Synthetic Lubricants Market Report

Published Date: 02 February 2026 | Report Code: synthetic-lubricants

Synthetic Lubricants Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Synthetic Lubricants market, offering insights into market size, growth trends, segmentation, regional analysis, and forecasts for the year 2023 to 2033.

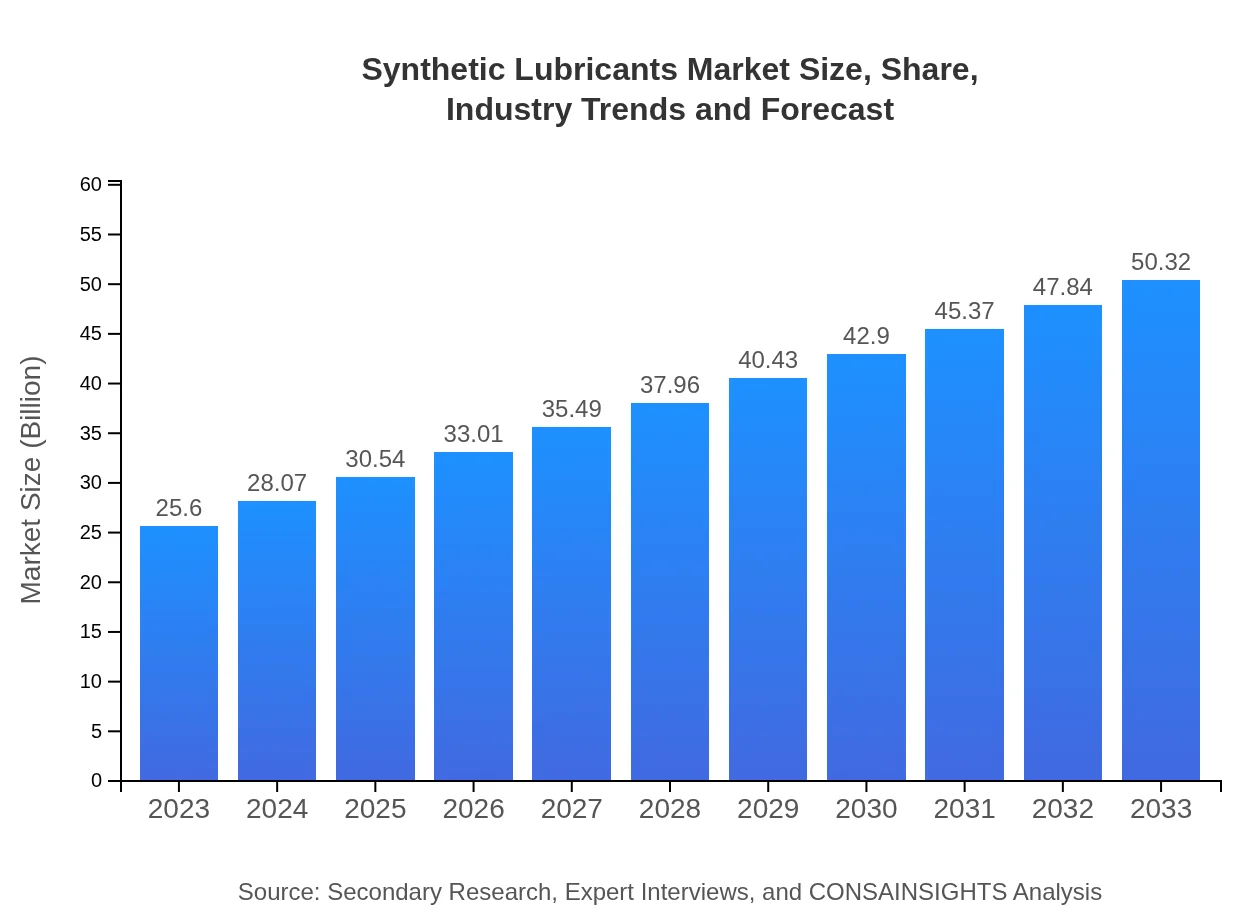

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $25.60 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $50.32 Billion |

| Top Companies | Exxon Mobil Corporation, Royal Dutch Shell, BP PLC, TotalEnergies, Castrol Limited |

| Last Modified Date | 02 February 2026 |

Synthetic Lubricants Market Overview

Customize Synthetic Lubricants Market Report market research report

- ✔ Get in-depth analysis of Synthetic Lubricants market size, growth, and forecasts.

