Surgical Equipment Market Report

Published Date: 31 January 2026 | Report Code: surgical-equipment

Surgical Equipment Market Size, Share, Industry Trends and Forecast to 2033

This report provides in-depth insights into the Surgical Equipment market from 2023 to 2033, covering market size, growth rates, industry analysis, segmentation, regional insights, technology trends, and forecasts.

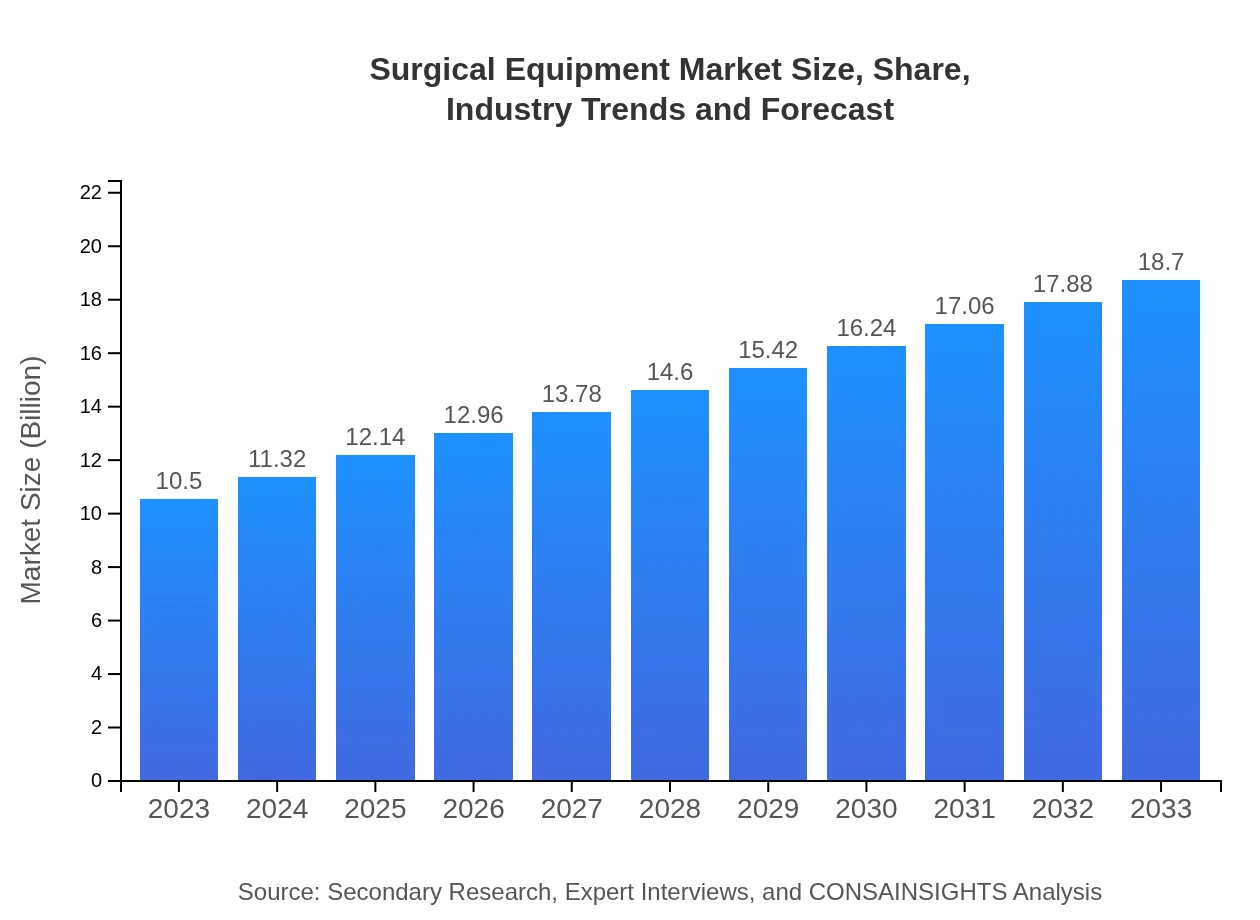

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $18.70 Billion |

| Top Companies | Medtronic , Johnson & Johnson, Stryker Corporation, B. Braun |

| Last Modified Date | 31 January 2026 |

Surgical Equipment Market Overview

Customize Surgical Equipment Market Report market research report

- ✔ Get in-depth analysis of Surgical Equipment market size, growth, and forecasts.

