Surgical Drills

Published Date: 31 January 2026 | Report Code: surgical-drills

Surgical Drills Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the surgical drills market, covering key insights, segmentation, and regional insights from 2023 to 2033, including market size, trends, and forecasts.

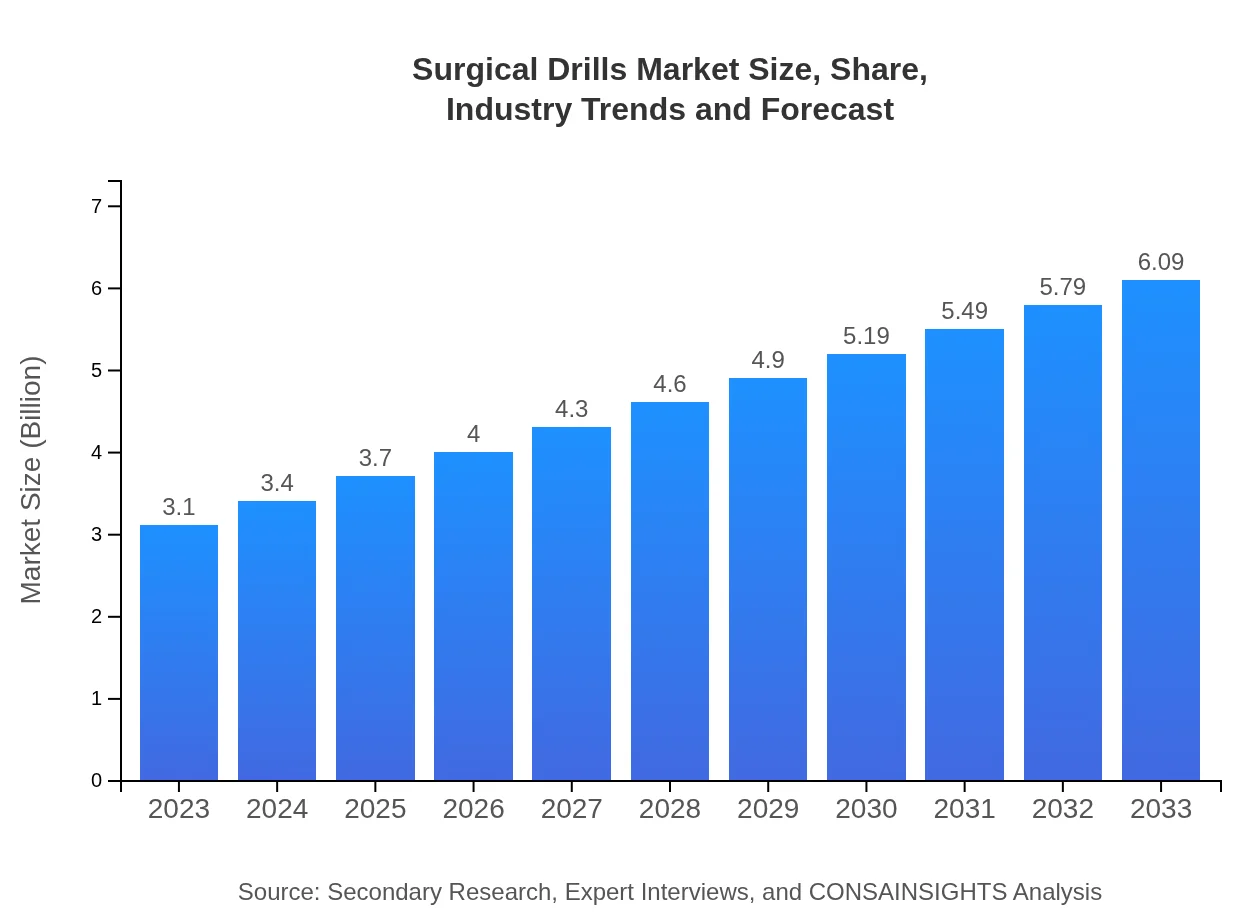

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.10 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $6.09 Billion |

| Top Companies | DePuy Synthes, Stryker Corporation, Medtronic , Zimmer Biomet, B. Braun |

| Last Modified Date | 31 January 2026 |

Surgical Drills Market Overview

Customize Surgical Drills market research report

- ✔ Get in-depth analysis of Surgical Drills market size, growth, and forecasts.

