Switzerland Wet Pet Food Market Report

Published Date: 31 January 2026 | Report Code: switzerland-wet-pet-food

Switzerland Wet Pet Food Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Switzerland Wet Pet Food market, examining key insights, trends, and forecasts from 2023 to 2033. It covers market size, growth rates, segments, and regional analyses to offer valuable foresight for stakeholders and industry players.

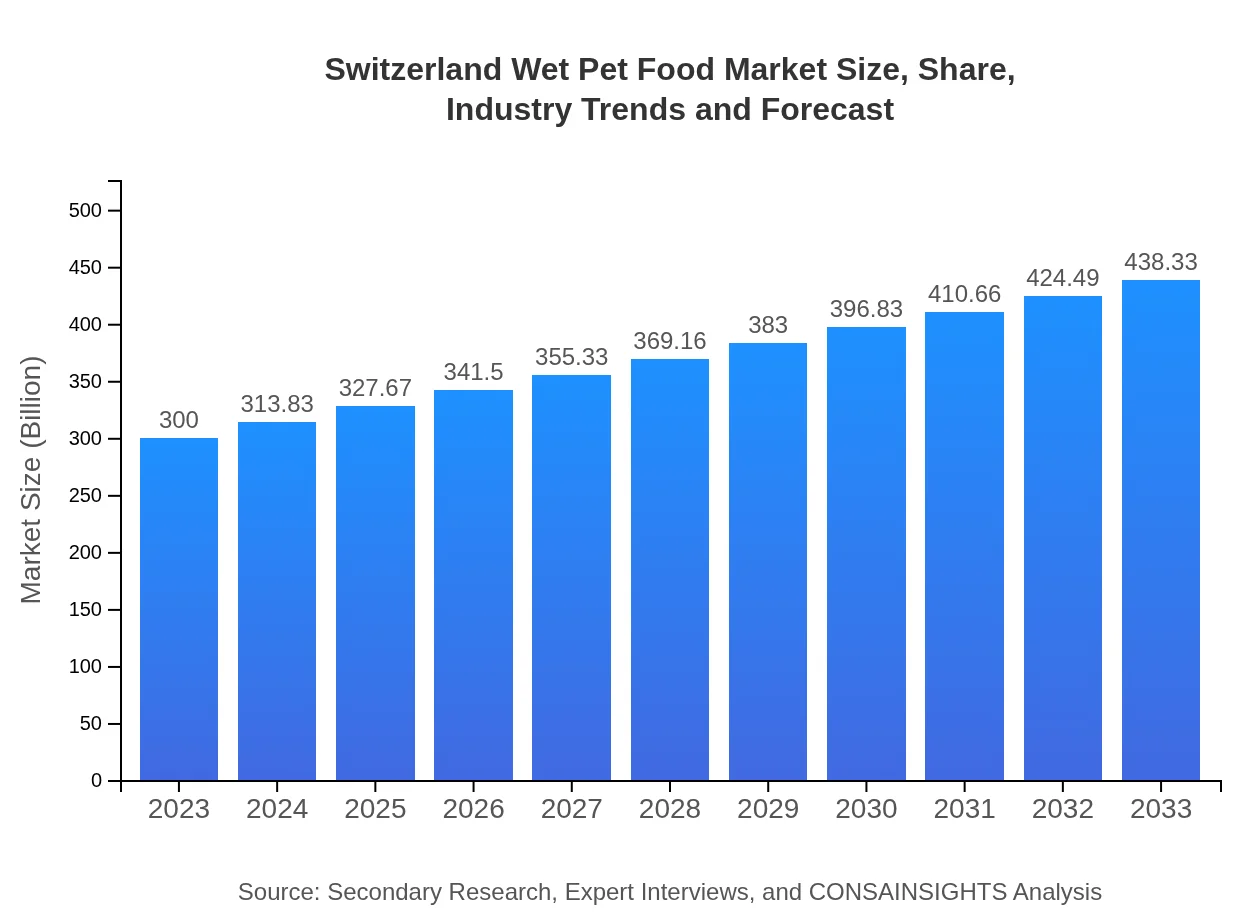

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $300.00 Million |

| CAGR (2023-2033) | 3.8% |

| 2033 Market Size | $438.33 Million |

| Top Companies | Nestlé Purina PetCare, Mars Petcare, Royal Canin, Hill's Pet Nutrition, Blue Buffalo |

| Last Modified Date | 31 January 2026 |

Switzerland Wet Pet Food Market Overview

Customize Switzerland Wet Pet Food Market Report market research report

- ✔ Get in-depth analysis of Switzerland Wet Pet Food market size, growth, and forecasts.