- ✔ Understand Synthetic Lubricants's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Synthetic Lubricants

What is the Market Size & CAGR of Synthetic Lubricants market in 2023?

Synthetic Lubricants Industry Analysis

Synthetic Lubricants Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Synthetic Lubricants Market Analysis Report by Region

Europe Synthetic Lubricants Market Report:

Europe's market for synthetic lubricants is anticipated to increase from $6.32 billion in 2023 to $12.42 billion in 2033. The emphasis on sustainability and innovation in lubricant formulations are key factors supporting market expansion in this region.Asia Pacific Synthetic Lubricants Market Report:

The Asia Pacific region is expected to witness significant growth in the Synthetic Lubricants market from $5.21 billion in 2023 to $10.24 billion in 2033. Key factors driving this growth include increased industrialization, rising automotive production, and growing environmental awareness leading to the adoption of synthetic lubricants.North America Synthetic Lubricants Market Report:

North America holds a significant share of the Synthetic Lubricants market, projected to grow from $8.27 billion in 2023 to $16.25 billion by 2033. The growth is driven by the presence of major automotive manufacturers and stringent environmental regulations promoting the use of high-performance lubricants.South America Synthetic Lubricants Market Report:

In South America, the market is projected to grow from $2.29 billion in 2023 to $4.49 billion in 2033. Economic growth and expanding industrial activities are boosting the demand for synthetic lubricants, especially in the automotive and manufacturing sectors.Middle East & Africa Synthetic Lubricants Market Report:

The Middle East and Africa region is expected to grow from $3.52 billion in 2023 to $6.91 billion in 2033. Increasing oil production activities and the striving for efficiency in machinery operation contribute to this growth.Tell us your focus area and get a customized research report.

