Surgical Stapler Market Report

Published Date: 31 January 2026 | Report Code: surgical-stapler

Surgical Stapler Market Size, Share, Industry Trends and Forecast to 2033

This report presents a comprehensive analysis of the Surgical Stapler market, including insights on market size, growth projections, trend analysis, and regional breakdowns from 2023 to 2033.

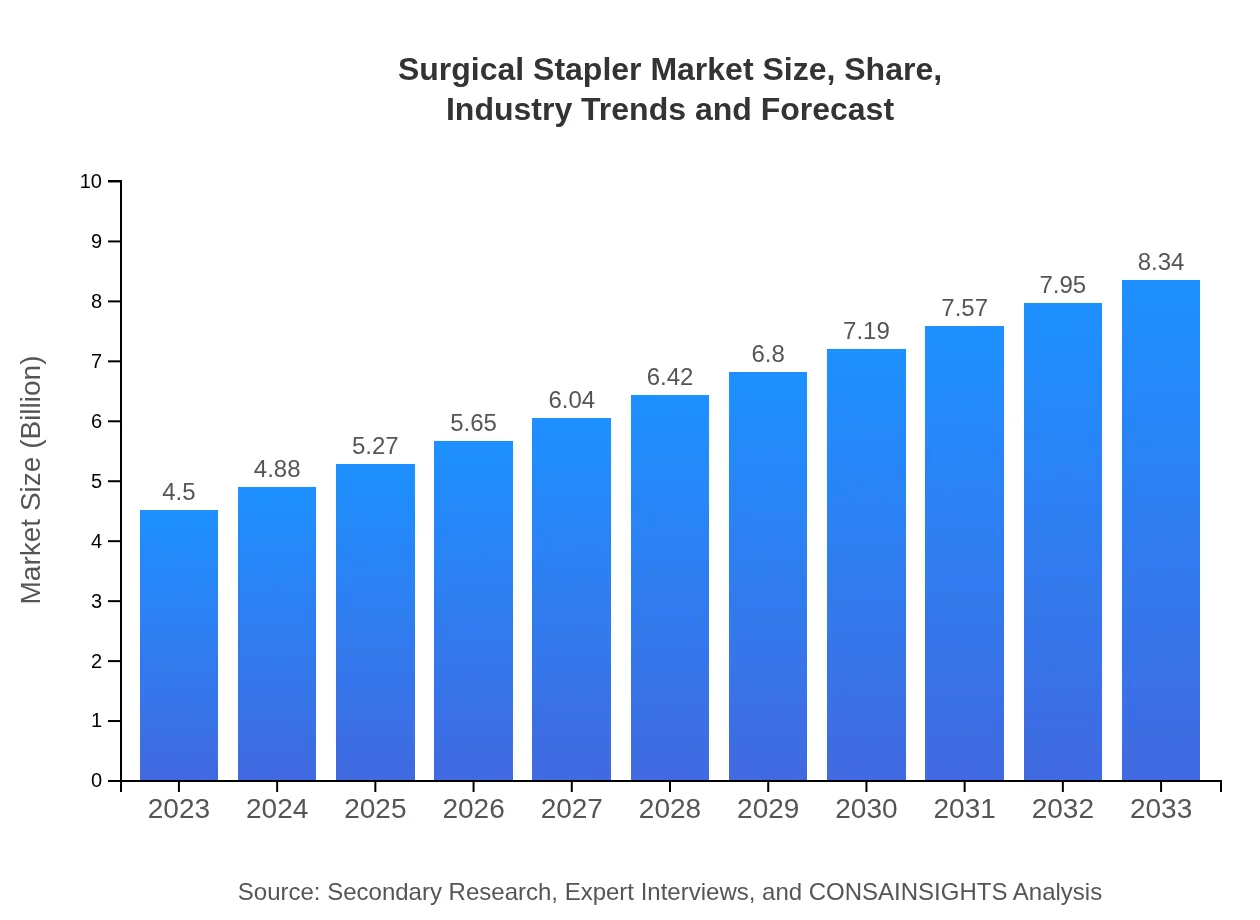

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $4.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $8.34 Billion |

| Top Companies | Johnson & Johnson, Medtronic , Surgical Innovations, B. Braun, Ethicon |

| Last Modified Date | 31 January 2026 |

Surgical Stapler Market Overview

Customize Surgical Stapler Market Report market research report

- ✔ Get in-depth analysis of Surgical Stapler market size, growth, and forecasts.

