Surge Arrester Market Report

Published Date: 22 January 2026 | Report Code: surge-arrester

Surge Arrester Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Surge Arrester market, exploring key insights, trends, and forecasts from 2023 to 2033. It covers market size, segmentation, regional dynamics, and leading players in the industry.

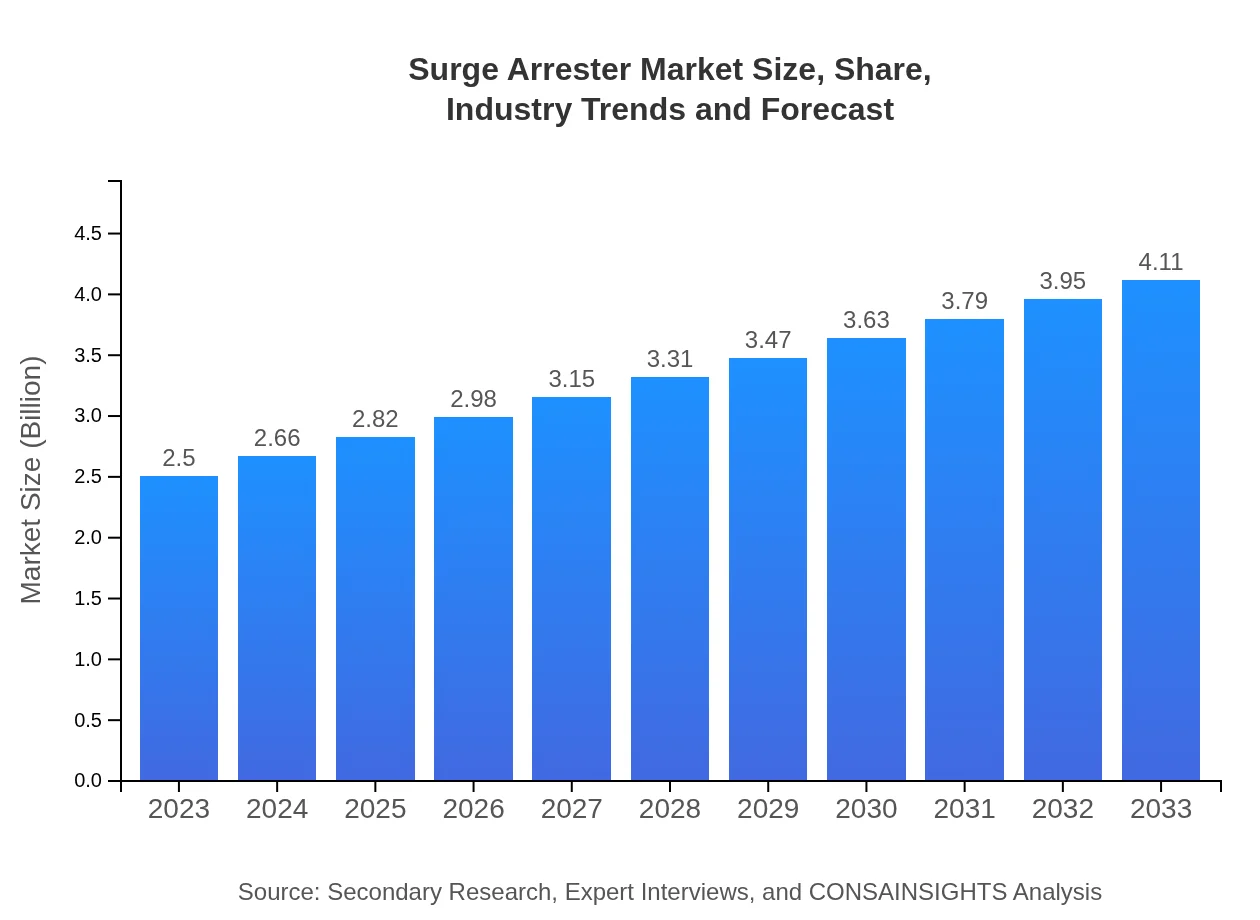

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $4.11 Billion |

| Top Companies | ABB, Siemens , Schneider Electric, Eaton, General Electric |

| Last Modified Date | 22 January 2026 |

Surge Arrester Market Overview

Customize Surge Arrester Market Report market research report

- ✔ Get in-depth analysis of Surge Arrester market size, growth, and forecasts.