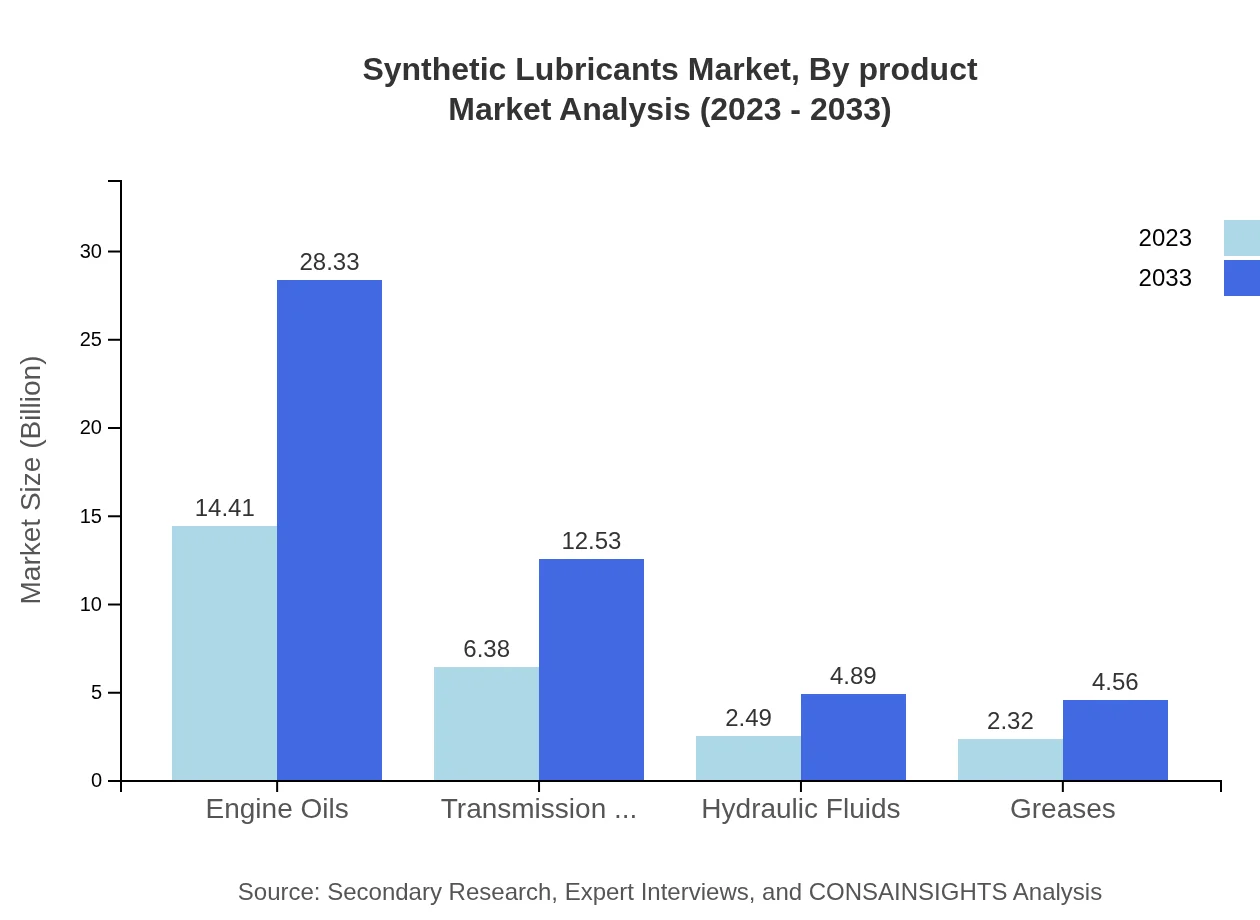

Synthetic Lubricants Market Analysis By Product

In the Synthetic Lubricants market, Engine Oils represent the largest segment with a market size of $14.41 billion in 2023, growing to $28.33 billion by 2033, holding a 56.3% market share. Transmission Fluids follow, with a 2023 market size of $6.38 billion, projected to reach $12.53 billion by 2033 (24.91% share). Other significant segments include Hydraulic Fluids and Greases, each growing steadily over the forecast period.

