Supplier Relationship Management Software Market Report

Published Date: 31 January 2026 | Report Code: supplier-relationship-management-software

Supplier Relationship Management Software Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Supplier Relationship Management Software market, including market size, trends, forecasts, and insights spanning from 2023 to 2033. It aims to equip stakeholders with valuable data for strategic decision-making.

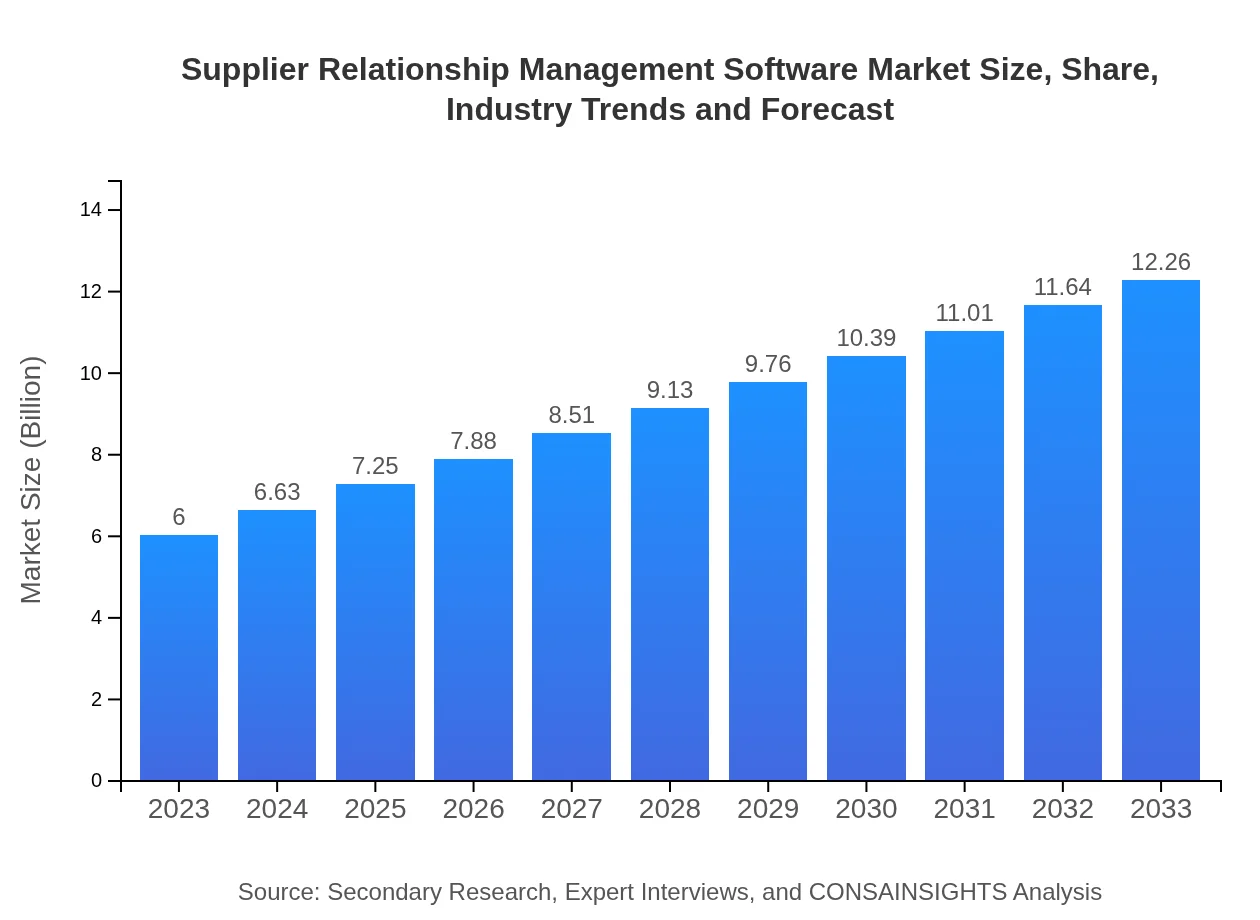

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $6.00 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $12.26 Billion |

| Top Companies | SAP SE, Oracle Corporation, Jaggaer, Coupa Software |

| Last Modified Date | 31 January 2026 |

Supplier Relationship Management Software Market Overview

Customize Supplier Relationship Management Software Market Report market research report

- ✔ Get in-depth analysis of Supplier Relationship Management Software market size, growth, and forecasts.

