Synthetic Diamond Market Report

Published Date: 02 February 2026 | Report Code: synthetic-diamond

Synthetic Diamond Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the synthetic diamond market, including detailed insights on market size, growth forecasts from 2023 to 2033, and an overview of key industry drivers, challenges, segments, and trends.

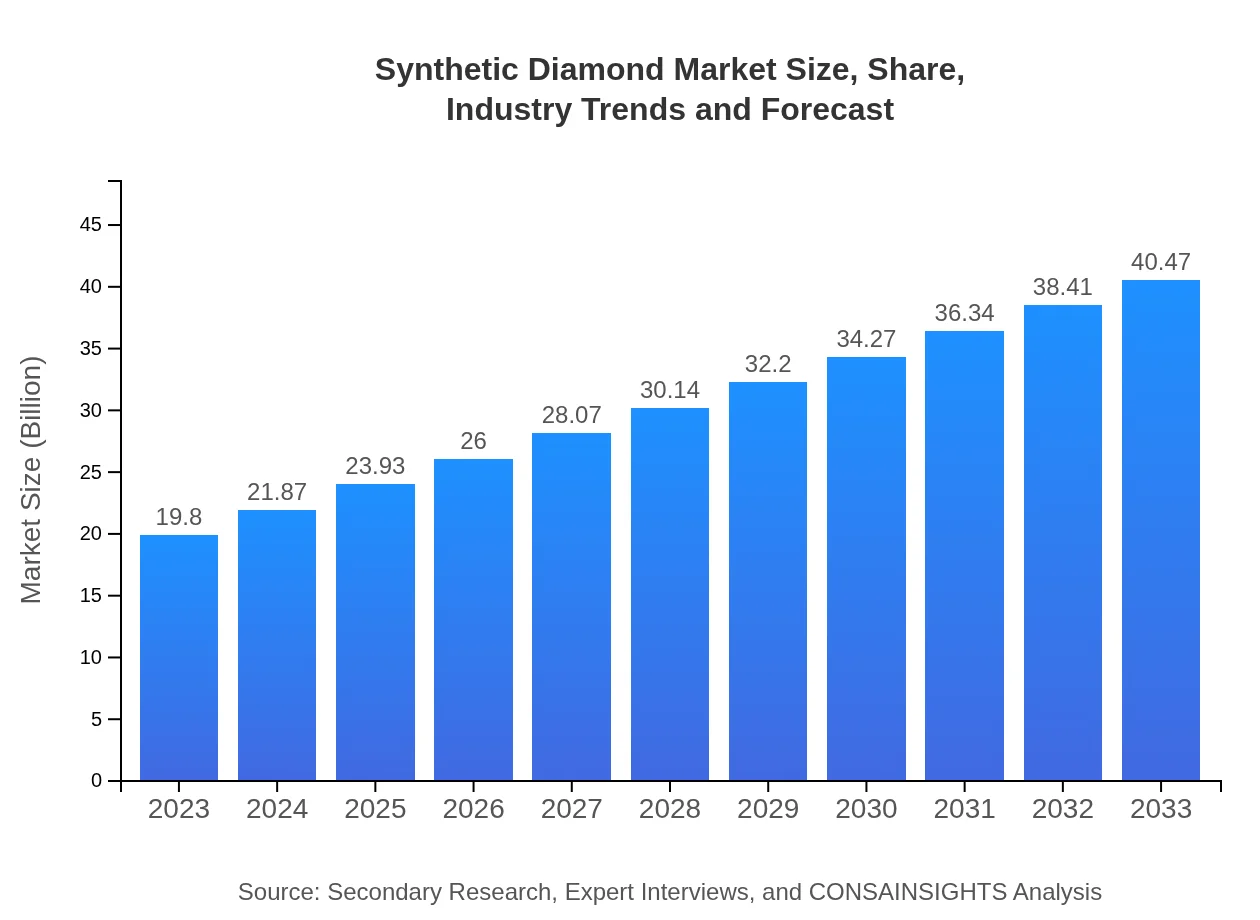

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $19.80 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $40.47 Billion |

| Top Companies | De Beers Group, Element Six, ALTR Created Diamonds, Diamonds Made in Space |

| Last Modified Date | 02 February 2026 |

Synthetic Diamond Market Overview

Customize Synthetic Diamond Market Report market research report

- ✔ Get in-depth analysis of Synthetic Diamond market size, growth, and forecasts.