- ✔ Understand Surgical Drills's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Surgical Drills

What is the Market Size & CAGR of Surgical Drills market in 2023?

Surgical Drills Industry Analysis

Surgical Drills Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Surgical Drills Market Analysis Report by Region

Europe Surgical Drills:

Europe's market for surgical drills is expected to expand from $0.95 billion in 2023 to $1.86 billion in 2033, largely due to an increase in surgical interventions and technological advancements in medical devices.Asia Pacific Surgical Drills:

In the Asia Pacific region, the surgical drills market is projected to grow from $0.60 billion in 2023 to $1.18 billion in 2033, driven by increasing healthcare infrastructure and a higher incidence of surgical procedures.North America Surgical Drills:

North America holds a significant share of the surgical drills market, with a size estimate of $1.08 billion in 2023, growing to $2.11 billion by 2033. The region's advanced healthcare system and high surgical procedure volume fuel this growth.South America Surgical Drills:

The market in South America is expected to rise from $0.24 billion in 2023 to $0.47 billion in 2033. Growing investment in healthcare facilities and increasing awareness about advanced surgical technologies are major growth drivers.Middle East & Africa Surgical Drills:

The Middle East and Africa surgical drills market is anticipated to grow from $0.24 billion in 2023 to $0.47 billion in 2033, as healthcare accessibility improves and investments in medical technology increase.Tell us your focus area and get a customized research report.

