Supplementary Cementitious Materials Market Report

Published Date: 02 February 2026 | Report Code: supplementary-cementitious-materials

Supplementary Cementitious Materials Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Supplementary Cementitious Materials market from 2023 to 2033, covering market size, growth rate, key trends, regional insights, and competitive landscape.

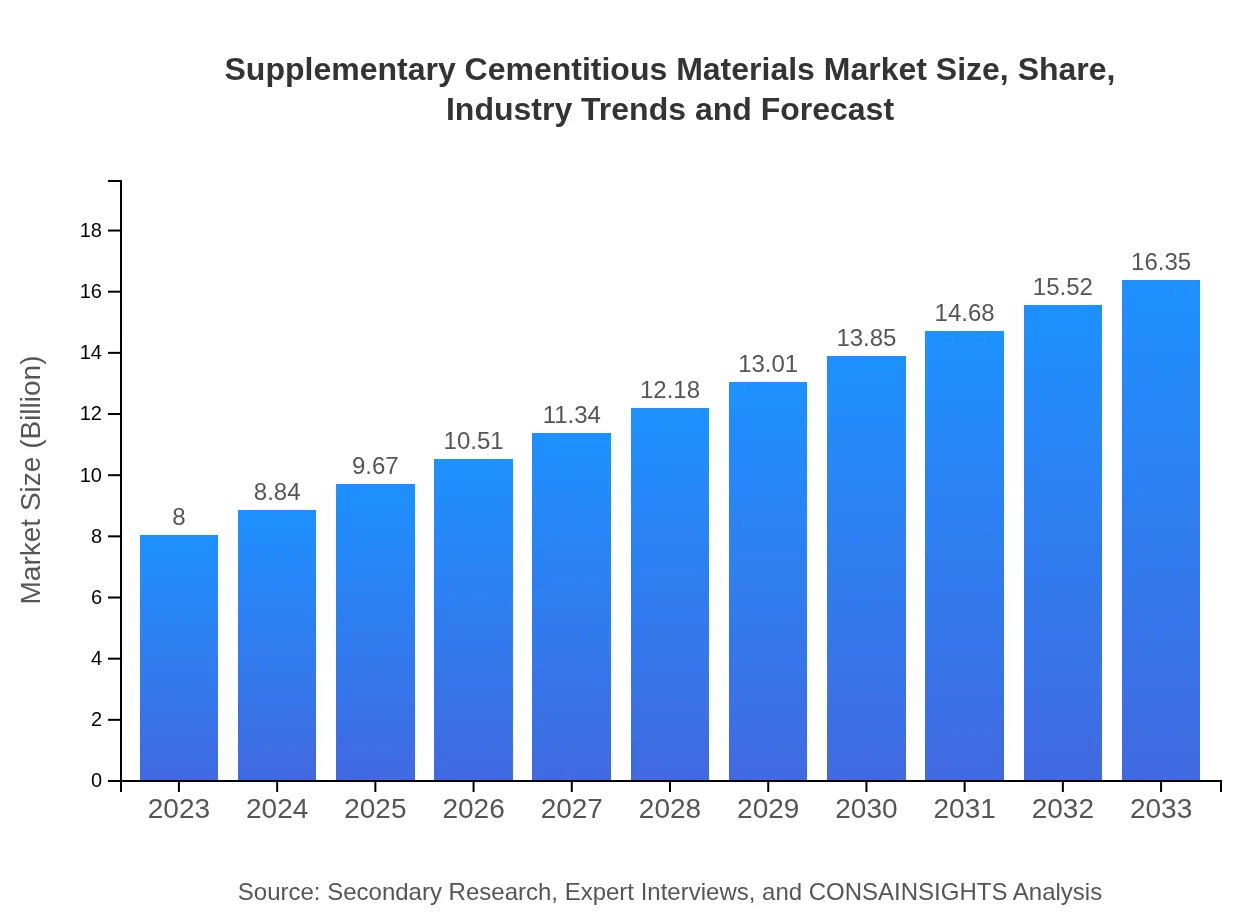

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $8.00 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $16.35 Billion |

| Top Companies | LafargeHolcim, Cemex, HeidelbergCement, BASF |

| Last Modified Date | 02 February 2026 |

Supplementary Cementitious Materials Market Overview

Customize Supplementary Cementitious Materials Market Report market research report

- ✔ Get in-depth analysis of Supplementary Cementitious Materials market size, growth, and forecasts.

