Surgical Sealants And Adhesives Market Report

Published Date: 31 January 2026 | Report Code: surgical-sealants-and-adhesives

Surgical Sealants And Adhesives Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Surgical Sealants and Adhesives market from 2023 to 2033, covering key insights, market trends, segmentation, and future forecasts. It aims to inform stakeholders on the current market landscape and projected growth patterns.

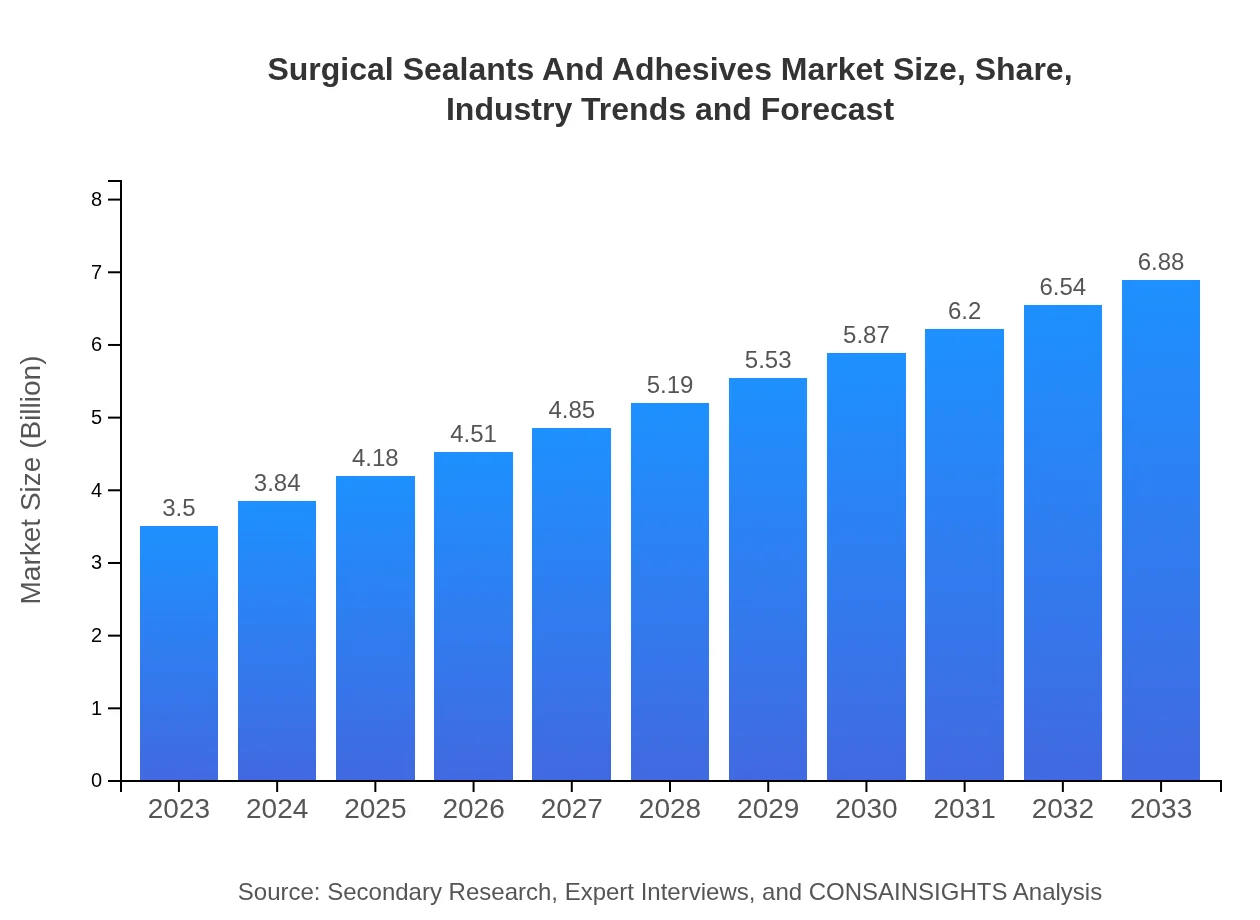

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $6.88 Billion |

| Top Companies | Johnson & Johnson, Baxter International Inc., Medtronic , CSL Behring |

| Last Modified Date | 31 January 2026 |

Surgical Sealants And Adhesives Market Overview

Customize Surgical Sealants And Adhesives Market Report market research report

- ✔ Get in-depth analysis of Surgical Sealants And Adhesives market size, growth, and forecasts.