- ✔ Understand Supplier Relationship Management Software's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Supplier Relationship Management Software

What is the Market Size & CAGR of Supplier Relationship Management Software market in 2023?

Supplier Relationship Management Software Industry Analysis

Supplier Relationship Management Software Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Supplier Relationship Management Software Market Analysis Report by Region

Europe Supplier Relationship Management Software Market Report:

The European market, currently valued at USD 1.48 billion, is expected to double to USD 3.03 billion by 2033. The growth can be linked to stringent regulatory frameworks and a pressing need for sustainability in supplier management practices.Asia Pacific Supplier Relationship Management Software Market Report:

In the Asia Pacific region, the Supplier Relationship Management Software market is projected to grow from USD 1.21 billion in 2023 to USD 2.47 billion by 2033. This growth is driven by rapid industrialization, increasing digital adoption, and a growing focus on supply chain optimization among organizations in key economies like China and India.North America Supplier Relationship Management Software Market Report:

In North America, the market size is estimated at USD 2.09 billion in 2023, with projections of reaching USD 4.27 billion by 2033. The region is a front-runner in technological adoption, particularly in cloud-based solutions, favorable to both large enterprises and small and medium-sized enterprises.South America Supplier Relationship Management Software Market Report:

The South American market is expected to rise from USD 0.41 billion in 2023 to USD 0.83 billion by 2033. The growth is attributed to the increasing awareness of digital transformations and the need for enhanced supplier collaboration among the region’s manufacturing and retail sectors.Middle East & Africa Supplier Relationship Management Software Market Report:

The Middle East and Africa market is projected to grow from USD 0.82 billion in 2023 to USD 1.67 billion by 2033. This increase is driven by the region’s diversification efforts and the rising importance of effective supplier management in enhancing operational efficiency.Tell us your focus area and get a customized research report.