- ✔ Understand Switzerland Wet Pet Food's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Switzerland Wet Pet Food

What is the Market Size & CAGR of Switzerland Wet Pet Food market in 2023?

Switzerland Wet Pet Food Industry Analysis

Switzerland Wet Pet Food Market Segmentation and Scope

Tell us your focus area and get a customized research report.

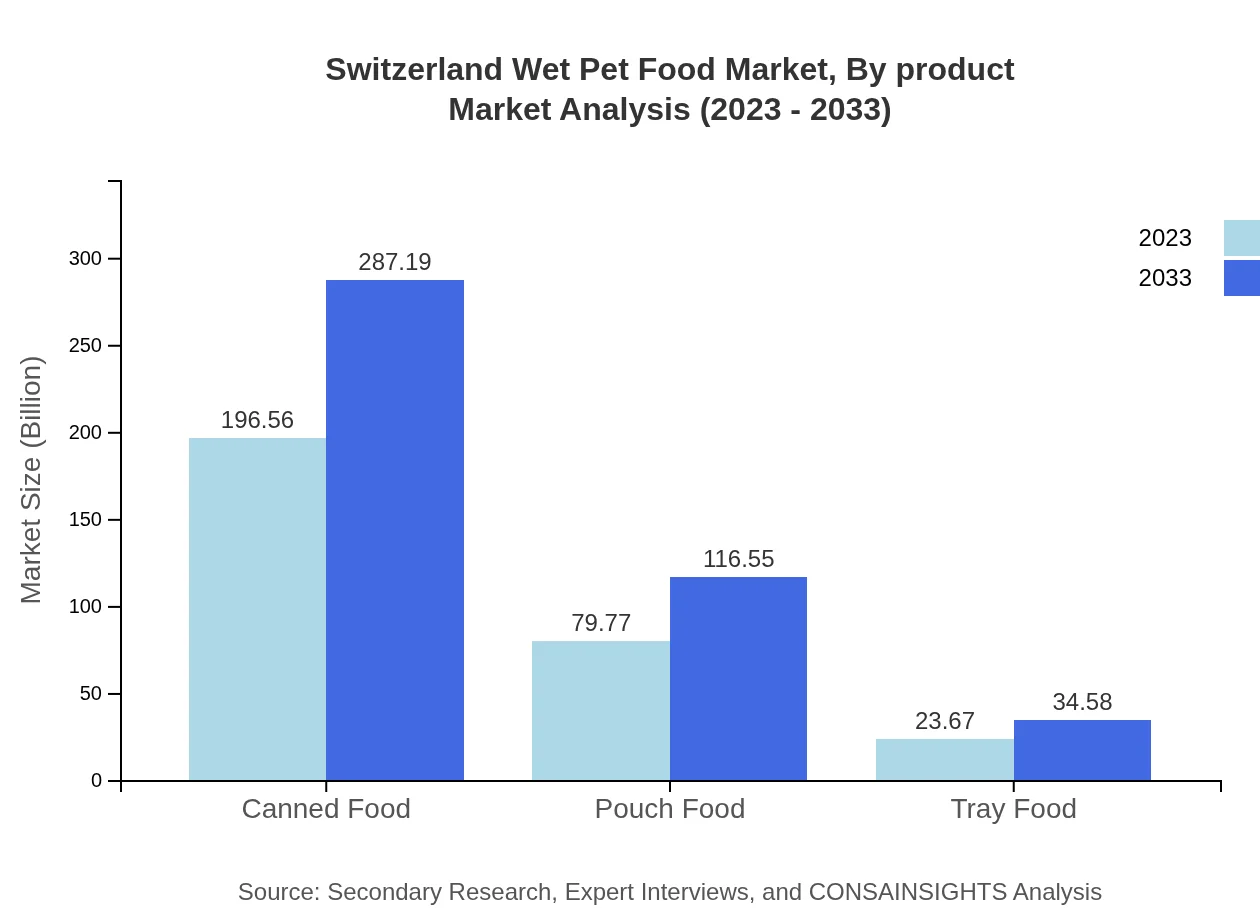

Switzerland Wet Pet Food Market Analysis By Product

The product segmentation in the Switzerland wet pet food market includes various forms of products such as canned food, pouch food, and tray food. Canned food remains the leading segment with a market size of 196.56 million CHF in 2023, expected to grow to 287.19 million CHF by 2033, valued for its long shelf life and nutritional advantages. Pouch food, which offers convenience, accounts for substantial sales, ranging from 79.77 million CHF in 2023 to an anticipated 116.55 million CHF by 2033. Tray foods, although smaller, also form a crucial segment with increasing consumer interest in ready-to-feed options.

