Surgical Sutures Market Report

Published Date: 31 January 2026 | Report Code: surgical-sutures

Surgical Sutures Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the Surgical Sutures market, analyzing trends, forecasts, and data for the period from 2023 to 2033. It includes market size, segmentation, regional analysis, and profiles of key industry players.

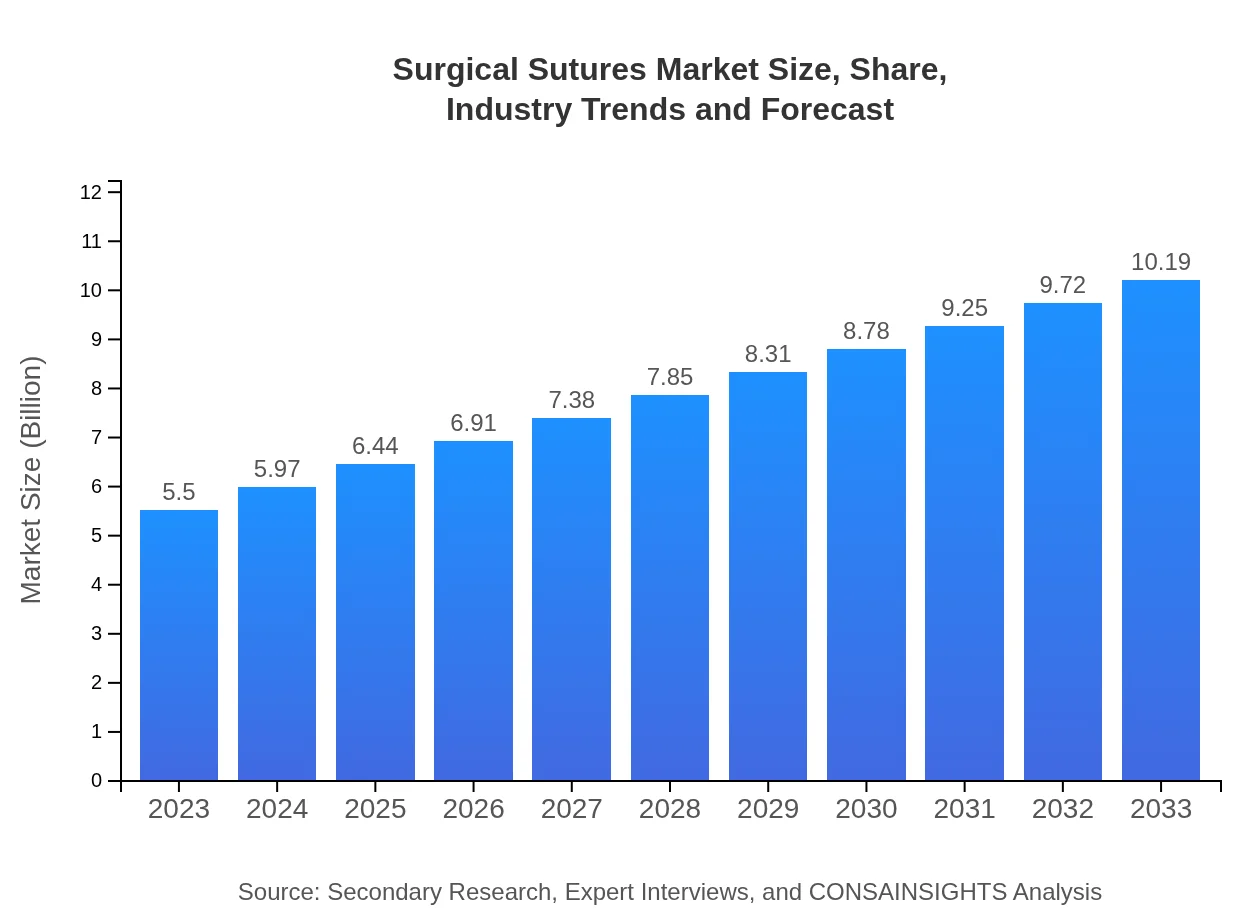

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $10.19 Billion |

| Top Companies | Ethicon, Inc., Medtronic plc, B. Braun Melsungen AG, Surgicraft |

| Last Modified Date | 31 January 2026 |

Surgical Sutures Market Overview

Customize Surgical Sutures Market Report market research report

- ✔ Get in-depth analysis of Surgical Sutures market size, growth, and forecasts.

