Synthetic Graphite Market Report

Published Date: 02 February 2026 | Report Code: synthetic-graphite

Synthetic Graphite Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Synthetic Graphite market, including market size, growth trends, and segmentation. Insights cover the years 2023 to 2033, focusing on industry dynamics, regional analysis, and future forecasts.

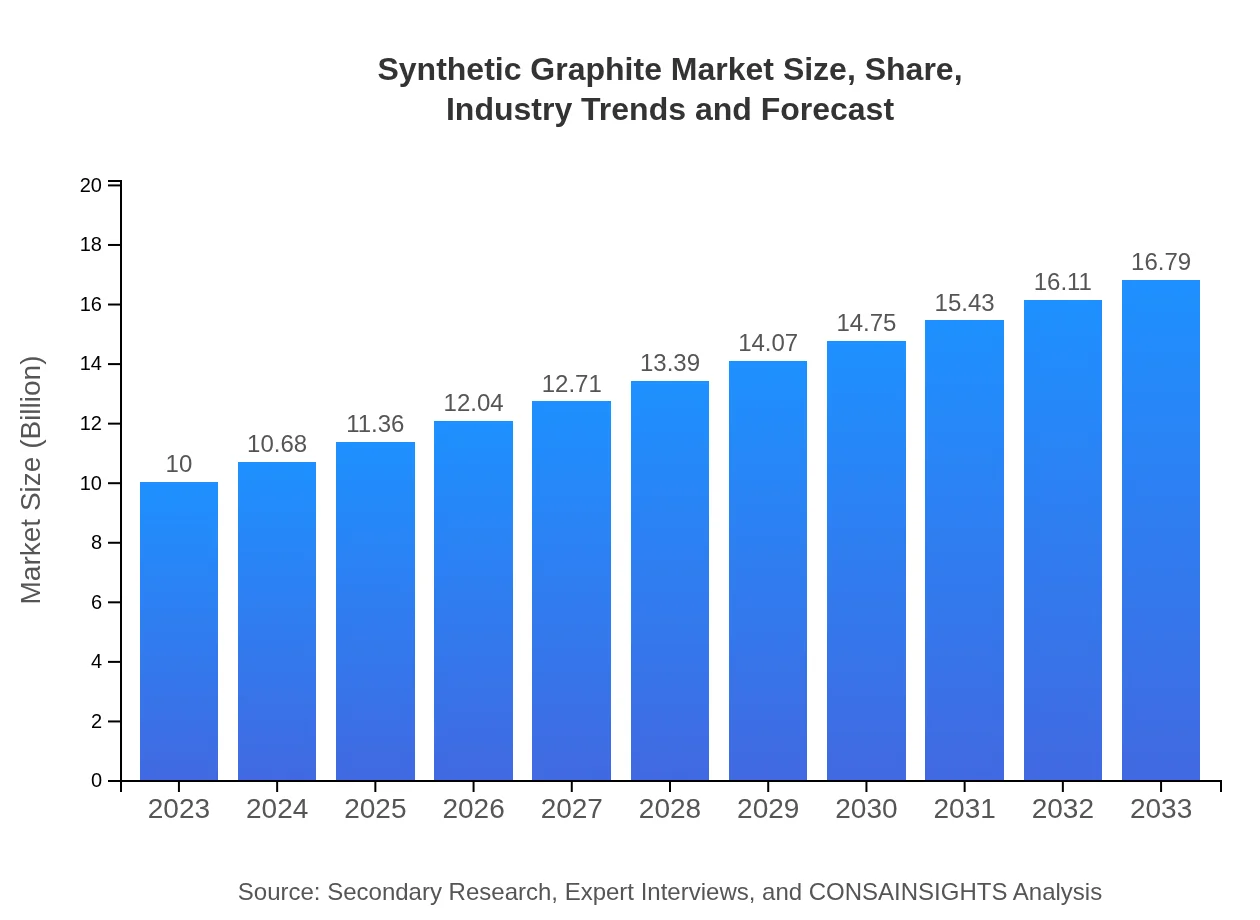

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $16.79 Billion |

| Top Companies | Graphite India Ltd., SGL Carbon, Mason Graphite |

| Last Modified Date | 02 February 2026 |

Synthetic Graphite Market Overview

Customize Synthetic Graphite Market Report market research report

- ✔ Get in-depth analysis of Synthetic Graphite market size, growth, and forecasts.