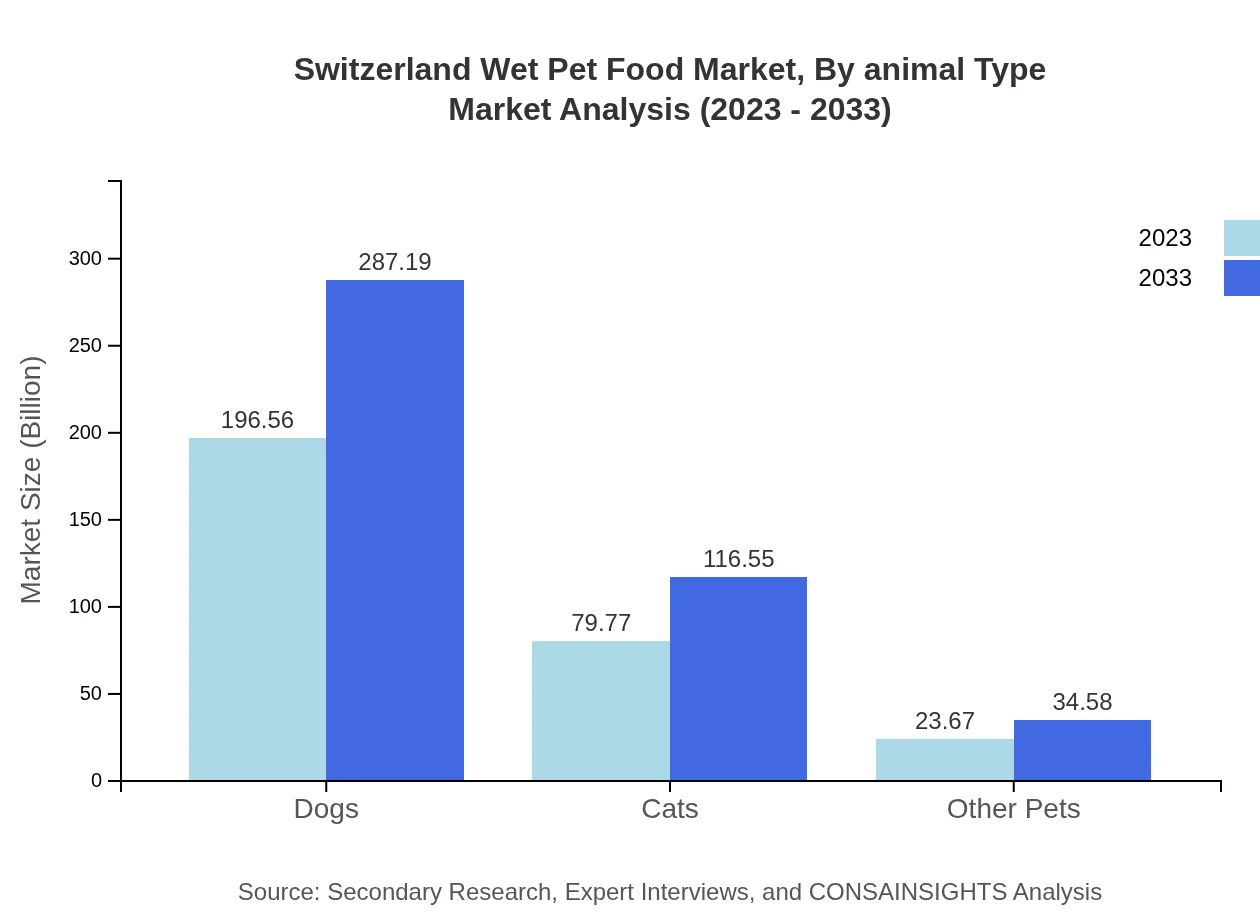

Switzerland Wet Pet Food Market Analysis By Animal Type

In terms of animal type, the market is dominated by products for dogs, which are expected to contribute significantly with a market value of 196.56 million CHF in 2023 and anticipated growth to 287.19 million CHF by 2033. Cat food is also a vital segment, forecasted to grow from 79.77 million CHF to 116.55 million CHF. The 'Other Pets' category, though smaller, captures niche market interest, expanding from 23.67 million CHF to 34.58 million CHF over the same period.