- ✔ Understand Surge Arrester's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Surge Arrester

What is the Market Size & CAGR of Surge Arrester market in 2023?

Surge Arrester Industry Analysis

Surge Arrester Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Surge Arrester Market Analysis Report by Region

Europe Surge Arrester Market Report:

The European surge arrester market is anticipated to grow from $0.71 billion in 2023 to $1.18 billion in 2033, influenced by a shift towards renewable energy and increased investment in smart grid technology.Asia Pacific Surge Arrester Market Report:

The Asia Pacific market, valued at $0.49 billion in 2023, is expected to reach $0.81 billion by 2033. This growth stems from urbanization, industrialization, and increased electricity consumption, driving demand for surge protection devices.North America Surge Arrester Market Report:

North America stands out with an estimated market value of $0.91 billion in 2023, projected to grow to $1.50 billion by 2033. A key driver includes stringent safety regulations and modernization of electrical grids.South America Surge Arrester Market Report:

In South America, the market is projected to expand from $0.23 billion in 2023 to $0.38 billion in 2033, fueled by growing infrastructure projects and the need for reliable electrical networks.Middle East & Africa Surge Arrester Market Report:

Market growth in the Middle East and Africa is expected to shift from $0.15 billion in 2023 to $0.24 billion by 2033, driven by infrastructural developments and rising energy consumption.Tell us your focus area and get a customized research report.