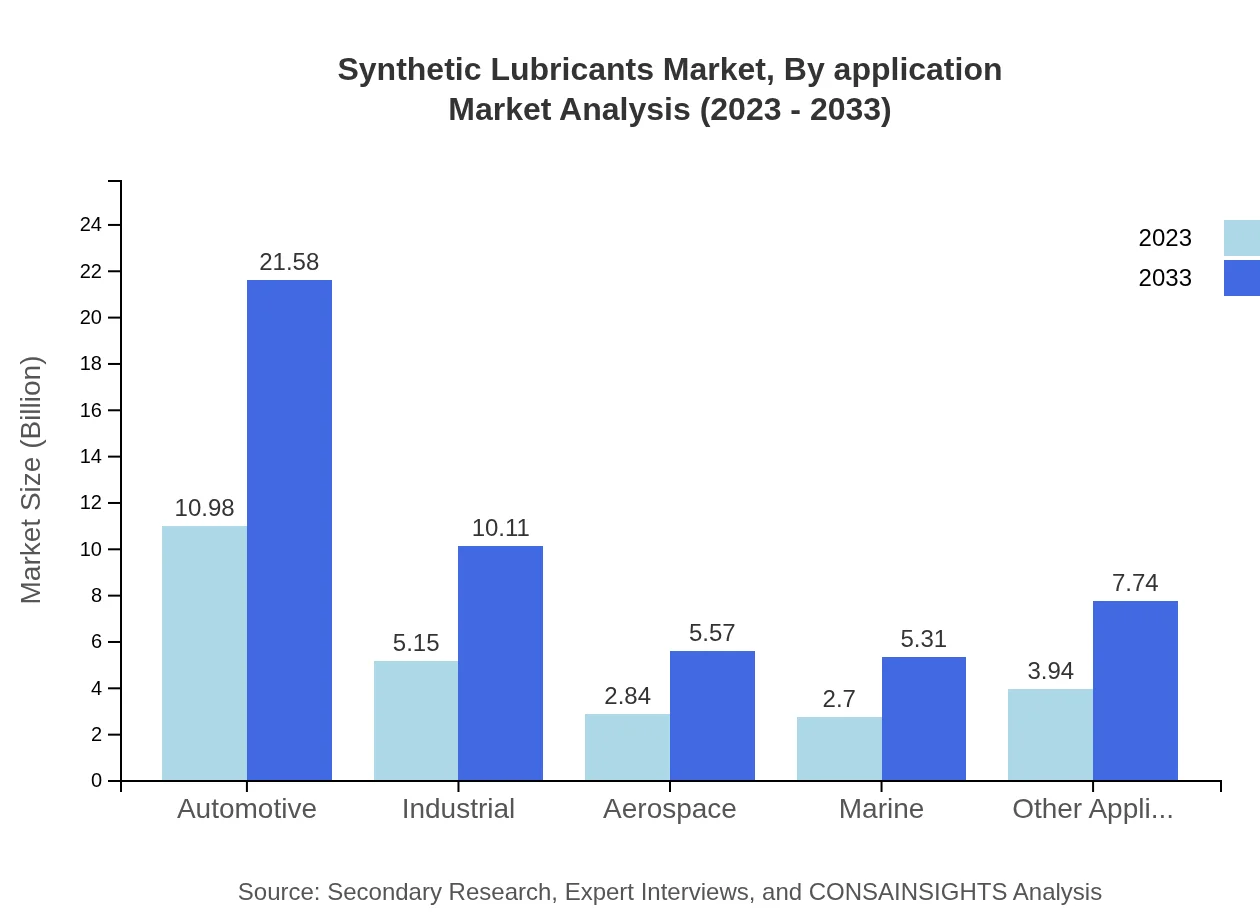

Synthetic Lubricants Market Analysis By Application

The Automotive segment dominates the application chart with a value of $10.98 billion in 2023, anticipated to reach $21.58 billion by 2033 (42.89% share). The Industrial and Energy & Power segments are also noteworthy with respective sizes of $5.15 billion and $2.84 billion in 2023, highlighting the broad applicability of synthetic lubricants.

