Surface Mount Technology Market Report

Published Date: 31 January 2026 | Report Code: surface-mount-technology

Surface Mount Technology Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Surface Mount Technology (SMT) market, exploring market dynamics, sizing, forecasts for 2023-2033, and regional insights to offer stakeholders a profound understanding of market trends and opportunities.

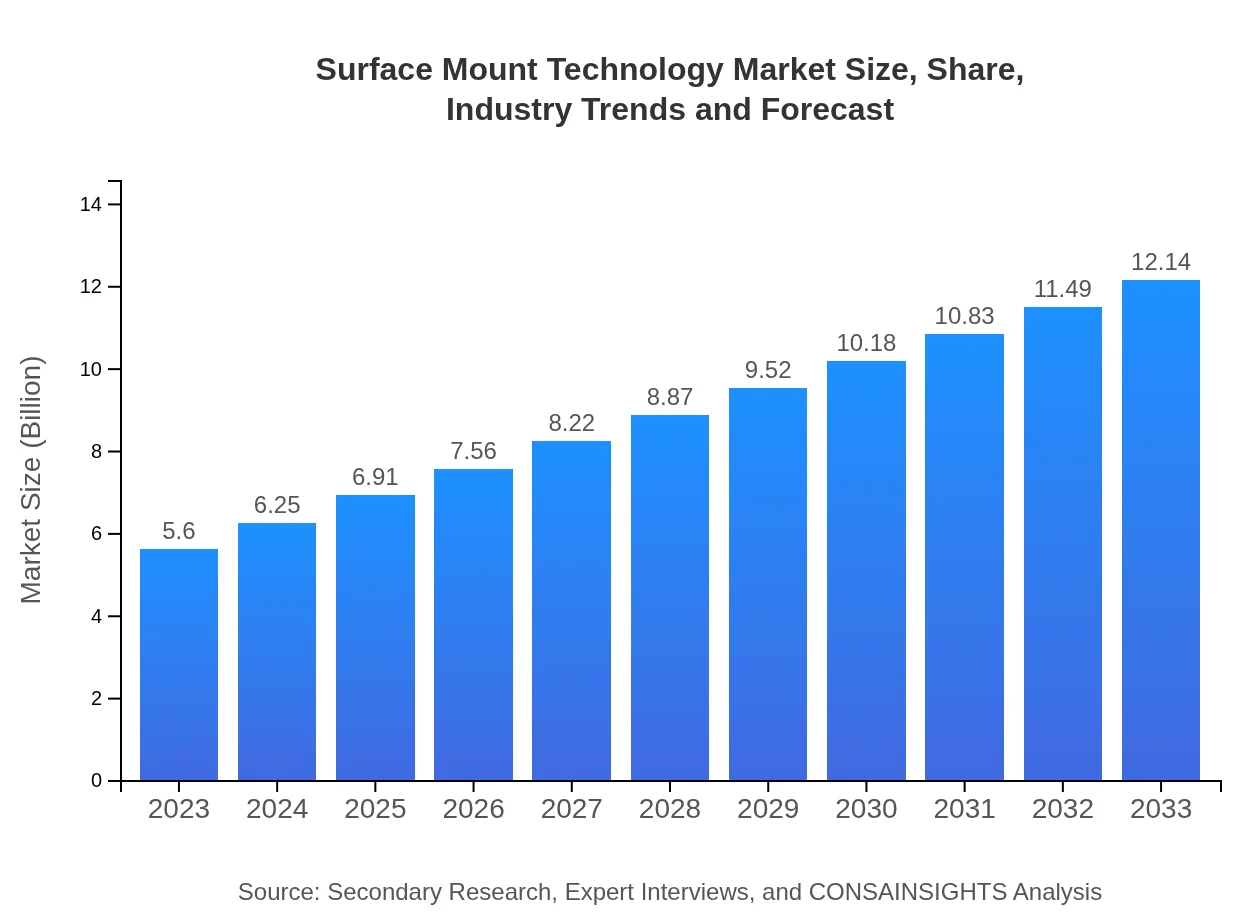

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $12.14 Billion |

| Top Companies | Samsung Electronics, Panasonic, Texas Instruments, Yamaha Motor Company |

| Last Modified Date | 31 January 2026 |

Surface Mount Technology Market Overview

Customize Surface Mount Technology Market Report market research report

- ✔ Get in-depth analysis of Surface Mount Technology market size, growth, and forecasts.