- ✔ Understand Synthetic Graphite's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Synthetic Graphite

What is the Market Size & CAGR of Synthetic Graphite market in 2023?

Synthetic Graphite Industry Analysis

Synthetic Graphite Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Synthetic Graphite Market Analysis Report by Region

Europe Synthetic Graphite Market Report:

Europe represents a market size of $3.45 billion in 2023, projected to increase to $5.78 billion by 2033. The region has been at the forefront of adopting sustainable practices and technologies, with an increasing shift towards green energy solutions driving the demand for synthetic graphite.Asia Pacific Synthetic Graphite Market Report:

In 2023, the Asia Pacific region holds a significant market share valued at $1.71 billion, projected to reach $2.87 billion by 2033. The rapid industrialization, coupled with growing demand in battery production, has significantly boosted the region's synthetic graphite market. Countries like China and Japan are leading producers, driven by their strong automotive and electronics sectors.North America Synthetic Graphite Market Report:

North America, valued at $3.40 billion in 2023, is anticipated to expand to $5.71 billion by 2033. The region's growth is propelled by the rapid adoption of electric vehicles and advancements in battery technology, alongside regulatory support for cleaner technologies.South America Synthetic Graphite Market Report:

The South American market is estimated at $0.62 billion in 2023 and is expected to grow to $1.04 billion by 2033. The burgeoning demand for clean energy solutions and investments in mining industries are likely to drive growth, although market development is slower compared to other regions.Middle East & Africa Synthetic Graphite Market Report:

The Middle East and Africa market is currently valued at $0.83 billion in 2023, with expectations to reach $1.38 billion by 2033. The growth in this region is slow but steady, influenced by investments in renewable energy and advances in industrial manufacturing.Tell us your focus area and get a customized research report.