- ✔ Understand Supplementary Cementitious Materials's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Supplementary Cementitious Materials

What is the Market Size & CAGR of Supplementary Cementitious Materials market in 2023?

Supplementary Cementitious Materials Industry Analysis

Supplementary Cementitious Materials Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Supplementary Cementitious Materials Market Analysis Report by Region

Europe Supplementary Cementitious Materials Market Report:

Europe's market is set to increase from $1.94 billion in 2023 to $3.97 billion by 2033. The region has strict environmental regulations that promote the use of SCMs to lower carbon emissions, alongside a robust construction industry focused on sustainable practices.Asia Pacific Supplementary Cementitious Materials Market Report:

The Asia Pacific region is witnessing a surge in the SCM market, projected to grow from $1.61 billion in 2023 to $3.29 billion by 2033. This growth is driven by rapid urbanization and infrastructure development, particularly in developing countries like India and China. Increased investment in sustainable construction practices further bolsters demand for SCMs in this region.North America Supplementary Cementitious Materials Market Report:

North America is anticipated to grow significantly, from $2.77 billion in 2023 to approximately $5.67 billion by 2033. The emphasis on sustainability in construction, fueled by various legislative measures and a booming infrastructure sector, is a primary driver for SCM usage in the region.South America Supplementary Cementitious Materials Market Report:

In South America, the market is expected to expand from $0.75 billion in 2023 to $1.54 billion by 2033. The ongoing infrastructure projects and green initiatives led by various governments are crucial in fostering the growth of SCM applications in concrete production.Middle East & Africa Supplementary Cementitious Materials Market Report:

The Middle East and Africa region is expected to see growth from $0.92 billion in 2023 to $1.89 billion by 2033, driven by infrastructural investments and the growing adoption of sustainable construction methodologies across various countries.Tell us your focus area and get a customized research report.

