Sugar Decorations And Inclusions Market Report

Published Date: 31 January 2026 | Report Code: sugar-decorations-and-inclusions

Sugar Decorations And Inclusions Market Size, Share, Industry Trends and Forecast to 2033

This report covers the comprehensive analysis of the Sugar Decorations and Inclusions market, highlighting key insights, trends, and forecasts from 2023 to 2033. It delves into market size, segmentation, regional performance, and technological advancements shaping the industry.

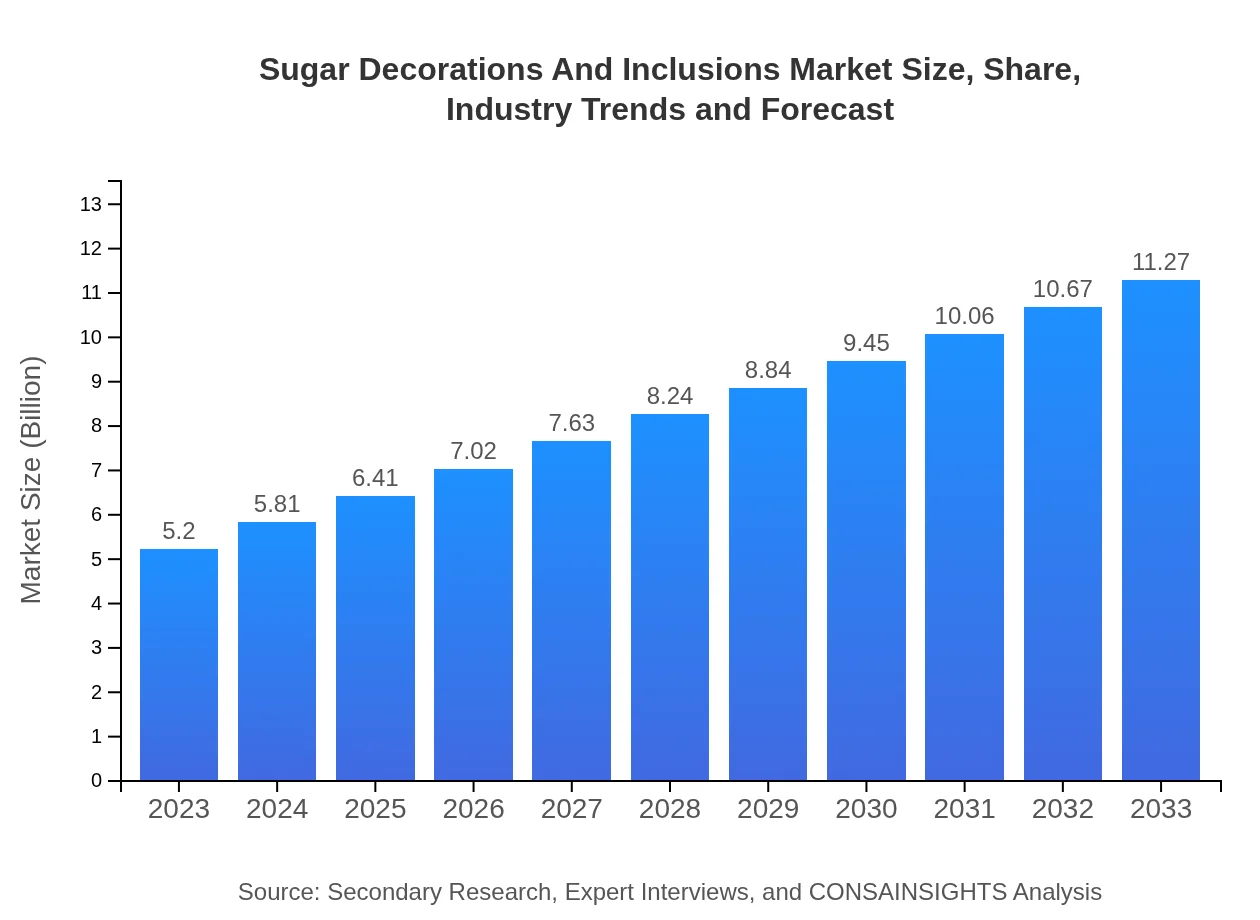

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.20 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $11.27 Billion |

| Top Companies | Mondelez International, Inc., Cargill, Inc., Barry Callebaut, Olam International |

| Last Modified Date | 31 January 2026 |

Sugar Decorations And Inclusions Market Overview

Customize Sugar Decorations And Inclusions Market Report market research report

- ✔ Get in-depth analysis of Sugar Decorations And Inclusions market size, growth, and forecasts.