- ✔ Understand Surgical Equipment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Surgical Equipment

What is the Market Size & CAGR of the Surgical Equipment market in 2023?

Surgical Equipment Industry Analysis

Surgical Equipment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Surgical Equipment Market Analysis Report by Region

Europe Surgical Equipment Market Report:

Europe's surgical equipment market is projected to grow from USD 3.75 billion in 2023 to USD 6.68 billion in 2033. The region benefits from a strong healthcare system, with increasing focus on surgical advancements and high adoption rates of innovative surgical technologies.Asia Pacific Surgical Equipment Market Report:

In the Asia Pacific region, the surgical equipment market is anticipated to grow from USD 1.83 billion in 2023 to USD 3.26 billion in 2033. Factors contributing to this growth include increasing healthcare investments, a rapidly expanding patient population, and a higher number of surgical procedures performed as a result of chronic diseases.North America Surgical Equipment Market Report:

North America dominates the surgical equipment market, expected to rise from USD 3.47 billion in 2023 to USD 6.17 billion in 2033. This growth is attributed to advanced healthcare facilities, a high volume of surgical procedures, and substantial investments in medical technologies.South America Surgical Equipment Market Report:

The South American surgical equipment market is expected to grow modestly, from USD 0.05 billion in 2023 to USD 0.09 billion in 2033. Growth in this region is driven by improvements in healthcare infrastructure and increasing healthcare spending as economies recover and develop.Middle East & Africa Surgical Equipment Market Report:

In the Middle East and Africa, the market is expected to expand from USD 1.41 billion in 2023 to USD 2.50 billion in 2033. Growth drivers include improving healthcare access and investments in modern surgical technologies as part of a broader push for enhanced healthcare provisions.Tell us your focus area and get a customized research report.

