Surgical Robots Market Report

Published Date: 31 January 2026 | Report Code: surgical-robots

Surgical Robots Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Surgical Robots market, covering market size, growth trends, regional insights, and key players from 2023 to 2033. It offers forecasts and strategic insights into the future landscape of the industry.

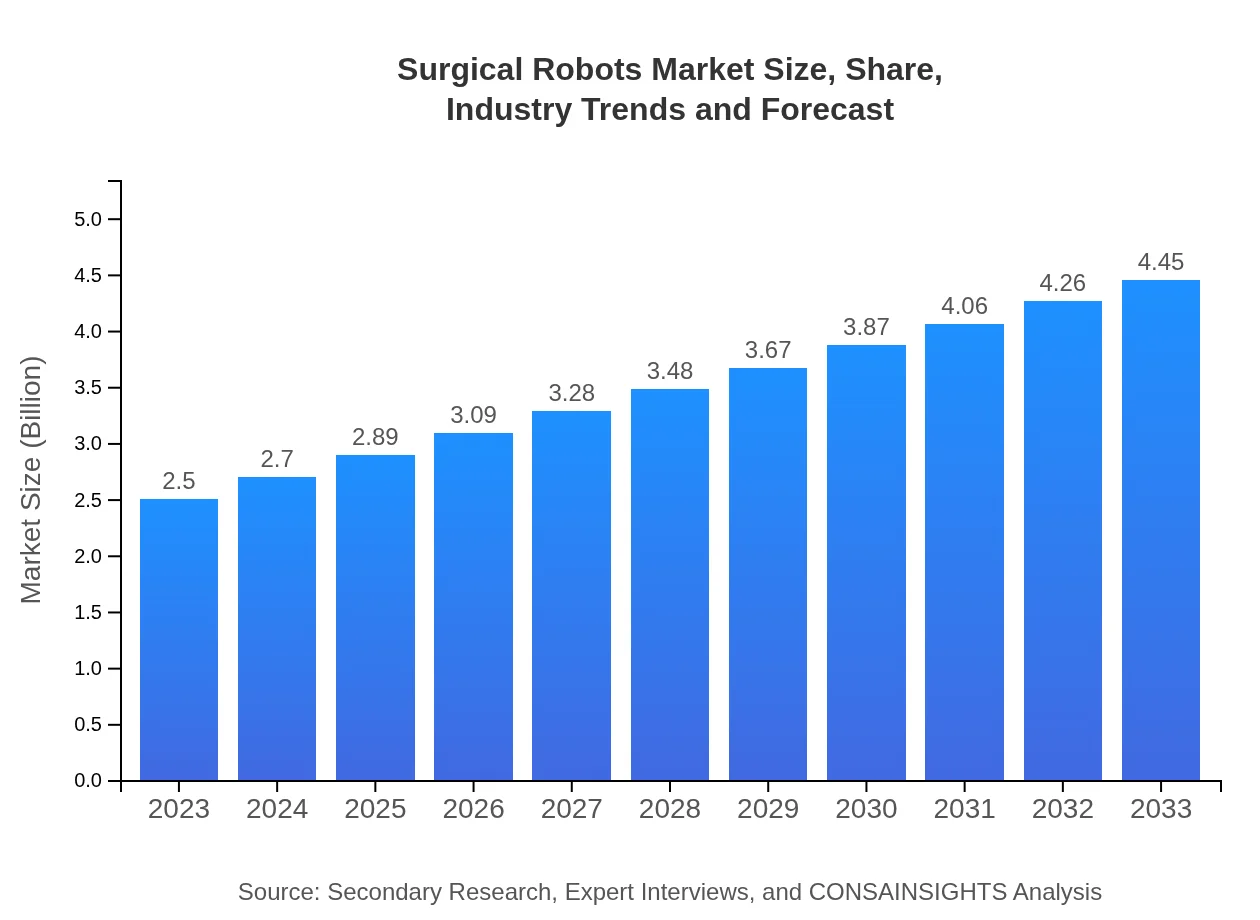

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $4.45 Billion |

| Top Companies | Intuitive Surgical, Medtronic , Stryker Corporation |

| Last Modified Date | 31 January 2026 |

Surgical Robots Market Overview

Customize Surgical Robots Market Report market research report

- ✔ Get in-depth analysis of Surgical Robots market size, growth, and forecasts.

