Syntactic Foam Market Report

Published Date: 02 February 2026 | Report Code: syntactic-foam

Syntactic Foam Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the syntactic foam market, including market overview, size estimates, regional insights, and future trends through 2033. It covers industry dynamics, segmentation, leading companies, and projections for growth, ensuring comprehensive insights for stakeholders.

| Metric | Value |

|---|---|

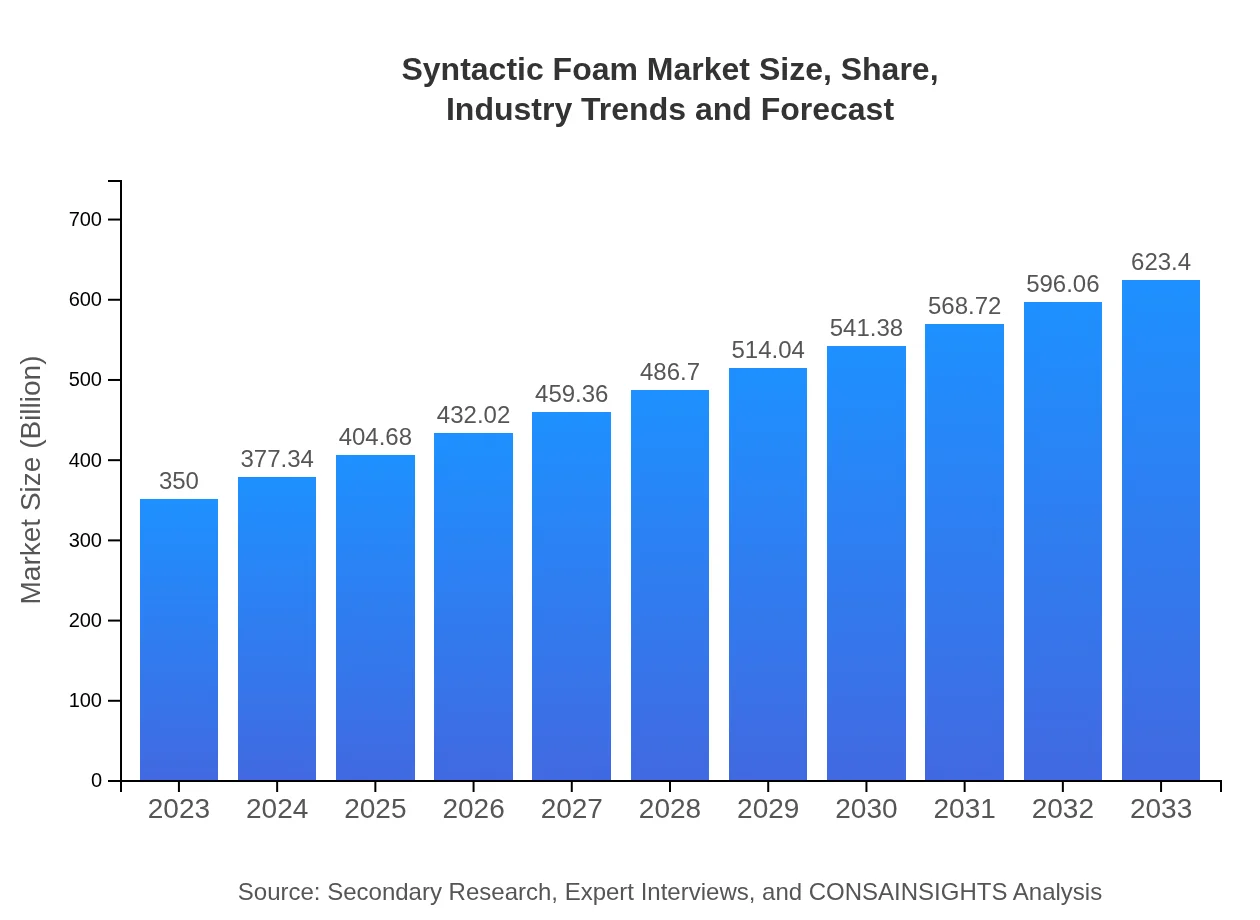

| Study Period | 2023 - 2033 |

| 2023 Market Size | $350.00 Million |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $623.40 Million |

| Top Companies | Rhetech, Inc., Huntsman Corporation, SABIC, BASF SE |

| Last Modified Date | 02 February 2026 |

Syntactic Foam Market Overview

Customize Syntactic Foam Market Report market research report

- ✔ Get in-depth analysis of Syntactic Foam market size, growth, and forecasts.

