Surface Inspection Market Report

Published Date: 22 January 2026 | Report Code: surface-inspection

Surface Inspection Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the surface inspection market from 2023 to 2033, exploring key insights, market trends, growth projections, and regional dynamics that shape the industry. Detailed analysis is provided for market size, segmentation, technology advancements, and key players within the market.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

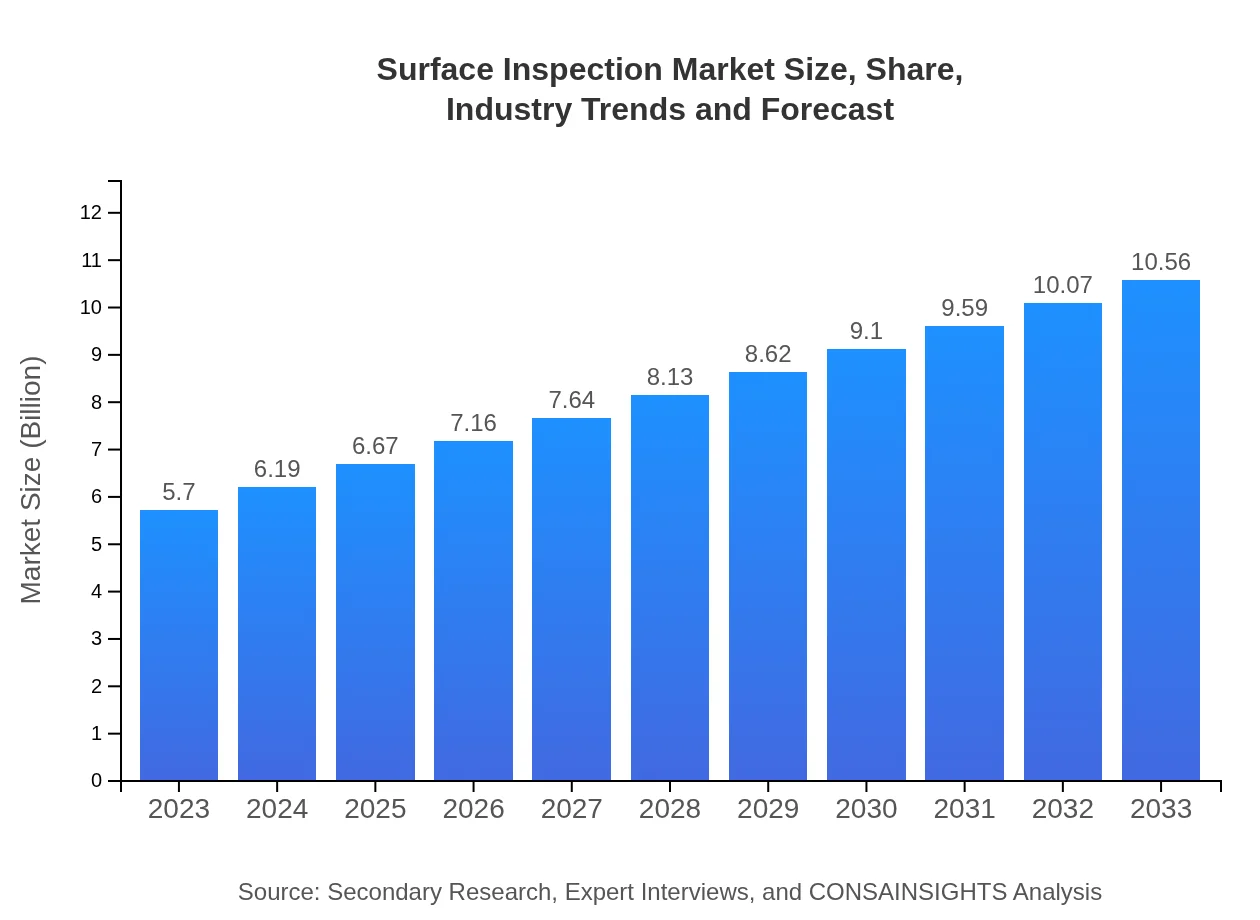

| 2023 Market Size | $5.70 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $10.56 Billion |

| Top Companies | Cognex Corporation, Hexagon AB, KUKA AG, OMRON Corporation |

| Last Modified Date | 22 January 2026 |

Surface Inspection Market Overview

Customize Surface Inspection Market Report market research report

- ✔ Get in-depth analysis of Surface Inspection market size, growth, and forecasts.

