Sulfur Market Report

Published Date: 02 February 2026 | Report Code: sulfur

Sulfur Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the sulfur market from 2023 to 2033, highlighting key insights, market trends, and growth forecasts. It covers market overview, size, segmentation, regional analysis, technologies, and competitive landscape to equip stakeholders with essential data and projections.

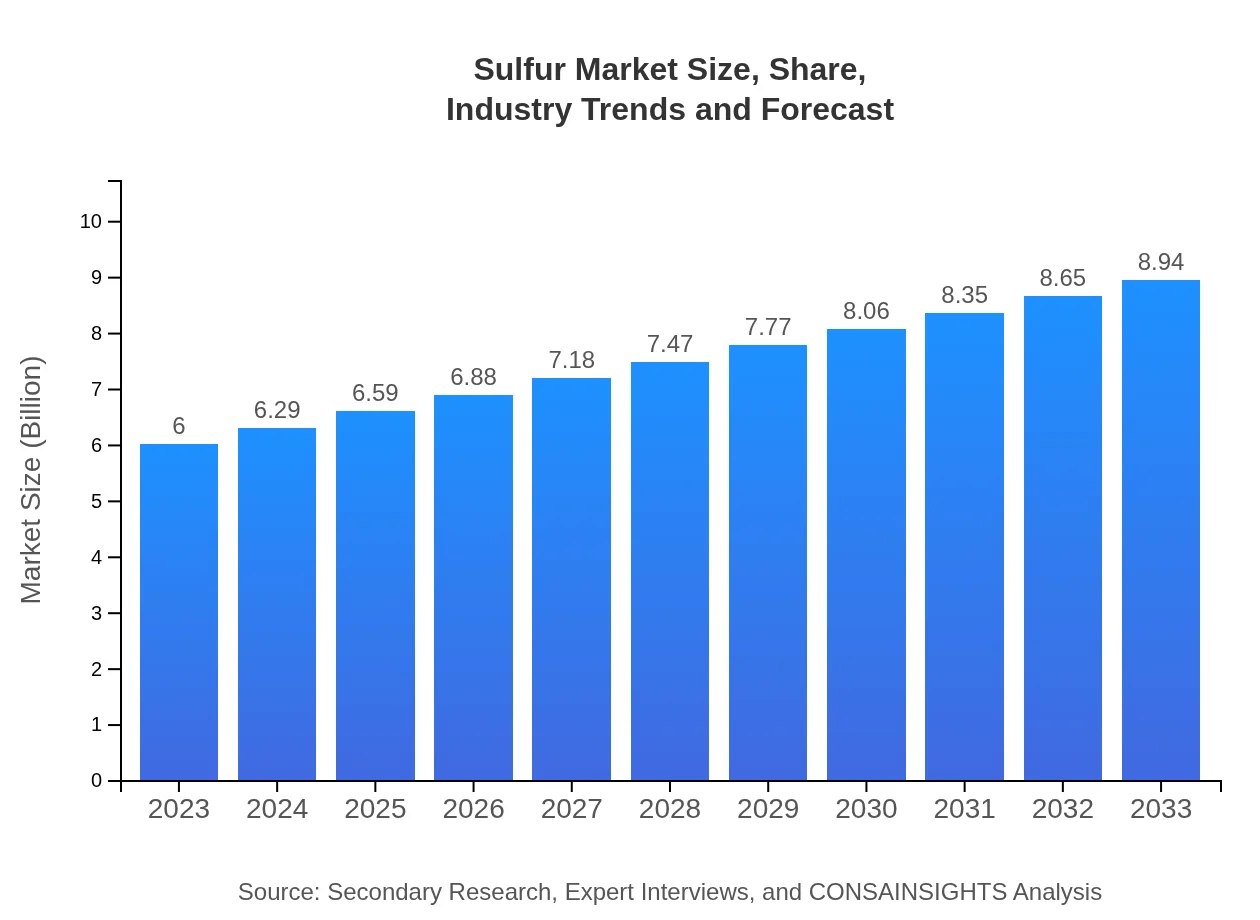

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $6.00 Billion |

| CAGR (2023-2033) | 4.0% |

| 2033 Market Size | $8.94 Billion |

| Top Companies | Sulfur International, BASF SE, KPC Chemicals, Mosaic Company |

| Last Modified Date | 02 February 2026 |

Sulfur Market Overview

Customize Sulfur Market Report market research report

- ✔ Get in-depth analysis of Sulfur market size, growth, and forecasts.