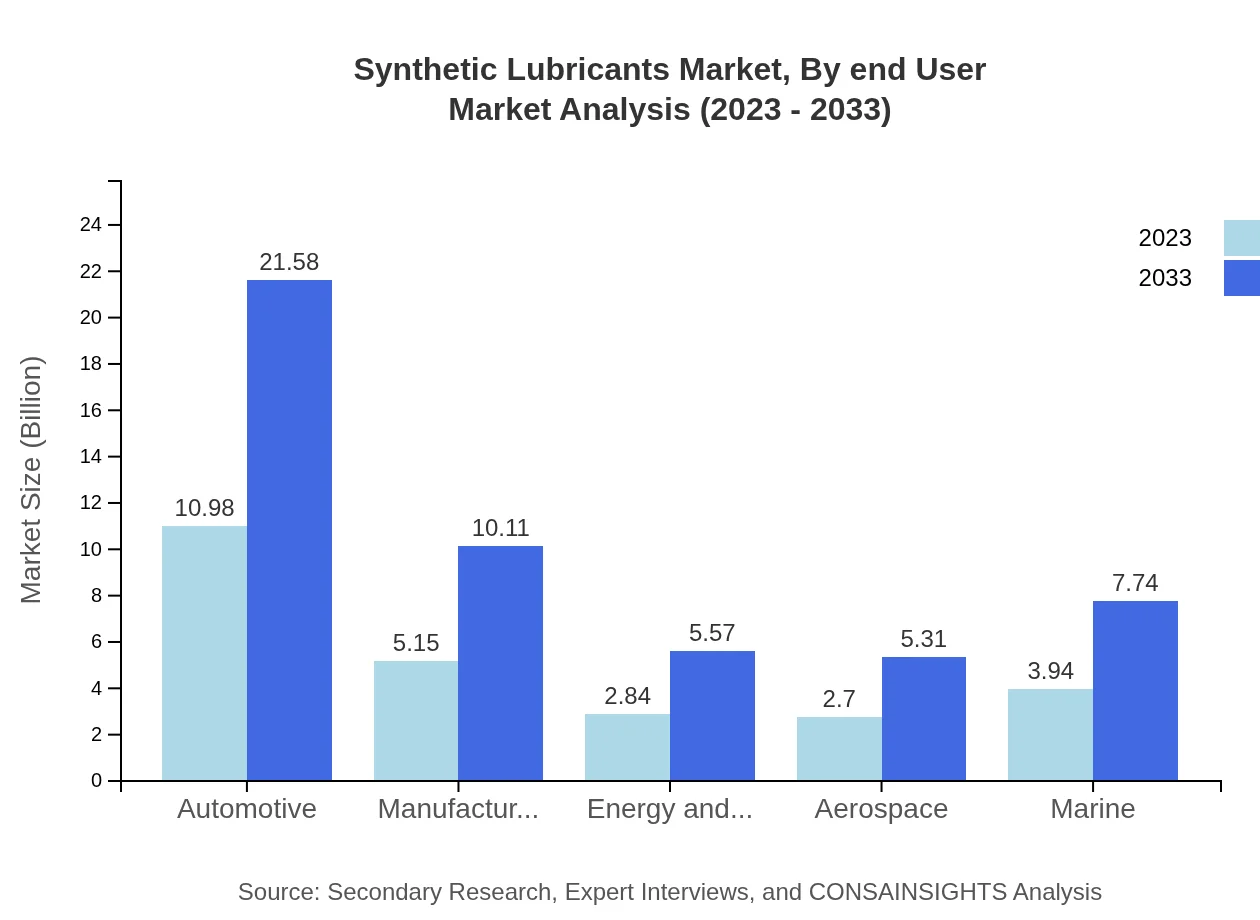

Synthetic Lubricants Market Analysis By End User

End-user industries such as Automotive and Industrial are the primary consumers of synthetic lubricants. Automotive usage is projected at $10.98 billion in 2023, while Industrial applications stand at $5.15 billion. Other sectors, like Aerospace and Marine, are also key contributors, showcasing the versatility of synthetic lubricants across various industries.