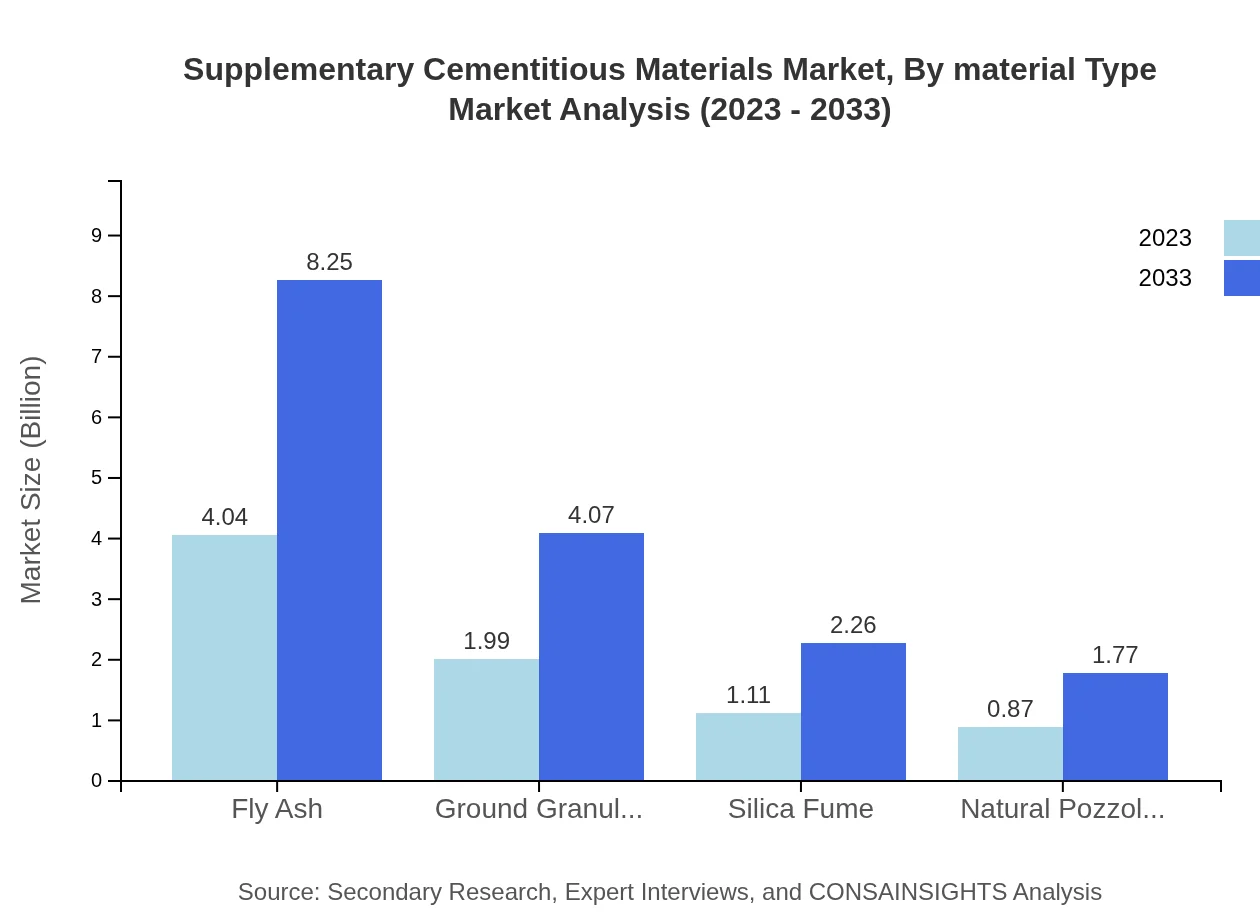

Supplementary Cementitious Materials Market Analysis By Material Type

By material type, the market is dominated by fly ash, with predicted growth from $4.04 billion in 2023 to $8.25 billion by 2033, due to its widespread application in various concrete formulations. Ground Granulated Blast Furnace Slag (GGBFS) follows as a significant contributor, expected to double its market size from $1.99 billion to $4.07 billion over the same period.