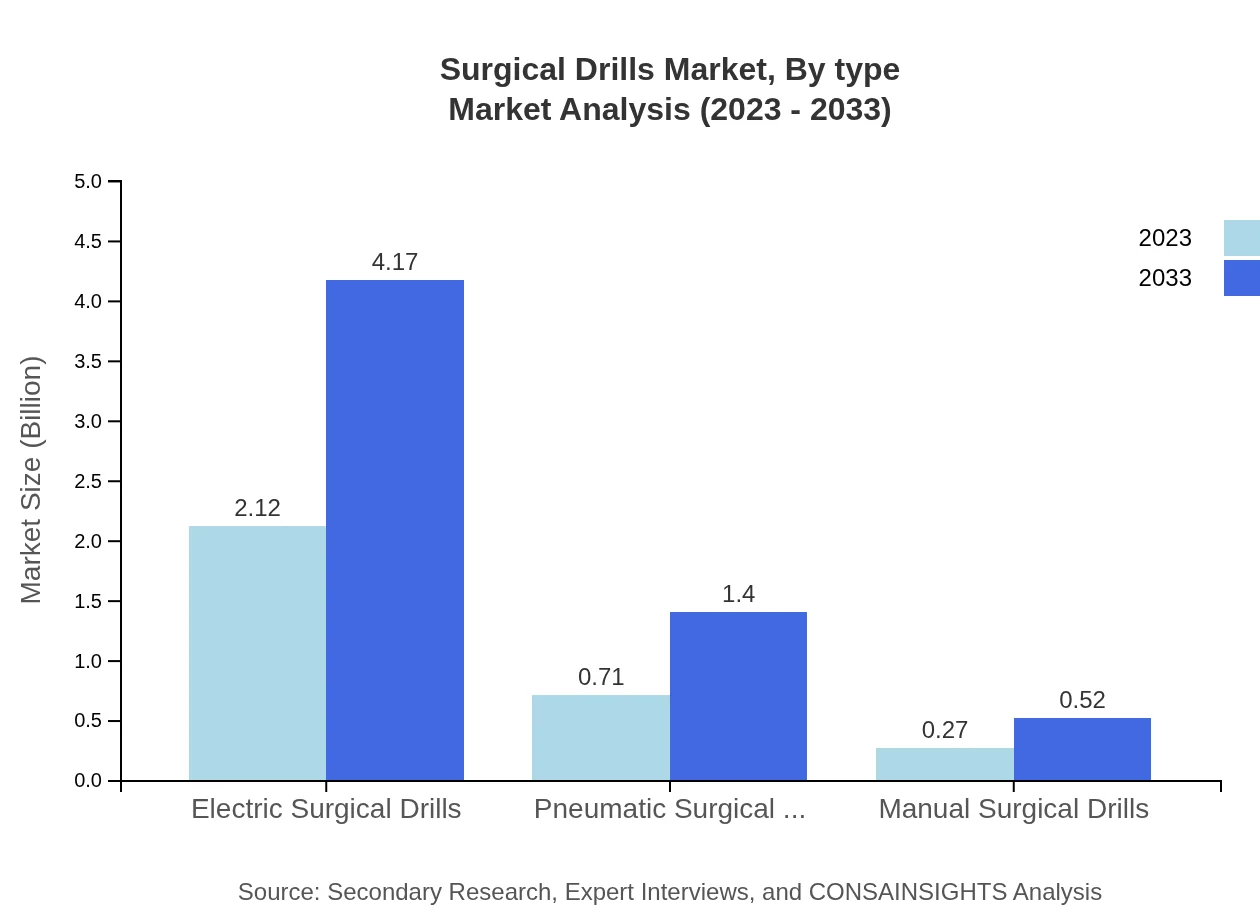

Surgical Drills Market Analysis By Type

Electric surgical drills represent the largest segment, with market sizes expected to grow from $2.12 billion in 2023 to $4.17 billion by 2033, holding a share of 68.41% throughout this period. Pneumatic drills are also significant, anticipated to expand from $0.71 billion to $1.40 billion, capturing 22.98% market share. Manual drills, although smaller, will grow modestly from $0.27 billion to $0.52 billion.