- ✔ Understand Surgical Stapler's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Surgical Stapler

What is the Market Size & CAGR of Surgical Stapler market in 2023?

Surgical Stapler Industry Analysis

Surgical Stapler Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Surgical Stapler Market Analysis Report by Region

Europe Surgical Stapler Market Report:

The European market is anticipated to grow from $1.37 billion in 2023 to $2.55 billion by 2033, fueled by advanced healthcare technologies and a strong focus on innovative surgical solutions.Asia Pacific Surgical Stapler Market Report:

The Asia Pacific region's Surgical Stapler market is projected to grow from $0.85 billion in 2023 to $1.58 billion by 2033, driven by increasing surgical volumes and advancements in healthcare infrastructure.North America Surgical Stapler Market Report:

North America holds a significant market share, with an expected growth from $1.60 billion in 2023 to $2.96 billion by 2033. The region's dominance is attributed to the prevalence of chronic diseases and a high number of surgical procedures.South America Surgical Stapler Market Report:

In South America, the market is expected to rise from $0.23 billion in 2023 to $0.42 billion by 2033. Growing healthcare expenditure and improved accessibility to surgical treatments are significant growth factors.Middle East & Africa Surgical Stapler Market Report:

The Middle East and Africa market is also forecasted to rise from $0.45 billion in 2023 to $0.83 billion by 2033, supported by increasing healthcare investments and growing awareness of advanced surgical techniques.Tell us your focus area and get a customized research report.

