Surgical Rasps Market Report

Published Date: 31 January 2026 | Report Code: surgical-rasps

Surgical Rasps Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Surgical Rasps market, covering market trends, size, regional insights, and industry forecasts from 2023 to 2033. Key segments, market leaders, and technological advancements are also discussed in detail.

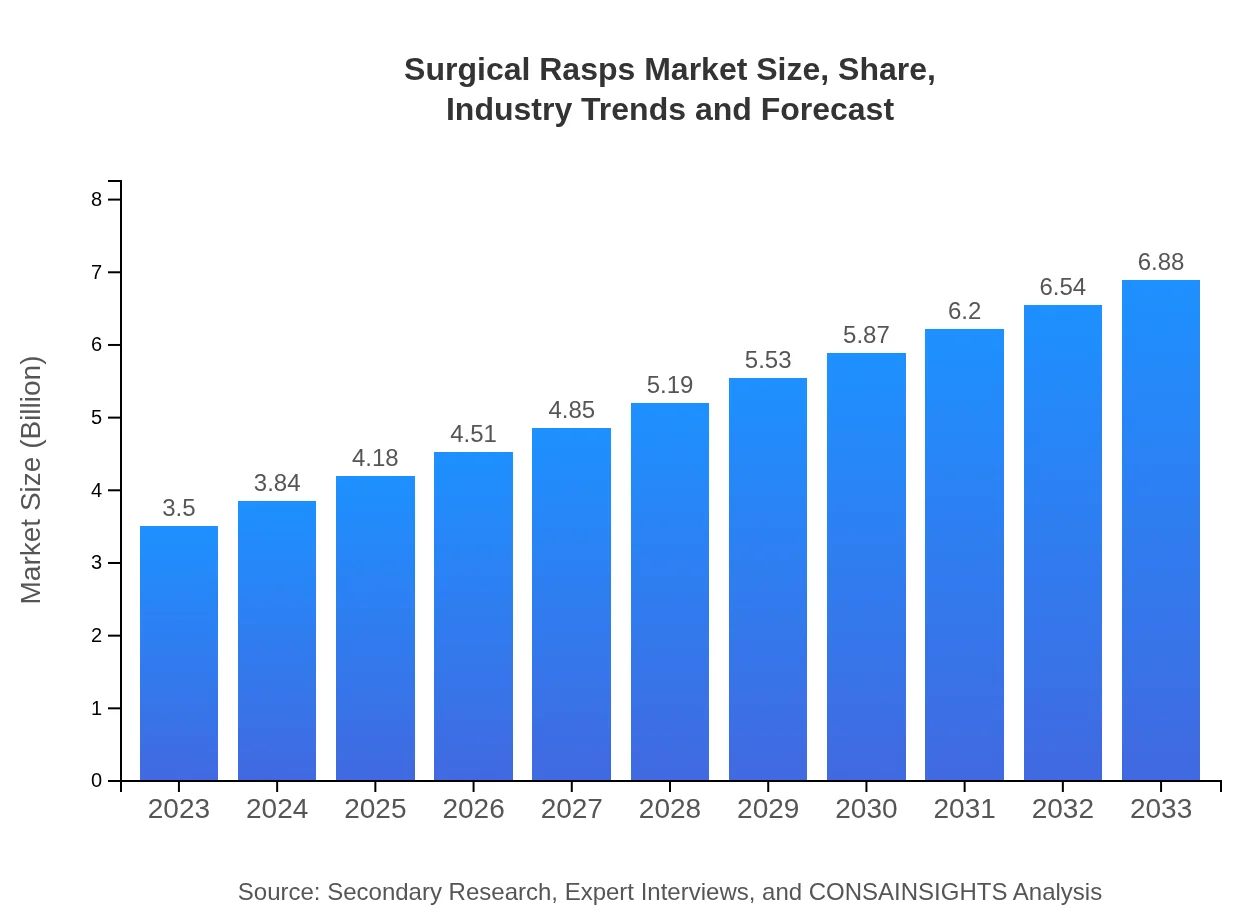

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $6.88 Billion |

| Top Companies | Medtronic , Johnson & Johnson, Stryker Corporation, B. Braun Melsungen AG |

| Last Modified Date | 31 January 2026 |

Surgical Rasps Market Overview

Customize Surgical Rasps Market Report market research report

- ✔ Get in-depth analysis of Surgical Rasps market size, growth, and forecasts.

