Sustained Release Excipients Market Report

Published Date: 31 January 2026 | Report Code: sustained-release-excipients

Sustained Release Excipients Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Sustained Release Excipients market, showcasing current market trends, forecasts for 2023-2033, and key insights into market dynamics, segmentation, and leading players within the industry.

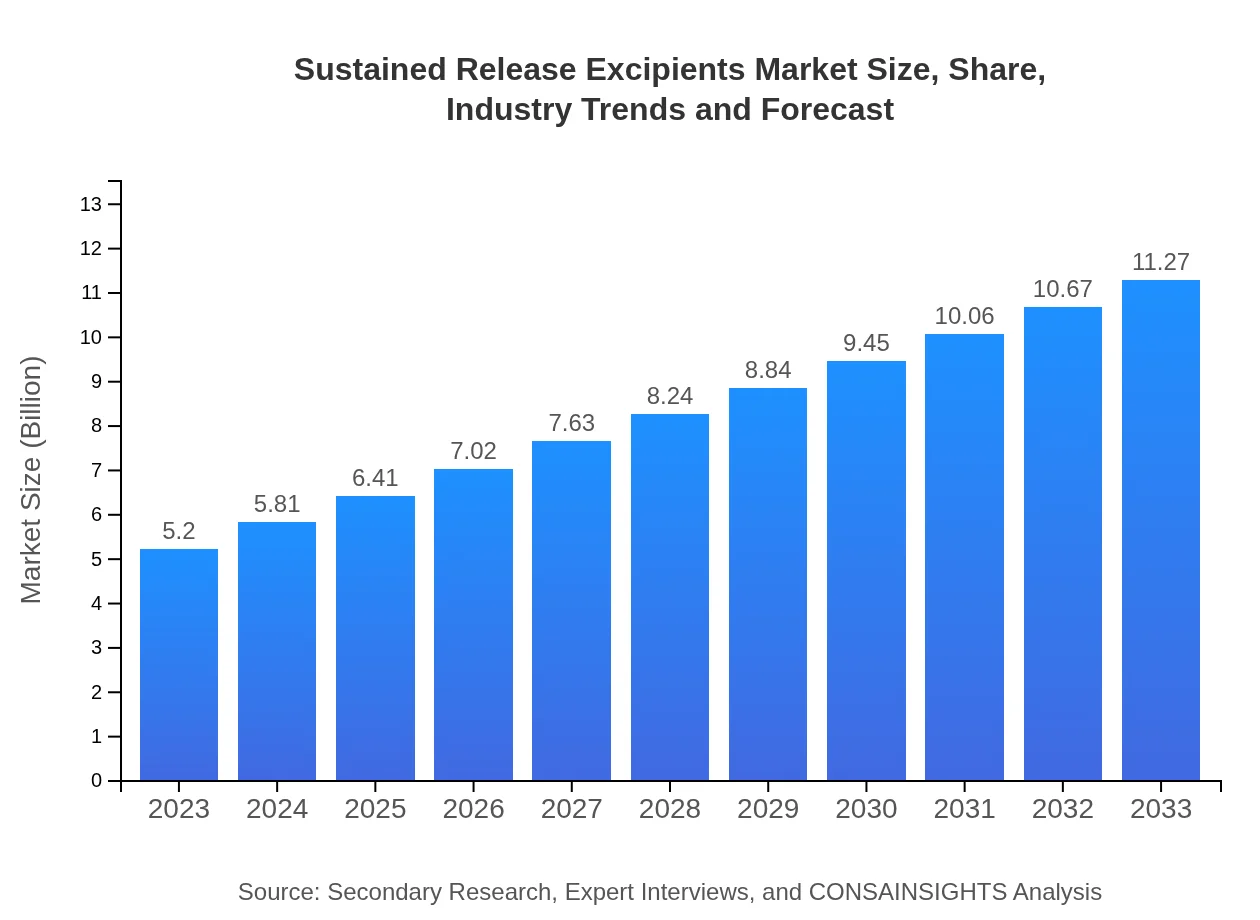

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.20 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $11.27 Billion |

| Top Companies | Evonik Industries AG, Gattefossé, Ashland Global Holdings Inc., BASF SE, FMC Corporation |

| Last Modified Date | 31 January 2026 |

Sustained Release Excipients Market Overview

Customize Sustained Release Excipients Market Report market research report

- ✔ Get in-depth analysis of Sustained Release Excipients market size, growth, and forecasts.