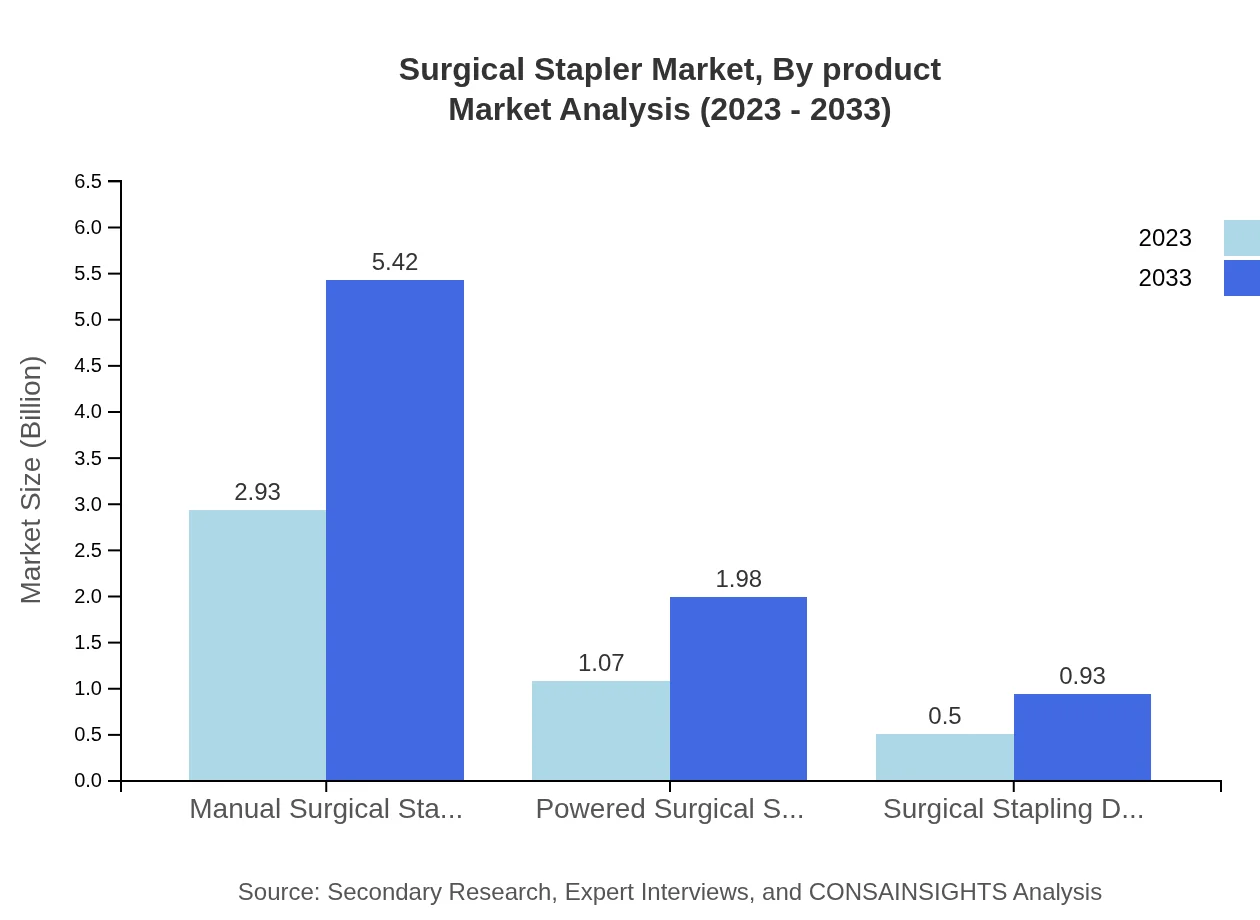

Surgical Stapler Market Analysis By Product

The market is segmented into manual surgical staplers, powered surgical staplers, and surgical stapling devices. Manual surgical staplers commanded a market size of $2.93 billion in 2023, expected to reach $5.42 billion by 2033. Powered surgical staplers accounted for $1.07 billion in 2023 and are projected to grow to $1.98 billion. Surgical stapling devices made $0.50 billion in 2023 and are estimated at $0.93 billion by 2033.