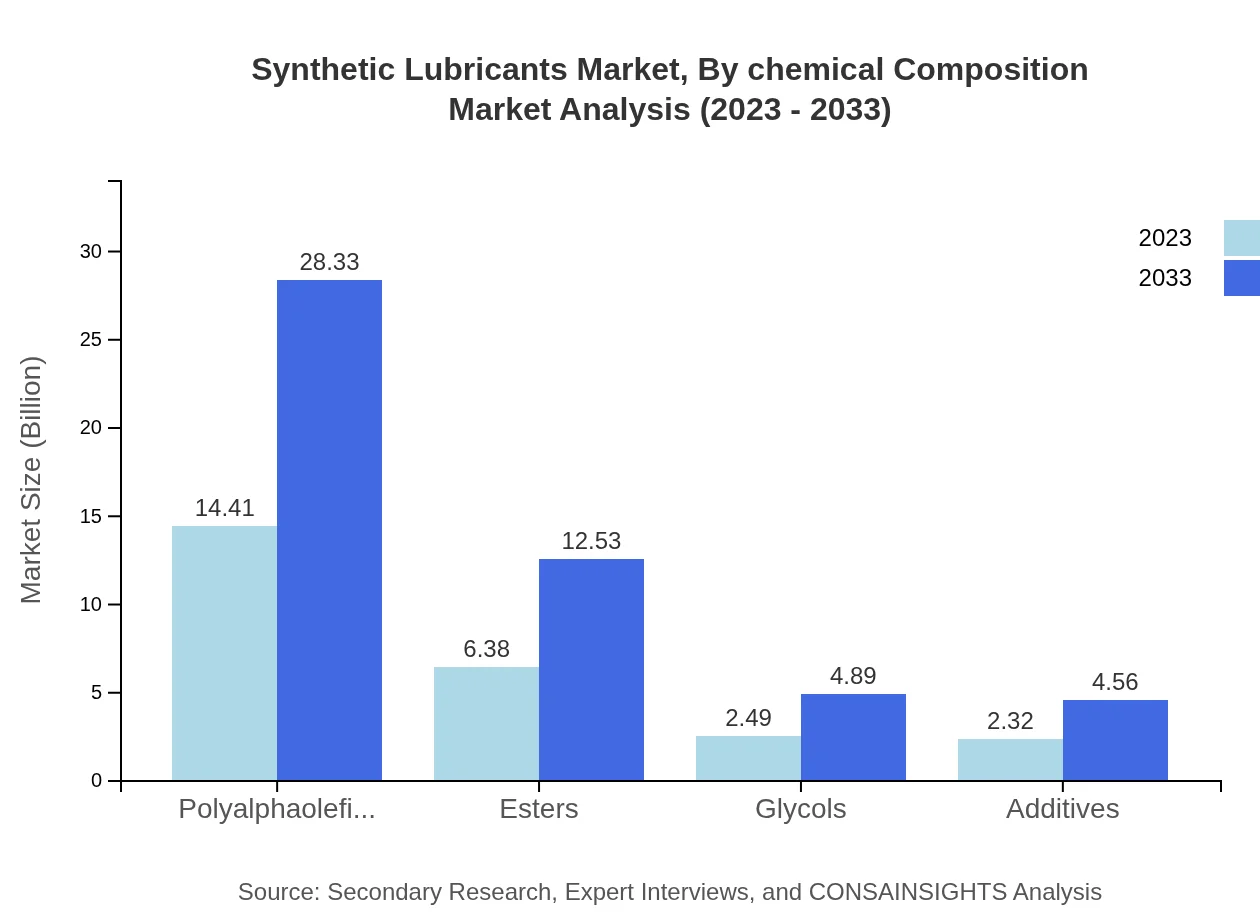

Synthetic Lubricants Market Analysis By Chemical Composition

Polyalphaolefins (PAO) dominate with a notable size of $14.41 billion in 2023, continuing to grow to $28.33 billion by 2033. Esters and Glycols hold respective shares of the market, valued at $6.38 billion and $2.49 billion in 2023, reflecting the diversity in chemical formulations impacting lubricant performance.

