Surveillance Radar Market Report

Published Date: 03 February 2026 | Report Code: surveillance-radar

Surveillance Radar Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Surveillance Radar market, including market trends, size forecasts for 2023 to 2033, technology advancements, and regional insights, offering valuable information for industry stakeholders.

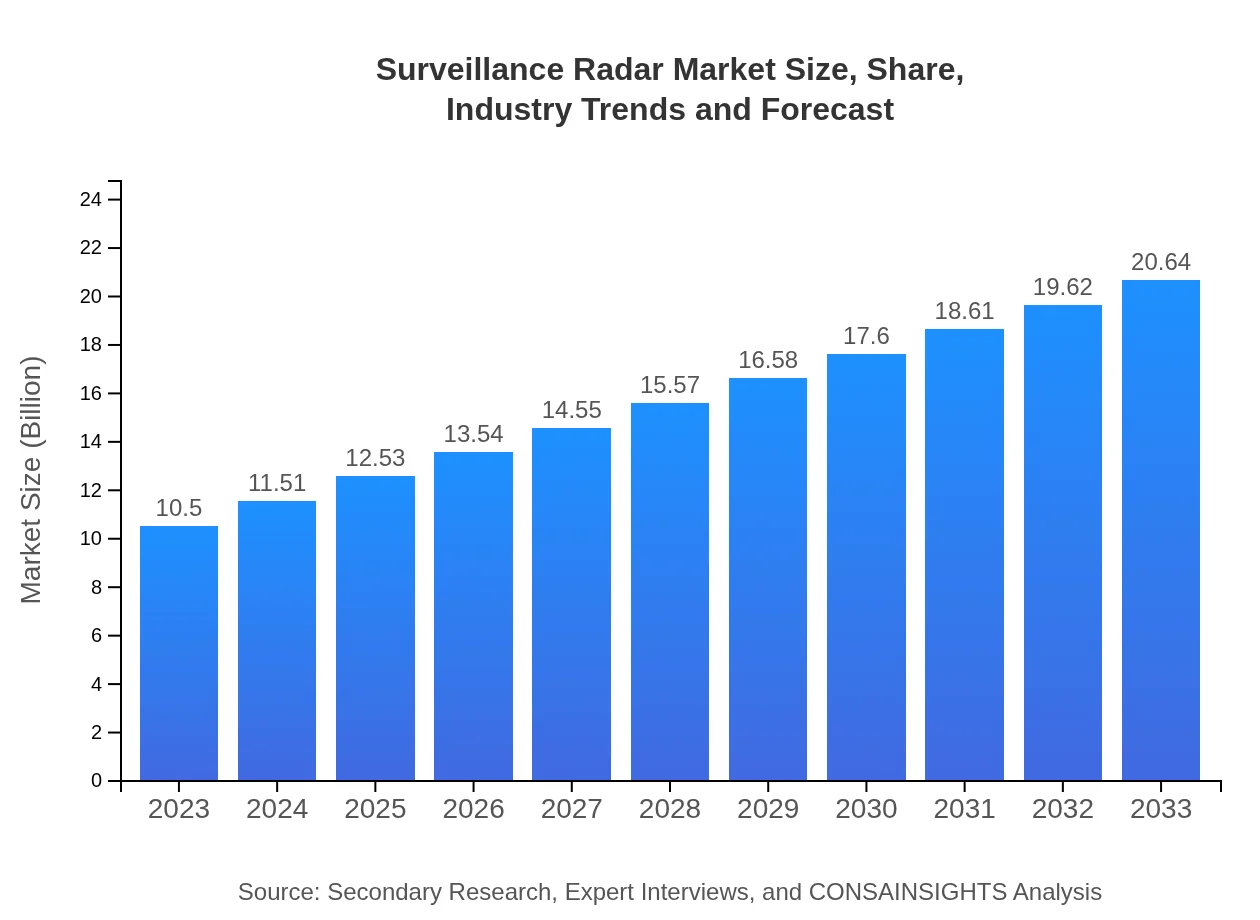

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $20.64 Billion |

| Top Companies | Raytheon Technologies Corporation, Lockheed Martin Corporation, Northrop Grumman Corporation, BAE Systems, Thales Group |

| Last Modified Date | 03 February 2026 |

Surveillance Radar Market Overview

Customize Surveillance Radar Market Report market research report

- ✔ Get in-depth analysis of Surveillance Radar market size, growth, and forecasts.

