Surgical Snare Market Report

Published Date: 31 January 2026 | Report Code: surgical-snare

Surgical Snare Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive market report analyzes the Surgical Snare market, providing insights on its growth and dynamics from 2023 to 2033. It covers market sizes, trends, segmentations, and regional insights to offer a complete understanding of the industry's landscape.

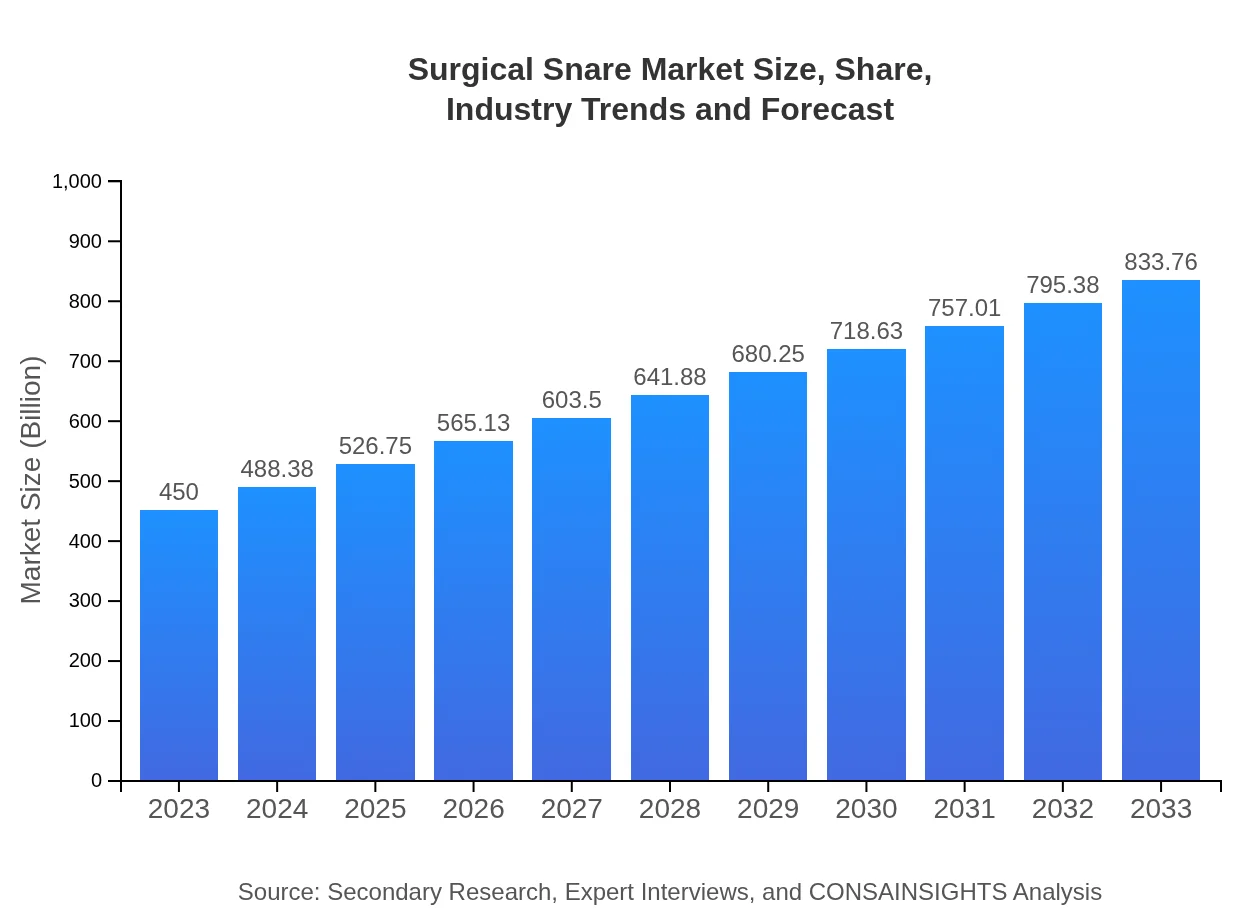

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $450.00 Million |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $833.76 Million |

| Top Companies | Medtronic , Boston Scientific, Johnson & Johnson, Olympus Corporation, Cook Medical |

| Last Modified Date | 31 January 2026 |

Surgical Snare Market Overview

Customize Surgical Snare Market Report market research report

- ✔ Get in-depth analysis of Surgical Snare market size, growth, and forecasts.