- ✔ Understand Syntactic Foam's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Syntactic Foam

What is the Market Size & CAGR of Syntactic Foam market in 2023?

Syntactic Foam Industry Analysis

Syntactic Foam Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Syntactic Foam Market Analysis Report by Region

Europe Syntactic Foam Market Report:

The European market is robust, starting at $121.27 million in 2023 and expected to grow to $216.01 million by 2033. This growth can be attributed to the region's strong automotive and aerospace industries, with major players focusing on lightweight materials to enhance fuel efficiency.Asia Pacific Syntactic Foam Market Report:

In the Asia Pacific region, the syntactic foam market size in 2023 stands at $60.37 million, anticipated to reach $107.54 million by 2033. The growth is driven by rapid industrialization and increasing demand in the aerospace and automotive sectors across countries like China and India.North America Syntactic Foam Market Report:

North America represents a significant portion of the syntactic foam market with a size of $120.89 million in 2023, projected to grow to $215.32 million by 2033. The aerospace and defense sectors remain the primary outlets for growth, supported by extensive technological advancements and government spending on military applications.South America Syntactic Foam Market Report:

The South American market currently reflects a smaller size with estimates of -$0.77 million in 2023, expected to decline to -$1.37 million by 2033 due to economic challenges and reduced production activities in the petrochemical industries, impacting syntactic foam demand.Middle East & Africa Syntactic Foam Market Report:

The Middle East and Africa syntactic foam market is growing steadily, with a size of $48.23 million in 2023 and forecasted to reach $85.91 million by 2033. Strong investments in infrastructure and oil and gas sectors are boosting demand for syntactic foams in offshore applications.Tell us your focus area and get a customized research report.