- ✔ Understand Surgical Sutures's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Surgical Sutures

What is the Market Size & CAGR of the Surgical Sutures market in 2023 and 2033?

Surgical Sutures Industry Analysis

Surgical Sutures Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Surgical Sutures Market Analysis Report by Region

Europe Surgical Sutures Market Report:

The European Surgical Sutures market is anticipated to increase from $1.48 billion in 2023 to $2.74 billion in 2033. Technological advancements and stringent regulatory standards are driving product innovations, although market growth may be moderated by reimbursement challenges in certain regions.Asia Pacific Surgical Sutures Market Report:

The Asia Pacific region is a rapidly growing market, expected to rise from $1.12 billion in 2023 to $2.07 billion by 2033, fueled by increasing healthcare expenditure, a growing population, and improving surgical infrastructure. Countries like India and China are seeing a surge in surgical procedures, driving demand for innovative suture solutions.North America Surgical Sutures Market Report:

North America remains the largest market for Surgical Sutures, estimated at $2.00 billion in 2023, with growth to $3.70 billion by 2033. The presence of major market players, high healthcare spending, and advanced healthcare infrastructure contribute to this dominance.South America Surgical Sutures Market Report:

In South America, the market for Surgical Sutures is projected to grow from $0.45 billion in 2023 to $0.83 billion in 2033. Increased awareness of surgical safety and advancements in medical technology are significant growth factors, particularly in Brazil and Argentina.Middle East & Africa Surgical Sutures Market Report:

The Middle East and Africa market for Surgical Sutures is expected to grow from $0.46 billion in 2023 to $0.85 billion by 2033. Growth is supported by rising surgical operations and improving access to healthcare facilities across various regions.Tell us your focus area and get a customized research report.

