Super Absorbent Polymer Market Report

Published Date: 02 February 2026 | Report Code: super-absorbent-polymer

Super Absorbent Polymer Market Size, Share, Industry Trends and Forecast to 2033

This report provides an extensive analysis of the Super Absorbent Polymer market from 2023 to 2033, covering market size, growth trends, segmentation, regional insights, and leading competitors. It aims to furnish stakeholders with comprehensive insights necessary for informed decision-making.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

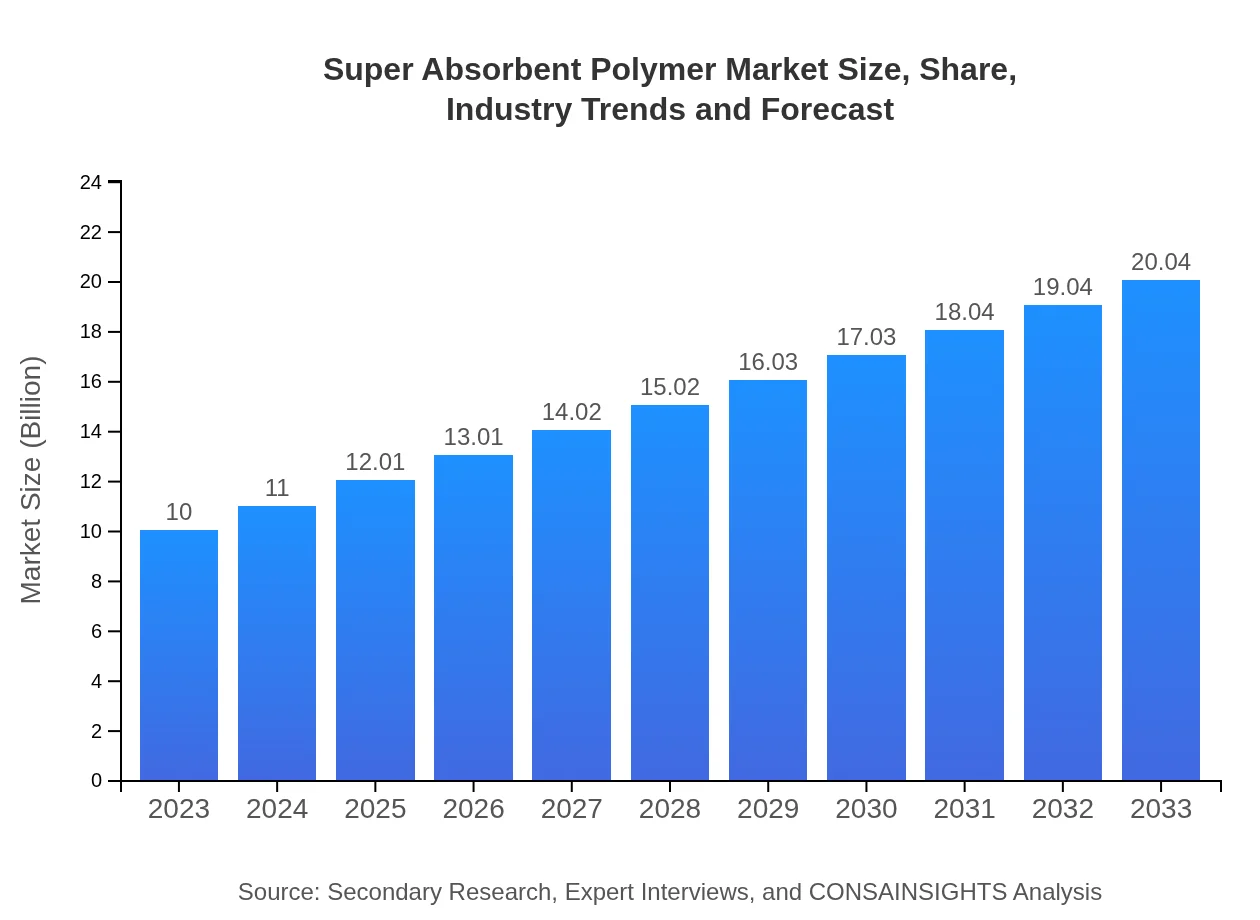

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 7% |

| 2033 Market Size | $20.04 Billion |

| Top Companies | BASF SE, Evonik Industries AG, Nippon Shokubai Co., Ltd., Sumitomo Seika Chemicals Co., Ltd., LG Chem Ltd. |

| Last Modified Date | 02 February 2026 |

Super Absorbent Polymer Market Overview

Customize Super Absorbent Polymer Market Report market research report

- ✔ Get in-depth analysis of Super Absorbent Polymer market size, growth, and forecasts.