- ✔ Understand Sustained Release Excipients's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Sustained Release Excipients

What is the Market Size & CAGR of Sustained Release Excipients market in 2033?

Sustained Release Excipients Industry Analysis

Sustained Release Excipients Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Sustained Release Excipients Market Analysis Report by Region

Europe Sustained Release Excipients Market Report:

The European market is projected to expand from $1.38 billion in 2023 to $2.99 billion by 2033. A strong focus on research and development, coupled with stringent regulatory frameworks, encourages innovation in sustained release technologies within the pharmaceutical industry.Asia Pacific Sustained Release Excipients Market Report:

The Asia Pacific market is experiencing rapid growth, projected to increase from $1.05 billion in 2023 to $2.27 billion by 2033, driven by expanding pharmaceutical and nutraceutical sectors, along with rising health awareness among consumers. The region's significant investment in healthcare infrastructure also fosters market growth.North America Sustained Release Excipients Market Report:

North America is one of the leading regions, with the market expected to grow from $1.88 billion in 2023 to $4.07 billion by 2033. The robust healthcare system, high investment in drug development, and the presence of key market players make it a prominent market for sustained release excipients.South America Sustained Release Excipients Market Report:

In South America, the market is set to grow from $0.45 billion in 2023 to $0.99 billion by 2033, benefitting from increasing collaborations between local pharmaceutical companies and global excipient manufacturers. The rise in chronic diseases and an aging population are also key factors propelling market expansion.Middle East & Africa Sustained Release Excipients Market Report:

The Middle East and Africa market is anticipated to grow from $0.44 billion in 2023 to $0.96 billion by 2033, as countries in the region enhance their healthcare capabilities and improve access to advanced therapeutic solutions, thus driving demand for sustained release excipients.Tell us your focus area and get a customized research report.