- ✔ Understand Surgical Snare's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Surgical Snare

What is the Market Size & CAGR of Surgical Snare market in 2023?

Surgical Snare Industry Analysis

Surgical Snare Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Surgical Snare Market Analysis Report by Region

Europe Surgical Snare Market Report:

In Europe, the market size is expected to grow from $125.42 million in 2023 to $232.37 million by 2033. The region's focus on technological innovation and high healthcare spending contribute to this growth.Asia Pacific Surgical Snare Market Report:

In the Asia Pacific region, the surgical snare market is projected to grow from $91.08 million in 2023 to $168.75 million by 2033. This growth is driven by increasing surgical procedures and rising investments in healthcare infrastructure.North America Surgical Snare Market Report:

North America leads the market with a size of $159.62 million in 2023, predicted to reach $295.73 million by 2033. This growth is fueled by technological advancements and a high prevalence of chronic diseases requiring surgical interventions.South America Surgical Snare Market Report:

The South American market, though smaller, is expected to experience growth from $18.45 million in 2023 to $34.18 million by 2033. Factors include improving healthcare access and rising awareness about advanced surgical technologies.Middle East & Africa Surgical Snare Market Report:

The Middle East and Africa region is anticipated to grow from $55.44 million in 2023 to $102.72 million by 2033, driven by increasing healthcare investments and growing demand for advanced surgical procedures.Tell us your focus area and get a customized research report.