- ✔ Understand Sugar Decorations And Inclusions's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Sugar Decorations And Inclusions

What is the Market Size & CAGR of Sugar Decorations And Inclusions market in 2023?

Sugar Decorations And Inclusions Industry Analysis

Sugar Decorations And Inclusions Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Sugar Decorations And Inclusions Market Analysis Report by Region

Europe Sugar Decorations And Inclusions Market Report:

Europe represents a significant portion of the market with a size of $1.63 billion in 2023, projected to grow to $3.54 billion by 2033. Increasing preference for visually appealing desserts and the rise of boutique bakeries are pivotal to this market's expansion.Asia Pacific Sugar Decorations And Inclusions Market Report:

In the Asia Pacific region, the market size was estimated at $0.96 billion in 2023, with projections of reaching $2.08 billion by 2033. The growth is driven by rapid industrialization in food processing and an increase in confectionery consumption, supported by rising disposable incomes.North America Sugar Decorations And Inclusions Market Report:

In North America, the market is valued at $1.90 billion in 2023, with forecasts indicating growth to $4.11 billion by 2033. This region leads in innovation, with high demand for custom cake decorations and premium confectionery products being major drivers.South America Sugar Decorations And Inclusions Market Report:

The South American market for Sugar Decorations and Inclusions had an estimated size of $0.13 billion in 2023, expected to grow to $0.29 billion by 2033. This growth is attributed to the increasing popularity of baking as a home-based activity and the rising demand for specialty decorations.Middle East & Africa Sugar Decorations And Inclusions Market Report:

The Middle East and Africa market is valued at $0.57 billion in 2023 and expected to reach $1.25 billion by 2033. The growth is driven by a burgeoning food service industry and a rising trend of gourmet food experiences among consumers.Tell us your focus area and get a customized research report.