- ✔ Understand Sulfur's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Sulfur

What is the Market Size & CAGR of Sulfur market in 2023?

Sulfur Industry Analysis

Sulfur Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Sulfur Market Analysis Report by Region

Europe Sulfur Market Report:

Europe is expected to witness steady growth, with the market size increasing from 1.93 million metric tons in 2023 to 2.87 million metric tons by 2033. Regulatory frameworks supporting environmental sustainability are driving the use of sulfur in cleaner technologies, particularly in agricultural applications.Asia Pacific Sulfur Market Report:

The Asia Pacific region is projected to become a major hub for sulfur consumption, with a market size of 1.04 million metric tons in 2023, growing to 1.55 million metric tons by 2033. The growth is driven by agricultural expansion and industrialization in emerging economies like India and China, contributing to increased demand for fertilizers and chemical manufacturing.North America Sulfur Market Report:

The North American market reached 2.22 million metric tons in 2023, with projections of 3.31 million metric tons by 2033. The United States is a leading producer and consumer, driven by demand in the oil and gas sectors, along with industrial chemical processes.South America Sulfur Market Report:

In South America, the sulfur market size is estimated at 0.41 million metric tons in 2023, expected to rise to 0.60 million metric tons by 2033. The agricultural sector plays a key role, with growing rice and soybean production in Brazil and Argentina necessitating higher sulfur fertilizer applications.Middle East & Africa Sulfur Market Report:

In the Middle East and Africa, the sulfur market size is projected to grow from 0.41 million metric tons in 2023 to 0.60 million metric tons by 2033. This growth is primarily driven by increase in oil and gas extraction activities and growing agricultural needs in the region.Tell us your focus area and get a customized research report.