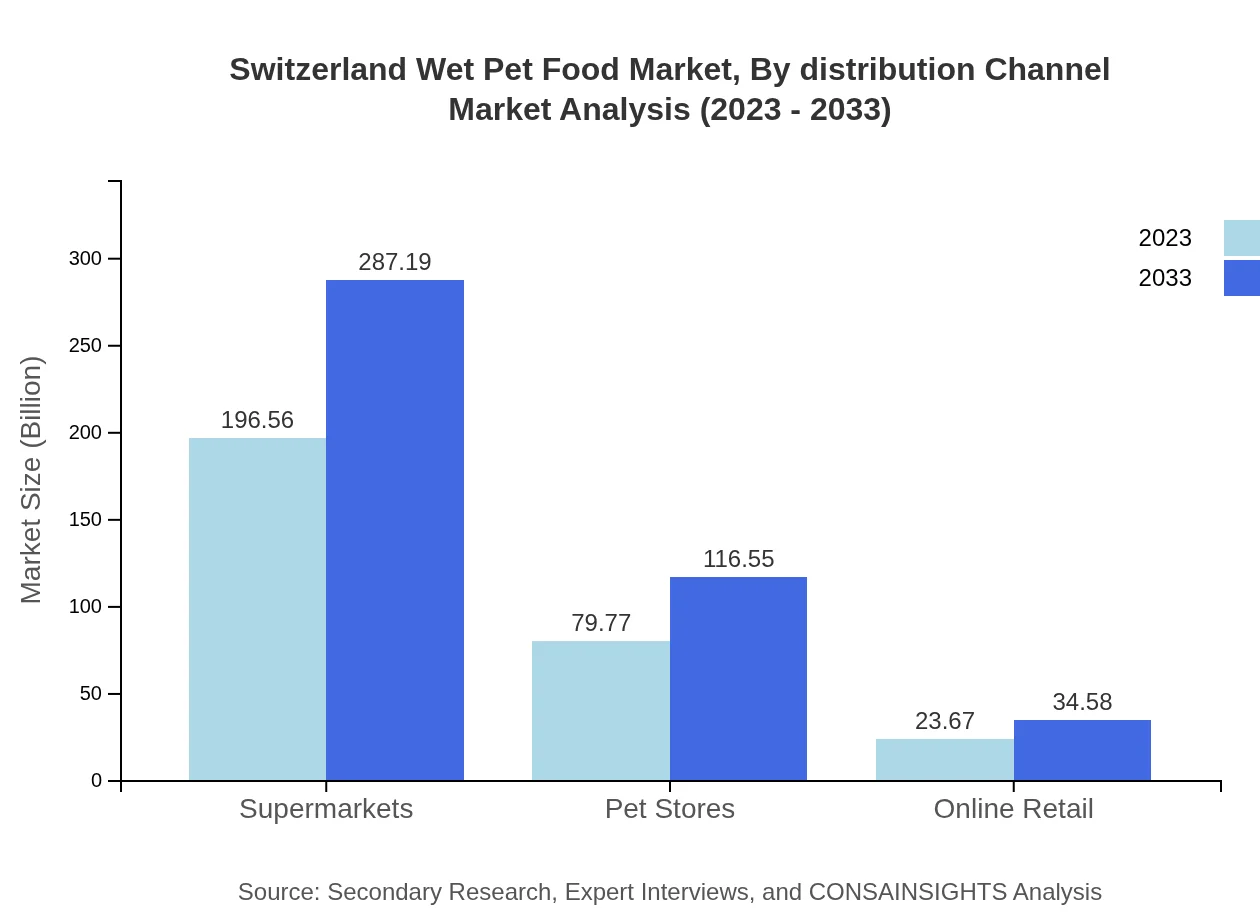

Switzerland Wet Pet Food Market Analysis By Distribution Channel

Distribution channels are key to market accessibility, with supermarkets leading the sales channel at 196.56 million CHF in 2023, projected to increase to 287.19 million CHF by 2033. Pet stores also play a crucial role, with expected sales rising from 79.77 million CHF to 116.55 million CHF. Online retail is gradually gaining traction, from 23.67 million CHF to 34.58 million CHF, reflecting consumers' changing shopping preferences.