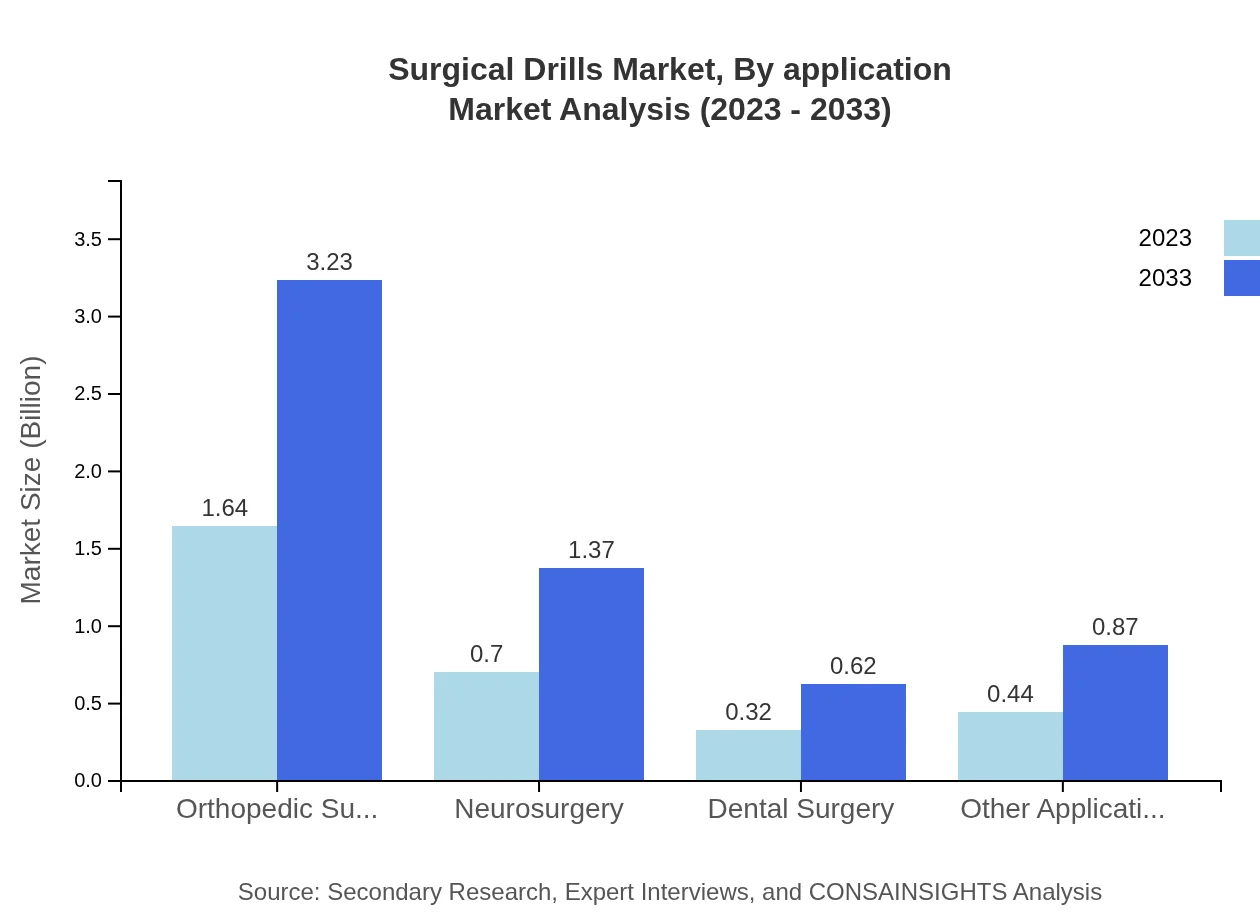

Surgical Drills Market Analysis By Application

Orthopedic surgery dominates the application segment, growing from $1.64 billion to $3.23 billion by 2033, maintaining a market share of 52.98%. Neurosurgery and dental surgery follow, with projected growth from $0.70 to $1.37 billion, and $0.32 to $0.62 billion, respectively.