- ✔ Understand Surgical Rasps's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Surgical Rasps

What is the Market Size & CAGR of Surgical Rasps market in 2023?

Surgical Rasps Industry Analysis

Surgical Rasps Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Surgical Rasps Market Analysis Report by Region

Europe Surgical Rasps Market Report:

The European Surgical Rasps market is predicted to grow from $1.08 billion in 2023 to $2.12 billion by 2033. The region's focus on research and development along with stringent regulatory standards ensures the availability of high-quality surgical tools. The increasing elderly population also drives demand for orthopedic surgeries, further augmenting market growth.Asia Pacific Surgical Rasps Market Report:

In the Asia-Pacific region, the Surgical Rasps market is expected to grow from $0.67 billion in 2023 to $1.31 billion in 2033, driven by increased healthcare expenditure, rising surgical procedures, and the growing prevalence of chronic diseases. Emerging economies are heavily investing in healthcare infrastructure, which will create a favorable environment for the surgical rasps market.North America Surgical Rasps Market Report:

North America leads the market with anticipated growth from $1.22 billion in 2023 to $2.41 billion in 2033. The region's dominance is attributed to advanced healthcare facilities, high surgical volumes, and significant investment in healthcare technology. The presence of key players also contributes to the robust growth potential in this region.South America Surgical Rasps Market Report:

The South American market is anticipated to expand from $0.06 billion in 2023 to $0.12 billion by 2033. Growth is fueled by an increase in dental and orthopedic procedures due to a burgeoning population and improving access to healthcare services. Market players have a significant opportunity to penetrate this region by addressing local healthcare challenges.Middle East & Africa Surgical Rasps Market Report:

In the Middle East and Africa, the market is expected to grow from $0.47 billion in 2023 to $0.92 billion in 2033. This growth is supported by an increase in the number of healthcare facilities and the expectation of improved healthcare policies. The focus on patient safety will render surgical rasps indispensable, promoting their adoption across various surgical institutions.Tell us your focus area and get a customized research report.