- ✔ Understand Surveillance Radar's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Surveillance Radar

What is the Market Size & CAGR of Surveillance Radar market in 2023?

Surveillance Radar Industry Analysis

Surveillance Radar Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Surveillance Radar Market Analysis Report by Region

Europe Surveillance Radar Market Report:

Europe's Surveillance Radar market is estimated to grow from $3.30 billion in 2023 to $6.48 billion in 2033, driven by geopolitical tensions and a collective effort by NATO countries to bolster defense capabilities.Asia Pacific Surveillance Radar Market Report:

In the Asia Pacific, the market is expected to grow from $2.10 billion in 2023 to $4.12 billion in 2033, driven by increased military spending and growing demand for advanced surveillance solutions in countries like India and China.North America Surveillance Radar Market Report:

North America is projected to grow from $3.53 billion in 2023 to $6.94 billion in 2033, primarily due to heightened defense budgets and ongoing modernization efforts within armed forces throughout the U.S. and Canada.South America Surveillance Radar Market Report:

The South American market is anticipated to expand from $0.57 billion in 2023 to $1.11 billion in 2033, fueled by investments in infrastructure and national security measures, despite economic challenges in some regions.Middle East & Africa Surveillance Radar Market Report:

In the Middle East and Africa, the market is expected to increase from $1.01 billion in 2023 to $1.99 billion in 2033, as regional conflicts and security threats necessitate advanced surveillance and defense systems.Tell us your focus area and get a customized research report.