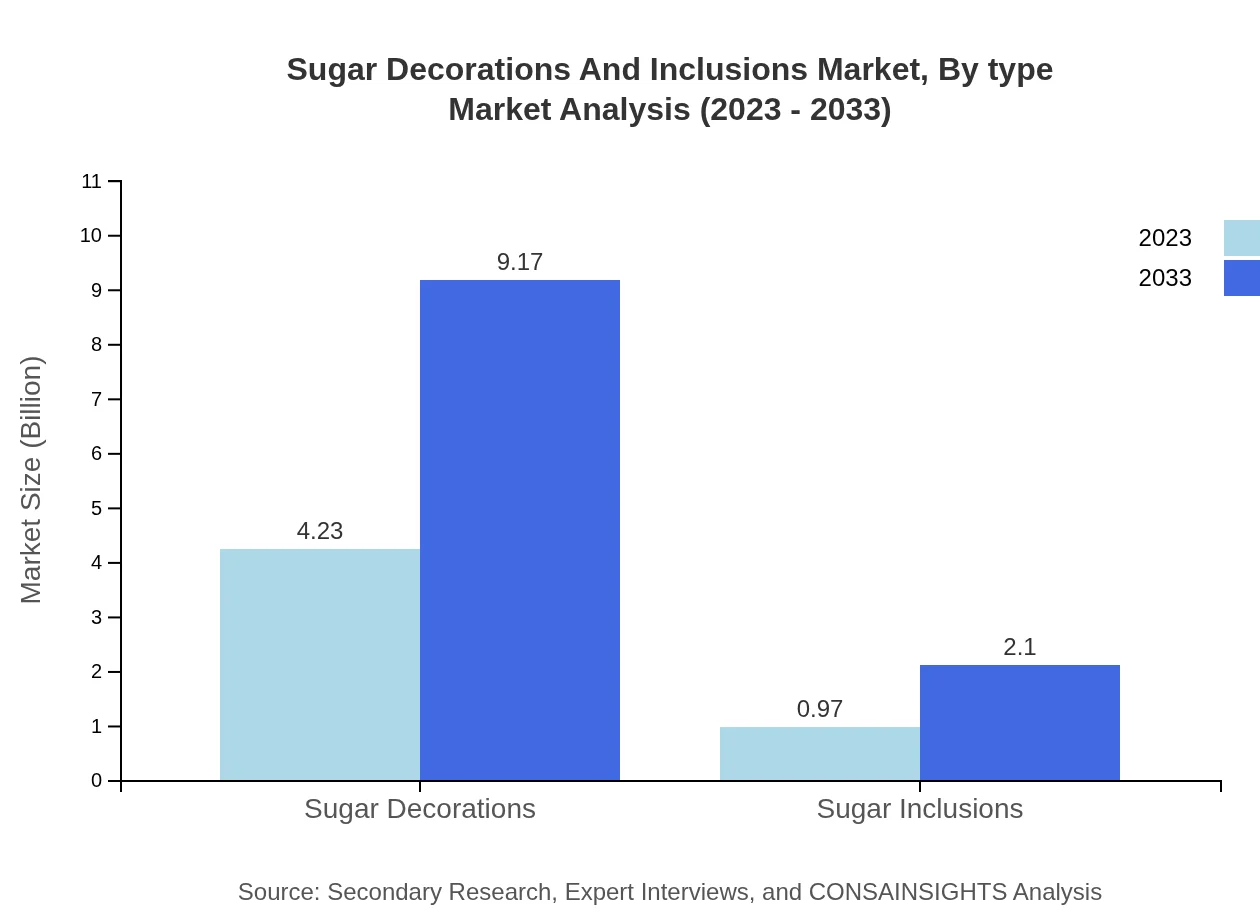

Sugar Decorations And Inclusions Market Analysis By Type

The market can be divided into sugar decorations and sugar inclusions. Sugar decorations dominate the market with a size of $4.23 billion in 2023 and are expected to grow to $9.17 billion by 2033, reflecting substantial market shares. Sugar inclusions are growing, currently at $0.97 billion and projected to reach $2.10 billion, showcasing an increased demand for functional ingredients in product recipes.