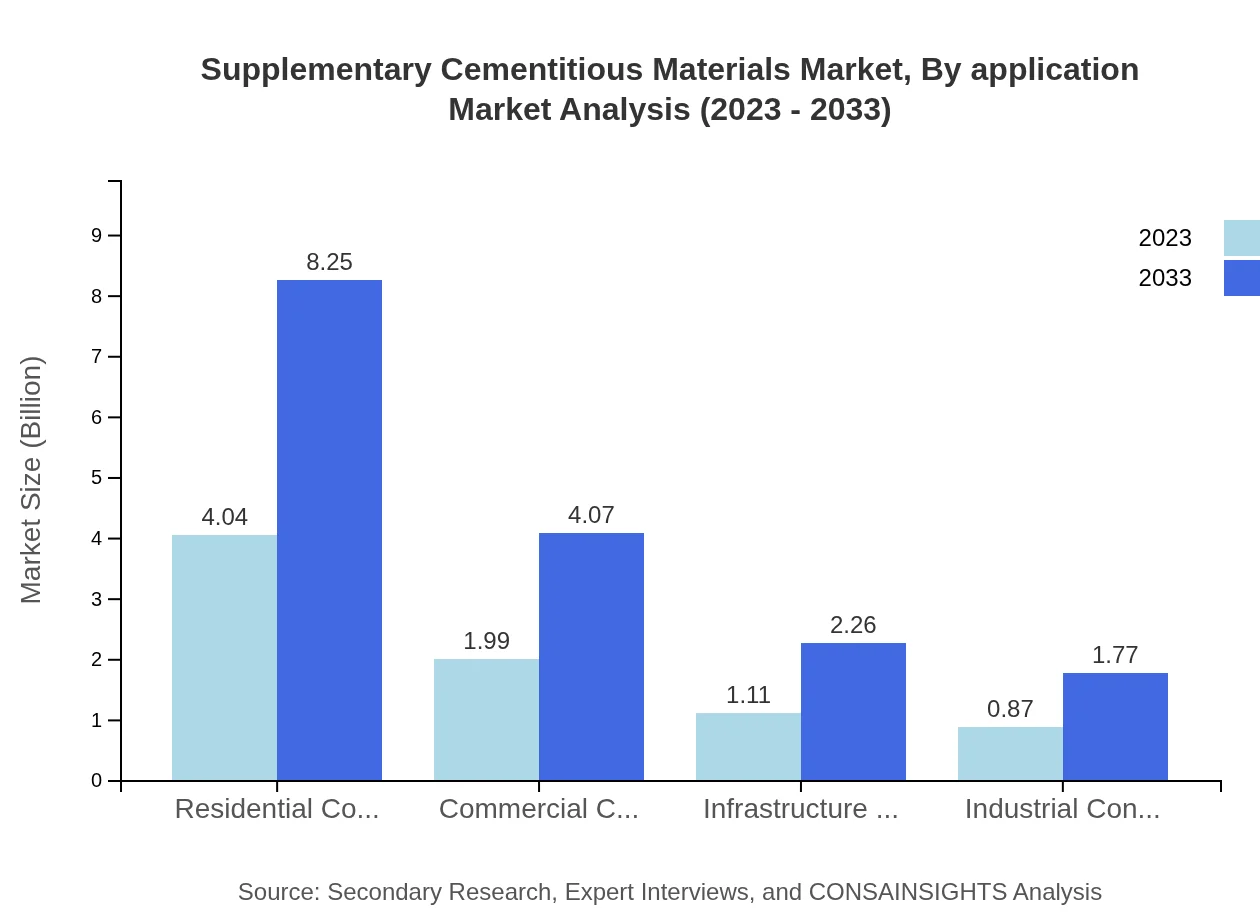

Supplementary Cementitious Materials Market Analysis By Application

In the application segment, residential construction leads, progressing from $4.04 billion in 2023 to $8.25 billion in 2033. Infrastructure projects also represent substantial growth potential with an increase predicted from $1.11 billion to $2.26 billion, reflecting the urgent need for modernized infrastructure.