- ✔ Understand Surgical Sealants And Adhesives's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Surgical Sealants And Adhesives

What is the Market Size & CAGR of Surgical Sealants And Adhesives market in 2023?

Surgical Sealants And Adhesives Industry Analysis

Surgical Sealants And Adhesives Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Surgical Sealants And Adhesives Market Analysis Report by Region

Europe Surgical Sealants And Adhesives Market Report:

The European market is expected to increase from USD 0.86 billion in 2023 to USD 1.70 billion by 2033. Continuous advancements in surgical technologies and favorable reimbursement policies aid in the adoption of surgical sealants and adhesives in this region.Asia Pacific Surgical Sealants And Adhesives Market Report:

In the Asia Pacific region, the market is projected to grow from USD 0.74 billion in 2023 to USD 1.46 billion by 2033, illustrating a strong growth trajectory bolstered by rising healthcare investments and increasing surgical procedures within emerging markets such as India and China.North America Surgical Sealants And Adhesives Market Report:

North America dominates the Surgical Sealants and Adhesives market, projected to grow from USD 1.15 billion in 2023 to USD 2.27 billion by 2033. This growth is supported by a high volume of surgical procedures and substantial R&D investments from established market players.South America Surgical Sealants And Adhesives Market Report:

The South American market is expected to witness growth from USD 0.33 billion in 2023 to USD 0.64 billion by 2033. Growing awareness regarding advanced surgical solutions and rising healthcare demands will likely drive market expansion in this region.Middle East & Africa Surgical Sealants And Adhesives Market Report:

The Middle East and Africa market is forecasted to rise from USD 0.42 billion in 2023 to USD 0.82 billion by 2033, driven by increasing healthcare infrastructure developments and greater acceptance of advanced surgical solutions.Tell us your focus area and get a customized research report.