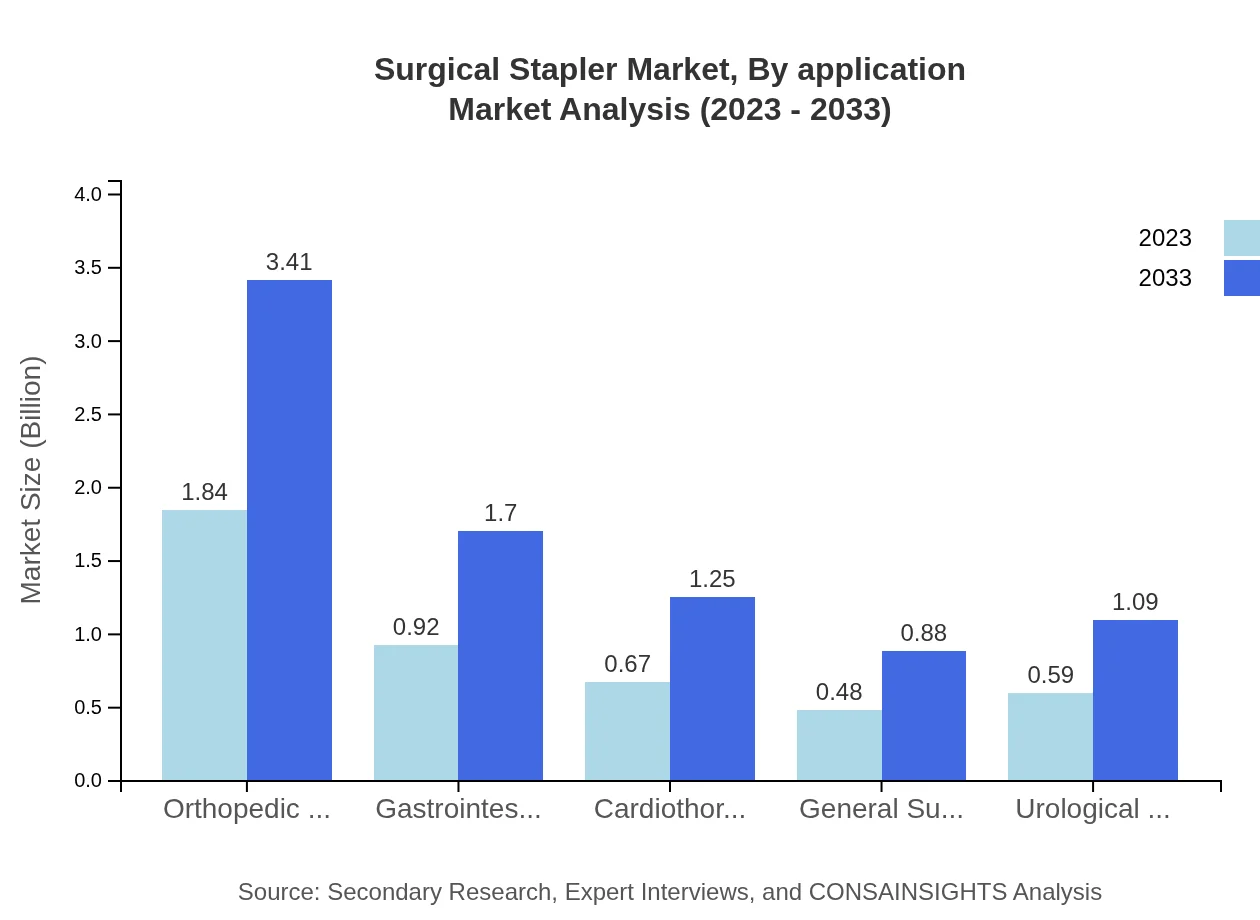

Surgical Stapler Market Analysis By Application

Applications in the market include orthopedic surgery, gastrointestinal surgery, cardiothoracic surgery, and others. Orthopedic surgery leads with a market size of $1.84 billion in 2023, projected to rise to $3.41 billion by 2033. Gastrointestinal surgery is forecasted to grow from $0.92 billion to $1.70 billion, while cardiothoracic surgery is expected to increase from $0.67 billion to $1.25 billion.