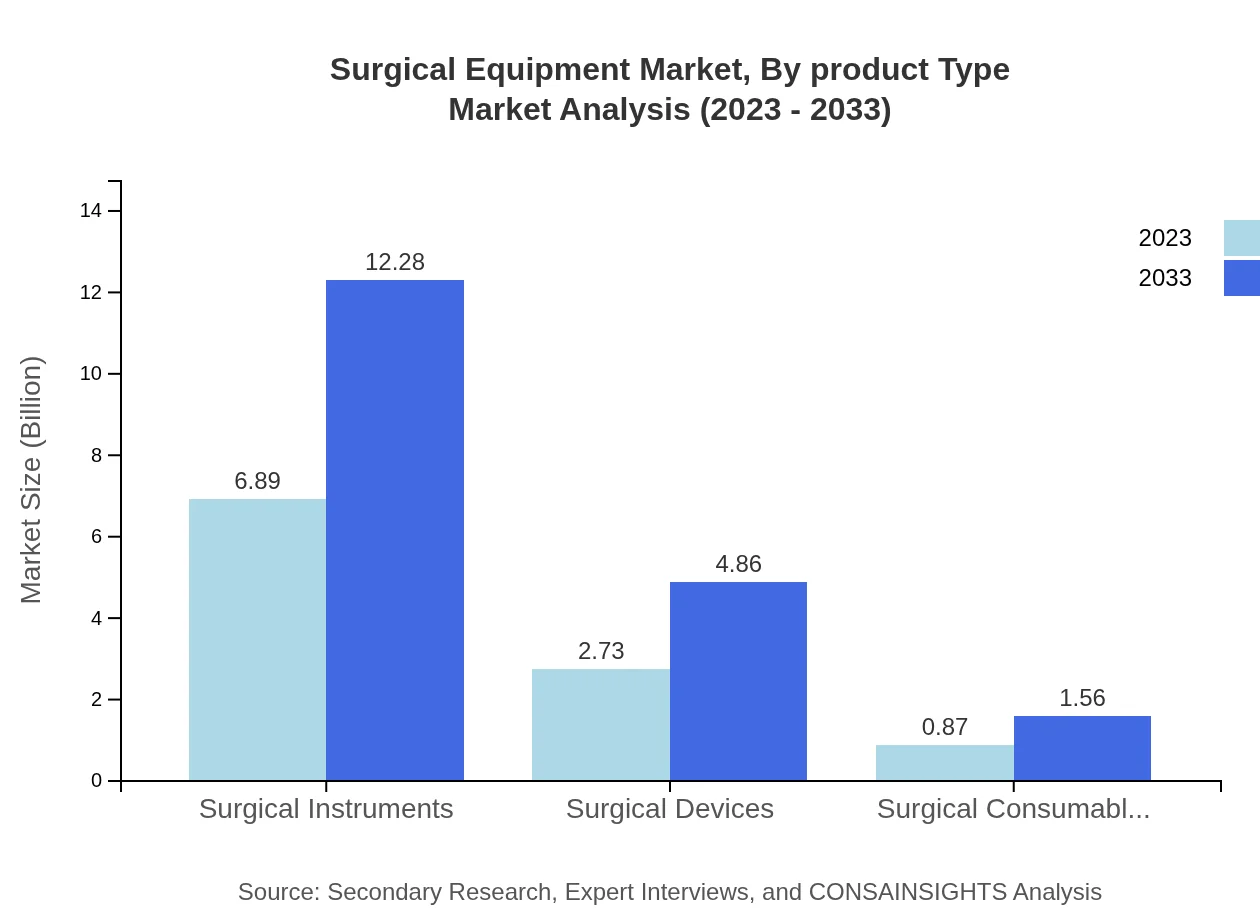

Surgical Equipment Market Analysis By Product Type

The market is primarily segmented into three categories: Surgical Instruments, Surgical Devices, and Surgical Consumables. Surgical Instruments hold a significant share of 65.66% in 2023, with a value of USD 6.89 billion, expected to grow to USD 12.28 billion by 2033, reflecting consistent demand across surgical practices. Surgical Devices, including advanced technologies, account for 26.01% of the market share with potential growth owing to advancements and adoption across various healthcare settings.