- ✔ Understand Surgical Robots's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Surgical Robots

What is the Market Size & CAGR of Surgical Robots market in 2023?

Surgical Robots Industry Analysis

Surgical Robots Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Surgical Robots Market Analysis Report by Region

Europe Surgical Robots Market Report:

The European surgical robots market is valued at approximately $0.77 billion in 2023, with prospects of reaching $1.38 billion by 2033. The demand for minimally invasive surgeries and robust healthcare systems are key factors contributing to this growth.Asia Pacific Surgical Robots Market Report:

In the Asia Pacific region, the surgical robots market was valued at approximately $0.47 billion in 2023 and is projected to reach $0.85 billion by 2033. Increasing healthcare expenditure, a growing elderly population, and a rising number of surgeries drive this market's growth.North America Surgical Robots Market Report:

North America holds the largest share of the surgical robots market, valued at $0.88 billion in 2023, expected to expand to $1.56 billion by 2033. The region benefits from advanced healthcare technologies, government investments, and prominent players in the surgical robots industry.South America Surgical Robots Market Report:

The South American market is relatively smaller, valued at about $0.06 billion in 2023 with a potential increase to $0.10 billion by 2033. Market growth is supported by increasing awareness of robotic-assisted surgeries and improvements in healthcare infrastructure.Middle East & Africa Surgical Robots Market Report:

The market in the Middle East and Africa was valued at $0.32 billion in 2023, and is expected to grow to $0.57 billion by 2033. Factors such as increasing healthcare budgets and a rising demand for advanced surgical solutions influence market dynamics in this region.Tell us your focus area and get a customized research report.