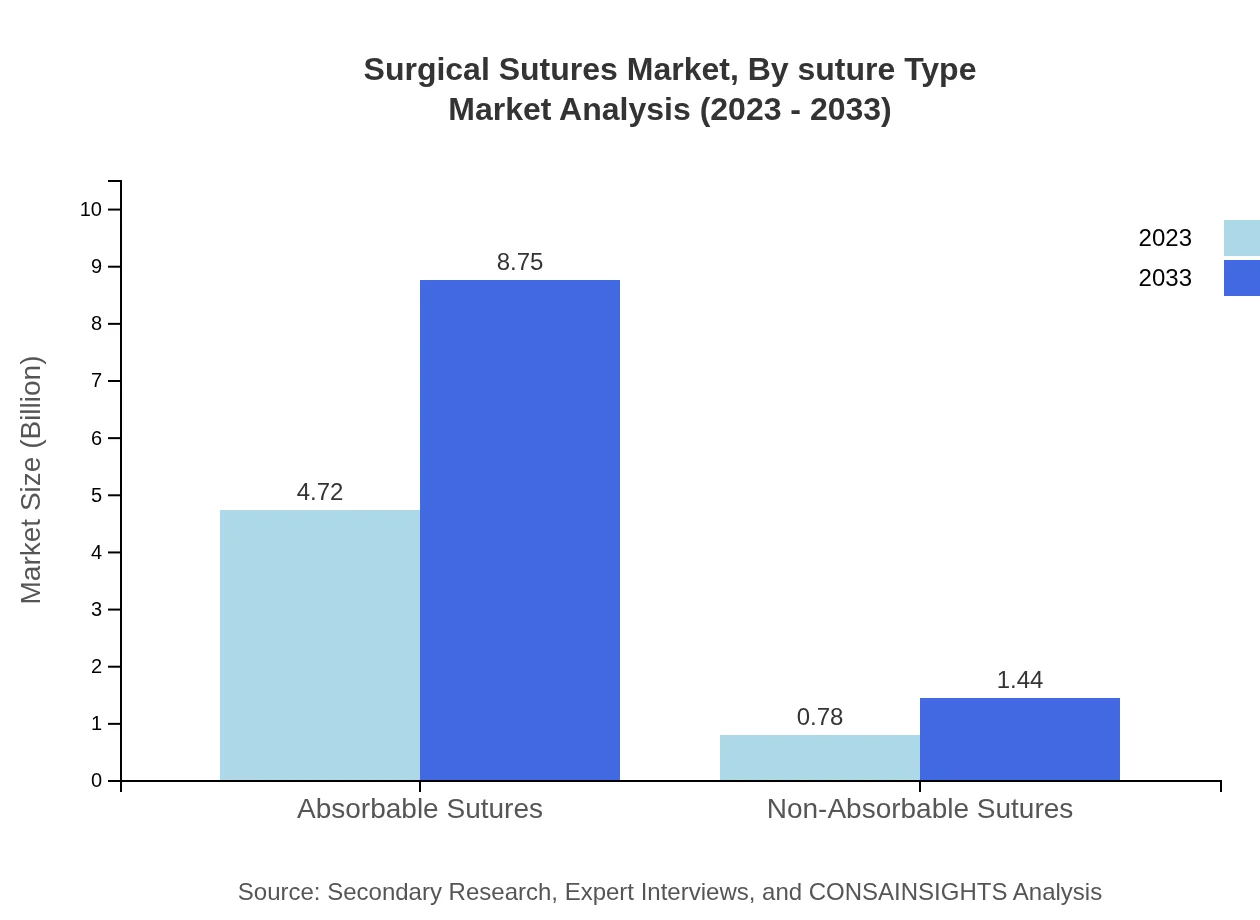

Surgical Sutures Market Analysis By Suture Type

The Surgical Sutures market, segmented by material type, shows that absorbable sutures account for a significant share, projected to exhibit a market size increase from $4.72 billion in 2023 to $8.75 billion by 2033, holding 85.83% market share. Non-absorbable sutures, while smaller, also show growth from $0.78 billion to $1.44 billion, with a market share of 14.17%.