- ✔ Understand Super Absorbent Polymer's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Super Absorbent Polymer

What is the Market Size & CAGR of Super Absorbent Polymer market in 2023-2033?

Super Absorbent Polymer Industry Analysis

Super Absorbent Polymer Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Super Absorbent Polymer Market Analysis Report by Region

Europe Super Absorbent Polymer Market Report:

The European market is expected to expand from USD 2.96 billion in 2023 to USD 5.94 billion by 2033. This growth trajectory is fueled by increasing regulatory demands for environmental sustainability and the growing health awareness leading to higher consumption of hygiene products.Asia Pacific Super Absorbent Polymer Market Report:

In 2023, the Asia Pacific region accounted for a market size of USD 1.78 billion, projected to reach USD 3.58 billion by 2033, driven primarily by the rapid growth in the hygiene product market and increased agricultural applications in countries like China and India. Increased urbanization and awareness of environmental cleanliness further fuel demand.North America Super Absorbent Polymer Market Report:

The North American market is estimated to grow from USD 3.80 billion in 2023 to USD 7.62 billion by 2033, driven by innovations in product use cases, stringent regulations on hygiene, and a robust health and wellness culture.South America Super Absorbent Polymer Market Report:

South America is witnessing gradual growth in the Super Absorbent Polymer market, with a projected growth from USD 0.24 billion in 2023 to USD 0.48 billion by 2033. The agricultural sector's growth alongside rising living standards correlates with heightened demand for hygiene products.Middle East & Africa Super Absorbent Polymer Market Report:

The Middle East and Africa region is anticipated to grow from USD 1.21 billion in 2023 to USD 2.43 billion by 2033, supported by an increasing population, urbanization, and an emphasis on improving sanitary conditions.Tell us your focus area and get a customized research report.