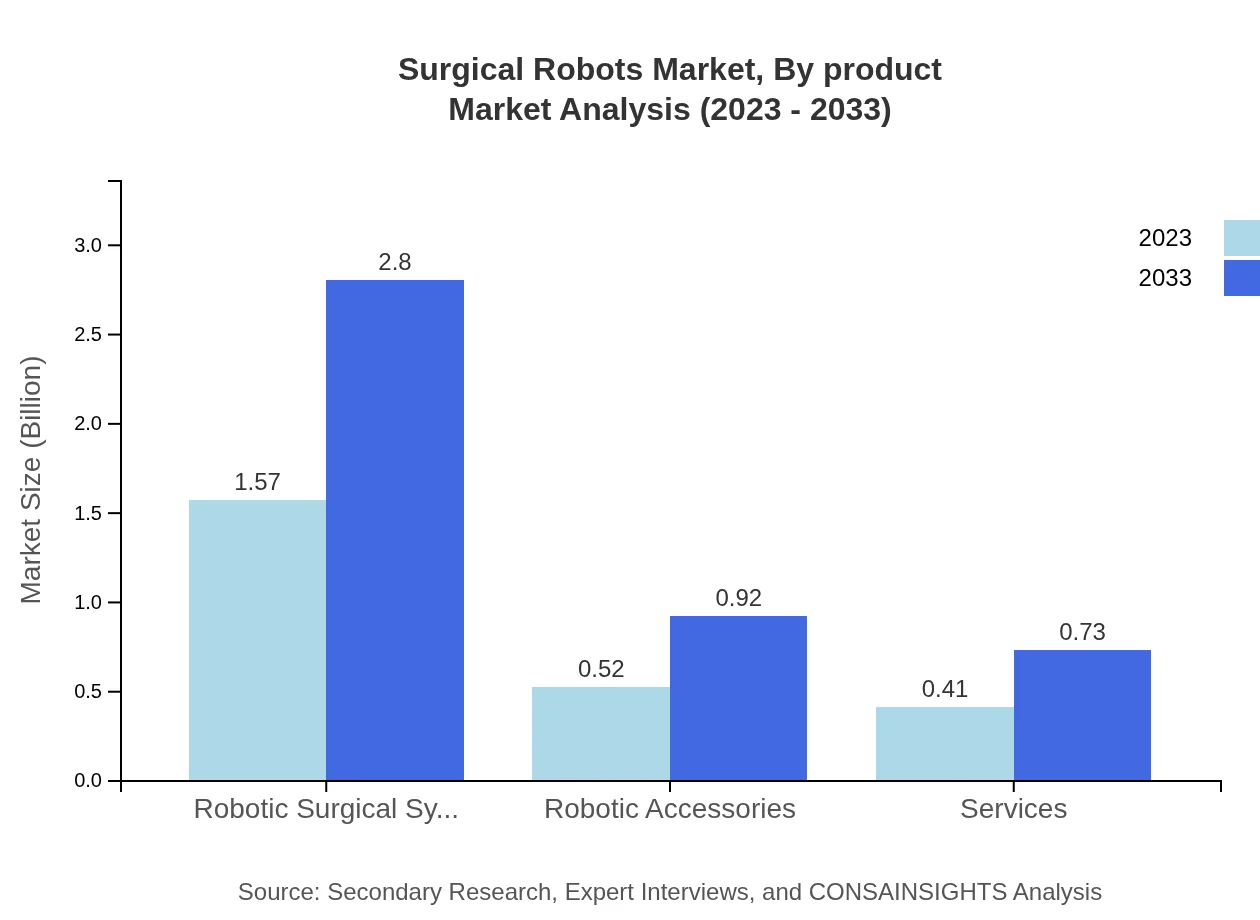

Surgical Robots Market Analysis By Product

The surgical robots market by product includes robotic surgical systems and robotic accessories. In 2023, the market for robotic surgical systems was $1.57 billion, expected to grow to $2.80 billion by 2033, maintaining a share of 62.9% throughout this period. Robotic accessories also play a crucial role, growing from $0.52 billion in 2023 to $0.92 billion by 2033.