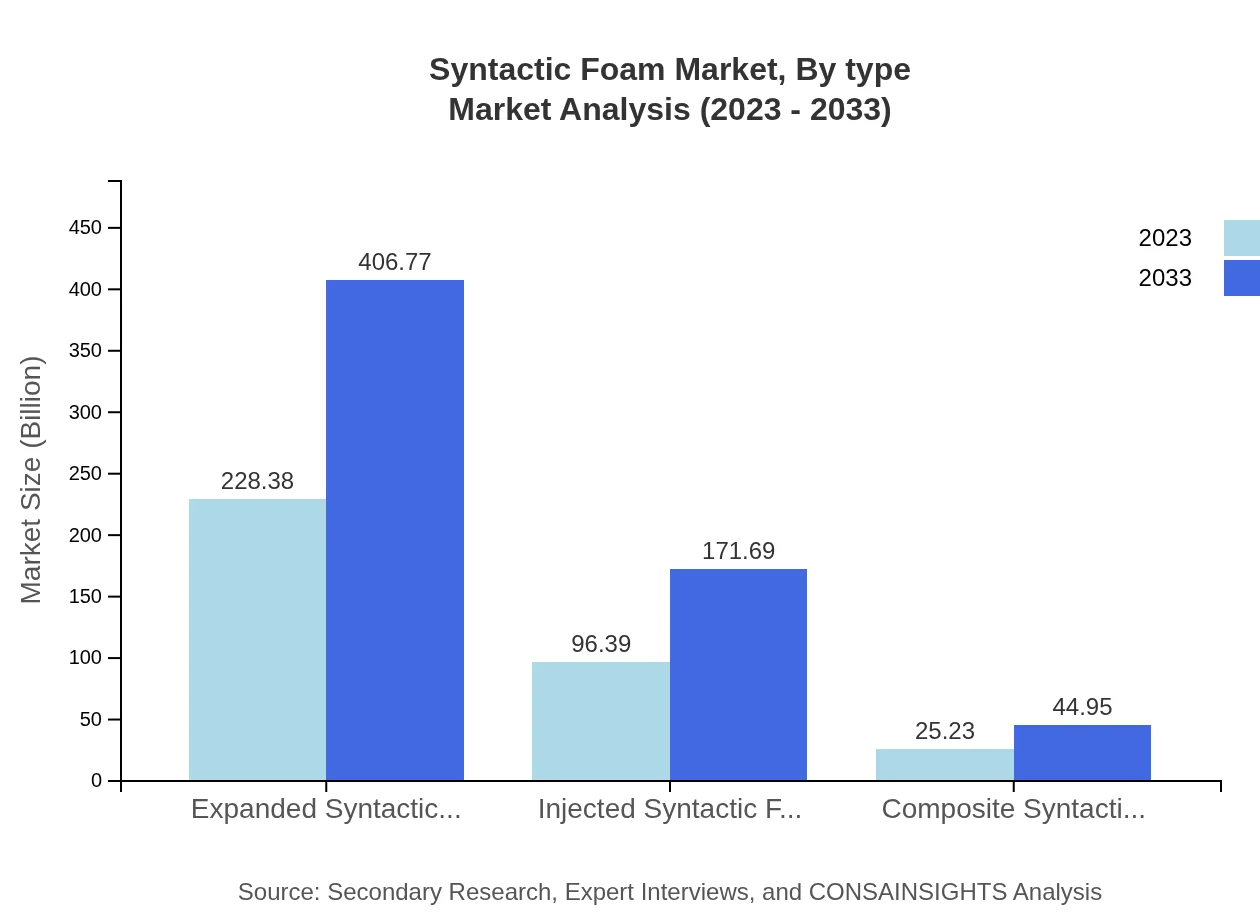

Syntactic Foam Market Analysis By Type

The market encompasses various formulations, including expanded, injected, and composite syntactic foams. Expanded syntactic foam leads the market by size at $228.38 million in 2023, increasing to $406.77 million by 2033, capturing 65.25% market share. Injected syntactic foam follows with figures of $96.39 million in 2023, expected to rise to $171.69 million by 2033.