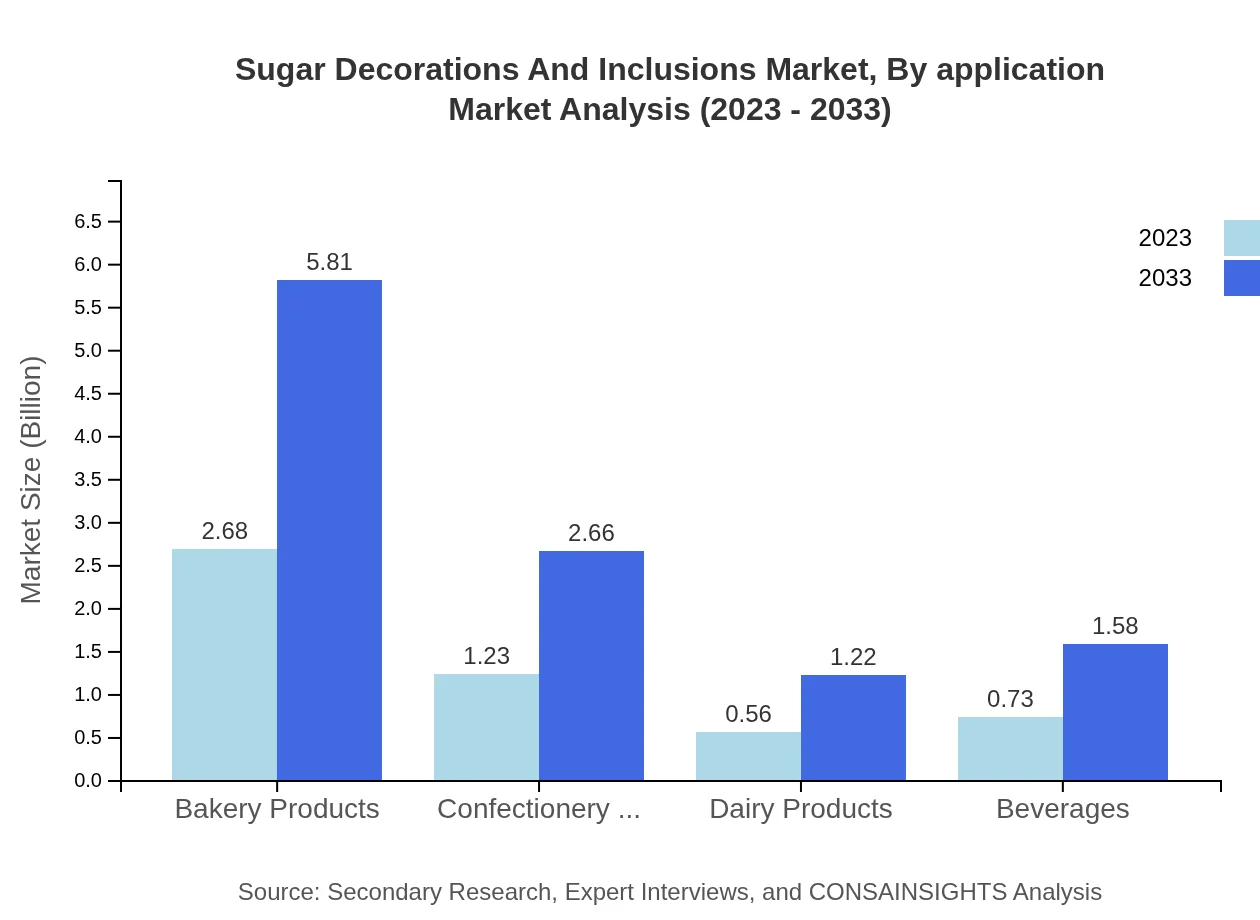

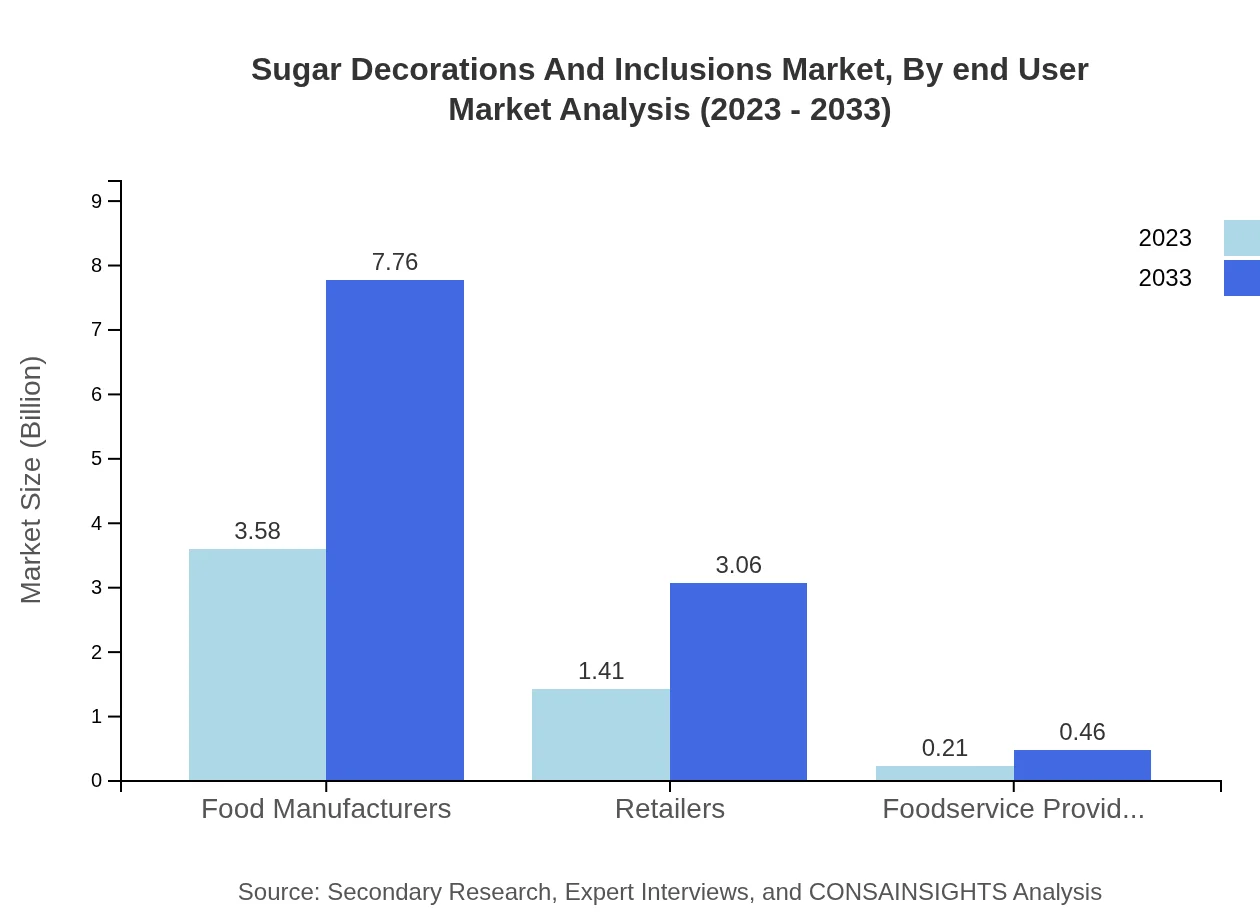

Sugar Decorations And Inclusions Market Analysis By Application

Market applications are categorized into food manufacturers, retailers, and foodservice providers. Food manufacturers hold the largest share at 68.8% in 2023, translating to a market size of $3.58 billion, while retailers account for 27.15%, contributing $1.41 billion. The foodservice sector is a smaller yet growing segment, currently at $0.21 billion, expected to expand as culinary experiences gain popularity.