- ✔ Understand Surface Mount Technology's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Surface Mount Technology

What is the Market Size & CAGR of Surface Mount Technology market in 2023?

Surface Mount Technology Industry Analysis

Surface Mount Technology Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Surface Mount Technology Market Analysis Report by Region

Europe Surface Mount Technology Market Report:

Europe's SMT market is valued at approximately 1.84 billion USD in 2023 and is expected to escalate to 4.00 billion USD by 2033. Innovation and emphasis on sustainability in manufacturing are driving this growth in the region.Asia Pacific Surface Mount Technology Market Report:

The Asia Pacific region accounts for a significant share of the Surface Mount Technology market, valued at approximately 1.08 billion USD in 2023. By 2033, it is expected to reach 2.34 billion USD, driven by the booming consumer electronics industry and increasing manufacturing capabilities.North America Surface Mount Technology Market Report:

North America recorded a market size of 1.83 billion USD in 2023, projected to grow to 3.97 billion USD by 2033. The growth is propelled by advancements in automotive technology and an increase in connected devices.South America Surface Mount Technology Market Report:

In South America, the SMT market is anticipated to see growth from 0.53 billion USD in 2023 to 1.16 billion USD by 2033. The expansion is supported by rising investments in technology and a growing middle class with increased electronics consumption.Middle East & Africa Surface Mount Technology Market Report:

The Surface Mount Technology market in the Middle East and Africa is valued at 0.31 billion USD in 2023 and is set to increase to 0.68 billion USD by 2033. The growth is underpinned by rising infrastructural developments and a focus on technology adoption across various industries.Tell us your focus area and get a customized research report.