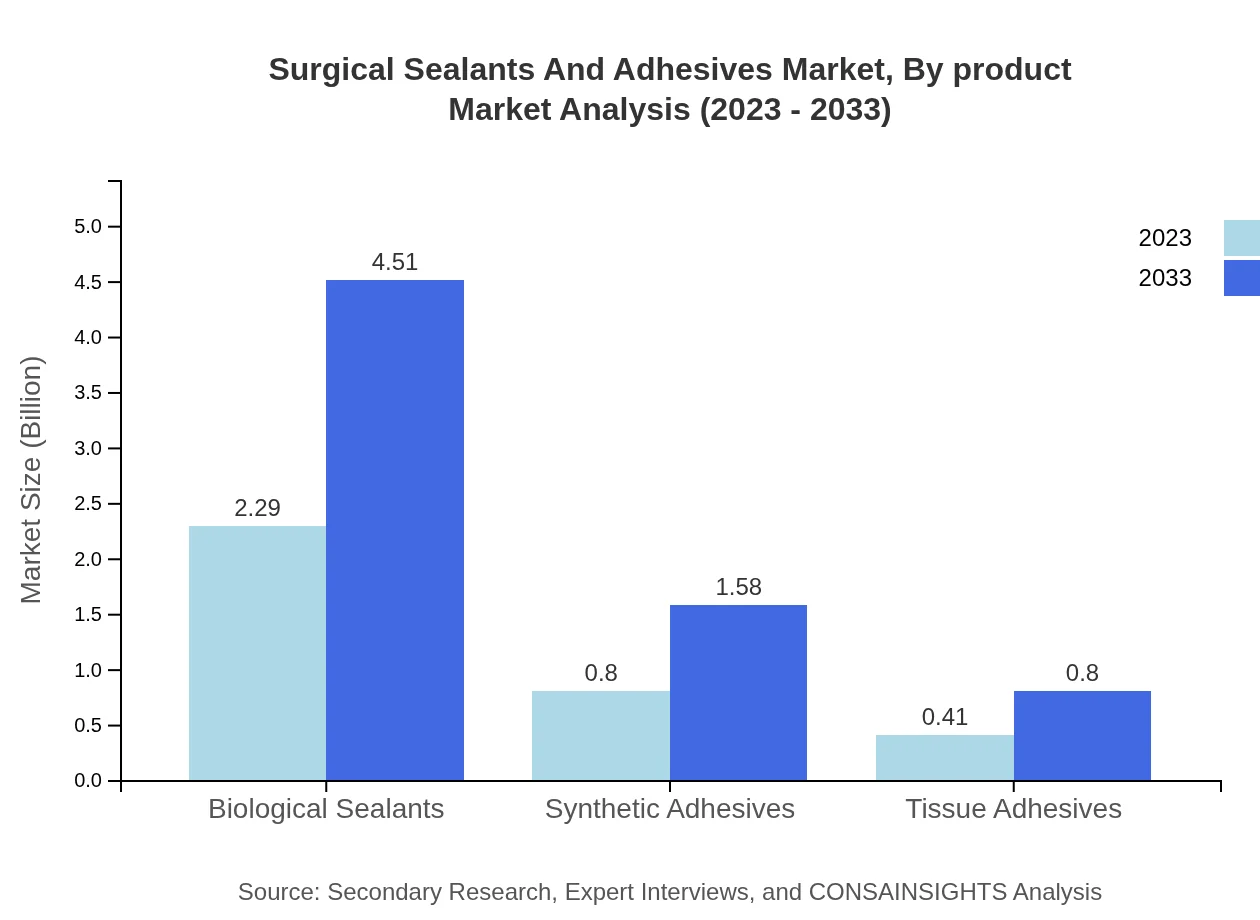

Surgical Sealants And Adhesives Market Analysis By Product

The Biological Sealants segment leads the market, with a size of USD 2.29 billion in 2023 and expected to reach USD 4.51 billion by 2033, holding a share of 65.49% throughout the forecast. Synthetic Adhesives hold a market size of USD 0.80 billion with a projected growth to USD 1.58 billion, and Tissue Adhesives account for USD 0.41 billion in 2023, growing to USD 0.80 billion.