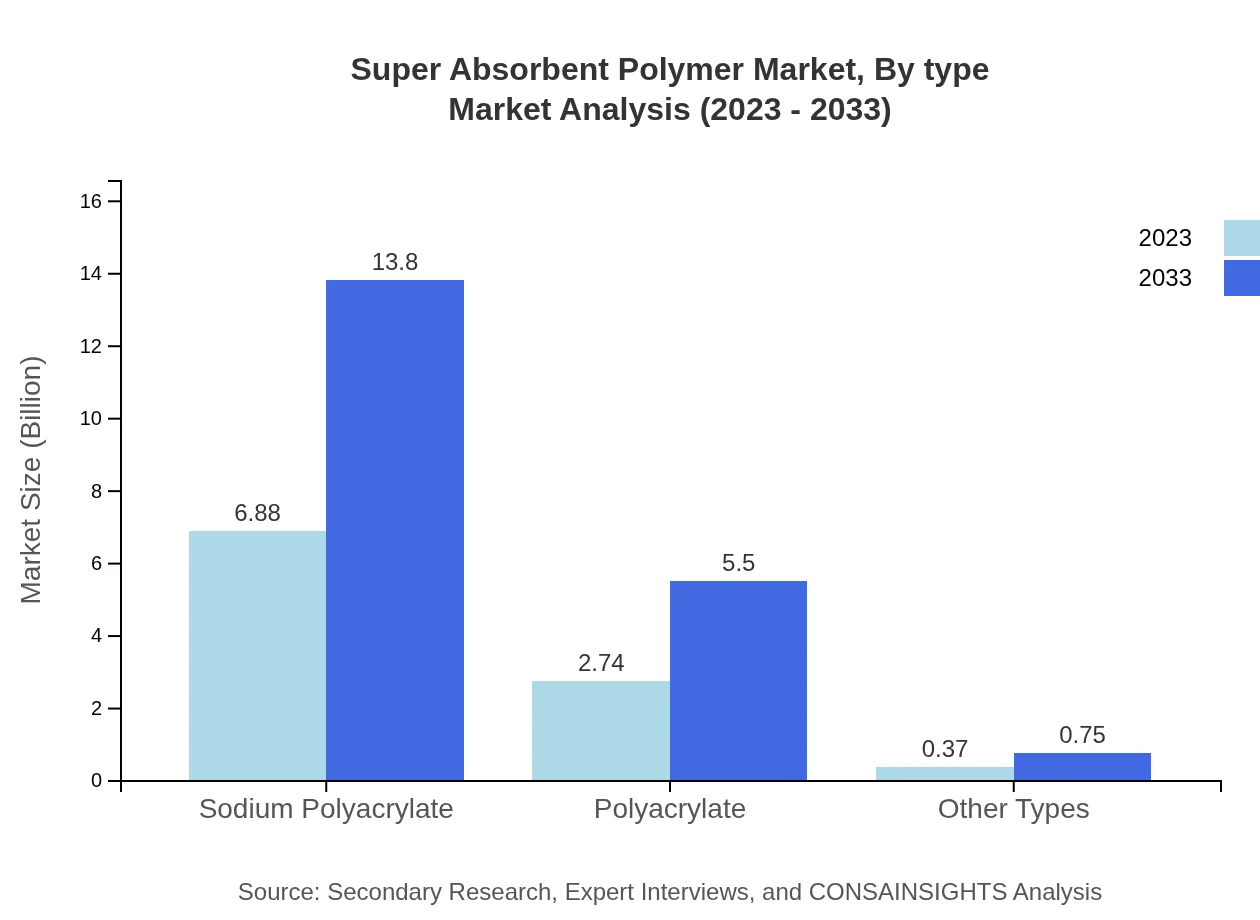

Super Absorbent Polymer Market Analysis By Type

Sodium Polyacrylate dominates the Super Absorbent Polymer market, accounting for a size of USD 6.88 billion in 2023 and projected to grow to USD 13.80 billion by 2033, contributing significantly to market share at 68.83%. Polyacrylate follows, with a market size of USD 2.74 billion in 2023 and expected to reach USD 5.50 billion, capturing about 27.44% of the market share. Other types contribute marginally with estimates of USD 0.37 billion in size in 2023.