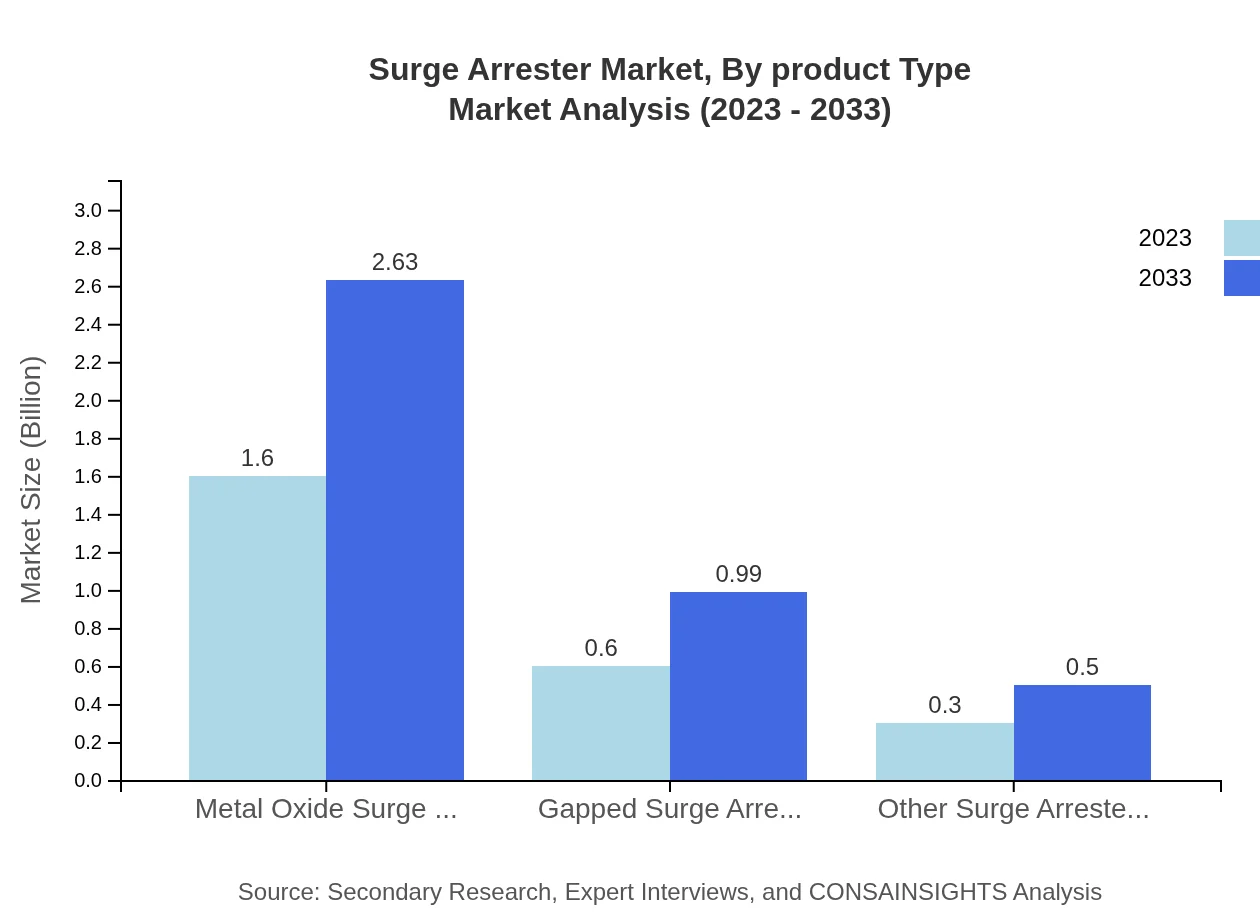

Surge Arrester Market Analysis By Product Type

Metal oxide surge arresters comprise the leading segment, with a market size growing to $2.63 billion by 2033. Gapped surge arresters and other types follow, indicating diverse product demand vital for tailored electrical solutions.