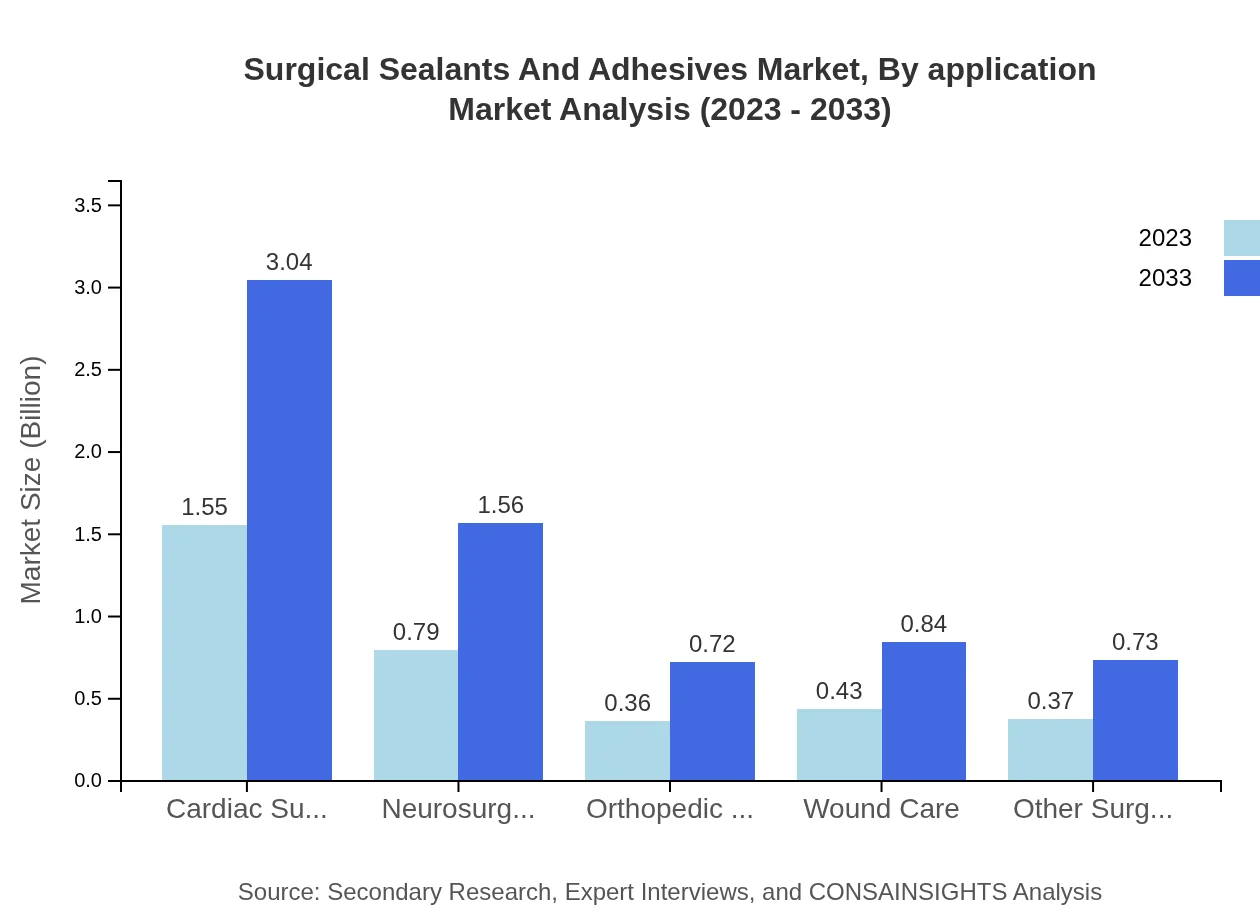

Surgical Sealants And Adhesives Market Analysis By Application

By application, Cardiac Surgery holds a significant market size of USD 1.55 billion in 2023, expected to grow to USD 3.04 billion by 2033, representing 44.18% of the market. Key segments also include Neurosurgery and Orthopedic Surgery, which hold respective shares of 22.62% and 10.4%.