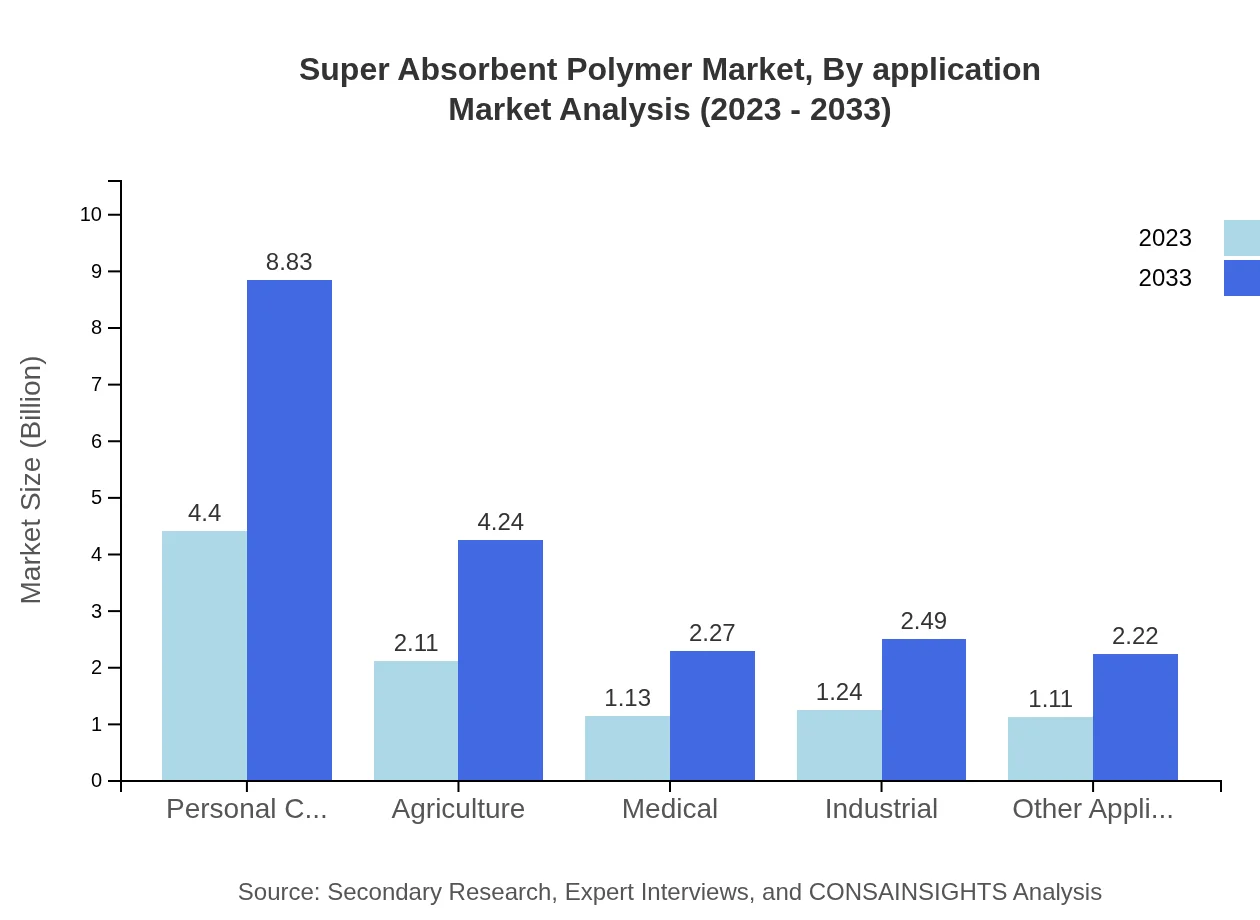

Super Absorbent Polymer Market Analysis By Application

The healthcare sector leads the application segment, showing a market size of USD 4.40 billion in 2023 expected to rise to USD 8.83 billion by 2033, driven by rising hygiene needs. Consumer goods and personal care products also represent notable applications, with market sizes of USD 2.11 billion and 4.40 billion respectively in 2023. The agriculture sector is seeing increasing adoption of SAP, projected to reach USD 2.27 billion by 2033.

