Surgical Visualization Systems Market Report

Published Date: 31 January 2026 | Report Code: surgical-visualization-systems

Surgical Visualization Systems Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Surgical Visualization Systems market, covering trends, opportunities, market size, and forecasts from 2023 to 2033. Insights include market segmentation by technology and application areas, alongside regional performance and key players in the industry.

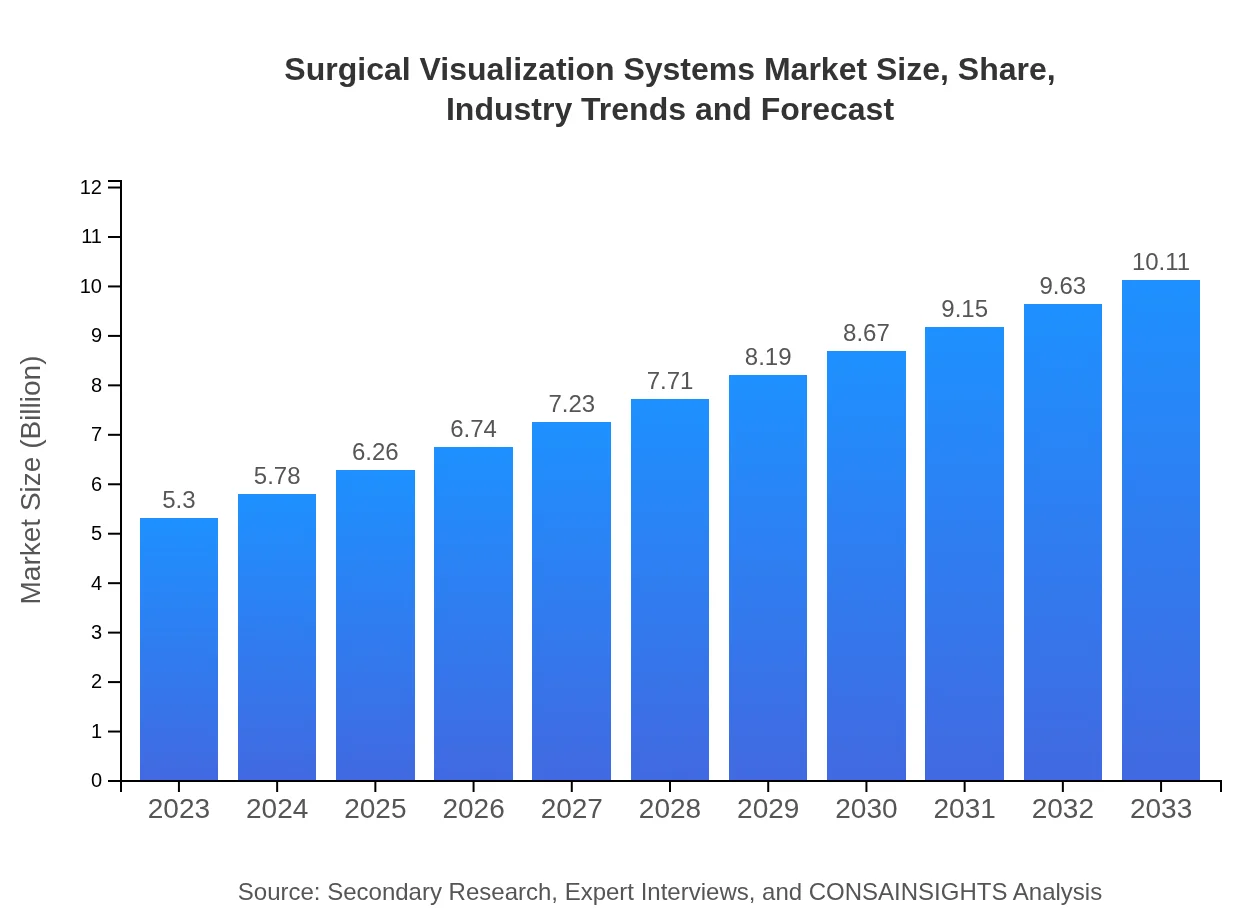

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.30 Billion |

| CAGR (2023-2033) | 6.5% |

| 2033 Market Size | $10.11 Billion |

| Top Companies | Stryker Corporation, Olympus Corporation, Medtronic , Karl Storz, GE Healthcare |

| Last Modified Date | 31 January 2026 |

Surgical Visualization Systems Market Overview

Customize Surgical Visualization Systems Market Report market research report

- ✔ Get in-depth analysis of Surgical Visualization Systems market size, growth, and forecasts.