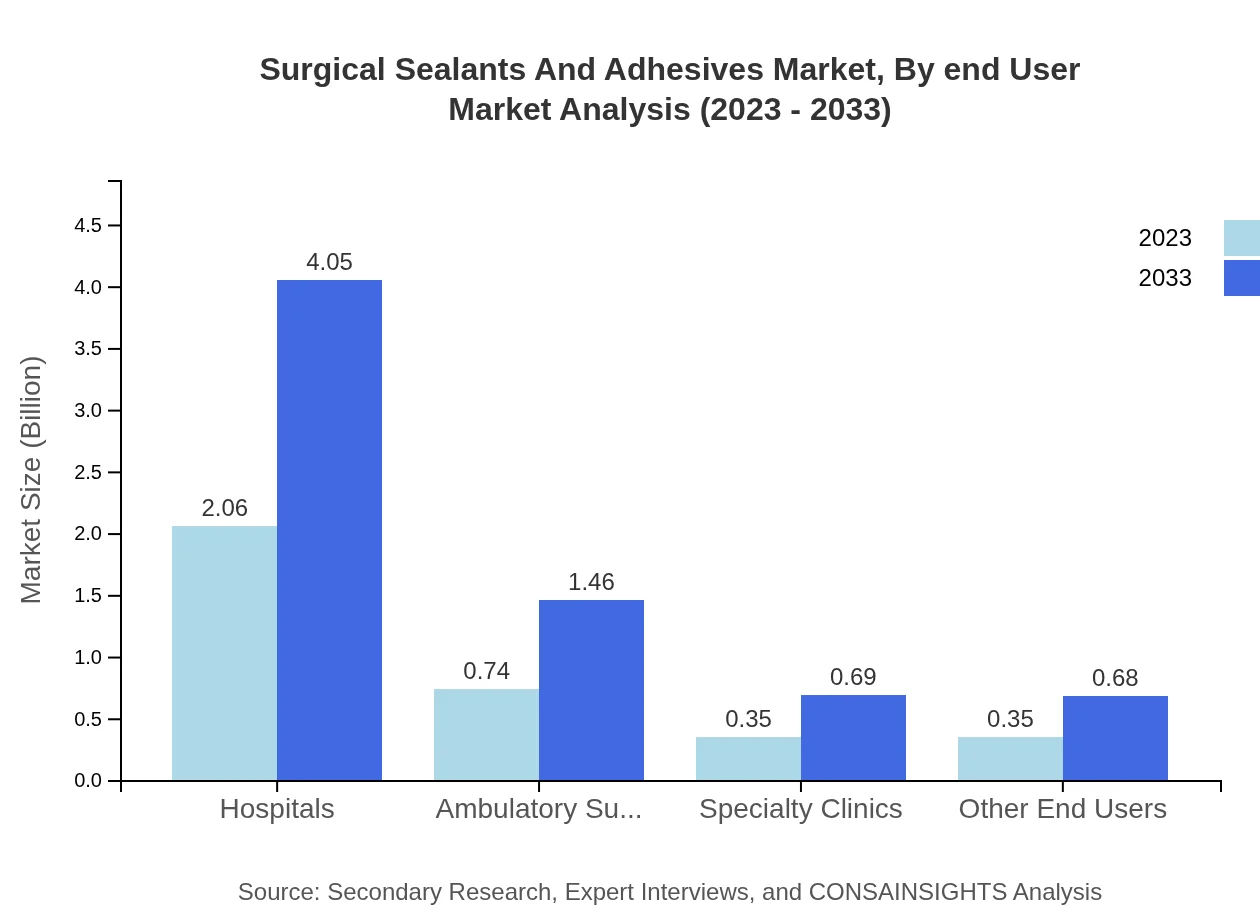

Surgical Sealants And Adhesives Market Analysis By End User

Hospitals dominate the end-user market with a size of USD 2.06 billion in 2023 and a forecasted size of USD 4.05 billion by 2033 (share: 58.85%). Ambulatory Surgical Centers and Specialty Clinics follow, showing robust growth trajectories.