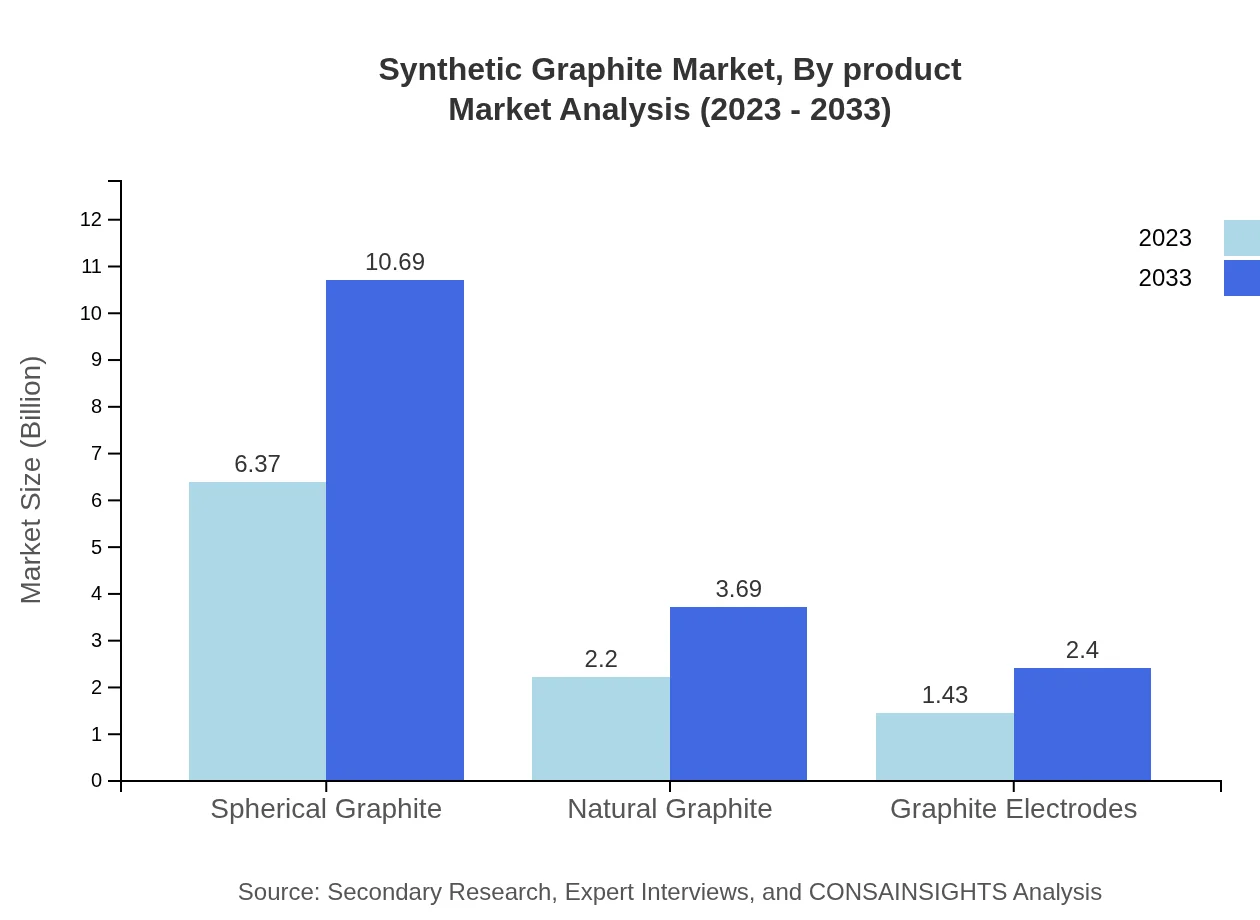

Synthetic Graphite Market Analysis By Product

High Purity Synthetic Graphite is projected to grow from $6.37 billion in 2023 to $10.69 billion by 2033, holding a share of 63.67%. Medium Grade Synthetic Graphite is forecasted from $2.20 billion to $3.69 billion with a 22.01% share. Low Grade Synthetic Graphite is set to rise from $1.43 billion to $2.40 billion, maintaining a 14.32% market share, primarily focusing on cost-sensitive applications. Spherical Graphite equally reflects growth from $6.37 billion to $10.69 billion, underlining its importance in battery technology.

