companies in the sugar Based excipients industry?

Key players in the sugar-based excipients market include major pharmaceutical and chemical companies focused on innovative excipient formulations to improve bioavailability and product stability, although specific company names were not provided in this context.

What are the primary factors driving the growth in the sugar Based excipients industry?

Primary growth factors include increasing demand for oral drug formulations, a rise in the prevalence of chronic diseases, and innovations in sugar-based excipients that enhance drug solubility and absorption, driving market expansion.

Which region is the fastest Growing in the sugar Based excipients?

Europe is identified as the fastest-growing region for sugar-based excipients, with the market projected to grow from $0.84 billion in 2023 to $1.65 billion by 2033, showcasing significant growth potential.

Does ConsaInsights provide customized market report data for the sugar Based excipients industry?

Yes, ConsaInsights offers customized market report data for the sugar-based excipients industry, catering to specific client needs and enabling detailed insights into market trends and forecasts.

What deliverables can I expect from this sugar Based excipients market research project?

Deliverables include comprehensive market analysis reports, segmented data, regional insights, competitive analysis, and trends forecasting to support informed decision-making in the sugar-based excipients sector.

What are the market trends of sugar Based excipients?

Market trends indicate a growing preference for natural and synthetic sugar-based excipients, increased use in pharmaceuticals and food industries, and a shift towards eco-friendly production practices.