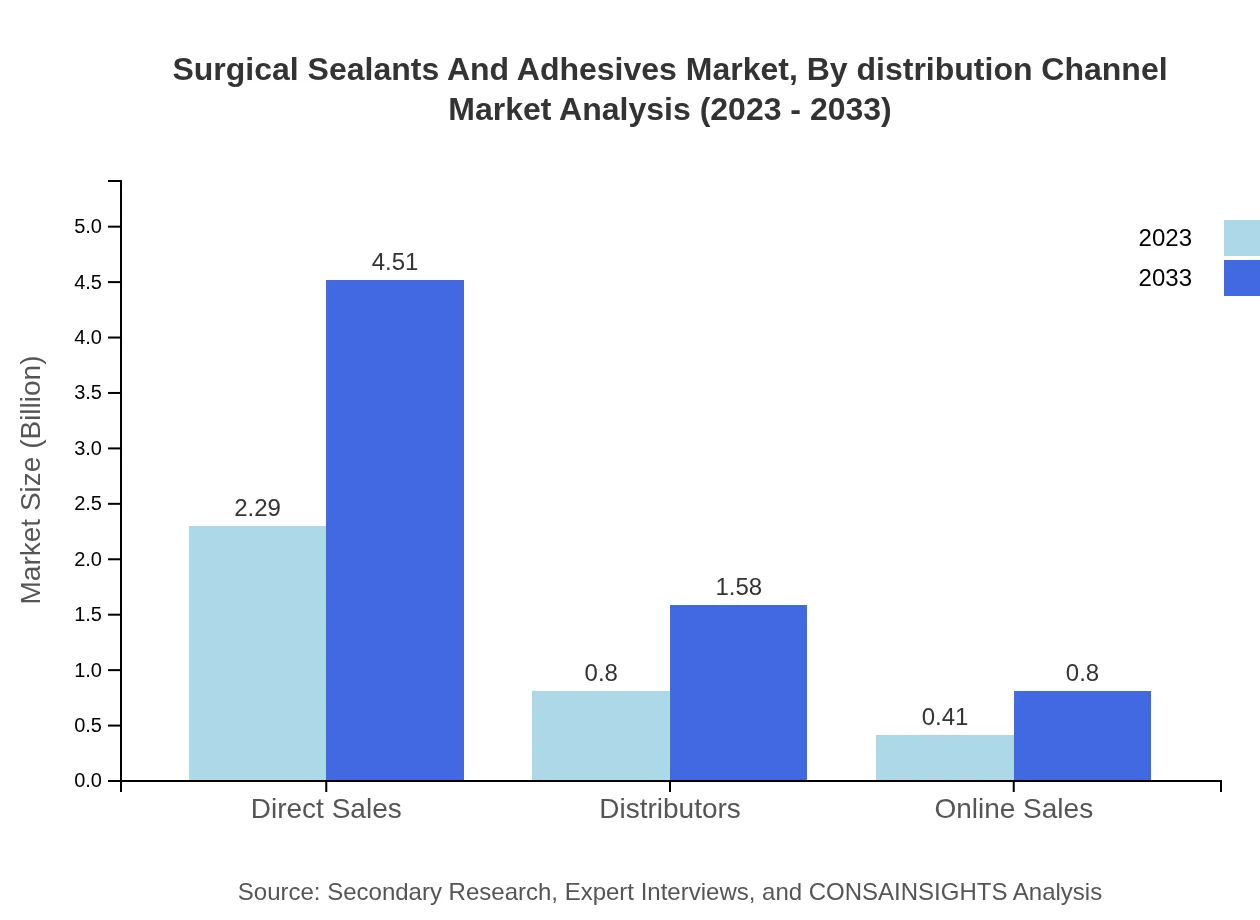

Surgical Sealants And Adhesives Market Analysis By Distribution Channel

The Direct Sales segment accounts for USD 2.29 billion in 2023 growing to USD 4.51 billion by 2033 (65.49% share). Distribution is increasingly facilitated through online channels, indicating a shift in purchasing preferences.