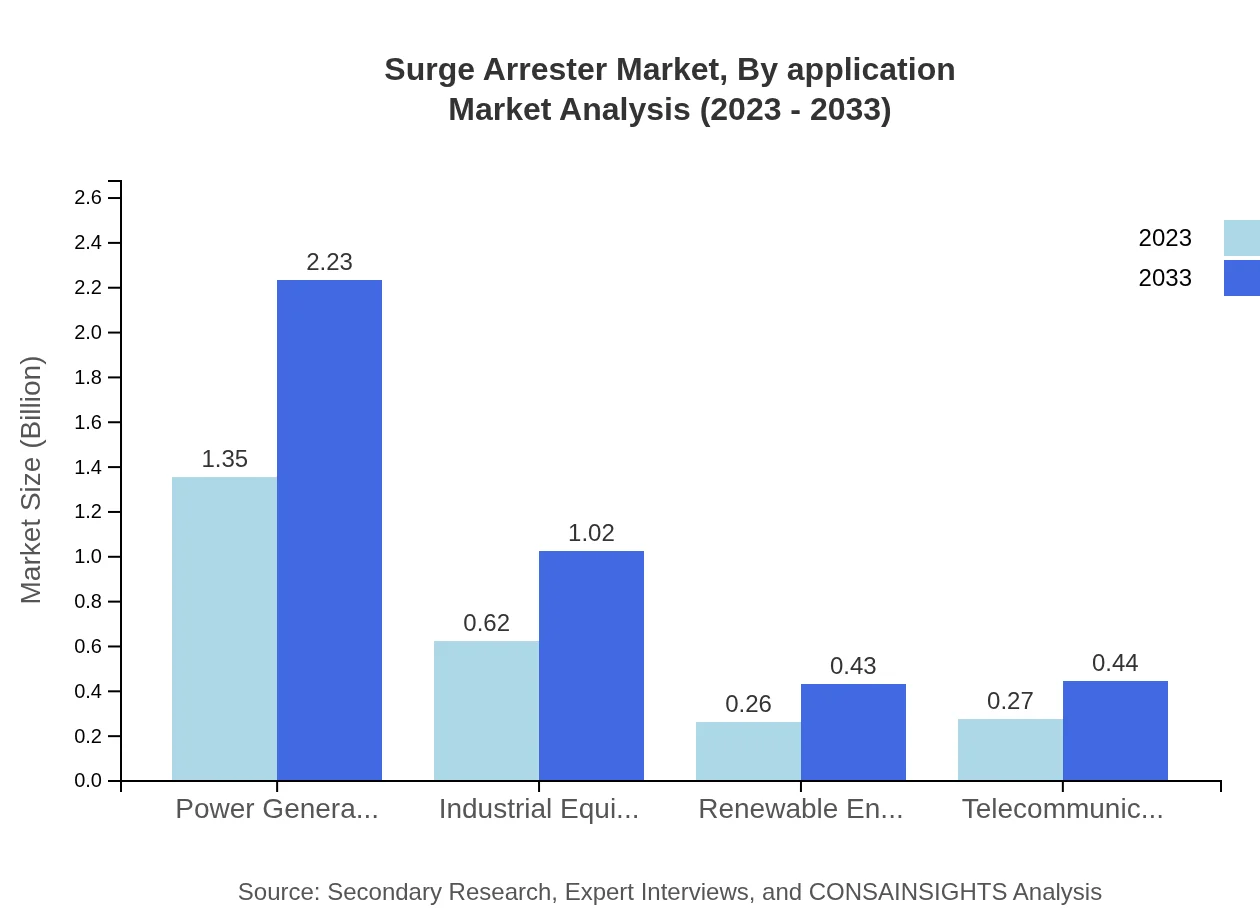

Surge Arrester Market Analysis By Application

The utility sector dominates the application segment, projected to expand to $2.23 billion by 2033, as electrical utilities are increasingly adopting protective solutions to mitigate surge risks.