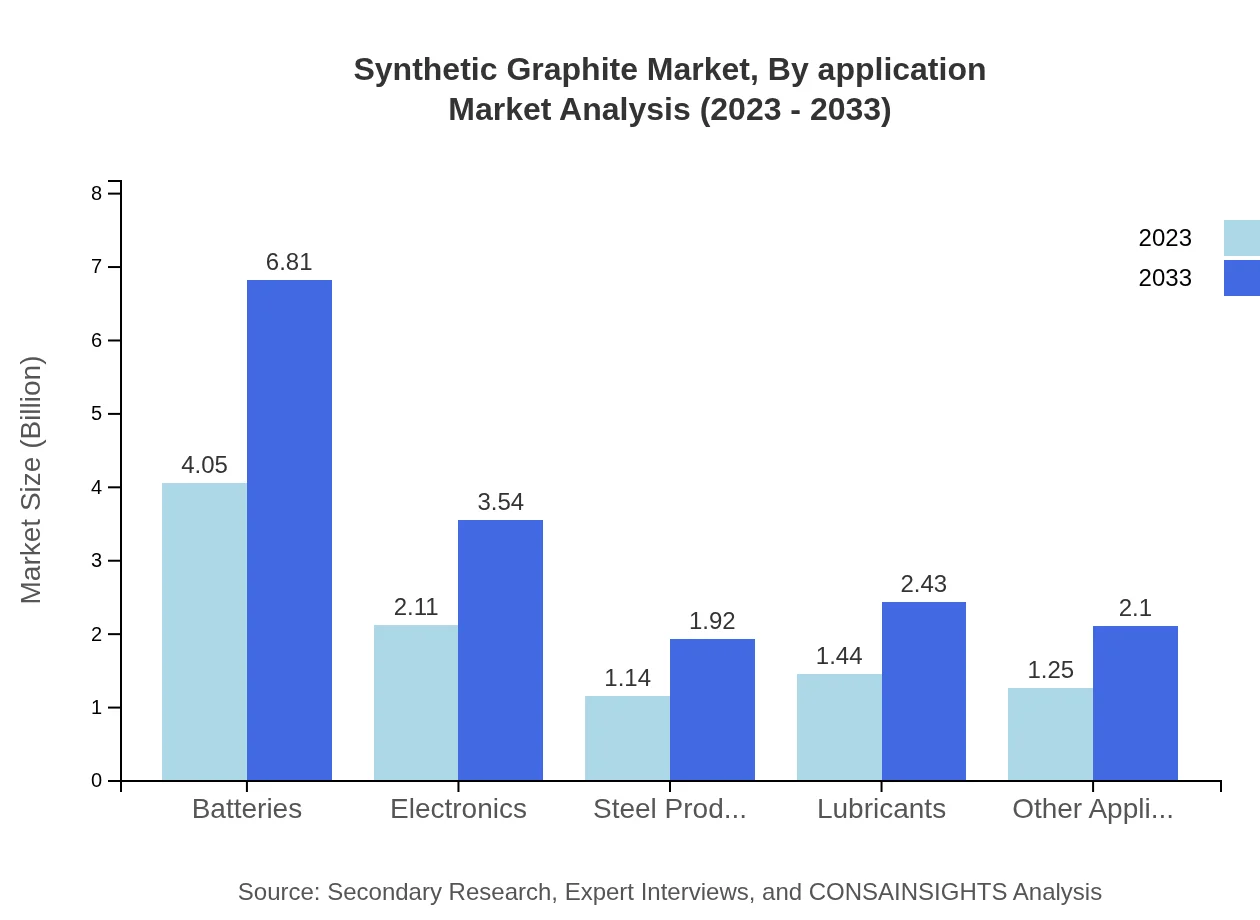

Synthetic Graphite Market Analysis By Application

Applications in Batteries dominate the market, projected to maintain a 40.54% share, growing from $4.05 billion to $6.81 billion. Electronics applications are anticipated to grow from $2.11 billion to $3.54 billion, capturing 21.09% of the market share. The Automotive sector is seeing an increase alongside Aerospace, Renewable Energy, Lubricants, and Other Applications, each contributing to the overall growth but at varying paces, reflecting diversified usage across different sectors.