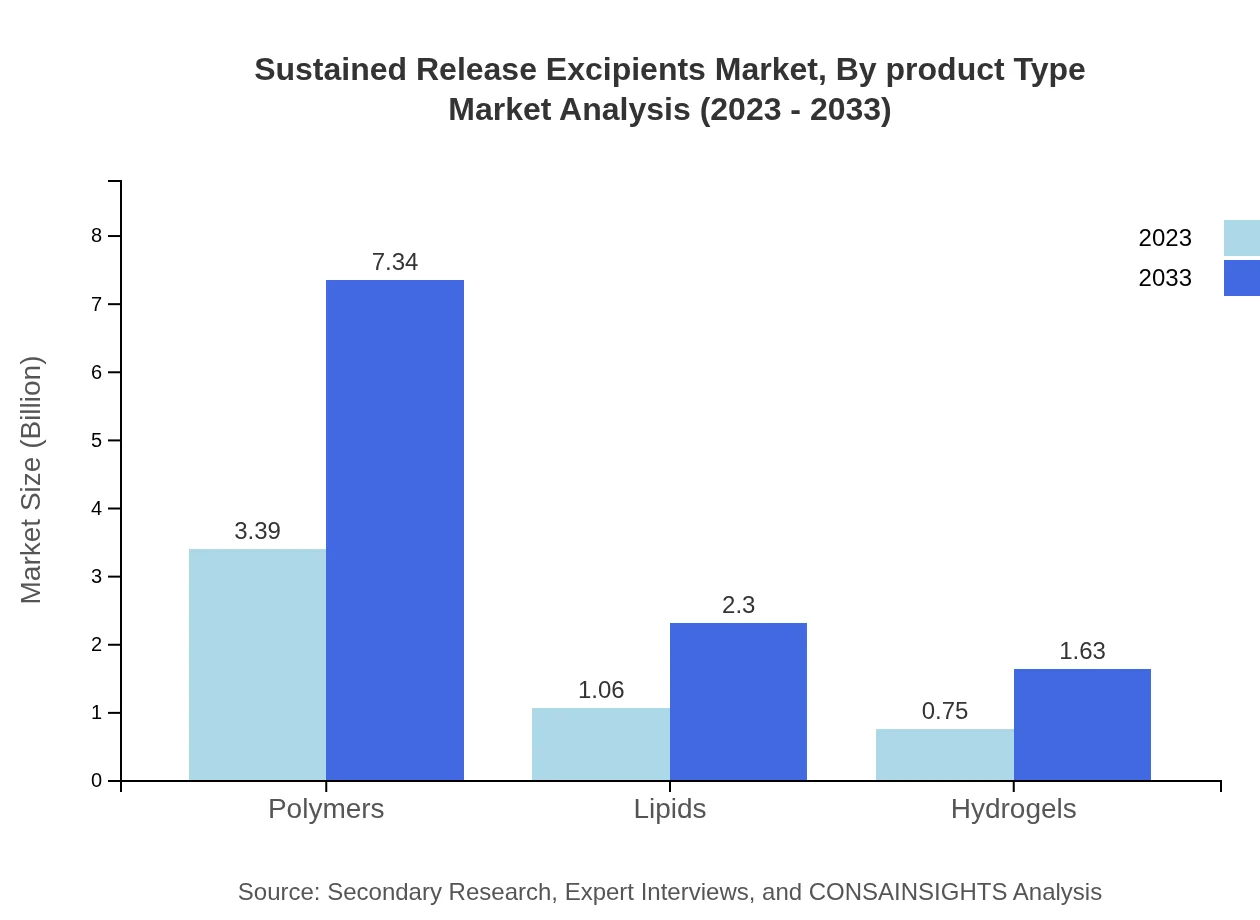

Sustained Release Excipients Market Analysis By Product Type

The by-product type segment highlights that polymers dominate the sustained release excipients market, projected to reach $7.34 billion by 2033 from $3.39 billion in 2023, holding a significant market share of 65.14%. Lipids will see growth from $1.06 billion in 2023 to $2.30 billion by 2033, maintaining a 20.36% share. Hydrogels are expected to grow from $0.75 billion to $1.63 billion, with a 14.5% share, showcasing their importance in various formulations.