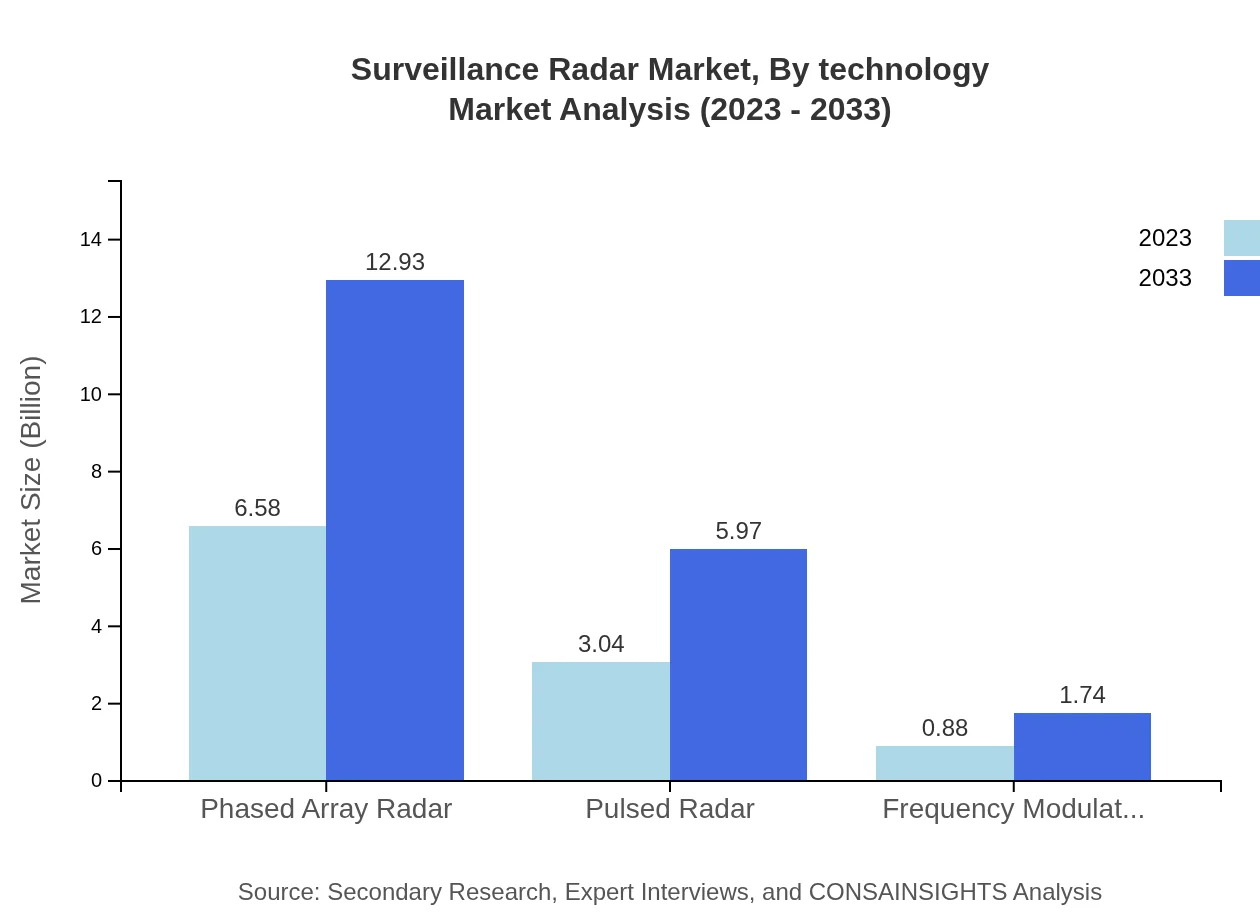

Surveillance Radar Market Analysis By Technology

Phased Array Radar dominates the market, constituting a significant share due to its adaptability and performance metrics under various conditions, while Pulsed Radar and Frequency Modulated Radar are also important segments filled with innovations catering to specific applications.