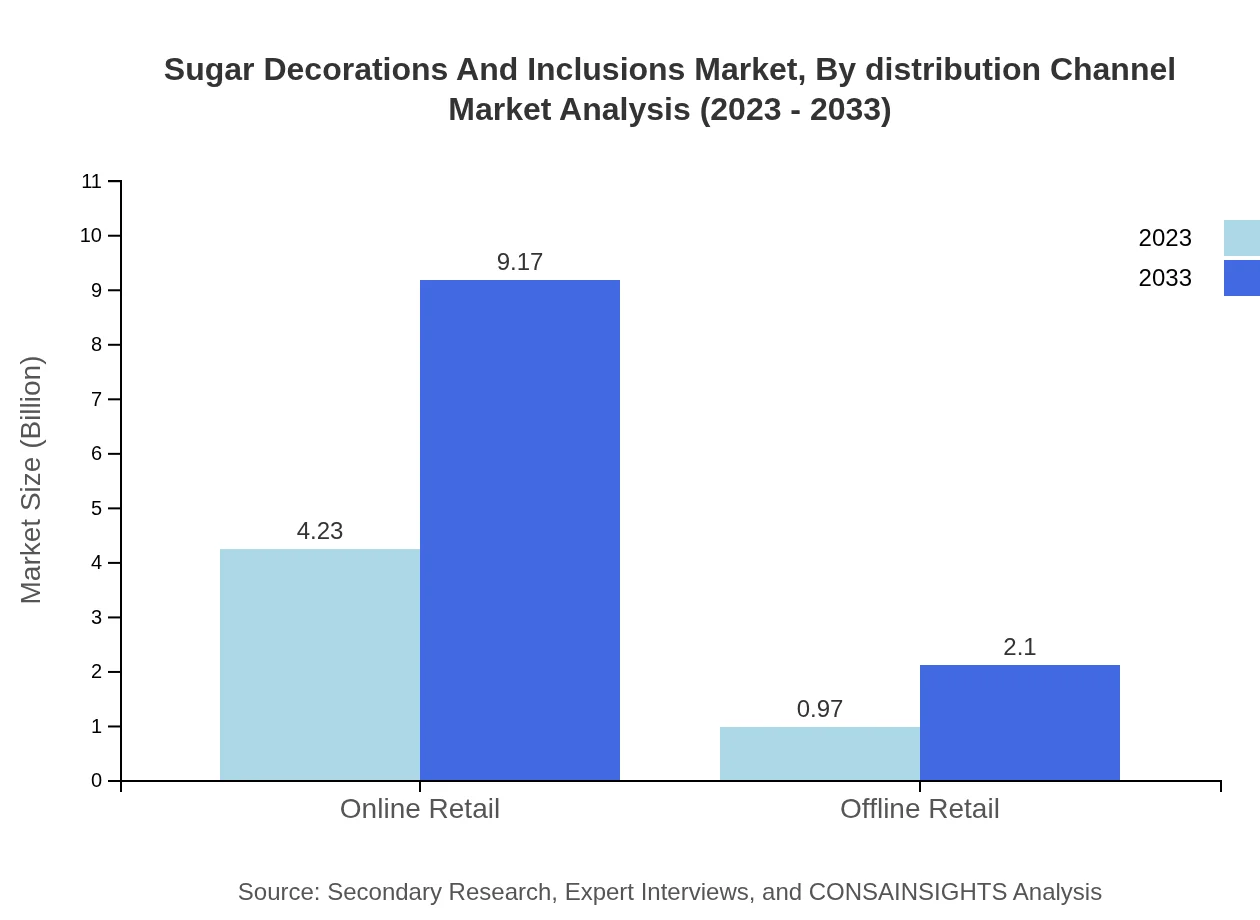

Sugar Decorations And Inclusions Market Analysis By Distribution Channel

The distribution channels include online and offline retail. Online retail captured an extensive share of 81.39% with a market size of $4.23 billion in 2023, reflecting consumer preference for convenient shopping. The offline market also shows growth, reaching $0.97 billion, influenced by traditional shopping patterns.