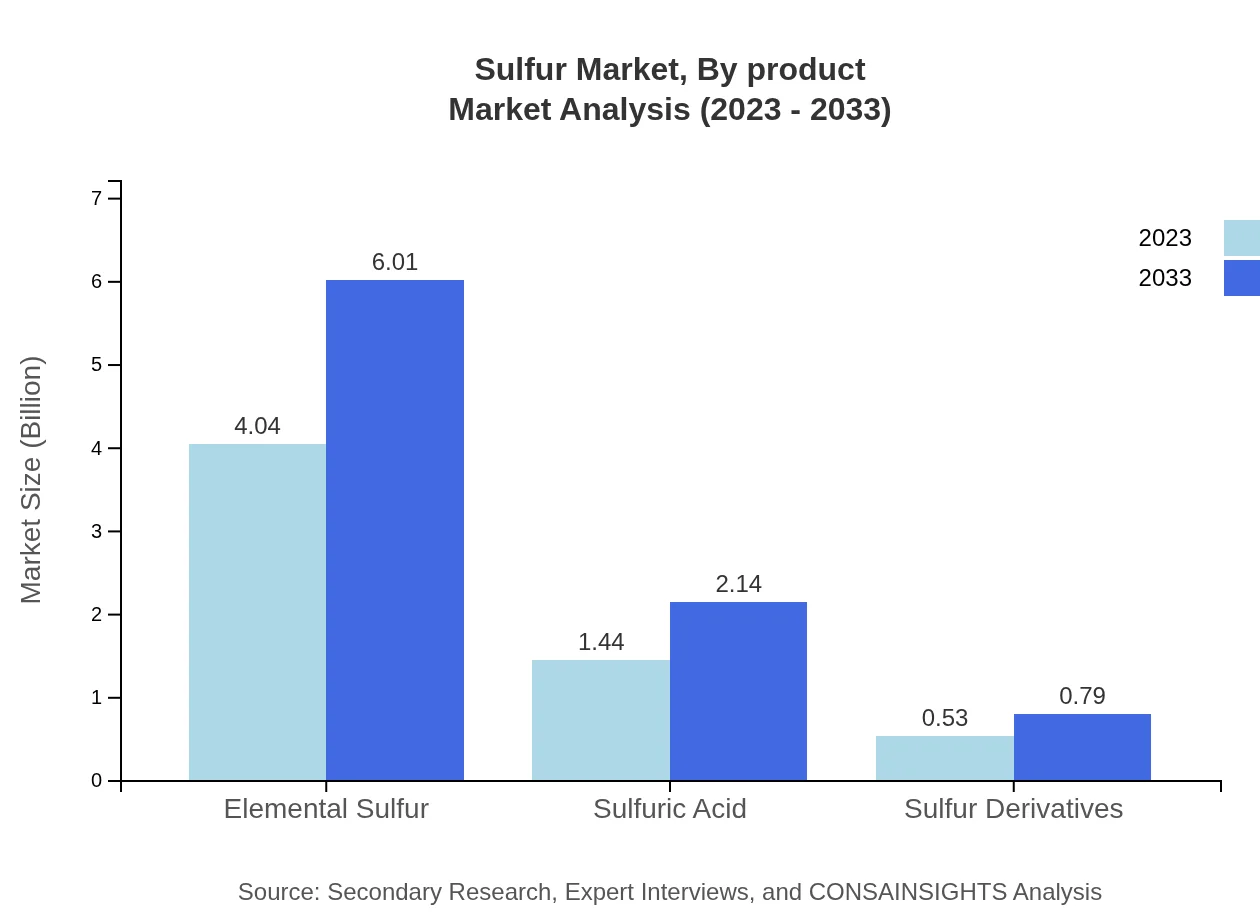

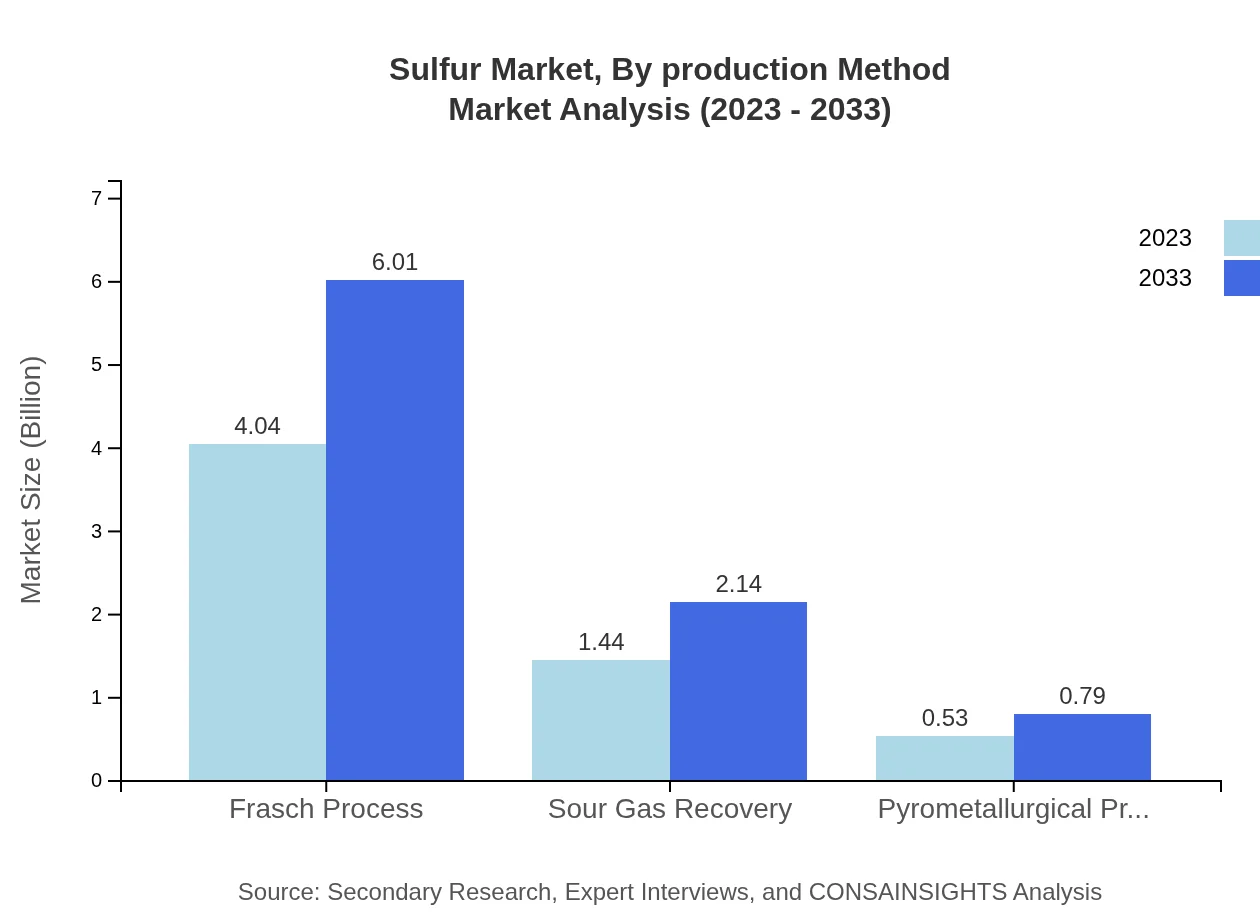

Sulfur Market Analysis By Product

The sulfur market is predominantly driven by elemental sulfur which accounted for 4.04 million metric tons in 2023, growing to 6.01 million metric tons by 2033. Sulfuric acid follows with a market of 1.44 million metric tons in 2023 expected to reach 2.14 million metric tons by 2033. Sulfur derivatives represent a smaller but significant portion with 0.53 million metric tons in 2023 and growing to 0.79 million metric tons by 2033.