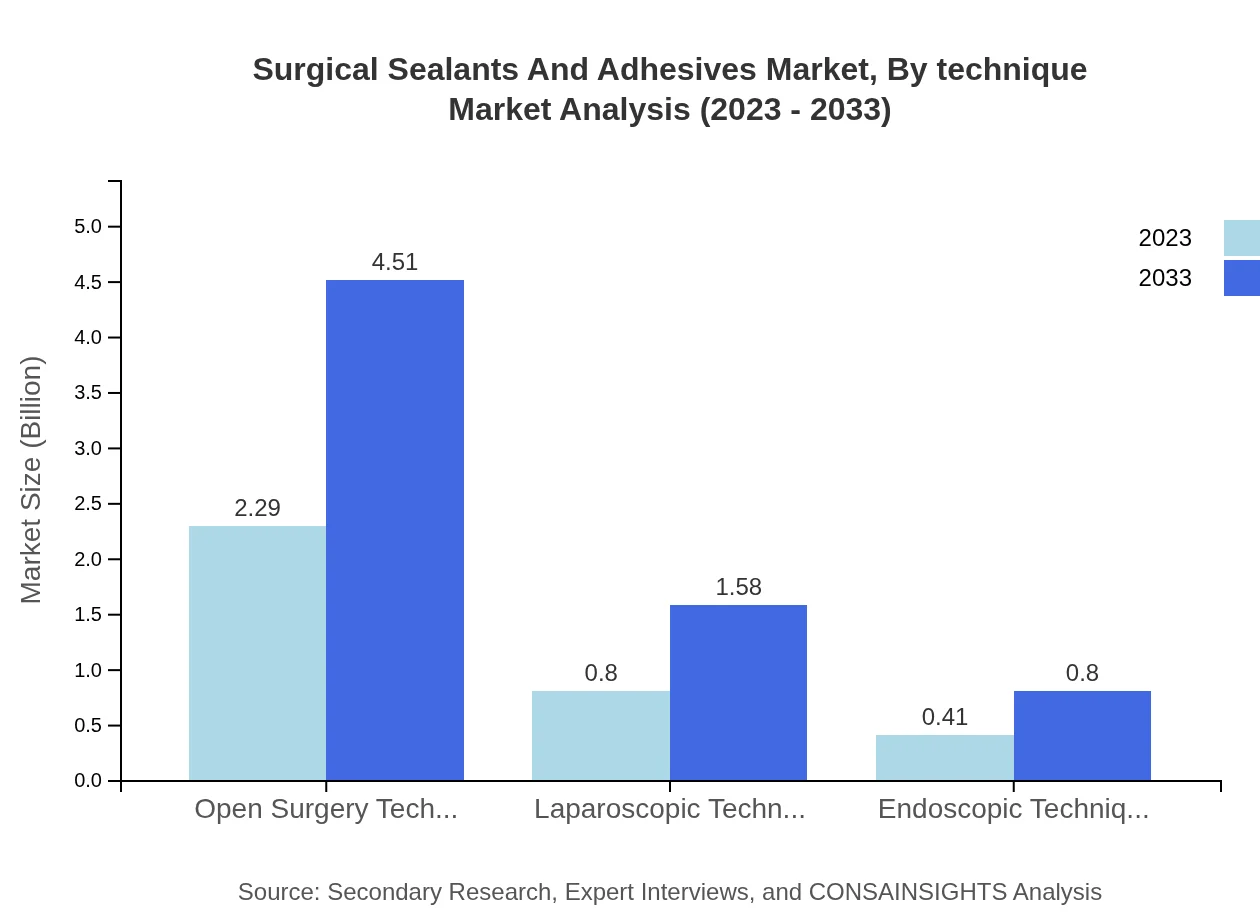

Surgical Sealants And Adhesives Market Analysis By Technique

Open Surgery Techniques lead the market segments with a size of USD 2.29 billion in 2023 expected to increase to USD 4.51 billion by 2033. Advances in Laparoscopic and Endoscopic techniques also indicate substantial market presence.

Surgical Sealants And Adhesives Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Surgical Sealants And Adhesives Industry

Johnson & Johnson:

A leader in the medical device industry, Johnson & Johnson offers a variety of surgical sealants and adhesives known for their quality and efficacy across multiple surgical applications.Baxter International Inc.:

Baxter is known for its innovative biomedical products, including a range of advanced sealants that enhance the recovery process in surgeries.Medtronic :

Medtronic develops high-performance surgical sealants and adhesives, contributing significantly to improved surgical outcomes with its diverse product offerings.CSL Behring:

CSL Behring specializes in biotherapies and offers advanced surgical sealants, focusing on safe tissue adherence and effective hemostatic solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of surgical Sealants And Adhesives?

The global surgical sealants and adhesives market is currently valued at approximately $3.5 billion, with a projected compound annual growth rate (CAGR) of 6.8% from 2023 to 2033, indicating a significant growth trajectory in the coming years.

What are the key market players or companies in this surgical Sealants And Adhesives industry?

Key players in the surgical sealants and adhesives market include companies like Johnson & Johnson, Medtronic, and B. Braun Melsungen AG. Their strong market positions are enhanced by continuous R&D and product innovation tailored to surgical applications.

What are the primary factors driving the growth in the surgical Sealants And Adhesives industry?

Growth in the surgical sealants and adhesives industry is propelled by an increasing volume of surgical procedures, advancements in adhesive technology, and a rising prevalence of chronic diseases. Moreover, favorable reimbursement policies contribute positively to market expansion.

Which region is the fastest Growing in the surgical Sealants And Adhesives?

The fastest-growing region in the surgical sealants and adhesives market is North America, with the market expected to grow from $1.15 billion in 2023 to $2.27 billion by 2033. Asia-Pacific follows closely, expecting growth from $0.74 billion to $1.46 billion in the same timeframe.

Does ConsaInsights provide customized market report data for the surgical Sealants And Adhesives industry?

Yes, ConsaInsights specializes in providing customized market report data tailored to specific needs in the surgical sealants and adhesives industry, ensuring relevant insights into market dynamics, regional performance, and competitor analysis.

What deliverables can I expect from this surgical Sealants And Adhesives market research project?

Deliverables from the surgical sealants and adhesives market research project typically include a comprehensive report, detailed data analysis, visual charts, and strategic insights. Additionally, market forecasts and competitor assessments will be included to guide decision-making.

What are the market trends of surgical Sealants And Adhesives?

Current market trends in surgical sealants and adhesives indicate a shift towards biological sealants, which are projected to grow significantly. Innovations in adhesive technology and increasing consumer demand for minimally invasive procedures are also shaping the industry.