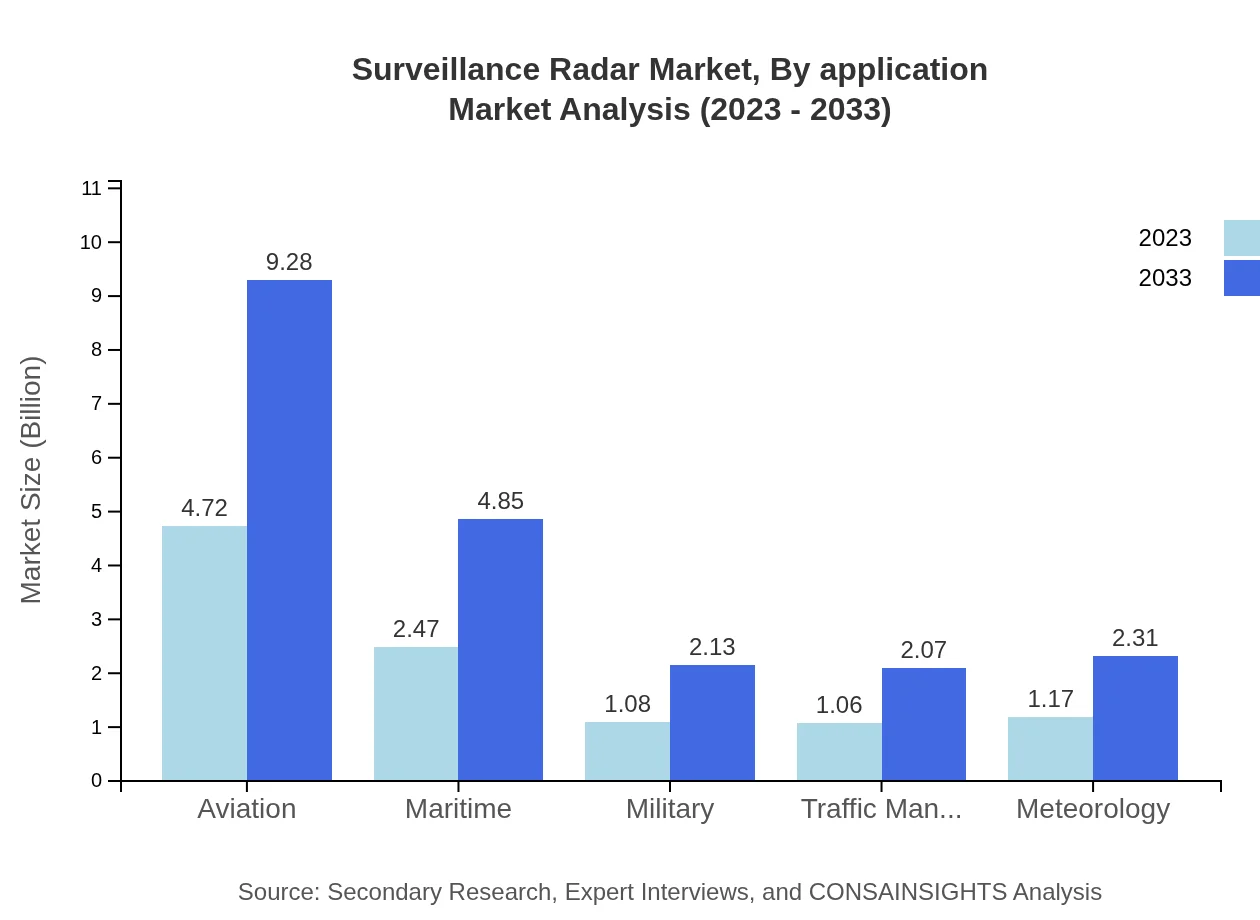

Surveillance Radar Market Analysis By Application

The Defense and Security segment accounts for a substantial portion of market revenue, followed closely by Commercial applications such as traffic management and meteorological solutions, showcasing the versatility of radar technologies across sectors.