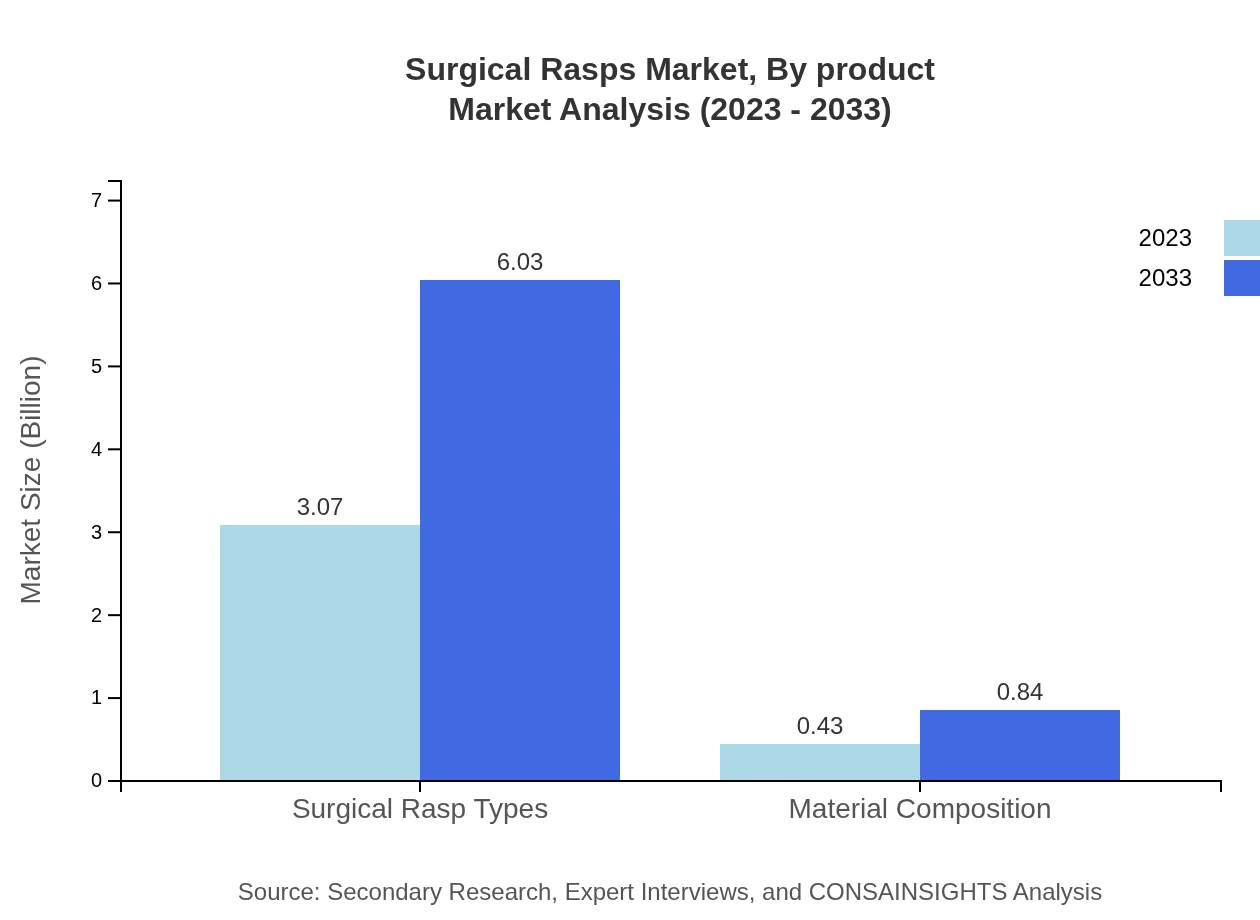

Surgical Rasps Market Analysis By Product

The Surgical Rasp Market is segmented by product type into hand-held and powered rasps. In 2023, the market size is approximately $3.07 billion, with a projected increase to $6.03 billion by 2033. Hand-held rasps dominate due to their versatility and ease of use, accounting for 87.73% share of the market.