- ✔ Understand Surgical Visualization Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Surgical Visualization Systems

What is the Market Size & CAGR of Surgical Visualization Systems market in 2023?

Surgical Visualization Systems Industry Analysis

Surgical Visualization Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Surgical Visualization Systems Market Analysis Report by Region

Europe Surgical Visualization Systems Market Report:

In Europe, the market size is anticipated to grow from USD 1.67 billion in 2023 to USD 3.18 billion by 2033. The focus on surgical safety and minimally invasive procedures, as well as robust healthcare systems, contribute to the demand for advanced visualization technologies amongst European countries. Regulations supporting healthcare innovations further bolster market growth.Asia Pacific Surgical Visualization Systems Market Report:

The Asia Pacific region is characterized by a growing healthcare infrastructure and improving access to technological solutions in surgical visualization. The market is expected to grow from USD 1.02 billion in 2023 to USD 1.94 billion in 2033, reflecting the increasing demand for high-quality surgical systems in countries like China and India. The rise in surgical procedures and enhancements in surgical safety are significant factors influencing this market growth.North America Surgical Visualization Systems Market Report:

North America represents a significant share of the global Surgical Visualization Systems market, expected to grow from USD 1.76 billion in 2023 to USD 3.35 billion by 2033. The high adoption of advanced surgical technologies, coupled with extensive research and development in the area of surgical devices, leads to an increased demand for visualization systems.South America Surgical Visualization Systems Market Report:

The South American market for Surgical Visualization Systems is projected to increase from USD 0.52 billion in 2023 to USD 1.00 billion by 2033. Growth is fueled by improving healthcare facilities and the increasing focus on quality surgical outcomes. Coupled with rising investments in the healthcare sector, the demand for advanced visualization systems is on the rise.Middle East & Africa Surgical Visualization Systems Market Report:

The Middle East and Africa market for Surgical Visualization Systems is expected to grow from USD 0.33 billion in 2023 to USD 0.64 billion by 2033. A mix of improving healthcare infrastructure, a rising number of surgical procedures, and government initiatives toward enhancing the quality of surgical practices are driving this growth.Tell us your focus area and get a customized research report.