- ✔ Understand Surface Inspection's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Surface Inspection

What is the Market Size & CAGR of Surface Inspection market in 2023 and 2033?

Surface Inspection Industry Analysis

Surface Inspection Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Surface Inspection Market Analysis Report by Region

Europe Surface Inspection Market Report:

The European surface inspection market is forecasted to grow from $1.74 billion in 2023 to $3.23 billion by 2033. Innovation and sustainability practices, along with investments in research and development, are enhancing the capabilities of inspection technologies across various sectors in Europe.Asia Pacific Surface Inspection Market Report:

In the Asia Pacific region, the surface inspection market is expected to grow from $1.15 billion in 2023 to $2.13 billion by 2033, driven by robust industrialization, particularly in countries like China and India. The increasing demand for quality control in manufacturing processes fosters the adoption of advanced inspection technologies.North America Surface Inspection Market Report:

The North American market is anticipated to increase from $1.92 billion in 2023 to $3.57 billion by 2033. The presence of major manufacturing hubs, along with strict regulatory frameworks in industries like automotive and aerospace, significantly contributes to market growth in this region.South America Surface Inspection Market Report:

South America is poised for growth, with the market expected to expand from $0.49 billion in 2023 to $0.91 billion by 2033. The region's focus on modernizing its industrial base and improving production quality standards plays a critical role in advancing the surface inspection market.Middle East & Africa Surface Inspection Market Report:

The Middle East and Africa region is projected to grow from $0.40 billion in 2023 to $0.74 billion by 2033. Increased investment in infrastructure and the adoption of advanced inspection technologies are crucial for maintaining quality and safety standards across industries.Tell us your focus area and get a customized research report.