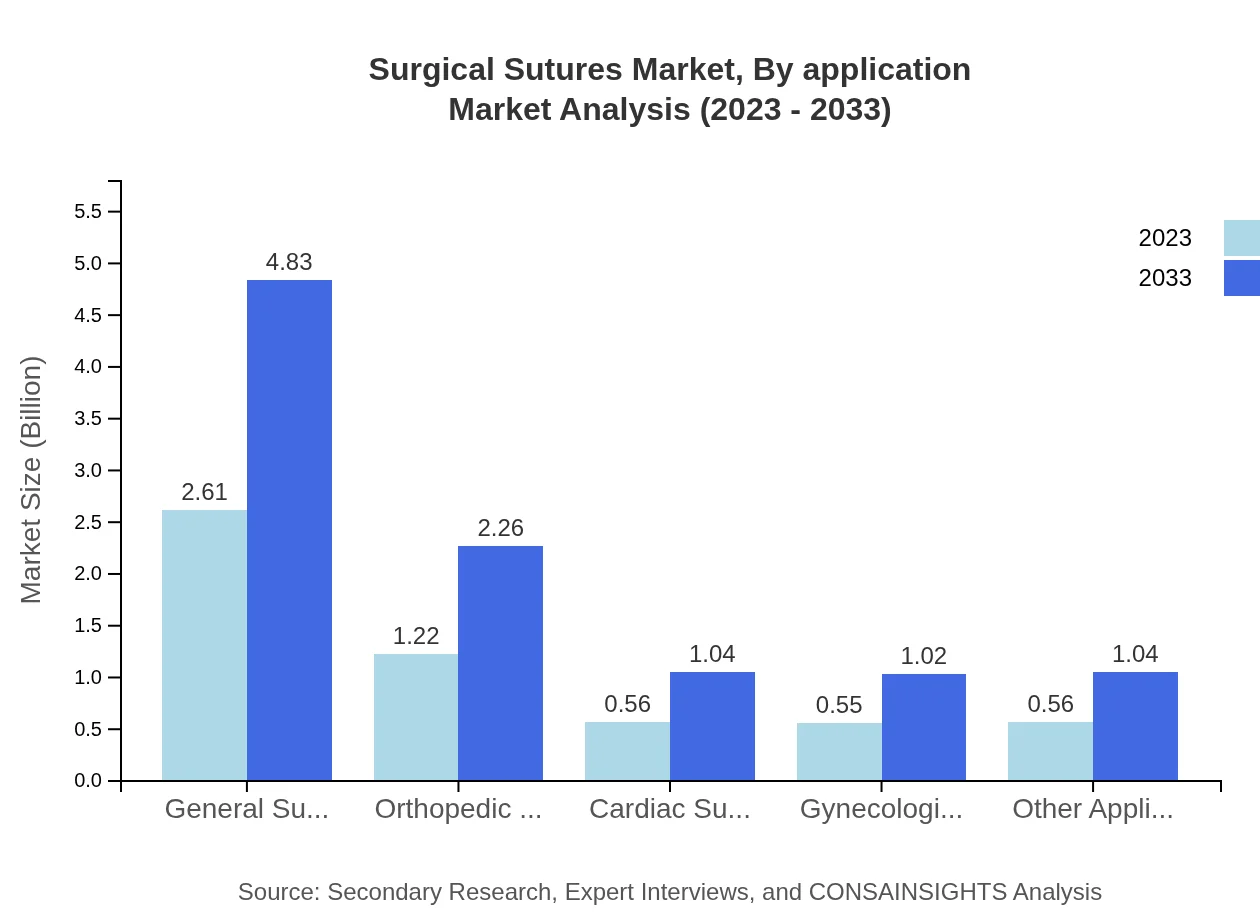

Surgical Sutures Market Analysis By Application

General surgery remains the largest application sector, expected to grow from $2.61 billion in 2023 to $4.83 billion by 2033, capturing 47.38% of the market. Other applications like orthopedic and cardiac surgeries also show robust growth, highlighting the increasing complexity and volume of surgical interventions.