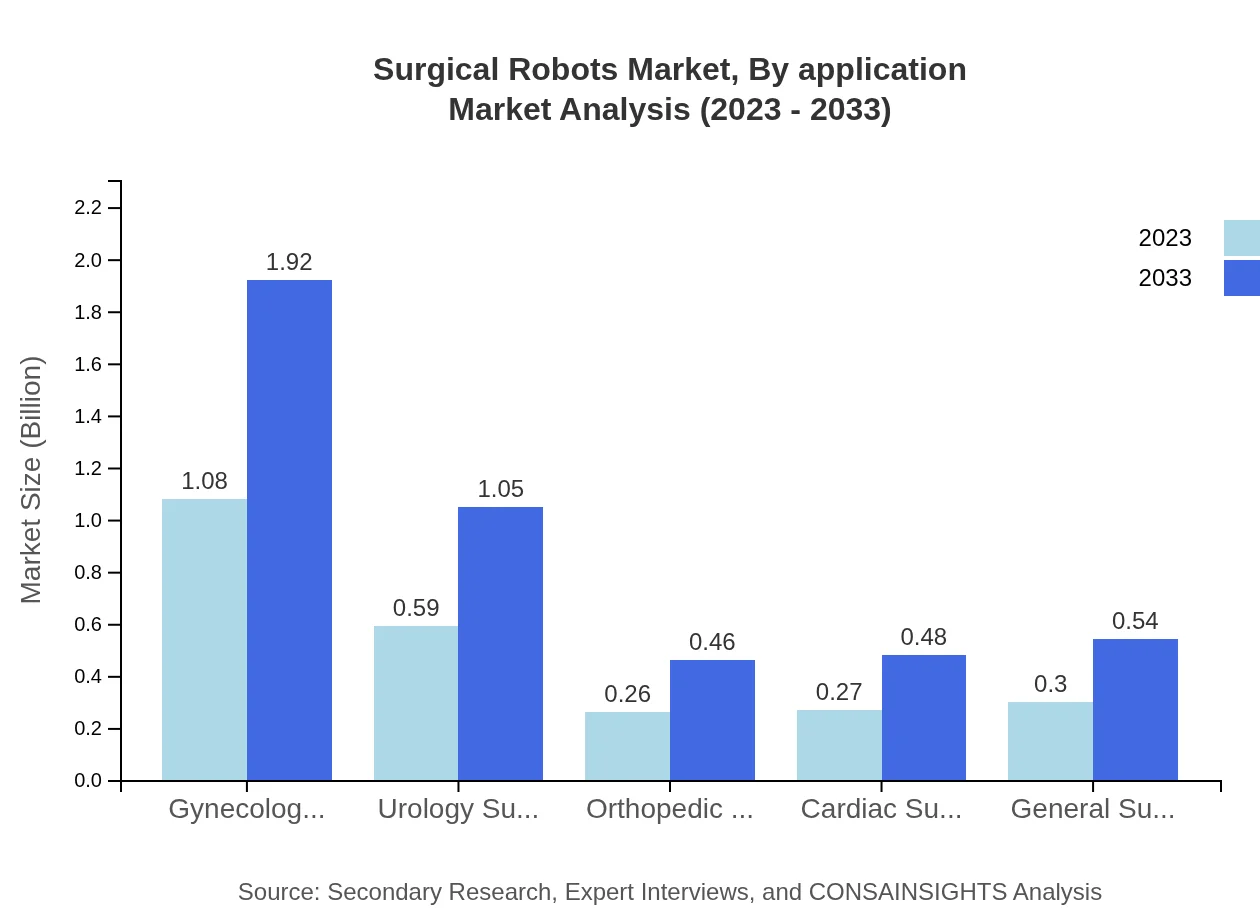

Surgical Robots Market Analysis By Application

Applications in the surgical robots market include gynecology, urology, orthopedic, cardiac, and general surgeries. Gynecology surgery holds the highest market share at 43.19% in 2023, valued at $1.08 billion, and is projected to reach $1.92 billion by 2033. Other applications show significant growth potential, particularly urology and orthopedic surgeries.