- ✔ Understand Synthetic Diamond's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Synthetic Diamond

What is the Market Size & CAGR of Synthetic Diamond market in 2023?

Synthetic Diamond Industry Analysis

Synthetic Diamond Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Synthetic Diamond Market Analysis Report by Region

Europe Synthetic Diamond Market Report:

The European market is expected to grow from $5.81 billion in 2023 to $11.87 billion by 2033, driven by stringent regulations promoting sustainable resources and the demand for synthetic diamonds in luxury jewelry.Asia Pacific Synthetic Diamond Market Report:

The Asia Pacific region is expected to show significant growth, with a projected market size growing from $3.94 billion in 2023 to $8.06 billion by 2033. The rise is attributed to increasing industrial activity and demand for synthetic diamonds in electronics and jewelry.North America Synthetic Diamond Market Report:

North America’s market is forecasted to grow from $6.62 billion in 2023 to $13.53 billion by 2033, led by high demand for synthetic diamonds in manufacturing and technology sectors, bolstered by innovations in production techniques.South America Synthetic Diamond Market Report:

In South America, the market is expected to increase from $1.04 billion in 2023 to $2.12 billion by 2033. The growth is supported by expanding industrial applications and rising awareness of the benefits of synthetic vs. natural diamonds.Middle East & Africa Synthetic Diamond Market Report:

In the Middle East and Africa, the synthetic diamond market is projected to rise from $2.39 billion in 2023 to $4.89 billion by 2033, fueled by increasing construction activities and a growing interest in synthetic diamond applications in various industries.Tell us your focus area and get a customized research report.