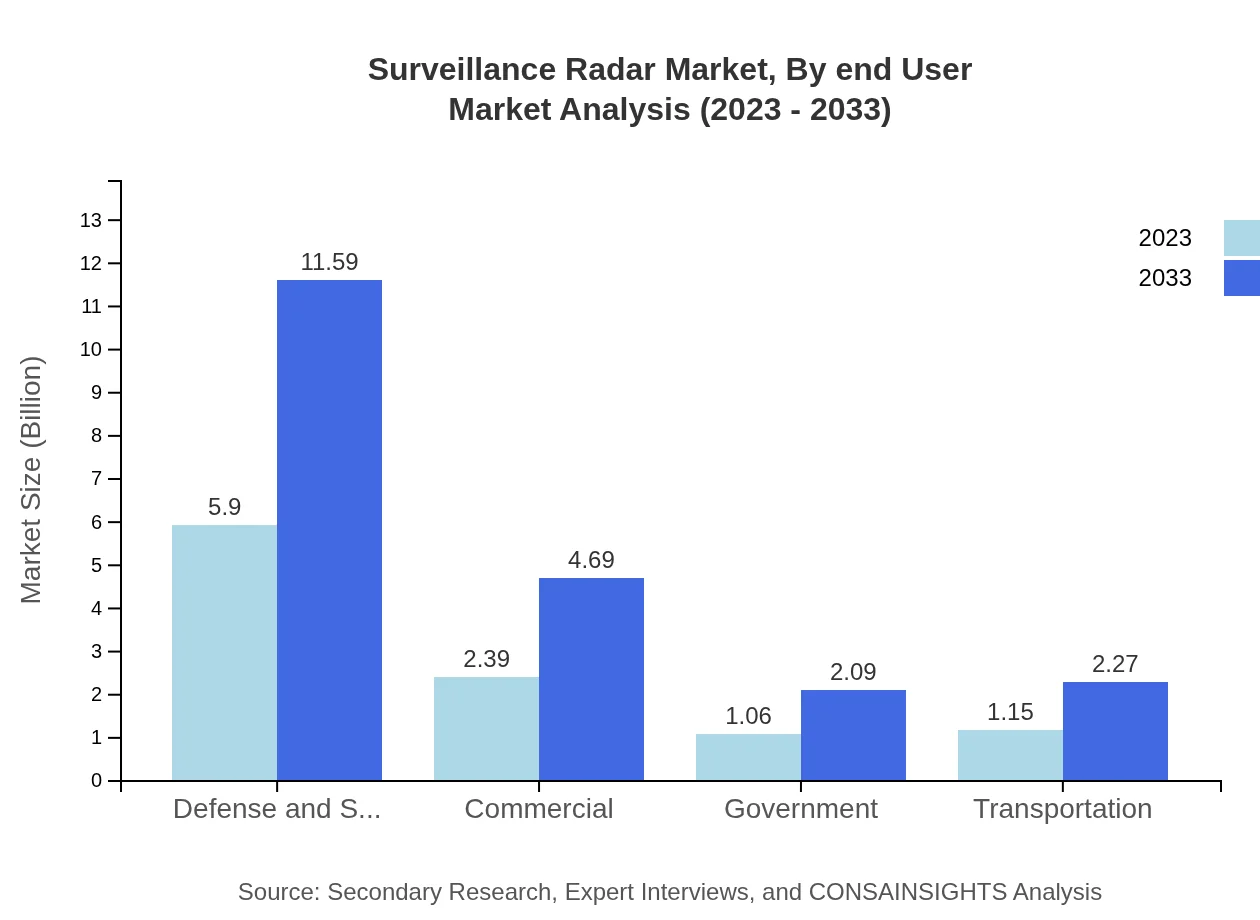

Surveillance Radar Market Analysis By End User

The Military segment leads in market share, bolstered by governmental defense budgets, while Commercial and Civil end-users are witnessing increasing investments in radar systems for safety, logistics, and infrastructure management.