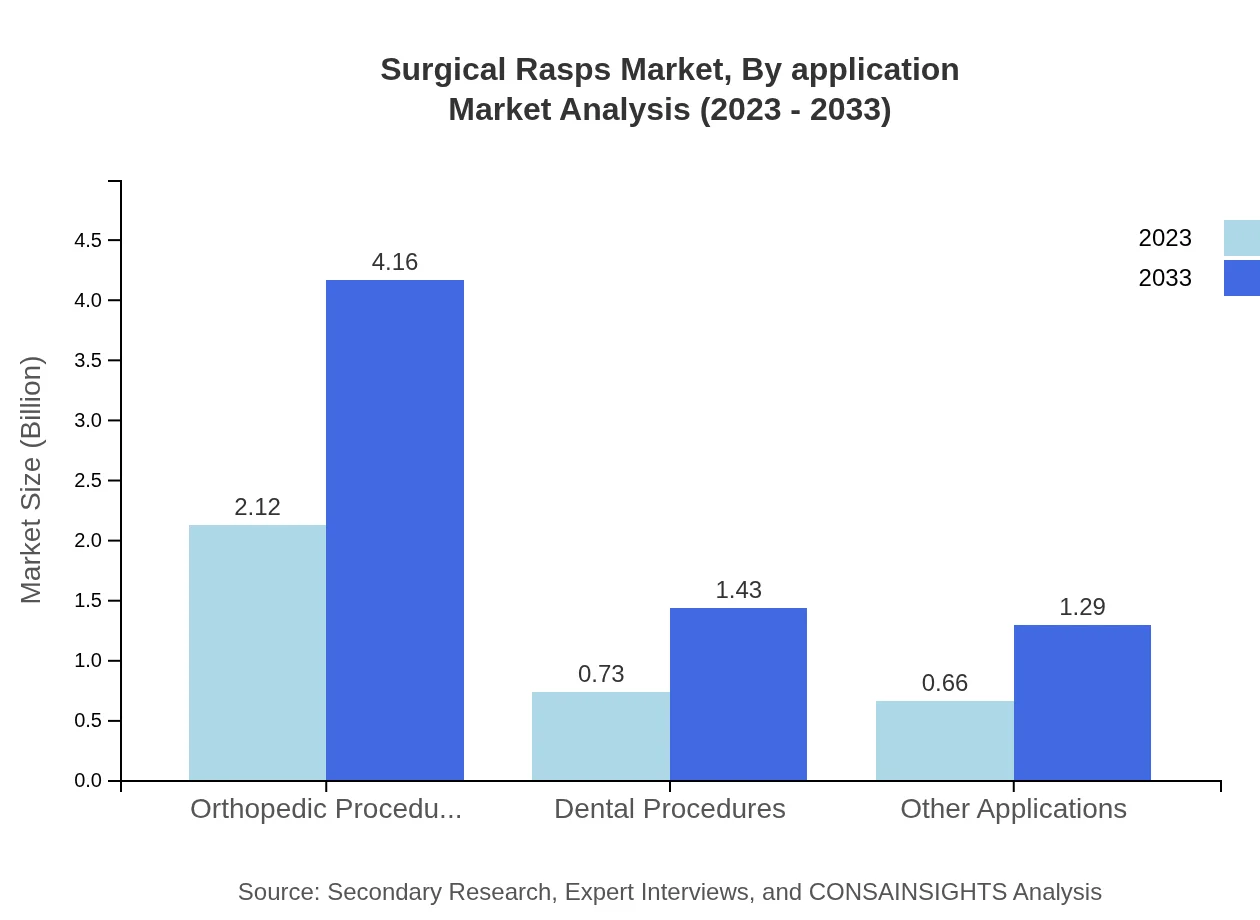

Surgical Rasps Market Analysis By Application

The market is segmented by application into orthopedic procedures, dental procedures, and other applications. Orthopedic procedures occupy a substantial market share of 60.44%, with projections indicating growth from $2.12 billion in 2023 to $4.16 billion by 2033. Dental procedures also capture a significant portion, growing steadily alongside increasing dental health awareness.