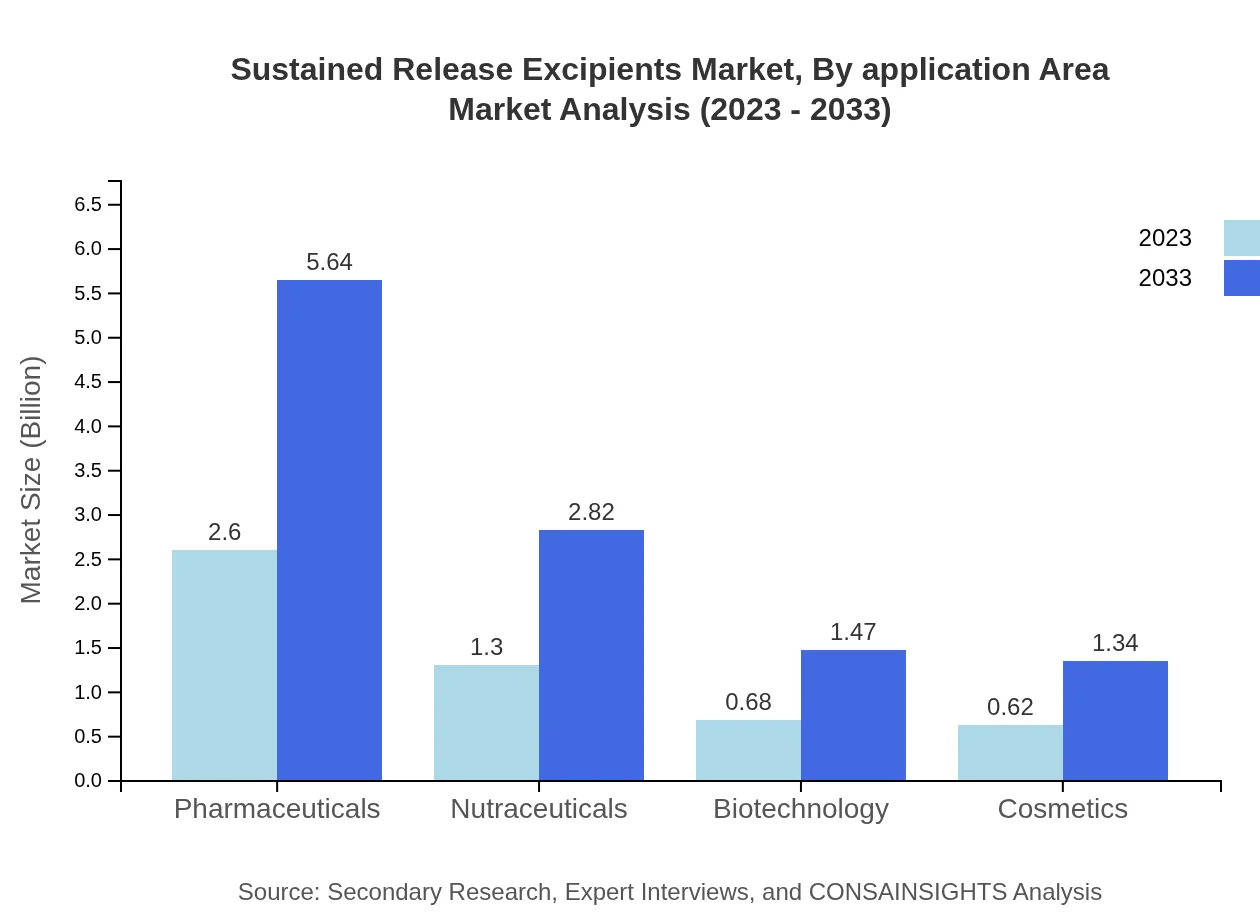

Sustained Release Excipients Market Analysis By Application Area

By application area, pharmaceuticals are leading the segment with a market size of $5.64 billion by 2033, up from $2.60 billion in 2023, maintaining a share of 50.05%. Nutraceuticals will experience growth from $1.30 billion to $2.82 billion, capturing 24.99% share. Biotechnology and cosmetics will also grow steadily, holding shares of 13.04% and 11.92%, respectively.