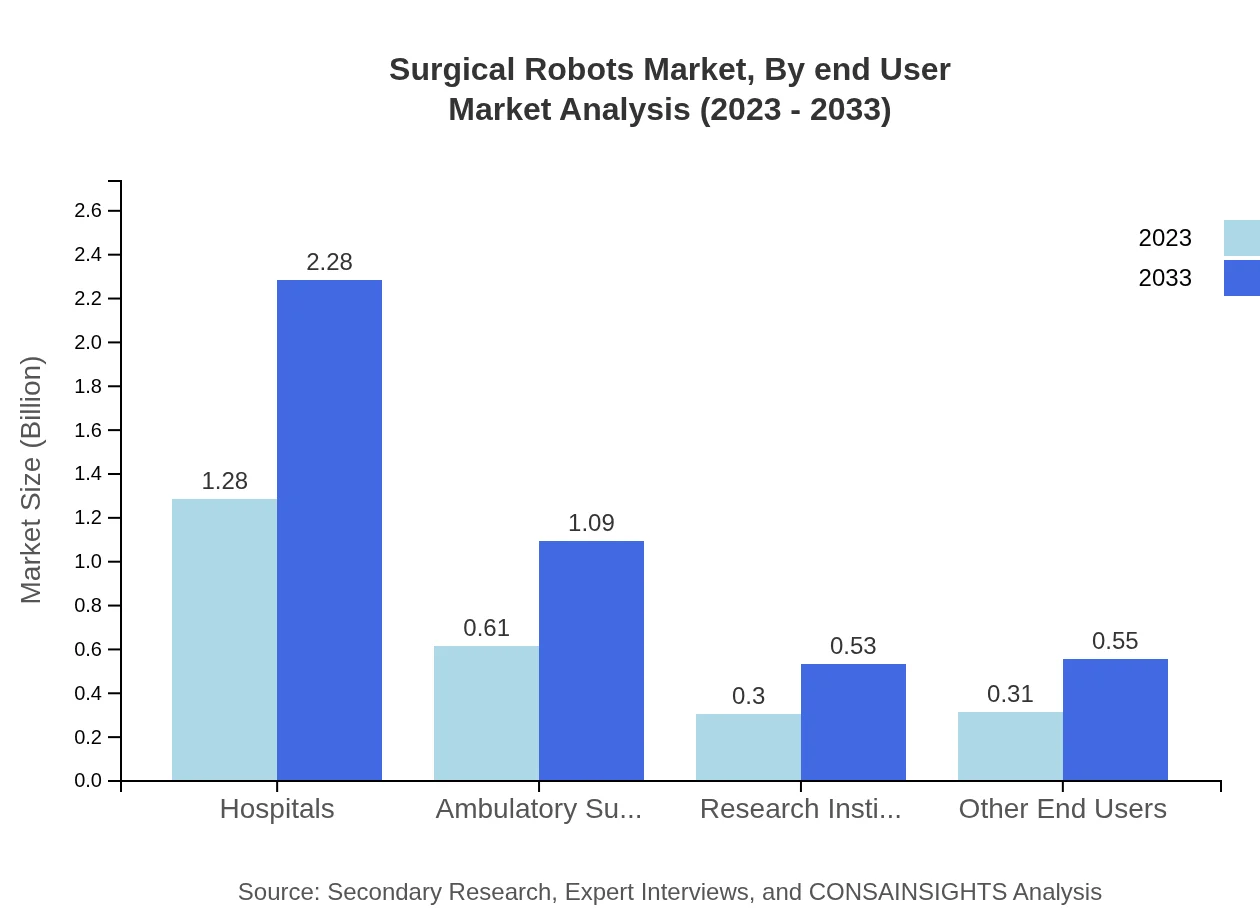

Surgical Robots Market Analysis By End User

The end-user segmentation in the surgical robots market comprises hospitals, ambulatory surgical centers, and research institutes. Hospitals are the largest segment, valued at $1.28 billion in 2023 with a substantial share of 51.31%. Ambulatory surgical centers are also important, projected to increase from $0.61 billion in 2023 to $1.09 billion by 2033.