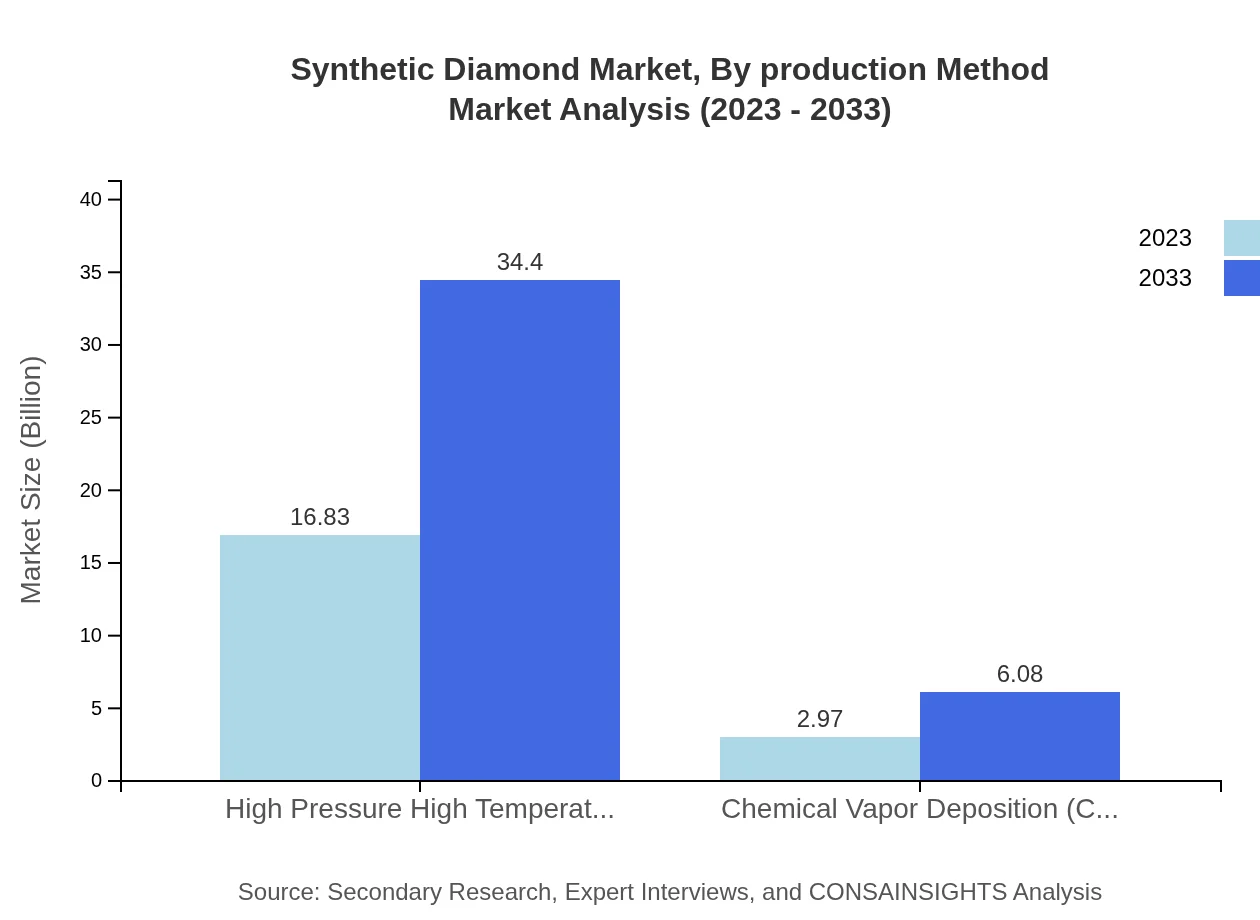

Synthetic Diamond Market Analysis By Production Method

The synthetic diamond market by production method comprises two primary types: High Pressure High Temperature (HPHT) and Chemical Vapor Deposition (CVD). HPHT diamonds represented approximately 84.99% of the market in 2023, valued at $16.83 billion. In contrast, CVD diamonds accounted for 15.01%, valued at $2.97 billion. By 2033, HPHT is projected to grow to $34.40 billion, while CVD will reach $6.08 billion.