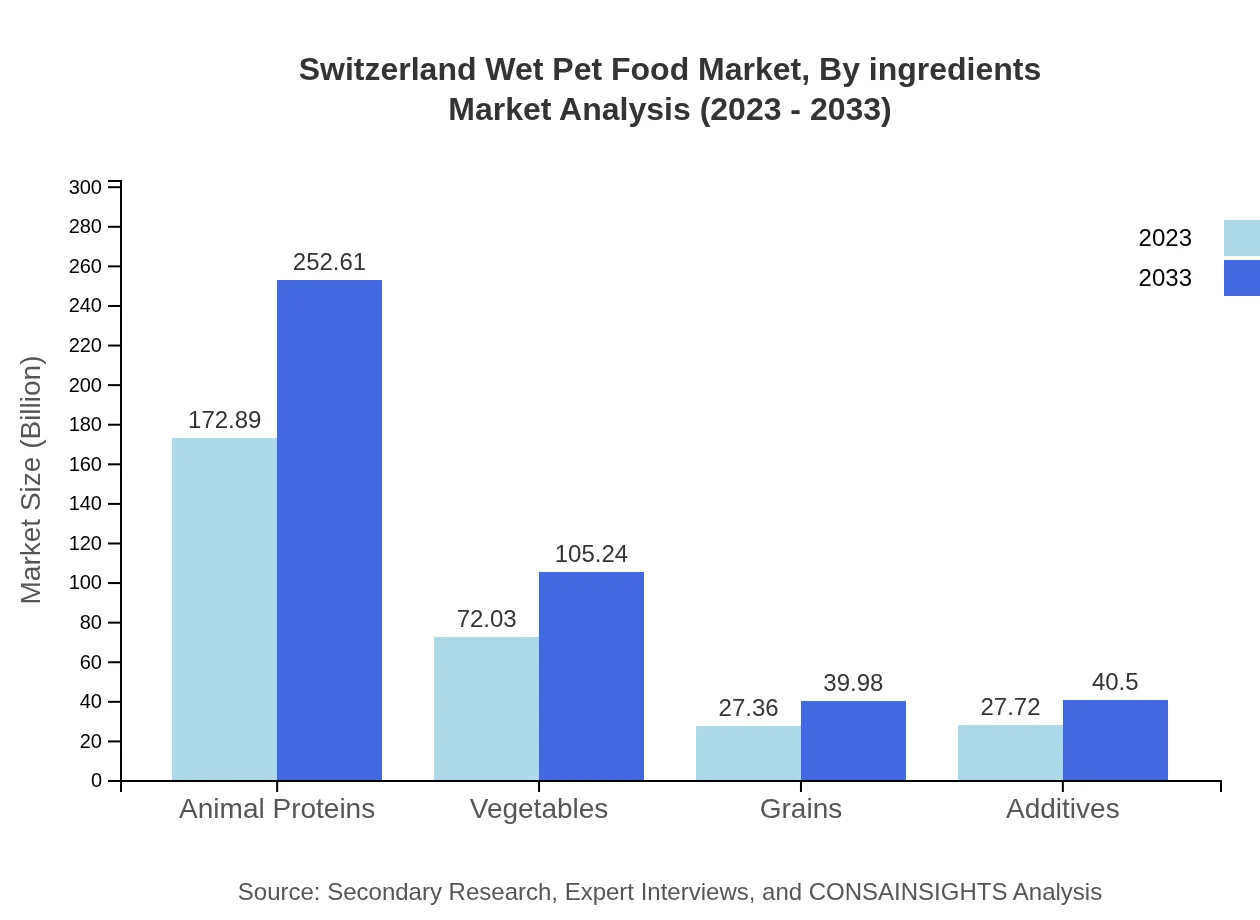

Switzerland Wet Pet Food Market Analysis By Ingredients

The ingredient segmentation reveals that animal proteins are the dominant choice in wet pet food, expanding from 172.89 million CHF to 252.61 million CHF, making up 57.63% of the overall market. Vegetables and grains also factor into formulations, growing from 72.03 million CHF to 105.24 million CHF and from 27.36 million CHF to 39.98 million CHF respectively. Additives, capturing 9.24% of the market, highlight the importance of nutritional enhancements.