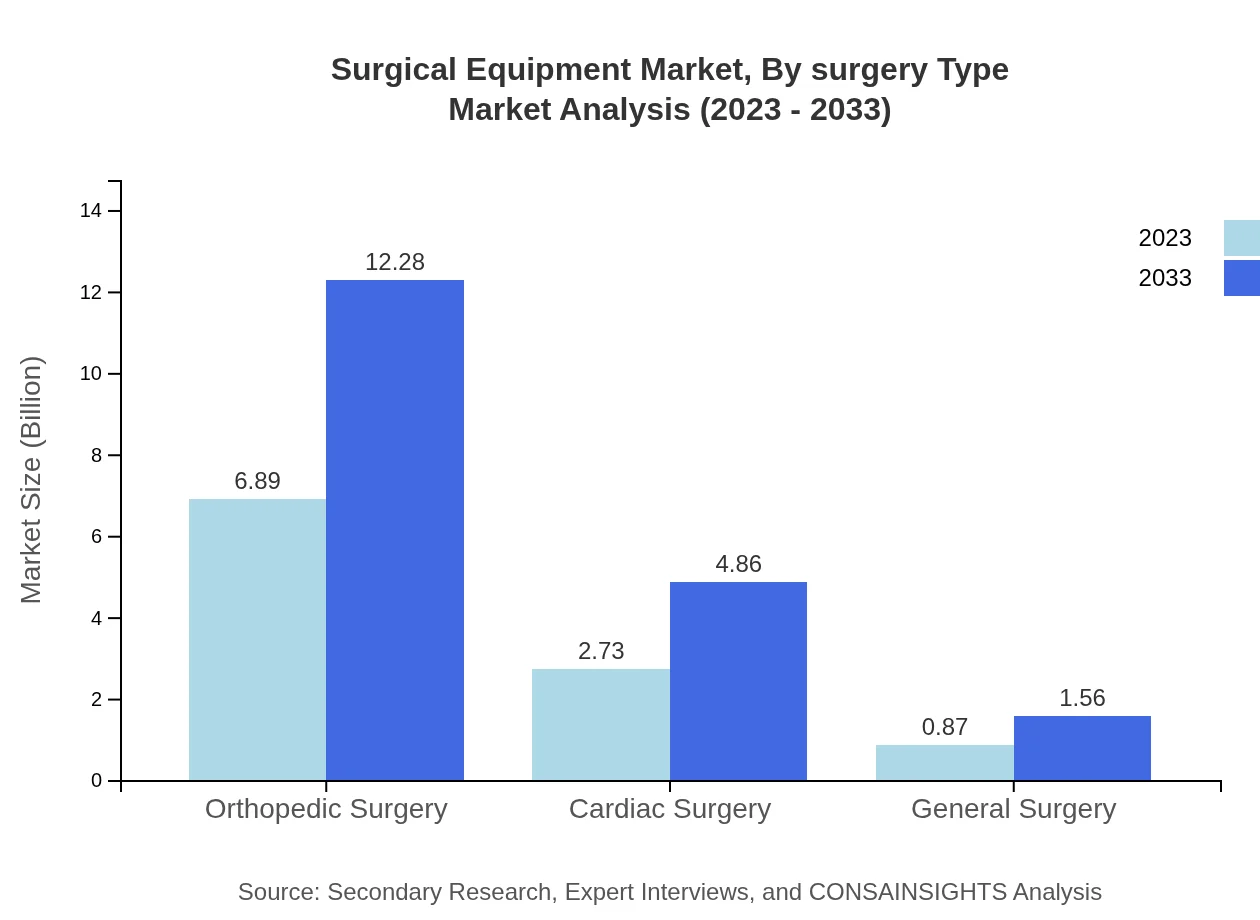

Surgical Equipment Market Analysis By Surgery Type

The market segments by surgery types include Orthopedic, Cardiac, and General Surgery. Orthopedic Surgery remains the dominant segment with a share of 65.66% valued at USD 6.89 billion in 2023, anticipated to reach USD 12.28 billion by 2033. This growth reflects growing trends in joint replacement and repairs amid an aging population, while Cardiac Surgery and General Surgery are forecasted to grow each holding a share of 26.01% and 8.33% respectively.