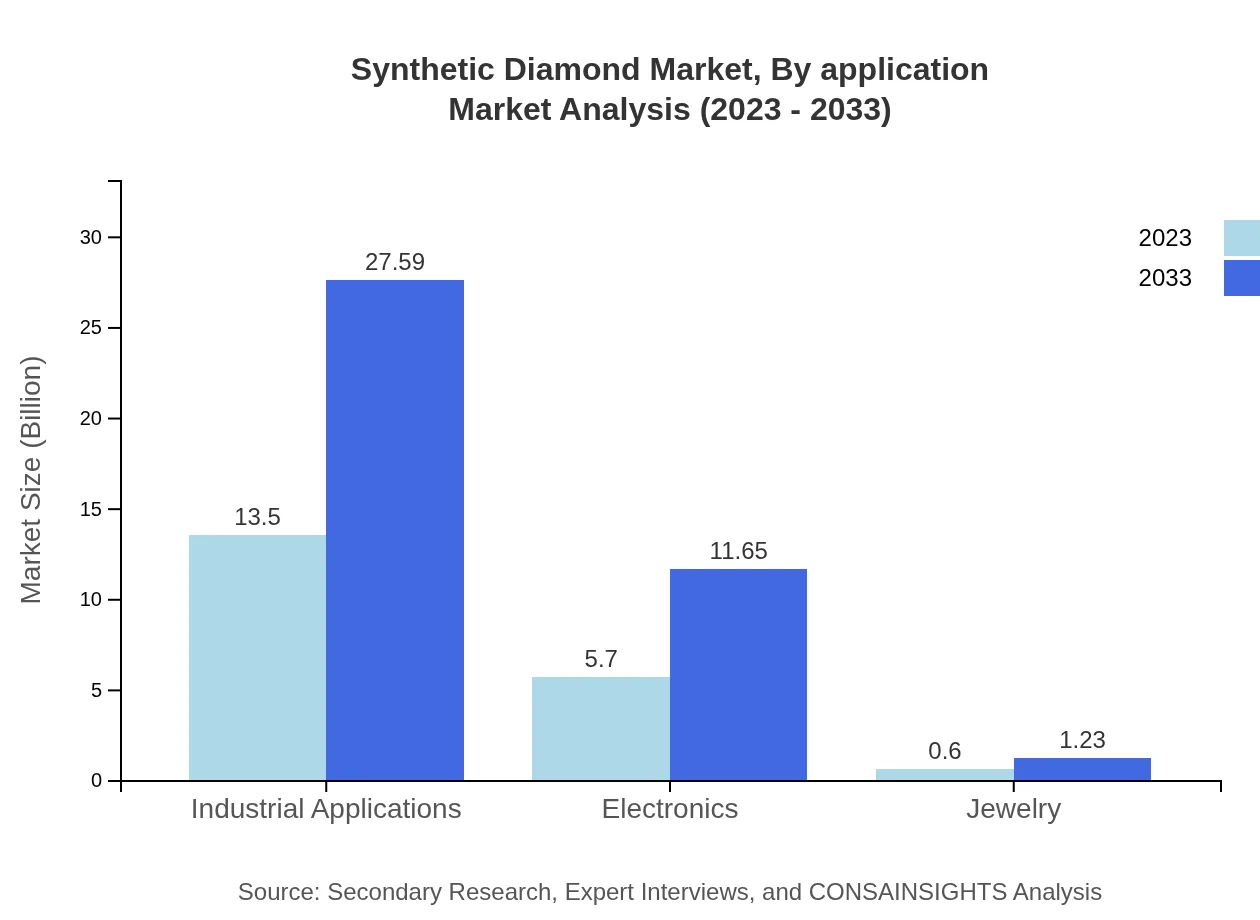

Synthetic Diamond Market Analysis By Application

The application segments of synthetic diamonds include jewelry, industrial uses, electronics, and construction. Industrial applications dominate the market, with a size of $13.50 billion in 2023, increasing to $27.59 billion by 2033. The jewelry segment, although smaller, is projected to grow from $0.60 billion to $1.23 billion in the same timeframe.