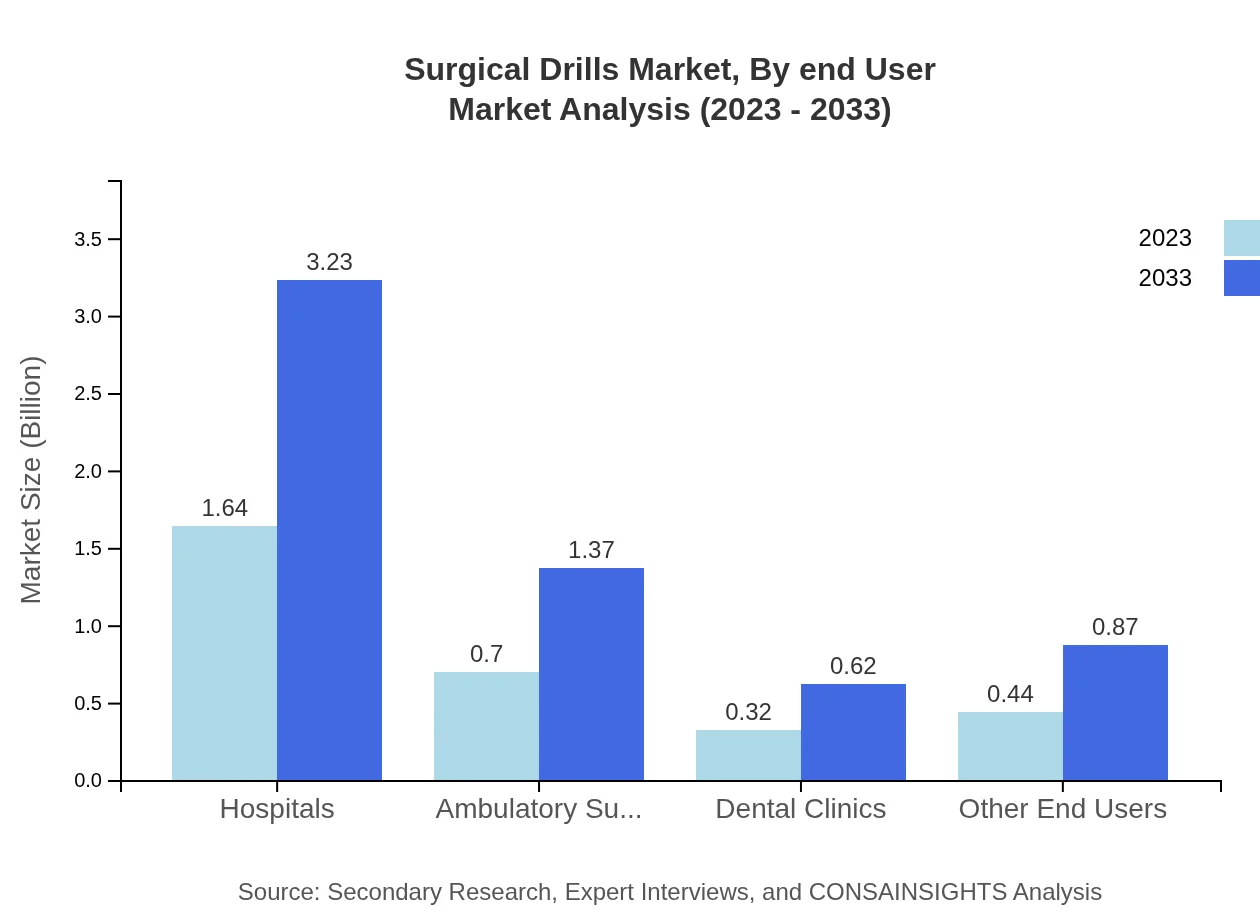

Surgical Drills Market Analysis By End User

Hospitals are the primary end-users in the surgical drills market, expected to grow from $1.64 billion in 2023 to $3.23 billion in 2033, holding 52.98% of market share. Ambulatory surgical centers also play a pivotal role, increasing sales from $0.70 billion to $1.37 billion.