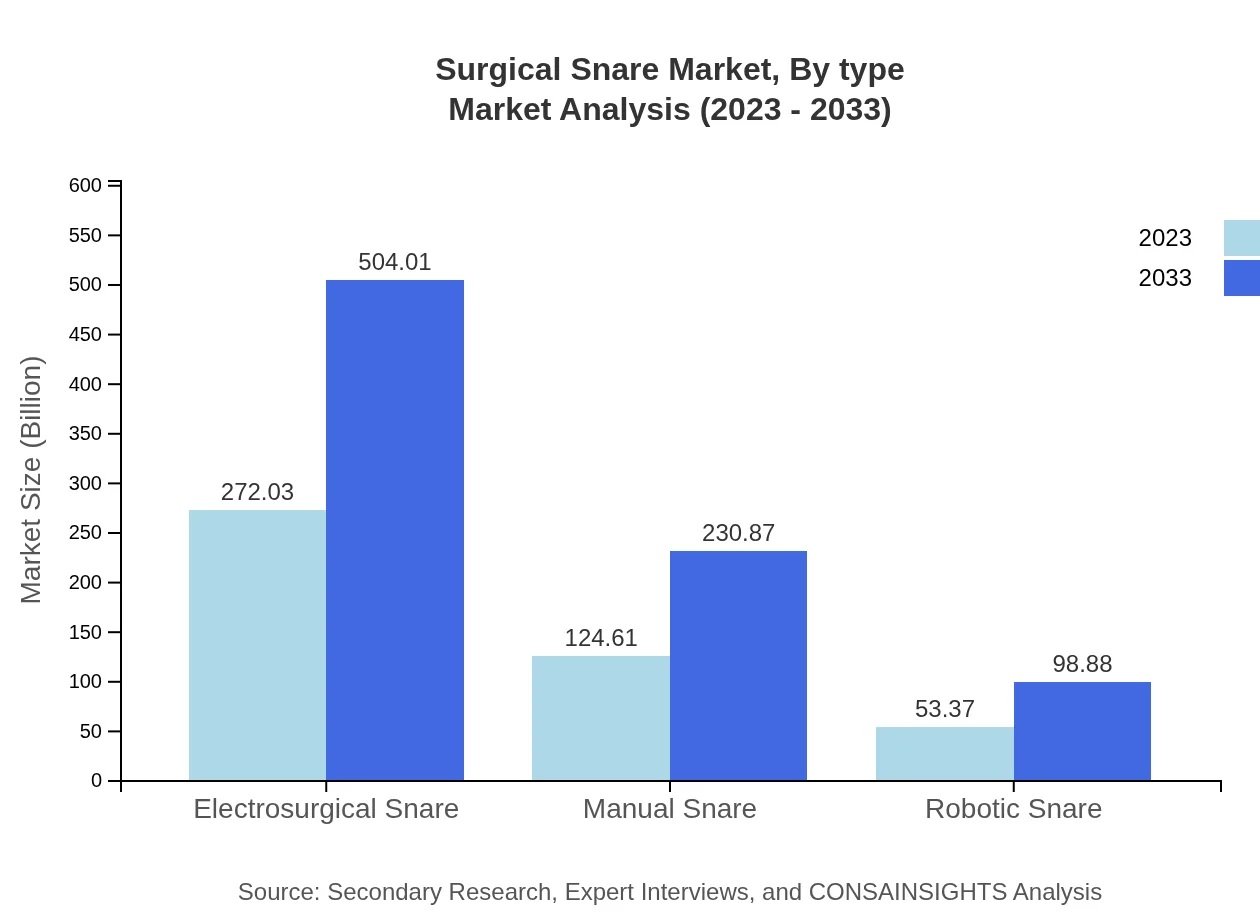

Surgical Snare Market Analysis By Type

The surgical snare market segment analysis reveals that Electrosurgical Snare holds a significant market position with a size of $272.03 million in 2023, expected to increase to $504.01 million by 2033. Manual Snare follows with a market size of $124.61 million in 2023, growing to $230.87 million by 2033. Robotic Snare's market reflects a growing interest with sizes projected from $53.37 million in 2023 to $98.88 million by 2033.