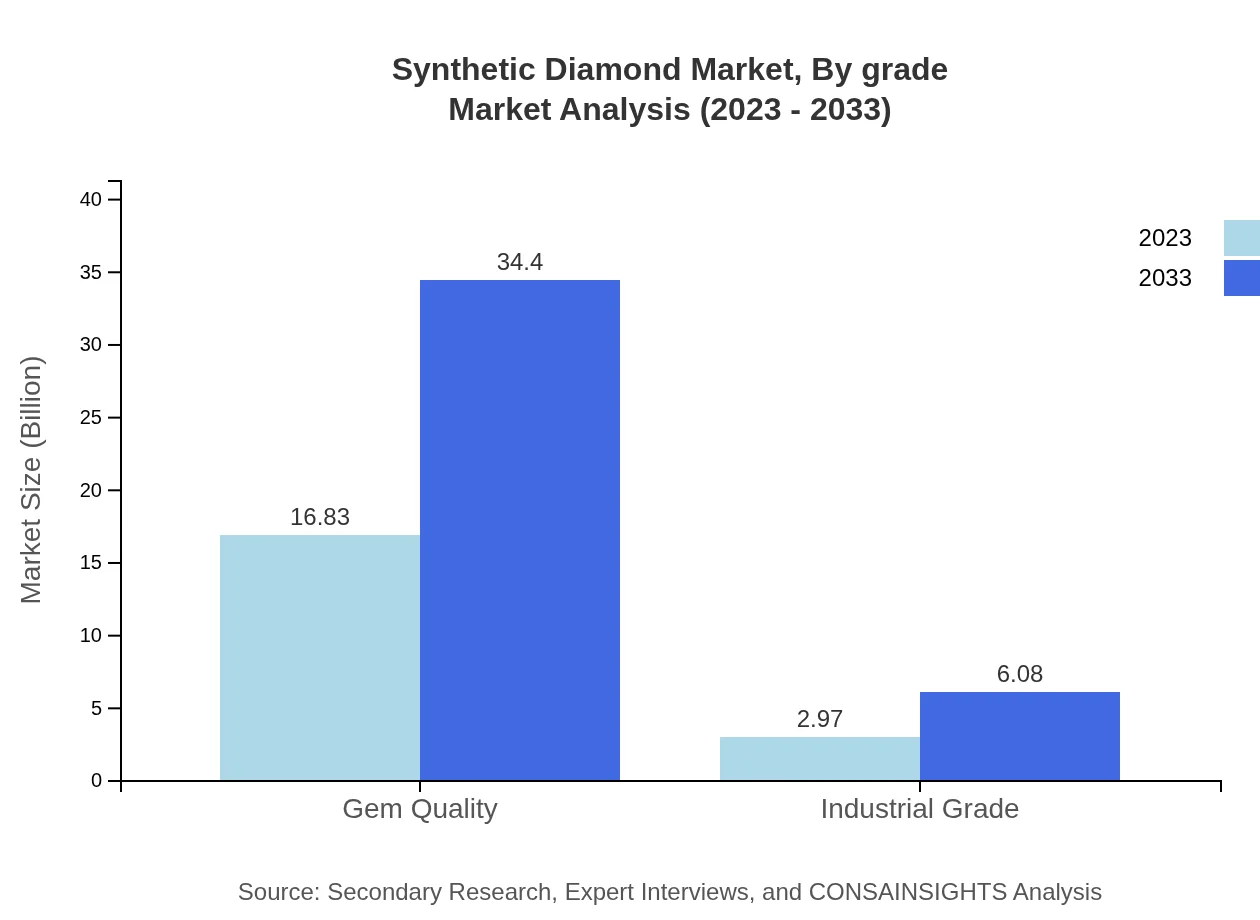

Synthetic Diamond Market Analysis By Grade

The market is divided into gem-quality and industrial-grade diamonds. The gem-quality sector encompasses luxury jewelry applications, valued at $16.83 billion in 2023 and projected to grow to $34.40 billion by 2033. In contrast, industrial-grade diamonds, critical for manufacturing, are anticipated to rise from $2.97 billion to $6.08 billion over the same period.