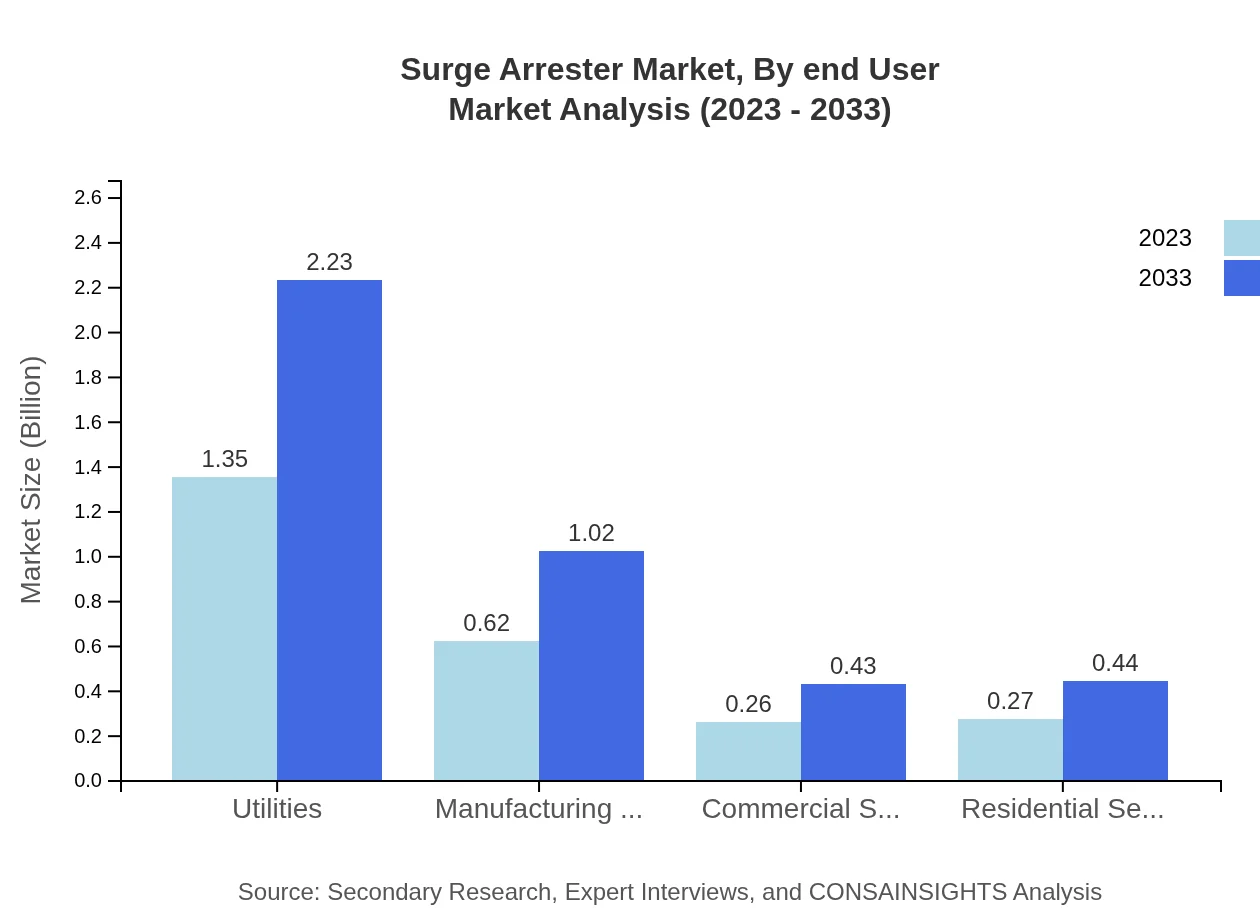

Surge Arrester Market Analysis By End User

Utilities hold a sizable market share, representing over 54% in 2023, while the manufacturing and telecommunications sectors are key contributors, reflecting a trend of increasing reliability needed in electrification.