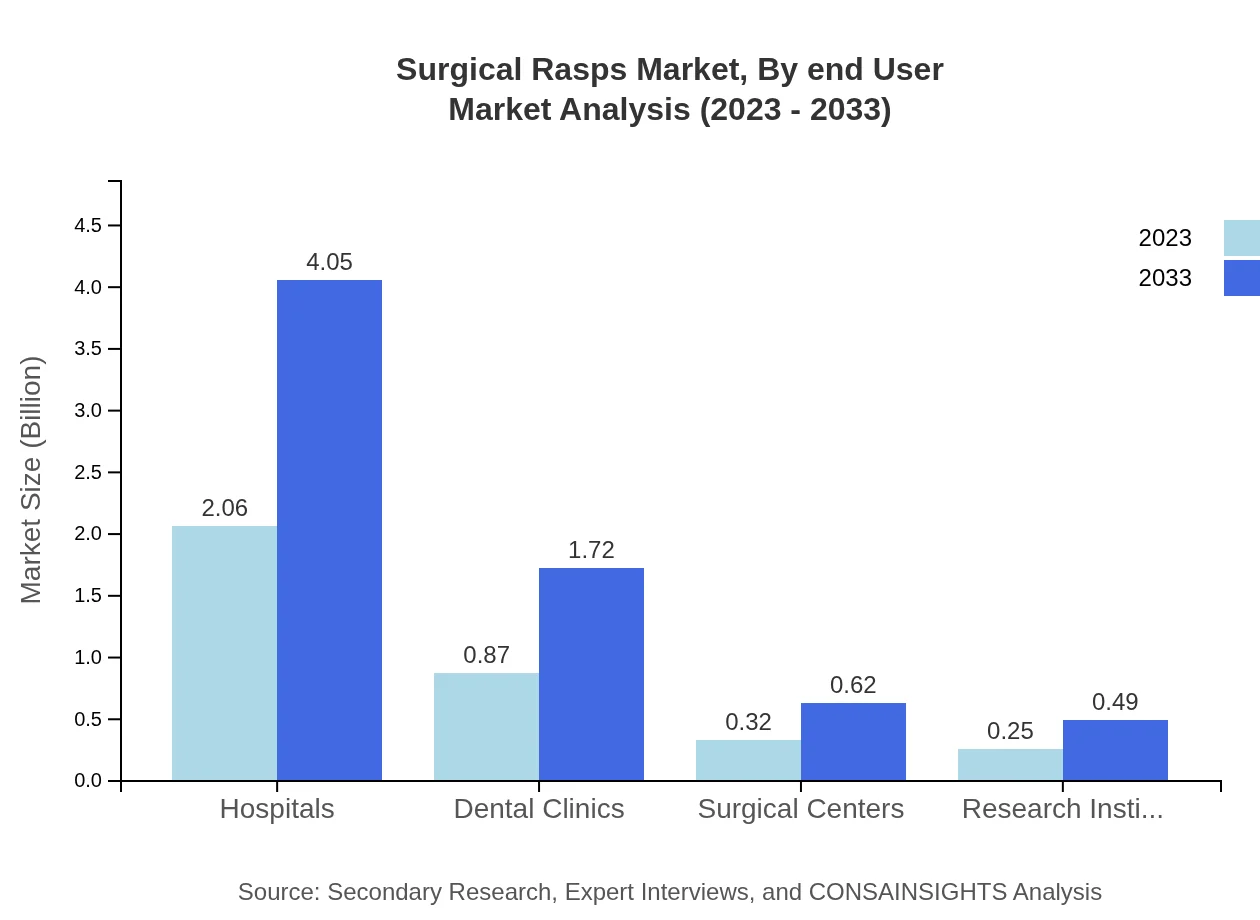

Surgical Rasps Market Analysis By End User

The end-user segment includes hospitals, dental clinics, surgical centers, and research institutes. Hospitals lead with a market share of 58.91%, expanding from $2.06 billion in 2023 to $4.05 billion by 2033. The increasing surgical procedures in hospitals are a key factor influencing this growth.