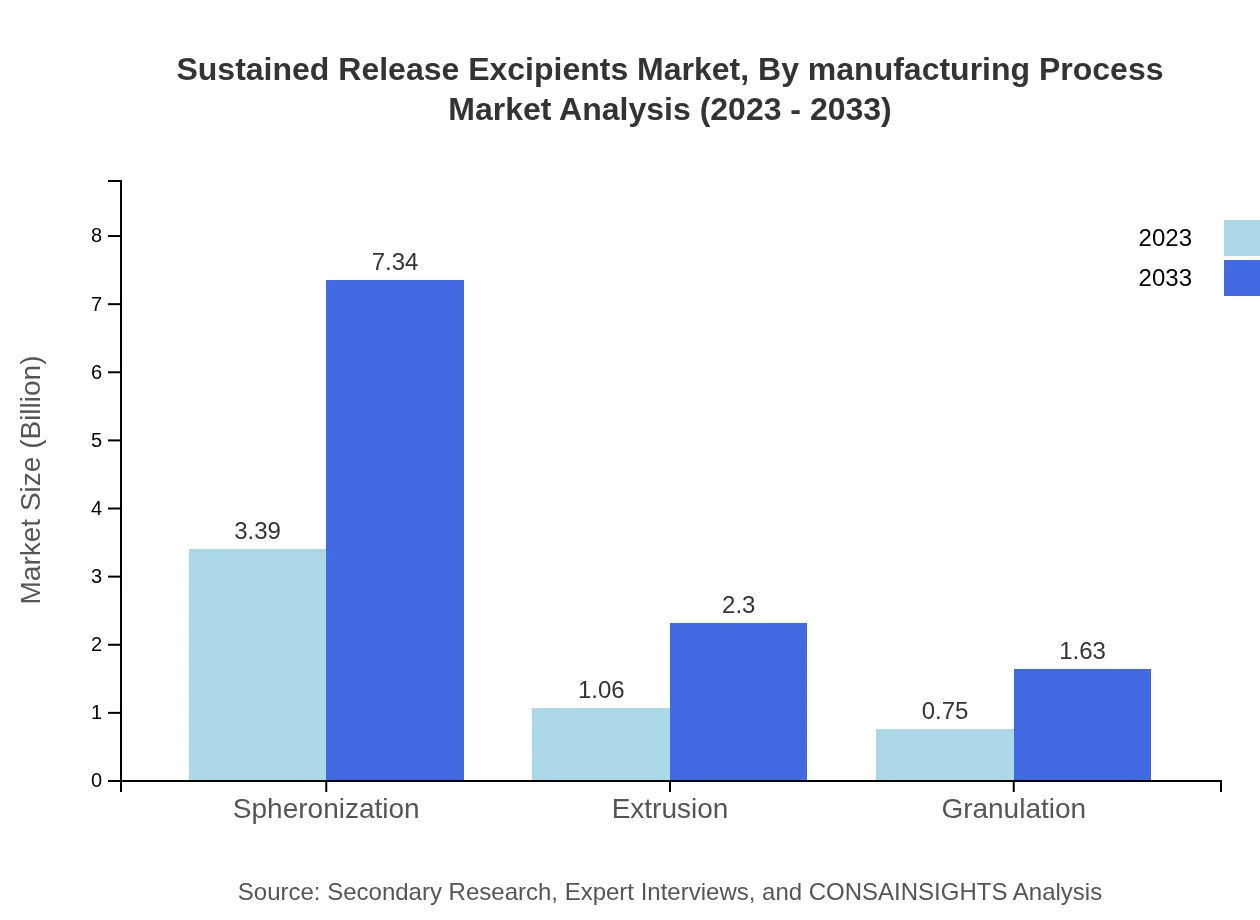

Sustained Release Excipients Market Analysis By Manufacturing Process

The manufacturing process segment reveals that spheronization remains the leading process, projected to grow from $3.39 billion in 2023 to $7.34 billion by 2033 with a 65.14% market share. Extrusion and granulation processes are also poised for growth, with sizes of $1.06 billion (up to $2.30 billion) and $0.75 billion (up to $1.63 billion) in the same timeframe, holding shares of 20.36% and 14.5%, respectively.