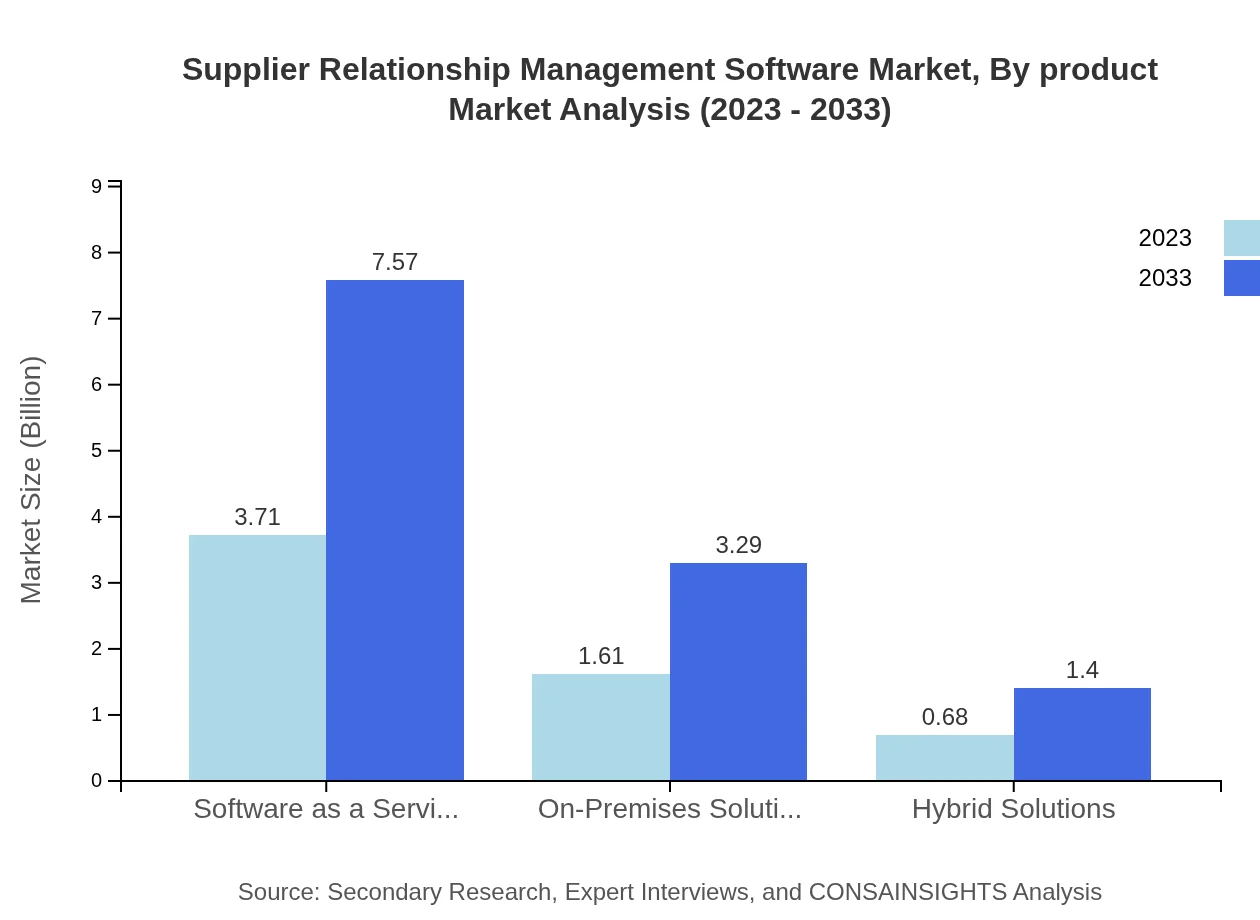

Supplier Relationship Management Software Market Analysis By Product

The Supplier Relationship Management Software segment shows a growing inclination towards Software as a Service (SaaS) solutions, which are anticipated to grow from USD 3.71 billion in 2023 to USD 7.57 billion by 2033, capturing 61.75% of the market share throughout this period. On-Premises solutions are projected to grow from USD 1.61 billion to USD 3.29 billion, holding a 26.85% share. Hybrid solutions, while smaller, are also expected to see growth, with sizes increasing from USD 0.68 billion to USD 1.40 billion.