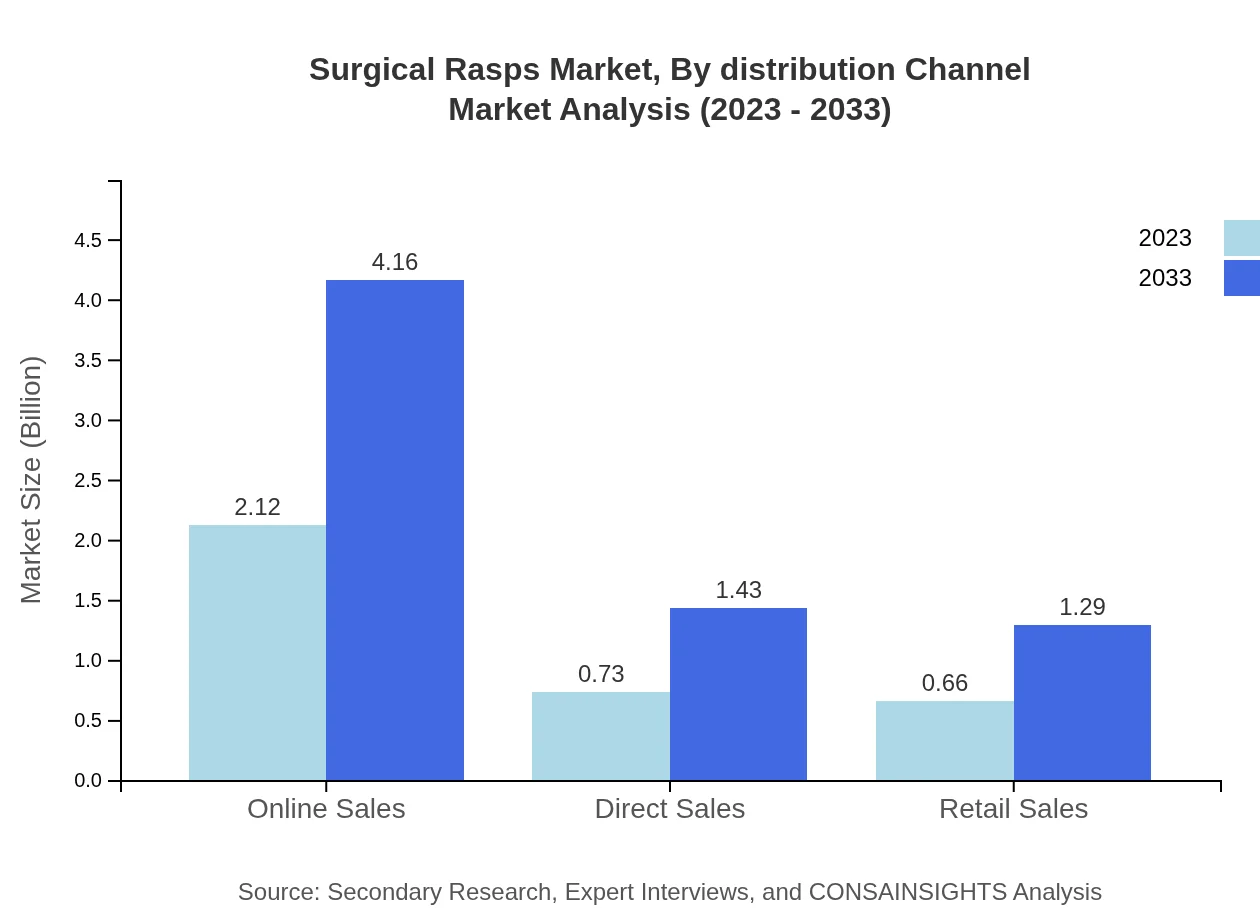

Surgical Rasps Market Analysis By Distribution Channel

Distribution channels for surgical rasps include online sales, direct sales, and retail sales. Online sales are projected to grow from $2.12 billion in 2023 to $4.16 billion by 2033, accounting for a substantial market share of 60.44%. The growing trend towards e-commerce and direct-to-consumer sales models significantly influences this growth.