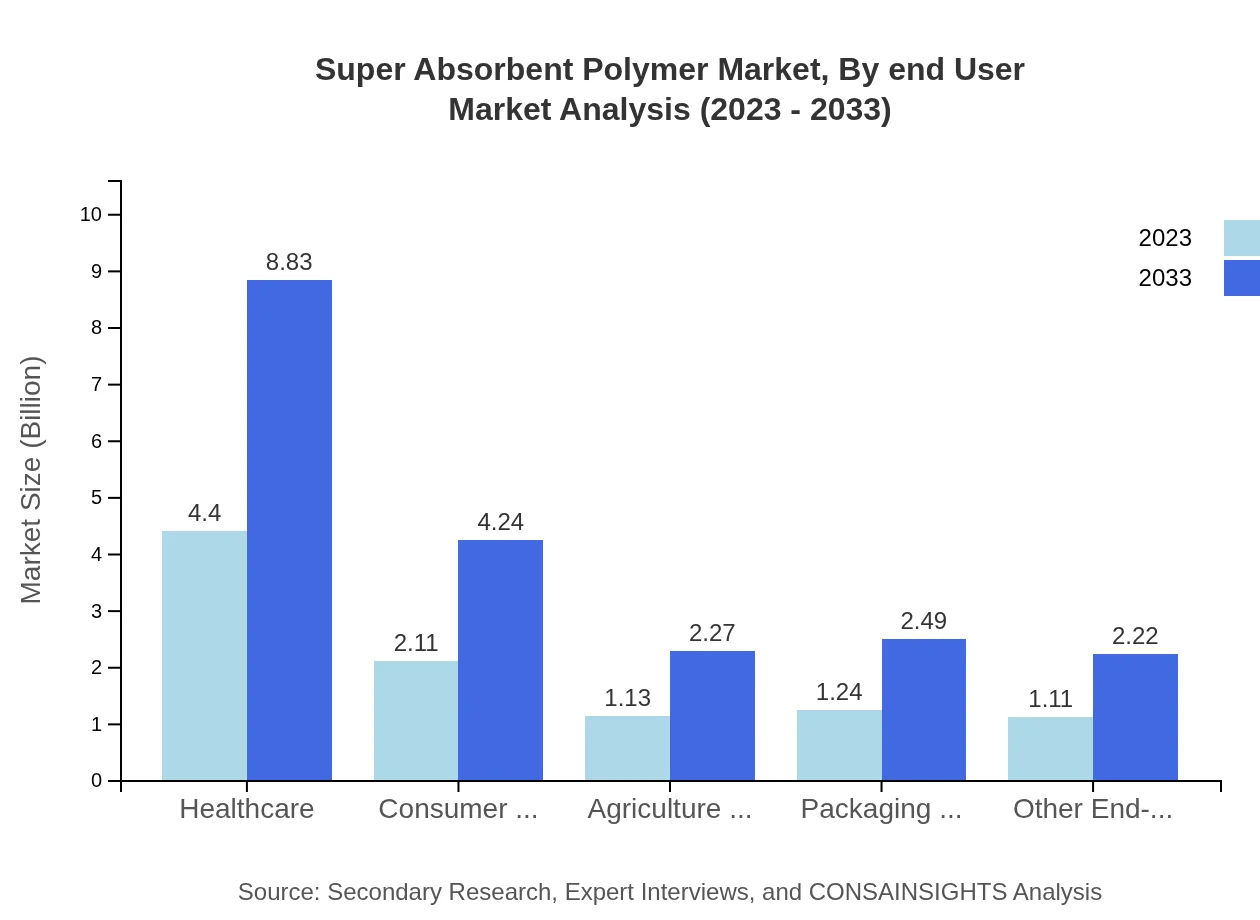

Super Absorbent Polymer Market Analysis By End User

Leading end-user industries include healthcare, accounting for an expected market growth from USD 4.40 billion in 2023 to USD 8.83 billion by 2033, making up 44.04% of the market share. The consumer goods segment is projected to mirror this growth, emphasizing the need for SAP in products like disposable hygiene items.