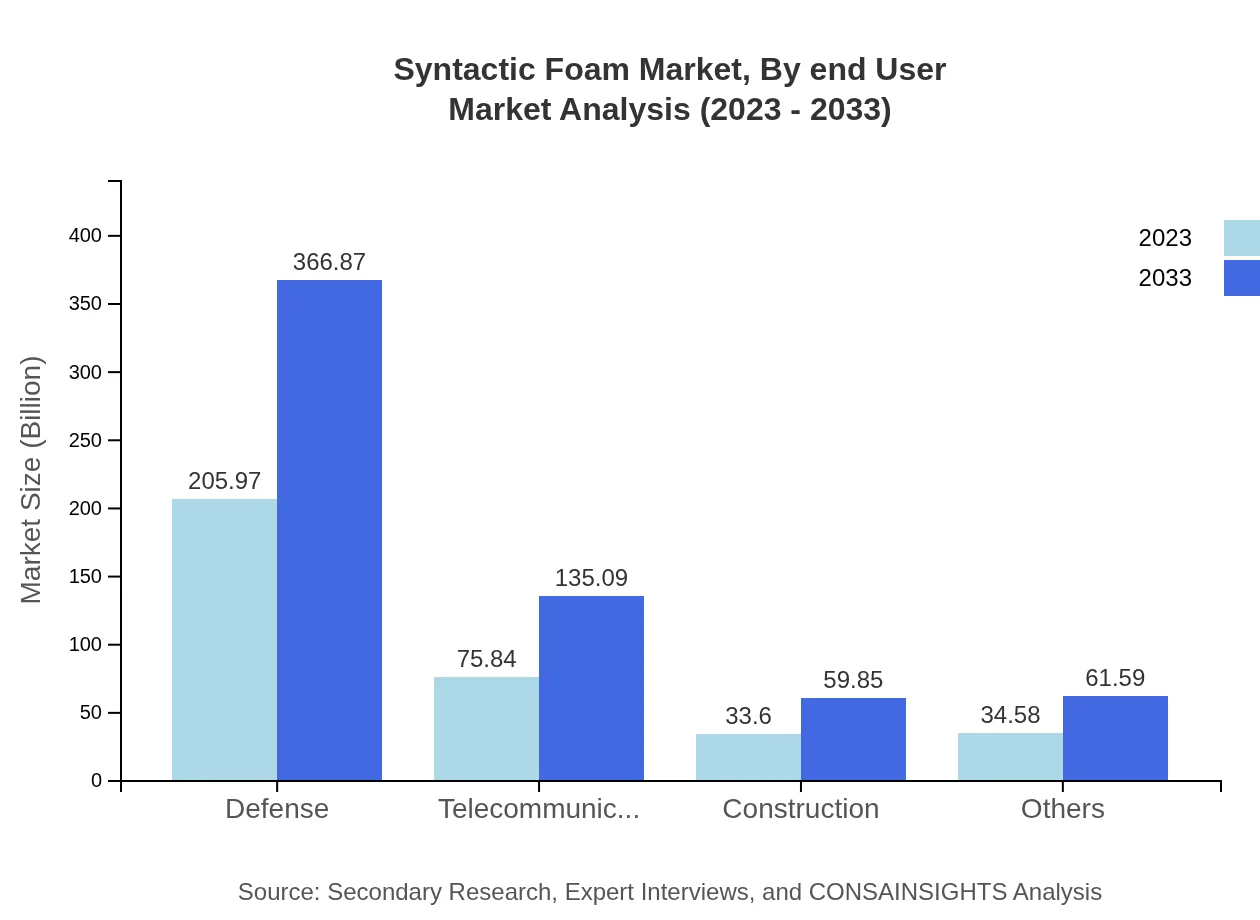

Syntactic Foam Market Analysis By Application

Applications in defense and telecommunications are key drivers of market growth, with defense applications valued at $205.97 million in 2023 and expected to reach $366.87 million by 2033, holding 58.85% market share. Telecommunications applications are also growing, projected to increase from $75.84 million to $135.09 million in the same period.