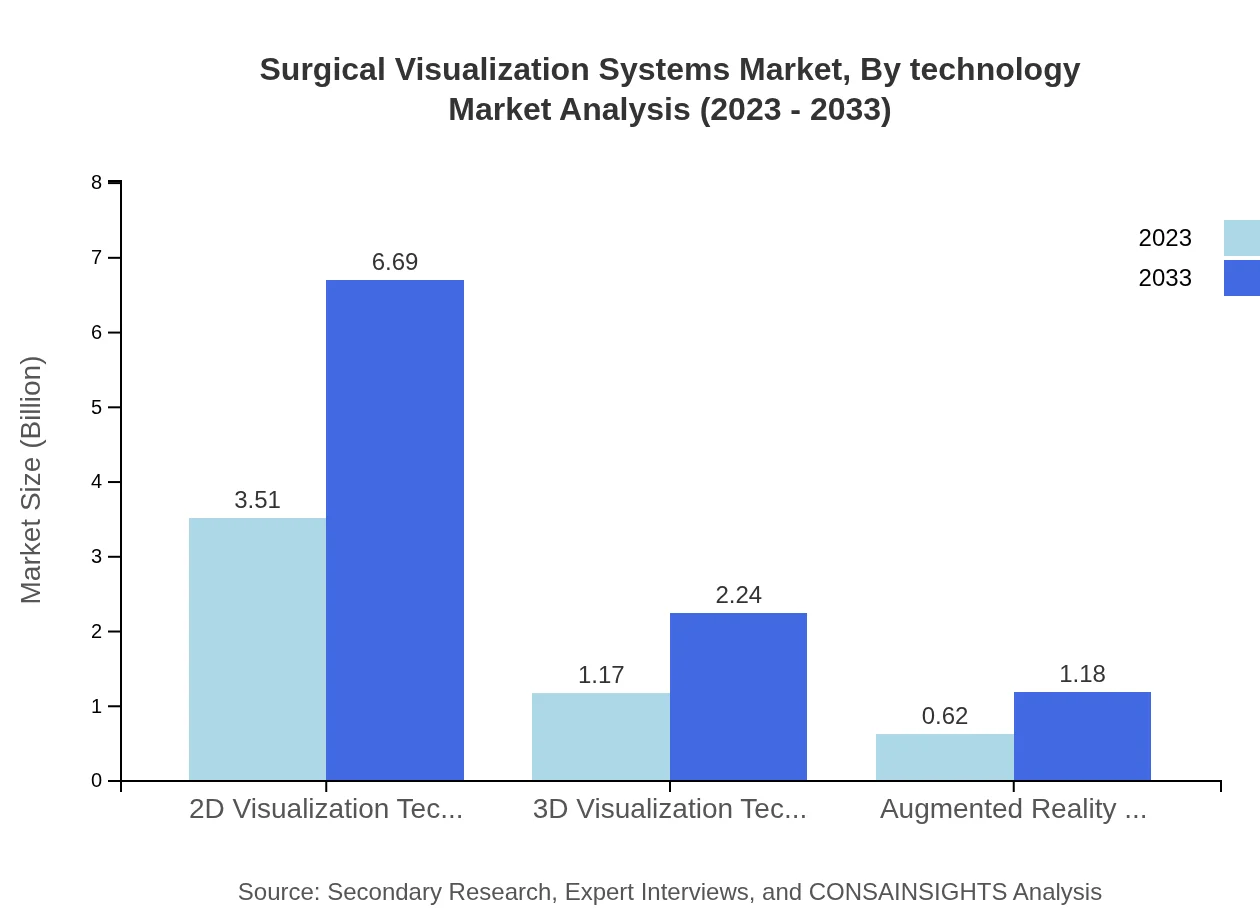

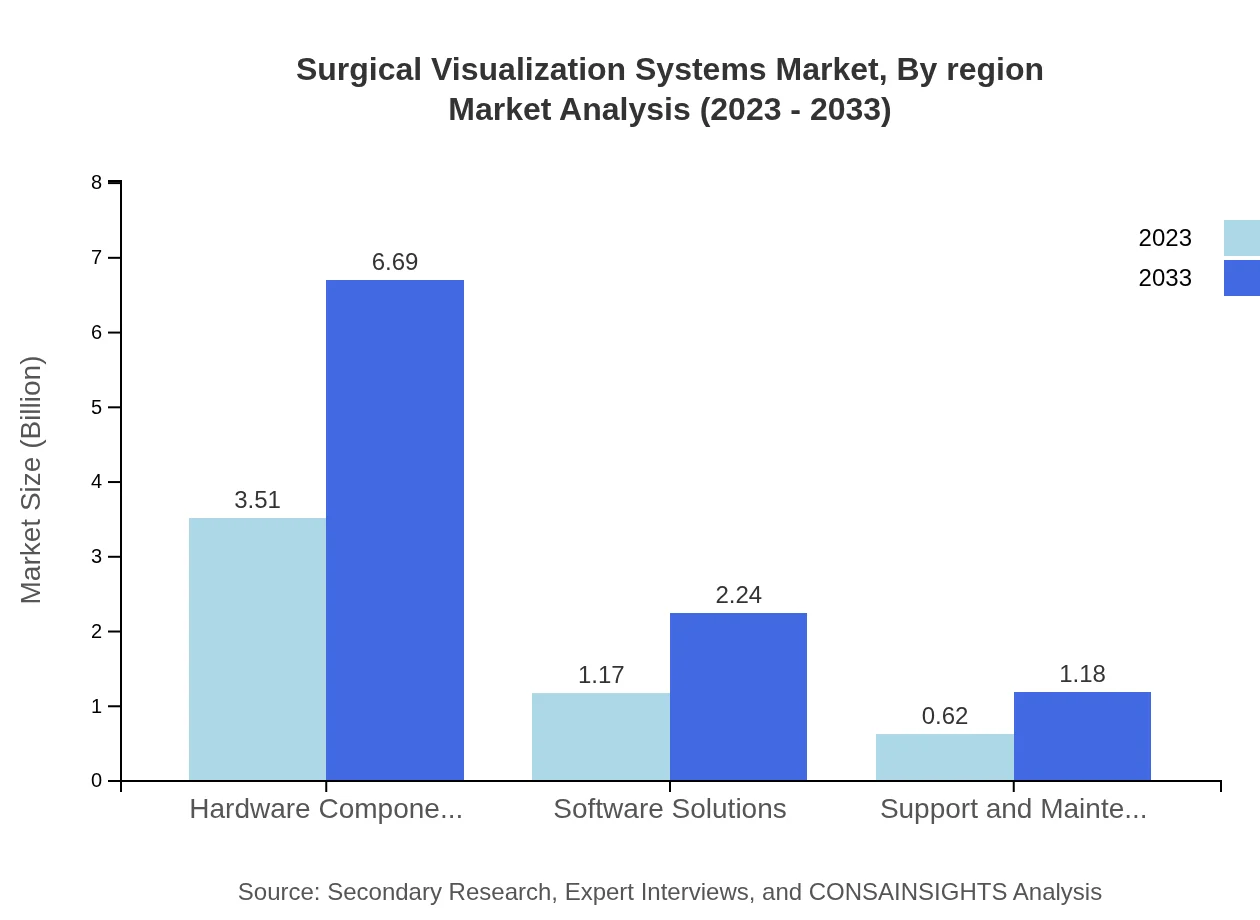

Surgical Visualization Systems Market Analysis By Technology

The technological segmentation includes hardware components such as imaging devices, visualization systems, and software solutions. As of 2023, hardware components dominate the market with a size of USD 3.51 billion, accounting for approximately 66.16% of the total market share. Software solutions hold a market size of USD 1.17 billion, while support and maintenance services are valued at USD 0.62 billion. By 2033, hardware systems are projected to reach USD 6.69 billion, software solutions USD 2.24 billion, and support services USD 1.18 billion.