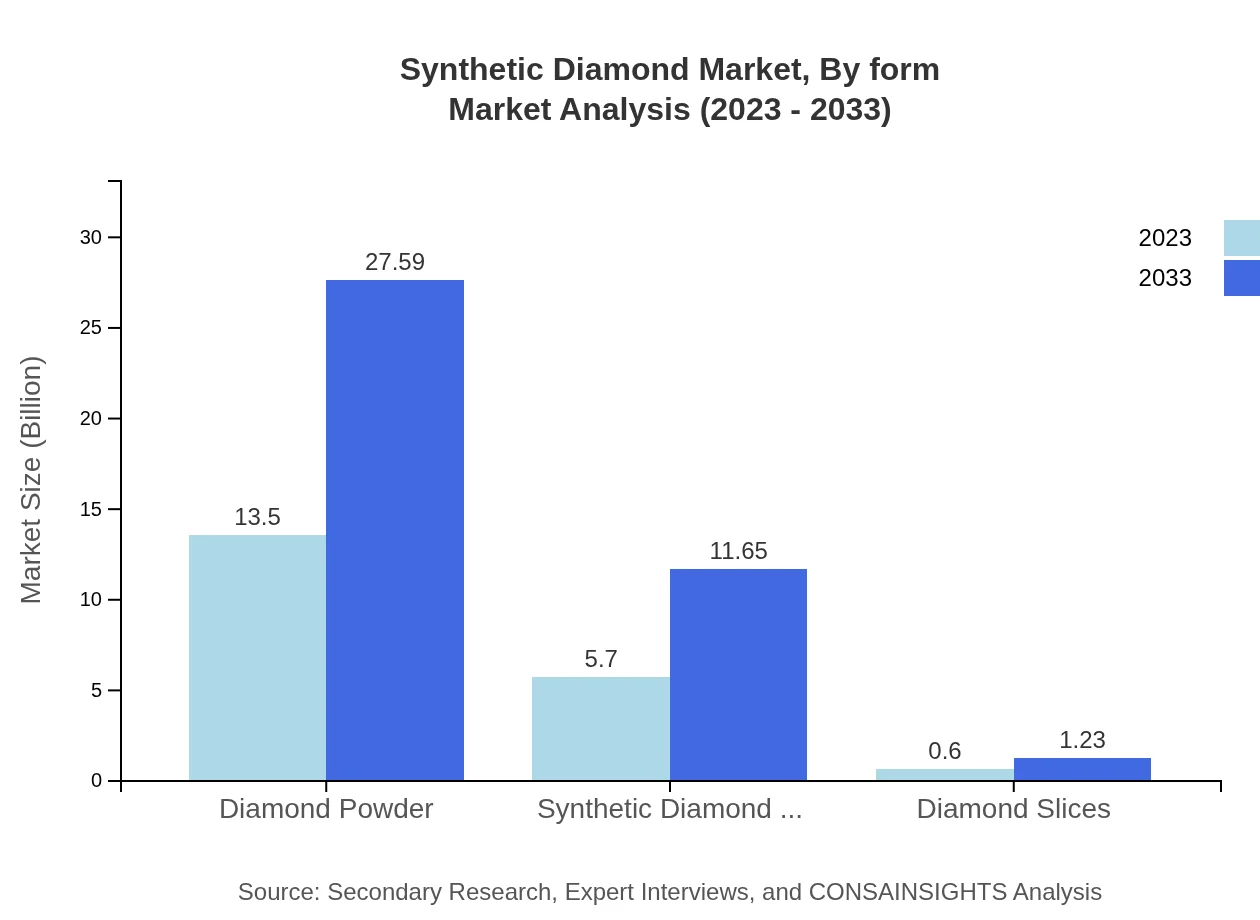

Synthetic Diamond Market Analysis By Form

Form segmentation consists of diamond powder, synthetic diamond crystals, and diamond slices. Diamond powder holds the largest share, valued at $13.50 billion in 2023 and expected to reach $27.59 billion by 2033. Synthetic diamond crystals follow, with a market size of $5.70 billion in 2023, projected to grow to $11.65 billion.