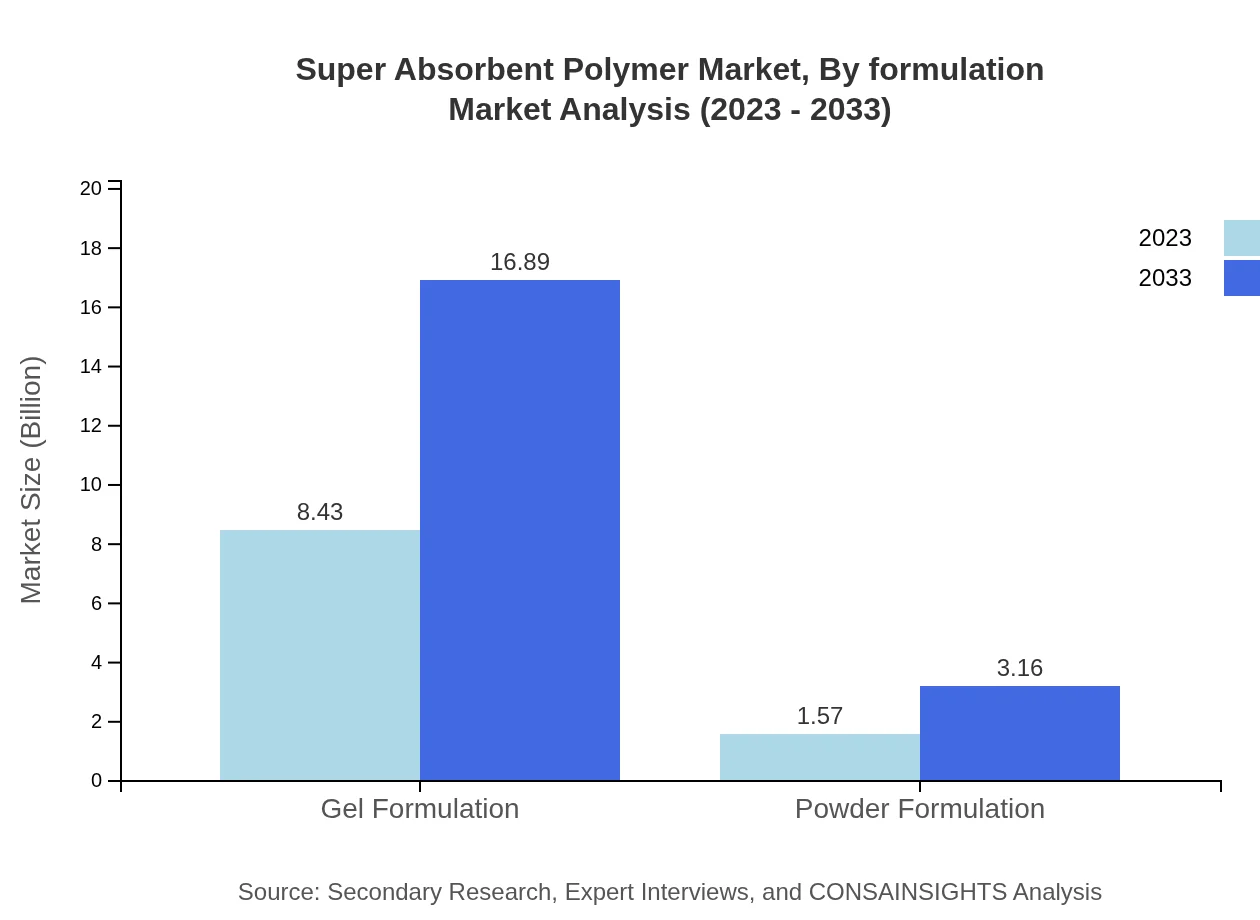

Super Absorbent Polymer Market Analysis By Formulation

Gel formulation dominates the SAP market, holding a share of 84.25% in 2023, indicating significant demand for advanced absorbent products. This segment is expected to see further growth, reaching USD 16.89 billion by 2033. Powder formulations, while less prevalent, are positioned for growth from USD 1.57 billion to USD 3.16 billion in the same period.