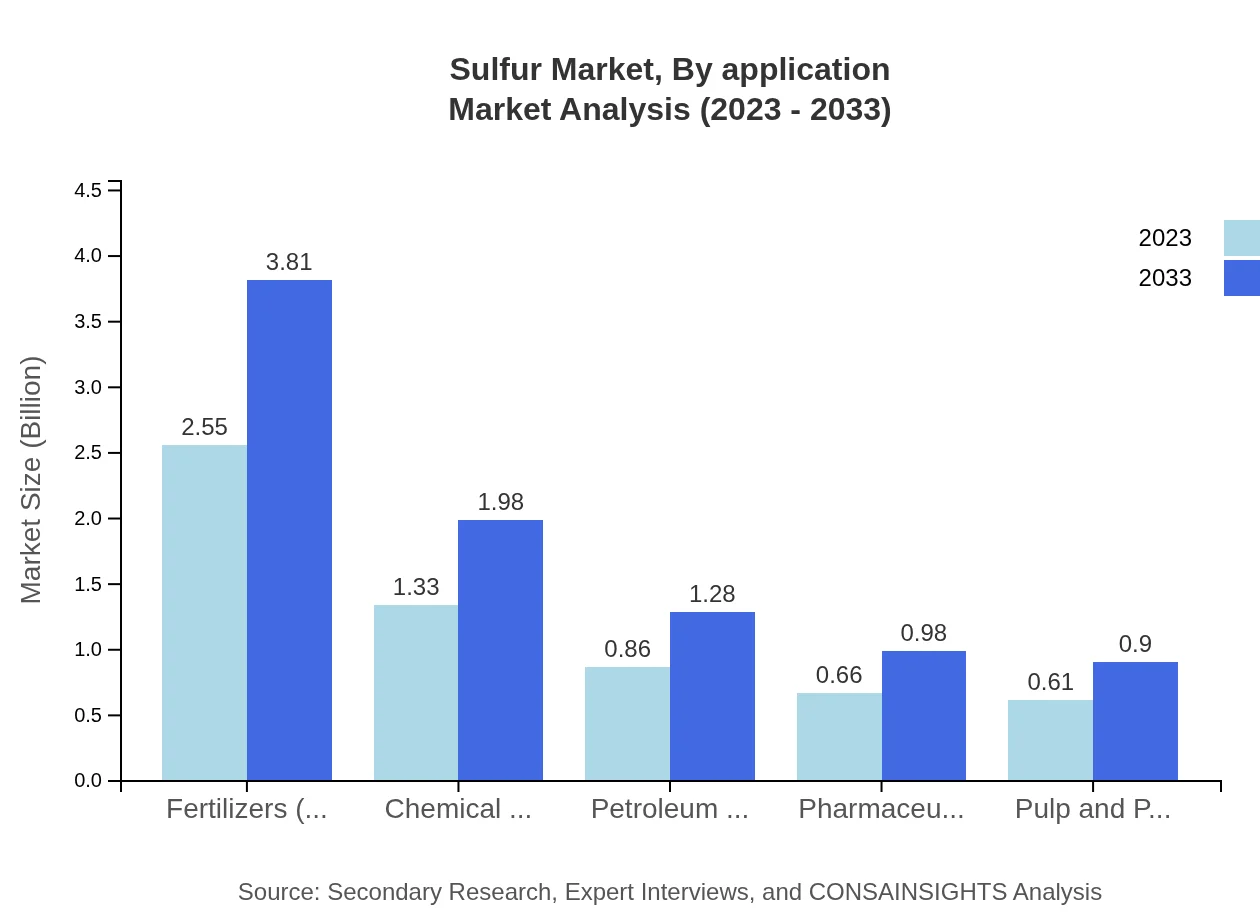

Sulfur Market Analysis By Application

Agriculture is the leading application segment, accounting for 2.55 million metric tons in 2023, projected to expand to 3.81 million metric tons by 2033. Chemical manufacturing follows closely behind with 1.33 million metric tons in 2023 and growth to 1.98 million metric tons by 2033. Petroleum refining, automotive applications, and construction also contribute significantly to overall sulfur demand.