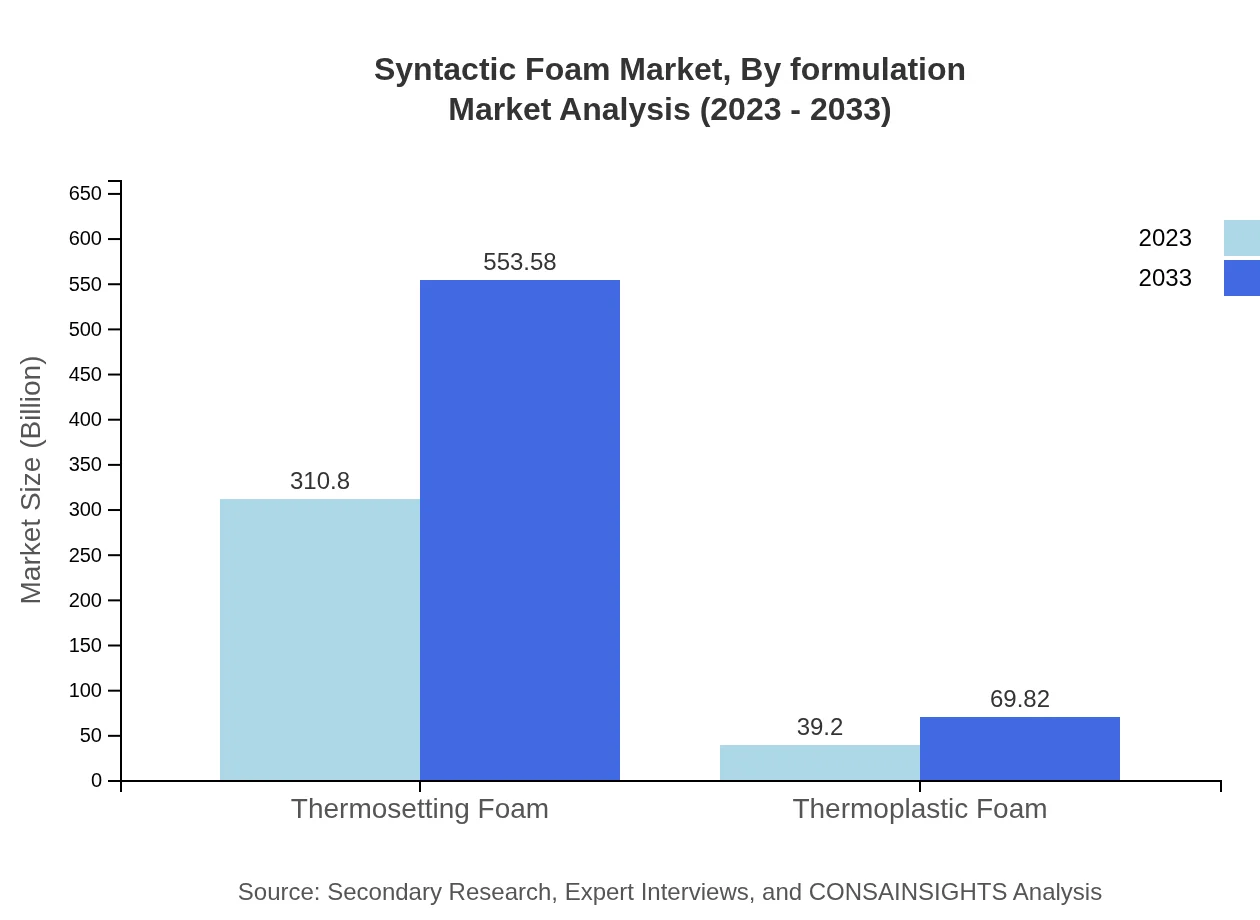

Syntactic Foam Market Analysis By Formulation

The market includes thermosetting and thermoplastic foams, with thermosetting foams dominating sales at $310.80 million in 2023, anticipated to expand to $553.58 million by 2033. Meanwhile, thermoplastic foams are expected to grow from $39.20 million to $69.82 million.