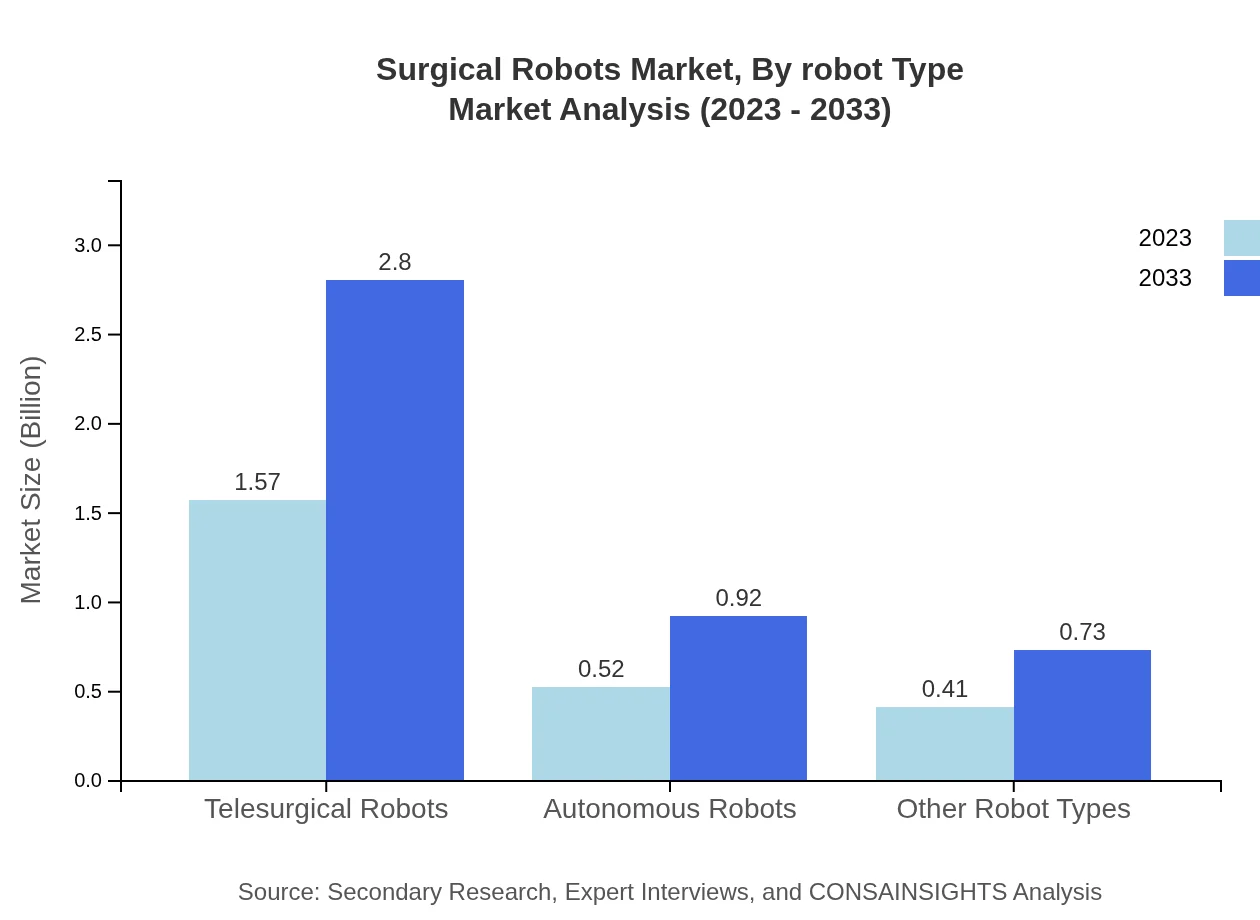

Surgical Robots Market Analysis By Robot Type

The market by robot type includes telesurgical robots, autonomous robots, and more. Telesurgical robots lead with a market value of $1.57 billion in 2023, expected to grow to $2.80 billion by 2033, maintaining a significant 62.9% market share over the forecast period.