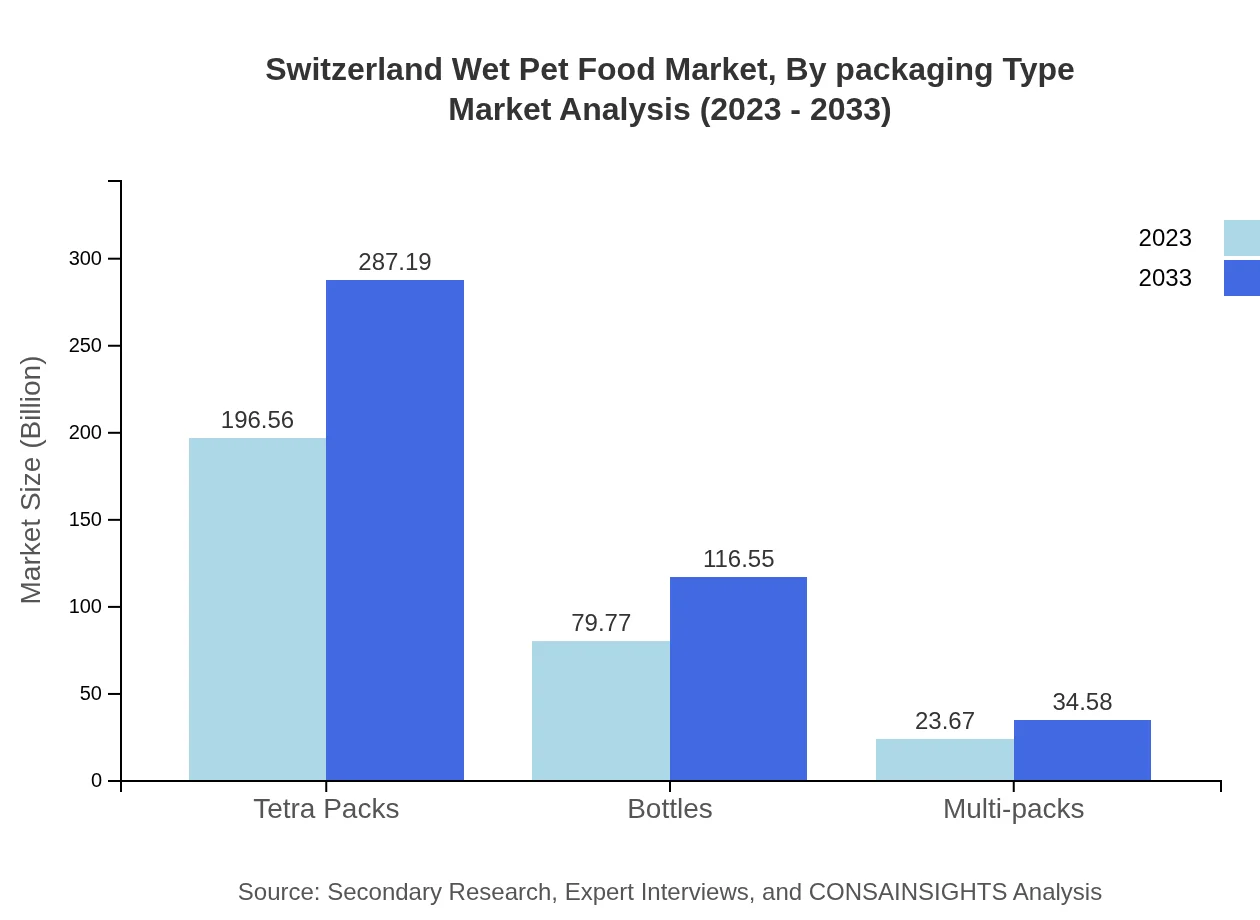

Switzerland Wet Pet Food Market Analysis By Packaging Type

Packaging types are equally important, with Tetra packs leading at a market size of 196.56 million CHF in 2023 and projected to grow to 287.19 million CHF. Bottles and multi-packs also contribute to the market, with growth trajectories from 79.77 million CHF to 116.55 million CHF and from 23.67 million CHF to 34.58 million CHF respectively, favoring convenience and portion-control features.

Switzerland Wet Pet Food Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Switzerland Wet Pet Food Industry

Nestlé Purina PetCare:

A leading player offering a wide range of wet pet food products that focus on health and nutrition, driving innovation in the category.Mars Petcare:

Known for its premium pet food brands, Mars Petcare emphasizes quality and sustainable sourcing, playing a significant role in shaping market trends.Royal Canin:

Specializes in high-nutritional wet food tailored for specific breeds and health needs, contributing to the increasing interest among pet owners.Hill's Pet Nutrition:

Offers science-based nutrition products and emphasizes veterinarian-recommended diets in its wet food offerings.Blue Buffalo:

Targets health-conscious pet owners with natural and holistic pet food options, impacting consumer choice in the premium segment.We're grateful to work with incredible clients.

FAQs

What is the market size of Switzerland Wet Pet Food?

The Switzerland Wet Pet Food market is valued at approximately $300 million in 2023, with a projected CAGR of 3.8% leading to exponential growth by 2033, indicating a burgeoning demand in the pet food sector.

What are the key market players or companies in the Switzerland Wet Pet Food industry?