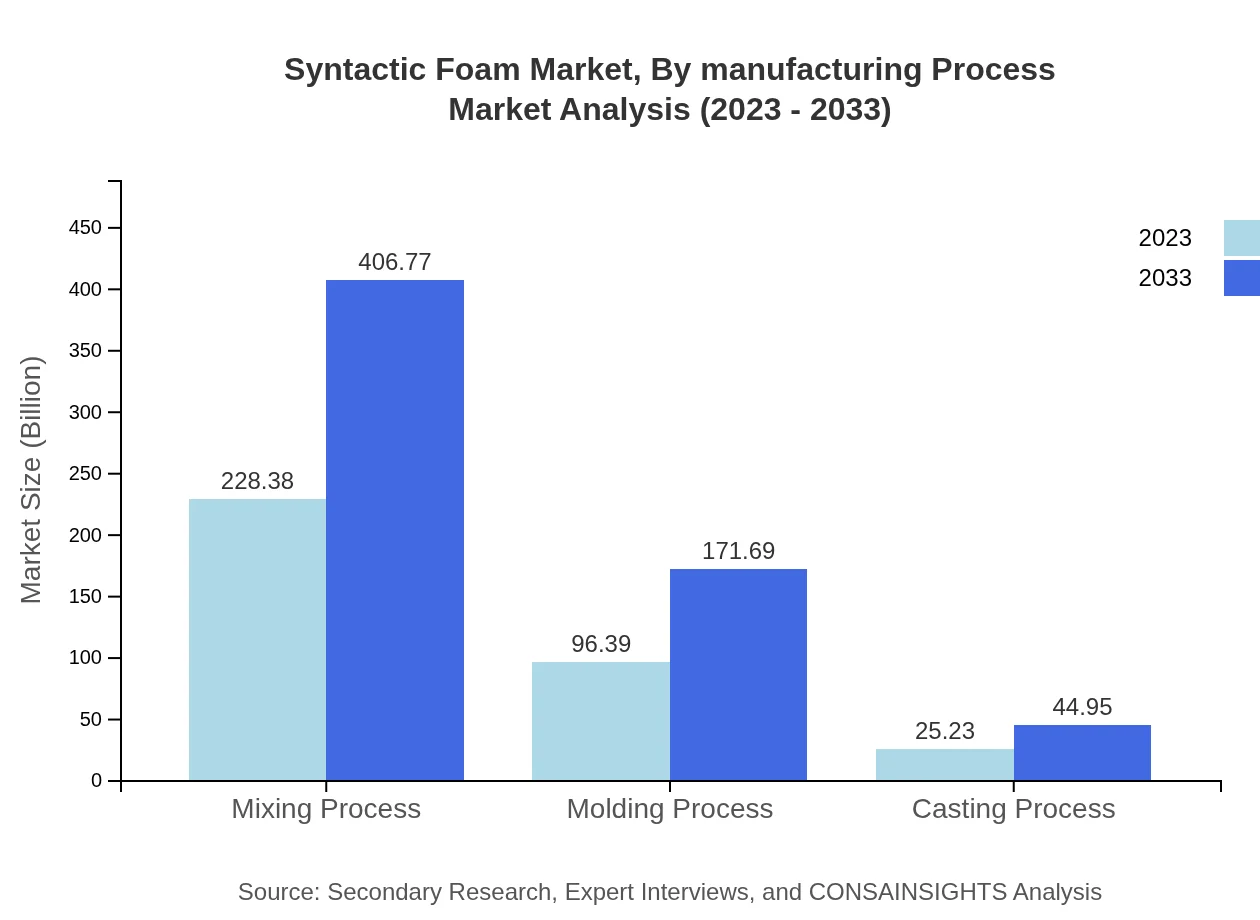

Syntactic Foam Market Analysis By Manufacturing Process

Manufacturing processes include mixing, molding, and casting. The mixing process is the most significant, showing a size of $228.38 million in 2023, growing to $406.77 million by 2033. Molding and casting processes follow with expected growth reflecting ongoing technological advancements.