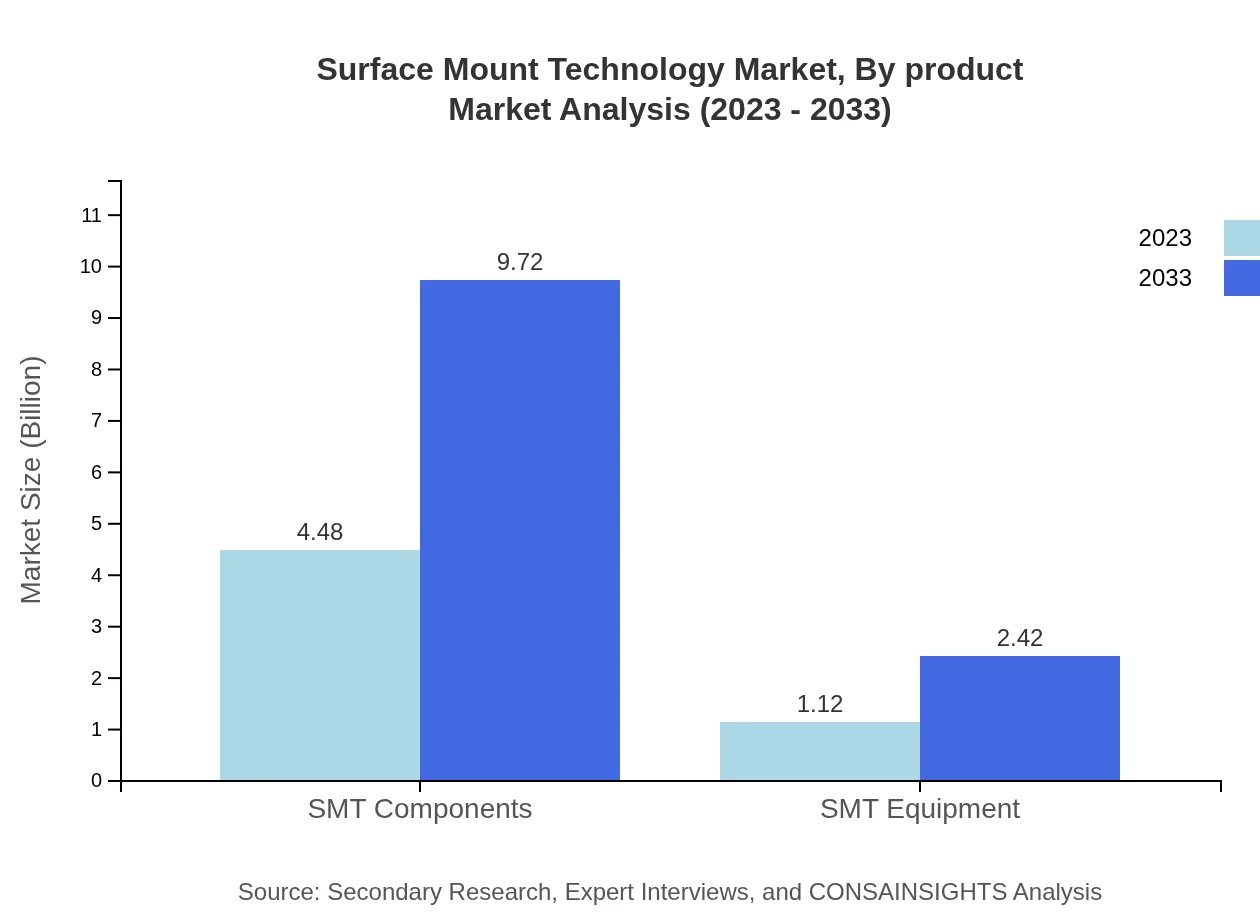

Surface Mount Technology Market Analysis By Product

The SMT components market is set to dominate the segment, valued at 4.48 billion USD in 2023 and projected to reach 9.72 billion USD by 2033. The SMT equipment market is smaller but growing, estimated at 1.12 billion USD in 2023, with a target of 2.42 billion USD by 2033.