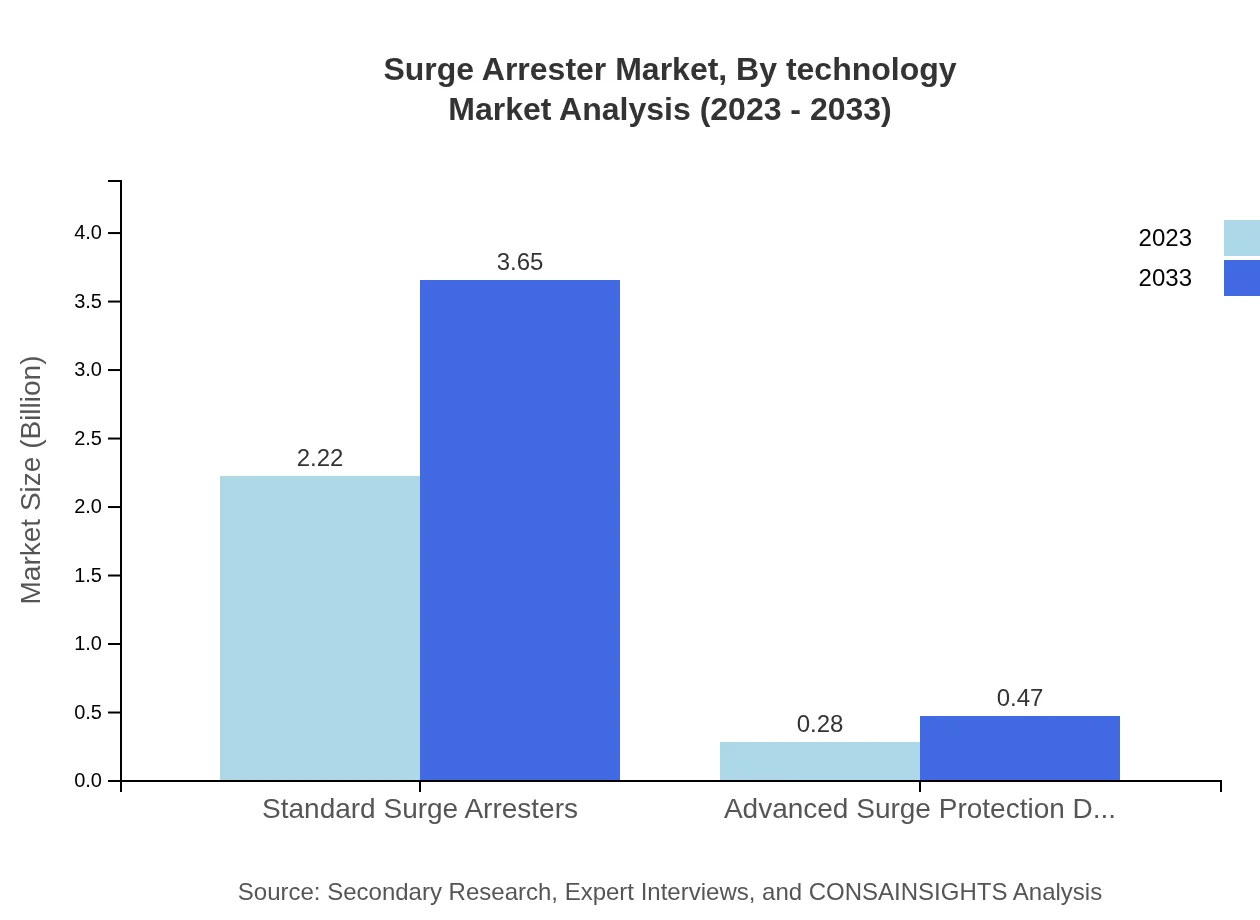

Surge Arrester Market Analysis By Technology

The evolution of surge protection technology, particularly in advanced surge protection devices, captures an increasing share as companies adopt newer innovations for effective power surge management.