The key market players include prominent pet food companies such as Nestlé Purina, Mars Petcare, and Hill’s Pet Nutrition. These companies dominate the market with innovative products and a wide distribution network.

What are the primary factors driving the growth in the Switzerland Wet Pet Food industry?

Growth is primarily driven by increasing pet ownership, rising awareness of pet nutrition, and a shift towards premium, health-oriented pet food products. The trend towards convenience and variety also plays a significant role.

Which region is the fastest Growing in the Switzerland Wet Pet Food?

The North America region stands out as the fastest-growing area within the Switzerland Wet Pet Food market, projected to grow from $104.10 million in 2023 to $152.10 million by 2033, reflecting a significant uptake.

Does ConsaInsights provide customized market report data for the Switzerland Wet Pet Food industry?

Yes, ConsaInsights offers customized market reports tailored to specific requirements, providing in-depth analysis and detailed insights into market trends, competitive landscape, and consumer behavior in the Switzerland Wet Pet Food industry.

What deliverables can I expect from this Switzerland Wet Pet Food market research project?

Deliverables include comprehensive market analysis reports, growth projections, competitive assessments, and detailed segmentation data covering regions, products, and distribution channels specific to the Switzerland Wet Pet Food market.

What are the market trends of Switzerland Wet Pet Food?

Key trends include the rising demand for packaged wet food options like pouches and tetra packs, increased focus on natural ingredients, and the shift towards online retailing, reflecting changing consumer purchasing behaviors.