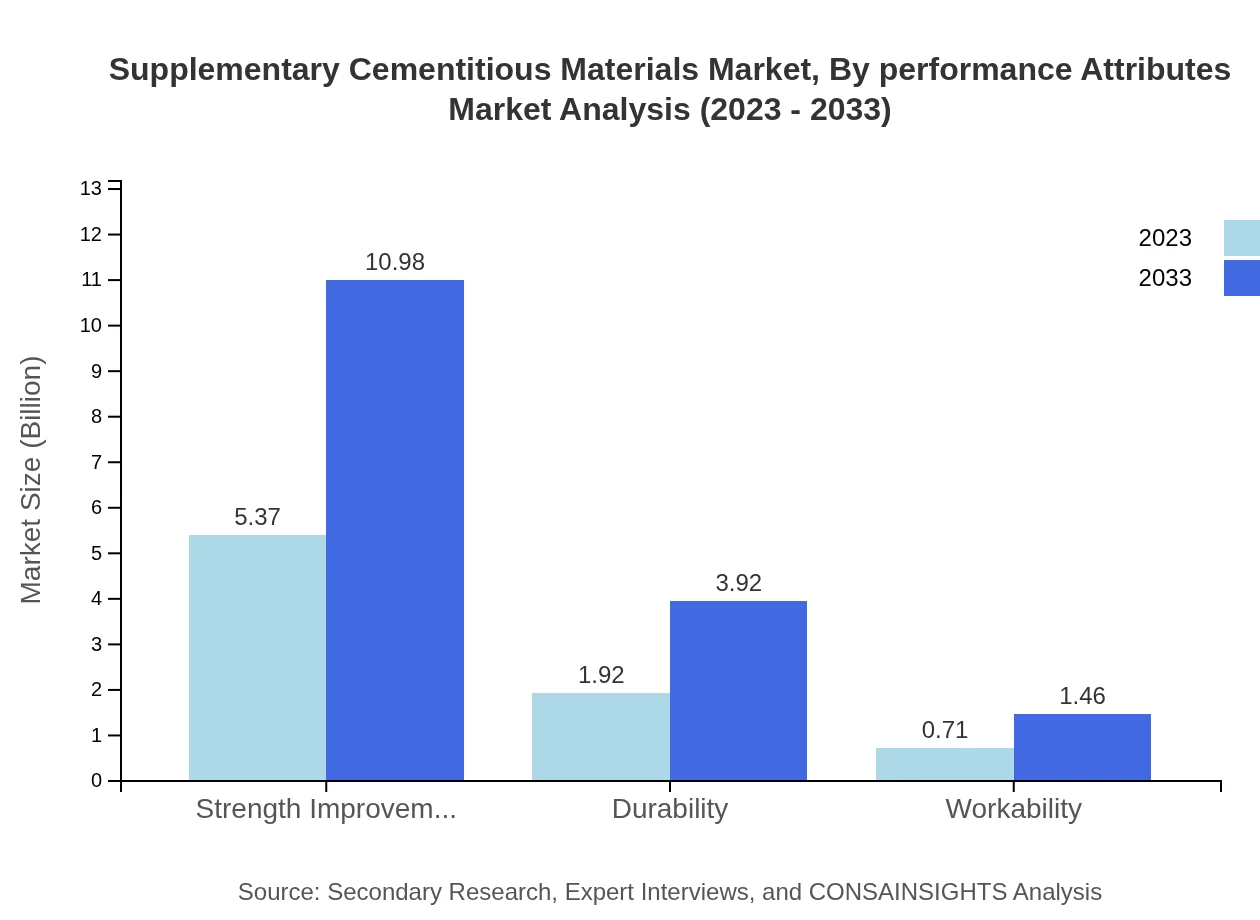

Supplementary Cementitious Materials Market Analysis By Performance Attributes

In terms of performance attributes, strength improvement remains paramount with a market size expected to grow from $5.37 billion in 2023 to $10.98 billion in 2033. Durability and workability also show favorable growth trajectories, reflecting the increasing need for high-performance concrete.