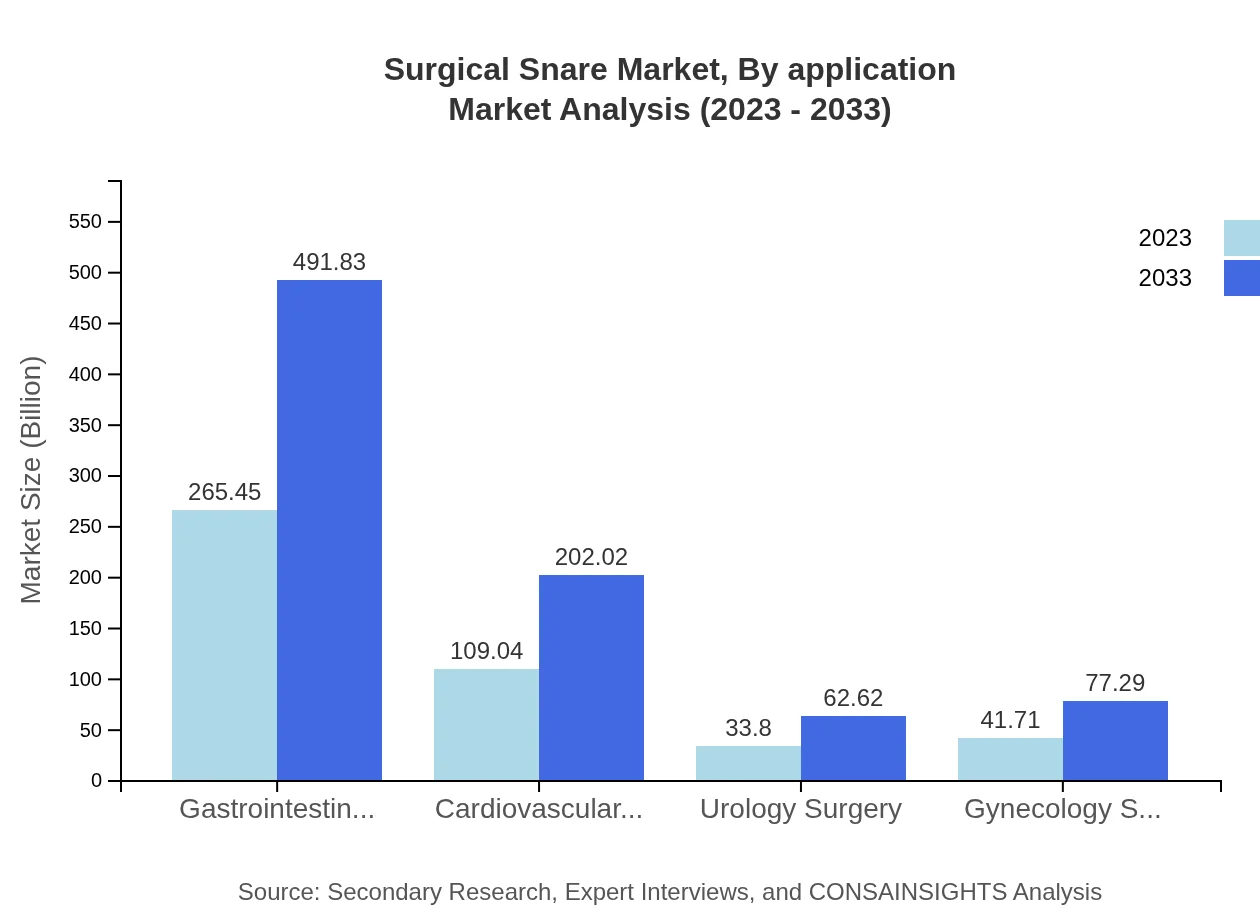

Surgical Snare Market Analysis By Application

In terms of application, the gastrointestinal surgery segment dominates the market, with a size of $265.45 million in 2023, increasing to $491.83 million by 2033. Cardiovascular surgery captures a market of $109.04 million in 2023, expected to grow to $202.02 million by 2033. Urology surgery and gynecology surgery mark growth as well, indicating diverse applications of surgical snares across various sectors.

Surgical Snare Market Analysis By End User

Hospitals represent the largest end-user segment with a size of $272.03 million in 2023, projecting to $504.01 million by 2033. Ambulatory surgery centers follow with a size of $124.61 million in 2023, expected to reach $230.87 million by 2033. Research institutions will also see growth from $53.37 million to $98.88 million over the same period.