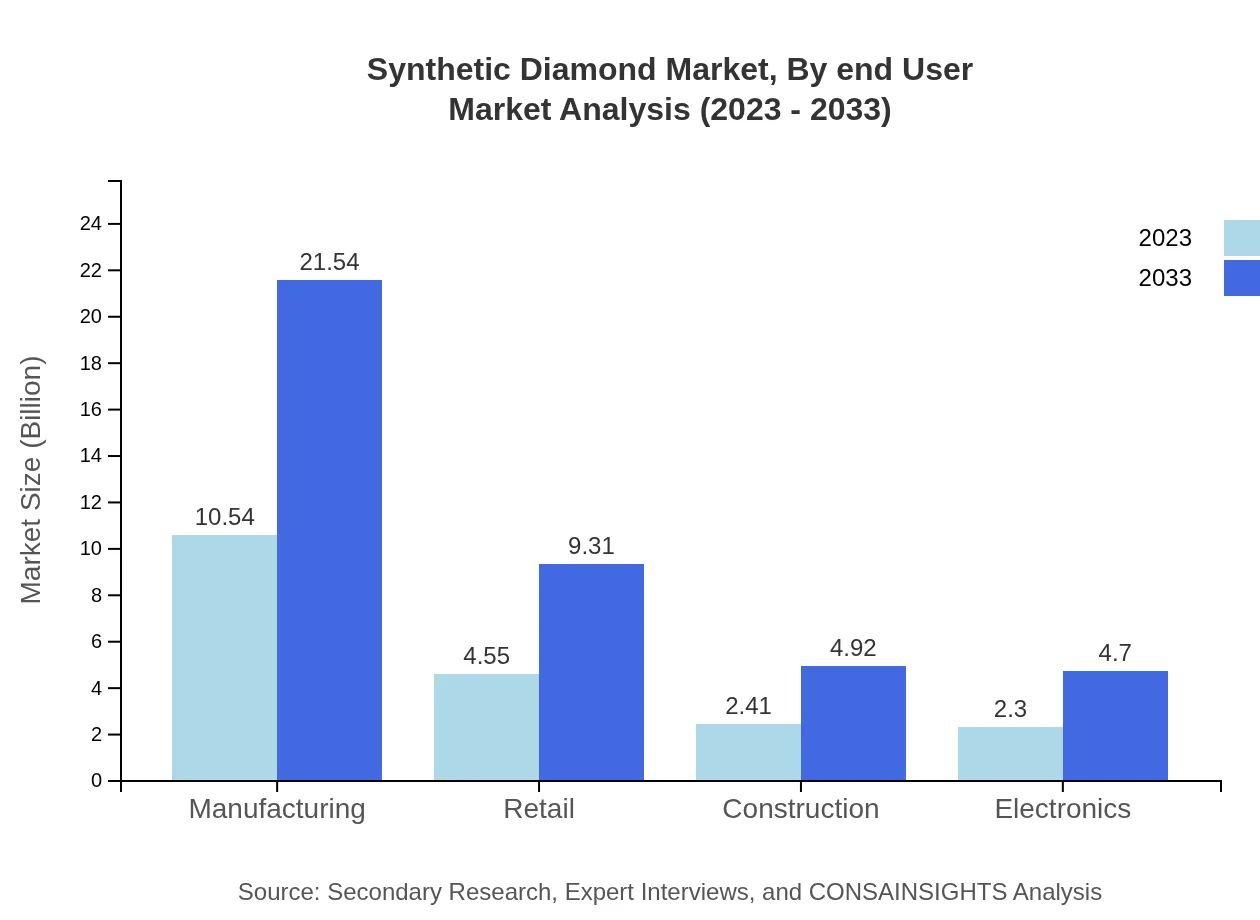

Synthetic Diamond Market Analysis By End User

End-users include manufacturing, retail, electronics, and construction sectors. Manufacturing is the leading segment, expected to grow from $10.54 billion in 2023 to $21.54 billion by 2033. Retail, while smaller, will see growth from $4.55 billion to $9.31 billion during the same period.

Synthetic Diamond Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Synthetic Diamond Industry

De Beers Group:

A leading player in both natural and synthetic diamonds, known for its innovation and commitment to sustainability and ethical sourcing.Element Six:

Specializes in industrial synthetic diamonds, providing advanced solutions for various applications in manufacturing and technology.ALTR Created Diamonds:

Focuses on producing high-quality synthetic diamonds for the jewelry market, ensuring ethically sourced products.Diamonds Made in Space:

Innovates in the creation of diamonds using unique methods, targeting niche markets and high-value applications.We're grateful to work with incredible clients.

FAQs

What is the market size of synthetic Diamond?

The global synthetic diamond market is projected to reach approximately $19.8 billion by 2033, with a compound annual growth rate (CAGR) of 7.2% from 2023 onward.

What are the key market players or companies in the synthetic Diamond industry?

Key players in the synthetic diamond market include Diamond Foundry, De Beers Group, and Planetary Resources. These companies lead innovations and production capacity, contributing significantly to the overall market landscape.

What are the primary factors driving the growth in the synthetic diamond industry?

Growth drivers include the increasing demand for synthetic diamonds in industrial applications, advancements in production technology, and a rising preference for ethical and sustainable jewelry options among consumers.

Which region is the fastest growing in the synthetic diamond market?

The North American region is projected to witness the fastest growth, with the market increasing from $6.62 billion in 2023 to $13.53 billion by 2033.

Does ConsaInsights provide customized market report data for the synthetic diamond industry?

Yes, ConsaInsights offers customized market report data tailored to specific inquiries and business needs within the synthetic diamond industry.

What deliverables can I expect from this synthetic diamond market research project?

Deliverables include detailed market analysis, regional insights, segment performance reports, and strategic recommendations to inform investment decisions in the synthetic diamond sector.

What are the market trends of synthetic diamond?

Current trends in the synthetic diamond market include the growth of e-commerce channels for diamond sales, increasing applications in advanced electronics, and a surge in demand for lab-grown diamonds in jewelry.