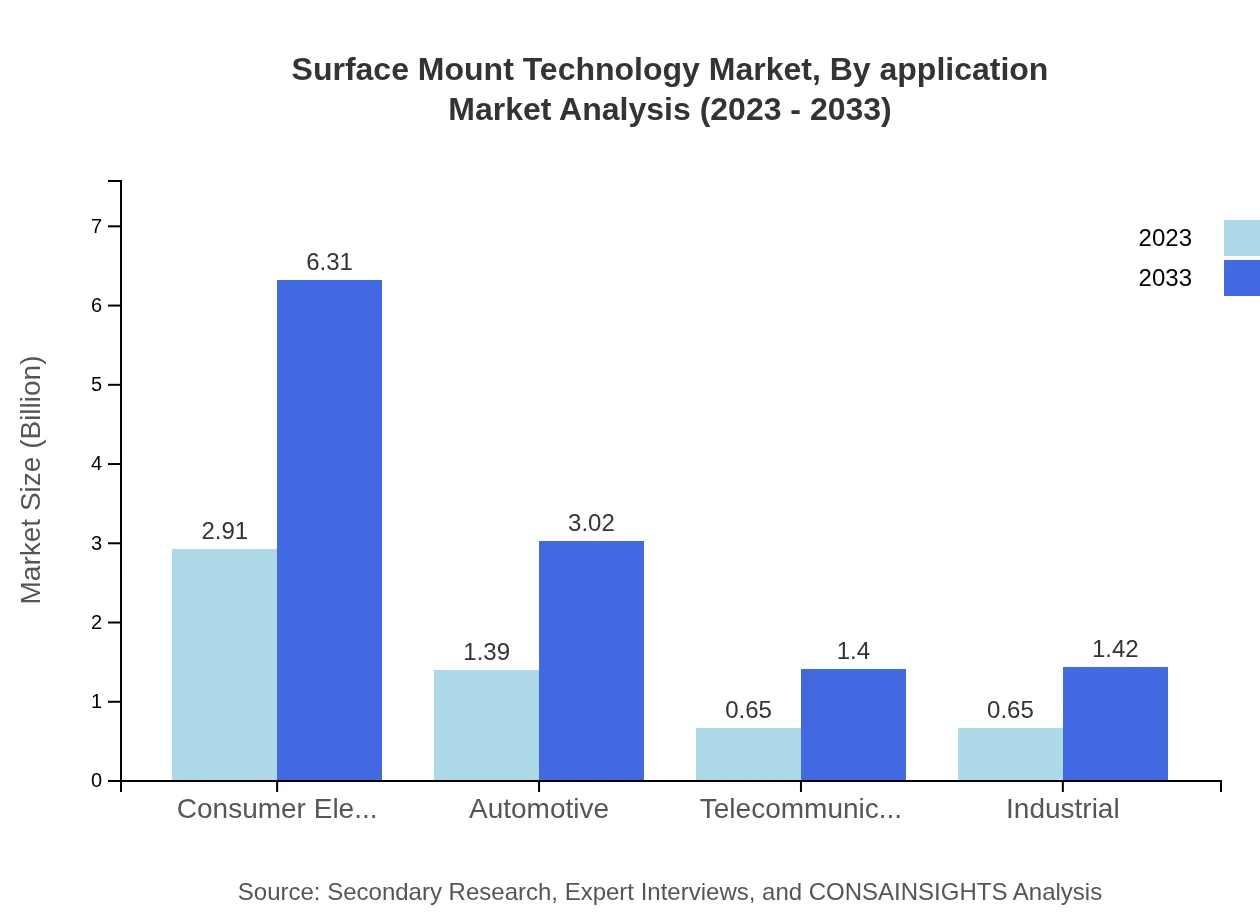

Surface Mount Technology Market Analysis By Application

In terms of application, the consumer electronics segment leads with a projected size of 2.91 billion USD in 2023, expected to expand to 6.31 billion USD by 2033. Other significant applications include automotive and telecommunications, which are also experiencing favorable growth rates.