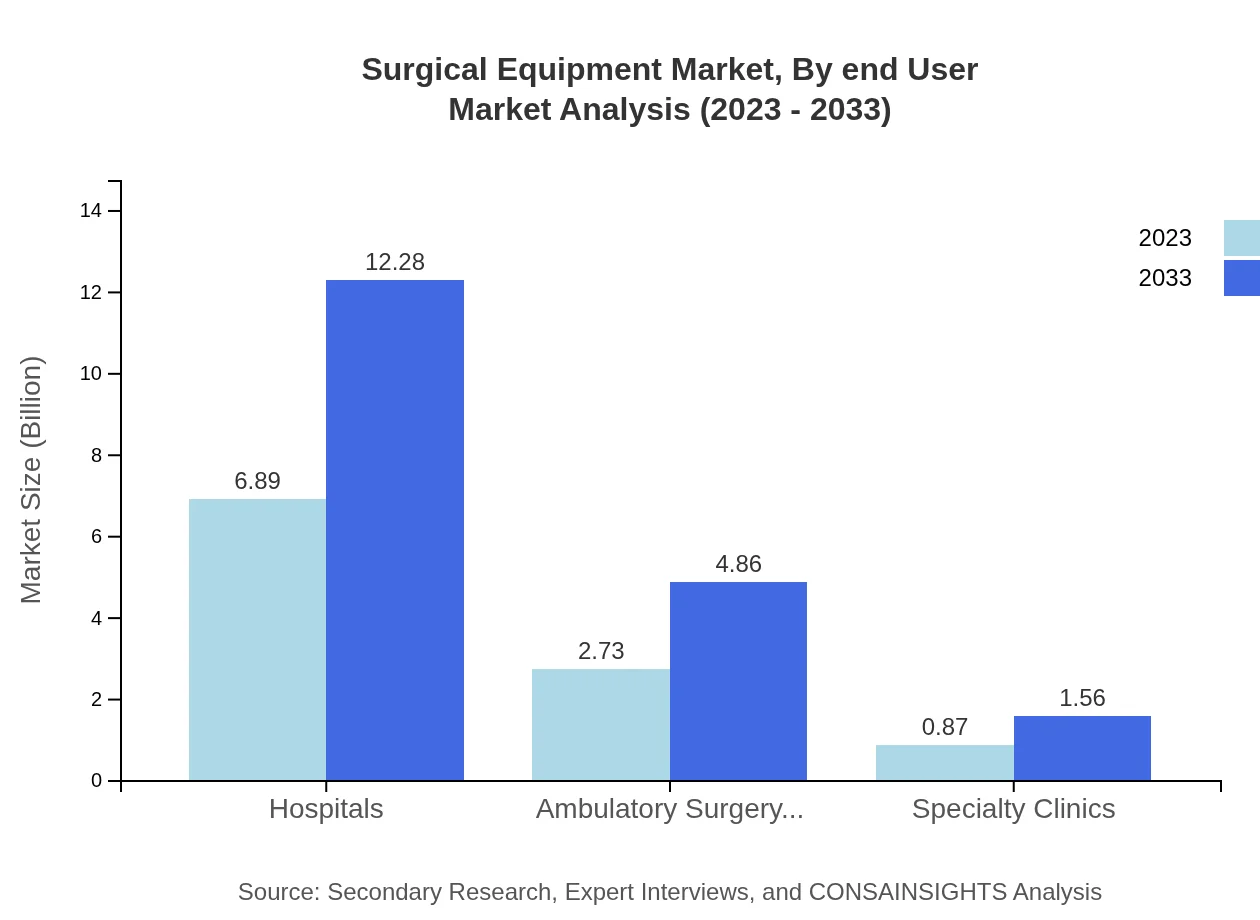

Surgical Equipment Market Analysis By End User

Key end-users include Hospitals, Ambulatory Surgery Centers, and Specialty Clinics. Hospitals are projected to maintain a share of 65.66%, with USD 6.89 billion in 2023, due to their extensive surgical capabilities. Ambulatory Surgery Centers are showing growth with a share of 26.01%. Specialty Clinics, while smaller, also contribute significantly with their niche offerings.