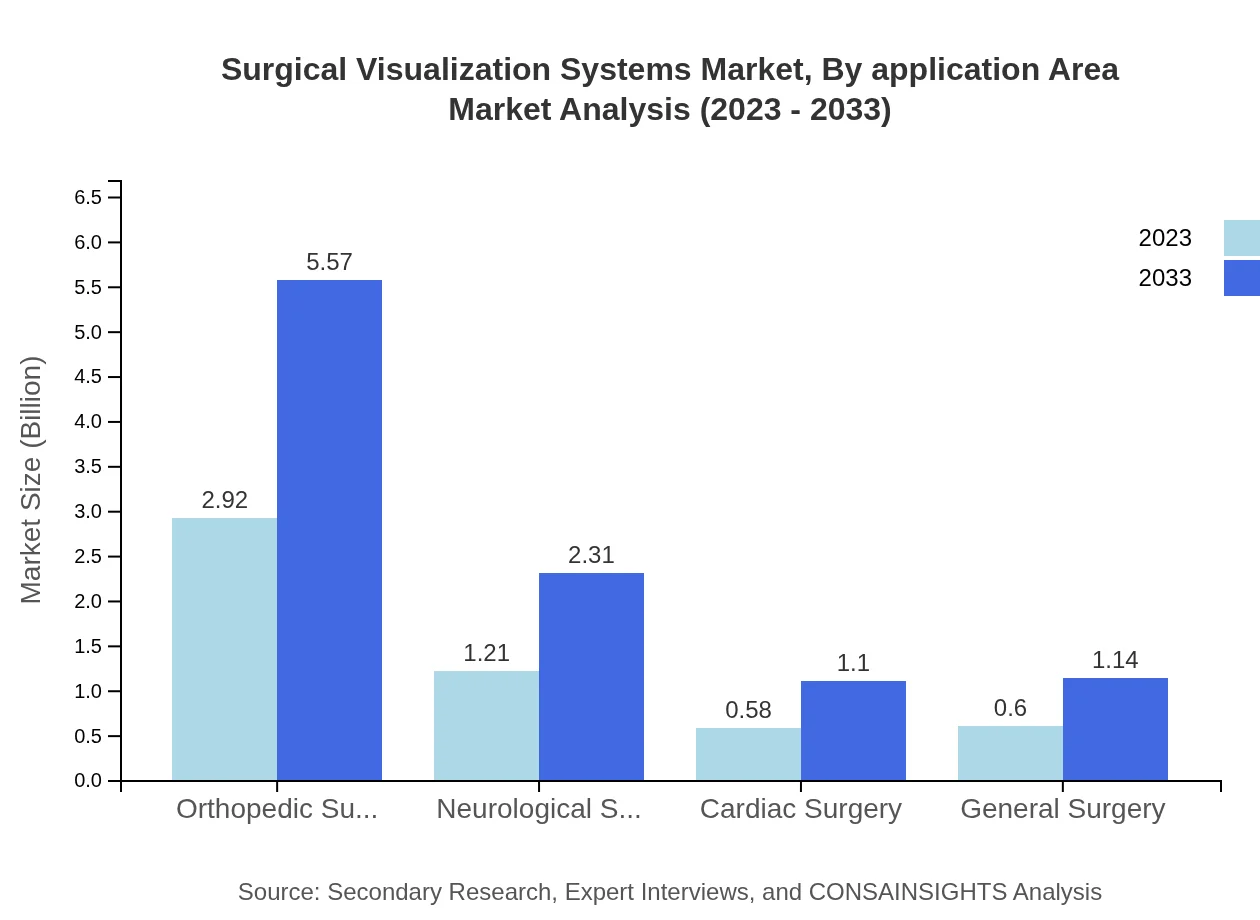

Surgical Visualization Systems Market Analysis By Application Area

Application segments for Surgical Visualization Systems include orthopedic surgery, neurological surgery, cardiac surgery, and general surgery. Orthopedic surgery is the leading segment, with a market size of USD 2.92 billion in 2023, holding 55.09% of the market share. Neurological surgery accounts for USD 1.21 billion (22.81% share), while cardiac surgery and general surgery comprise USD 0.58 billion (10.86% share) and USD 0.60 billion (11.24% share), respectively. By 2033, orthopedic surgery is expected to grow to USD 5.57 billion, neurological to USD 2.31 billion, cardiac to USD 1.10 billion, and general surgery to USD 1.14 billion.