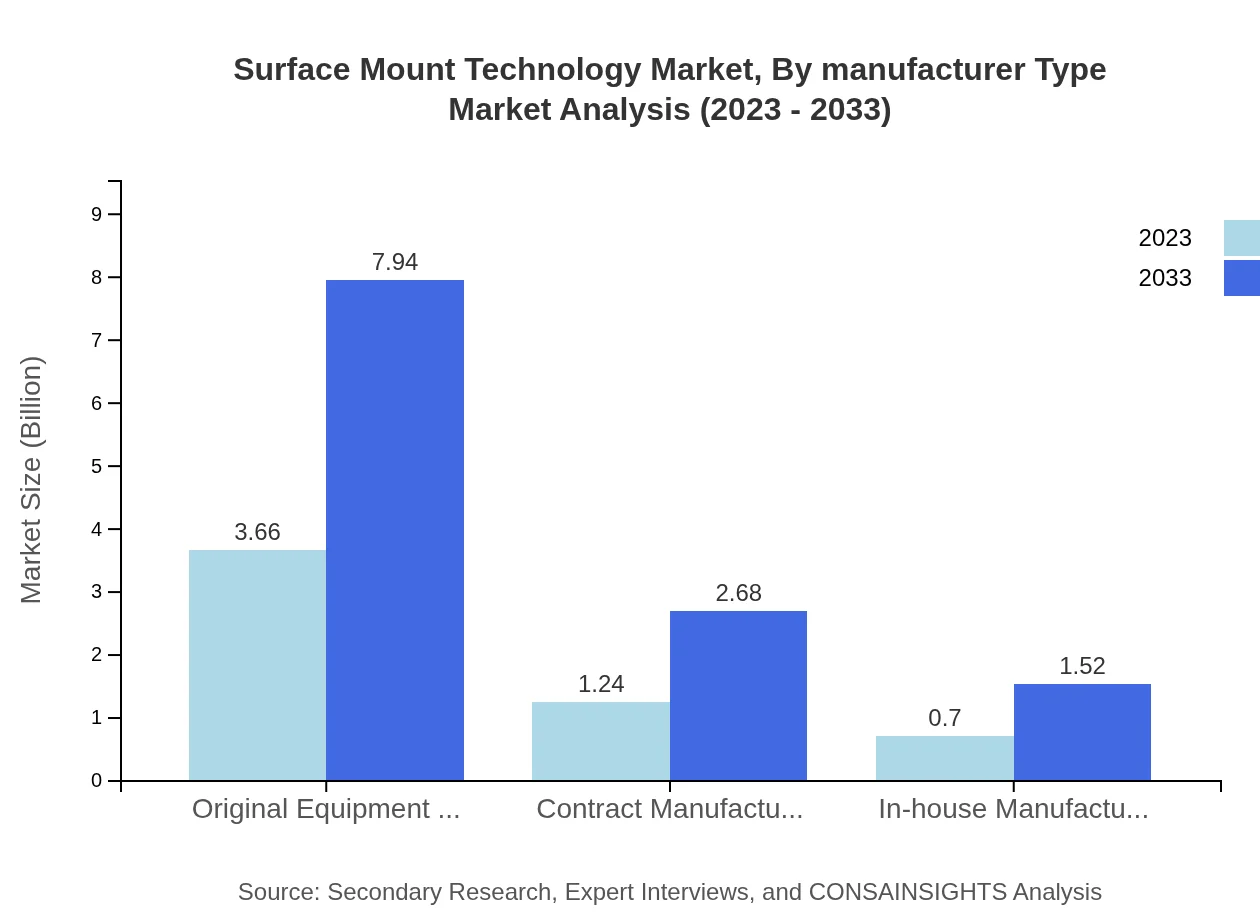

Surface Mount Technology Market Analysis By Manufacturer Type

The SMT market is largely influenced by Original Equipment Manufacturers (OEMs), holding a sizable share at 3.66 billion USD in 2023 and expected to achieve 7.94 billion USD by 2033. Contract manufacturers and in-house manufacturers also contribute significantly, with respective shares aligned with increasing outsourcing trends.