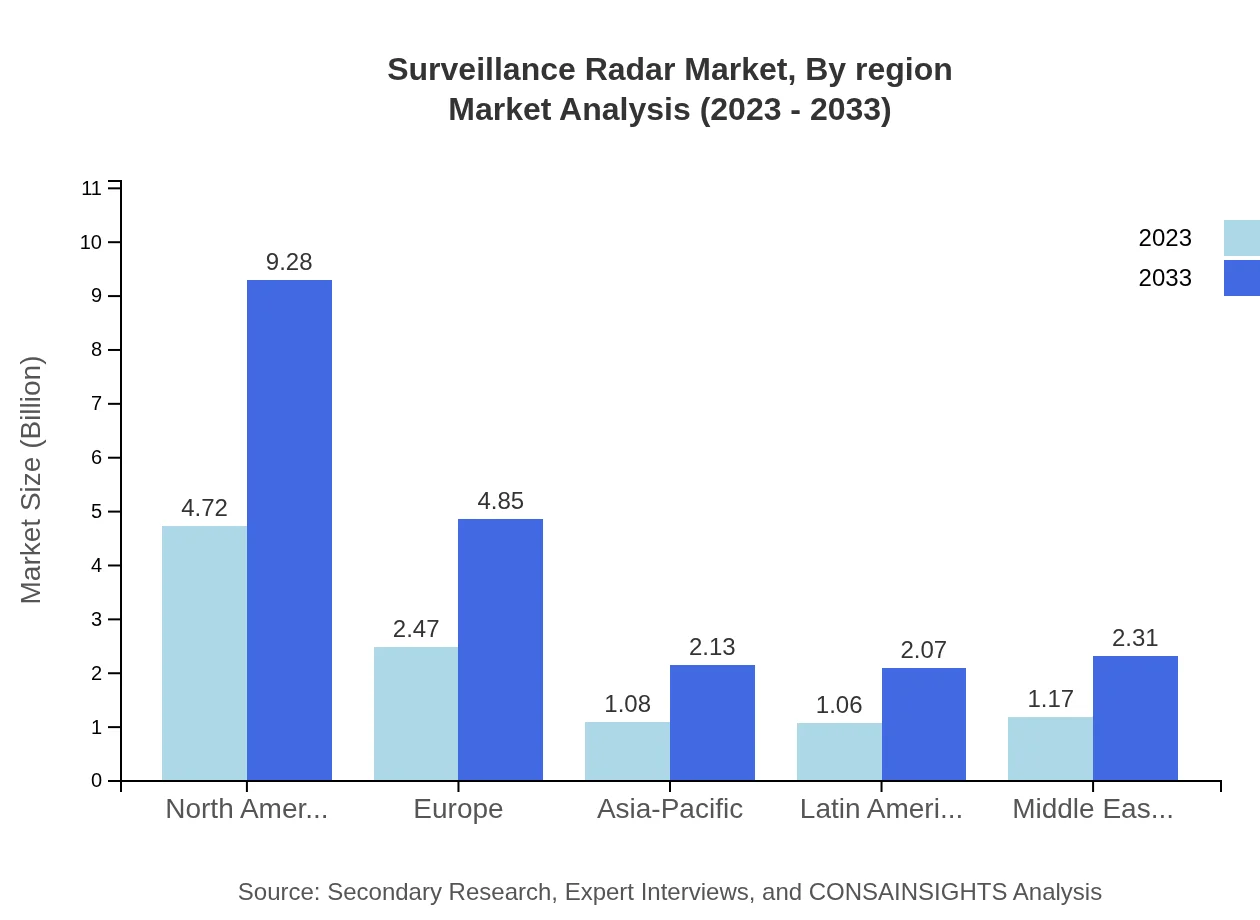

Surveillance Radar Market Analysis By Region

Regional analyses emphasize that North America and Europe lead significantly in market value, while Asia-Pacific is witnessing rapid growth due to increasing defense expenditures and technological advancements in radar applications.