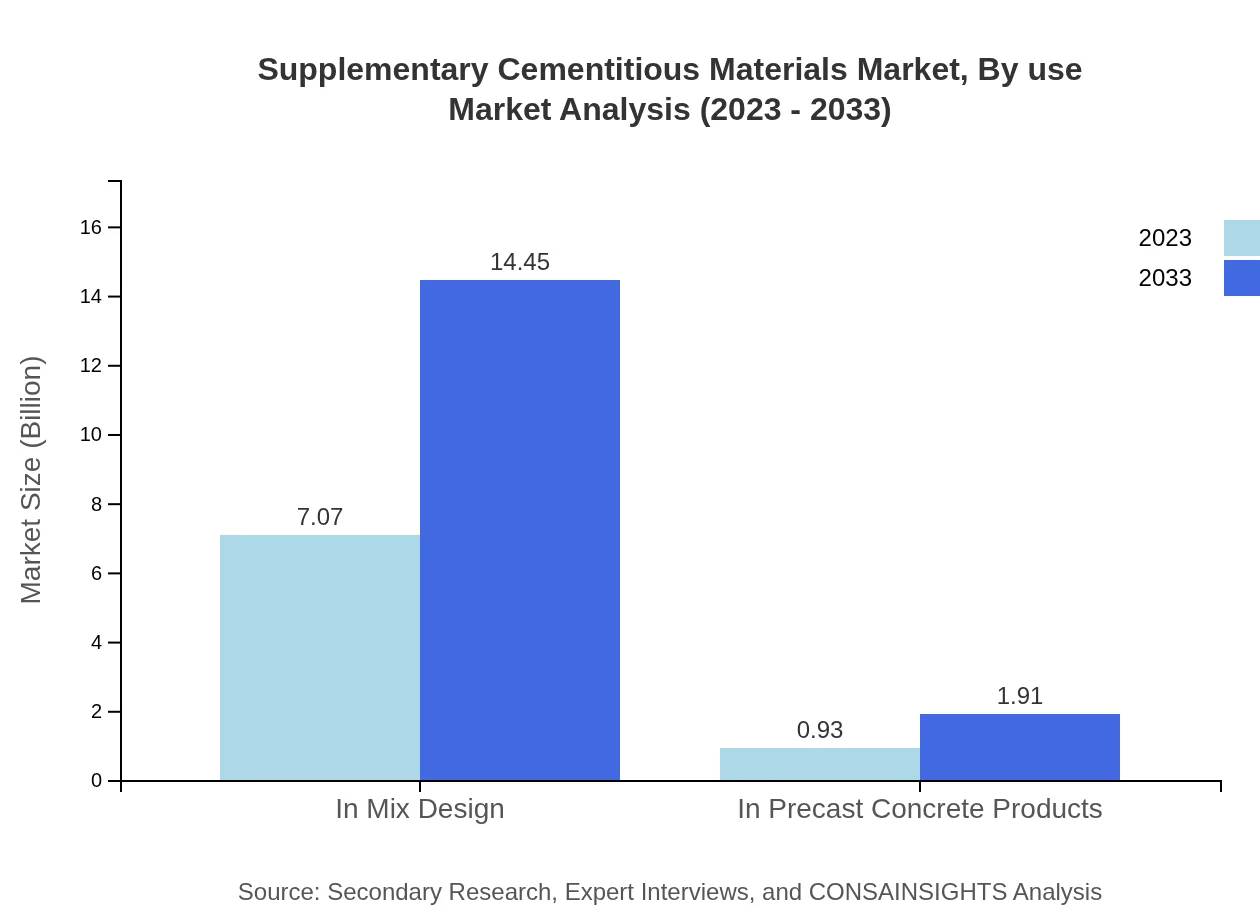

Supplementary Cementitious Materials Market Analysis By Use

Use-wise, the segment for adoptions in commercial construction is projected to increase from $1.99 billion to $4.07 billion, showcasing enhanced design innovations and structural performance expectations.

Supplementary Cementitious Materials Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Supplementary Cementitious Materials Industry

LafargeHolcim:

A leading global building materials company known for its innovations in cement and concrete, particularly with supplementary materials that reduce carbon footprints in construction.Cemex:

A multinational building materials firm that specializes in concrete and aggregates while committing to sustainability through its SCM product offerings.HeidelbergCement:

A major player in the global construction materials industry, offering wide-ranging supplementary cementitious materials to enhance long-term durability and performance.BASF:

A world-leading chemical company heavily involved in the development of performance additives in cementitious applications to improve workability and adaptability.We're grateful to work with incredible clients.

FAQs

What is the market size of supplementary Cementitious Materials?

The global supplementary cementitious materials market size is approximately $8 billion in 2023, with a projected growth rate of 7.2% CAGR, signaling significant expansion opportunities through 2033.

What are the key market players or companies in this supplementary Cementitious Materials industry?

Key players in the supplementary cementitious materials industry include LafargeHolcim, CEMEX, HeidelbergCement, and Boral Limited, significantly contributing to market trends and competitive dynamics.

What are the primary factors driving the growth in the supplementary Cementitious Materials industry?

Growth factors include increased construction activities, the need for sustainable building materials, and regulatory push towards reducing carbon emissions via eco-friendly alternatives.

Which region is the fastest Growing in the supplementary Cementitious Materials?

North America is the fastest-growing region, with its market expanding from $2.77 billion in 2023 to $5.67 billion by 2033, fueled by investment in infrastructure and residential construction.

Does ConsaInsights provide customized market report data for the supplementary Cementitious Materials industry?

Yes, ConsaInsights offers customized market reports tailored to specific business needs, allowing clients to gain insights aligned with their market strategy and objectives.

What deliverables can I expect from this supplementary Cementitious Materials market research project?

Deliverables include comprehensive market analysis, segmented data, competitive landscape evaluations, and regional insights to assist in strategic decision-making.

What are the market trends of supplementary Cementitious Materials?

Current trends include increased use of fly ash and slag in construction, innovations in sustainable materials, and a growing emphasis on durability and strength improvements in cement mixtures.