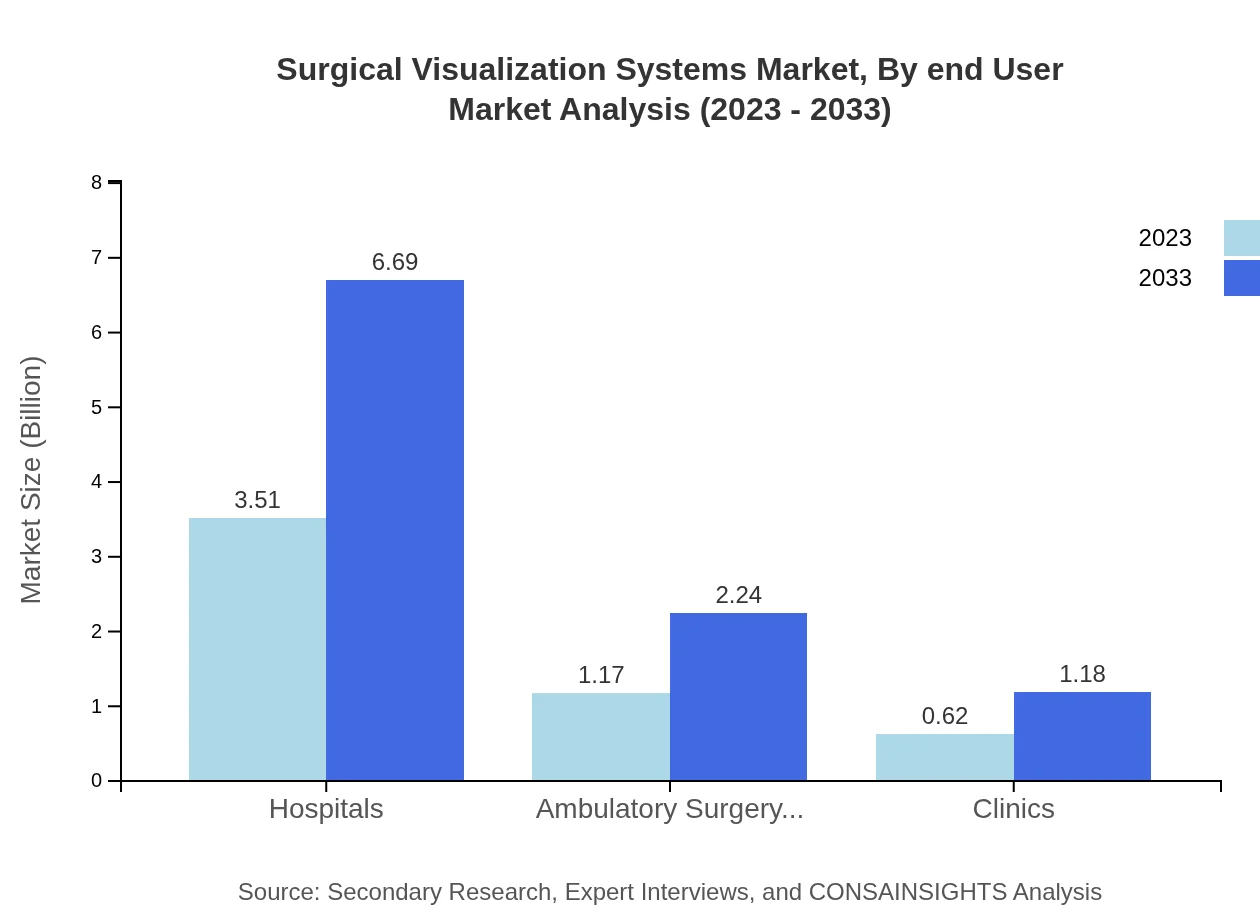

Surgical Visualization Systems Market Analysis By End User

End-user segmentation includes hospitals, ambulatory surgery centers, and clinics. Hospitals dominate with a market size of USD 3.51 billion, equating to 66.16% of the total market share in 2023, while ambulatory surgery centers and clinics hold market sizes of USD 1.17 billion (22.13% share) and USD 0.62 billion (11.71% share) respectively. Forecasts indicate that by 2033, these figures will rise to USD 6.69 billion for hospitals, USD 2.24 billion for ambulatory centers, and USD 1.18 billion for clinics.

Surgical Visualization Systems Market Analysis By Region

Regional analysis highlights varying market dynamics, with hardware components as the main driver across all regions. North America leads in terms of market share, especially in advanced surgical technologies. Europe shows a strong inclination towards safety-focused surgical systems, while growth in Asia Pacific is fueled by enhancements in healthcare infrastructure. South America is catching up with its demand for better surgical outcomes, while the Middle East and Africa are witnessing gradual increases in healthcare investments that support the adoption of surgical visualization technology.

Surgical Visualization Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Surgical Visualization Systems Industry

Stryker Corporation:

Stryker is a leader in innovative medical technologies, including surgical visualization, with a focus on improving procedural outcomes through advanced imaging and visualization systems.Olympus Corporation:

Olympus specializes in developing high-quality visualization and imaging technologies for minimally invasive surgeries and endoscopic procedures.Medtronic :

Medtronic provides comprehensive surgical solutions, including visualization systems that enhance surgical precision and outcomes.Karl Storz:

Karl Storz is recognized for its pioneering work in endoscopy and surgical imaging, contributing significantly to the advancement of surgical visualization technologies.GE Healthcare:

GE Healthcare offers advanced imaging and visualization solutions, enhancing surgical planning and performance through innovation.We're grateful to work with incredible clients.

FAQs

What is the market size of surgical visualization systems?

The surgical visualization systems market is projected to reach $5.3 billion by 2033, growing at a CAGR of 6.5%. The market presents significant opportunities driven by technological advancements and increasing surgical procedures.

What are the key market players or companies in this surgical visualization systems industry?

Key players in the surgical visualization systems market include major medical device manufacturers, technology firms, and software developers focused on innovative solutions in visualization technologies and surgical assistance.

What are the primary factors driving the growth in the surgical visualization systems industry?

Key growth factors for the surgical visualization systems industry include an increase in surgical procedures, advancements in imaging technologies, the demand for minimally invasive surgeries, and the integration of Augmented Reality in surgical practices.

Which region is the fastest Growing in the surgical visualization systems?

Asia Pacific is the fastest-growing region in the surgical visualization systems market, with growth projected from $1.02 billion in 2023 to $1.94 billion by 2033, reflecting a growing healthcare infrastructure and rising medical expenditure.

Does ConsaInsights provide customized market report data for the surgical visualization systems industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs, including detailed analyses, forecasts, and insights relevant to clients in the surgical visualization systems sector.

What deliverables can I expect from this surgical visualization systems market research project?

From this market research project, clients can expect comprehensive reports, market size forecasts, trend analyses, competitive landscape insights, and tailored recommendations for strategic decision-making.

What are the market trends of surgical visualization systems?

Current market trends in surgical visualization systems include the increasing adoption of 3D visualization technologies, the rise of Augmented Reality applications, and the expanding use of advanced imaging techniques.