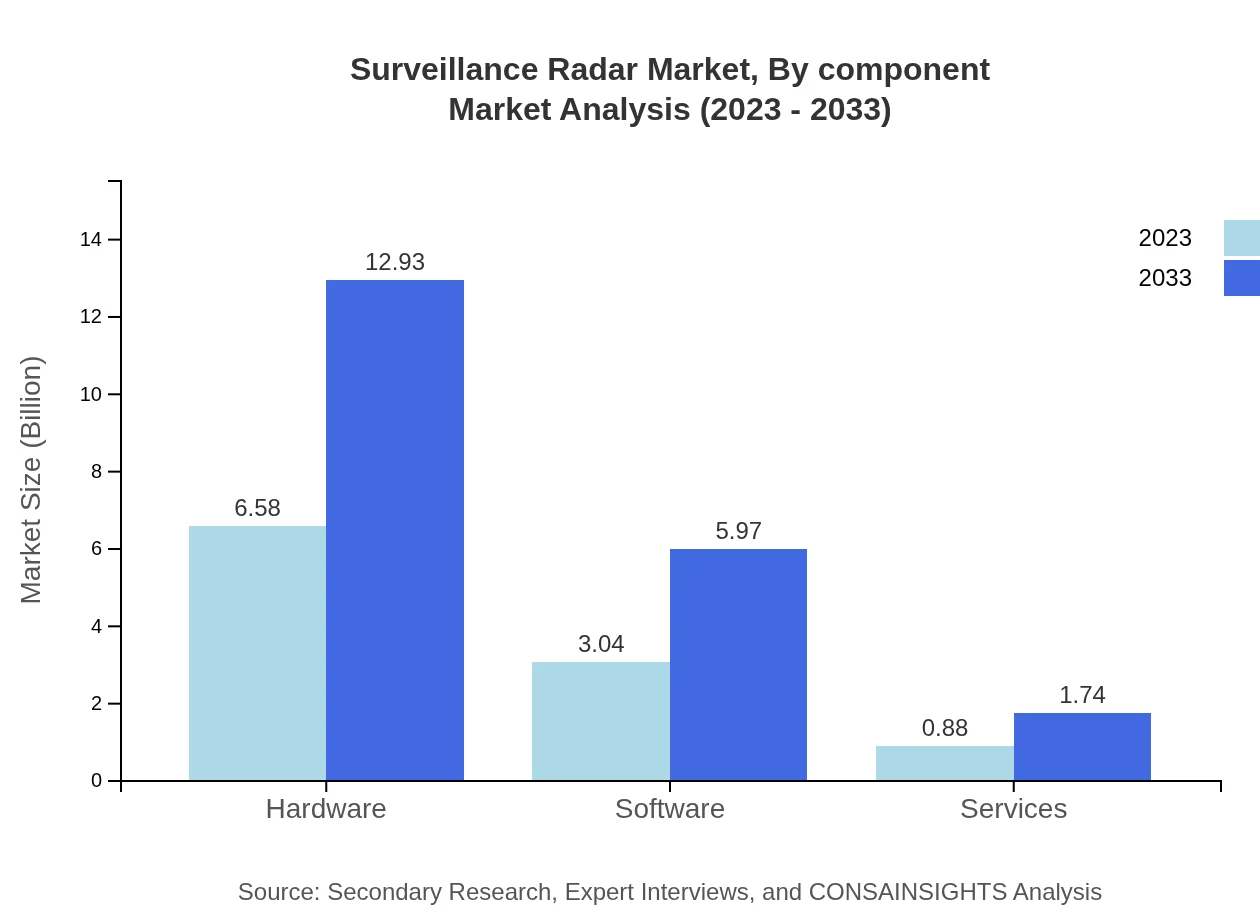

Surveillance Radar Market Analysis By Component

The Hardware component leads in market size, comprising a substantial portion of investment in radar systems. The Software and Services segments follow as critical supporting elements that enhance operational capabilities and integration.

Surveillance Radar Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Surveillance Radar Industry

Raytheon Technologies Corporation:

A major player in defense technologies, providing advanced radar and sensor solutions for military and commercial applications.Lockheed Martin Corporation:

Known for its cutting-edge radar systems for air and missile defense, Lockheed Martin is a leader in innovating surveillance technologies.Northrop Grumman Corporation:

Provides a variety of surveillance radar systems that enhance defense operations and situational awareness.BAE Systems:

A leader in security and defense electronics, offering advanced surveillance technologies for military applications.Thales Group:

Offers innovative radar systems that address various defense and civil market needs, enhancing operational effectiveness.We're grateful to work with incredible clients.

FAQs

What is the market size of Surveillance Radar?

The global Surveillance Radar market is projected to reach $10.5 billion by 2033, growing at a CAGR of 6.8% from its current market size in 2023.

What are the key market players or companies in the Surveillance Radar industry?

The key players in the Surveillance Radar industry include major defense contractors, technology firms specializing in radar technology, and governmental defense agencies, all contributing to innovation and market growth.

What are the primary factors driving the growth in the Surveillance Radar industry?

Growth is driven by increasing security threats, advancements in radar technology, and rising military expenditure. Demand for efficient surveillance systems across various sectors also fuels industry expansion.

Which region is the fastest Growing in the Surveillance Radar?

The Asia-Pacific region is the fastest-growing market for Surveillance Radar, expanding from $2.10 billion in 2023 to $4.12 billion by 2033, highlighting significant development opportunities.

Does ConsaInsights provide customized market report data for the Surveillance Radar industry?

Yes, ConsaInsights offers customized market report data tailored to specific research needs, helping stakeholders make informed decisions based on unique market requirements.

What deliverables can I expect from this Surveillance Radar market research project?

Deliverables include detailed market analyses, regional insights, competitor landscapes, and future forecasts, providing a comprehensive understanding of industry dynamics and opportunities.

What are the market trends of Surveillance Radar?

Key trends include increased automation in surveillance systems, integration with AI technologies, and an emphasis on environmental sustainability in radar operations, shaping the industry's future.