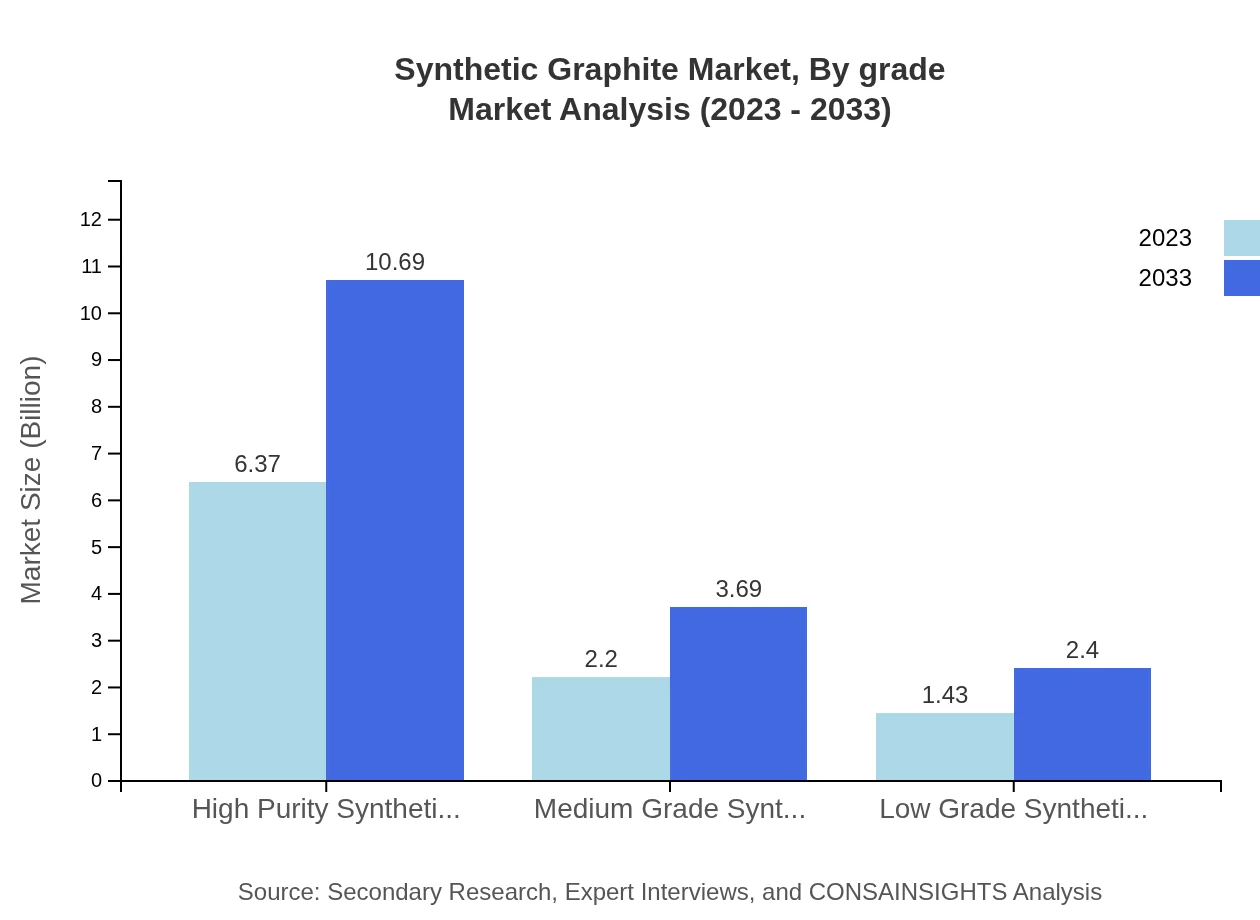

Synthetic Graphite Market Analysis By Grade

High Purity Synthetic Graphite remains the largest segment, reflecting significant demand from high-end applications. Market trends indicate stable growth for Medium Grade and Low Grade options, although they cater to different industrial needs with expected slower growth rates than their high purity counterparts.