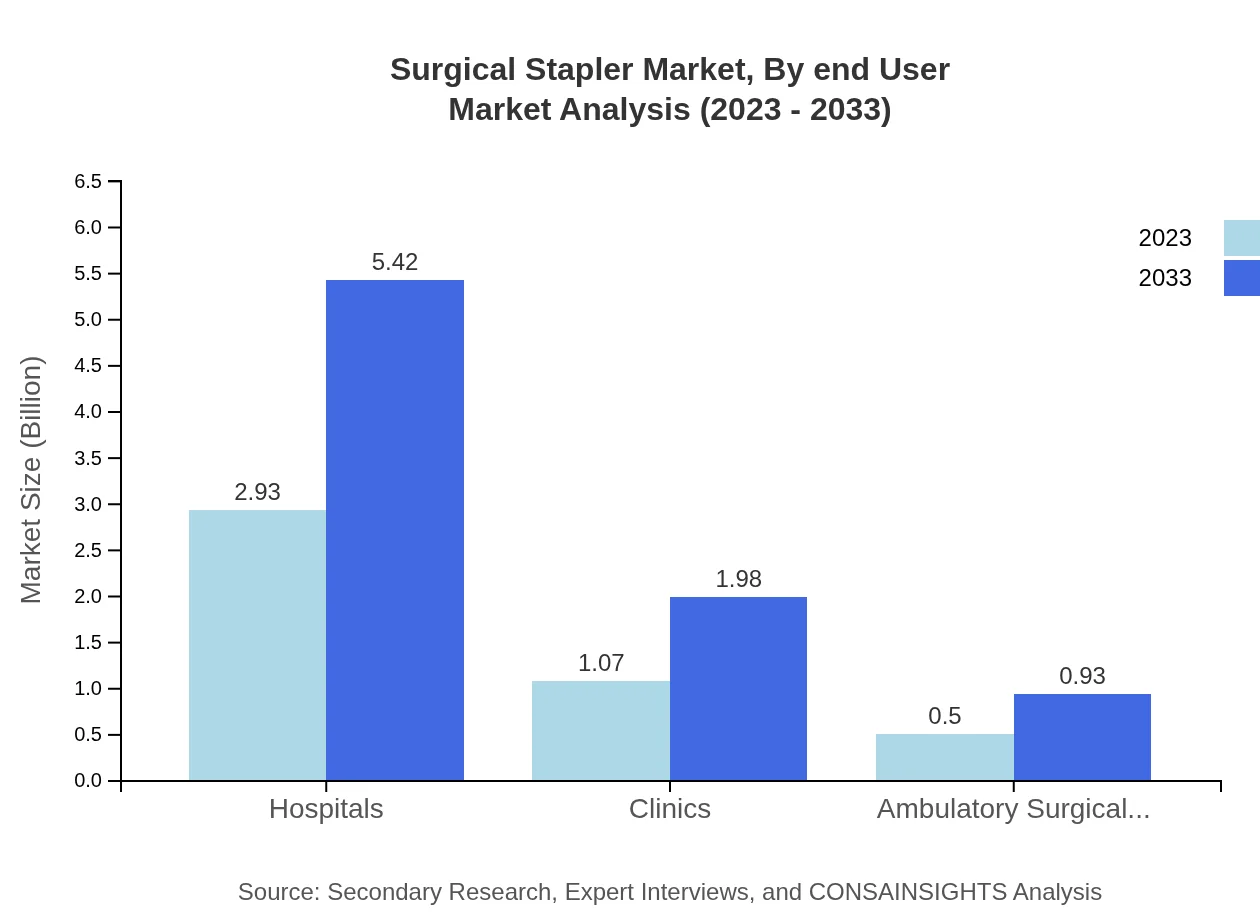

Surgical Stapler Market Analysis By End User

End-users include hospitals, clinics, and ambulatory surgical centers. Hospitals dominate this segment with a value of $2.93 billion in 2023, rising to $5.42 billion by 2033. Clinics and ambulatory surgical centers accounted for $1.07 billion and $0.50 billion respectively in 2023, growing to $1.98 billion and $0.93 billion by 2033.