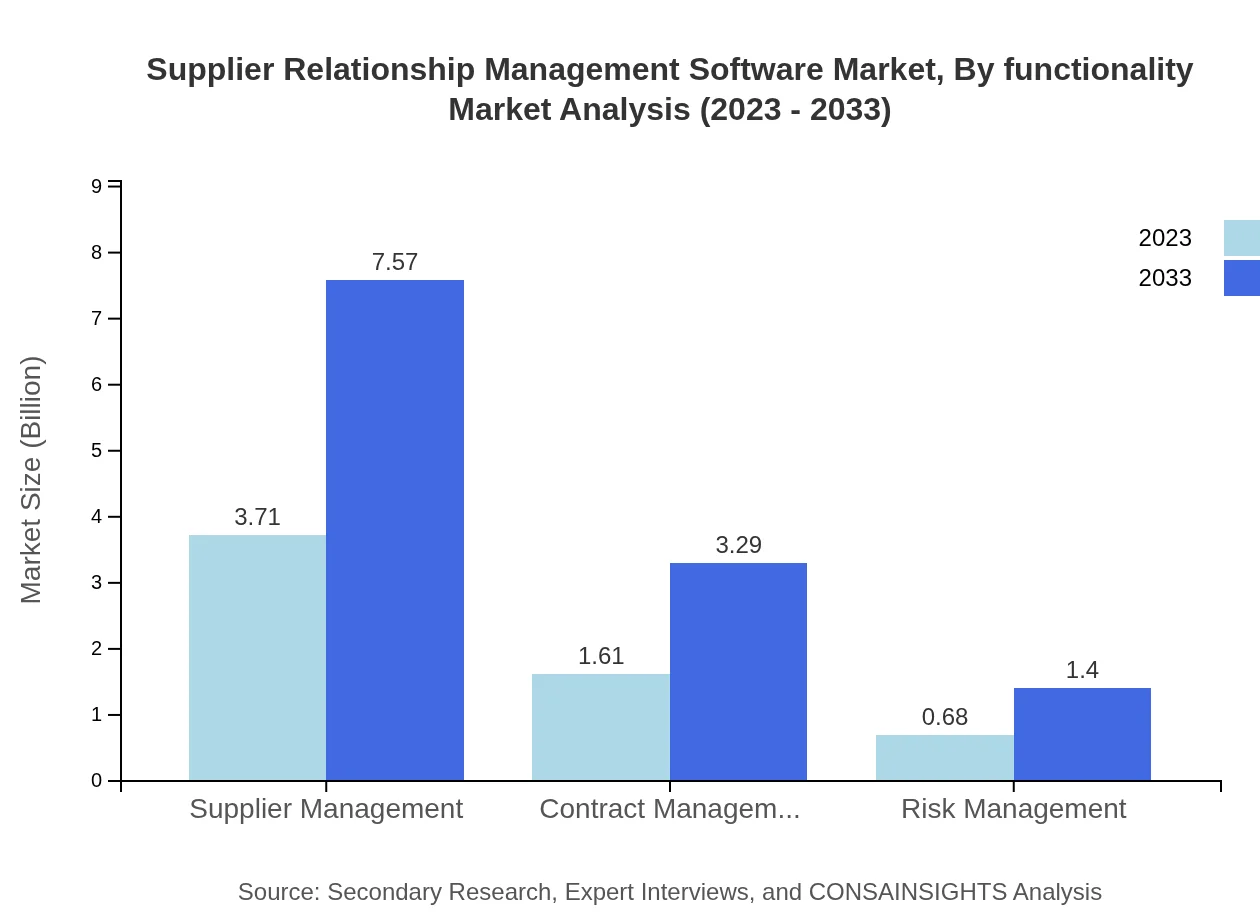

Supplier Relationship Management Software Market Analysis By Functionality

The functionality sectors demonstrate varying growth patterns, with Supplier Management leading at USD 3.71 billion projected for 2023, growing to USD 7.57 billion. Contract Management follows with an estimated growth from USD 1.61 billion to USD 3.29 billion. Meanwhile, Risk Management, while smaller in revival, will expand from USD 0.68 billion to eventually reach USD 1.40 billion, ensuring compliance amidst evolving regulations.