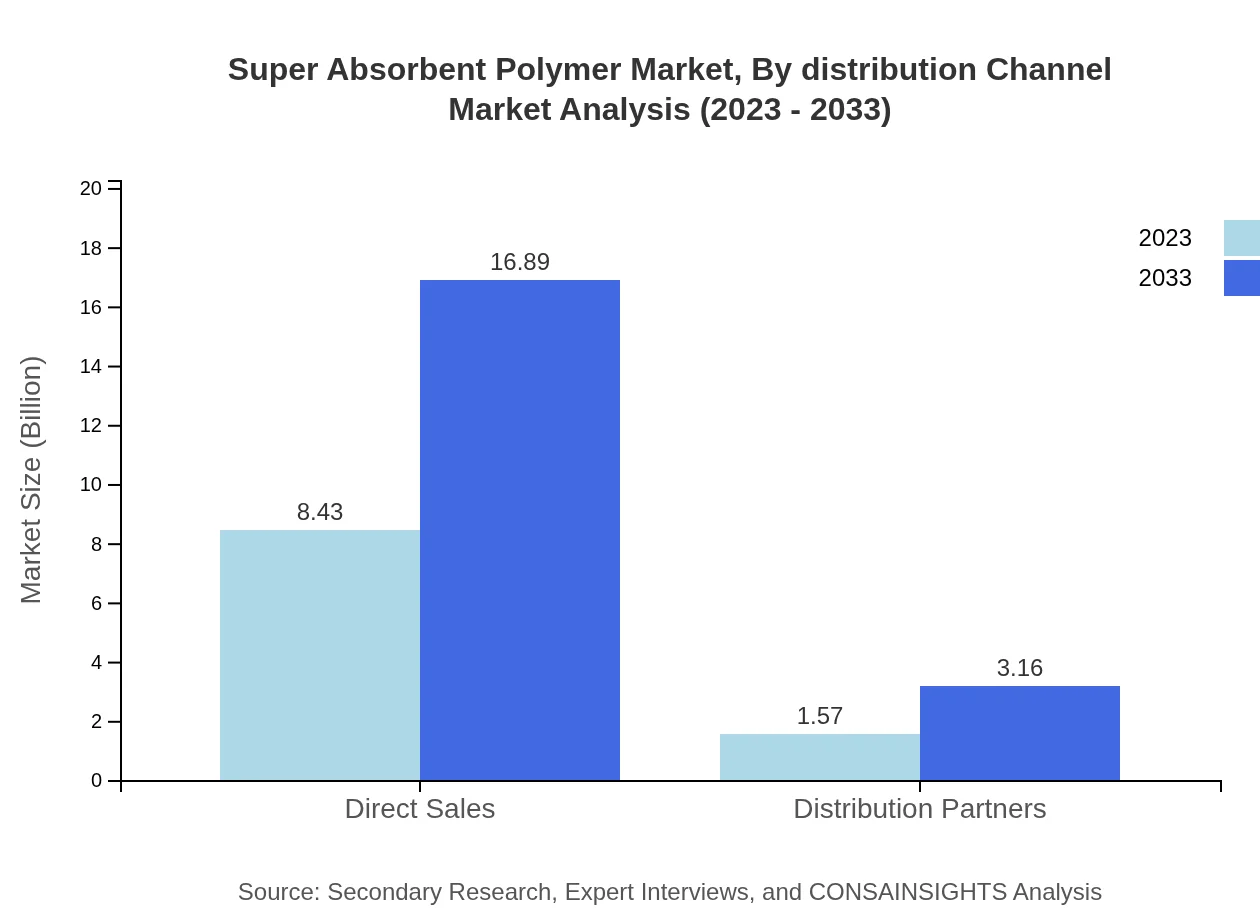

Super Absorbent Polymer Market Analysis By Distribution Channel

Distribution through direct sales represents the largest share, accounting for USD 8.43 billion in 2023 and anticipated to increase to USD 16.89 billion by 2033, underscoring the direct relationship manufacturers maintain with their clients. Distribution partnerships also play a critical role in reaching broader markets, showing potential growth opportunities.

Super Absorbent Polymer Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Super Absorbent Polymer Industry

BASF SE:

BASF is a global leader in chemical production, including Super Absorbent Polymers. The company focuses on innovation and sustainability in its products, catering to the needs of various end-user markets.Evonik Industries AG:

Evonik specializes in specialty chemicals and has a strong presence in the SAP market, offering advanced products designed for various applications in healthcare and consumer goods.Nippon Shokubai Co., Ltd.:

A pioneer in the production of Super Absorbent Polymers, Nippon Shokubai focuses on high-performance materials for use in the hygiene and healthcare sectors.Sumitomo Seika Chemicals Co., Ltd.:

Known for its innovation in chemical production, Sumitomo Seika offers a variety of SAPs and is focused on expanding its market presence through strategic partnerships.LG Chem Ltd.:

LG Chem is one of the largest chemical companies in South Korea, providing a range of Super Absorbent Polymers for applications in diapers, feminine hygiene products, and agriculture.We're grateful to work with incredible clients.

FAQs

What is the market size of super Absorbent Polymer?

The global super-absorbent polymer market size is projected at $10 billion in 2023, with a robust CAGR of 7% anticipated through 2033, indicating significant growth driven by diverse applications across industries.

What are the key market players or companies in this super Absorbent Polymer industry?

Key players in the super-absorbent polymer market include BASF, Nippon Shokubai, and Evonik Industries, among others, who are leading in innovation and capacity expansion to meet rising demand globally.

What are the primary factors driving the growth in the super Absorbent Polymer industry?

Growth in the super-absorbent polymer industry is driven by increasing applications in personal care products, agriculture, and healthcare, supported by advancements in production technology and rising consumer awareness of hygiene products.

Which region is the fastest Growing in the super Absorbent Polymer market?

The Asia Pacific region is poised to be the fastest-growing market for super-absorbent polymers, with market values expected to escalate from $1.78 billion in 2023 to $3.58 billion by 2033, reflecting robust industrial demand.

Does ConsaInsights provide customized market report data for the super Absorbent Polymer industry?

Yes, ConsaInsights offers customized market report data for the super-absorbent polymer industry, tailoring insights based on specific client needs for strategic decision-making.

What deliverables can I expect from this super Absorbent Polymer market research project?

Deliverables from this research project include comprehensive market analysis reports, segment data breakdowns, trend forecasting, and strategic recommendations tailored for decision-making in the super-absorbent polymer market.

What are the market trends of super Absorbent Polymer?

Trends in the super-absorbent polymer market indicate a shift towards sustainable materials and innovations in formulation types, particularly gel formulations, which dominate the market share at 84.25% in 2023.