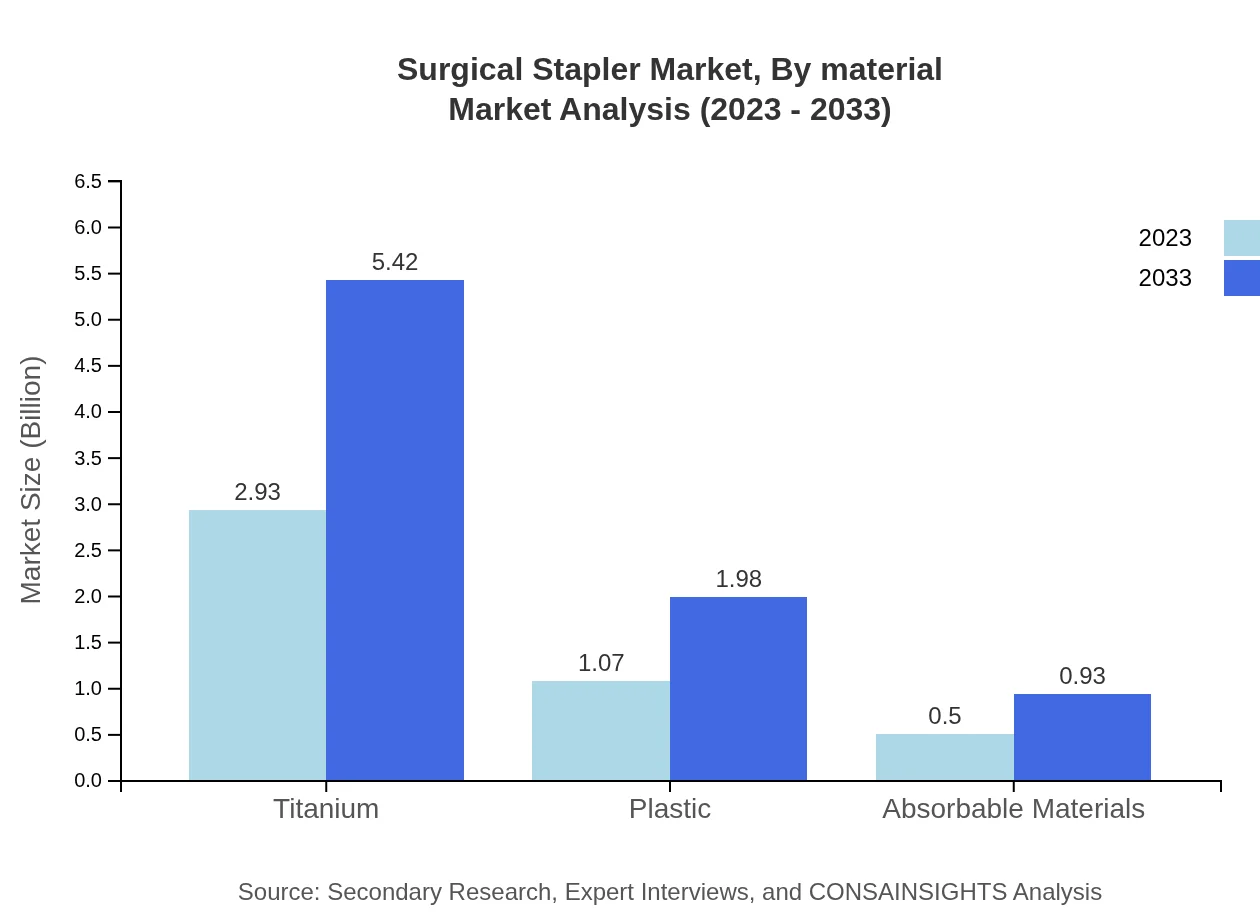

Surgical Stapler Market Analysis By Material

Materials used in surgical staplers include titanium, plastic, and absorbable materials. Titanium constituted a significant market size of $2.93 billion in 2023, expected to grow to $5.42 billion. Plastic accounted for $1.07 billion, projected at $1.98 billion, while absorbable materials reported a market value of $0.50 billion, with an estimated size of $0.93 billion by 2033.