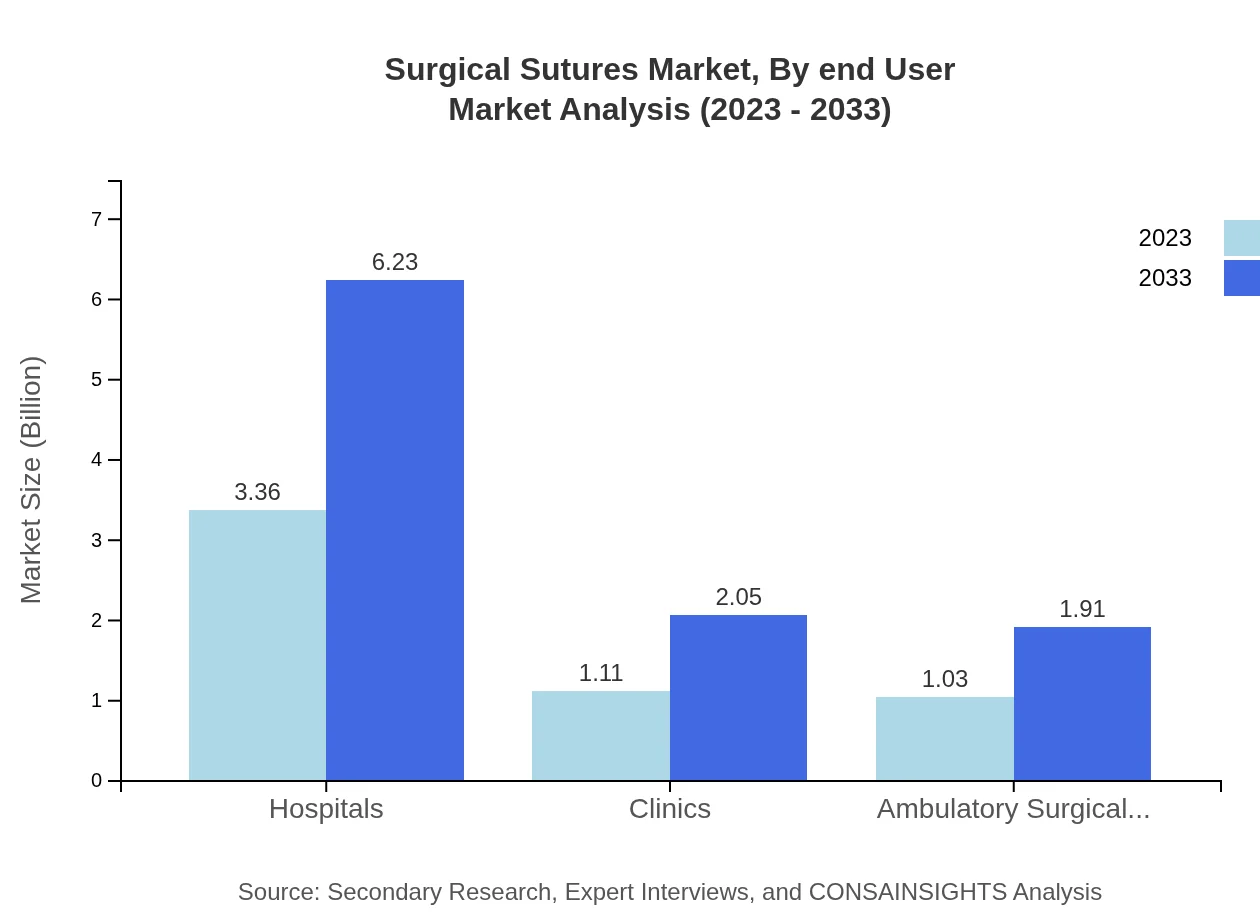

Surgical Sutures Market Analysis By End User

Hospitals are the leading end-users of surgical sutures, significantly increasing from $3.36 billion in 2023 to $6.23 billion by 2033 with a market share of 61.09%. Ambulatory surgical centers and clinics also play a crucial role, capturing essential segments due to their rising popularity in outpatient surgeries.