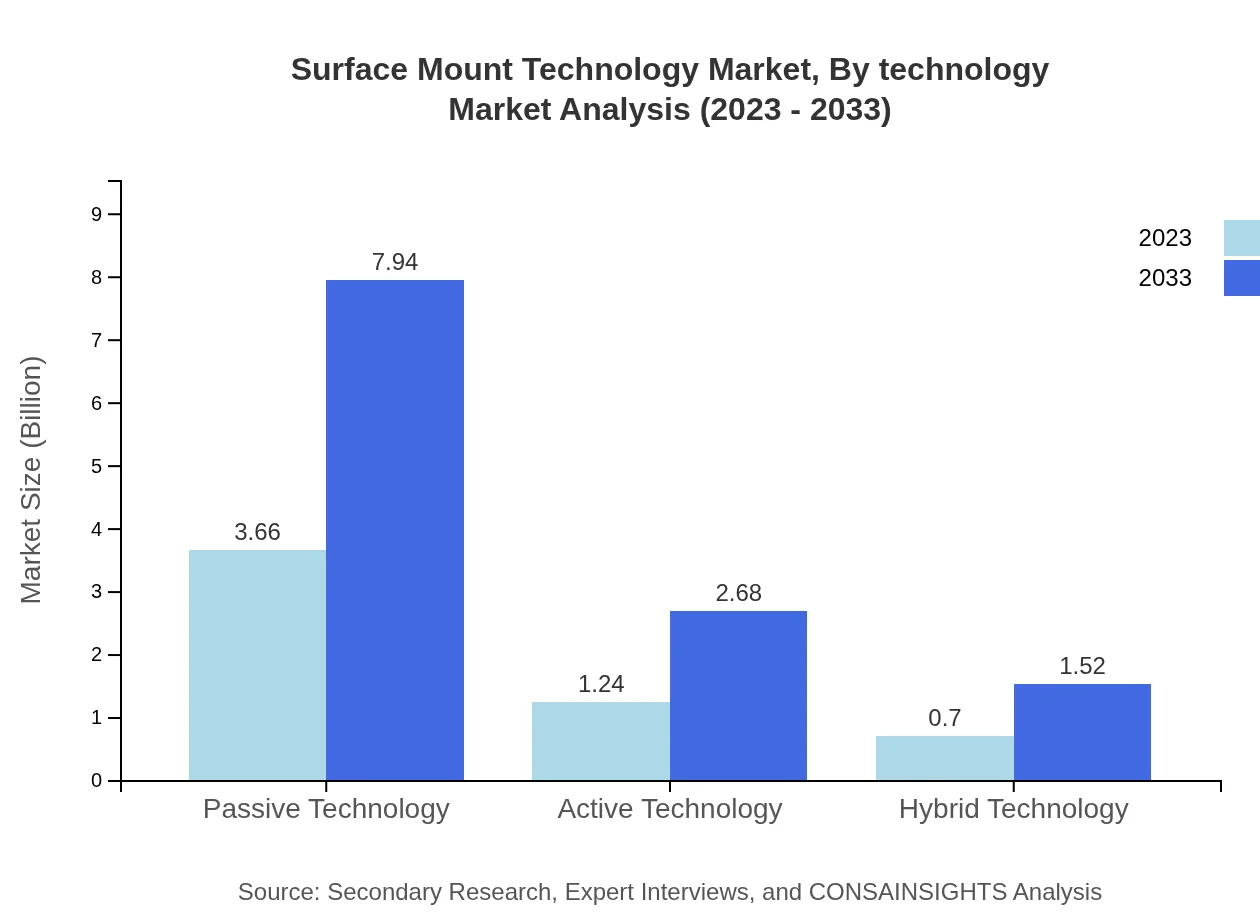

Surface Mount Technology Market Analysis By Technology

Passive technology leads this market segment at 3.66 billion USD in 2023, set to grow to 7.94 billion USD by 2033, driven by the need for energy-efficient components. Active technology and hybrid technology also contribute to growth, though to a lesser extent.