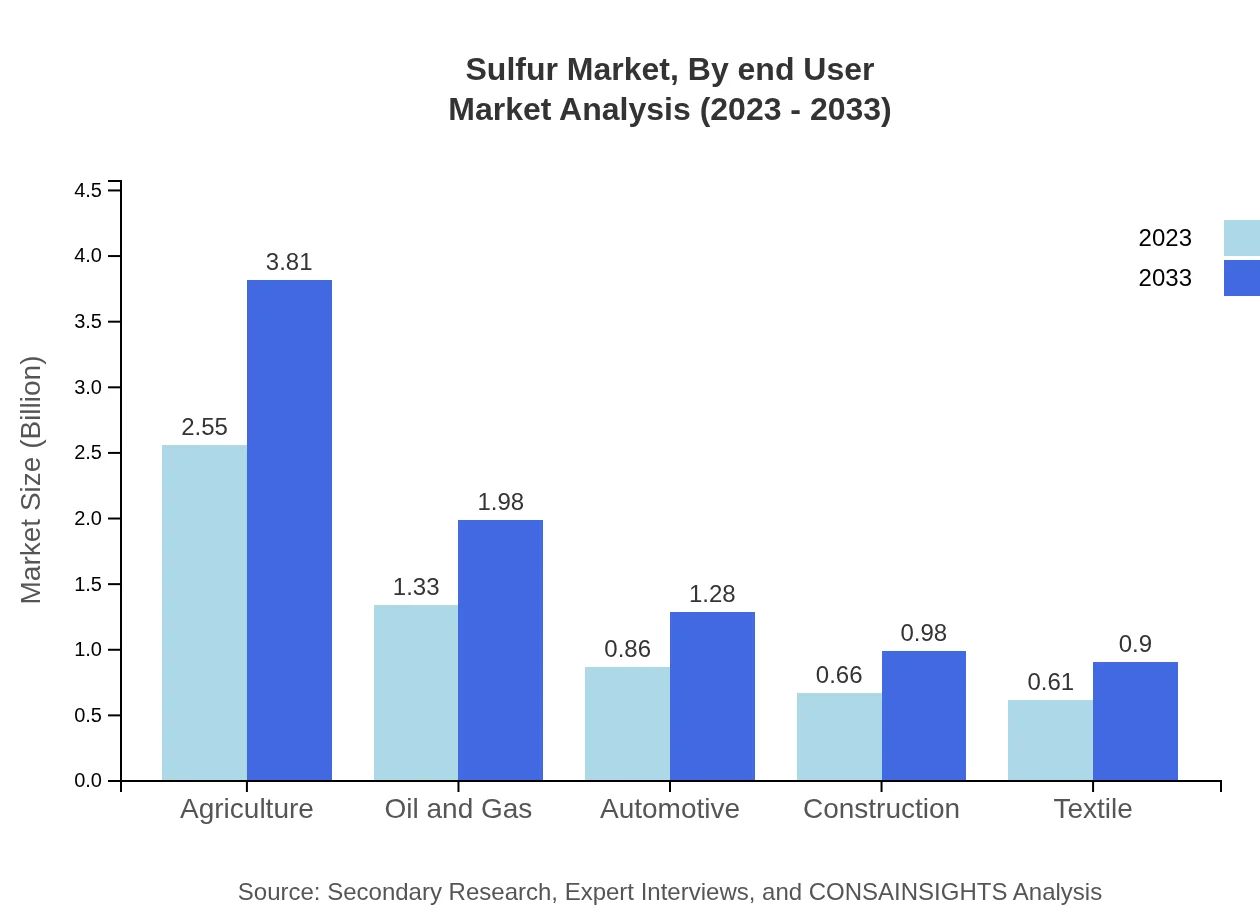

Sulfur Market Analysis By End User

Key end-user industries for sulfur include agriculture, accounting for 42.57% of the market share in 2023, chemical manufacturing at 22.1%, and petroleum refining at 14.27%. These sectors play a critical role in sustaining the sulfur market, driven by their diverse applications and increasing demand for sulfur-based products.

Sulfur Market Analysis By Production Method

The Frasch process is the dominant method of sulfur production, representing 67.25% share of the market in 2023 with expectations to grow to 67.25% by 2033. Sour gas recovery follows, capturing a substantial 23.92% share in 2023. Technological advancements in these methods are likely to enhance production efficiencies, addressing both demand and environmental concerns.

Sulfur Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Sulfur Industry

Sulfur International:

A leading producer of sulfur in North America, specializing in sulfuric acid production and sulfur derivatives with a strong commitment to sustainability.BASF SE:

One of the largest chemical producers globally, BASF engages extensively in sulfur production for fertilizers and industrial chemicals, focusing on innovative and sustainable solutions.KPC Chemicals:

KPC Chemicals is a key player in the sulfur market, heavily involved in the extraction and production processes while pushing for technological innovations in sulfur recovery.Mosaic Company:

A leading producer of phosphate and potash fertilizers which heavily incorporates sulfur into its product lines, driving demand within the agricultural segment.We're grateful to work with incredible clients.

FAQs

What is the market size of sulfur?

The sulfur market is valued at approximately $6 billion as of 2023, with a projected CAGR of 4.0%. By 2033, this market is expected to expand significantly, reflecting growth trends in various industrial applications.

What are the key market players or companies in the sulfur industry?

Key players in the sulfur market include companies such as BASF, Elementia, and Marathon Petroleum. These organizations are pivotal in driving innovation and maintaining market competitiveness within the sulfur sector.

What are the primary factors driving the growth in the sulfur industry?

Growth in the sulfur industry is primarily driven by increasing demand for fertilizers, robust industrial applications, and advancements in sulfur recovery technologies. These factors contribute to a stable demand for sulfur in various markets.

Which region is the fastest Growing in the sulfur market?

The fastest-growing region in the sulfur market is North America, with a projected growth from $2.22 billion in 2023 to $3.31 billion by 2033. This growth trend is indicative of increased industrial activities and improved recovery methods.

Does ConsaInsights provide customized market report data for the sulfur industry?

Yes, ConsaInsights offers customized market report data for the sulfur industry. This includes tailored insights into market size, growth forecasts, and various segment analyses designed to meet specific client needs.

What deliverables can I expect from this sulfur market research project?

Deliverables from the sulfur market research project typically include a comprehensive report, detailed market analysis, segment performance insights, and actionable recommendations tailored to your business objectives.

What are the market trends of sulfur?

Current market trends in the sulfur industry include a shift towards sustainable agricultural practices, increasing use in chemical manufacturing, and innovations in sulfur processing technologies, contributing to growth and enhanced applications.