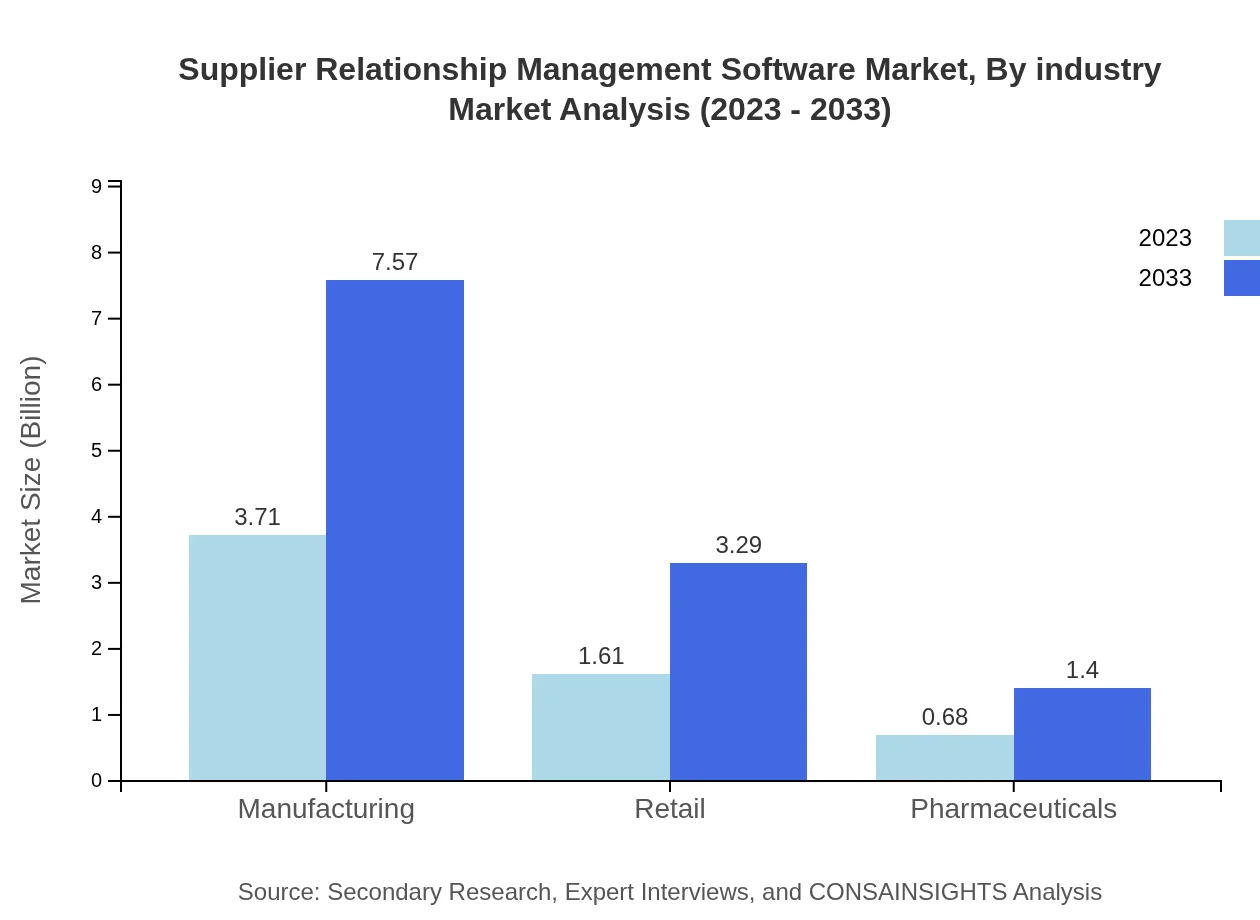

Supplier Relationship Management Software Market Analysis By Industry

The manufacturing sector represents a significant portion of the market, with a size projected at USD 3.71 billion in 2023, achieving USD 7.57 billion by 2033 due to its continual need for operational efficiency and risk mitigation. The retail industry, estimated to grow from USD 1.61 billion to USD 3.29 billion, reflects similar trends as demand centers on better supplier relationships. The pharmaceutical sector notably is emerging, anticipated to grow and realize USD 1.40 billion by 2033, aligning with the increasing focus on compliance and supplier performance.