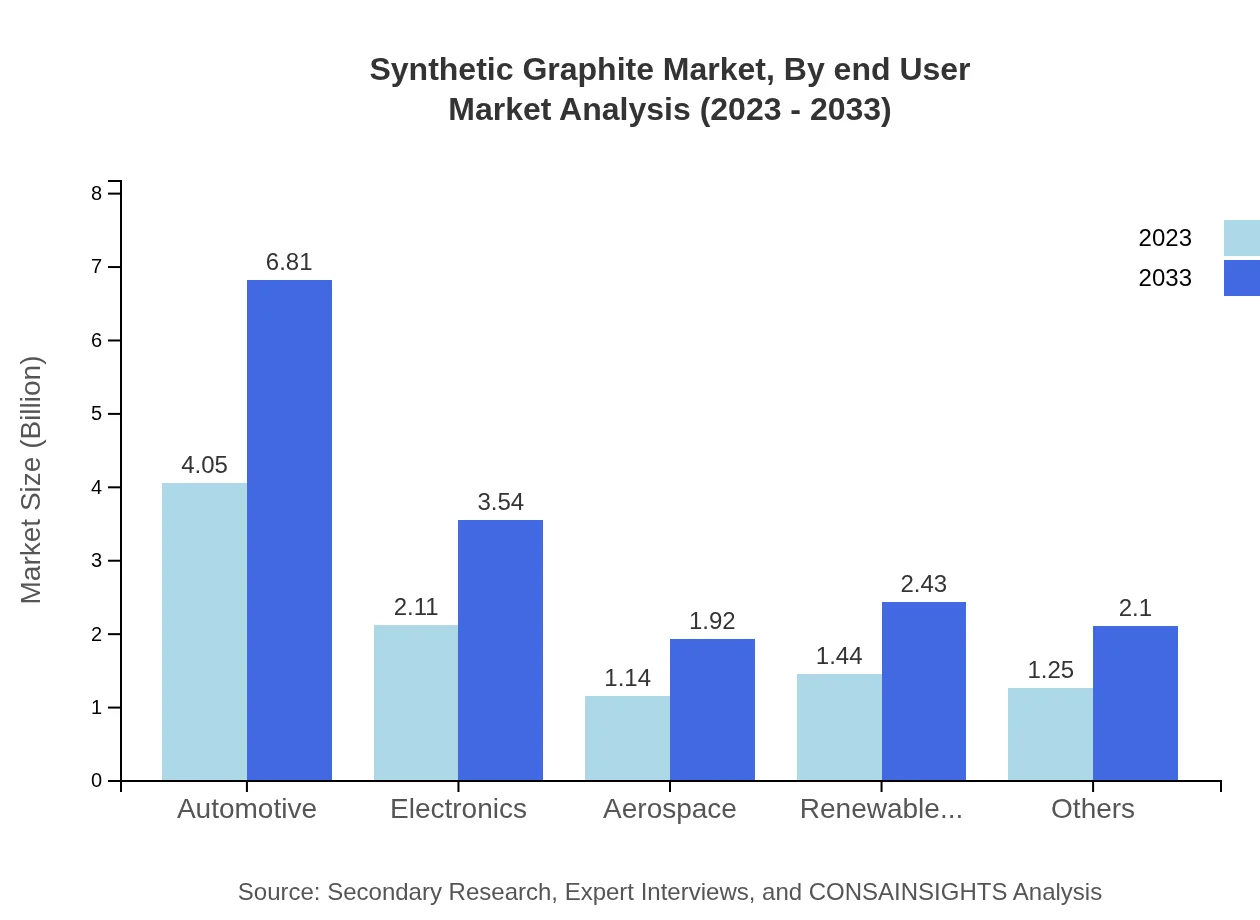

Synthetic Graphite Market Analysis By End User

The Automotive industry leads as the largest consumer, followed by the Electronics sector. Other end-user industries, such as Aerospace and Energy, are also anticipated to grow, influenced by technological advancements and an increasing focus on electric mobility and renewable resources, solidifying the importance of synthetic graphite across various applications.

Synthetic Graphite Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Synthetic Graphite Industry

Graphite India Ltd.:

A major player in the synthetic graphite industry, renowned for its extensive product portfolio, including various grades and applications, and commitment to sustainability.SGL Carbon:

Known for its high-quality graphite products, SGL Carbon leads in innovation and R&D efforts, focusing on developing advanced solutions for battery and electronics applications.Mason Graphite:

Emphasizes on high purity graphite production with a focus on sustainable practices. Mason Graphite is well-positioned in the electric vehicle battery manufacturing segment.We're grateful to work with incredible clients.

FAQs

What is the market size of synthetic graphite?

The global synthetic graphite market is valued at approximately $10 billion in 2023, with a projected growth rate (CAGR) of 5.2% expected to continue until 2033.

What are the key market players or companies in the synthetic graphite industry?

Key players in the synthetic graphite industry include major manufacturing companies and suppliers, who contribute significantly to market innovation and production capabilities, although detailed names are not specified here.

What are the primary factors driving the growth in the synthetic graphite industry?

The growth in the synthetic graphite industry is driven by the increasing demand for batteries in electric vehicles and renewable energy systems, as well as advancements in electronics and aerospace applications that require high-performance materials.

Which region is the fastest Growing in the synthetic graphite market?

The fastest-growing region for synthetic graphite is Europe, with a forecasted market increase from $3.45 billion in 2023 to $5.78 billion by 2033, reflecting a strong demand for advanced materials.

Does ConsaInsights provide customized market report data for the synthetic graphite industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the synthetic graphite industry, enabling clients to obtain detailed insights and analytics that cater to their research objectives.

What deliverables can I expect from this synthetic graphite market research project?

Expected deliverables from the synthetic graphite market research project include comprehensive market analysis reports, trend forecasts, competitive landscape assessments, and segmented data by application and geography.

What are the market trends of synthetic graphite?

Current market trends in synthetic graphite include the rise of high-purity synthetic grades for advanced applications, increasing integration in electric vehicle manufacturing, and enhancements in production technologies for better efficiency.