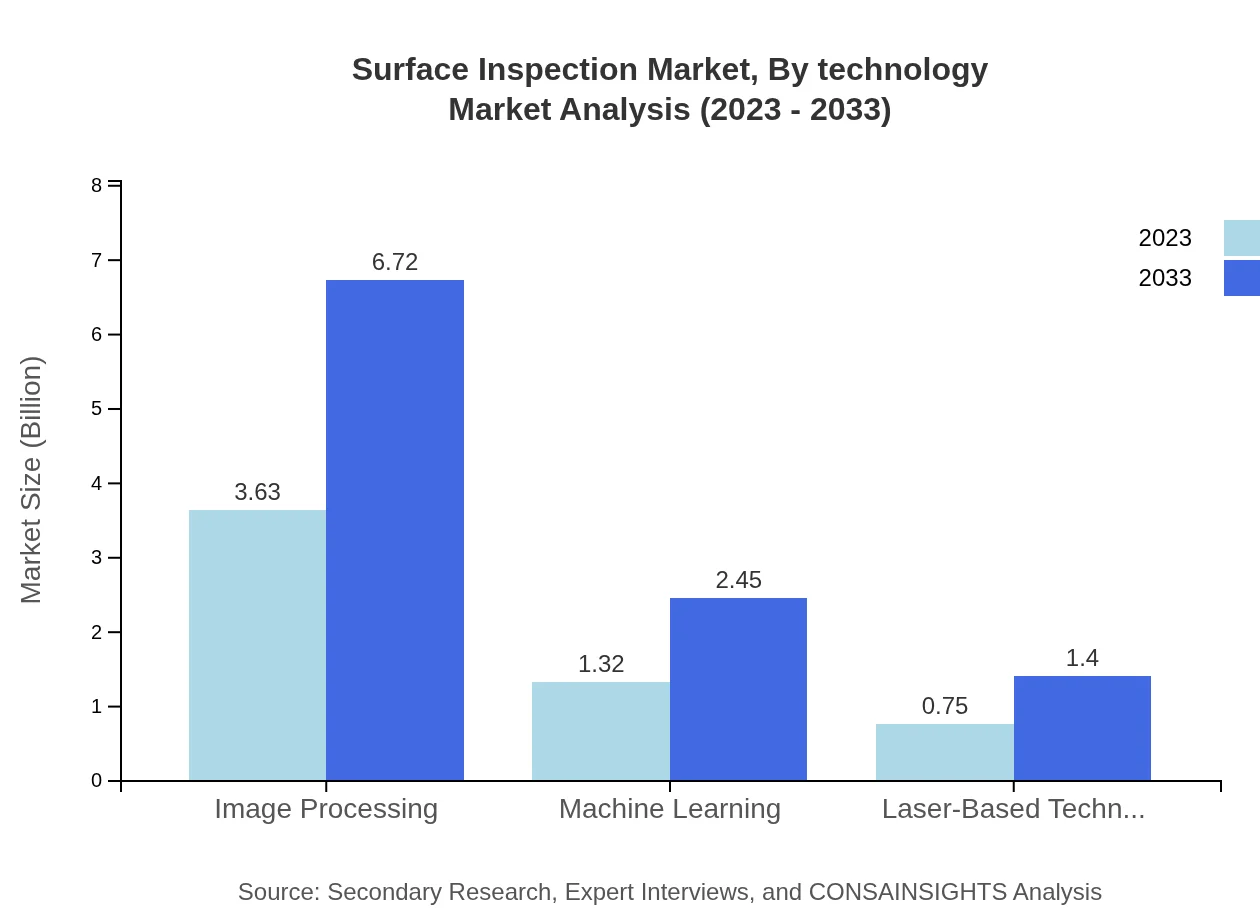

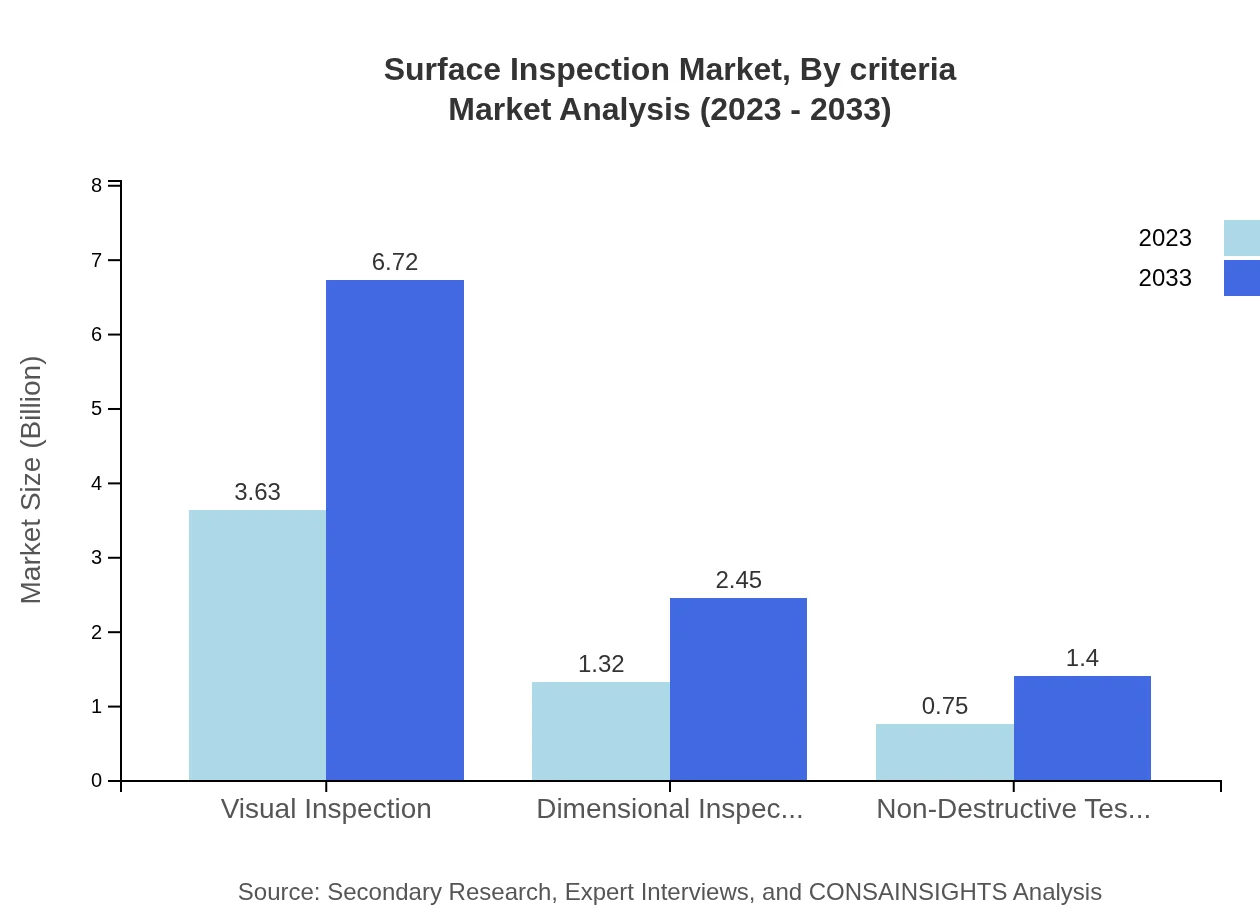

Surface Inspection Market Analysis By Technology

The Surface Inspection Market by technology shows significant growth, with visual inspection leading the segment size from $3.63 billion in 2023 to $6.72 billion by 2033. This technology accounted for 63.6% market share in both years. Dimensional inspection and non-destructive testing are also critical segments, growing from $1.32 billion to $2.45 billion and $0.75 billion to $1.40 billion, respectively, maintaining shares of 23.17% and 13.23%.