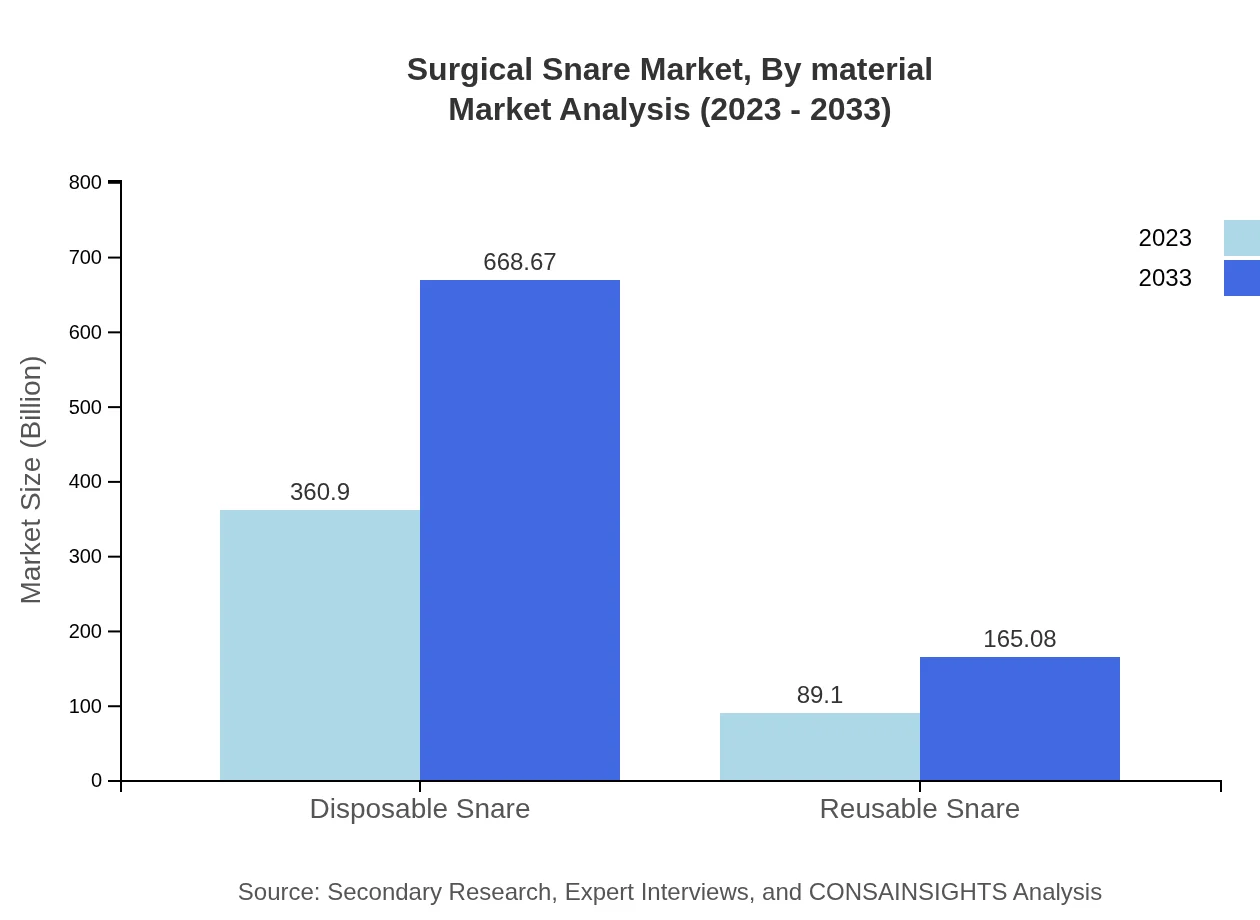

Surgical Snare Market Analysis By Material

The disposable snare segment is expected to dominate with a size of $360.90 million in 2023, projected to climb to $668.67 million by 2033. Reusable snares, while smaller, will also see growth, growing from $89.10 million in 2023 to $165.08 million by 2033.

Surgical Snare Market Analysis By Region

Global Surgical Snare Market, By Region Market Analysis (2023 - 2033)

The regional market analysis shows North America leading, followed by Europe and Asia Pacific. Each region presents unique growth drivers, including technological advancements in healthcare and an increasing demand for minimally invasive procedures.

Surgical Snare Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Surgical Snare Industry

Medtronic :

Medtronic is a worldwide leader in medical technology, offering innovative surgical products including advanced surgical snares designed for various surgical procedures.Boston Scientific:

Boston Scientific specializes in minimally invasive medical devices, including surgical snares that support safe and effective surgical interventions.Johnson & Johnson:

Johnson & Johnson's Ethicon division produces a wide range of surgical tools, including surgical snares, focused on improving patient outcomes.Olympus Corporation:

Olympus is recognized for its advanced surgical products and innovative technology, including cutting-edge surgical snares for effective procedures.Cook Medical:

Cook Medical specializes in medical devices and is well-known for its effective and innovatively designed surgical snares used in various surgical applications.We're grateful to work with incredible clients.

FAQs

What is the market size of surgical Snare?

The surgical snare market is projected to reach $450 million by 2033, growing at a CAGR of 6.2%. The market is expected to see significant growth across various segments and regions in the coming years.

What are the key market players or companies in this surgical Snare industry?

The surgical snare market includes major players like Medtronic, Boston Scientific, Johnson & Johnson, Olympus Corporation, and Smith & Nephew. These companies are renowned for their innovative technologies and a strong focus on expanding their product lines.

What are the primary factors driving the growth in the surgical snare industry?

Key factors driving growth include increasing instances of surgical procedures, advancements in minimally invasive surgical technologies, and the rise in gastrointestinal and cardiovascular surgeries, which prioritize safety and efficacy in surgical instruments.

Which region is the fastest Growing in the surgical snare market?

North America is currently the fastest-growing region, expected to reach $295.73 million by 2033. Europe and Asia Pacific also show promising growth, emphasizing the global expansion of surgical technologies.

Does ConsaInsights provide customized market report data for the surgical snare industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the surgical snare industry. This includes detailed insights into regional markets, segments, and competitor analysis.

What deliverables can I expect from this surgical snare market research project?

Deliverables from the surgical snare market research project will include comprehensive market reports, detailed competitor analysis, segmentation data, and forecasts for market growth across various regions.

What are the market trends of surgical snare?

Market trends indicate an increase in disposable surgical snares due to their convenience, along with the adoption of robotic-assisted surgical procedures, which enhance precision and reduce recovery time for patients.