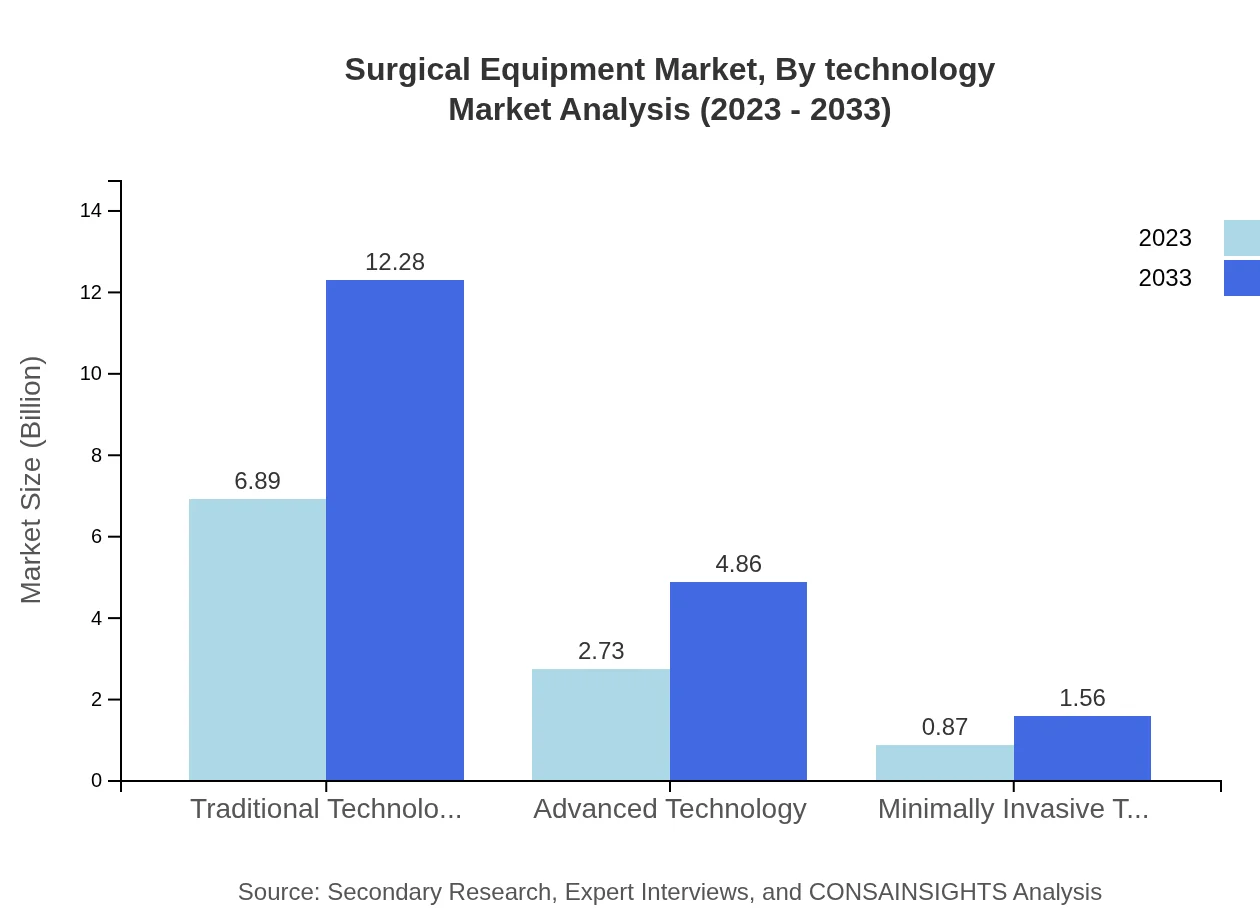

Surgical Equipment Market Analysis By Technology

The market is segmented into Traditional Technology (65.66% share), Advanced Technology (26.01% share), and Minimally Invasive Technology (8.33%). Traditional Technology, valued at USD 6.89 billion in 2023, will maintain importance in surgeries, while Advanced and Minimally Invasive Technologies are gaining traction due to their effectiveness and improved recovery times.

Surgical Equipment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Surgical Equipment Industry

Medtronic :

A global leader in medical technology, Medtronic is known for its innovative solutions in surgical equipment, enhancing the precision and efficiency of surgical procedures.Johnson & Johnson:

A renowned healthcare leader, Johnson & Johnson provides a broad range of surgical instruments and technologies, focusing on patient-centric solutions and advancing surgical care.Stryker Corporation:

Stryker specializes in medical devices and surgical instruments that enhance surgical outcomes, particularly in the orthopedic segment.B. Braun:

B. Braun is known for its extensive portfolio of surgical equipment, contributing significantly to the healthcare market by providing high-quality surgical solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of surgical equipment?

The global surgical equipment market is estimated to reach $10.5 billion in 2023, with a projected CAGR of 5.8% over the next decade, indicating robust growth driven by technological advancements and increasing healthcare expenditures.

What are the key market players or companies in the surgical equipment industry?

Key players in the surgical equipment industry include large multinational companies such as Johnson & Johnson, Medtronic, Stryker Corporation, and Karl Storz, among others. These corporations drive innovation and market growth through strategic partnerships and advances in medical technology.

What are the primary factors driving the growth in the surgical equipment industry?

Growth in the surgical equipment market is driven by several factors, including the rising prevalence of chronic diseases, technological advancements like minimally invasive surgeries, increased funding in healthcare facilities, and the growing geriatric population requiring surgical interventions.

Which region is the fastest Growing in the surgical equipment market?

The fastest-growing region in the surgical equipment market is Asia Pacific, expected to grow from $1.83 billion in 2023 to $3.26 billion by 2033, driven by increasing investments in healthcare infrastructure and a rising patient population.

Does ConsInsights provide customized market report data for the surgical equipment industry?

Yes, ConsInsights offers customized market report data tailored to specific needs within the surgical equipment industry, allowing clients to access targeted insights relevant to market trends, competitive analysis, and strategic planning.

What deliverables can I expect from this surgical equipment market research project?

Clients can expect comprehensive deliverables including detailed market reports, segment analysis, competitive landscape overviews, regional insights, and projections for the surgical equipment market, providing actionable intelligence for decision-making.

What are the market trends of surgical equipment?

Current trends in the surgical equipment market include the increasing demand for minimally invasive surgical procedures, advancements in robotic surgery technology, a shift towards outpatient surgery centers, and a focus on sustainable and eco-friendly surgical solutions.