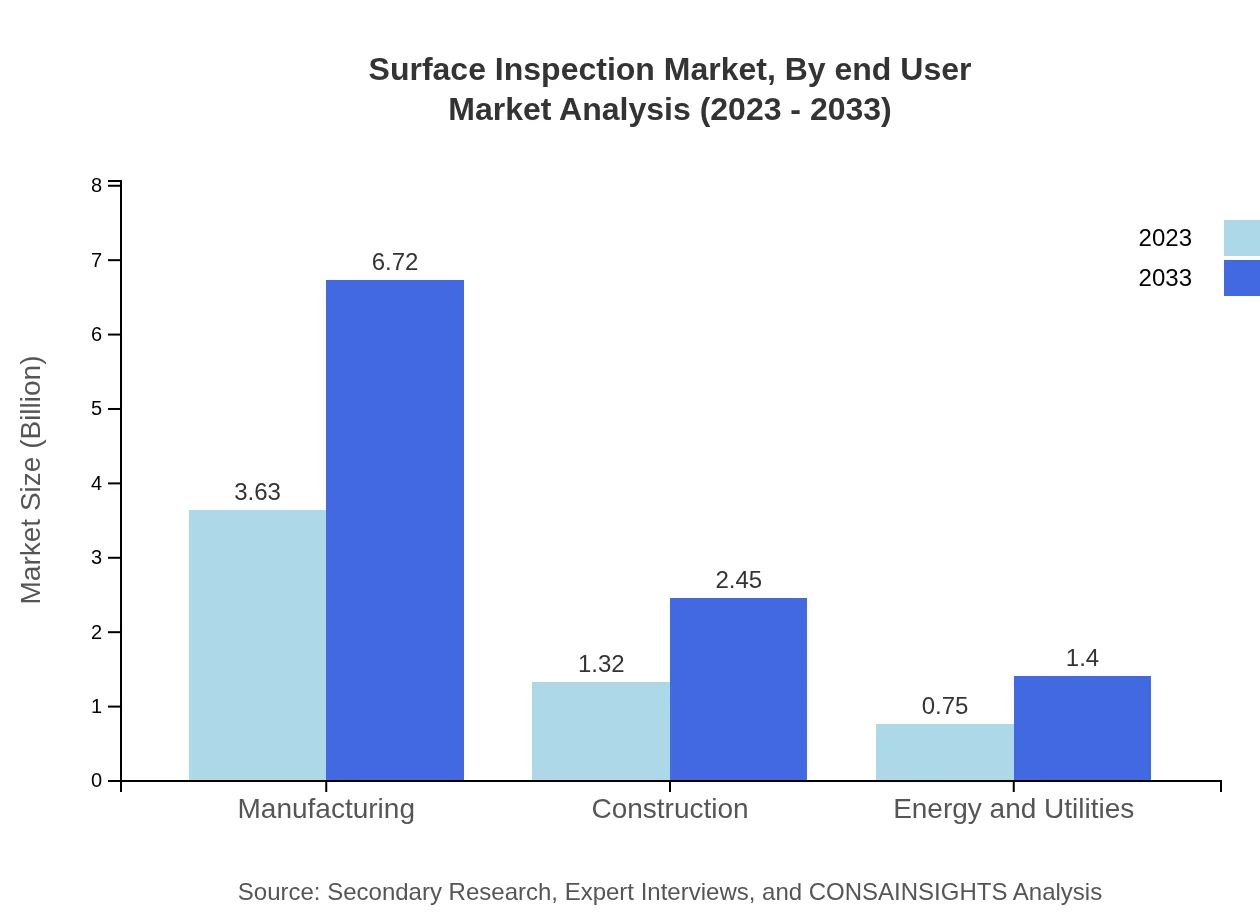

Surface Inspection Market Analysis By Application

The application segment of the surface inspection market demonstrates varied demands across industries. Manufacturing sees significant activity, with market sizes reflecting $3.63 billion in 2023 and expected to grow to $6.72 billion. The construction segment is also notable, expanding from $1.32 billion to $2.45 billion, while energy and utilities show growth from $0.75 billion to $1.40 billion.