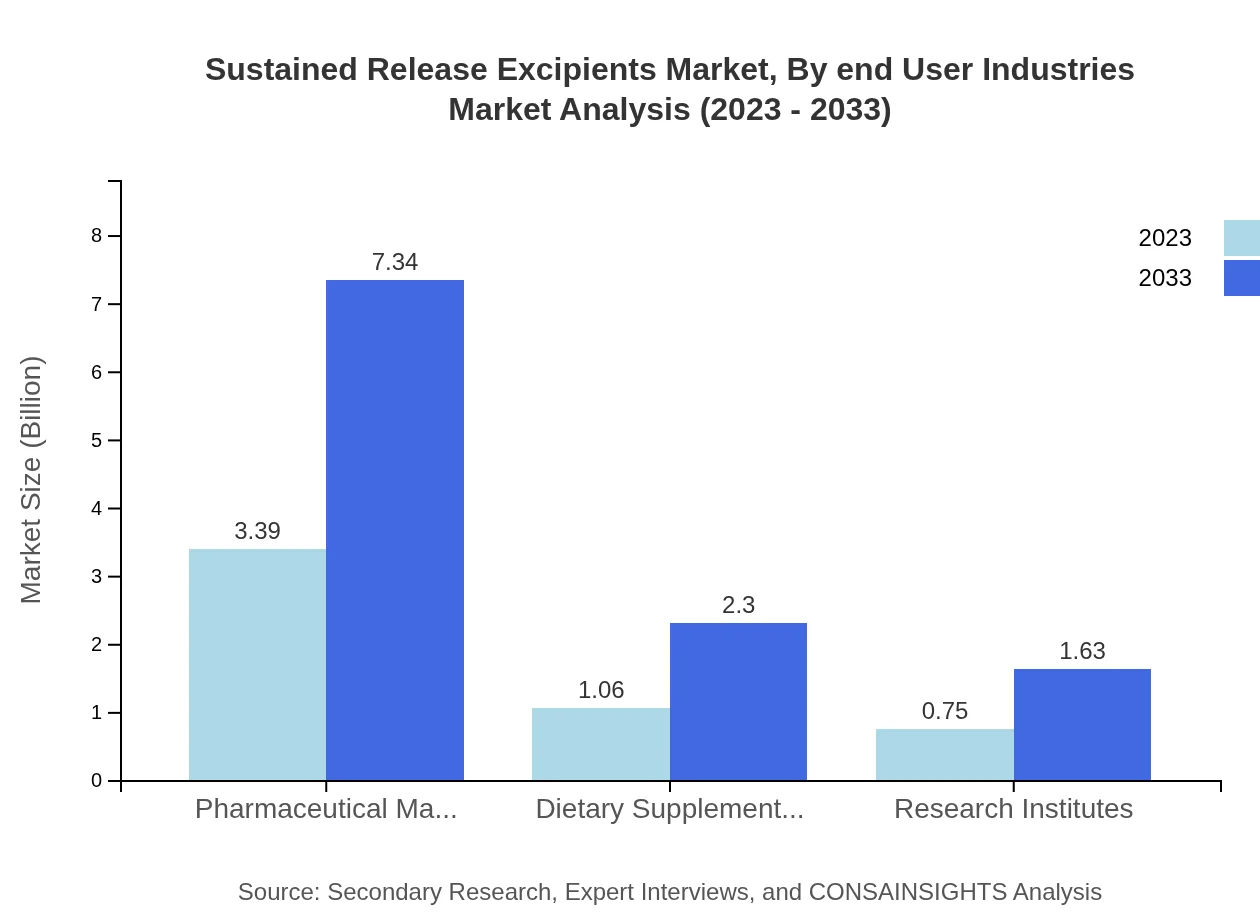

Sustained Release Excipients Market Analysis By End User Industries

In terms of end-user industries, pharmaceutical manufacturers account for a substantial portion of the market, anticipated to grow from $3.39 billion in 2023 to $7.34 billion by 2033 (65.14% share). Dietary supplement manufacturers will also see an increase from $1.06 billion to $2.30 billion (20.36% share), alongside notable growth in research institutes, which will rise from $0.75 billion to $1.63 billion (14.5% share).

Sustained Release Excipients Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Sustained Release Excipients Industry

Evonik Industries AG:

Evonik is a global leader in specialty chemicals, providing a broad range of excipients for the pharmaceutical industry, enhancing drug delivery systems and stability.Gattefossé:

A pioneering company in the field of excipients, Gattefossé specializes in lipids and offers advanced solutions for sustained release formulations.Ashland Global Holdings Inc.:

Ashland provides specialty chemical products and operates in various sectors, including pharmaceuticals, offering pharmaceutical excipients that enhance product performance.BASF SE:

BASF is a leading chemical company that produces a wide variety of excipients, boosting innovation in drug delivery and supporting the effective sustained release of medications.FMC Corporation:

FMC Corporation specializes in green solutions and provides a range of sustainable technologies, including excipients that support sustainable drug formulations.We're grateful to work with incredible clients.

FAQs

What is the market size of sustained Release Excipients?

The sustained-release excipients market is projected to grow from USD 5.2 billion in 2023 to approximately USD 11.2 billion by 2033, witnessing a CAGR of 7.8% during this period.

What are the key market players or companies in this sustained Release Excipients industry?

Key players in the sustained-release excipients market include major pharmaceutical companies and specialized excipient manufacturers focusing on innovative delivery systems, ensuring the quality and efficacy of sustained-release formulations.

What are the primary factors driving the growth in the sustained Release Excipients industry?

Growth in the sustained-release excipients industry is driven by increased demand for advanced drug formulations, rising chronic disease prevalence, and the need for improved patient compliance, alongside technological advancements in excipient development.

Which region is the fastest Growing in the sustained Release Excipients?

The fastest-growing region for sustained-release excipients is North America, with the market projected to increase from USD 1.88 billion in 2023 to USD 4.07 billion by 2033, driven by high research activities and pharmaceutical innovation.

Does ConsaInsights provide customized market report data for the sustained Release Excipients industry?

Yes, ConsaInsights offers customized market reports for the sustained-release excipients industry, tailored to specific client needs, including detailed forecasts, competitive analysis, and regional market insights.

What deliverables can I expect from this sustained Release Excipients market research project?

Deliverables include comprehensive market analysis, segmentation data, growth forecasts, competitive landscape overview, and insights into key trends influencing the sustained-release excipients market.

What are the market trends of sustained Release Excipients?

Current trends in the sustained-release excipients market include the rising adoption of novel excipients, increasing focus on targeted drug delivery systems, and the application of biocompatible materials in pharmaceutical formulations.