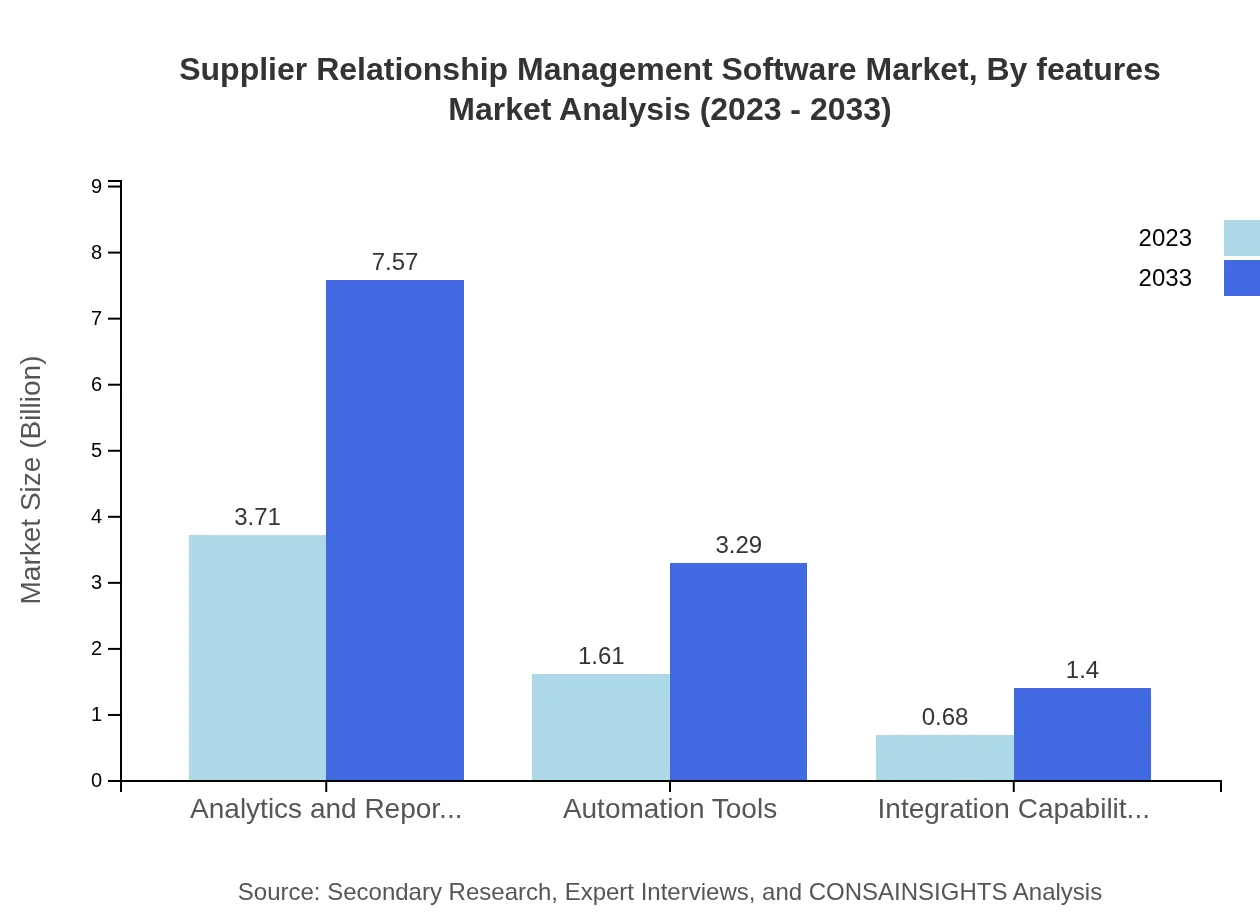

Supplier Relationship Management Software Market Analysis By Features

In terms of features, enhanced analytics and reporting share a significant market with a resilience advantage as it also anticipates higher growth from USD 3.71 billion in 2023 to USD 7.57 billion. Features like automation tools are predicted to grow at a similar trend, moving from USD 1.61 billion to USD 3.29 billion, as companies pivot towards efficiency and streamlined operations.

Supplier Relationship Management Software Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Supplier Relationship Management Software Industry

SAP SE:

SAP SE is a multinational software corporation known for its ERP solutions, including advanced supplier relationship management capabilities that improve procurement and foster supplier collaboration.Oracle Corporation:

Oracle Corporation provides an extensive suite of integrated cloud applications, including supplier management tools that leverage AI to optimize supplier engagement and performance.Jaggaer:

Jaggaer specializes in spend management solutions, offering advanced SRM capabilities that empower organizations to enhance supplier relationships and manage compliance effectively.Coupa Software:

Coupa Software provides a cloud-based spend management platform equipped with powerful SRM features designed to enhance visibility, collaboration, and overall supplier performance.We're grateful to work with incredible clients.

FAQs

What is the market size of supplier Relationship Management Software?

The supplier relationship management software market is valued at approximately $6 billion in 2023, with a projected CAGR of 7.2% through 2033, indicating robust growth and a substantial demand for innovative supplier management solutions.

What are the key market players or companies in this supplier Relationship Management Software industry?

Key players in the supplier relationship management software market include SAP Ariba, Oracle, Coupa, Jaggaer, and Ivalua, each offering unique solutions aimed at enhancing supplier collaboration and procurement efficiency across industries.

What are the primary factors driving the growth in the supplier Relationship Management Software industry?

The growth of the supplier relationship management software industry is driven by digital transformation initiatives, increased supply chain complexities, demand for cost efficiency, and the need for enhanced analytics and reporting capabilities to inform strategic decision-making.

Which region is the fastest Growing in the supplier Relationship Management Software?

The fastest-growing region for supplier relationship management software is North America, expected to grow from $2.09 billion in 2023 to $4.27 billion by 2033, reflecting a significant investment in technological advancements and operational efficiency.

Does ConsainInsights provide customized market report data for the supplier Relationship Management Software industry?

Yes, ConsainInsights offers customized market reports tailored to specific requirements within the supplier relationship management software industry, enabling clients to access focused insights and data relevant to their strategic needs.

What deliverables can I expect from this supplier Relationship Management Software market research project?

Deliverables from the supplier relationship management software market research project include comprehensive reports, detailed market analysis, segment profiles, growth forecasts, and actionable insights to support strategic planning and decision-making.

What are the market trends of supplier Relationship Management Software?

Current market trends in supplier relationship management software include an increasing adoption of SaaS solutions, integration capabilities, automation tools, and a focus on analytics and reporting, driving efficiency in supply chain operations.