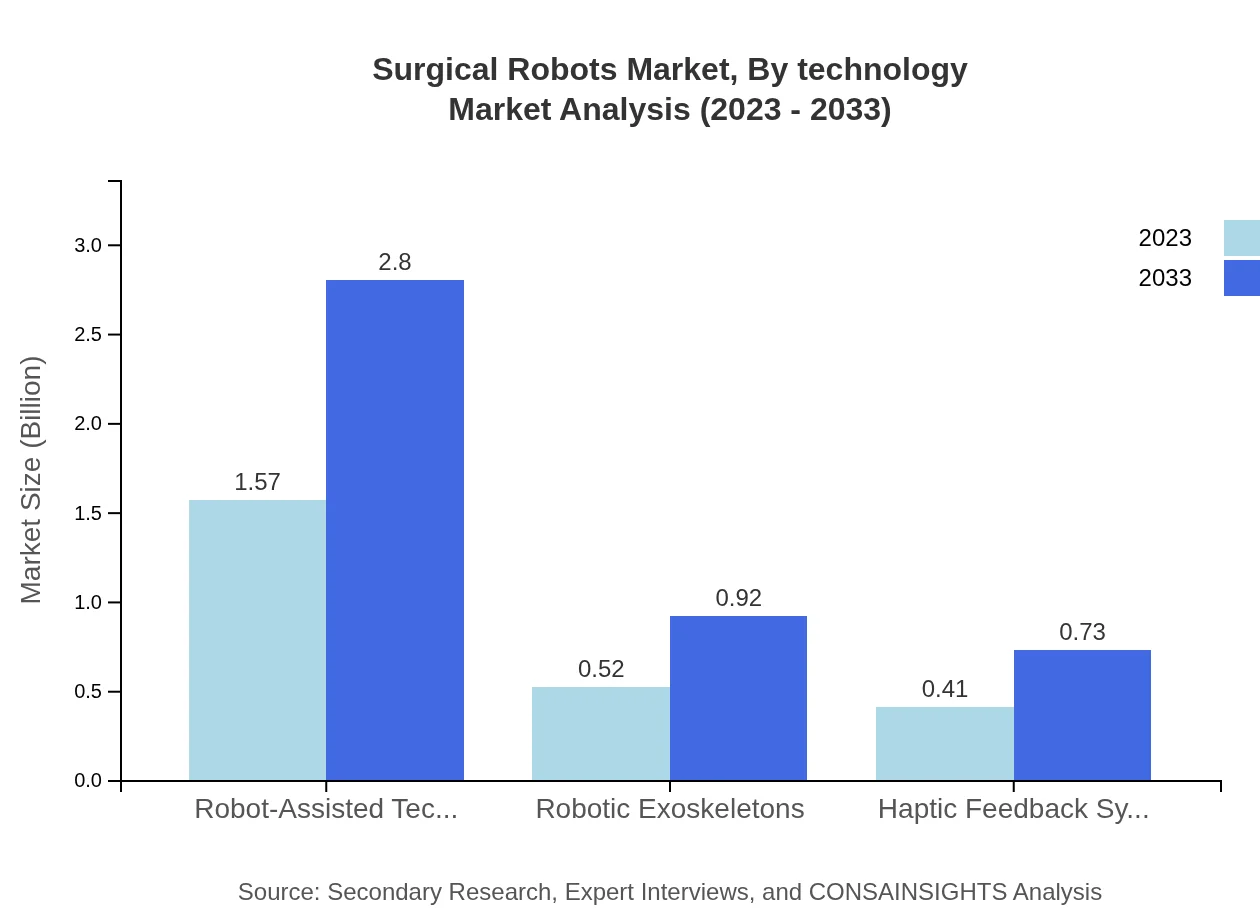

Surgical Robots Market Analysis By Technology

Technological advancements in the surgical robots market encompass robot-assisted technology, robotic exoskeletons, and haptic feedback systems. Robot-assisted technology dominates the market with a size of $1.57 billion in 2023, anticipated to expand to $2.80 billion by 2033, representing a consistent share of 62.9%.

Surgical Robots Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Surgical Robots Industry

Intuitive Surgical:

A pioneer in the robotic surgical systems market known for the da Vinci Surgical System, which revolutionized minimally invasive surgery.Medtronic :

A major player in healthcare solutions, Medtronic enhances surgical offerings through innovative robotic-assisted products designed for precision and safety.Stryker Corporation:

Specializing in orthopedic and surgical products, Stryker integrates robotics into its product line, improving surgical effectiveness.We're grateful to work with incredible clients.

FAQs

What is the market size of surgical robots?

The surgical robots market is valued at approximately $2.5 billion in 2023, with a projected CAGR of 5.8% through to 2033, indicating significant growth as technology advances and adoption increases across various medical specialties.

What are the key market players or companies in the surgical robots industry?

Key players in the surgical robots industry include Intuitive Surgical, Medtronic, Stryker Corporation, and Siemens Healthineers, each contributing to the market through innovative robotic systems and complementary solutions expanding the capabilities of minimally invasive surgeries.

What are the primary factors driving the growth in the surgical robots industry?

The growth of the surgical robots industry is driven by increasing demand for minimally invasive procedures, advancements in robotic technology, aging population necessitating more surgeries, and growing acceptance from hospitals and surgical centers to invest in robotic systems.

Which region is the fastest Growing in the surgical robots market?

North America is currently the fastest-growing region in the surgical robots market, projected to increase from $0.88 billion in 2023 to $1.56 billion by 2033, reflecting rising adoption rates and investments in advanced medical technologies.

Does ConsaInsights provide customized market report data for the surgical robots industry?

Yes, ConsaInsights offers customized market report data tailored to the surgical robots industry, allowing clients to gain insights specific to their interests and needs, facilitating strategic decisions based on the latest market trends and projections.

What deliverables can I expect from this surgical robots market research project?

From the surgical robots market research project, expect comprehensive reports including market size analysis, trend forecasts, competitive landscape assessments, regional insights, and segmentation data, providing a holistic understanding of current and future market dynamics.

What are the market trends of surgical robots?

Key market trends in surgical robots include increased focus on robot-assisted surgeries, enhanced precision through technological integrations, expansion into outpatient settings, and rising demand for training and support services, contributing to the evolving landscape of surgical procedures.