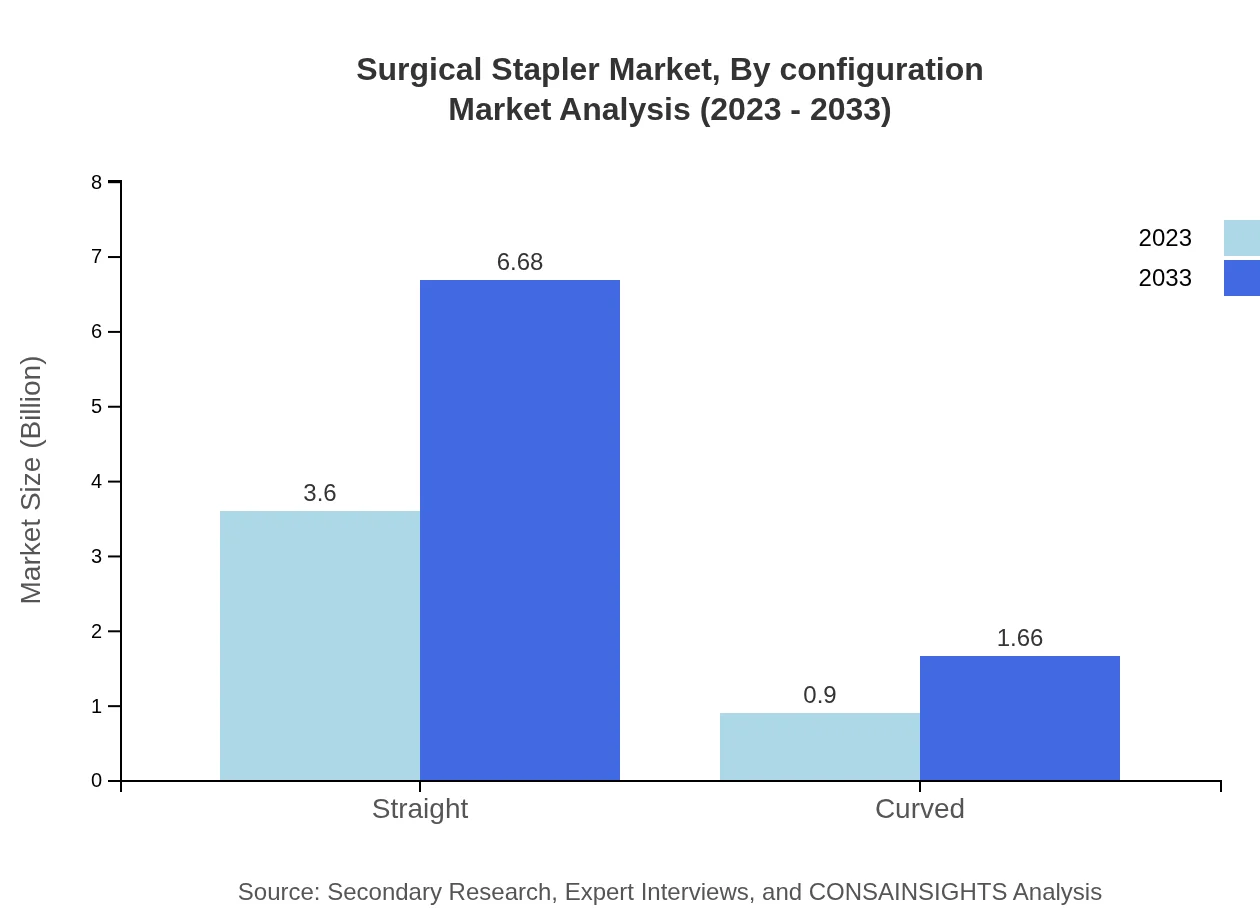

Surgical Stapler Market Analysis By Configuration

In terms of configuration, straight and curved surgical staplers are most prevalent. Straight staplers dominated with a market size of $3.60 billion in 2023, growing to $6.68 billion. Curved staplers held a value of $0.90 billion, projected to rise to $1.66 billion by 2033.

Surgical Stapler Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in the Surgical Stapler Industry

Johnson & Johnson:

A global leader in medical devices, Johnson & Johnson is known for its innovative surgical solutions and extensive range of surgical staplers.Medtronic :

Medtronic specializes in developing a comprehensive suite of surgical staplers used in various surgical procedures with an emphasis on minimally invasive techniques.Surgical Innovations:

Focused on advancing surgical techniques, Surgical Innovations provides innovative and effective surgical staplers to enhance patient outcomes.B. Braun:

B. Braun is renowned for its commitment to improving surgical outcomes through safe and effective surgical staplers designed for various medical fields.Ethicon:

As part of Johnson & Johnson, Ethicon offers a wide spectrum of surgical staplers, emphasizing quality, reliability, and safety.We're grateful to work with incredible clients.

FAQs

What is the market size of surgical Stapler?

The global surgical stapler market is projected to reach $4.5 billion by the year 2033, growing at a CAGR of 6.2% from 2023. This growth indicates a robust demand for surgical staplers across various medical facilities.

What are the key market players or companies in this surgical Stapler industry?

Key players in the surgical stapler market include Medtronic, Johnson & Johnson, Ethicon, Covidien, and 3M. These companies are known for their innovative products and hold significant market share, contributing to advancements in surgical technologies.

What are the primary factors driving the growth in the surgical stapler industry?

Factors such as increasing surgical procedures globally, technological advancements in stapling devices, and a surge in minimally invasive surgeries are driving the growth of the surgical stapler market, enhancing patient outcomes and operational efficiency.

Which region is the fastest Growing in the surgical stapler market?

The Asia Pacific region is the fastest-growing in the surgical stapler market, with a projected market size increase from $0.85 billion in 2023 to $1.58 billion by 2033, reflecting a robust CAGR and rising healthcare investments.

Does ConsaInsights provide customized market report data for the surgical Stapler industry?

Yes, ConsaInsights offers customized market report data tailored to client needs, providing in-depth analysis, specific market segments, and unique insights suited to individual business objectives and goals regarding the surgical-stapler market.

What deliverables can I expect from this surgical Stapler market research project?

From the surgical-stapler market research project, you can expect detailed reports including market size analysis, growth forecasts, segment data, competitive landscape, and trend identifications which support informed decision-making.

What are the market trends of surgical Stapler?

Current trends in the surgical stapler market include the increasing adoption of powered staplers, advancements in biocompatible materials, and a focus on developing staplers for specific surgical applications, enhancing safety and efficacy in procedures.