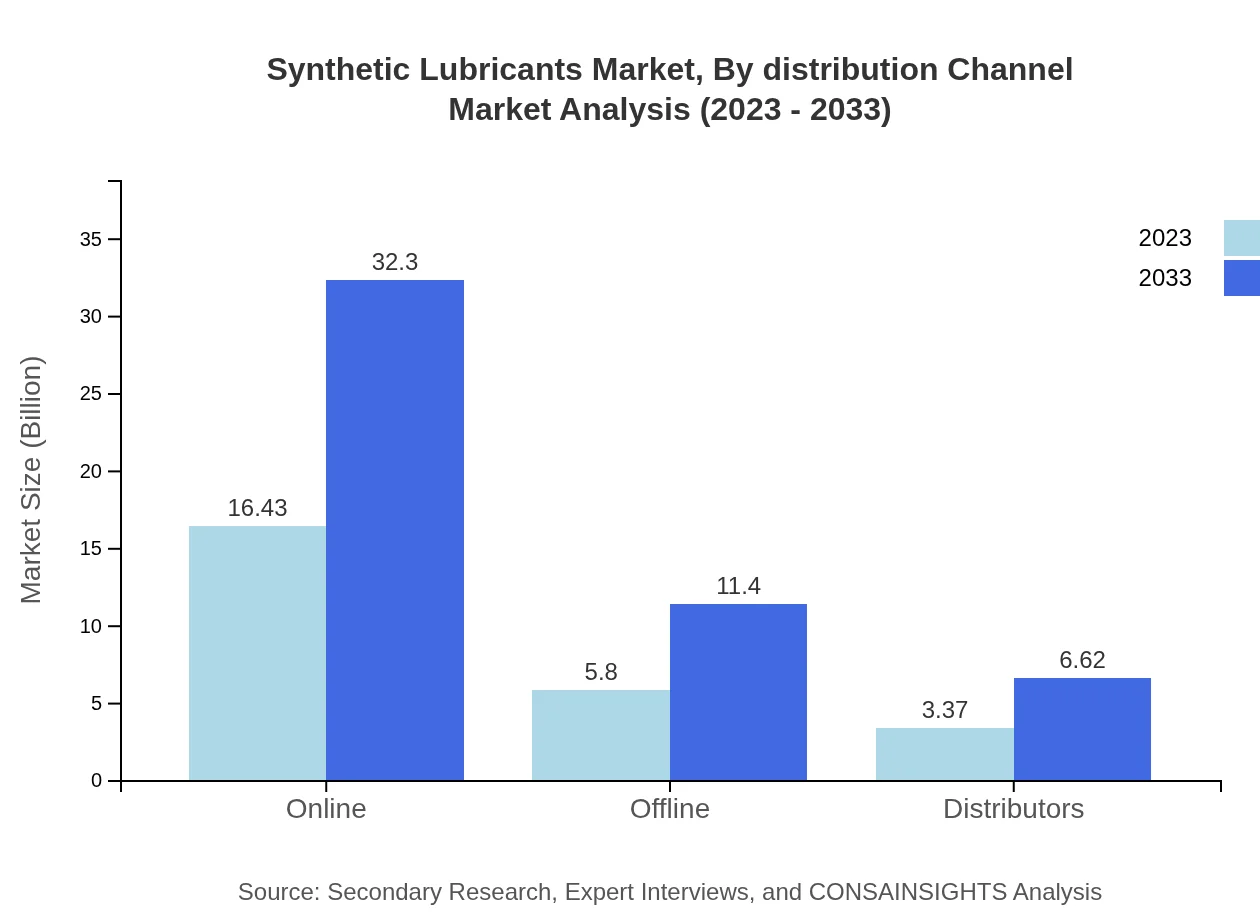

Synthetic Lubricants Market Analysis By Distribution Channel

Sales through online channels form the largest distribution segment, estimated at $16.43 billion in 2023 and potentially growing to $32.30 billion by 2033, as customers increasingly prefer the convenience of online purchasing. Offline sales remain significant, with a share driven by traditional retail outlets and distributors.

Synthetic Lubricants Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Synthetic Lubricants Industry

Exxon Mobil Corporation:

Exxon Mobil is a world leader in synthetic lubricants offering a wide range of high-performance products used across both consumer and industrial applications.Royal Dutch Shell:

Shell produces a vast portfolio of synthetic lubricants renowned for their quality and innovation, focusing on sustainability and meeting stringent environmental standards.BP PLC:

BP provides high-quality synthetic lubricants focused on advancing performance in the automotive and industrial segments with a committed approach to sustainability.TotalEnergies:

TotalEnergies has a strong presence in the synthetic lubricants market with robust technology and innovative products impacting both new and existing applications.Castrol Limited:

Castrol is recognized for its diverse range of synthetic lubricants, notable in the automotive sector offering solutions for enhanced engine performance and protection.We're grateful to work with incredible clients.

FAQs

What is the market size of synthetic Lubricants?

The synthetic lubricants market is projected to reach a size of $25.6 billion by 2033, growing at a CAGR of 6.8% from its current valuation. This growth is driven by increasing demand across various applications including automotive and manufacturing.

What are the key market players or companies in this synthetic Lubricants industry?

Key players in the synthetic lubricants industry include major corporations like ExxonMobil, Shell, Chevron, and BASF, known for their extensive portfolios and innovation in lubricant technologies. Their competitive strategies significantly influence market trends and dynamics.

What are the primary factors driving the growth in the synthetic Lubricants industry?

The growth of the synthetic lubricants industry is largely driven by increased automotive production, advancements in lubricant formulations, and growing environmental regulations mandating high-performance lubricants. Additionally, the expanding industrial sector enhances demand.

Which region is the fastest Growing in the synthetic Lubricants?

North America is the fastest-growing region for synthetic lubricants, with the market expected to rise from $8.27 billion in 2023 to $16.25 billion by 2033. The significant growth is attributed to rising automotive and industrial sectors.

Does ConsaInsights provide customized market report data for the synthetic Lubricants industry?

Yes, Consainsights offers customized market report data tailored to specific needs within the synthetic lubricants industry, allowing businesses to gain insights relevant to their unique market challenges and strategic goals.

What deliverables can I expect from this synthetic Lubricants market research project?

You can expect comprehensive reports including market size analysis, growth forecasts, competitive landscape assessments, and segmentation data across various applications and regions, providing a well-rounded view of market dynamics.

What are the market trends of synthetic Lubricants?

Current market trends in synthetic lubricants include a shift towards bio-based alternatives, advancements in technology leading to high-performance formulations, and increasing adoption in emerging markets. E-commerce growth is also reshaping distribution channels.