Surface Mount Technology Market Analysis By Soldering Type

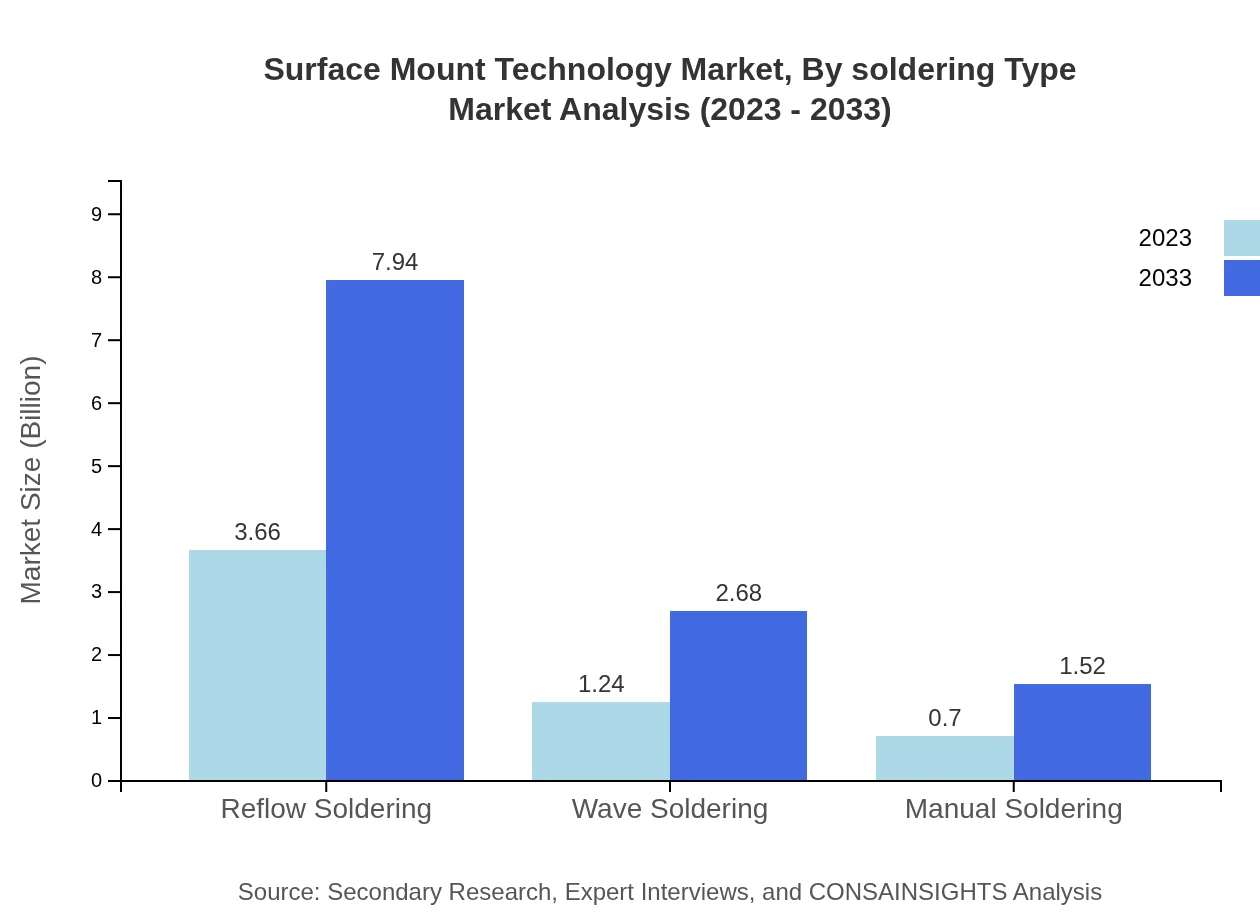

SMT also incorporates various soldering techniques, with reflow soldering dominating the segment. This technique's market size in 2023 is estimated at 3.66 billion USD, with prospects to reach 7.94 billion USD by 2033. Wave soldering and manual soldering follow but represent smaller portions of the market.

Surface Mount Technology Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Surface Mount Technology Industry

Samsung Electronics:

A global leader in electronics and SMT, Samsung prioritizes innovation in component manufacturing and integrated solutions, contributing to efficiencies in modern electronics.Panasonic:

Panasonic specializes in SMT solutions, emphasizing advanced manufacturing technologies and sustainable practices that enhance product quality and performance.Texas Instruments:

Known for its semiconductor innovations, Texas Instruments leverages SMT for enhanced performance, supporting the automotive and telecommunications sectors.Yamaha Motor Company:

Yamaha is well-regarded for its precision equipment used in SMT processes, driving advancements in the efficiency of manufacturing lines.We're grateful to work with incredible clients.

FAQs

What is the market size of surface Mount Technology?

The global surface-mount technology market is valued at approximately $5.6 billion as of 2023, with a projected CAGR of 7.8% from 2023 to 2033, indicating robust growth in the sector.

What are the key market players or companies in this surface Mount Technology industry?

Key players in the surface-mount technology industry include leading semiconductor manufacturers, equipment suppliers, and contract manufacturers that specialize in high-volume production and innovative SMT solutions.

What are the primary factors driving the growth in the surface Mount Technology industry?

The growth of the surface-mount technology market is driven by increasing demand for compact electronic devices, advancements in automation technology, and a significant rise in consumer electronics utilization.

Which region is the fastest Growing in the surface Mount Technology?

The fastest-growing region in the surface-mount technology market is Europe, with its market size projected to expand from $1.84 billion in 2023 to $4.00 billion by 2033, showcasing a strong growth trajectory.

Does ConsaInsights provide customized market report data for the surface Mount Technology industry?

Yes, ConsaInsights offers customized market reports tailored specifically to the surface-mount technology industry, addressing unique client needs for data and insights.

What deliverables can I expect from this surface Mount Technology market research project?

Deliverables from the surface-mount technology market research project include detailed market analysis, segment insights, competitive landscape reports, and growth forecasts tailored to various stakeholders in the industry.

What are the market trends of surface Mount Technology?

Current trends in the surface-mount technology market include the growing emphasis on miniaturization, increased automation in manufacturing, and the rising importance of eco-friendly materials in SMT practices.