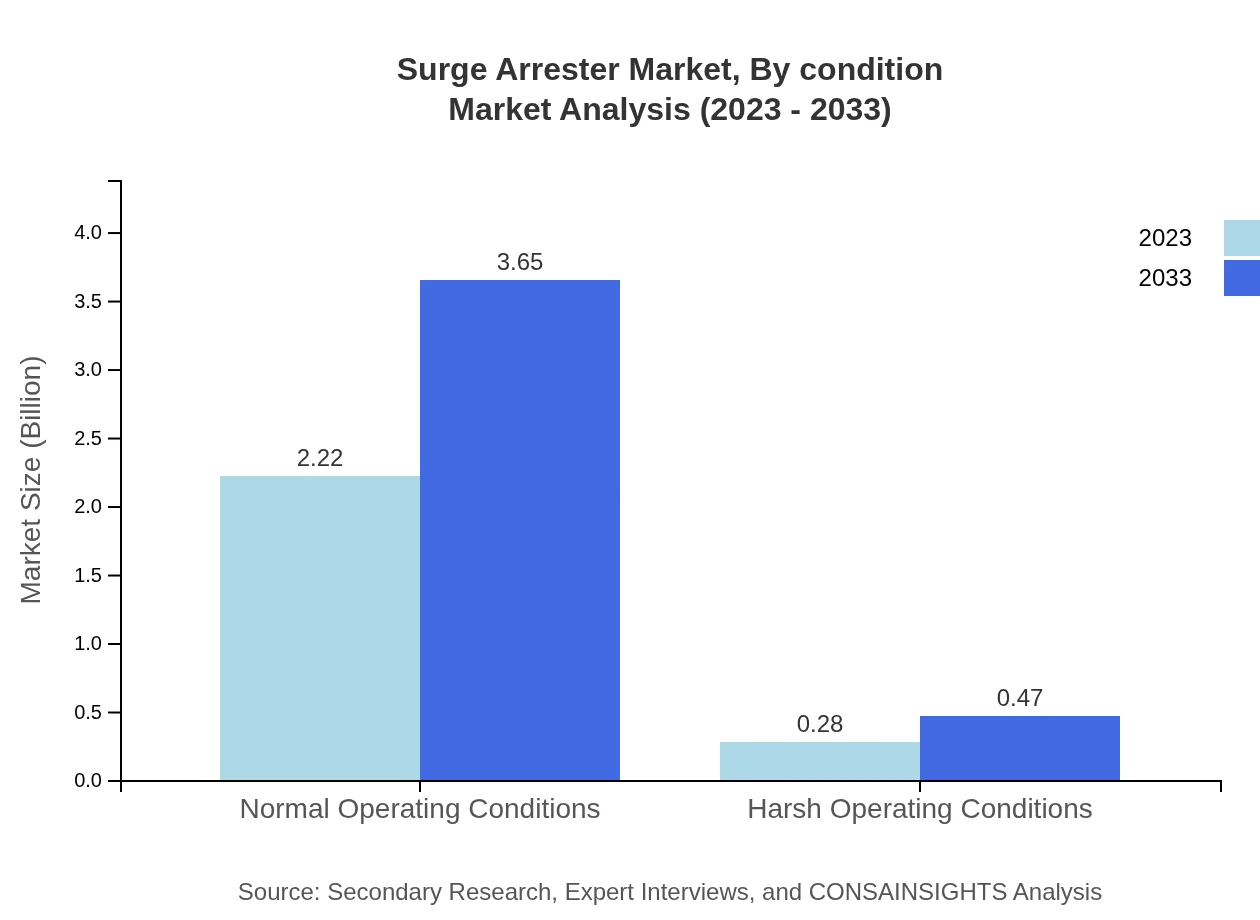

Surge Arrester Market Analysis By Condition

Normal operating conditions dominate the segment at 88.66% market share, indicating the predominance of standard surge arresters in typical applications while harsh operating conditions grow slowly.

Surge Arrester Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Surge Arrester Industry

ABB:

A leading global technology company focused on electrical products, including advanced surge arresters and protection devices, contributing significantly to power systems management.Siemens :

Another industry giant, Siemens develops innovative surge protection solutions that enhance electrical network reliability and security across various sectors worldwide.Schneider Electric:

A prominent player in energy management and automation, Schneider offers a comprehensive portfolio of surge arresters and protection solutions suited for modern infrastructure.Eaton:

Eaton specializes in electrical components, including surge protection devices that reduce risks in residential, commercial, and industrial applications.General Electric:

GE is known for advanced electrical equipment and solutions, contributing to the development and innovation of surge protection technologies.We're grateful to work with incredible clients.

FAQs

What is the market size of surge Arrester?

The global surge arrester market is currently valued at approximately $2.5 billion with a projected CAGR of 5% from 2023 to 2033, indicating a steady growth trajectory as demand for electrical protection solutions increases across various industries.

What are the key market players or companies in this surge Arrester industry?

Key players in the surge arrester industry include Siemens AG, Eaton Corporation, ABB Ltd., Schneider Electric, and General Electric. These companies lead through innovation, extensive product lines, and a robust market presence worldwide.

What are the primary factors driving the growth in the surge Arrester industry?

Growth factors include increasing demand for power supply stability, expansion of renewable energy investments, and stringent regulations on electrical safety standards. Additionally, technological advancements in surge protection devices fuel market expansion.

Which region is the fastest Growing in the surge Arrester market?

The fastest-growing region in the surge arrester market is North America, with a market size of $0.91 billion in 2023, projected to grow to $1.50 billion by 2033, driven by rising industrial activities and infrastructure investments.

Does ConsaInsights provide customized market report data for the surge Arrester industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs within the surge arrester industry. These reports can include in-depth analyses on market trends, forecasts, and competitive landscapes.

What deliverables can I expect from this surge Arrester market research project?

Deliverables include comprehensive market analysis reports, detailed segmentation data, competitive landscape assessments, and tailored insights to support strategic decision-making in the surge arrester market.

What are the market trends of surge Arrester?

Current trends indicate a shift towards smart surge protectors, increased adoption of metal oxide surge arresters, and a growing emphasis on energy-efficient solutions that align with global sustainability initiatives.