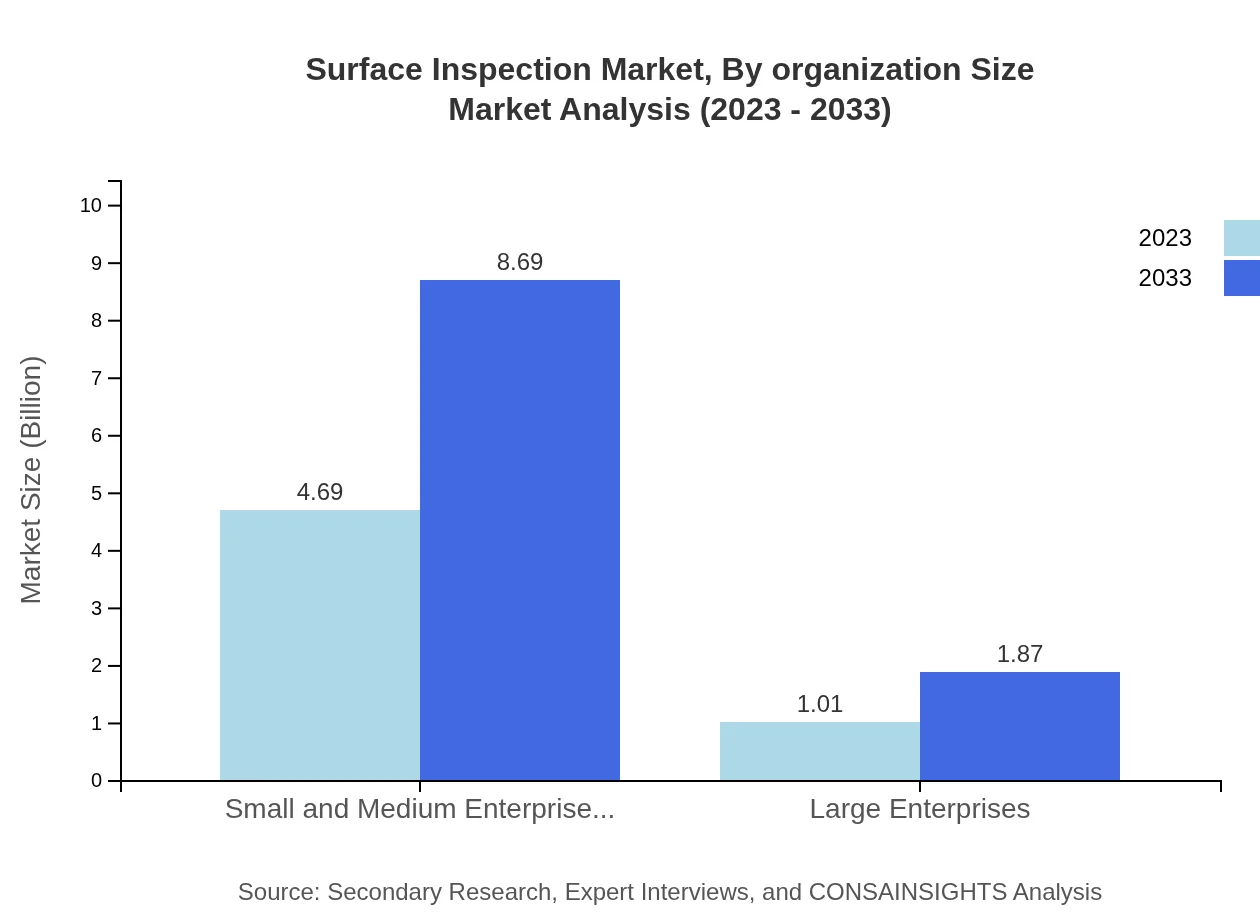

Surface Inspection Market Analysis By Organization Size

Small and Medium Enterprises (SMEs) dominate the surface inspection market, with their size increasing from $4.69 billion in 2023 to $8.69 billion by 2033. Large enterprises follow with a market size of $1.01 billion in 2023 expected to rise to $1.87 billion, comprising 17.68% of the market.