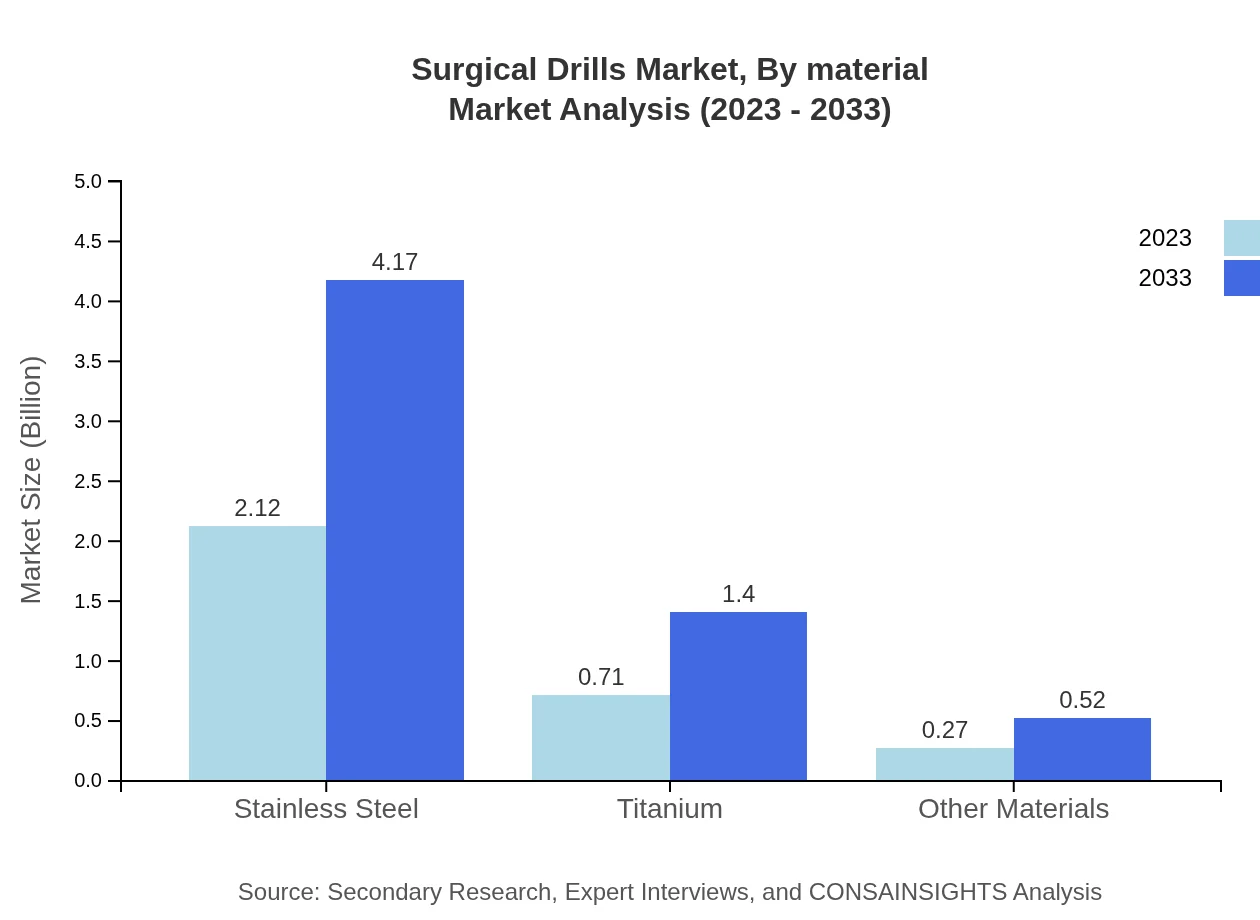

Surgical Drills Market Analysis By Material

The materials used in surgical drills feature stainless steel as the leading type, anticipated to grow from $2.12 billion to $4.17 billion, making up 68.41% of the market. Titanium drills are also significant, expecting to rise from $0.71 billion to $1.40 billion, capturing 22.98% of the material segment.

Surgical Drills Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Surgical Drills Industry

DePuy Synthes:

A leader in surgical technologies, DePuy Synthes specializes in orthopedic and neurological surgical drills, known for innovative products that enhance surgical precision.Stryker Corporation:

Stryker is renowned for its cutting-edge surgical drills and instruments, providing solutions that cater to a wide range of surgical applications.Medtronic :

Medtronic, a global leader in medical technology, offers advanced surgical drill technologies that address various surgical needs and improve patient outcomes.Zimmer Biomet:

Zimmer Biomet specializes in orthopedic reconstruction and surgical products, including high-quality drills aiding in complex surgical procedures.B. Braun:

B. Braun manufactures innovative surgical instruments, including surgical drills designed to provide safety and efficacy in clinical settings.We're grateful to work with incredible clients.

FAQs

What is the market size of surgical Drills?

The global market size for surgical drills is projected to reach approximately $3.1 billion in 2023, with an expected CAGR of 6.8% over the next decade, indicating robust growth driven by advancements in surgical technologies.

What are the key market players or companies in the surgical Drills industry?

Key players in the surgical drills market include Medtronic, Johnson & Johnson, Stryker Corporation, and Zimmer Biomet. These companies are essential for innovation and market presence, driving competitive dynamics within the industry.

What are the primary factors driving the growth in the surgical drills industry?

Growth in the surgical drills market is driven by increasing surgical procedures, technological advancements, and a rising prevalence of orthopedic and dental surgeries, along with a growing geriatric population requiring more surgical interventions.

Which region is the fastest Growing in the surgical drills market?

The Asia Pacific region is the fastest-growing in the surgical drills market, with projections of growth from $0.60 billion in 2023 to $1.18 billion by 2033. This growth is fueled by increasing healthcare expenditure and improving surgical infrastructure.

Does ConsaInsights provide customized market report data for the surgical drills industry?

Yes, ConsaInsights offers customized market report data for the surgical drills industry, enabling stakeholders to gain tailored insights that meet specific business needs and strategic objectives.

What deliverables can I expect from this surgical drills market research project?

Expect comprehensive deliverables including detailed market analysis, segmentation data, regional insights, competitive landscape reviews, and forecasts that aid in strategic decision-making for stakeholders in the surgical drills market.

What are the market trends of surgical drills?

Current market trends include an increasing adoption of electric surgical drills, a shift toward minimally invasive surgeries, and greater emphasis on durable materials like stainless steel and titanium, reflecting advancements in surgical technologies.