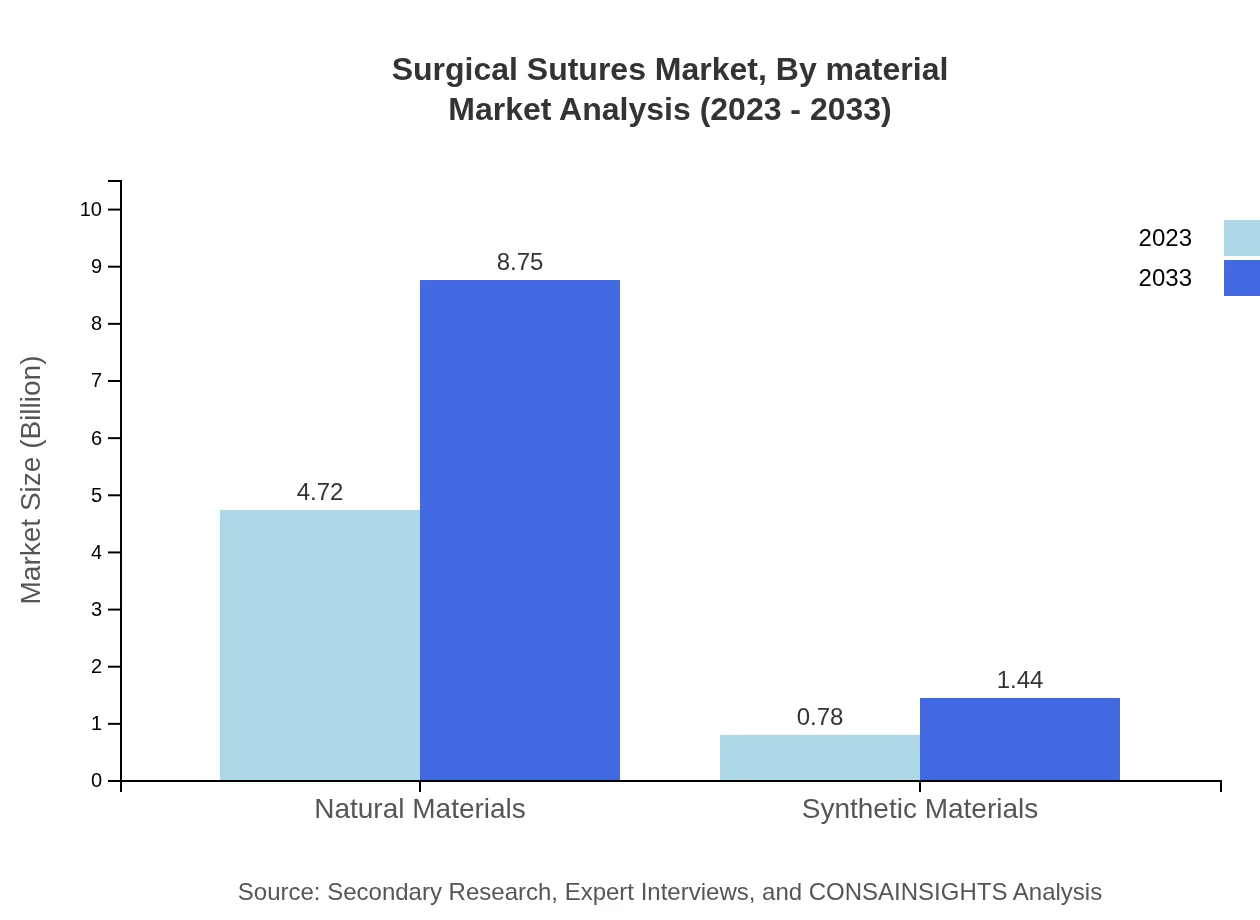

Surgical Sutures Market Analysis By Material

In terms of materials, natural materials dominate with a size projected to rise from $4.72 billion in 2023 to $8.75 billion in 2033. Synthetic materials, although smaller, are witnessing growth and are expected to expand from $0.78 billion to $1.44 billion, indicating a diversification in material usage and preferences.

Surgical Sutures Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in the Surgical Sutures Industry

Ethicon, Inc.:

A subsidiary of Johnson & Johnson, Ethicon is a leading manufacturer specializing in surgical sutures for a wide range of surgical procedures, known for their innovative and high-quality products.Medtronic plc:

Medtronic offers a comprehensive array of surgical sutures along with an advanced technology platform that enhances surgical outcomes and patient care.B. Braun Melsungen AG:

Providing a broad spectrum of surgical sutures, B. Braun is focused on innovative healthcare solutions, ensuring high quality and safety standards.Surgicraft:

Surgicraft specializes in the production of surgical sutures and other medical products, emphasizing sterile and reliable solutions for surgical practices.We're grateful to work with incredible clients.

FAQs

What is the market size of surgical Sutures?

The global surgical sutures market was valued at $5.5 billion in 2023, with a projected CAGR of 6.2% anticipated through 2033, highlighting strong growth potential within this industry.

What are the key market players or companies in the surgical sutures industry?

Key players in the surgical sutures market include industry leaders like Johnson & Johnson, Medtronic, and Ethicon. These companies dominate the segment with a wide array of product offerings and innovations, contributing to overall market growth.

What are the primary factors driving the growth in the surgical sutures industry?

The growth in the surgical sutures industry is primarily driven by advancements in manufacturing technologies, increase in surgical procedures worldwide, and a growing aging population requiring surgical interventions, fostering demand for sutures.

Which region is the fastest Growing in the surgical sutures market?

The Asia-Pacific region is the fastest-growing market for surgical sutures, expanding from $1.12 billion in 2023 to $2.07 billion by 2033, fueled by rising healthcare infrastructure and increasing surgical demand.

Does ConsaInsights provide customized market report data for the surgical sutures industry?

Yes, ConsaInsights offers customized market report data tailored to the surgical sutures industry, providing insights that align with specific client needs for strategic decision-making.

What deliverables can I expect from this surgical sutures market research project?

Expect comprehensive deliverables including detailed market analysis, competitive landscape overview, segment analysis, regional insights, and actionable strategic recommendations tailored to the surgical sutures industry.

What are the market trends of surgical sutures?

Current trends in the surgical sutures market include a shift towards absorbable sutures, technological advancements in materials, increasing preference for minimally invasive procedures, and greater investments in healthcare globally.