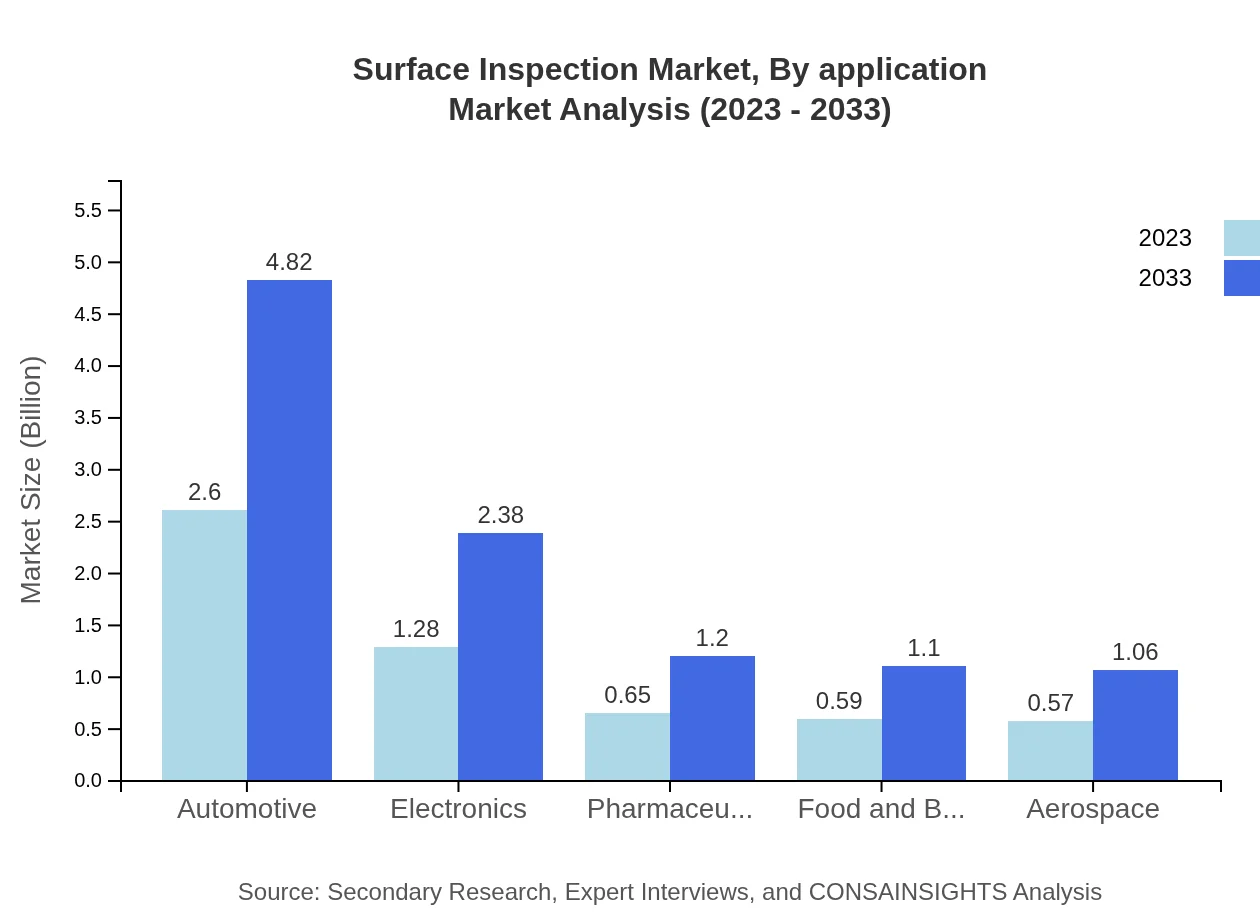

Surface Inspection Market Analysis By End User

The automotive segment is one of the largest end-users, growing from $2.60 billion in 2023 to $4.82 billion by 2033, retaining a 45.64% market share. Other sectors like electronics and pharmaceuticals also contribute significantly to the market, expanding from $1.28 billion and $0.65 billion to $2.38 billion and $1.20 billion, respectively.

Surface Inspection Market Analysis By Criteria

Inspection criteria relate closely to specific industry needs, with quality assurance emerging as a pivotal focus. Future inspections will likely be driven by innovations in machine learning and integrated systems, enhancing precision across all segments.

Surface Inspection Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Surface Inspection Industry

Cognex Corporation:

Cognex provides innovative machine vision systems, serving various industries by enhancing product quality and increasing manufacturing efficiencies.Hexagon AB:

Hexagon is a leading provider of measurement technologies, offering comprehensive solutions for surface inspection in manufacturing and construction sectors.KUKA AG:

KUKA specializes in automation technology and robotics, enhancing the inspection processes through effective automation solutions.OMRON Corporation:

OMRON offers advanced automation solutions and inspection systems that improve production quality and operational efficiency in numerous industries.We're grateful to work with incredible clients.

FAQs

What is the market size of surface Inspection?

The global surface inspection market is valued at approximately $5.7 billion in 2023 and is expected to grow at a CAGR of 6.2%, reaching significant growth by 2033.

What are the key market players or companies in the surface Inspection industry?

Key players in the surface inspection market include industry leaders who provide advanced inspection technologies and solutions. These companies are pivotal in driving innovation and maintaining competitiveness in the surface inspection sector.

What are the primary factors driving the growth in the surface Inspection industry?

Growth in the surface inspection industry is driven by technological advancements, increased demand for quality control, and the proliferation of automation across various sectors. Additionally, regulatory compliance needs in manufacturing spur further growth.

Which region is the fastest Growing in the surface Inspection market?

The fastest-growing region in the surface inspection market is Europe, projected to grow from $1.74 billion in 2023 to $3.23 billion by 2033, indicating strong market potential and investment.

Does ConsaInsights provide customized market report data for the surface Inspection industry?

Yes, ConsaInsights offers customized market report data tailored to specific requirements in the surface inspection industry, allowing businesses to gain insights relevant to their unique needs.

What deliverables can I expect from this surface Inspection market research project?

From the surface inspection market research project, you can expect comprehensive reports including market analysis, regional trends, segment data, and competitive landscape insights to support informed decision-making.

What are the market trends of surface Inspection?

Current trends in the surface inspection market include growing adoption of AI and machine learning for improved accuracy, increasing automation in production lines, and expansion of inspection technologies into new sectors such as aerospace and pharmaceuticals.