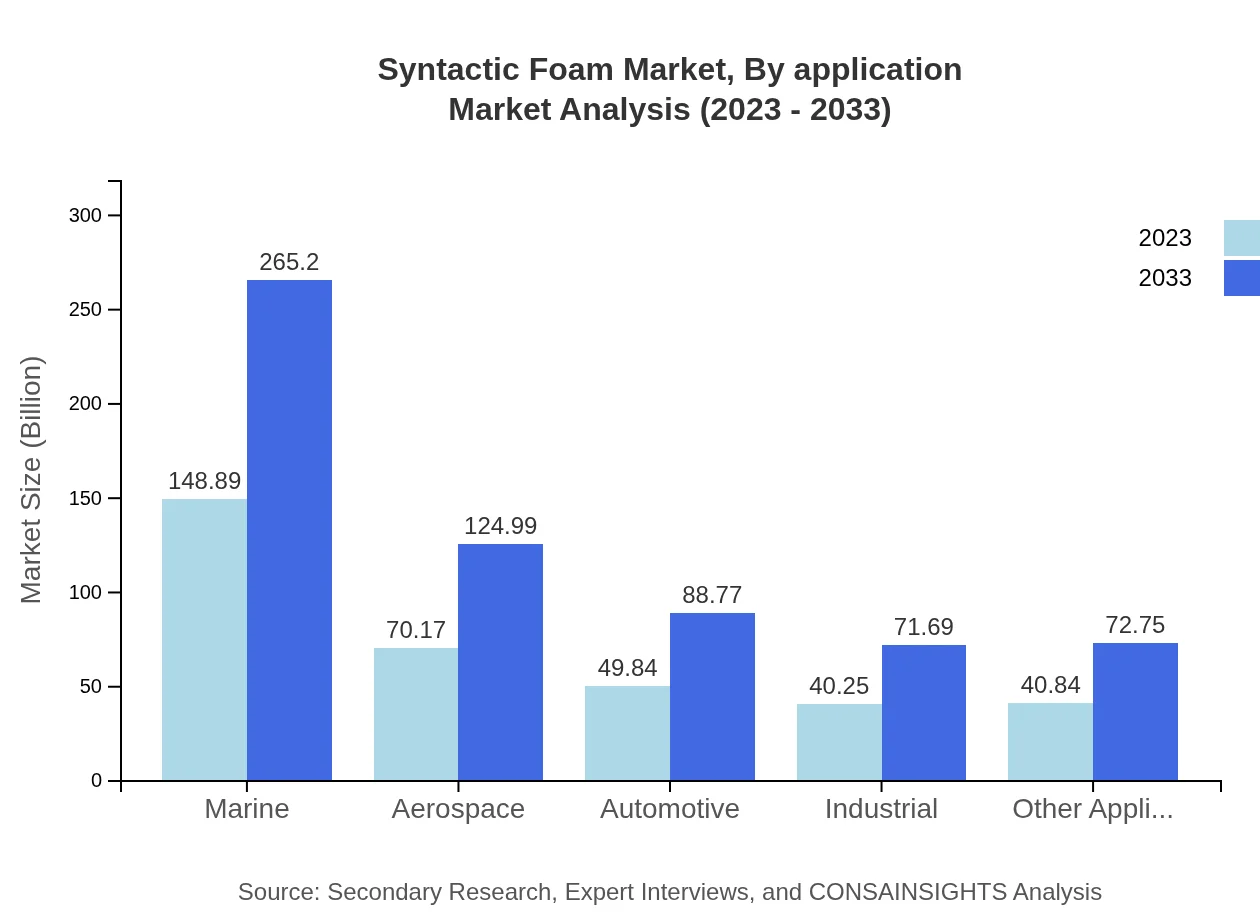

Syntactic Foam Market Analysis By End User

The end-user segments prominently include aerospace, automotive, and marine industries. Marine applications lead with a projected market of $148.89 million in 2023 to $265.20 million in 2033, encompassing 42.54% of the market share. Aerospace applications are also significant, expected to grow from $70.17 million to $124.99 million.

Syntactic Foam Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Syntactic Foam Industry

Rhetech, Inc.:

Rhetech is a leading global provider of engineered thermoplastic and thermosetting specialty materials, focusing on innovative syntactic foam solutions for aerospace and marine applications.Huntsman Corporation:

Huntsman is recognized for its advanced formulations of syntactic foams used in diverse applications, emphasizing sustainability and environmental responsibility.SABIC:

SABIC is a prominent player known for its innovative thermoplastic syntactic foams, enhancing performance in aerospace and automotive industries with a focus on lightweight materials.BASF SE:

BASF is a global chemical giant that provides high-performance syntactic foam products tailored to specific industry needs, leading in research and development.We're grateful to work with incredible clients.

FAQs

What is the market size of syntactic foam?

The global syntactic foam market is projected to reach approximately $350 million by 2033, growing at a CAGR of 5.8% from its current valuation. This growth is expected to be driven by increasing demand across various applications.

What are the key market players or companies in the syntactic foam industry?

Prominent companies in the syntactic foam industry include 3M, Huntsman Corporation, and General Plastics Manufacturing Company. These firms are recognized for their advancements in material science and product development, significantly influencing the market landscape.

What are the primary factors driving the growth in the syntactic foam industry?

Key growth drivers in the syntactic foam industry include advancements in technology, increasing demand from the aerospace and marine sectors, and the need for lightweight materials. These factors enable manufacturers to innovate and enhance product performance.

Which region is the fastest Growing in the syntactic foam?

The North America region is the fastest-growing in the syntactic foam market, expected to grow from $120.89 million in 2023 to $215.32 million by 2033. This surge is attributed to advancements in aerospace and defense applications.

Does ConsaInsights provide customized market report data for the syntactic foam industry?

Yes, ConsaInsights offers customized market report data tailored to the unique needs of stakeholders in the syntactic foam industry. This includes specific analyses based on regional and segment data.

What deliverables can I expect from this syntactic foam market research project?

Expect comprehensive market analysis, competitive landscape profiling, and trend forecasts as key deliverables in the syntactic foam market research project. Detailed regional and segment insights will also be included.

What are the market trends of syntactic foam?

Current trends in the syntactic foam market include the increasing adoption of environmentally friendly materials and the growing demand for high-performance solutions in aerospace and defense applications. Additionally, investment in R&D is rising.