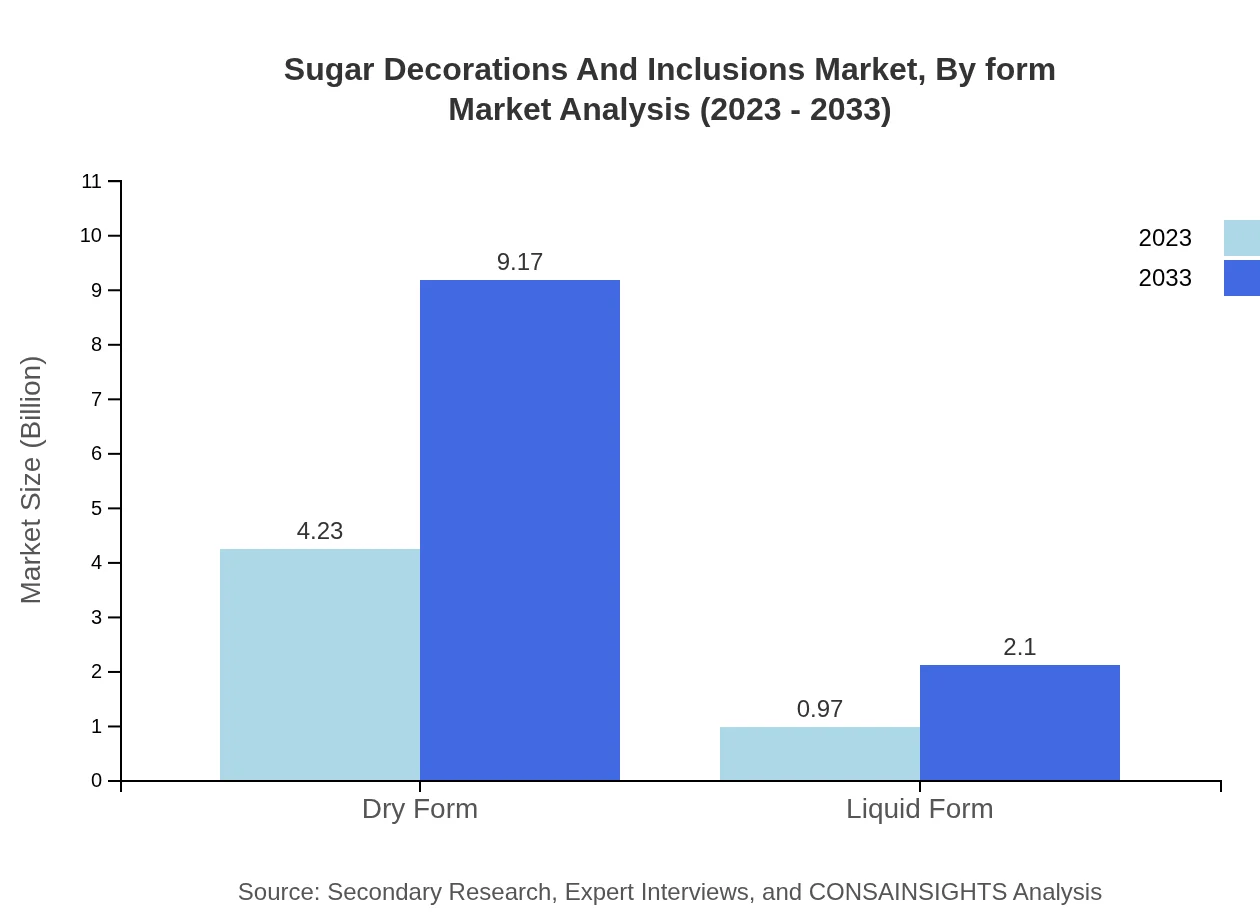

Sugar Decorations And Inclusions Market Analysis By Form

Form segmentation includes dry and liquid variants. Dry forms dominate the market with a size of $4.23 billion in 2023 compared to liquid forms at $0.97 billion. The dry form’s versatility in applications reinforces its prominent market presence.

Sugar Decorations And Inclusions Market Analysis By End User

End-users include bakery products, confectionery products, dairy products, and beverages. Bakery products take the lead with a significant share of 51.57% and a market size of $2.68 billion. Confectionery products follow with a 23.58% share, underscoring the strong consumer preference for sweets and treats.

Sugar Decorations And Inclusions Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Sugar Decorations And Inclusions Industry

Mondelez International, Inc.:

A global leader in snacking, Mondelez produces a range of sweets and decorations, pushing innovation into its product lines.Cargill, Inc.:

Cargill is a major player in the food industry, providing high-quality sugar decorations and inclusions, emphasizing sustainable practices.Barry Callebaut:

A leading manufacturer of high-quality chocolate and cocoa products, Barry Callebaut offers innovative solutions in sugar decorations and inclusions.Olam International:

Olam specializes in the sourcing and marketing of agricultural products, providing a variety of sugar-based inclusions for the food industry.We're grateful to work with incredible clients.

FAQs

What is the market size of sugar Decorations And Inclusions?

The global market size for sugar decorations and inclusions is projected to reach approximately $5.2 billion by 2033, growing at a CAGR of 7.8% from 2023 to 2033.

What are the key market players or companies in this sugar Decorations And Inclusions industry?

Key players in the sugar decorations and inclusions industry include top food manufacturers, suppliers specializing in edible decorations, and major confectionery companies that influence market trends and innovation.

What are the primary factors driving the growth in the sugar Decorations And Inclusions industry?

Growth in the sugar decorations and inclusions industry is driven by rising consumer demand for innovative food products, increasing popularity of customized cakes and desserts, and the booming retail and food service sectors.

Which region is the fastest Growing in the sugar Decorations And Inclusions?

The fastest-growing region in the sugar decorations and inclusions market is North America, with a market size projected to grow from $1.90 billion in 2023 to $4.11 billion by 2033.

Does ConsaInsights provide customized market report data for the sugar Decorations And Inclusions industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the sugar decorations and inclusions industry, ensuring clients receive relevant and actionable insights.

What deliverables can I expect from this sugar Decorations And Inclusions market research project?

From this market research project, clients can expect detailed reports featuring market size data, growth forecasts, competitive analysis, industry trends, and segment insights to support informed decision-making.

What are the market trends of sugar Decorations And Inclusions?

Current trends in the sugar decorations and inclusions market include a shift towards natural and organic ingredients, increased online retail sales, and innovative product offerings catering to health-conscious consumers.