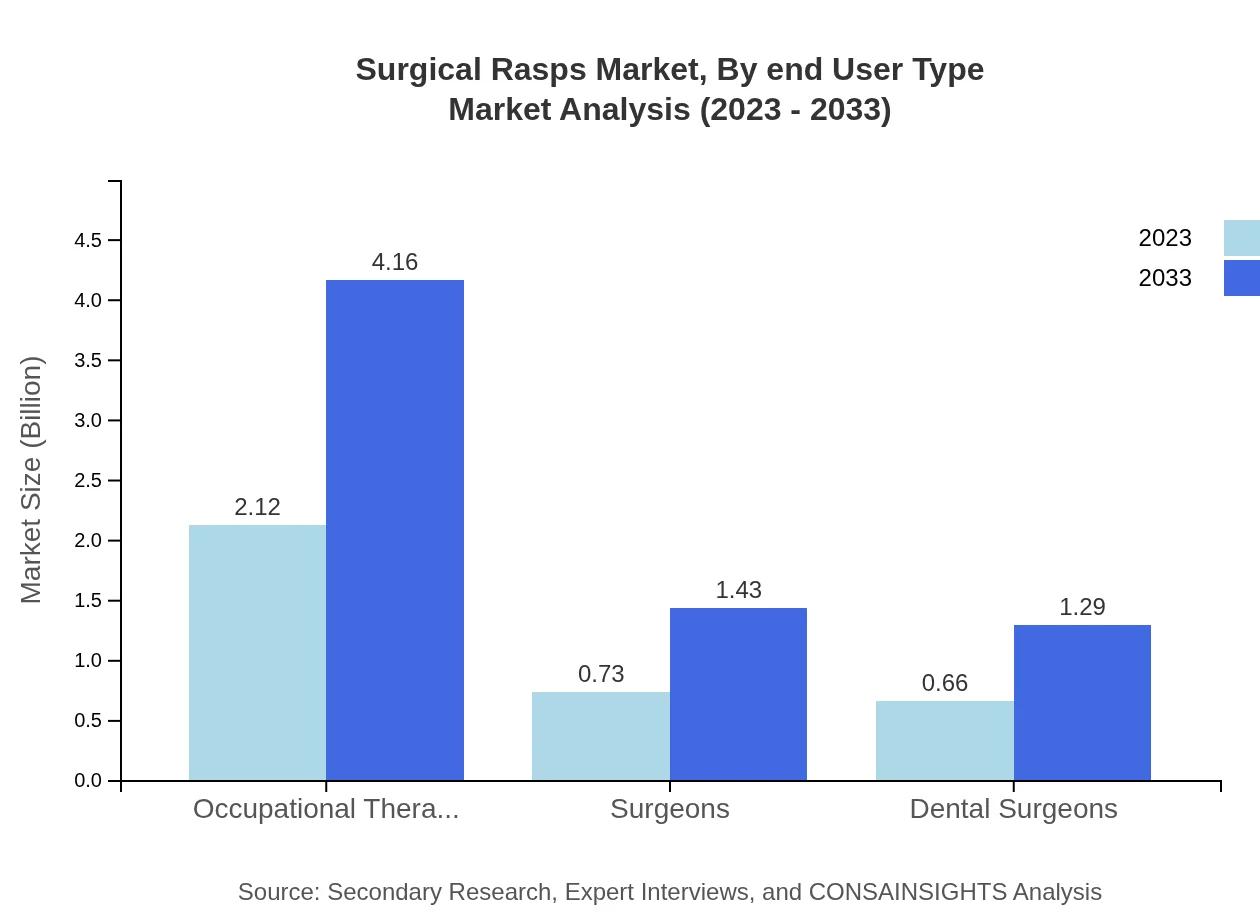

Surgical Rasps Market Analysis By End User Type

This segment encompasses various professionals utilizing surgical rasps, including surgeons, dental surgeons, and occupational therapists. Each segment showcases growth potential, with surgical and dental surgeons making up 20.8% and 18.76% of the market respectively, driven by increasing demand for surgical precision in their respective fields.

Surgical Rasps Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Surgical Rasps Industry

Medtronic :

Medtronic is a global leader in all aspects of medical technology and is renowned for developing innovative surgical tools, including high-quality surgical rasps. Their commitment to advancing healthcare technology establishes them as a trusted name in the industry.Johnson & Johnson:

Johnson & Johnson is a prominent player in the medical device sector, providing comprehensive surgical solutions. Their advanced surgical rasp designs facilitate enhanced surgical performance and optimize patient outcomes.Stryker Corporation:

Stryker Corporation focuses on innovative technologies in surgical instruments, contributing to advancements in surgical rasps. Their continuous investment in R&D underscores their commitment to improving surgical procedures.B. Braun Melsungen AG:

B. Braun Melsungen AG is known for its high-quality surgical instruments and devices. Their expertise in surgical rasp manufacturing positions them as key innovators in improving surgical efficacy.We're grateful to work with incredible clients.

FAQs

What is the market size of surgical Rasps?

The surgical-rasps market is valued at approximately $3.5 billion in 2023, with a projected growth at a CAGR of 6.8%, expected to reach new heights by 2033, as advancements in surgical techniques and demand increase.

What are the key market players or companies in the surgical Rasps industry?

Key players in the surgical-rasps market include leading medical device manufacturers and companies focused on surgical tools, contributing to innovation and quality advancements in surgical rasp technologies.

What are the primary factors driving the growth in the surgical Rasps industry?

Factors such as increased demand for minimally invasive surgeries, advancements in surgical technology, and a rising aging population are primary growth drivers within the surgical-rasps industry.

Which region is the fastest Growing in the surgical Rasps?

The Asia Pacific region is anticipated to exhibit the fastest growth, expanding from a market size of $0.67 billion in 2023 to $1.31 billion by 2033, driven by increased healthcare access and surgical procedures.

Does ConsaInsights provide customized market report data for the surgical Rasps industry?

Yes, ConsaInsights specializes in providing customized market reports tailored to the specific needs of stakeholders in the surgical-rasps industry, offering in-depth analysis and insights.

What deliverables can I expect from this surgical Rasps market research project?

Deliverables include detailed market analysis reports, growth forecasts, competitive landscape insights, and segmented market data focusing on types and regional variations in the surgical-rasps industry.

What are the market trends of surgical Rasps?

Current market trends indicate a shift towards high-precision surgical tools, increased usage of digital technologies, and growth in online sales channels, underpinning the evolving landscape of surgical-rasps.